The advanced pain treatment for cancer industry at the global level is poised to experience gigantic growth between 2025 and 2035 with increasing cases of cancer, setup of therapies for pain treatment, and increased awareness for palliative therapy. Proper pain management serves as a stimulus to enhance quality of life among cancer patients and thus the rising demands for new drugs, medical devices, and alternative therapies.

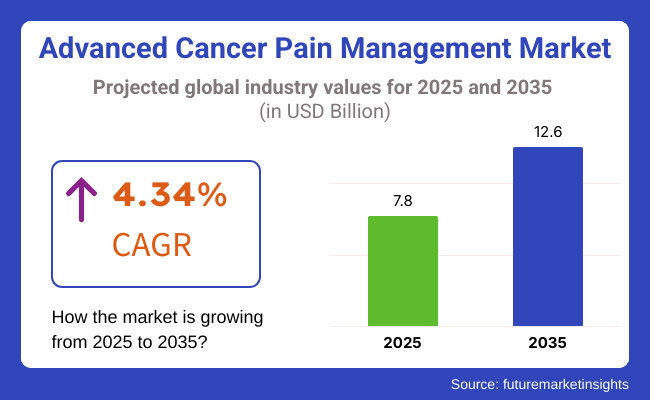

Advanced Cancer Pain Management Market in 2025 was approximately USD 7.8 Billion. Advanced Cancer Pain Management Market would be USD 12.6 Billion in 2035 and have a 4.34% compound annual growth rate. The market grew with the new drug formulation innovation, R&D of targeted medication, and growing uses of non-opioid pain management medicines.

The North American region is a premier market for advanced cancer pain management, driven by a strong healthcare infrastructure, high adoption rates of advanced pain management technology, and high R&D spends. The United States of America and Canada are the pace setters in new product development and commercialization of pain relief drugs.

The European market is driven by increasing government backing for palliative care and the increasing cancer diagnosis. The UK, France, and Germany are among the top nations in embracing new pain management techniques, including non-opioid drugs and precision medicine.

Asia-Pacific is experiencing maximum growth in cancer pain management market due to rise in cancer cases, better health infrastructure, and growing awareness towards pain management product. China, India, and Japan are spending heavily on health technology and the availability of more palliative care services.

Latin America is witnessing slow market growth as a result of greater accessibility to medical services and government efforts to improve cancer care. Brazil and Mexico are the key drivers in the domestic market, with emphasis laid on developing pain management services and boosting access to basic medications.

Middle East & Africa is also slowly adjusting to the advanced cancer pain management market through increased healthcare infrastructure investment and increased awareness of the cancer program. The UAE and South Africa are spearheading the initiative for improvement of pain management solutions in the region.

With ongoing innovation happening in pain management therapies and growing focus on individualized medicine, the market for advanced cancer pain management is likely to grow consistently over the next decade, opening new windows of opportunity for pharma companies, doctors, and medical device companies.

Challenges

High Cost of Advanced Pain Management Therapies

The Advanced Cancer Pain Management Market is gravely under threat from the exorbitant prices of advanced pain relief treatments such as opioid analgesics, neuromodulation devices, and targeted drug delivery systems. Chronic pain management is out of reach for the majority of cancer patients because of poor insurance coverage and excessive out-of-pocket costs.

Enormous research and development costs involved in new pain relief solutions also drive treatment costs to astronomical levels. To solve this issue, healthcare professionals and policymakers will need to cooperate with enhancing reimbursement policy, enhancing access to cheap generics, and investing in cheap pain breakthroughs.

Opioid Crisis and Regulatory Restrictions

The general opioid epidemic has created stringent regulation practices and monitored opioid prescribing trends, avoiding a barrier to cancer pain sufferers with opioid addicts. Health organizations and governments set stringent opioid prescribing regulations to avoid addiction and abuse, limiting or excluding patients from the medications they so desperately need.

Opioid stigma also contributes partially to under-treating cancer pain. To assist in meeting this challenge, medical practitioners will have to promote patient education, design alternative pain relief measures such as non-opioid medications and intervention therapies, and agitate for balanced legislation finding the balance between need for accessibility and possible abuse.

Opportunities

Advancements in Non-Opioid Pain Management Solutions

Growth areas in the market include the rising requirement for non-opioid alternatives to pain management in oncology, which is a prime growth market. Nerve block treatments, targeted biologics, cannabinoid therapeutics, and neuromodulation procedures are being considered because they are both therapeutic in nature and less likely to induce addiction.

Increased R&D spending on new pain relief mechanisms can drive the adoption of the alternatives. Alongside, the addition of digital health technologies such as wearable pain monitoring and artificial intelligence-driven pain regulation systems can enhance patient outcomes to the fullest while refining customized care regimens.

Integration of Palliative Care and Holistic Pain Management

Holistic pain care and palliative care growth gives huge market growth opportunities to the Advanced Cancer Pain Management Market. Patients and physicians are giving growing significance to the benefits of the integration of complementary interventions such as acupuncture, mindfulness-based stress reduction, physiotherapy, and counseling into chronic pain management therapy.

The interventions promote the comfort of patients with less drug dependencies on high dosages. Health and research facilities that invest in multidisciplinary pain treatment programs can differentiate themselves from the competition by offering patient-centered, end-to-end solutions.

During the period 2020 to 2024, the Advanced Cancer Pain Management Market observed greater emphasis on opioid stewardship, which transformed into multimodal pain management modalities. Disparity in pain care access, brought to limelight by the pandemic, contributed to digital interventions in health care such as pain consultations through telemedicine. Strict opioid policies and reimbursement issues kept universal treatment availability in check.

Looking forward to 2025 to 2035, the industry will see revolutionary shifts with advancements in precision medicine, AI-driven pain diagnosis, and customized pain management approaches. Patient-specific treatment paradigms, regenerative medicine strategies, and bioelectronic pain relief systems will re-shape the market. The adoption of block chain-based prescription monitoring and global collaborations for pain management will further augment regulatory adherence and cross-border availability of efficacious treatments.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict opioid prescription policies, limited access to essential pain medications |

| Technological Advancements | Growth in telemedicine pain consultations, limited adoption of AI-based pain assessment |

| Industry Adoption | Increased focus on multimodal pain management, rise of cannabis-based treatments |

| Supply Chain and Sourcing | Dependence on traditional opioid manufacturing, limited diversification of supply chains |

| Market Competition | Dominance of pharmaceutical giants in opioid and non-opioid pain management |

| Market Growth Drivers | Rising cancer prevalence, opioid dependency concerns, growing demand for non-opioid treatments |

| Sustainability and Energy Efficiency | Initial development of sustainable pain relief solutions |

| Integration of Smart Monitoring | Limited AI-based pain tracking and predictive analytics |

| Advancements in Pain Management Innovation | Traditional reliance on opioids, slow adoption of non-invasive therapies |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven prescription monitoring, expansion of non-opioid regulatory frameworks |

| Technological Advancements | Widespread use of AI-driven pain diagnostics, wearable pain monitoring devices, and bioelectronic pain relief |

| Industry Adoption | Expansion of precision pain medicine, integration of digital therapeutics and palliative care programs |

| Supply Chain and Sourcing | Rise of localized production, sustainable sourcing of alternative pain relief solutions |

| Market Competition | Growth of biotech startups, digital pain management platforms, and innovative device manufacturers |

| Market Growth Drivers | Increased investment in personalized pain management, regenerative medicine, and holistic therapies |

| Sustainability and Energy Efficiency | Widespread adoption of eco-friendly drug production, biodegradable pain relief patches, and energy-efficient devices |

| Integration of Smart Monitoring | Full-scale implementation of AI-driven pain assessment, real-time patient monitoring, and automated pain relief recommendations |

| Advancements in Pain Management Innovation | Expansion of neuromodulation, gene therapy for pain relief, and digital pain management ecosystems |

The United States leads the market for advanced cancer pain management with high healthcare spending, advanced pain management technologies, and robust pharmaceutical research. Major players' presence investing in novel pain relief drugs, opioid substitutes, and neurostimulation devices also drives the market forward.

In addition, the increasing number of cancer cases, coupled with government support encouraging palliative care, plays an important role in fueling market growth. Increasing use of telemedicine for the management of pain and opioid surveillance programs also strongly influences market direction.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The United Kingdom is a front-runner in sophisticated cancer pain treatment, supported by its well-developed healthcare system, government-sponsored palliative care programs, and growing research on non-opioid pain management therapies.

The National Health Service (NHS) is central to the provision of widespread access to pain management options, including integrative therapies like acupuncture and cognitive-behavioral therapy (CBT). Further, increasing investments in cancer research and drug development drive the growth of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

Germany, France, and Italy are the dominant markets in the European Union's market for advanced pain management of cancer. These nations have strong health care systems, governmental provision of support for palliative care that is strong, and increasing emphasis on alternative pain management like nerve-block therapy and medical cannabis.

The European Medicines Agency (EMA) increases market availability and makes regulation and development of pain drugs easier. Furthermore, greater collaboration among research institutions and drug firms contributes to even more innovation in this area.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Japan leads the world in sophisticated cancer pain management because of its medical device and pharmaceutical technology. The high incidence of cancer and aging population in the country fuel the demand for efficient pain management technologies.

Government-sponsored programs emphasizing pain relief training, and an associated high uptake of neurostimulation devices and opioid-sparing strategies, boost the growth of the market. Personalized medicine and AI-based pain management technologies strengthen Japan's ranking in this sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The South Korean market is fast becoming the focal point for sophisticated pain management of cancer, driven by a robust pharma sector, rising incidence of cancer, and government efforts to enhance palliative care services.

The nation's National Cancer Center is a great contributor in the development of new pain relieving therapies, and large investments in digital health and telemedicine increase patient access to pain relieving solutions. The emphasis of South Korea to adopt AI and robotics in healthcare also contributes significantly to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Monoclonal antibodies are the newest class of medications for managing cancer pain that has progressed to an advanced level. Monoclonal antibodies attack specific pathways of pain and cancer inflammatory markers. By selectively blocking the pain receptors and suppressing inflammation, monoclonal antibodies provide a promising therapy for individuals with severe cancer pain.

Their capacity for the preservation of pain relief with less side effect compared to classic opioids makes them a first-line therapy among oncologists and pain specialists. Ongoing investigations and clinical trials establishing their efficacy and safety drive the growing popularity of monoclonal antibodies as pain medications.

Cannabinoids are widely popular in the cancer pain treatment industry because of their dual analgesic and anti-inflammatory effects. The drugs, extracted from plants or produced in the lab, target the endocannabinoid system to alter the sensation of pain.

Cannabinoid drugs alleviate patients from neuropathic and chronic pain, especially if standard analgesics do not work. Regulatory punishment and the growing use of medical marijuana in most of the globe have also accelerated the need for cannabinoid-based therapy in the treatment of cancer pain.

Intravenous delivery is still a mainstay of palliative cancer pain treatment, especially in the hospital and palliative care settings. IV drug administration provides quick onset of action and is ideal for patients with breakthrough pain episodes that need to be alleviated quickly.

Monoclonal antibodies and some formulations of opioids are routinely given through intravenous routes to provide targeted dosing and long-term pain management. Hospitals and medical professionals like IV delivery because it avoids the gastrointestinal tract and guarantees the drug's effectiveness even in patients with compromised absorption.

Oral drug delivery remains a commonly used route of administration for cancer pain medication due to convenience and patient compliance. Most cancer pain management medications, such as cannabinoids and aminoindane therapy, are manufactured in tablet or liquid preparations for oral intake.

Increased popularity of oral preparations is because of its non-invasive route and the ability to administer over the long term. With drug developments enhancing the bioavailability of oral cancer pain drugs, this route of administration is predicted to continue to see growth in the market.

In-hospital pharmacies play a critical role in delivering upper-end cancer pain medication, predominantly among those given palliative and inpatient interventions. In-hospital pharmacies ensure timely availability of essential medicines such as monoclonal antibodies and intravenous opioids that require closer monitoring by the professionals. Hospital pharmacies continue being the primary route to specialist pain medicines because regimens in treatments for cancer continue to get complex.

Retail pharmacies also play a large role in the treatment of cancer pain by providing prescription drugs to outpatients and home-based care recipients. Patients who need sustained pain relief, particularly through oral and cannabinoid-based treatments, also tend to use retail pharmacies for their pharmacy needs. The trend towards specialist oncology pharmacies and pharmacist pain management consultations has also boosted the role of retail pharmacies for this niche.

Advanced cancer pain management market is driven by increasing incidence of cancer, growing need for palliative care, and innovation in pain relief therapeutics. Companies are focusing on developing targeted drugs, novel delivery forms, and digital health integrations in order to improve pain management protocols. AI-based diagnostics, personalized medicine, and opioid-free pain relief solutions are emerging as disruptive trends in this marketplace.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Pfizer Inc. | 15-20% |

| Johnson & Johnson | 12-16% |

| Novartis AG | 10-14% |

| Eli Lilly and Company | 8-12% |

| Teva Pharmaceuticals | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pfizer Inc. | Developing next-generation opioid and non-opioid pain management drugs, investing in AI-driven pain assessment solutions. |

| Johnson & Johnson | Focusing on advanced drug formulations, including extended-release analgesics and targeted pain relief therapies. |

| Novartis AG | Pioneering monoclonal antibody treatments and cannabinoid-based pain management solutions. |

| Eli Lilly and Company | Expanding its portfolio with aminoindane-class pain relievers and innovative drug delivery systems. |

| Teva Pharmaceuticals | Manufacturing cost-effective generics and biosimilars for cancer pain relief, emphasizing accessibility. |

Key Company Insights

Pfizer Inc. (15-20%)

Pfizer dominates with a robust pipeline of opioid and non-opioid analgesics, based on AI-enabled diagnostics and real-time patient monitoring for maximized pain management.

Johnson & Johnson (12-16%)

Johnson & Johnson targets new drug forms and long-acting solutions, enhancing sustained pain control and reducing side effects.

Novartis AG (10-14%)

Novartis focuses on biologic drugs, such as monoclonal antibodies and cannabinoid-based analgesics, against chronic cancer pain.

Eli Lilly and Company (8-12%)

Eli Lilly is investigating aminoindane-class analgesics and new transdermal and oral delivery systems for better patient compliance.

Teva Pharmaceuticals (5-9%)

Teva Pharmaceuticals has a strong foothold in generic and biosimilar pain drugs, enabling more affordable and accessible advanced cancer pain management.

Other Key Players (40-50% Combined)

A number of pharmaceutical and biotechnology companies help advance cancer pain management through new drug classes, alternative treatments, and digital health integrations. Major players include:

The overall market size for advanced cancer pain management market was USD 7.8 Billion in 2025.

The advanced cancer pain management market expected to reach USD 12.6 Billion in 2035.

The demand for the advanced cancer pain management market will be driven by the rising prevalence of cancer, increasing adoption of targeted pain therapies, advancements in drug formulations, growing preference for non-opioid alternatives, and expanding access to palliative care services across healthcare facilities.

The top 5 countries which drives the development of advanced cancer pain management market are USA, UK, Europe Union, Japan and South Korea.

Monoclonal Antibodies and Cannabinoids growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 17: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Asia Pacific Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 19: Asia Pacific Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 21: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Asia Pacific Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 82: Asia Pacific Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: Asia Pacific Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Asia Pacific Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 91: Asia Pacific Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 97: Asia Pacific Market Attractiveness by Drug Class, 2023 to 2033

Figure 98: Asia Pacific Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: Asia Pacific Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 100: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 101: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 104: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 109: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 110: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 111: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 115: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 116: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 117: MIDDLE EAST AND AFRICA Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: MIDDLE EAST AND AFRICA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: MIDDLE EAST AND AFRICA Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 120: MIDDLE EAST AND AFRICA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sports Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Infusion Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA