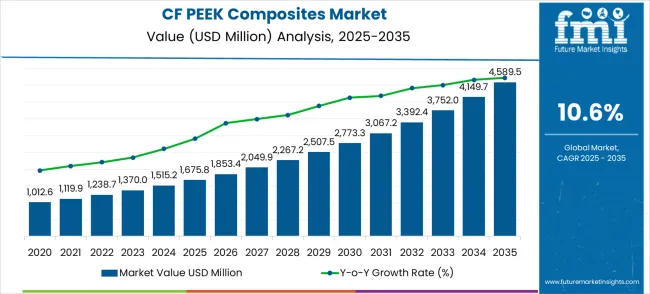

The CF PEEK Composites Market is valued at USD 1,675.8 million in 2025 and is forecasted to reach USD 4,589.5 million by 2035, reflecting a CAGR of 10.6%. From 2021 to 2025, the market grows from USD 1,012.6 million to USD 1,675.8 million, with intermediate values of USD 1,119.9 million, USD 1,238.7 million, USD 1,370.0 million, and USD 1,515.2 million. This early growth is fueled by the increasing demand for CF/PEEK composites in industries such as aerospace, automotive, and healthcare, where high-strength, lightweight materials are critical for performance and efficiency. The adoption of these composites in advanced manufacturing processes helps drive their growing share in these sectors, especially in components requiring excellent mechanical properties and resistance to harsh environments

Between 2026 and 2030, the market is expected to continue expanding from USD 1,675.8 million to USD 2,773.3 million, passing through USD 1,853.4 million, USD 2,049.9 million, and USD 2,267.2 million. This period reflects a higher rate of market penetration, particularly in the aerospace and automotive industries, where fuel efficiency, high strength-to-weight ratio, and durability are essential. The introduction of more advanced applications, including in medical devices and next-generation transport solutions, contributes to this robust growth. By 2030, the market will reach USD 3,067.2 million, driven by technological advancements and increasing demand for lighter, stronger materials. From 2031 to 2035, the market is expected to further accelerate, reaching USD 4,589.5 million, with values progressing through USD 3,392.4 million, USD 3,752.0 million, and USD 4,149.7 million, supported by the continued adoption of CF/PEEK composites in a wide range of industries.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,676 million |

| Forecast Value in (2035F) | USD 4,589.5 million |

| Forecast CAGR (2025 to 2035) | 10.6% |

The aerospace and defense market contributes about 35-40%, driven by the increasing demand for lightweight, high-strength materials in aircraft, spacecraft, and defense applications, where CF/PEEK composites are valued for their superior mechanical properties, high thermal stability, and resistance to chemical degradation. The automotive market adds roughly 20-25%, as the automotive industry adopts CF/PEEK composites to reduce vehicle weight and improve fuel efficiency, particularly in high-performance and electric vehicles.

The industrial equipment market contributes around 15-18%, as CF/PEEK composites are used in manufacturing parts and components for machinery, such as gears, bearings, and seals, due to their strength and wear resistance. The medical devices market accounts for approximately 10-12%, driven by the use of CF/PEEK composites in implants, surgical tools, and prosthetics, where biocompatibility and mechanical strength are critical. The electronics market contributes about 8-10%, as CF/PEEK composites are increasingly used in advanced electronics for components requiring high durability, heat resistance, and electrical insulation.

Market expansion is being supported by the increasing demand for lightweight, high-strength materials in aerospace and automotive applications, creating corresponding need for advanced composite solutions that can provide superior performance characteristics while reducing overall system weight and improving fuel efficiency. Modern aerospace and automotive designs require sophisticated material solutions that can withstand extreme operating conditions while maintaining structural integrity, dimensional stability, and long-term reliability across diverse environmental challenges. CF/PEEK composites provide the necessary strength, stiffness, and thermal resistance to ensure optimal performance in demanding applications while offering significant weight reduction benefits.

The growing emphasis on eco-friendliness and energy efficiency across transportation and industrial sectors is driving demand for advanced composite materials that enable lighter structures, improved fuel economy, and enhanced operational efficiency while maintaining superior performance characteristics. Advanced applications require materials that deliver exceptional mechanical properties, chemical resistance, and thermal stability while supporting comprehensive design optimization and manufacturing efficiency. Regulatory requirements and industry standards are establishing stringent performance and safety protocols that necessitate specialized composite technologies with validated characteristics and thorough testing documentation.

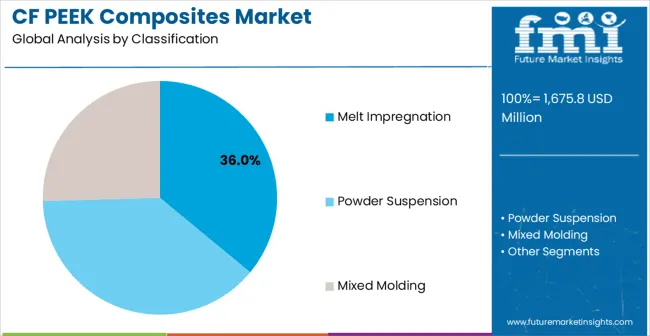

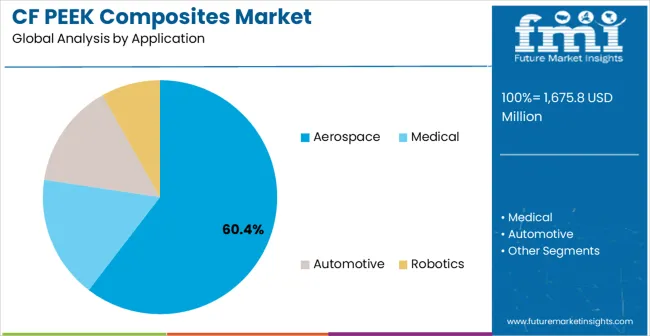

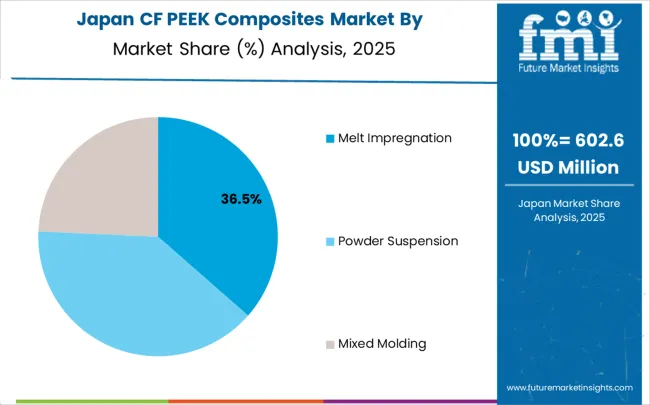

The market is segmented by manufacturing process, end-use industry, and region. By manufacturing process, the market is divided into melt impregnation, powder suspension, and mixed molding. Based on end-use industry, the market is categorized into aerospace, medical, automotive, and robotics. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Melt impregnation manufacturing processes are projected to account for 36.0% of the CF PEEK Composites Market in 2025. This leading share is supported by the superior fiber-matrix interface characteristics and consistent quality performance that melt impregnation techniques provide for high-performance composite applications. Melt impregnation processes offer excellent fiber wet-out, uniform resin distribution, and optimized mechanical properties that make them preferred manufacturing approaches for aerospace, automotive, and medical applications requiring superior performance reliability. The segment benefits from established processing capabilities, comprehensive quality control protocols, and extensive validation databases that facilitate adoption across demanding applications requiring consistent performance characteristics.

Melt impregnation composite manufacturing technology continues advancing through development of enhanced processing parameters, improved temperature control systems, and optimized fiber handling techniques that support next-generation composite requirements and manufacturing efficiency optimization. The segment growth reflects increasing adoption of melt impregnation processes in expanding aerospace manufacturing facilities and growing automotive composite applications that require superior mechanical properties and manufacturing consistency. Manufacturers are developing next-generation melt impregnation systems with automated processing capabilities, comprehensive monitoring systems, and enhanced quality assurance that address evolving composite requirements while maintaining optimal processing efficiency and product quality standards.

Automotive applications are expected to represent 60.4% of CF/PEEK composite demand in 2025. This dominant share reflects the extensive adoption of lightweight composite materials in automotive manufacturing for weight reduction, fuel efficiency improvement, and performance enhancement across diverse vehicle systems and components. Modern automotive applications utilize CF/PEEK composites for structural components, under-the-hood applications, and electric vehicle components that require exceptional strength, thermal resistance, and chemical compatibility while contributing to overall vehicle weight optimization. The segment benefits from ongoing automotive electrification trends, increasing fuel efficiency requirements, and growing demand for high-performance materials that support advanced vehicle technologies.

Automotive industry transformation toward electric and autonomous vehicle technologies is driving significant CF/PEEK composite demand as manufacturers implement lightweight materials for battery enclosures, structural reinforcements, and thermal management systems requiring superior performance characteristics. The segment expansion reflects increasing emphasis on vehicle efficiency optimization, emission reduction, and advanced material integration that depend on superior composite performance and comprehensive application validation. Advanced automotive applications are incorporating CF/PEEK composites in critical safety systems, powertrain components, and chassis applications that require sophisticated material technologies with enhanced performance characteristics and comprehensive reliability validation.

The CF PEEK Composites Market is advancing rapidly due to increasing demand for lightweight high-performance materials and growing adoption of advanced composites in critical applications. The market faces challenges including high material costs, complex processing requirements, and limited processing infrastructure for specialized applications. Technological advancement efforts and cost reduction initiatives continue to influence product development and market expansion patterns.

The growing implementation of automated manufacturing systems and next-generation processing technologies in CF/PEEK composite production is enabling enhanced quality consistency, improved manufacturing efficiency, and reduced production costs while maintaining superior performance characteristics. Advanced manufacturing approaches provide precision process control, comprehensive quality monitoring, and optimized production throughput that support cost-effective composite manufacturing for diverse applications. These technological advances enable manufacturers to achieve higher levels of production efficiency and quality consistency while reducing manufacturing costs and improving market accessibility for advanced composite materials.

CF/PEEK composite manufacturers are developing eco-conscious material approaches and circular economy integration that enable material recycling, waste reduction, and comprehensive environmental responsibility while maintaining superior performance characteristics. Green composite technologies provide renewable content integration, recyclability enhancement, and comprehensive lifecycle optimization that support environmental compliance and corporate responsibility objectives. These environmentally responsible innovations foster broader market adoption by providing enhanced environmental benefits and comprehensive green compliance that meet evolving regulatory requirements and customer expectations for eco-friendly advanced materials.

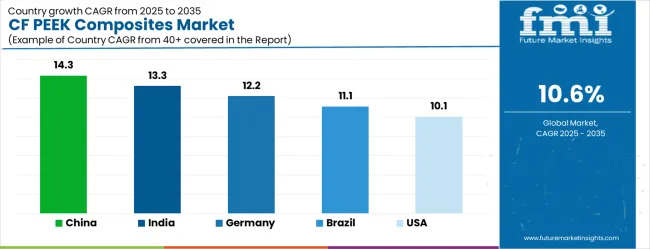

| Country | CAGR (2025-2035) |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| Brazil | 11.1% |

| United States | 10.1% |

| United Kingdom | 9.0% |

| Japan | 8.0% |

The CF PEEK Composites Market demonstrates varied growth patterns across key countries, with China leading at a 14.3% CAGR through 2035, driven by massive aerospace industry development, automotive electrification initiatives, and government support for advanced materials manufacturing. India follows at 13.3%, supported by expanding aerospace manufacturing capabilities, growing automotive industry, and increasing foreign investment in advanced materials production. Germany records 12.2% growth, emphasizing precision manufacturing excellence, aerospace industry leadership, and automotive innovation capabilities. Brazil shows strong growth at 11.1%, developing aerospace industry capabilities and expanding automotive manufacturing. The United States maintains 10.1% growth, focusing on aerospace technology leadership and automotive electrification. The United Kingdom demonstrates 9.0% expansion, supported by aerospace industry excellence and advanced materials research. Japan records 8.0% growth, leveraging manufacturing precision and advanced materials expertise.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from CF/PEEK composites in China is projected to expand at the highest growth rate with a CAGR of 14.3% through 2035, driven by unprecedented aerospace industry development, comprehensive automotive electrification programs, and government support for advanced materials manufacturing capabilities. The country's ambitious aerospace development includes commercial aircraft manufacturing, space exploration programs, and military aviation advancement that require sophisticated composite materials with superior performance characteristics. Major automotive manufacturers are implementing extensive electrification programs that demand lightweight materials for battery systems, structural components, and thermal management applications. Government initiatives promoting advanced materials development are driving domestic production capabilities and technology advancement across composite manufacturing sectors. Leading international aerospace and automotive companies are establishing manufacturing facilities that require comprehensive composite supply chains and technical expertise.

The CF PEEK Composites Market in India is projected to grow at a CAGR of 13.3%, supported by expanding aerospace manufacturing capabilities, growing automotive industry development, and increasing foreign direct investment in advanced materials production and technology development. The country's comprehensive aerospace development includes domestic aircraft manufacturing, defense applications, and space program advancement that require high-performance composite materials with superior characteristics. Government programs promoting advanced manufacturing are creating favorable conditions for composite material adoption and technology development. Major international companies are establishing manufacturing facilities that require comprehensive composite material capabilities and technical support services. Educational institutions and research organizations are developing expertise that supports advanced composite applications and manufacturing requirements.

Demand for CF/PEEK composites in Germany is projected to expand at a CAGR of 12.2%, supported by the country's leadership in precision manufacturing, aerospace industry excellence, and automotive innovation capabilities across diverse advanced technology sectors. German manufacturers are implementing sophisticated composite solutions that meet stringent quality standards while supporting complex aerospace and automotive applications requiring superior performance characteristics. The country's extensive aerospace industry is driving significant composite demand for commercial aircraft components, defense applications, and advanced propulsion systems. Research institutions are collaborating with industry partners to develop next-generation composite technologies that maintain German competitiveness in global advanced materials markets. Advanced manufacturing partnerships are facilitating technology development and knowledge sharing across composite suppliers and aerospace manufacturers.

The CF PEEK Composites Market in Brazil is projected to expand at a CAGR of 11.1%, driven by expanding aerospace industry capabilities, growing automotive manufacturing, and increasing emphasis on advanced materials development across diverse industrial applications. Brazilian aerospace companies are investing in composite materials to enhance aircraft performance and support competitive positioning in global aviation markets while building domestic manufacturing capabilities. Government programs supporting aerospace development are facilitating access to advanced materials technologies and comprehensive technical expertise. Regional manufacturing centers are developing specialized capabilities that support composite applications across aerospace, automotive, and industrial sectors. International partnerships are providing technology transfer opportunities and technical assistance for advanced composite implementations.

Demand for CF/PEEK composites in the United States is projected to grow at a CAGR of 10.1%, driven by aerospace technology leadership, automotive electrification programs, and comprehensive advanced materials research and development initiatives. American aerospace companies are implementing sophisticated composite solutions to maintain global competitiveness while supporting cutting-edge aircraft development and space exploration programs. The automotive industry is driving significant composite demand for electric vehicle applications, autonomous vehicle systems, and advanced powertrain components requiring superior performance characteristics. Government initiatives supporting advanced materials research are creating substantial demand for innovative composite technologies and comprehensive development programs. Regional technology clusters are developing specialized expertise that supports diverse composite applications and emerging technology requirements.

The sale of CF/PEEK composites in the United Kingdom is projected to expand at a CAGR of 9.0%, supported by aerospace industry excellence, advanced materials research capabilities, and increasing emphasis on high-performance composite development across diverse applications. British aerospace companies are investing in composite materials to support advanced aircraft programs, defense applications, and comprehensive technology development while maintaining competitive positioning in global markets. The country's strong research infrastructure is facilitating technology development and innovation across diverse composite requirements and applications. Government initiatives supporting aerospace industry development are creating favorable conditions for composite material adoption and technology advancement. Advanced research partnerships are enabling knowledge sharing and technical collaboration that supports comprehensive composite implementation across aerospace and industrial applications.

Revenue from CF/PEEK composites in Japan is projected to expand at a CAGR of 8.0%, supported by manufacturing precision capabilities, advanced materials expertise, and comprehensive emphasis on technology excellence across diverse high-performance applications. Japanese manufacturers are implementing sophisticated composite solutions that demonstrate superior performance characteristics while supporting various aerospace, automotive, and industrial applications requiring exceptional quality and reliability. The country's aerospace and automotive industries are driving demand for high-performance composites that support precision manufacturing and comprehensive quality requirements. Collaborative research programs between industry and academic institutions are developing innovative composite technologies that maintain Japan's competitive advantage in global advanced materials markets. Quality management systems and continuous improvement principles are driving adoption of composite solutions that enhance manufacturing excellence and application performance. Advanced materials research is enabling development of next-generation composite technologies that provide enhanced performance characteristics and comprehensive application optimization.

The CF PEEK Composites Market in Europe is projected to expand from USD 453.2 million in 2025 to USD 1,241.9 million by 2035, registering a CAGR of 11% over the forecast period. Germany is expected to maintain its leadership with 31.8% market share in 2025, projected to grow to 32.3% by 2035, supported by its extensive aerospace and automotive industry capabilities and advanced composite manufacturing infrastructure. France follows with 20.4% market share in 2025, expected to reach 20.7% by 2035, driven by aerospace industry leadership and advanced materials development programs.

The Rest of Europe region is projected to maintain stable share at 18.9% throughout the forecast period, attributed to emerging composite manufacturing initiatives in Eastern European countries and expanding advanced materials applications. United Kingdom contributes 15.6% in 2025, projected to reach 15.3% by 2035, supported by aerospace industry development and advanced materials research capabilities. Italy maintains 13.3% share in 2025, expected to grow to 14.7% by 2035, while other European countries demonstrate steady growth patterns reflecting regional aerospace and automotive industry development.

The CF PEEK Composites Market is characterized by competition among established polymer manufacturers, specialized composite producers, and advanced materials companies. Companies are investing in advanced manufacturing technologies, product innovation programs, comprehensive technical support services, and strategic partnerships to deliver high-performance, reliable, and cost-effective composite solutions. Strategic collaborations, technological advancement, and market expansion initiatives are central to strengthening product portfolios and application expertise.

Toray Industries, Inc., Japan-based, offers comprehensive CF/PEEK composite solutions with focus on aerospace applications, advanced manufacturing processes, and global technical support capabilities across diverse high-performance applications. Victrex plc (Victrex) UK, provides specialized PEEK polymer technologies emphasizing performance optimization, application development, and comprehensive customer support for demanding composite applications. Evonik Industries AG (Evonik), Germany, delivers advanced materials technologies with focus on automotive applications, aerospace systems, and comprehensive technical expertise.

Solvay S.A. (Solvay) offers extensive composite material solutions with emphasis on aerospace industry leadership, advanced manufacturing capabilities, and comprehensive application support. ZYPEEK specializes in high-performance PEEK materials with focus on automotive applications and advanced composite development. Shenzhen WOTE Advanced Materials and other Chinese manufacturers including Shandong Kaisheng New Materials, Pfluon, Nanjing Shousu Special Engineering Plastics Products, Shandong Haoran special plastics, and Jiangsu Junhua Special Polymer Materials contribute specialized expertise and comprehensive manufacturing capabilities across regional and global markets.

CF/PEEK (Carbon Fiber/Polyetheretherketone) composites represent the pinnacle of high-performance engineering materials, combining exceptional strength-to-weight ratios with chemical resistance and temperature stability. With the market surging from $1,675.8M to $4,589.5M at 11% CAGR, driven by aerospace lightweighting demands, medical implant innovation, and automotive electrification, this advanced materials sector requires coordinated stakeholder action to address manufacturing scalability, cost optimization, and application development challenges.

How Governments Could Accelerate Advanced Materials Leadership?

Strategic Materials Initiative: Recognize CF/PEEK composites as critical materials for national competitiveness and establish dedicated funding for domestic manufacturing capabilities, reducing dependence on foreign suppliers for aerospace and defense applications.

Advanced Manufacturing Infrastructure: Invest in national research facilities for composite processing technology development including automated fiber placement, additive manufacturing, and in-situ consolidation techniques that enable next-generation production capabilities.

Aerospace & Defense Procurement: Leverage government purchasing power through military and space programs to create demand certainty for domestic CF/PEEK suppliers while advancing state-of-the-art applications in critical defense systems.

Research & Development Funding: Support fundamental research in PEEK chemistry, carbon fiber surface treatments, and processing optimization that maintains technological leadership in high-performance composites essential for advanced manufacturing.

Skilled Workforce Development: Fund specialized training programs in composite manufacturing, advanced materials engineering, and automated production systems to address the critical shortage of qualified personnel in high-tech materials sectors.

How Materials Standards Organizations Could Enable Market Expansion?

Performance Characterization Standards: Establish comprehensive testing protocols for CF/PEEK composite mechanical properties, environmental resistance, and long-term durability that enable reliable design data and supplier qualification across applications.

Manufacturing Quality Standards: Develop process control guidelines for different CF/PEEK manufacturing methods (melt impregnation, powder suspension, mixed molding) ensuring consistent quality and enabling process optimization across suppliers.

Application-Specific Guidelines: Create tailored standards for aerospace (damage tolerance, fire resistance), medical (biocompatibility, sterilization), and automotive (crash performance, environmental exposure) applications addressing specific regulatory requirements.

Recycling & Environmental Protocols: Establish standards for CF/PEEK composite end-of-life processing, recycling methods, and eco-impact assessment that address growing environmental concerns while maintaining performance requirements.

International Harmonization: Lead global coordination on CF/PEEK testing methods and qualification procedures enabling international trade and reducing duplicative certification requirements for global suppliers.

How Composite Manufacturers Could Maximize Market Opportunities?

Process Innovation Leadership: Develop proprietary manufacturing technologies that improve fiber-matrix integration, reduce void content, and enable complex geometries while maintaining the exceptional properties that justify CF/PEEK premium pricing.

Application-Specific Optimization: Engineer specialized CF/PEEK formulations and processing methods optimized for specific end-uses rather than generic approaches, creating differentiated products with superior performance characteristics.

Automated Manufacturing Integration: Invest in advanced automation including robotic fiber placement, intelligent process monitoring, and quality control systems that enable consistent production at scale while reducing labor costs.

Technical Service Excellence: Provide comprehensive application engineering, design optimization, and processing support that creates customer dependency and enables premium pricing through superior technical partnership.

Supply Chain Integration: Establish vertical integration or strategic partnerships spanning PEEK resin production, carbon fiber supply, and composite processing to control quality and costs throughout the value chain.

How End-User Industries Could Optimize Composite Value?

Design-for-Manufacturing Excellence: Integrate CF/PEEK composite capabilities into product design from initial concepts rather than material substitution, maximizing weight savings and performance benefits while optimizing manufacturing feasibility.

Lifecycle Cost Analysis: Implement comprehensive cost models that consider CF/PEEK composites' superior durability, reduced maintenance requirements, and end-of-life value rather than focusing solely on initial material costs.

Performance Validation Programs: Develop rigorous testing and validation protocols that demonstrate CF/PEEK composite performance advantages in real-world applications, building confidence for expanded use in critical applications.

Supply Chain Partnership: Establish long-term strategic relationships with CF/PEEK suppliers including joint technology development, capacity planning, and risk sharing to ensure material availability and performance optimization.

Cross-Industry Knowledge Transfer: Participate in industry consortiums sharing CF/PEEK application experience and best practices across aerospace, medical, and automotive sectors to accelerate learning and adoption.

How Raw Material Suppliers Could Strengthen the Value Chain?

PEEK Resin Optimization: Develop enhanced PEEK formulations with improved processability, environmental resistance, and specific performance characteristics tailored for composite applications rather than generic polymer grades.

Carbon Fiber Integration: Create specialized carbon fiber surface treatments and sizing systems optimized for PEEK matrix compatibility, improving interfacial bonding and composite performance.

Processing Aid Development: Formulate specialized additives, release agents, and processing aids that optimize CF/PEEK manufacturing while maintaining final composite properties and regulatory compliance.

Quality Assurance Excellence: Implement advanced quality control systems ensuring consistent raw material properties that enable predictable composite performance and reduce manufacturing variability.

Technical Collaboration: Establish close working relationships with composite processors providing application-specific raw material optimization and processing guidance that creates mutual dependency and value creation.

How Financial Stakeholders Could Unlock Growth Potential?

Manufacturing Capacity Investment: Finance specialized CF/PEEK production equipment including autoclaves, compression molding systems, and automated processing lines required for consistent, high-quality composite manufacturing.

Technology Development Funding: Support R&D initiatives in next-generation processing methods, material formulations, and manufacturing automation that can significantly reduce costs while maintaining performance advantages.

Market Development Capital: Back companies expanding CF/PEEK applications into emerging sectors including renewable energy, industrial equipment, and consumer electronics where high-performance materials are becoming critical.

Supply Chain Resilience Investment: Finance vertical integration initiatives and strategic inventory programs that ensure material availability during supply disruptions while optimizing costs across the value chain.

Global Expansion Support: Provide capital for international manufacturing and distribution capabilities that enable CF/PEEK suppliers to serve global markets while managing logistics costs and trade complexities.

How Research Institutions Could Drive Innovation?

Fundamental Materials Research: Conduct advanced studies on fiber-matrix interactions, processing-property relationships, and failure mechanisms that enable next-generation CF/PEEK composite designs and applications.

Processing Technology Development: Develop breakthrough manufacturing methods including additive manufacturing, continuous fiber processing, and hybrid manufacturing approaches that expand CF/PEEK composite design possibilities.

Application Innovation: Lead collaborative research with industry partners exploring novel CF/PEEK applications in emerging fields including space systems, renewable energy, and biomedical devices.

Environmental Research: Advance recycling technologies, bio-based PEEK alternatives, and lifecycle assessment methodologies that address ecological concerns while maintaining performance standards.

Modeling & Simulation Advancement: Develop sophisticated predictive models for CF/PEEK composite behavior enabling virtual design optimization and reducing physical testing requirements for new applications.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 1,676 million |

| Manufacturing Process | Melt Impregnation, Powder Suspension, and Mixed Molding |

| End-Use Industry | Aerospace, Medical, Automotive, and Robotics |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Toray Industries, Inc., Victrex plc (Victrex), Evonik Industries AG (Evonik), Solvay S.A. (Solvay), ZYPEEK, Shenzhen WOTE Advanced Materials Co., Ltd., Shandong Kaisheng New Materials Co., Ltd., Pfluon, Nanjing Shousu Special Engineering Plastics Products Co., Ltd., Shandong Haoran special plastics Co., Ltd., Jiangsu Junhua Special Polymer Materials Co., Ltd. |

| Additional Attributes | Dollar sales by manufacturing process and end-use industry segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established polymer manufacturers and specialized composite producers, buyer preferences for different manufacturing processes and performance characteristics, integration with advanced aerospace and automotive applications, innovations in manufacturing process technologies and green material approaches, and adoption of next-generation composite formulations and automated production systems for enhanced performance and cost optimization. |

The global CF PEEK Composites Market is estimated to be valued at USD 1,675.8 million in 2025.

The market size for the CF PEEK Composites Market is projected to reach USD 4,589.5 million by 2035.

The CF PEEK Composites Market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in CF PEEK Composites Market are melt impregnation, powder suspension and mixed molding.

In terms of application, aerospace segment to command 60.4% share in the CF PEEK Composites Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CF-PEEK for Medical Market Size and Share Forecast Outlook 2025 to 2035

CFRP Propeller Shaft Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Geocomposites Market

Dental Composites Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Composites Market

APAC Biocomposites Market Growth - Trends & Forecast 2025 to 2035

Plastic Composites Market

Advanced Composites Market Trends - Growth & Forecast 2025 to 2035

Industry Share Analysis for Advanced Composites Companies

Ballistic Composites Market Size and Share Forecast Outlook 2025 to 2035

Wear Grade PEEK Polymer Market Size and Share Forecast Outlook 2025 to 2035

Structural Composites Market Size and Share Forecast Outlook 2025 to 2035

Automotive Composites Market Growth - Trends & Forecast 2025 to 2035

Carbon Fiber Composites Market Size, Growth, and Forecast 2025 to 2035

Graphene Nanocomposites Market 2025 to 2035

Carbon Fiber Composites for Prosthetics Market 2025-2035

Metal Matrix Composites Market

Polyurethane Composites Market

Polycarbonate Composites Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA