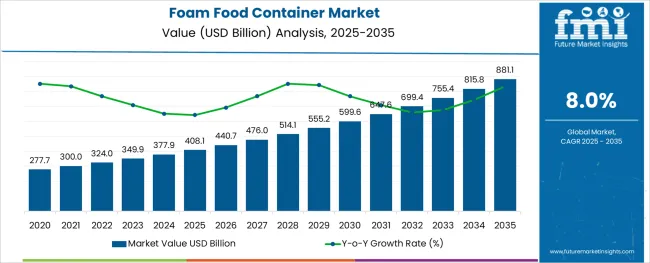

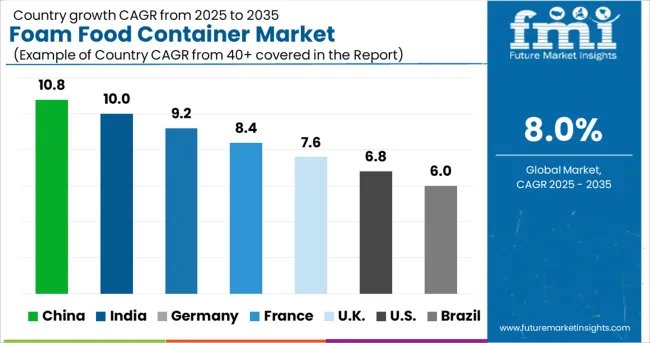

The Foam Food Container Market is estimated to be valued at USD 408.1 billion in 2025 and is projected to reach USD 881.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The foam food container market continues to show strong presence across the foodservice and packaging sectors, primarily driven by demand for cost effective, lightweight, and thermally insulating food packaging solutions. Despite growing environmental concerns, expanded polystyrene-based containers remain in widespread use due to their low cost, structural rigidity, and heat-retention properties.

The proliferation of quick-service restaurants (QSRs), rising takeaway culture, and increased consumption of convenience foods have contributed to sustained demand for foam based packaging. Manufacturers are responding to regulatory and consumer pressures by investing in recycling initiatives, exploring biodegradable foam alternatives, and engaging in packaging redesigns to reduce waste volume.

At the same time, supply chain efficiencies and bulk procurement by institutional buyers have bolstered the market's stability. The future outlook remains cautiously optimistic as companies balance environmental regulations with the need for affordable and practical food packaging, especially in high-volume, low-margin food operations.

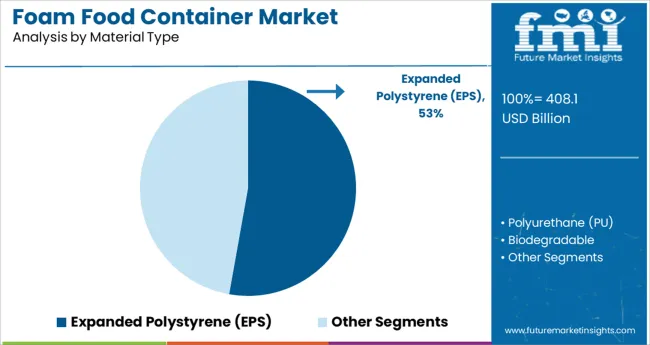

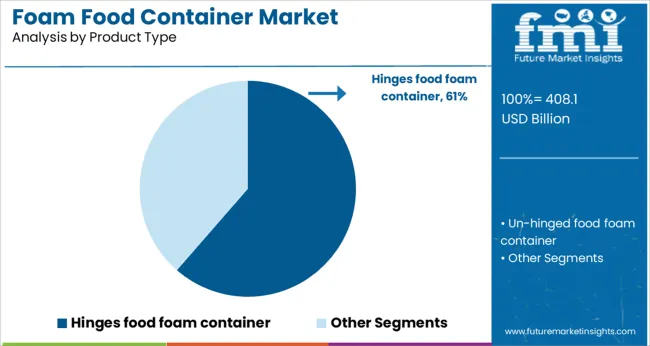

The market is segmented by Material Type, Product Type, Distribution Channel, and Application and region. By Material Type, the market is divided into Expanded Polystyrene (EPS), Polyurethane (PU), and Biodegradable. In terms of Product Type, the market is classified into Hinges food foam container and Un-hinged food foam container.

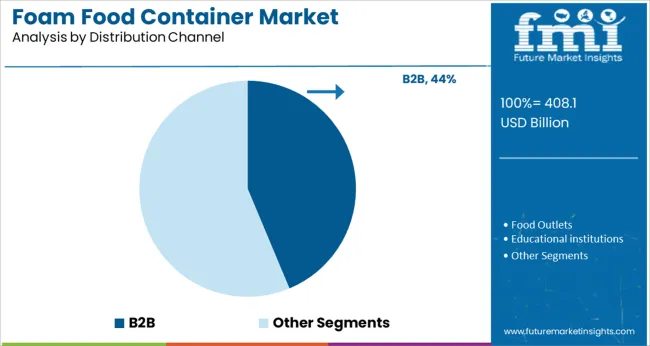

Based on Distribution Channel, the market is segmented into B2B, Food Outlets, Educational institutions, Corporate offices, Healthcare, B2C, Online retail / Ecommerce, Supermarket / Hypermarket, Convenience stores, and Mom and Pop stores. By Application, the market is divided into Ready to eat food, Frozen food, Ice cream & dairy products, Bakery & confectionery food items, and Meat, seafood & poultry items. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is noted that the expanded polystyrene (EPS) sub-segment constitutes 52.80% of the total market under the material type category, making it the leading material choice. This dominance is driven by EPS’s inherent properties such as lightweight composition, superior insulation capabilities, and high cost-efficiency. The material’s ability to maintain food temperature while resisting moisture and physical impact has supported its continued preference, particularly among high-volume foodservice establishments.

Its ease of molding and scalability in manufacturing have also contributed to widespread adoption across both standardized and customized container formats. Additionally, industry reliance on bulk, disposable packaging for perishable items has further solidified EPS’s leading position despite growing environmental scrutiny.

The segment’s resilience is underpinned by ongoing investments in post-consumer recycling programs and technological innovations aimed at reducing environmental load.

Hinges food foam containers are expected to account for 61.40% of total market revenue within the product type category, marking them as the most dominant format. This leadership is attributed to the convenience and secure closure offered by hinged designs, which prevent spills and preserve food integrity during transit. Their utility in packaging both hot and cold meals has made them indispensable in quick-service restaurants, food trucks, and institutional catering services.

The single-piece construction reduces production complexity and assembly time, streamlining operational efficiency for high-volume users. Additionally, these containers provide stackability and ease of storage, making them suitable for compact storage solutions in commercial kitchens.

The reinforced edge sealing and improved insulation performance have further contributed to their dominance, especially in takeaway and delivery-centric foodservice operations.

The B2B distribution channel holds a 43.70% share of the overall market, positioning it as a key contributor within the distribution structure. This segment’s strength is driven by direct procurement practices adopted by institutional buyers, foodservice chains, and wholesale distributors aiming to manage large-scale supply needs. Bulk ordering, negotiated pricing contracts, and reliable supply timelines have made B2B transactions more favorable for vendors operating on slim margins.

Foam food containers are typically purchased in large volumes by hospitals, universities, and catering businesses, reinforcing the B2B channel’s economic viability. Furthermore, long-term vendor relationships and compliance-driven sourcing have encouraged repeat business, stabilizing demand patterns across this channel.

As manufacturers streamline logistics and optimize fulfillment systems to cater to enterprise clients, the B2B channel continues to exhibit steady performance and remains integral to the market’s overall growth trajectory.

Foam food container are mainly used for ready to eat food products which need to be consumed within 1-2 days. Foam food containers are mainly used in restaurants and food outlets which are mainly used for packaging of ready to eat food like burgers, sandwiches, hot dog, etc.

Key players for foam food container market can be segmented based on Tier 1, Tier2 and Tier 3 based categories.

Tier 1 players: Genpak, LLC, Dart Container Corporation, Biopac India Corporation Ltd., Landaal Packaging Systems, Inc., Harwal Group of Companies, etc.

Tier 2 players: Great Northern Corporation, Megafoam Containers Enterprise Sdn Bhd, Republic Plastics, Ltd., Styrotech Corporation, Packaging Resources Inc., Beltec Sdn bhd, Citi Pak LLC, etc.

Tier 3 players: Reach Plastic Industrial Co., Ltd., Di Xiang Trading Co., Ltd., Bestern Industry And Trade Co., Ltd., Luheng Papers Company Ltd., Jeafer Foodservice Solutions Ltd., Industrial (Shenzhen) Co., Ltd., ZBR Packaging Materials Co., Ltd., etc.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global foam food container market is estimated to be valued at USD 408.1 billion in 2025.

It is projected to reach USD 881.1 billion by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are expanded polystyrene (eps), polyurethane (pu) and biodegradable.

hinges food foam container segment is expected to dominate with a 61.4% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Foam Cooler Box Market Analysis - Growth & Trends 2025 to 2035

Foam Packaging Inserts Market Analysis, Size, Share & Forecast 2025 to 2035

Foam Labels Market Trends and Growth 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA