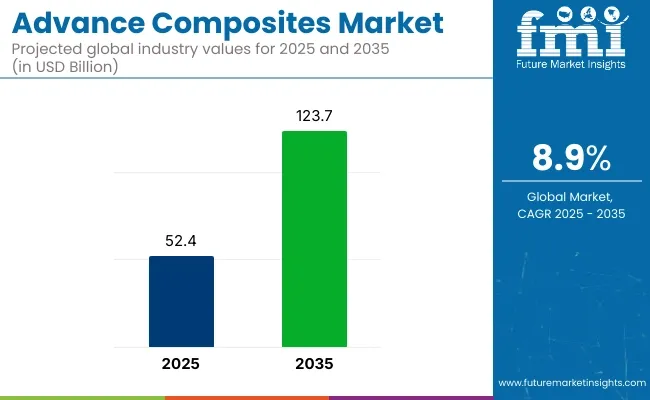

The advanced composites market is projected to grow from USD 52.4 billion in 2025 to USD 123.7 billion by 2035, registering a CAGR of 8.9% during the forecast period. Sales in 2024 reached USD 48.1 billion, reflecting the sector's resilience and growing demand across aerospace, automotive, construction, and renewable energy industries. This growth is attributed to the increasing need for lightweight, durable, and high-performance materials that enhance efficiency and sustainability in various applications.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 52.4 Billion |

| Projected Market Size in 2035 | USD 123.7 Billion |

| CAGR (2025 to 2035) | 8.9% |

Companies are enhancing their product offerings to meet the growing demand for advanced composites. For instance Hexcel Corporation is a global leader in advanced lightweight composites technology continues to innovate in the development of high-performance composite materials. In May 2025, Hexcel Corporation announced that it will demonstrate its latest developments for the Aerospace markets at the Paris Air Show 2025.

“As the aerospace industry gathers at the Paris Air Show, Hexcel will showcase its broad portfolio of innovative lightweight composite technology used across commercial and military aircraft,” said Tom Gentile, Chairman, CEO and President, Hexcel Corporation. “Hexcel’s advanced material solutions enable stronger and lighter aircraft designs, delivering extended range, greater fuel efficiency, and lower emissions. Our commitment to developing high-performance material solutions is shaping the future of flight.”

“With a comprehensive portfolio of high-performance solutions on display, Hexcel continues to shape the future of aerospace manufacturing delivering the materials, technologies, and expertise that enable the industry to fly faster and more efficiently,” concludes Thierry Merlot, Hexcel President

The shift towards sustainable and energy-efficient solutions is influencing the advanced composites market. Manufacturers are focusing on developing composites that are recyclable, bio-based, and made from renewable resources.

Innovations include the integration of nanotechnology to enhance material properties, the development of smart composites with self-healing capabilities, and the use of automated manufacturing processes to improve efficiency and reduce waste. These advancements align with global sustainability goals and regulatory requirements, making advanced composites an attractive option for environmentally conscious industries.

The advanced composites market is poised for significant growth, driven by increasing demand in aerospace, automotive, construction, and renewable energy industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of advanced composites is anticipated to rise, offering cost-effective and high-performance solutions for various applications.

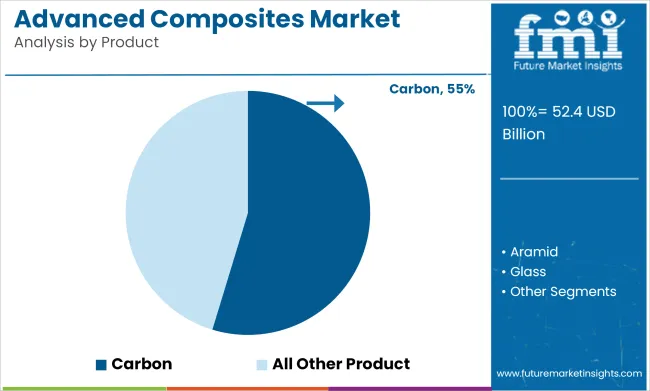

The carbon composites segment is projected to command approximately 54.7% of the advanced composites market by 2025, as their application across high-performance sectors has been continuously expanded. These composites have been engineered using carbon fibers embedded within polymer matrices, resulting in materials that offer excellent stiffness, fatigue resistance, and thermal stability while maintaining minimal weight.

Widespread adoption has been observed across aerospace, automotive, sporting goods, and energy industries, where structural performance and fuel efficiency are critical. Their superior mechanical characteristics under high stress and corrosive environments have been leveraged extensively in airframes, chassis components, and protective equipment.

Carbon composites have been manufactured with increasing process efficiency, including autoclave curing, resin transfer molding, and filament winding techniques. As recyclability technologies and cost optimization processes have progressed, their accessibility has been broadened across medium- and high-volume production sectors. With stringent emission standards and light weighting targets being enforced, demand for carbon-based composites is expected to be further stimulated, ensuring their continued dominance within the advanced composites product landscape.

The aerospace and defense sector is forecasted to represent the largest application share in the advanced composites market by 2025, reaching approximately 38.5%, as lightweight and high-strength materials have remained essential in aviation and military applications. Significant structural components ranging from fuselages and wing panels to radar domes and engine nacelles-have been increasingly constructed using advanced composites to reduce weight while enhancing mechanical reliability.

Adoption of composites in aerospace programs has been accelerated by both commercial aircraft OEMs and defense contractors, as fuel efficiency, payload capacity, and stealth capabilities have been prioritized. In addition, resistance to fatigue and environmental degradation has enabled extended service life in mission-critical systems.

Stringent regulatory certifications by aviation authorities and military specifications have been consistently met through high-performance composite integration. These materials have also been utilized for unmanned aerial vehicles (UAVs), space structures, and ballistic protection systems due to their customizable stiffness and directional strength. As next-generation aircraft and defense systems continue to emphasize operational efficiency and structural innovation, the aerospace and defense application segment is projected to retain its leading role in the advanced composites market through 2025 and beyond.

High Production Costs and Complex Manufacturing Processes

The Advanced Composites Market is limited by expensive raw materials and premium manufacturing processes. Advanced composites like carbon fiber and aramid composites require premium production processes, which drive costs up and limit mass-market entry.

Expensive tooling and labor-intensive production drive up total cost of production. The industry stakeholders need to invest in automation, new manufacturing technology, and low-cost raw material acquisition to drive affordability and scalability against this.

Recycling and Environmental Concerns

The recycling of advanced composite materials is one of the greatest challenges because traditional composites are non-biodegradable and have to be broken down through energy-intensive means. Aerospace and automotive industries are being pushed more and more to be more sustainable, but the lack of cheaply available recycling technologies is holding the industry back.

The development of new recycling processes, such as bio-based composite materials, and policy rewards for sustainable production can reverse these environmental concerns and move market take-up forward.

Growing Demand in Aerospace and Automotive Industries

The Advanced Composites Market is being propelled due to the ever-increasing demand for lightweight and high-performance material in aerospace and automotive industries. With the requirements of fuel efficiency, durability enhancement, and emissions reduction, manufacturers are compelled to include advanced composites in aircraft bodies, electric cars, and performance sports cars.

Organizations targeting increasing composite use, enhancing the manufacturing process efficiency, and developing alliances with OEMs will get an upper hand in the marketplace.

Expansion of Advanced Composites in Renewable Energy and Infrastructure

Application of next-generation composites in wind energy, construction, and infrastructure development offers new possibilities for growth. Application of carbon fiber composites by wind energy turbine manufacturers is increasingly being employed to make blades lighter yet more efficient, thereby increasing the potential for energy generation.

Composites are increasingly being applied to bridges, ship construction, and high-speed rail because they are more durable and corrosion-resistant. Companies which invest in composite technology for the infrastructure and energy from renewable resources are likely to be rewarded with this new business segment.

North America is expected to dominate the advanced composites market from 2018 to 2023, owing to the growth of the aerospace, automotive, and defense sectors in the United States. Major composite manufacturers in the country invest in research and development, helping to develop new lightweight and high-strength materials.

Market growth is also driven by government initiatives to promote the use of advanced composites in energy-efficient applications. Moreover, an increasing demand from the wind energy sector and the rising use of composites in various applications is propelling the market growth in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

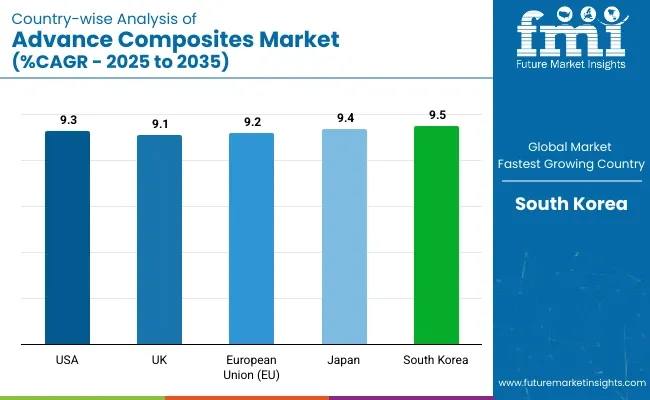

| USA | 9.3% |

Aerospace and automotive industries in the UK serve as prominent markets for advanced composites. There is an upsurge in investments in carbon fibre and glass fibre composites due to the growing production of electric vehicles and next-generation turbine blades and aircraft.

The rising sustainability projects supported by the government, which promotes sustainable materials, further aids the market expansion through green energy application. Additionally, collaborative research-development efforts between research institutions and manufacturers facilitate innovation in advanced composites technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.1% |

The European Union’s advanced composites market is currently led by Germany, France and Italy. Known for a strong automotive manufacturing, wind energy and aerospace bases, there's high demand for composite materials.

The European Commission’s sustainable materials and carbon-neutral manufacturing focus is growing investments in recyclable and bio-based composites. Market Growth is fueled by the increase in the funding for R&D of lightweight structures)

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.2% |

Japan is also a major market, with expertise in high-performance materials and robotics contributing to the advanced composites sector. Demand for both lightweight and durable composites is fueled by the country’s advanced manufacturing sector, especially in automotive and electronics.

Furthermore, investments in carbon fiber technology and government-supported research programs propel market growth. Japan's interest in sustainable composites also aligns with international environmental programmes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.4% |

South Korea is one of the fastest-growing advanced composites markets, backed by robust automotive and electronics industries. The country’s top companies are harnessing high-performance composites for electric vehicles and applications in renewable energy.

The national policies fostering innovation in materials science and the expanded partnerships with international manufacturers strengthen the country’s market position. Industry growth is further driven by South Korea's specialisation in nanocomposites and smart materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.5% |

The enhanced composites market is propelled by the rising need and application of lightweight in aircraft, automotive, and sustainable energy industries. The companies are targeting the technological advancements in composite manufacturing, sustainable material solutions, and artificial intelligence (AI) driven quality control processes. Advancements in thermoset composites, carbon fiber reinforcement, and automation of the manufacturing process are revolutionizing the field.

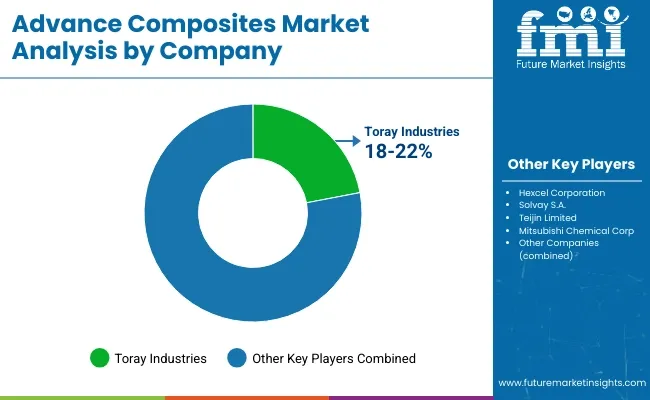

Toray Industries (18-22%)

Toray occupies a near-monopoly position in the carbon fiber market, with proprietary resin and fiber technology that can improve performance in aerospace and automotive markets.

Hexcel Corporation (14-18%)

Hexcel is a crucial player in high-performance aerospace composites with a focus on lighter, strong materials, for commercial and defense planes.

Solvay S.A. (10-14%)

Solvay is known to be a leader in thermoplastics composites and provides advanced material solutions to help customers create lighter components, improve fuel efficiency and increase structural integrity.

Teijin Limited (8-12%)

Teijin's core business is in aramid and carbon fiber composites for industrial applications, including next-generation mobility.

Mitsubishi Chemical Corporation (6-10%)

Mitsubishi Chemical is making an investment in eco-friendly composite solutions that focus on bio-based, renewable and recyclable materials as part of sustainable manufacturing, as per the company.

Other Key Players (40-50% Combined)

Dozens of companies are pushing innovations in advanced composites, particularly around next-gen materials and automation-based production methods. Key players include:

The overall market size for advanced composites market USD 52.4 Billion was in 2025.

The advanced composites market expected to reach USD 123.7 Billion in 2035.

The demand for the advanced composites market will be driven by increasing applications in aerospace and defense, rising adoption in automotive light weighting, growing demand in renewable energy sectors like wind energy, advancements in manufacturing technologies, and the need for high-strength, durable, and corrosion-resistant materials.

The top 5 countries which drives the development of advanced composites market are USA, UK, Europe Union, Japan and South Korea.

Aerospace & Defense and Automotive sectors growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share Analysis for Advanced Composites Companies

Advanced Polymer Composites Market Growth - Trends & Forecast 2025 to 2035

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA