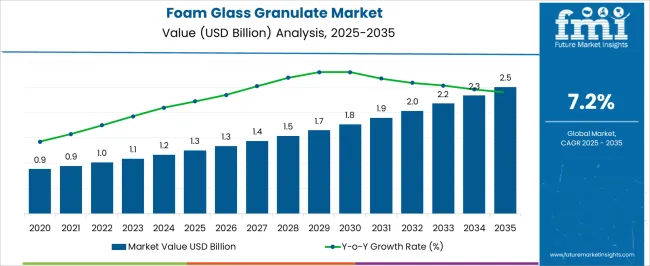

The Foam Glass Granulate Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Foam Glass Granulate Market Estimated Value in (2025 E) | USD 1.3 billion |

| Foam Glass Granulate Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The Foam Glass Granulate market is experiencing steady growth due to increasing adoption in energy-efficient construction and lightweight building materials. The market is being driven by the superior thermal insulation, fire resistance, and durability of foam glass granulate, which enable its widespread use in building and construction projects. In addition, the material's environmental sustainability, including recyclability and reduction of construction waste, is influencing market expansion.

Increasing urbanization and the rise in infrastructure projects in both developed and emerging markets are further accelerating demand. Manufacturers are investing in technological innovations to produce granulates with uniform particle sizes, improved compressive strength, and enhanced compatibility with various binders.

The market outlook is favorable, with future growth opportunities expected in modular construction, green building projects, and energy-efficient insulation solutions As the global construction sector increasingly prioritizes sustainability, foam glass granulate is anticipated to remain a critical material, offering long-term benefits in both performance and environmental impact.

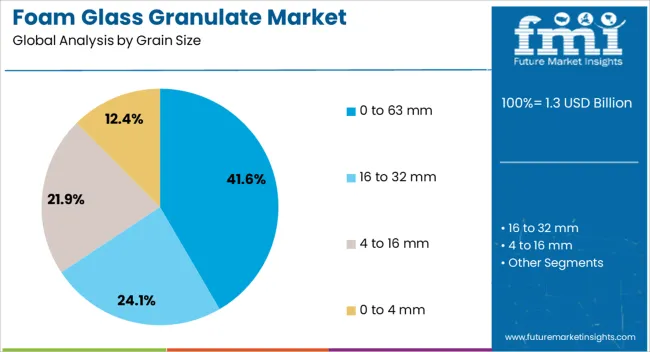

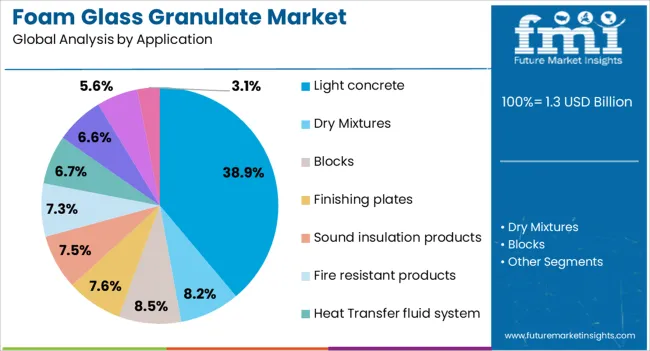

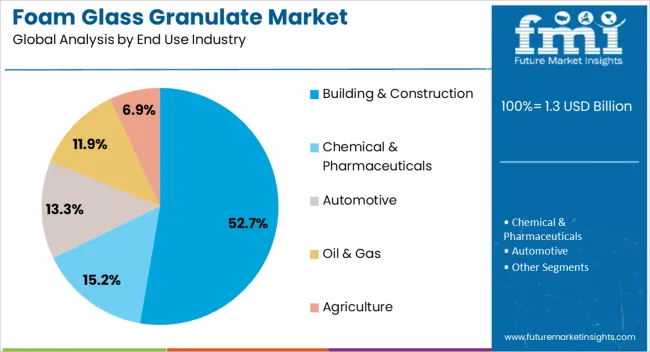

The foam glass granulate market is segmented by grain size, application, end use industry, and geographic regions. By grain size, foam glass granulate market is divided into 0 to 63 mm, 16 to 32 mm, 4 to 16 mm, and 0 to 4 mm. In terms of application, foam glass granulate market is classified into Light concrete, Dry Mixtures, Blocks, Finishing plates, Sound insulation products, Fire resistant products, Heat Transfer fluid system, Chemical Process System, Commercial piping & building, and Cryogenic Systems. Based on end use industry, foam glass granulate market is segmented into Building & Construction, Chemical & Pharmaceuticals, Automotive, Oil & Gas, and Agriculture. Regionally, the foam glass granulate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 0 to 63 mm grain size segment is projected to hold 41.60% of the Foam Glass Granulate market revenue in 2025, making it the leading grain size category. This dominance is being attributed to its versatility and ease of use in a wide range of construction applications, including lightweight concrete, screed, and insulation layers. The grain size allows for optimal compaction, uniform mixing, and consistent performance in thermal and acoustic insulation applications.

Growth in this segment has been supported by the increasing adoption of prefabricated building materials and modular construction techniques, which demand granulates with predictable behavior. Furthermore, the compatibility of this granulate size with various cementitious and binder systems has enabled broader adoption in building projects of different scales.

The segment's growth is reinforced by demand from environmentally conscious construction practices, where the combination of lightweight, durable, and recyclable material is highly valued The ease of transportation and handling of 0 to 63 mm granulates further contributes to its leading market position.

The light concrete application segment is expected to capture 38.90% of the total Foam Glass Granulate market revenue in 2025, emerging as the largest application segment. This predominance is being driven by the demand for lightweight yet high-strength concrete in residential, commercial, and infrastructural construction.

Foam glass granulate enhances thermal insulation and reduces structural load, which makes it particularly suitable for multi-story buildings and energy-efficient constructions. Adoption has been accelerated by increasing emphasis on green building certifications and energy efficiency standards, which prioritize lightweight materials that contribute to sustainable construction.

The segment's growth is also supported by ease of integration into traditional concrete mixtures without compromising strength or durability As governments and private developers continue to implement energy-efficient building codes and green construction incentives, the use of foam glass granulate in light concrete applications is expected to expand further, reinforcing this segment's market leadership.

The building and construction end-use industry is anticipated to hold 52.70% of the Foam Glass Granulate market revenue in 2025, making it the leading consumer segment. Growth in this segment is being driven by the rising demand for energy-efficient and lightweight building materials across residential, commercial, and industrial infrastructure projects. Foam glass granulate is valued for its thermal insulation, fire resistance, and environmental sustainability, which align with modern construction requirements.

Adoption has been reinforced by the expansion of urban development projects and large-scale infrastructure investments in both mature and emerging economies. Additionally, builders and contractors prefer this material due to its ease of handling, long-term durability, and compatibility with a variety of construction systems.

The segment's growth is also supported by increasing green building initiatives, which prioritize materials that reduce energy consumption and environmental impact As energy efficiency and sustainability continue to shape construction practices, the building and construction industry is expected to remain the primary driver of demand for foam glass granulate.

Foam glass granulate is the recent light weight building and insulation material. Foam glass granulates are manufactured from waste glass which is ecological for the long run. Foam glass granulates are also known as expanded glass granulates. Foam glass granulates are manufactured by milling & mixing of recycled glass with organic aggregates, then the mixture is melted down at high temperature. Apart from high insulation the foam glass granulates possess other properties such as fire resistance, frost resistance and high pressure resistance & dimensional stability.

The light weight nature of foam glass granulates is increasing its adoption as compared to other aggregate materials. Due these various properties foam glass granulates are getting attraction from several industries such as agriculture, automotive, oil & gas bio-filtration etc. Besides it the foam glass granulates are widely used in construction, chemical and pharmaceutical industries.

The rapidly increasing urbanization has escalated the growth of building and construction industry. Increasing government regulations in to promote the energy efficiency is increasing the demand for efficient insulation materials. For instance in 2025 International Energy Conservation Code (IECC) raised the energy standards by 30% over 2006 IECC.

Moreover, the revised International Energy Conservation Code (IECC), 2025 is expected to drive 25%-30% increase in insulation spending per unit and thus, such increasing regulations will boost the foam glass granulate market. Increasing need for energy efficiency has led to up surge in the insulation material demand from construction industry. According to study about 50%-60% energy is consumed by heating & cooling system of the total energy consumption in the developed & developing economies due to the inefficient insulation there is significant energy loss.

So to increasing demand for efficient insulating materials will up rise the foam glass granulate market. Besides it the growth of chemical & pharmaceutical industries will also drive the foam glass granulate market. In the recent years the manufacturers are focused on improving the product quality by continuous R & D and also to provide tailor made solutions as per the customer demands.

In the regions such as North America and Europe there are stringent government regulations and increasing government initiatives for energy efficient building development, owing to which there is increasing demand for insulation materials due to which North America and Europe makes a prominent market for foam glass granulate materials.

Increasing population & urbanization has boosted the building & construction and also the increasing presence of the chemical industries will drive the demand for insulating materials, owing to which Asia Pacific makes a promising market for foam glass granulates. High presence of oil & gas industry in the Middle East and growing construction in Africa collectively makes Middle East & Africa a potential market for foam glass granulate. As compared with others Latin America can be considered as moderate market region with steady growth.

Examples of some of the market participants operating in the global foam glass granulates market include,

Misapor AG, Liaver, REFAGLASS, Mike Wye & Associates Ltd, Zhejiang DEHO, Uusioaines, SIA JUMP, ShouBang, Zhejiang DEHO among others

The Foam Glass Granulate market research report presents a comprehensive assessment of the Foam Glass Granulate market and contains thoughtful insights, facts, historical data and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The Foam Glass Granulate market research report provides analysis and information according to Foam Glass Granulate market segments such as geographies, application and industry.

The Foam Glass Granulate Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with Foam Glass Granulate market attractiveness as per segments. The report also maps the qualitative impact of various market factors on Foam Glass Granulate market segments and geographies.

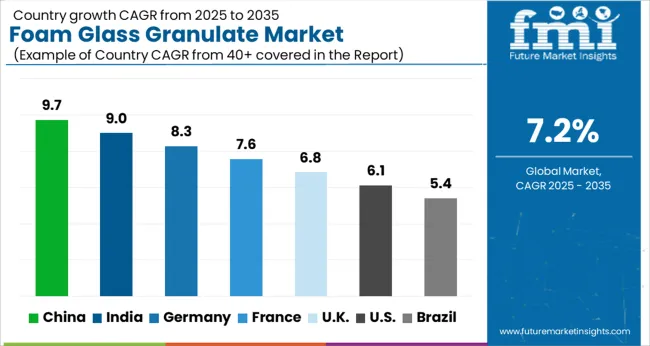

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The Foam Glass Granulate Market is expected to register a CAGR of 7.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.7%, followed by India at 9.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.4%, yet still underscores a broadly positive trajectory for the global Foam Glass Granulate Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.3%. The USA Foam Glass Granulate Market is estimated to be valued at USD 461.6 million in 2025 and is anticipated to reach a valuation of USD 836.1 million by 2035. Sales are projected to rise at a CAGR of 6.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 57.1 million and USD 37.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Grain Size | 0 to 63 mm, 16 to 32 mm, 4 to 16 mm, and 0 to 4 mm |

| Application | Light concrete, Dry Mixtures, Blocks, Finishing plates, Sound insulation products, Fire resistant products, Heat Transfer fluid system, Chemical Process System, Commercial piping & building, and Cryogenic Systems |

| End Use Industry | Building & Construction, Chemical & Pharmaceuticals, Automotive, Oil & Gas, and Agriculture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Owens Corning, Glapor Werk Mitterteich GmbH, Misapor AG, REFAGLASS, AeroAggregates of North America, LLC, Zhejiang Zhenshen Insulation Technology Corp., Polydros S.A., and Uusioaines Oy (Foamit) |

The global foam glass granulate market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the foam glass granulate market is projected to reach USD 2.5 billion by 2035.

The foam glass granulate market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in foam glass granulate market are 0 to 63 mm, 16 to 32 mm, 4 to 16 mm and 0 to 4 mm.

In terms of application, light concrete segment to command 38.9% share in the foam glass granulate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Type Vacuum Gripping System Market Size and Share Forecast Outlook 2025 to 2035

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA