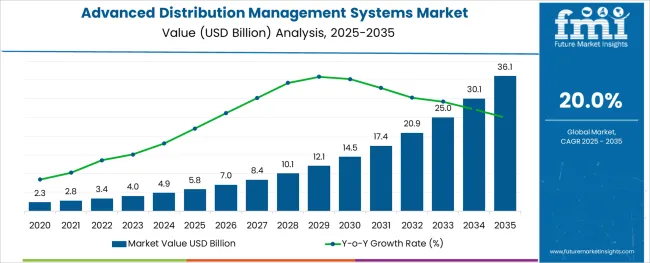

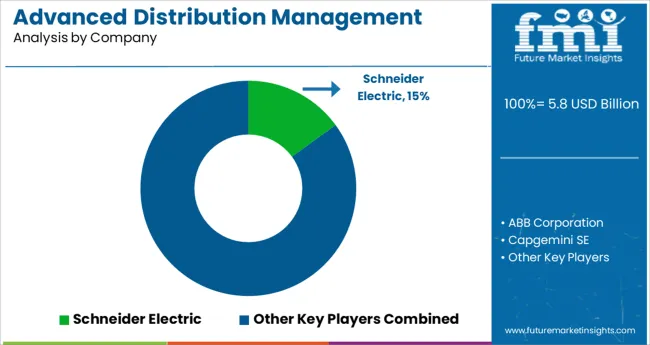

The Advanced Distribution Management Systems Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 36.1 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

The market is segmented by Solution, Application, and Industry and region. By Solution, the market is divided into ADMS Platforms and Services. In terms of Application, the market is classified into Distribution Management Systems, Supervisory Control & Data Acquisition, Outage Management Systems, Distributed Energy Resource Management Systems, Geospatial Information Systems, and Fault Location and Isolation & Service Restoration.

Based on Industry, the market is segmented into Energy & Utilities, Transportation & logistics, Oil & Gas, Manufacturing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

The online distribution channel is expected to generate 63.7% of market revenue in 2025, making it the most dominant sales route. The growth of e-commerce platforms has revolutionized procurement by offering convenience, broader product selections, and competitive pricing to end-users across industries.

Online channels enable buyers to access detailed product specifications, customization options, and customer reviews, simplifying purchase decisions. This has particularly benefited small and medium-sized enterprises lacking traditional supply chain networks.

Additionally, digital platforms have streamlined order fulfillment and reduced lead times, fostering faster adoption. Vendors are increasingly investing in online marketplaces and direct-to-customer websites to expand reach and improve customer engagement, reinforcing the online channel’s leadership in the stainless steel valve tag market.

The advanced distribution management system (ADMS) is software platform that supports in distribution management. It plays key role in improving overall distribution management. ADMS contains functions that automates the outage restoration. This allows energy provides to improve the distribution grid performance.

ADMS function developed for electric utilities includes fault location, isolation, & restoration, volt/volt ampere reactive optimization, and conservation through voltage reduction. IT also supports micro grids & electric vehicles and peak demand management.

The advanced distribution management systems market is estimated to register a CAGR of 20.0% from 2025 to 2035. Further, it is estimated that market grew at a CAGR of 14.5% during 2014 to 2024.

Further, the market is projected to grow in revenue from ~USD 3,371.0 Million in 2025 to ~USD 12,102.0 Million by 2035.

Increasing Adoption of Smart Grid to Reduce Greenhouse Gas Emissions

Notable amount of carbon dioxide is emitted due to burning of fossil fuels. The heat generated due to burning is used to power steam turbines. It is estimated that carbon dioxide emitted by this combustion is 40% of total carbon dioxide emission worldwide. Greenhouse gas is produced due to burning these fuels.

For reducing these greenhouse gas emission, the smart grid framework is used. Smart power generation use the renewable energy source such as wind, hydropower or solar.

Smart grid initiates smooth incorporation of renewable as well as other distributed energy resource. This also improves energy storage due to its advanced communication and control capabilities. Smart grid when deployed with energy storage and discharge aids in reducing the variability in renewable power sources.

By decoupling generation from demand, smart grids enable more flexible and responsive energy management. This enables efficient utilization of renewables energies such as solar and wind. Owing to this, the carbon emissions are notably reduced

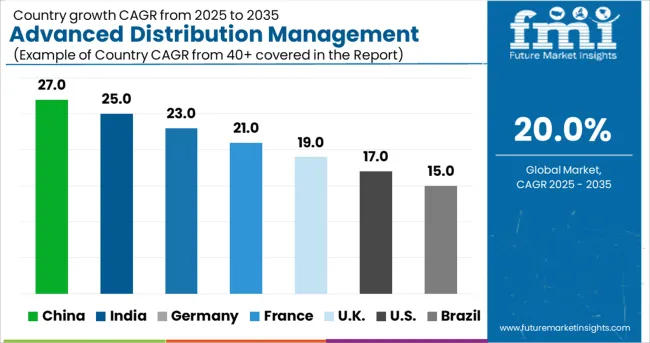

India is projected to be one of the most attractive markets in the forecast period. As per study, the country will grow at a CAGR of 34.4% through 2035.

The country is creating notable opportunities for advanced distribution management systems market. This can be attributed to high growth in industries such as transportation and energy & utilities. Government in the country is trying to balance the demand and supply of power in order to ensure efficiency and cost effectiveness. Also, the opportunity for ADMS market is huge in the country due to declining prices of software, hardware, and other related components. Hence, these factors propel the demand for ADMS in industries in India.

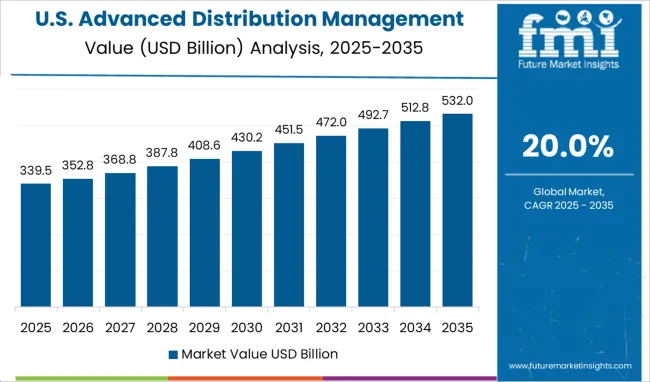

The advanced distribution management systems demand in the USA is expected to account for 75.8% market share of North America through 2035. USA is anticipated to grow in upcoming years as the country is a huge market for advanced distribution management systems.

The country is home to some of the major key vendors such as GE Digital, Oracle Corporation and others. These vendors are continuously investing in advanced distribution management systems and advancing the services with technological advancements. For instance, Oracle introduced Utilities Opower Distributed Energy Resources (DER), a customer engagement cloud service. Oracle Utilities Opower DER Customer Engagement is one of the four new products and more than 100 new features in the Opower platform, the industry’s leading suite of customer engagement and energy efficiency cloud services.

The sales in France is estimated to increase at a CAGR of 17.2% CAGR by 2035. The advanced distribution management systems market is rapidly evolving with new technologies and methodologies in the country.

France is among the fastest growing technology nation in the Western Europe region. With initiative like smart cities, the country is on the path to grow the fastest in terms of implementing advanced distribution management systems solution in private sector.

Rising urbanization is increasing the rate of electrification at houses and commercial places and end-use sectors, which is creating the demand for advanced distribution management system in the country. In-addition, rapid industrialization is bolstering the demand for smart grid technology and thus, fueling the growth of advanced distribution management systems market in France.

The ADMS platforms segment is expected to account for 28.7% market share by the end of 2035.

Demand is increasing for ADMS software platform by energy and utility companies as the ADMS software platform integrate outage management systems, supervisory control and data acquisition system, fault detection, isolation and service restoration and other applications. ADMS provides a common dashboard to collect, collate and analyze data from multiple power distribution applications. This is expected to propel the need for advanced distribution management systems solution.

The energy & utilities segment is expected to showcase a strong CAGR of 24.8% during the forecast period.

Demand for ADMS is increasing in energy and utility industry because ADMS helps utility companies to optimize energy distribution, reduce electricity losses and minimize shortages. ADMS helps operators of utility companies to manage various service like system outages, power supply restoration, network optimization, peak load management. Therefore, continuous developments and spending in energy and utility sector is proliferating opportunities for the advanced distribution management systems market.

With around 34.4% CAGR by 2035, fault location and isolation & service restoration segment will continue to gain traction.

The demand is increasing for FLISR application as the FLSIR can reduce the number of customers impacted by a fault by automatically isolating the trouble area and restoring service to remaining customers by transferring them to adjacent circuits. In addition, the fault isolation feature of the technology can help crews locate the trouble spots more quickly, resulting in shorter outage durations for the customers impacted by the faulted section.

The reduced number of customers interrupted (CI) and the associated customer minutes of interruptions (CMI) are the benefits of the technology. Hence, the rising demand for FLISR will positively impact the advanced distribution management systems market.

Key providers of advanced distribution management systems are focusing on adding new innovative capabilities into their current ADMS solution. This is helping them to enhance and upgrade their advanced distribution management systems portfolio.

| Attribute | Details |

|---|---|

| Market value in 2025 | USD 5.8 billion |

| Market CAGR 2025 to 2035 | 20.0% |

| Share of top 5 players | Around 20% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific Excluding Japan; Japan and Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, France, Italy, Spain, UK, India, Australia, New Zealand, China, Japan, India, Australia & New Zealand, GCC Countries and South Africa |

| Key Segments Covered | Solution, Application, Industry and Region |

| Key Companies Profiled | Schneider Electric; ABB Corporation; Capgemini SE; GE Digital; Oracle Corporation; Siemens AG; Tata Power DDL; Open Systems International; Survalent Technology Corporation; DNV GL; Etap; Axxiom; Grid Bright; Alstom; S&C Electric Company; Advanced Control Systems; Hitachi; Anterix; Hexagon Safety & Infrastructure |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global advanced distribution management systems market is estimated to be valued at USD 5.8 billion in 2025.

It is projected to reach USD 36.1 billion by 2035.

The market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types are adms platforms, services, _support & maintenance services, _consulting and _integration & implementation.

distribution management systems segment is expected to dominate with a 29.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sports Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA