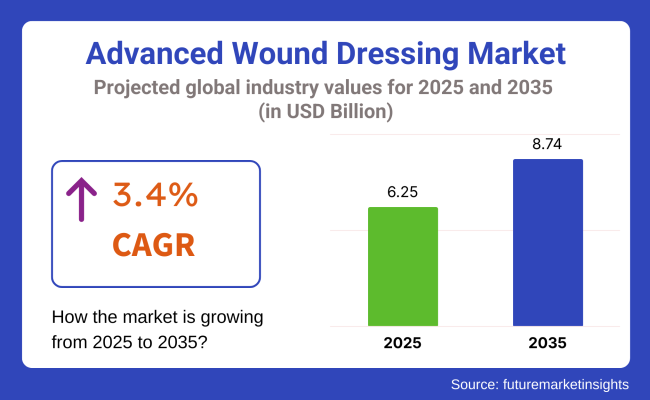

The global Advanced Wound Dressing Market is estimated to be valued at approximately USD 6.25 billion in 2025 and is projected to reach around USD 8.74 billion by 2035, growing at a CAGR of 3.4% during the forecast period. Market expansion is expected to be driven by the rising prevalence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure injuries.

Greater emphasis is being placed on home-based care and shift towards the adoption of disposable NPWT devices towards wound treatment. Technological innovations such as bioengineered dressings and antimicrobial foam products are being introduced to enhance healing outcomes.

Reimbursement frameworks across North America and Europe are being strengthened to support advanced wound therapies. Investments are being directed toward tissue regeneration, personalized care protocols, and real-time wound analytics, positioning the market to be transformed by clinical precision and remote care integration through 2035.

The advanced wound dressing market is being propelled by strategic initiatives from leading manufacturers focusing on innovation, acquisitions, and technology integration. Mölnlycke Health Care is fostering innovation through its 2025 Future Summit, uniting healthcare professionals to shape the future of wound dressing.

In 2024, Solventum announced the launch of the V.A.C.® Peel and Place Dressing, an integrated dressing and drape. “Solventum is committed to overcoming clinical challenges and improving access to care so that more patients may benefit from V.A.C.® Therapy, one of the most studied and effective advanced wound treatments available today,” said Chris Barry, executive vice president and group president, Medical Surgical, Solventum.

On January 2024, Medline Industries has launched the OptiView® Transparent Dressing with HydroCore™ Technology, allowing clinicians to monitor wounds without removal. These developments are driven by the rising prevalence of chronic wounds, demand for home-based care solutions, and the need for cost-effective, outcome-driven therapies.

North America maintained its leading position in the advanced wound dressing market due to well-established healthcare systems, high adoption of novel wound management technologies, and favourable reimbursement structures.

In the USA, increased utilization of portable NPWT devices and advanced dressings has been supported by policy incentives and domestic manufacturing initiatives. In Europe, market growth is being driven by strict regulatory frameworks, hospital-acquired pressure ulcer prevention mandates, and expanded telemedicine-based chronic wound care programs across Germany, France, and the UK.

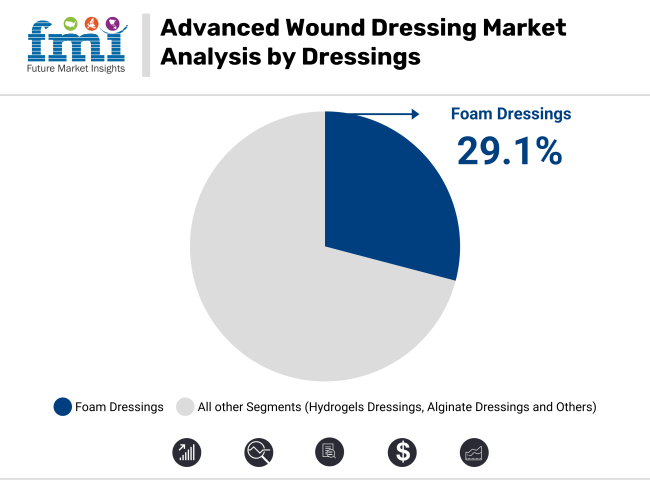

In 2025, Foam Dressings are projected to contribute 29.1% of the total revenue in the advanced wound dressing market. Their dominance has been attributed to their ability to manage wound exudate effectively while maintaining an optimal moist environment, which is essential for healing.

These dressings have been favored in both acute and chronic wound settings due to their extended wear time and reduced need for frequent changes. Their compatibility with antimicrobial agents and silicone layers has further improved their acceptance among healthcare providers. Additionally, their increased usage in home healthcare settings has been driven by ease of use and cost-efficiency.

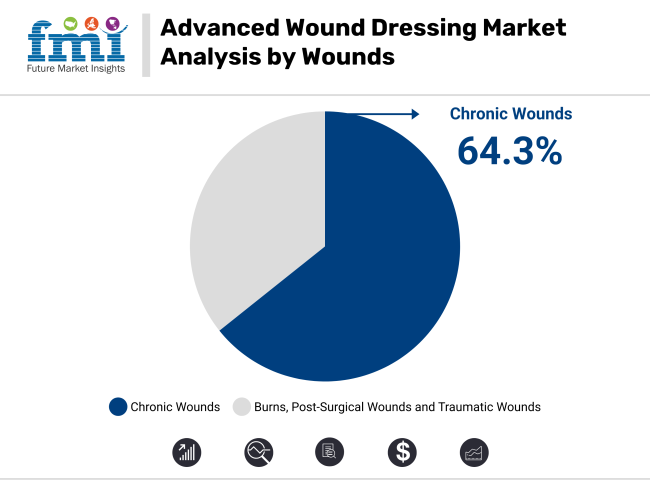

By 2025, Chronic Ulcers are expected to generate 64.3% of total market revenue in advanced wound dressing. This segment’s growth has been driven by the increasing prevalence of diabetes, obesity, and cardiovascular conditions factors known to delay wound healing. An aging population, prone to pressure ulcers and venous leg ulcers, has significantly contributed to rising treatment demand.

Advanced wound care therapies such as negative pressure wound therapy and enzymatic debridement have increasingly been utilized to manage these long-healing wounds. In addition, healthcare policies focused on reducing hospital-acquired infections have reinforced the priority placed on effective chronic wound management across global care settings.

|

Key Drivers |

Key Restraints |

|---|---|

| Personalized wound dressings based on genetics | Regulatory delays in approving new biomaterials |

| Smart dressings with real-time healing tracking | Ethical concerns over bioengineered skin grafts |

| Sustainable and biodegradable wound materials | Limited availability of advanced raw materials |

| AI-driven wound care solutions | High cost of R&D for next gen wound dressings |

| Antimicrobial dressings with nanotechnology | Complexity in clinical trials for innovative products |

| 3D-printed wound dressings for customized care | Resistance from traditional healthcare providers to adopt new solutions |

| Key Drivers | Impact |

|---|---|

| Personalized wound dressings based on genetics | Medium |

| Smart dressings with real-time healing tracking | High |

| Sustainable and biodegradable wound materials | Medium |

| AI-driven wound care solutions | High |

| Antimicrobial dressings with nanotechnology | High |

| 3D-printed wound dressings for customized care | Medium |

| Key Restraints | Impact |

|---|---|

| Regulatory delays in approving new biomaterials | High |

| Ethical concerns over bioengineered skin grafts | Medium |

| Limited availability of advanced raw materials | High |

| High cost of R&D for next gen wound dressings | High |

| Complexity in clinical trials for innovative products | Medium |

| Resistance from traditional healthcare providers to adopt new solutions | Medium |

The factors that limit the use of advanced wound dressings are high cost, lack of knowledge, supply chain problems, skepticism about effectiveness, regulations and reluctance to change. Manufacturers can boost sales by addressing these issues through cost-effective solutions, better distribution networks, and improved training.

Due to high healthcare expenditures, the presence of advanced chronic wound cases, and a well-established medical infrastructure in North America, the advanced wound dressing market will continue to grow strongly. The USA will be the largest market globally, driven by high demand due to aging population, diabetes cases prevalence, and advanced wound care technology.

Favourable reimbursement policies and the presence of key industry players will also augment regional growth. In Canada demand for advanced wound dressing will continue to grow steadily due to government healthcare initiatives for the overall wound management. The rising demand for homecare treatment and advanced bio-engineered dressings will be a key growth driver.

In Latin America, sales are also expected to grow, giving rise to the demand for advanced wound dressing as healthcare is upgraded, and the awareness of modern wound care is enhanced.

Brazil will continue to be a leading country, because of a rising geriatric population and greater number of diabetes-induced ulcers. The increasing prevalence of chronic wounds and growth in private healthcare institutions is expected to create significant demand growth in Mexico.

Sales in Argentina will occur gradually, but government initiatives promoting access to healthcare will support that process. But uncertainty in the economy and suggestions of affordability will continue to inhibit the broader uptake of smart wound dressings, especially among low-income communities through the area.

Over the next few years, sales of advanced wound dressing in Asia Pacific is expected to experience tremendous growth owing to growing healthcare awareness and increasing incidence of chronic diseases and medical infrastructure. India is likely to create sizeable opportunities for manufacturers, backed by its large diabetic population as well as increasing investments in advanced wound care solutions.

In Malaysia and Thailand the adoption will be further increased by improvements in healthcare systems and the rising number of private hospitals. Indonesia will see robust growth as healthcare access improves but affordability pressures may impede the speed of uptake. On the other hand, improved availability of modern wound care products is expected on account of government subsidies and local manufacturing.

The Middle East & Africa (MEA) market will continue to rise as healthcare systems modernize and awareness about advanced wound care increases. Demand will be led by Saudi Arabia, where government-backed efforts are increasing access to specialized wound therapies.

By virtue of its burgeoning medical tourism and growing investments in high-end healthcare facilities, sales are likely to grow in UAE during the forecast period.

With the expanding private healthcare sector and higher incidence of diabetic foot ulcers, South Africa will contribute to the growth in demand.

Overcoming these obstacles will be critical in achieving widespread adoption, as socio-economic diversity across regions presents another layer of complexity that could restrain growth potential even under the most favourable circumstances.

The European advanced wound dressing market is poised for sustained growth, bolstered by healthcare standards, an aging population, and a robust regulatory framework.

France will keep investing in wound care technologies, especially in bioengineered dressings and infection control. Further, Germany will continue to be a key country, in terms of innovations in advanced wound care.

Italy is experiencing increased demand for advanced wound dressing solutions, especially for homecare solutions and chronic wound management.

On the other hand, the UK will witness accelerated growth with NHS-backed initiatives revolutionising advanced wound treatment and dressing materials focusing on sustainability, continuing to further establish Europe’s position as a powerhouse in the innovation of wound care.

In 2024, several companies have made groundbreaking advancements in the Advanced Wound Care Market, driving innovation and improving patient outcomes. Cresilon Inc. secured USA FDA approval for Traumagel, an algae-derived hemostatic gel that stops severe bleeding within seconds without requiring manual pressure. This innovation is particularly useful for trauma care and battlefield applications, offering a rapid and effective solution for hemorrhages.

Melbourne-based biotech firm, PolyNovo, successfully developed and applied bioengineered skin substitutes using a patient’s own cells to treat severe burns. This lab-grown skin integrates seamlessly with the body, significantly reducing infection risks and enhancing tissue regeneration.

Meanwhile, Zoragen Biotechnologies advanced the field of hydrogel dressings, creating a new class of stretchable, self-healing, and pH-responsive hydrogels. These smart dressings can release therapeutic agents based on wound conditions, accelerating the healing process.

Medtronic introduced a revolutionary electrically stimulating suture system, where natural body movements generate small electric currents to speed up wound closure and inhibit bacterial growth.

This innovation holds promise in post-surgical recovery, reducing healing time compared to traditional sutures. Additionally, 3D Systems has expanded its footprint in bioprinting technology, enabling the production of personalized medical implants and skin grafts for trauma and burn patients, drastically improving treatment precision.

Other notable developments include MPPT (Micropore Particle Technology) from Smith+Nephew, a novel passive immunotherapy solution that absorbs wound exudate while breaking down bacterial biofilms, reducing infection rates without relying on antibiotics.

Furthermore, Aroa Biosurgery pioneered the use of Ovine Forestomach Matrix (OFM), a collagen-rich material derived from sheep forestomach, which has demonstrated superior results in tissue regeneration for chronic wounds. These advancements collectively mark a transformative year in wound care, improving both treatment efficacy and patient quality of life.

In 2024, the competitive environment was characterized by a heavy focus on research and technology solutions, as well as partnerships. Mature companies were growing their portfolios by acquiring new technologies and services or through partnerships; startups were disrupting the market with new solutions.

This trend boded well for the industry's future prospective as major players and emerging innovators alike would have the opportunity to contribute to this innovative field of wound dressings.

Increasing cases of chronic wounds, rising geriatric population, and continuous advancements in wound care technology are fuelling market growth.

Popular options include hydrogel dressings, foam dressings, alginate dressings, hydrocolloid dressings, and antimicrobial dressings.

Major companies include 3M Healthcare, Smith & Nephew, Mölnlycke Health Care, ConvaTec, and Coloplast.

High costs, limited awareness in developing regions, and reimbursement complexities remain key challenges.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Wound Type, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Wound Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 8: Global Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Wound Type, 2019 to 2034

Table 14: North America Market Volume (Unit Pack) Forecast by Wound Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 16: North America Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Wound Type, 2019 to 2034

Table 22: Latin America Market Volume (Unit Pack) Forecast by Wound Type, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 24: Latin America Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Wound Type, 2019 to 2034

Table 30: Western Europe Market Volume (Unit Pack) Forecast by Wound Type, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 32: Western Europe Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Wound Type, 2019 to 2034

Table 38: Eastern Europe Market Volume (Unit Pack) Forecast by Wound Type, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 40: Eastern Europe Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Wound Type, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Unit Pack) Forecast by Wound Type, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Wound Type, 2019 to 2034

Table 54: East Asia Market Volume (Unit Pack) Forecast by Wound Type, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 56: East Asia Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Wound Type, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Unit Pack) Forecast by Wound Type, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Wound Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Wound Type, 2019 to 2034

Figure 14: Global Market Volume (Unit Pack) Analysis by Wound Type, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Wound Type, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Wound Type, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 18: Global Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by Wound Type, 2024 to 2034

Figure 23: Global Market Attractiveness by End User, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Wound Type, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Wound Type, 2019 to 2034

Figure 38: North America Market Volume (Unit Pack) Analysis by Wound Type, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Wound Type, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Wound Type, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 42: North America Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by Wound Type, 2024 to 2034

Figure 47: North America Market Attractiveness by End User, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Wound Type, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Wound Type, 2019 to 2034

Figure 62: Latin America Market Volume (Unit Pack) Analysis by Wound Type, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Wound Type, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Wound Type, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 66: Latin America Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Wound Type, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Wound Type, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Wound Type, 2019 to 2034

Figure 86: Western Europe Market Volume (Unit Pack) Analysis by Wound Type, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Wound Type, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Wound Type, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 90: Western Europe Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Wound Type, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Wound Type, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Wound Type, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Unit Pack) Analysis by Wound Type, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Wound Type, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Wound Type, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Wound Type, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Wound Type, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Wound Type, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Unit Pack) Analysis by Wound Type, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Wound Type, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Wound Type, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Wound Type, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Wound Type, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Wound Type, 2019 to 2034

Figure 158: East Asia Market Volume (Unit Pack) Analysis by Wound Type, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Wound Type, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Wound Type, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 162: East Asia Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Wound Type, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Wound Type, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Wound Type, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Unit Pack) Analysis by Wound Type, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Wound Type, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Wound Type, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Wound Type, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA