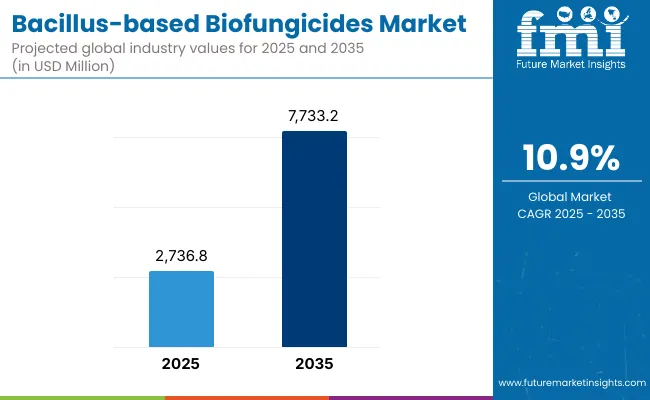

The Bacillus-based Biofungicides Market is expected to record a valuation of USD 2,736.8 million in 2025 and rise to USD 7,733.2 million by 2035, reflecting a CAGR of 10.9%. The first half of the decade (2025 to 2030) is forecast to add nearly USD 1.8 billion in incremental value, supported by adoption in fruits, vegetables, vines, and organic farming systems. From 2030 to 2035, a further USD 3.0 billion is projected as novel formulations such as micro-encapsulation and suspension concentrates gain stronger traction.

Bacillus-based Biofungicides Market Key Takeaways

| Metric | Value |

|---|---|

| Bacillus-based Biofungicides Market Estimated Value In (2025E) | USD 2,736.8 Million |

| Bacillus-based Biofungicides Market Forecast Value In (2035F) | USD 7,733.2 Million |

| Forecast CAGR (2025 to 2035) | 10.9% |

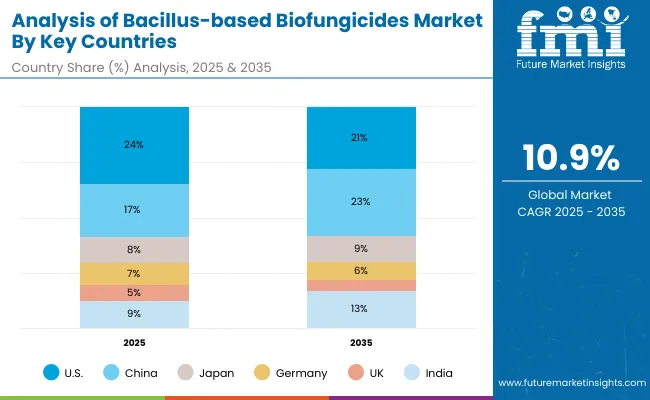

North America and Europe, together accounting for 55% of demand in 2025, will retain influence through regulatory support for biologicals and product innovation by leading companies like Bayer, BASF, Syngenta, and Certis Biologicals. However, East Asia and South Asia & Pacific are anticipated to outpace global averages, with CAGRs of 12.8% and 13.2%, respectively, driven by crop-protection policies, residue restrictions, and expanding organic acreage.

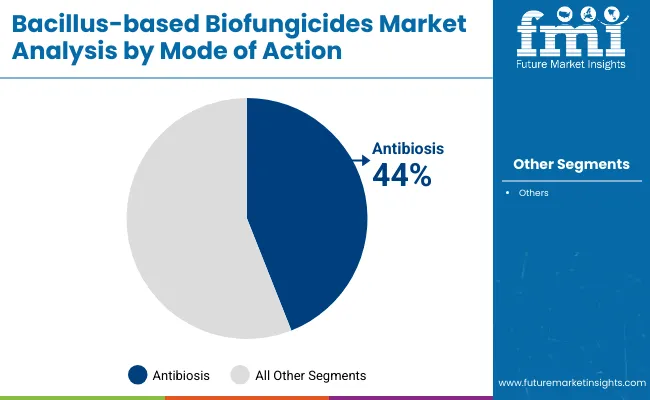

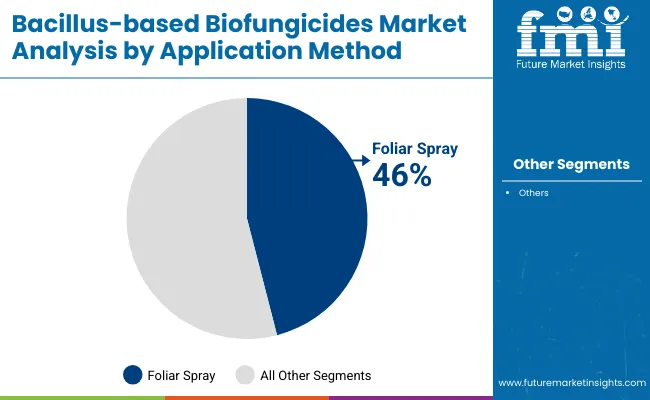

Mode of action is led by antibiosis at 44% share, where lipopeptides and metabolites provide broad-spectrum control, but induced systemic resistance (ISR) is set to post the highest CAGR of 12.9%. Foliar sprays dominate application at 46% share, while seed treatment and soil drench applications expand fastest.

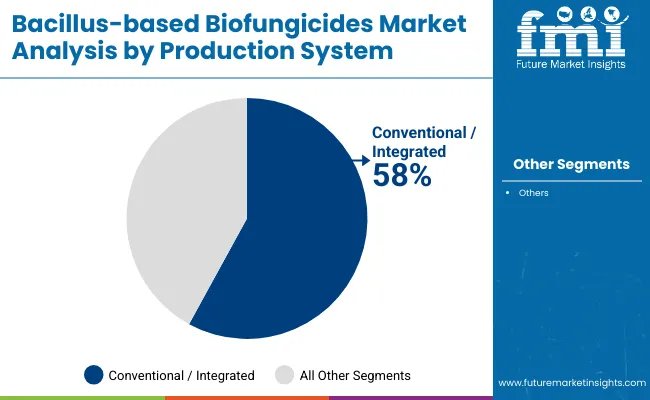

Conventional systems hold 58% share, but organic is forecast to climb rapidly at 13.5% CAGR, supported by sustainability goals and consumer-driven demand. The market’s outlook reflects strong convergence of biological efficacy, regulatory alignment, and farmer acceptance of integrated pest management (IPM).

The market’s expansion is being driven by the convergence of sustainability imperatives, regulatory pressures, and technological innovation. Growing restrictions on synthetic fungicides and rising consumer preference for residue-free produce are accelerating the shift toward bio-based crop protection. Bacillus strains, particularly B. amyloliquefaciens and B. subtilis, are favored due to their versatility across fruits, vegetables, cereals, and vines. Advances in formulation technologies, including suspension concentrates and micro-encapsulation, have improved field stability, shelf-life, and ease of application.

Biologicals are increasingly integrated into Integrated Pest Management (IPM) systems, enhancing compatibility with conventional products while reducing resistance risks. Strong adoption is also tied to the growth of organic farming, now supported by national policies in Asia-Pacific and Latin America. In addition, biocontrol companies and multinationals are expanding investments in strain development, novel delivery systems, and geographic reach, positioning Bacillus-based biofungicides as a central pillar of the next-generation crop protection market.

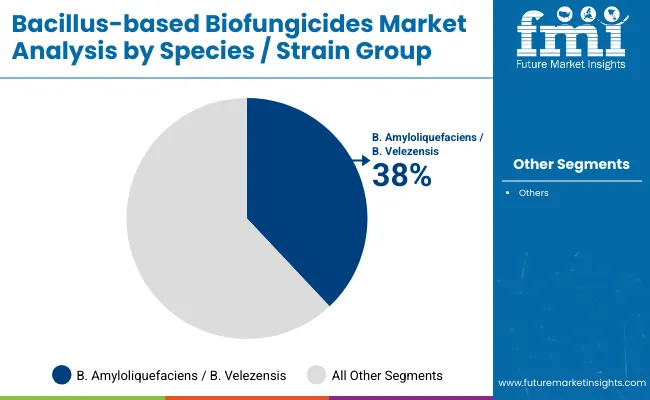

The Bacillus-based Biofungicides Market is segmented across species/strain group, formulation type, mode of action, application method, crop, production system, and region, each illustrating distinct adoption pathways and technological advancements. Strain-level differentiation highlights the dominance of B. amyloliquefaciens / B. velezensis and B. subtilis, both widely commercialized for broad-spectrum disease suppression.

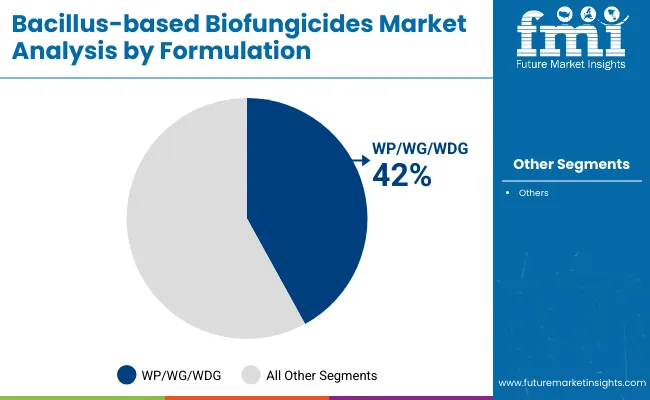

Formulation analysis reveals wettable powders (WP/WG/WDG) as the most widely used format, though suspension concentrates and micro-encapsulation are rapidly reshaping the landscape through superior stability and field performance. By mode of action, antibiosis leads, but induced systemic resistance (ISR) is expanding fastest as growers emphasize plant immunity.

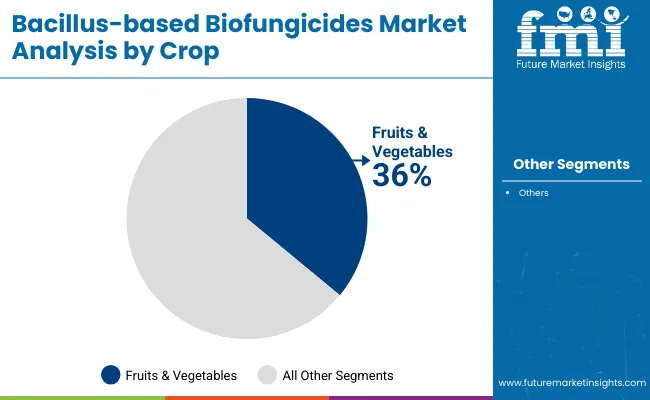

Application trends are led by foliar sprays, while soil drench, drip, and seed treatments record faster growth with protected cultivation. Fruits & vegetables remain the core crop segment, supported by regulatory restrictions on residues, whereas organic production systems are expanding rapidly at over 13% CAGR. Collectively, these segments underscore how strain innovation, formulation science, and diversified application methods are driving the structural evolution of the Bacillus-based biofungicides industry.

| Species/Strain Group | Share (2025) |

|---|---|

| B.amyloliquefaciens/B.velezensis | 38% |

| Others | 62% |

The species/strain group is dominated by B. amyloliquefaciens / B. velezensis, holding a 38% share in 2025. Their strong biocontrol efficacy is attributed to diverse lipopeptides and metabolites that provide reliable suppression of fungal pathogens across fruits, vegetables, and cereals. With a CAGR of 12.8%, these strains are anticipated to expand further due to their broad adoption in both conventional and organic systems. B. subtilis, at 32% share, remains highly relevant but grows at a slower rate compared to B. amyloliquefaciens.

Emerging strains such as B. pumilus and B. mycoides are gaining traction, particularly in resistance management and ISR activation, but collectively remain smaller contributors. The dominance of B. amyloliquefaciens / B. velezensis reflects scalability, versatility, and robust commercial validation across regions.

| Formulation | Share (2025) |

|---|---|

| WP/WG/WDG | 42% |

| Others | 58% |

By formulation, WP/WG/WDG (wettable powders, granules, and dispersible granules) lead with a 42% share in 2025. These formats dominate due to ease of storage, cost-efficiency, and wide compatibility with existing spraying equipment in fruits, vegetables, and cereals. However, SC/SL formulations, holding 36% share, are forecast to expand faster at 12.4% CAGR, supported by superior stability, lower dust risk, and better adhesion to foliage.

Micro-encapsulated and novel formulations, although only 10% in 2025, are projected to grow fastest at 13.6% CAGR, reflecting innovation-led adoption. Granular and dry flowable formats retain utility in soil and seed applications but remain smaller niches. WP/WG/WDG’s dominance underlines their established role in conventional farming, though newer liquid and encapsulated formats are reshaping long-term growth.

| Mode of Action | Share (2025) |

|---|---|

| Antibiosis ( lipopeptides , metabolites) | 44% |

| Others | 56% |

The primary mode of action is antibiosis, accounting for 44% of global share in 2025. Lipopeptides, surfactins, and metabolites produced by Bacillus strains are critical in suppressing a broad spectrum of fungal pathogens. Competitive exclusion and biofilm colonization follow with 28% share, enabling effective root-zone protection and niche competition.

Induced systemic resistance (ISR), though smaller at 20%, is projected to grow fastest at a 12.9% CAGR, as interest in plant immunity activation increases. Other mechanisms remain niche but serve important supplementary roles in IPM. Antibiosis is set to remain the leading mechanism due to proven efficacy, but ISR is expected to reshape adoption patterns as advanced Bacillus strains and formulations increasingly target preventive plant health.

| Application Method | Share (2025) |

|---|---|

| Foliar Spray | 46% |

| Others | 54% |

By application method, foliar spray dominates with a 46% share in 2025. Ease of adoption, established grower familiarity, and effectiveness in controlling aerial pathogens explain its dominance. Soil drench and drip applications, representing 26%, are expanding quickly at 12.3% CAGR, especially in horticulture and greenhouse systems where root health and soil pathogens are key.

Seed treatment, at 20% share, is projected to grow at 12.8% CAGR, reflecting rising integration with crop-protection packages and increasing emphasis on early-stage disease resistance. Post-harvest treatments, though only 8% share, provide important opportunities in export chains where residue-free compliance is crucial. Foliar spraying will continue to anchor usage, but seed treatment and soil applications are gaining momentum as Bacillus biofungicides integrate deeper into IPM frameworks.

| Crop | Share (2025) |

|---|---|

| Fruits & Vegetables | 36% |

| Others | 64% |

The crop segment is led by fruits & vegetables, holding a 36% share in 2025. This dominance reflects high disease pressure, economic returns, and regulatory restrictions on synthetic fungicides in perishable produce. Bacillus biofungicides are widely adopted in tomatoes, cucumbers, peppers, leafy greens, and berries, driven by demand for residue-free protection in fresh markets.

Cereals & grains (20%) and vines & berries (14%) follow, with steady adoption as product performance improves in broad-acre systems. Oilseeds & pulses (12%) and ornamentals & turf (10%) represent smaller but steady demand niches. Fruits & vegetables will remain the primary driver, but the combination of cereals and vines indicates diversification across broad-acre and specialty segments.

| Production System | Share (2025) |

|---|---|

| Conventional / Integrated | 58% |

| Others | 42% |

By production system, conventional/integrated farming dominates with a 58% share in 2025. Bacillus biofungicides are widely adopted as complements to chemical fungicides in IPM systems, where they reduce chemical loads and manage resistance. However, organic systems, representing 42%, are forecast to grow faster at 13.5% CAGR, reflecting strong consumer-driven demand and government support for organic acreage in Asia, Europe, and Latin America.

Bacillus biofungicides’ favorable residue and safety profile make them essential in organic production, with their market penetration supported by global certification alignment. Conventional systems will maintain leadership due to larger scale, but organic farming is expected to significantly outpace them in relative growth.

| Country | 2025 Share |

|---|---|

| USA | 24% |

| China | 17% |

| Japan | 8% |

| Germany | 7% |

| UK | 5% |

| India | 9% |

| Country | 2035 Share |

|---|---|

| USA | 21% |

| China | 23% |

| Japan | 9% |

| Germany | 6% |

| UK | 4% |

| India | 13% |

Adoption of Bacillus-based biofungicides is evolving at different paces across regions, shaped by regulatory frameworks, residue-free requirements, and the maturity of integrated pest management (IPM) systems. In Asia-Pacific, growth is most dynamic, with India (12.8% CAGR) and China (12.1% CAGR) driving expansion through strong policy support, rising organic acreage, and demand for residue-compliant exports.

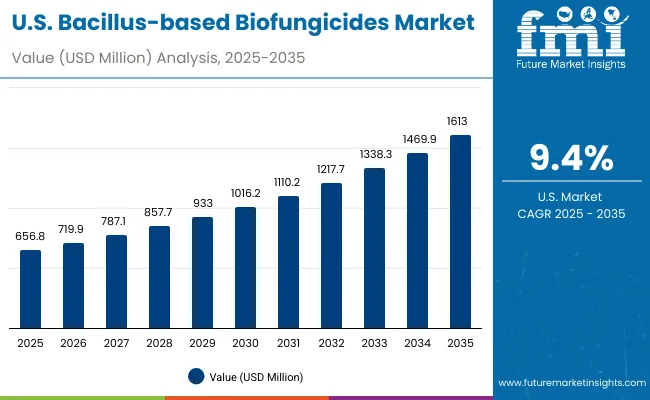

North America, led by the United States, retains influence with a 9.4% CAGR, supported by IPM maturity, specialty crop dominance, and stewardship programs, although its global share is projected to decline as Asia scales faster. Europe reflects steady but compliance-driven growth, with Germany (7.2% CAGR), France (6.6%), and the UK (7.5%) prioritizing traceability, ISR adoption, and premium horticulture.

Latin America, led by Brazil (11.0% CAGR), shows strong momentum in soybeans, fruits, and vegetables, while Japan and South Korea highlight innovation-led adoption of high-purity strains and advanced formulations in protected horticulture. Together, these dynamics reflect a global shift where Asia-Pacific and Latin America increasingly drive market growth, while North America and Europe consolidate through premium, compliance-led demand.

| Year | USA Bacillus-based biofungicides Market (USD Million) |

|---|---|

| 2025 | 656.8 |

| 2026 | 719.9 |

| 2027 | 787.1 |

| 2028 | 857.7 |

| 2029 | 933.0 |

| 2030 | 1,016.2 |

| 2031 | 1,110.2 |

| 2032 | 1,217.7 |

| 2033 | 1,338.3 |

| 2034 | 1,469.9 |

| 2035 | 1,613.0 |

Growth in the United States is projected at a 9.4% CAGR, with share easing from 24% in 2025 to 21% by 2035 as Asia expands faster. Adoption will remain anchored in fruits & vegetables, vines/berries, and conventional IPM programs where Bacillus products rotate with synthetics to manage resistance and residues.

WP/WG/WDG and SC/SL formats will dominate due to application familiarity and compatibility with existing rigs, while seed treatment and soil drench use cases gain share in protected cultivation. Retailer agronomy programs and biological specialists are expected to drive training, stewardship, and in-season recommendations. Rising organic acreage and export quality requirements will continue to reinforce demand for residue-compliant control, positioning Bacillus as a core pillar across specialty supply chains.

China is forecast to grow at 12.1% CAGR, with global share increasing from 17% (2025) to 23% (2035). Adoption is being propelled by residue restrictions, government support for biologicals, and rapid expansion in fruits & vegetables and greenhouse vegetables. B. amyloliquefaciens / B. velezensis and B. subtilis strains will dominate, with SC/SL and WP/WG formats scaling through distributors and co-ops.

ISR-oriented products are projected to rise as growers emphasize preventive plant health. Strong local manufacturing and technology transfer agreements are expected to broaden portfolios and improve price-performance across broad-acre cereals and specialty crops.

India is projected to post 12.8% CAGR, lifting share from 9% (2025) to 13% (2035). Growth is expected to be powered by fruits & vegetables, spices, and seed treatment in horticulture hubs, with rapid expansion in organic and residue-sensitive export value chains. WP/WG/WDG dominates early adoption for affordability and handling, while SC/SL ramps up in protected cultivation and drip systems.

ISR-based offerings are anticipated to scale for preventive programs against soil-borne and foliar pathogens. Co-ops, FPOs, and e-commerce platforms are expected to expand last-mile access and training, institutionalizing Bacillus within IPM.

Germany is expected to expand at 7.2% CAGR, with share moderating from 7% (2025) to 6% (2035) as Asia grows faster. Procurement remains compliance-led, emphasizing traceability, label integrity, and resistance management within IPM. Fruits & vegetables and vines/berries anchor demand, while cereals adoption develops in seed and soil programs.

SC/SL formats gain in high-value crops for better adhesion and coverage, and micro-encapsulated technologies are anticipated to build share as stability improves. Distributor agronomy and grower groups will continue to standardize best practices and efficacy trials.

France is forecast to grow at 6.6% CAGR. Adoption will remain focused on vegetables, vineyards, and berries, where residue-free requirements and export standards reinforce biological programs. ISR-oriented products are expected to gain relevance for preventive plant health, complementing antibiosis-led rotations. WP/WG remains mainstream for cost and handling; SC/SL formats scale in vineyards for coverage and rainfastness benefits. Co-ops and technical institutes will continue to drive trials and label stewardship.

The UK is projected to grow at 7.5% CAGR, with share easing from 5% (2025) to 4% (2035). Demand will concentrate in protected vegetables, soft fruits, ornamentals, and turf, where SC/SL and WP/WG formats fit established equipment and protocols. Retail stewardship and efficacy verification will remain central, while micro-encapsulated products gain interest for stability. Integration with seed treatment and soil applications is anticipated to expand in greenhouse systems.

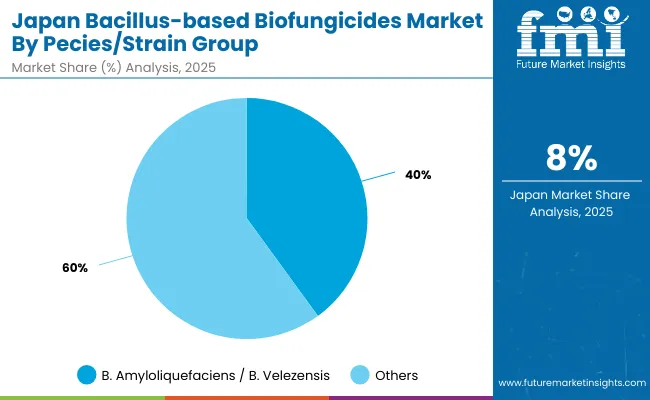

| Pecies /Strain Group | Market Share (%) |

|---|---|

| B. amyloliquefaciens / B. velezensis | 40% |

| Others | 60% |

Japan’s share is expected to edge up from 8% (2025) to 9% (2035), supported by premium horticulture, berries, and ornamentals. Adoption will remain innovation-led with a preference for high-purity strains and SC/SL for precision coverage. B. amyloliquefaciens / B. velezensis and B. subtilis dominate, while micro-encapsulated technologies gain interest for shelf-life and stability in complex programs. IPM rotations and residue-free positioning are expected to remain central in export chains.

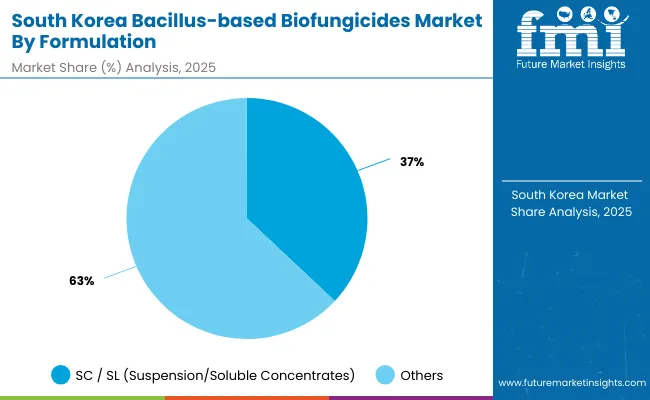

| Formulation | 2025 Share |

|---|---|

| SC / SL (suspension/soluble concentrates) | 37% |

| Others | 63% |

Growth in South Korea is expected to be centered on greenhouse vegetables, berries, and ornamentals, where SC/SL formulations provide strong usability and coverage. WP/WG remains relevant in broader programs, while micro-encapsulated formats expand with premium crops seeking better stability and shelf-life. Distributor agronomy and municipal greenhouse initiatives will continue to guide standardized protocols. Wider use in seed and soil programs is anticipated as ISR-focused labels increase.

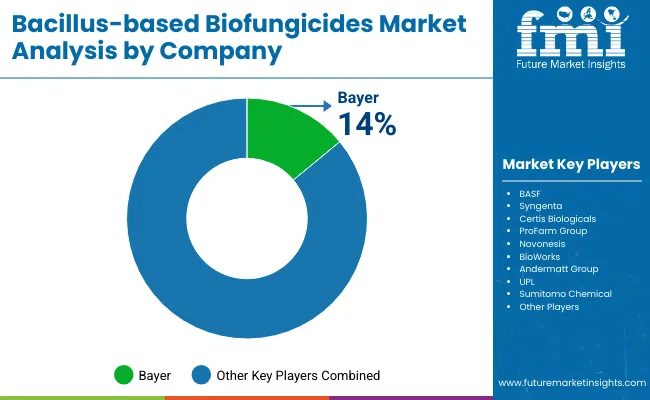

A leadership cluster of global crop-protection companies and specialized biological firms has been observed. Bayer is assessed to hold the largest value share in 2025 (≈14%), supported by a broad portfolio of B. amyloliquefaciens / B. velezensis and B. subtilis products across WP/WG/WDG and SC/SL formats and deep IPM channel penetration in North America and Europe. BASF and Syngenta scale through integrated programs and distribution depth, while Certis Biologicals and ProFarm Group maintain strong positions in specialty crops and organic chains.

Novonesis (resulting from the enzymes/microbes combination) strengthens the strain-development and fermentation backbone that supports next-gen formulations, including micro-encapsulated offerings. Regional specialists-BioWorks, Andermatt Group, UPL, Sumitomo Chemical-provide localized portfolios, greenhouse expertise, and co-development with distributor agronomy teams. Competitive edge is shifting toward formulation science (SC/SL, encapsulation), ISR claims, residue-management positioning, and data-backed IPM integration. Supply reliability, cold-chain stewardship, and label expansions in seed/soil/post-harvest uses are expected to define outperformance through 2035.

Key Developments in Bacillus-based Biofungicides Market

| Item | Details |

|---|---|

| Market Size, 2025 | USD 2,736.8 Million |

| Market Size, 2035 | USD 7,733.2 Million |

| Absolute Growth (2025-2035) | USD 4,996.4 Million |

| CAGR (2025 to 2035) | 10.90% |

| Value Added 2025 to 2030 | ~USD 1.80 Billion |

| Value Added 2030 to 2035 | ~USD 3.20 Billion |

| Species/Strain (2025) | B. amyloliquefaciens / B. velezensis leads (38% share) |

| Formulation (2025) | WP/WG/WDG leads (42% share) |

| Mode of Action (2025) | Antibiosis leads (44% share) |

| Application Method (2025) | Foliar spray leads (46% share) |

| Crop (2025) | Fruits & vegetables lead (36% share) |

| Production System (2025) | Conventional/Integrated leads (58% share) |

| Key Growth Regions (CAGR) | South Asia & Pacific 13.2% , East Asia 12.8% , Latin America 11.6% |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, China, India, Japan, South Korea, Germany, France, UK, Brazil |

| Key Companies Profiled | Bayer, BASF, Syngenta, Certis Biologicals, ProFarm Group, Novonesis , BioWorks , Andermatt Group, UPL, Sumitomo Chemical |

| Additional Attributes | IPM integration, ISR claims, residue-management positioning, micro-encapsulation, cold-chain and storage stability, seed/soil/foliar versatility |

The market is valued at USD 2,736.8 Million in 2025, led by strong adoption in fruits & vegetables (36% share) and dominance of B. amyloliquefaciens / B. velezensis strains (38% share).

The market is expected to reach USD 7,733.2 Million by 2035, reflecting an absolute growth of USD 4,996.4 Million over the forecast period.

A robust 10.9% CAGR has been projected, with East Asia (12.8%) and South Asia & Pacific (13.2%) expanding fastest.

B. amyloliquefaciens / B. velezensis leads with a 38% share in 2025, supported by broad-spectrum antibiosis and strong performance in both conventional and organic systems.

SC/SL suspension/soluble concentrates grow quickly at 12.4% CAGR, while micro-encapsulated/novel formats post the highest pace at 13.6% CAGR, improving stability and ease of use.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA