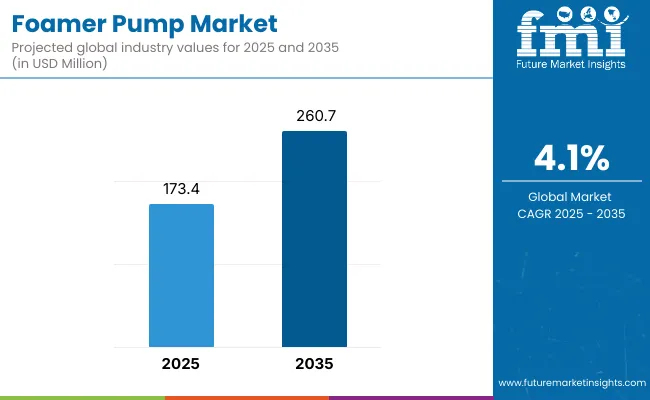

The foamer pump market is projected to grow from USD 173.4 million in 2025 to USD 260.7 million by 2035, reflecting a CAGR of 4.1%. Growth is being driven by heightened demand for personal care and skincare products that require controlled, foam-based dispensing. Rising adoption of foamer pumps in hand sanitizers, cleansers, and baby care solutions is fueling packaging innovation. Estimated 2024 sales are approximately USD 164.7 million.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 173.4 million |

| Industry Value (2035F) | USD 260.7 million |

| CAGR (2025 to 2035) | 4.1% |

New foamer pumps are being developed with fewer moving parts and compatibility with refill packs to meet sustainability regulations. Patented airless designs now allow for consistent foam texture across viscosities, including natural and sulfate-free formulas. Integration with tamper-evident seals and child-safe locks is also expanding use cases. Lightweight and recyclable materials are making these pumps more desirable for eco-conscious brands.

Foamer pumps are poised for wider application across skincare, bath products, and pet care, driven by consumer preferences for precision dispensing. Regulatory pressures are favoring BPA-free, recyclable components and compliant labeling systems. Growth opportunities lie in product customization and aesthetic packaging. As competition intensifies, players will focus on proprietary designs and ergonomic improvements to gain a competitive edge.

The below table presents the expected CAGR for the global foamer pump market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.8% |

| H2 (2024 to 2034) | 4.0% |

| H1 (2025 to 2035) | 4.0% |

| H2 (2025 to 2035) | 4.2% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.8%, followed by a slightly higher growth rate of 4.0% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.0% in the first half and remain relatively moderate at 4.0% in the second half. In the first half (H1) the market witnessed a decrease of 120 BPS while in the second half (H2), the market witnessed an increase of 100 BPS.

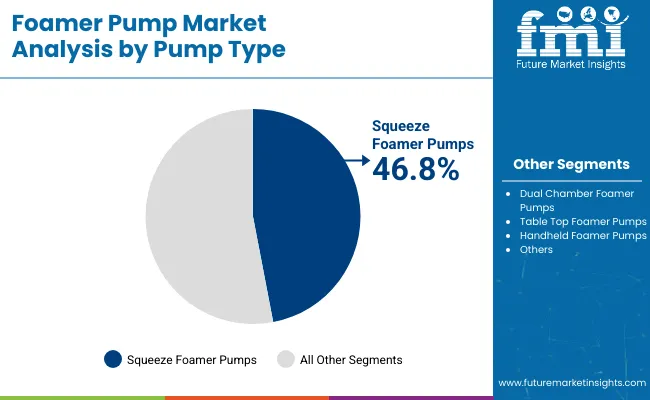

Squeeze foamer pumps are expected to hold the largest share of 46.8% in the foamer pump market in 2025, driven by their ease of use and economical construction. These pumps have been widely integrated into personal care and household packaging where controlled dispensing is critical. Their mechanical simplicity has enabled widespread deployment without requiring complex actuator mechanisms. Lower production costs and design versatility have contributed to their dominance across high-volume applications.

Brands have selected squeeze variants for small-format bottles used in travel kits, hygiene packs, and everyday personal care items. Their adaptability to various viscosities and formulations has ensured broad usage across skincare and baby care product lines. Improved venting designs and anti-leak features have further optimized user experience. These characteristics have made squeeze foamer pumps a practical choice for both premium and mass-market segments.

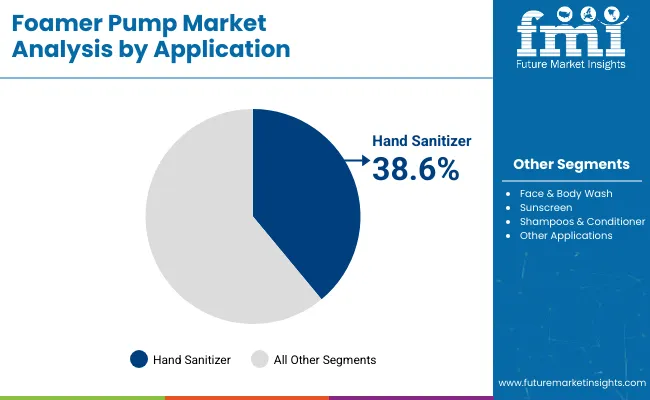

The hand sanitizer application segment is projected to account for 38.6% of the foamer pump market in 2025, influenced by consumer focus on hygiene and regulated dosing. The foam format has offered a mess-free, quick-drying alternative to traditional gel-based dispensers. Brands have adopted foamer pumps for better user control and reduced product wastage, especially in portable sanitizing solutions. Their compatibility with alcohol-based and alcohol-free formulas has widened their application scope.

Foamer pumps have supported public health infrastructure through integration in schools, offices, and retail environments. Custom branding, lockable pumps, and child-safe features have enhanced safety and visibility. The demand surge during recent health emergencies has further normalized foam dispensing in personal and institutional contexts. This has cemented the role of hand sanitizer as a key growth application for foamer pump systems.

Increasing Foam-Based Skincare and Hygiene Products Boost Foamer Pump Market

Consumers themselves actively choose foam-based products because of their smooth texture and luxurious feel, which creates demand for foamer pumps. In skincare and personal care, foaming soaps and cleansers produce a smooth lather that is silky on the skin, creating an improved experience. In contrast to liquid soaps, foam is easy to spread, meaning it requires less effort to apply and rinse off.

This makes it appealing to users who look for fast and effective hygiene products. Also, foaming products tend to incorporate milder components, which is why they suit sensitive skin as well as infant care products. Manufacturers take advantage of this penchant by launching upscale foaming forms, further spurring the uptake of foamer pumps. As consumers associate foam with quality and comfort, manufacturers continue to invest in innovative foamer pump solutions to meet demand.

Enhanced safety protocols Increase Foamer Pump Demand in Pharmaceutical & Cleaning Sectors

Safety and regulatory concerns positively influence the need for foamer pumps in a wide range of industries. Spills are minimized, waste is reduced, and user safety is improved through controlled dispensing, making foamer pumps a requirement for pharmaceuticals, household products, and industrial cleaners. Regulations promote their application in certain formulations to avoid direct contact with highly concentrated or harmful liquids, limiting risks of skin irritation and unintentional ingestion.

In the healthcare industry, foamer pumps provide accurate dosing for antiseptics and disinfectants to enhance infection control. Domestic and automotive cleaning products also gain benefits through foam, which adheres longer to surfaces, limiting contact with harsh chemicals. As global safety standards rise and consumer consciousness grows, companies apply foamer pumps to meet standards while enhancing product usability and efficacy.

Foamer Pump Performance Issues My Affect Consumer Satisfaction & Impact Demand

Eventually, foamer pumps may wear down, causing performance problems. The internal workings, depending on the exact mixing of air and liquid, can get worn out, causing clogging or inconsistent dispensing of the foam. This will annoy consumers who are expecting a high-quality consistent experience each time.

If the pump does not dispense the intended foam or clogs, consumers will find it hard to use the product, and this could result in poor reviews. Consumers can also choose other products with more consistent dispensing systems. These performance and durability issues, if not corrected, could undermine the demand for foamer pumps.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Smart & Touchless Dispensing Solutions | Increasing need for sensor-based, hygiene-oriented foamer pumps in medical and public applications. |

| Advanced Dispensing Technology | Improving user experience with accurate dosage adjustment and enhanced foam efficiency. |

| Healthcare & Pharmaceutical Applications | Growing use in medical-grade hand sanitizers, antiseptics, and wound care solutions. |

| E-commerce & Subscription-Based Packaging | Increasing demand for durable, leak-proof foamer pumps for direct-to-consumer shipments. |

| Customization & Branding Innovations | Customers looking for specialty foamer pump designs for differentiation and premium product segmentation. |

Tier 1 companies comprise market leaders capturing significant market share in global market. These industry leaders stand out for having a large product variety and a high production capacity. These industry giants stand out for having a wide geographic reach, a wealth of production experience in a variety of package styles, and a strong customer base.

They offer a variety of services, such as recycling and manufacturing, using state-of-the-art equipment, according to legal requirements, and offering the best possible quality. Among the well-known businesses in tier 1 are Sappi Limited, Felix Schoeller, SURTECO GmbH and Toppan Europe GmbH.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. They are distinguished by having a significant international presence and in-depth industry expertise. These market participants may not have cutting-edge technology or a broad worldwide reach, but they do guarantee regulatory compliance and have good technology.

Among the well-known businesses in tier 2 Richmond Containers CTP Ltd., Frapack Packagibg B.V., Raepak Ltd., APackaging Group, Weltrade Packaging, Sun-Rain Sprayer Co., Ltd., ScopeNEXT Ltd., Luencheong Dispensing Pump Ltd. (CLC), Matsa Group Ltd., Taplast srl and Radcom Packaging Private Limited.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets Due to their specialization in serving the demands of the local market, these companies are classified as belonging to the tier 3 sharing sector. They only operate on a small scale and within a limited geographic area. Within this specific context, Tier 3 is categorized as an unstructured market, denoting an industry that is significantly less formalized and structured than its organized rivals.

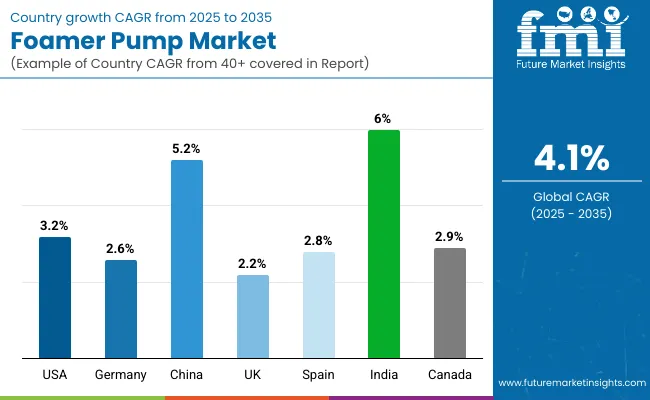

The section below covers the future forecast for the foamer pump market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 3.2% through 2035. In Western Europe, Germany is projected to witness a CAGR of 2.6% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

| Germany | 2.6% |

| China | 5.2% |

| UK | 2.2% |

| Spain | 2.8% |

| India | 6.0% |

| Canada | 2.9% |

The increasing USA demand for luxury skincare, hand washes, and shampoos fuels foamer pump adoption. Consumers demand high-quality, luxurious products with a rich, foamy feel that improves their overall experience. Brands react by adding foamer pumps to cleansers, facial washes, and liquid soaps to enhance product performance and minimize waste.

The trend towards soft, sulfate-free, and organic formulations is also driving demand for foamer pumps as they provide controlled dispensing and soft application. Meanwhile, social media and influencer marketing enhance visibility of luxury skincare routines to create even greater consumer interest in advanced packaging solutions such as foamer pumps that drive product appeal and functionality in the fast-growing personal care market.

Germany has a strong focus on hygiene in hospital, industrial, and public settings, and as such, demands for foamer pumps in soap dispensers and disinfectants is high. Hospitals, labs, and production sites need to have efficient touch-free dispensing mechanisms to preserve stringent hygiene requirements. Foamer pumps promote hand hygiene by ensuring a measured volume of disinfectant and saving product.

They are extensively applied in food processing facilities, where contamination hazards are high, allowing workers to sanitize hands efficiently. For instance, a German pharmaceutical firm incorporated foamer pumps into its hospital-grade disinfectants, enhancing application efficiency and minimizing overuse. This transition is consistent with Germany's strict hygiene regulations and sustainability objectives.

Leading companies in the foamer pump are creating and introducing new products with additional benefits and applications to the market. They are expanding their geographic reach and merging with other companies. Few of them are also working together to develop new products in partnerships with start-up businesses and regional brands.

Key Developments in Foamer Pump Market

The foamer pump industry is projected to witness CAGR of 4.1% between 2025 and 2035.

The global foamer pump industry stood at USD 567.5 million in 2024.

Global foamer pump industry is anticipated to reach USD 260.7 million by 2035 end.

South Asia & Pacific is set to record a CAGR of 5.6% in assessment period.

The key players operating in the foamer pump industry are Silgan Dispensing Systems Corporation, Albéa S.A., Rieke Corporation and AptarGroup.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Foamer Bottle Manufacturers

Defoamers Market Size & Trends 2025 to 2035

Fermentation Defoamer Market Size and Share Forecast Outlook 2025 to 2035

Non-Silicone Emulsion Defoamer Market Size and Share Forecast Outlook 2025 to 2035

Anti-Foaming Agents / Defoamers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA