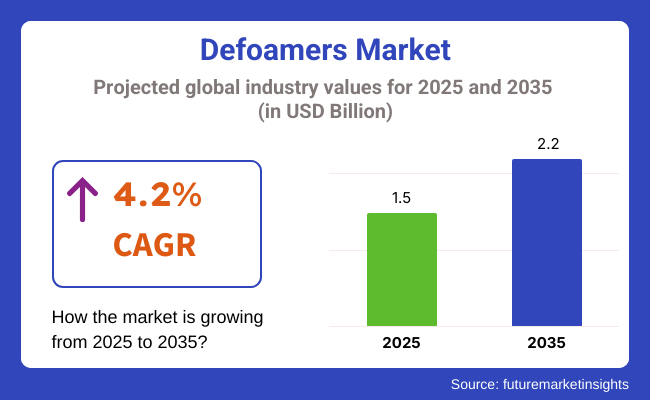

Global demand for defoamers is estimated at USD 1.5 billion in 2025. A steady rise is anticipated, with the market likely to attain USD 2.2 billion by 2035. This reflects a CAGR of 4.2% over the forecast period. Increased utilization across food processing, paints and coatings, and pulp and paper industries is expected to support this expansion. In 2025, a notable rise in food-grade defoamer usage has been recorded, attributed to enhanced production capacities and regulatory approvals.

In 2025, food-grade silicone-based defoamers have seen elevated usage in fermentation systems and filling lines. BASF announced in March 2025 the commissioning of its new food-safe defoamer production unit in Ludwigshafen, Germany. The company confirmed that output will align with European Union Regulation (EC) No. 1333/2008 on food additives. "Our expansion ensures stable supply while meeting the highest compliance thresholds," stated Julia Raquet, BASF's Senior Vice President for Nutrition & Health, in the release published on BASF’s global newsroom.

In the coatings segment, new generation defoamers have gained traction due to sustainability directives. Evonik launched TEGO Foamex 812 in late 2024. The solution was described as an ultra-efficient, low-VOC defoamer designed for high-solids and waterborne coatings. In the announcement, Dr. Claudine Mollenkopf, Head of Evonik’s Specialty Additives Division, explained, “This innovation reduces foam while enhancing surface flow and wetting-addressing urgent industry demand for cleaner chemistry.” Compatibility with advanced binders and performance under high-shear conditions have made it preferable in architectural and automotive coatings.

In pulp and paper manufacturing, oil-based and polyether defoamers have retained relevance. Kemira reported a 12% YoY rise in Asia-Pacific demand for its FennoFoam series in its 2024 sustainability report. The company emphasized foam control’s role in reducing freshwater intake and improving machine uptime. During a 2024 Q4 investor call, CEO Jari Rosendal confirmed, “We are embedding foam management within our digital solutions portfolio, particularly for large-scale fiber loops in Southeast Asia.”

Non-silicone defoamers have found expanding applications in biotechnology, detergents, and anaerobic wastewater systems. Improved shelf life, faster dispersion rates, and reduced active loss have enhanced their appeal. In 2025, Shin-Etsu Chemical announced a supply chain agreement with an Indian microbial fermentation provider to localize manufacturing of antifoam agents in southern India. The move was designed to reduce lead times and meet increasing demand for fermentation-grade products.

While concerns remain over trace residues and biodegradability, compliance-driven R&D has intensified. Multiple suppliers are working toward achieving OECD 301 biodegradability benchmarks. The global defoamers market is expected to remain resilient through 2035, anchored by compliance, formulation science, and sector-specific innovation.

The multifunctional silicone-based defoamers, yet again, are the leading untouchable and drooling worldwide. They are backed by their high efficacy, heating resistance, and long-term duration of foam death. They are widely used in the paper & pulp, paints & coatings, and water treatment industries, where foam formation can threaten normal operation, decrease efficiency, and create product defects.

In contrast to oil and powder defoamers, silicone-based defoamers have better spreading, lower surface tension, and high temperatures and chemical resistance. Their absolute compatibility with the water- and solvent-based forms makes them an unquestioned choice in factories that need effective and non-reactive foams.

Further, the innovations in silicon polymer technology and emulsification techniques are not only boosting the defoamer performance but also resulting in better dispersion and permanent stability, which in turn intensify the survival rate in extreme conditions.

Oil-based defoamers have been on the rise recently, with hikes especially among paints & coatings, adhesives, and construction materials, where foam reduction is key in achieving a uniform application, a nicer look, and higher durability. These de-foaming agents have been developed from sources like mineral oils, vegetable oils, and synthetic hydrocarbons, which not only degenerate but also microfoam and macrofoam effectively, thus guaranteeing the coatings and cementitious materials a defect-free status.

Going nose to nose with silicone defoamers, oil-based versions, besides being a money-saving option, are compatible with hydrophobic systems. Thus, they are prime choices for joint adhesives, latex paints, and concrete applications. As urbanization comes at an increasing rate and the infrastructure gets developed, the demand for quality construction materials and coatings is climbing sky-high, hence oil-based defoamers are used to great extent in high-end building materials.

The water & wastewater sector is among the biggest platforms for defoamers, the froth which is generated in excess is not only hindering the aeration processe but also reducing the filtration efficiency and the overall workings of the treatment plant. The sprayers are crucial for the management of biological foam, surfactant-based foam, and industrial wastewater foaming by which they ensure effective sludge separation and improved effluent quality.

Municipal and industrial water treatment operations that are close to silicone-based and polymer defoamers rely upon them since they possess not only low toxicity and high foam knockdown efficiency but also are biodegradable. Strained with environmental regulations pertaining to water wastewater discharge and treatment plant efficiency, the demand for biodegradable, eco-friendly, and non-persistent foaming solutions is on the rise. Besides, progress in minimizing the use of synthetic polymers as constituents of biodegradable Costas has promoted their dissemination in wastewater treatment through innovative approaches.

Foam construction in paper and pulp production processes, such as pulping, bleaching, and paper coating, is majorly offsetting the quality, increasing chemical consumption, and causing process inefficiencies. The de-watering agents are key players in reducing the enclosed air, better drainage, and avoiding foam defect issues in the paper-making process.

By far, the pulp & paper sector stands tall among other industrial areas, demanding high-performance defoamers associated with high shear, alkaline conditions, and fast aqueous phase dispersion stability. Silicone and polymer-based defoamers are used as premium products in the paper mills, and the world’s best technology in recycled fiber mills enhances fiber dispersion and, in turn, increases machine productivity. The growing tendency of the industry towards environmental sustainability and the continued have-not's basket to biodegradable and non-silicone defoaming solutions.

The defoamers market remains dominated by North America, which is buoyed by a robust industrial manufacturing sector, the much-needed environmental regulations on wastewater treatment, and a clear uptick in food processing and pharmaceutical industries. The USA and Canada are among the countries that widely apply silicone-based and bio-based defoamers in the chemical processing, petroleum refining, and pulp & paper sectors.

The use of non- toxic, biodegradable defoamers is being spurred on by the USA Environmental Protection Agency (EPA) and Food and Drug Administration (FDA) regulations, thus aiding market development. Water treatment processes have become another domain for defoaming applications, given that more industrial plants are now involved in water reuse and recycling initiatives.

With the coupled uplift in biopharmaceutical manufacturing and the specialty chemicals segment, the market for low-VOC and non-silicone defoamers is projected to skyrocket.

The defoamers market of Europe has seen an upward trajectory owing to an iron grip on the environmental agenda, ever-rising requirements regarding filling defoaming agents sustainably, and a constantly prolonged usage period in coatings, textiles, and agrochemicals. Green chemistry is the schooling of rising atmospheres in gas emissions, such as those promoted and utilized by countries like Germany, France, and the UK for foams in industrial processes.

The REACH regime of the European Union addresses chemical safety and VOC emissions and is the driving force behind the development of water-based and bio-based defoamers. Besides, the increasing need for high-performance anti-foaming agents in water treatment plants, adhesives & sealants, and fermentation-based food processing is backing the market up.

With the automotive and construction industries booming, defoamers are playing a major role in the betterment of coatings, adhesives, and construction chemicals, thus supporting further market growth.

The defoamers market in Asia-Pacific is the most rapidly expanding region, powered by industrialization, the need for wastewater treatment, and the growing demand for efficiency in the manufacturing sector. Countries such as China, India, Japan, and South Korea are experiencing considerable advances in defoamer consumption for diverse fields, including chemicals, pharmaceuticals, and water treatment.

The economic progress of China in the chemical processing and industrial production field definitely pertains to the demand growth of defoamers for petrochemical refining, paints & coatings, and polymer processing. On the other hand, the agricultural and food processing sectors in India are the ones that increase the need for FDA-approved defoamers in edible oil refining, dairy, and fermentation processes.

The most crucial players in this field, Japan and South Korea, are devoted to technological progress, especially focusing on the silicone-free area in water treatment coats, and the relation with the manufacturing of textiles and personal care products will also have a positive effect. Granting a need for environmental-safe defoamers in this scope is yet to burgeon in the region.

The Middle East & Africa (MEA) area is witnessing moderate growth in the defoamers market, the key reasons being oil & gas refining, infrastructure projects, and enhanced requirements of industrial wastewater treatment. Saudi Arabia, UAE, and South Africa, along with other countries, are on the list of users and investors of high-performance defoamers in petrochemical processing, mining, and construction industries.

Desalination plants and water recycling projects have been at the forefront propulsion driving the demand for efficient foam control agents in water treatment applications. Additionally, the region has been making more effort in keeping the environment safe, and observance of stricter rules on industrial waste disposal has made way for defoamer solutions in the region to be environmentally friendly.

Stringent Environmental Regulations on Chemical-Based Defoamers

The defoamers market faces one of its biggest challenges stemming from the environmental and health regulatory pressure on chemical-based defoamers. Government bodies like the EPA, FDA, and European Chemicals Agency (ECHA) are prohibiting the use of high VOCs and non-biodegradable anti-foaming agents.

The manufacturers have to follow the increasingly elaborate regulations about toxicity, biodegradability, and food safety, which affect the product formulations and increase the production costs. The transition to green chemistry and ecological products necessitates constant investment in the research and development of environmentally friendly materials.

High Cost of Silicone-Based Defoamers

Silicone-based defoamers, even though they are superior, are expensive and represent a serious problem in these markets, especially those which are sensitive to price changes. The increased price of raw materials, such as silicone polymers and specialty surfactants, has a negative effect on the profit margins of the manufacturers and leads to the overall price increase of the product.

In order to deal with that, the companies have set out to develop cost-effective, hybrid defoamer formulations that strike a balance between performance and affordability. Besides that, the expansion of bio-based alternatives could present the solution to cost concerns.

Growing Demand for Bio-Based and Sustainable Defoamers

The heightened emphasis on sustainability and environmental responsibility has led to a surge in demand for bio-based, biodegradable defoamers. The food & beverage, pharmaceutical, and personal care industries have started using natural and plant-based defoaming solutions for compliance with customer health concerns as well as regulatory standards, while manufacturers are looking to the future by investing in water-based and silicone-free formulations that Control foam effectively while causing minimal environmental twofold impact.

The emphasis on circular economy measures and the imposition of tighter sustainability requirements in industrial processing are projected to create positive growth opportunities for bio-based defoamers.

Expansion of Industrial Wastewater Treatment and Process Optimization

The focus on water sustainability and effective wastewater management is fueling global demand for high-efficiency defoaming agents in industrial water treatment facilities. With governments taking steps to impose stricter wastewater discharge standards, industries are adopting defoamers more effectively to treat the waste and ensure compliance with environmental regulations.

Furthermore, developments in nanoparticle and hybrid systems are helping to achieve higher efficiency, cut down chemical usage, and promote cost-effective, sustainable solutions for foam control. The demand for advanced defoamers will be considerably increased as wastewater treatment, desalination, and industrial process optimization continue to grow.

From 2020 to 2024, the defoamers market recorded steady growth due to the increase in wastewater treatment, food & beverage processing, and the production of paints, coatings, and pulp & paper in which manufacturers incorporate higher amounts of defoamers. Indeed, the necessary foams need to be reduced in liquid processes, and industries like using more foam for reasons such as production efficiency and quality assurance, which have gained less foam.

Market dynamics were also influenced by the shift to silicone-based, water-based, and bio-based defoamers, as well as obeying stricter environmental regulations on volatile organic compounds and hazardous chemicals. At the same time, intermittent raw materials pricing, regulatory issues, and formulation problems were barbed to the manufacturer.

The prospects for the defoamers market are bright because of, among other things, the application of AI, de-feminization, and nanotechnology-enhanced anti-foaming agents. Defatting tendencies in the processing of food with biodegradabl,e non-toxic defoamers, eco-friendly formulations for industrial applications, and AI-integrated foam control systems will drive the market in the future.

Formulations of self-regulating defoamer, in addition to the already mentioned real-time foam monitoring powered by AI and the blockchain technique quality control tracking, will cause increased efficiency and sustainability in defoamer applications.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shifts | 2020 to 2024 |

|---|---|

| Water & Wastewater Treatment Expansion | Water treatment facilities are increasingly using silicone-based and polymer defoamers. |

| Food & Beverage Processing | The FDA now approves food-grade defoamers for the dairy, brewing, and food processing industries. |

| Industrial Coatings, Paints, & Adhesives | Additive silicone and mineral oil-based defoamers in paints, coatings, and adhesives. |

| Pulp & Paper Industry Growth | The use of oil-based defoamers in paper and pulp washing and coating processes is increasing. |

| Sustainability & Eco-Friendly Defoamer Trends | Low-VOC and non-toxic defoamers have become popular because of regulatory restrictions. |

| Advancements in Nanotechnology & AI Integration | Nano-particle-based anti-foams agents are use-limited. |

| Market Growth Drivers | The market solution being problematic for the demand of process optimization, wastewater treatment, and green industrial business. |

| Market Shifts | 2025 to 2035 |

|---|---|

| Water & Wastewater Treatment Expansion | Artificial Intelligence-driven foam detection in wastewater processing, biodegradable defoamers, and nanotech-based foam suppression solutions. |

| Food & Beverage Processing | Biobased, non-toxic defoamers with Artificial Intelligence monitored food production optimization and smart dosing systems. |

| Industrial Coatings, Paints, & Adhesives | Next-gen graphene-infused defoamers that provide enhanced durability, AI-assisted surface quality monitoring, and VOC-free defoamer formulations. |

| Pulp & Paper Industry Growth | Smart sensor-enabled foam control, AI-assisted pulp processing optimization, and bio-derived foam inhibitors. |

| Sustainability & Eco-Friendly Defoamer Trends | AI-accomplishable e-green chemistry formulations, carbon-neutral(defoamer) production, and plant-based defoamers. |

| Advancements in Nanotechnology & AI Integration | Nan0-engineered defoamers with self-adaptive foam suppression and AI assistant process monitoring. |

| Market Growth Drivers | Market solution of product with the first-to-market AI ribbon & smart biodegradable technology, which comes with improved manufacturing processes. |

The defoamers market in the USA is witnessing steady growth brought about by more industrial applications, heightened water treatment demands, and the rising trend in the adoption of defoamers in food and beverage processing. The wastewater management standards set by the Environmental Protection Agency (EPA) are encouraging companies to use sustainable defoaming agents to enhance water treatment efficacy.

The progress of the chemical, pharmaceutical, and pulp & paper industries in the USA is additionally boosting the requirement for high-performance defoamers that can positively impact the process efficiency and reduce foam-related operational disruptions. Equally, food processing and brewing sectors are observing a boom in the utilization of food-grade defoamers to maintain product quality and to adhere to the FDA standards.

The orientation of the market is plastic-free, silicone-free, and biodegradable defoamers instead of traditional defoamers to meet the sustainability goals and conform to related regulations as a result of the technological innovations.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.3% |

The United Kingdom defoamers market is showing moderate growth, buoyed with the expansion of wastewater treatment, pharmaceutical manufacturing, and construction applications of defoamers in coatings and other areas.

Environmental policies in the UK are spurring the installation of industrial and municipal wastewater treatment plants with high-efficiency defoamers to bring about better performance through the removal of foams. Moreover, the rising trend of low-VOC and environment-friendly defoamers in the paints, coatings, and adhesives sector is also aiding the market's growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.3% |

The defoamers market in the European Union is rapidly developing and thriving due to the regulatory pressures on the environment, the increasing utilization of defoamers in industrial processing, and the growing demand in the behavioral and environmental sectors.

The EU's Water Framework Directive and the regulations related to industrial emissions promote the incorporation of efficient defoamers in the wastewater treatment and chemical manufacturing system. Besides, the major European manufacturers of paints and coatings, and adhesives are adopting more green alternatives for defoaming agents to abide by the VOC emissions policies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.1% |

The Japan defoamers market has been witnessing a moderate growth trend, which is attributable to the expanding sectors such as electronics, semiconductors, industrial water treatment chemical, and pharmaceutical processing that are utilizing the product.

The high-tech manufacturing sector of Japan, which mainly consists of semiconductors, electronics, and the specialty chemicals industry, is in need of precision-grade defoamers to ensure contamination-free methods of production. Furthermore, the growth of wastewater recycling systems and ultra-pure water systems are the main reasons for the increased usage of high-performance defoamers in industrial filters.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The South Korean defoamers market is developing on the back of escalating requirements in petrochemical processing, semiconductor manufacturing, and wastewater treatment sectors.

With the fabrication of semiconductors being the main thing that South Korea does, a variety of specialized low-contamination defoamers are prevalently required in chip-making and precision chemical processing. Besides, the expansion of the country's petrochemical and refining industries proves to be a powerful force by pushing the popularity of high-efficiency defoamers that, in turn, improve the situation of the lost time and operating costs.

Marking this as one of the major steps in the protection of the environment and helping the municipal water treatment facilities improve wastewater recycling and industrial water treatment, the South Korean government has also put its seal on these initiatives that favor market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The global defoamers market is witnessing a steady rise in sales due to increased demand from manufacturing units in sectors like wastewater treatment, food processing, paper & pulp, paints & coatings, and pharmaceuticals. Defoamers, which are alternatively known as anti-foaming agents, are typically employed in industrial processes to counteract foam formation, thus allowing for enhanced operation and product quality.

Another reason why the silicone section is huge is advancements in silicone-based and bio-based defoamer formulations, regulations that have been increasing on the issue of wastewater treatment, and the high-performance additives industry, which is getting bigger due to more investments.

Some of the foremost manufacturers are now leaning toward the production of low-VOC, non-toxic, and eco-friendly defoaming solutions, which are helpful in sustainable industrial applications and fulfilling regulatory requirements.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kemira Oyj | 8-12% |

| Evonik Industries AG | 6-10% |

| BASF SE | 5-9% |

| Dow Chemical Company | 4-8% |

| Shin-Etsu Chemical Co., Ltd. | 5-8% |

| Ecolab | 3-6% |

| Wacker Chemie | 2-5% |

| Other Companies (combined) | 65-70% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kemira Oyj | Water-based and silicone-free defoamers are from a global market leader, and thereby, they have high-performance solutions for pulp & paper, wastewater treatment, and industrial processes. |

| Evonik Industries AG | Logos silicone & no-silicone defoamers are the only ones on the market that ensure superior foam control in coatings, adhesives, and food processing industries. |

| BASF SE | An eco-friendly chemical company that provides versatile defoaming agents for paints & coatings, construction chemicals, and industrial applications by integrating eco-friendly formulations. |

| Dow Chemical Co. | Emulsion and silicone-based defoamers are their specialty which are of high stability and compatibility with many industrial fluids. |

| Shin-Etsu Chemical Co., Ltd. | Offers an innovative anti-foaming solution for the semiconductor, electronics, and chemical manufacturing industries by using the low-VOC, high-efficiency formula. |

| Ecolab | Offers defoamers for food & beverage, healthcare, and wastewater treatment, which are like regulatory compliance and process efficiency. |

| Wacker Chemie | Two types of defoamers are available-Both silicone-based and hybrid, they are used in coatings, personal care, and pharmaceutical applications. |

Key Company Insights

Kemira Oyj

Kemira is a world-renowned industrial water treatment and specialty chemicals company that offers high-performance, water-based, and silicone-free defoamers. The Fennosil and FennoCare defoamer lines of the company are the best. They got benefits such as strong foam suppression, low chemical consumption, and very high efficiency in the paper and pulp industry as well as in wastewater treatment. The utility is adding on sustainable alternatives that help in addressing environmental issues of defoaming solutions.

Evonik Industries AG

Evonik is an expert in silicone and non-silicone defoamers, as well as the food and coating industries. The company’s TEGO and Surfynol series incorporate low-VOC, high-efficiency formulations, thus facilitating better foam control and applicability to various chemical systems. Evonik is making investments in the development of bio-based defoamers, which would be used in sustainable industrial applications.

BASF SE

BASF stands as a major supplier of multifunctional defoamers. It has the ability to supply top-quality formulations for paints[]& coatings, industrial processing, and construction chemicals. The company’s Foamaster and Basopur series provide long-lasting foam control, optimized stability, and environmental compliance. The supplier is working on the development of low-emission. These biodegradable defoamer technologies will go hand in hand with the sustainability goals set by the company and the industry worldwide.

Dow Chemical Company

Dow Chemical is a prominent player in the silicone-based and emulsion defoamer segments, with a remarkable performance in the stability and foam suppression of agriculture, coatings, and wastewater treatment applications. What’s more, the company’s DOWSIL and XIAMETER defoamers benefit from low-surface-energy performance, compatibility, and processing efficiency improvements. Dow is on its way to bringing in more green defoamer solutions through the introduction of formulations that are non-hazardous, and biodegradable as well.

Shin-Etsu Chemical Co., Ltd.

Shin-Etsu is the one-stop shopping choice for advanced foam reduction solutions for the semiconductor, electronics, and chemical manufacturing sectors. The company’s Shin-Etsu Silicones product line guarantees consistent high-efficiency foam suppression, thermal stability, and less contamination risk. In the area of electronic-grade defoamers, Shin-Etsu is investing heavily in developing next-gen products, thus ensuring high performance in microelectronic manufacturing.

Ecolab

Ecolab is a proficient manufacturer of defoamers for food(b)& beverage processing, healthcare(healthcare)& industrial water treatment, reassured of regulatory compliance and better operational efficiency. The company’s Nalco Water Defoamers are food grade and non-toxic thus can be used in the most sensitive applications with improved safety. Apart from introducing AI in the overall operational process, Ecolab is also expanding its monitoring solutions to achieve better defoaming.

Wacker Chemie

Wacker Chemie, like its other counterparts, also provides hybrid and silicone-based defoamers. It shows its diverse application in coatings, personal care, and pharmaceutical fields. The company’s SILFOAM and WACKER Defoamer exhibit long foam suppression, superior dispersibility, and excellent chemical compatibilityWacker Chemie is cutting back on the carbon footprint through the introduction of low-emission, and powerful defoamer technologies.

Powder, Silicone, Oil, Emulsion, Polymer

Aqueous Systems, Solvent based Systems

Chemicals, Textile, Construction Materials, Paints & Coatings, Pulp & Paper, Food Processing, Pharmaceuticals, Household & Personal Care, Water & Wastewater Treatment

North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia and Pacific, Middle East and Africa

The global defoamers market is projected to reach USD 1.5 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 4.2% over the forecast period.

By 2035, the defoamers market is expected to reach USD 2.2 billion.

The silicone-based defoamers segment is expected to dominate due to their superior efficiency, high stability, and increasing use in industries such as food & beverage, water treatment, and paints & coatings.

Key players in the defoamers market include BASF SE, Evonik Industries AG, Dow Inc., Ashland Global, and Shin-Etsu Chemical Co., Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Medium of Dispersion, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Medium of Dispersion, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Medium of Dispersion, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Medium of Dispersion, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Medium of Dispersion, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Medium of Dispersion, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Medium of Dispersion, 2018 to 2033

Table 30: Europe Market Volume (Tons) Forecast by Medium of Dispersion, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Medium of Dispersion, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tons) Forecast by Medium of Dispersion, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Medium of Dispersion, 2018 to 2033

Table 46: MEA Market Volume (Tons) Forecast by Medium of Dispersion, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Medium of Dispersion, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Medium of Dispersion, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Medium of Dispersion, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Medium of Dispersion, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Medium of Dispersion, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Medium of Dispersion, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Medium of Dispersion, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Medium of Dispersion, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Medium of Dispersion, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Medium of Dispersion, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Medium of Dispersion, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Medium of Dispersion, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Medium of Dispersion, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Medium of Dispersion, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Medium of Dispersion, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Medium of Dispersion, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Medium of Dispersion, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Medium of Dispersion, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Medium of Dispersion, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Medium of Dispersion, 2018 to 2033

Figure 86: Europe Market Volume (Tons) Analysis by Medium of Dispersion, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Medium of Dispersion, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Medium of Dispersion, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Medium of Dispersion, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Medium of Dispersion, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Medium of Dispersion, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tons) Analysis by Medium of Dispersion, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Medium of Dispersion, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Medium of Dispersion, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Medium of Dispersion, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Medium of Dispersion, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Medium of Dispersion, 2018 to 2033

Figure 134: MEA Market Volume (Tons) Analysis by Medium of Dispersion, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Medium of Dispersion, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Medium of Dispersion, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Medium of Dispersion, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Foaming Agents / Defoamers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA