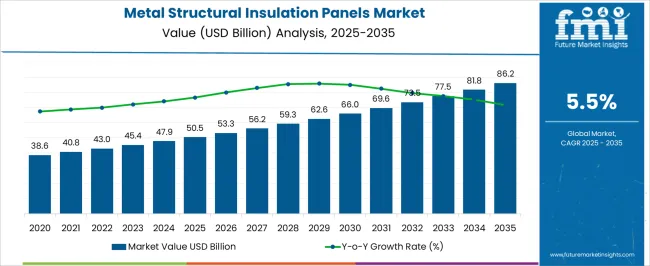

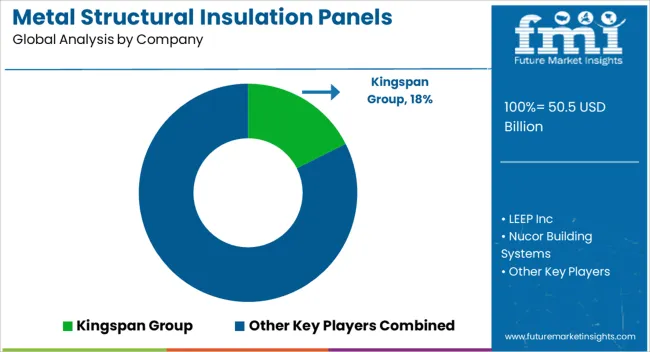

The metal structural insulation panels market is estimated to be valued at USD 50.5 billion in 2025 and is projected to reach USD 86.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Between 2025 and 2030, the market will increase from USD 50.5 billion to USD 66.0 billion, showing a steady upward curve. This block of growth highlights the rising use of structural insulated panels in construction projects due to their strength, thermal efficiency, and reduced assembly time. Their demand is being supported by increased construction activity in both residential and commercial sectors, with contractors favoring prefabricated solutions for faster delivery and reduced labor costs. The consistent year-on-year increases suggest stable demand across multiple geographies, particularly where infrastructure development and modernization projects are accelerating.

From 2030 to 2035, the market is expected to continue expanding from USD 66.0 billion to USD 86.2 billion, maintaining a smooth and predictable growth curve. This phase reflects strong adoption of structural insulated panels in industrial facilities, cold storage units, and large-scale housing projects. Their cost-effectiveness, design flexibility, and energy-efficient performance are making them a preferred choice for long-term construction investments. The curve shape indicates steady expansion rather than volatile shifts, which underscores the reliability of this market over the forecast period. Manufacturers are expected to focus on expanding production capacities and diversifying panel specifications to address varied regional construction needs. The market outlook suggests consistent growth opportunities for suppliers, with structural insulated panels establishing a long-term role in global building practices.

| Metric | Value |

|---|---|

| Metal Structural Insulation Panels Market Estimated Value in (2025 E) | USD 50.5 billion |

| Metal Structural Insulation Panels Market Forecast Value in (2035 F) | USD 86.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The metal structural insulation panels market holds a distinct position across multiple construction and materials-related domains, with its share reflecting both performance advantages and adoption trends in energy-conscious construction. Within the building and construction materials market, metal structural panels account for about 6%, representing a specialized segment compared to concrete, timber, and glass. In the insulation materials market, their share stands at nearly 8%, since they combine structural integrity with strong insulation performance, making them valuable in both residential and commercial projects. Within the prefabricated and modular construction market, metal structural insulation panels contribute approximately 10%, reflecting their popularity in modular housing, industrial facilities, and commercial spaces where quick assembly and durability are prioritized.

In the roofing and wall cladding materials market, their share is around 7%, as they compete with other cladding solutions while offering integrated insulation benefits. Finally, in the energy-efficient building solutions market, their contribution reaches close to 12%, highlighting their role in reducing thermal losses and supporting compliance with stricter energy standards. Taken together, these percentages show that metal structural insulation panels are particularly strong in modular construction and energy-efficient building categories, while holding moderate but steady roles in general construction and insulation markets. Their importance lies in their dual function as both a structural and thermal solution, giving them a competitive edge as modern construction trends emphasize efficiency, durability, and prefabrication.

The metal structural insulation panels market is witnessing strong growth driven by increasing demand for energy-efficient building solutions, tightening building codes, and the rising adoption of prefabricated construction techniques. These panels are being preferred due to their excellent thermal performance, reduced labor costs, and shorter installation timelines, making them ideal for large-scale commercial and institutional builds.

Government incentives for green buildings, along with growing retrofitting activity in aging infrastructure, are further catalyzing their uptake.

With construction firms under pressure to meet environmental standards and reduce project durations, the demand for pre-engineered, insulated solutions continues to climb across developed and emerging regions alike.

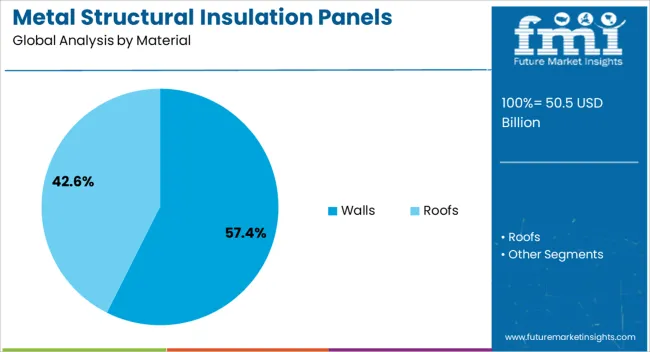

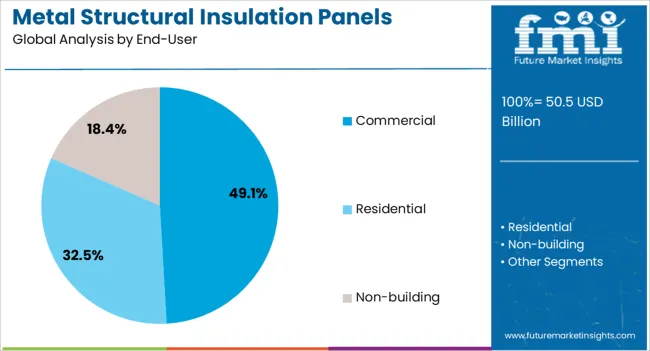

The metal structural insulation panels market is segmented by material, end-user, and geographic regions. By material, metal structural insulation panels market is divided into walls and roofs. In terms of end-user, metal structural insulation panels market is classified into commercial, residential, and non-building. Regionally, the metal structural insulation panels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The walls segment is expected to account for 57.40% of the total market by 2025, establishing it as the leading material application. This dominance is driven by the critical need for thermal insulation in external and internal walls, where heat loss or gain is most significant. Metal SIPs used in wall systems offer improved strength-to-weight ratios, seamless integration with architectural finishes, and superior fire resistance. Their rapid assembly capability makes them particularly attractive in modular and offsite construction. Additionally, their performance in acoustic insulation and structural stability further supports their preference in commercial and high-density residential builds.

The commercial segment is projected to lead with 49.10% share of the end-user market in 2025. This leadership is fueled by the growing use of metal SIPs in offices, retail complexes, and institutional structures that demand both high energy efficiency and long-term durability. Rising energy costs and ESG compliance requirements are pushing developers to choose materials that offer lifecycle cost advantages. Commercial builders are also embracing SIPs to speed up project delivery timelines and meet LEED or similar certification standards. With an increasing number of green-certified commercial properties, the segment continues to present strong growth potential for SIP-based construction solutions.

The metal structural insulation panels market is growing as demand rises for durable, energy-efficient, and cost-effective building solutions. Opportunities are expanding in industrial, cold storage, and modular construction projects, while trends emphasize prefabrication, quick installation, and aesthetic improvements. Challenges persist in high costs, design limitations, and raw material price volatility. In my opinion, companies that enhance design flexibility, strengthen supply chains, and offer competitive pricing will achieve long-term success, positioning insulated metal panels as a cornerstone in the evolving global construction industry.

Demand for metal structural insulation panels has been reinforced by their strength, durability, and superior insulation properties. Widely adopted in residential, commercial, and industrial projects, these panels provide thermal efficiency while reducing construction time and costs. Their ability to withstand harsh environments and deliver long-term performance has strengthened market preference. In my opinion, demand will continue to expand as builders and developers adopt materials that combine structural strength with energy efficiency, making insulated metal panels a preferred solution in modern construction.

Opportunities are evident in industrial facilities, warehouses, and cold storage projects where structural insulated panels ensure both durability and temperature control. Food and beverage industries are increasingly using them for refrigerated storage and distribution centers. Export opportunities are also expanding for manufacturers offering certified, high-performance panels. I believe companies focusing on large-scale industrial applications and expanding into cold chain infrastructure projects will capture significant opportunities, as these sectors require reliable, cost-efficient, and performance-driven insulation materials for long-term operations.

Trends in the metal structural insulation panels market highlight the shift toward modular and prefabricated construction methods. These panels are increasingly used for quick-assembly housing, commercial outlets, and industrial buildings due to their ease of installation and design flexibility. Advancements in coatings and finishes are also enhancing panel aesthetics, broadening their appeal in architectural applications. In my opinion, this trend signals a transition from traditional building techniques to faster, more efficient construction solutions, where insulated metal panels play a central role in driving modern building practices.

Challenges include high upfront costs compared to conventional materials, which often deter smaller contractors and budget-conscious builders. Design limitations in achieving complex architectural shapes also restrict adoption in high-end projects. Dependence on metal supply chains exposes manufacturers to price fluctuations, creating further uncertainty. In my assessment, success will depend on improving cost-efficiency, expanding design versatility, and building resilient supply networks. Without addressing these barriers, broader adoption of metal structural insulation panels may face hurdles in both developed and emerging construction markets.

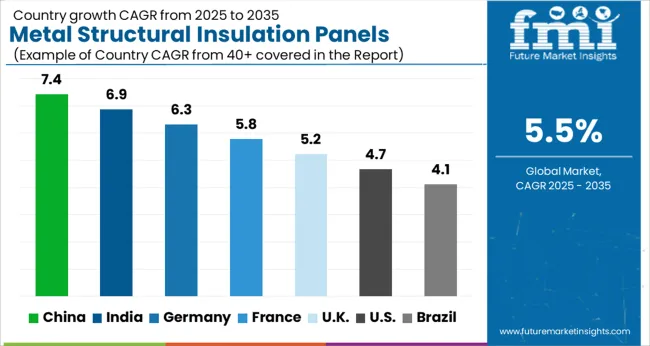

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

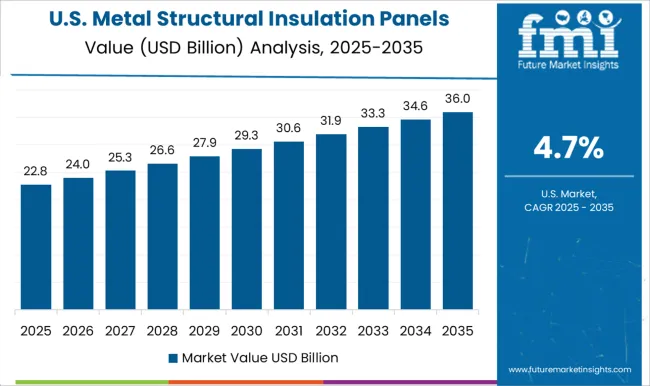

| USA | 4.7% |

| Brazil | 4.1% |

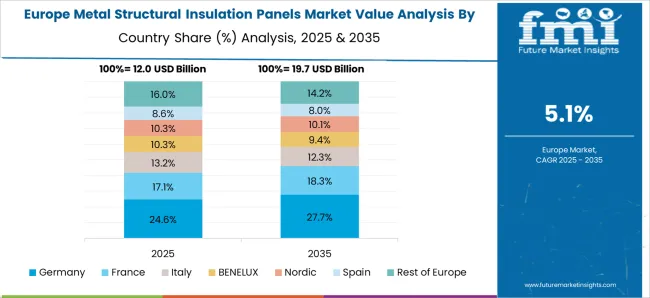

The global metal structural insulation panels market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads with a growth rate of 7.4%, followed by India at 6.9%, and France at 5.8%. The United Kingdom records a growth rate of 5.2%, while the United States shows the slowest growth at 4.7%. Growth is supported by rising demand for energy-efficient building materials, rapid construction activities, and the integration of metal SIPs in industrial and residential projects. Emerging markets such as China and India are seeing faster expansion due to infrastructure investments and urban housing needs, while developed economies like the USA, UK, and France focus on premium applications, advanced coatings, and compliance with stricter building standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The metal structural insulation panels market in China is projected to grow at a CAGR of 7.4%. Growth is fueled by large-scale construction projects, industrial infrastructure, and strong housing demand. Metal SIPs are increasingly adopted due to their strength, thermal efficiency, and cost-effectiveness compared to conventional materials. Chinese manufacturers are expanding capacity and investing in automated production lines to cater to rising domestic and export demand. Government-backed infrastructure initiatives, particularly in industrial parks and public housing, are further boosting adoption.

The metal structural insulation panels market in India is expected to grow at a CAGR of 6.9%. Rapid infrastructure development, rising urban housing demand, and growth in cold storage facilities are major growth drivers. The adoption of SIPs in commercial and industrial construction is expanding as developers seek cost-effective, energy-efficient solutions. Indian manufacturers are collaborating with international companies to introduce advanced panel technologies. Supportive government policies aimed at promoting efficient building materials are further enhancing adoption, positioning India as a high-potential market.

The metal structural insulation panels market in France is projected to grow at a CAGR of 5.8%. Adoption is driven by the country’s strong emphasis on efficient construction materials and compliance with European building standards. SIPs are increasingly used in residential, industrial, and commercial projects due to their durability and insulation properties. French manufacturers are focusing on advanced coatings and fire-resistant materials to strengthen competitiveness. Growing interest in modular construction methods and pre-engineered building solutions also supports market expansion.

The metal structural insulation panels market in the UK is projected to grow at a CAGR of 5.2%. Market growth is supported by strong demand in commercial and industrial construction, particularly in warehouses and retail facilities. SIPs are also gaining traction in modular housing projects due to their quick installation and thermal performance. UK producers are emphasizing compliance with safety standards and offering premium-grade panels with advanced weather-resistant finishes. The rise of e-commerce and logistics-related construction is further strengthening demand.

The metal structural insulation panels market in the USA is projected to grow at a CAGR of 4.7%. While slower compared to emerging economies, demand is supported by adoption in industrial facilities, data centers, and commercial buildings. The market benefits from replacement and retrofit projects where energy efficiency and structural strength are prioritized. Manufacturers are investing in new coatings, fire-resistant materials, and lightweight panel designs to meet building code requirements. The USA market remains important due to its focus on premium and high-performance applications.

Competition in the metal structural insulation panels sector is shaped by construction scale, steelmaking integration, and insulation system engineering. Kingspan Group and its joint venture Kingspan Jindal Pvt Ltd dominate with advanced insulated panel systems distributed across commercial and industrial projects worldwide. ArcelorMittal, Tata Steel, and Nucor Building Systems leverage steelmaking capacity to offer vertically integrated solutions, ensuring secure raw material supply alongside tailored panel designs. LEEP Inc and ThermaSteel position themselves in North America with lightweight structural insulated panels that cater to energy-conscious building designs. Flexospan Steel Buildings and Structall Building Systems focus on modular structures, pre-engineered applications, and regional contractor networks. MIB Facades and Direct Metals emphasize cladding, facades, and custom assemblies, targeting niche architectural segments. This blend of global steel majors and regional construction specialists reflects a market where competition balances scale with tailored service. Strategies emphasize load-bearing capacity, thermal performance, and prefabrication efficiency.

Kingspan drives R&D in fire-rated panels and high-R insulation systems, while Tata Steel and ArcelorMittal highlight durability and lifecycle cost savings in infrastructure projects. Nucor and Flexospan market modular building kits using insulated panels for faster site installation. ThermaSteel and LEEP showcase light-gauge framing and foam-core integration to reduce labor costs. MIB Facades and Direct Metals focus on aesthetics, positioning insulated metal panels as solutions that combine strength with design flexibility. Product brochures highlight R-values, span capabilities, acoustic performance, and compliance with building codes, supported with visuals of cross-sectional panels, fastening systems, and finished structures. Messaging underscores speed of construction, reduced energy use, and structural reliability. By blending technical specifications with architectural appeal, brochures serve both as design references and persuasive tools, positioning insulated metal panels as essential for modern construction where strength, efficiency, and adaptability converge.

| Item | Value |

|---|---|

| Quantitative Units | USD 50.5 billion |

| Material | Walls and Roofs |

| End-User | Commercial, Residential, and Non-building |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kingspan Group, LEEP Inc, Nucor Building Systems, MIB Facades Limited, ArcelorMittal, ThermaSteel, Flexospan Steel Buildings Inc, Tata Steel Ltd, Kingspan Jindal Pvt Ltd, Direct metals LLC, and Structall Building Systems |

| Additional Attributes | Dollar sales by product type (steel-faced vs aluminum-faced panels), Dollar sales by application (residential, commercial, industrial, cold storage), Trends in energy-efficient building materials and modular construction, Use in roofing, walls, and flooring systems, Growth in demand for lightweight and durable structures, Regional adoption patterns across North America, Europe, and Asia-Pacific. |

The global metal structural insulation panels market is estimated to be valued at USD 50.5 billion in 2025.

The market size for the metal structural insulation panels market is projected to reach USD 86.2 billion by 2035.

The metal structural insulation panels market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in metal structural insulation panels market are walls and roofs.

In terms of end-user, commercial segment to command 49.1% share in the metal structural insulation panels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Metal Fiber Felt Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA