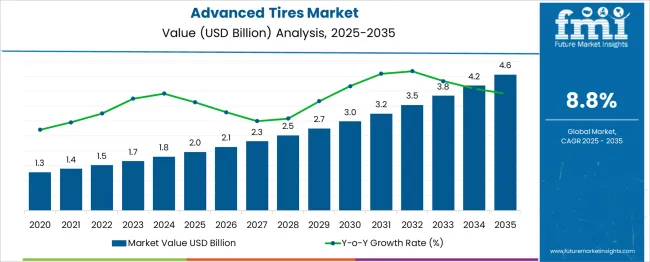

The Advanced Tires Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period. Between 2025 and 2030, the market is projected to increase by USD 1.0 billion, moving from USD 2.0 billion to USD 3.0 billion, reflecting an average annual growth rate of around USD 0.2 billion. This early-phase growth is driven by the shift towards electric vehicles (EVs), autonomous vehicles, and rising demand for tires that provide greater fuel efficiency and lower environmental impact.

From 2030 to 2035, the market continues to experience significant growth, adding USD 1.6 billion to reach USD 4.6 billion. This later phase of growth is marked by a higher rate of expansion, supported by advances in tire technology, including the integration of smart sensors, improved tread designs, and sustainable materials. The USD 2.6 billion opportunity underscores a dynamic market evolution, with advanced tires playing a crucial role in the automotive industry's transition to more sustainable, high-performance solutions.

| Metric | Value |

|---|---|

| Advanced Tires Market Estimated Value in (2025 E) | USD 2.0 billion |

| Advanced Tires Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The advanced tires market is expanding rapidly, driven by growing demand for intelligent mobility, enhanced fuel efficiency, and real-time tire performance monitoring. As the automotive industry pivots toward electric and autonomous vehicles, tire technologies are evolving to support adaptive load handling, improved traction, and connected data feedback.

Regulatory mandates on safety, pressure monitoring systems (TPMS), and sustainability are accelerating the adoption of smart tire solutions across both commercial and passenger segments. Additionally, OEMs are integrating advanced tires in premium vehicle lines to deliver optimized performance, extended life, and predictive maintenance capabilities.

The market is also witnessing rising R&D investment in new material compositions, including low rolling resistance compounds and sensor-integrated sidewalls.

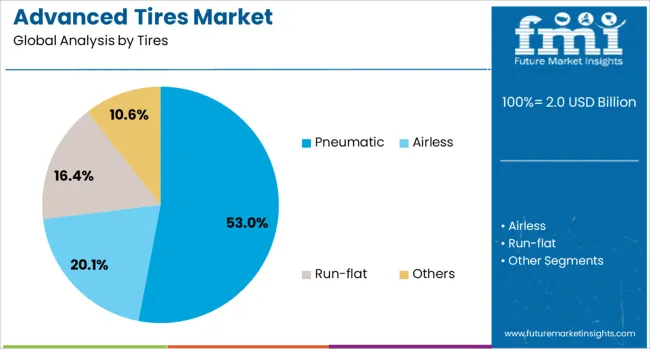

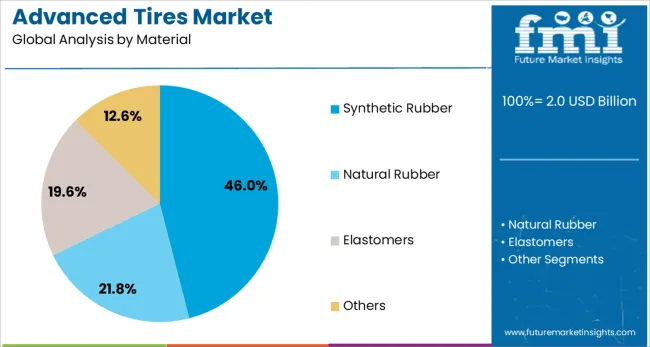

The advanced tires market is segmented by tires, material, technology, sales channel, vehicle, and geographic regions. The tires of the advanced tires market are divided into Pneumatic, Airless, Run-flat, and Others. In terms of material, the advanced tires market is classified into Synthetic Rubber, Natural Rubber, Elastomers, and Others.

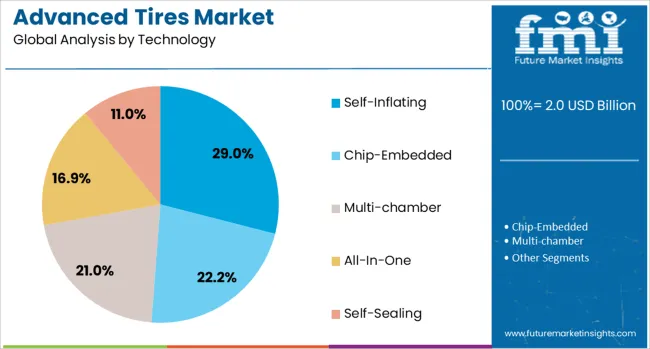

The advanced tires market is segmented into Self-Inflating, Chip-Embedded, Multi-chamber, All-In-One, and Self-Sealing. The sales channel of the advanced tires market is segmented into OEM and aftermarket. The advanced tires market is segmented into Light-duty, Heavy-duty, and Off-highway. Regionally, the advanced tires industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Pneumatic tires are anticipated to lead the advanced tires market with a 53.00% revenue share in 2025. Their dominance is due to their proven balance of flexibility, shock absorption, and wide applicability across passenger cars, commercial fleets, and heavy-duty vehicles.

Despite the emergence of airless alternatives, pneumatic tires remain favored for their comfort, safety, and cost-effectiveness. Innovation in pneumatic structures, including real-time inflation systems and embedded sensors-has helped bridge the gap between traditional and intelligent tire functions.

These enhancements make them compatible with next-gen vehicle platforms, particularly in urban and long-haul mobility.

Synthetic rubber is expected to command 46.00% of the advanced tire material market share by 2025, making it the most widely used material in this category. Its prevalence stems from its superior durability, temperature resistance, and ability to maintain performance under high-speed or load-intensive conditions.

Advanced formulations of synthetic rubber, such as silica-reinforced compounds, offer enhanced grip and fuel economy. Manufacturers are increasingly leveraging synthetic blends to reduce rolling resistance and meet emissions standards, especially in high-performance and electric vehicle tires.

The material’s compatibility with automated production and precision molding also supports scalable manufacturing of technologically enhanced tires.

Self-inflating technology is projected to capture 29.00% of the market share within the advanced tires segment by 2025. This leading position is driven by the rising need for automated air pressure regulation to improve safety, extend tire life, and boost fuel efficiency.

Self-inflating systems monitor internal pressure and adjust inflation levels without driver input, reducing downtime and maintenance frequency. This technology is gaining traction in military, commercial logistics, and off-road applications, where consistent tire pressure is critical for performance and reliability.

Integration with vehicle telematics and predictive analytics further enhances the value proposition of self-inflating systems in connected vehicle ecosystems.

The advanced tires market is expanding due to the increasing demand for high-performance tires in automotive, transportation, and industrial applications. With advancements in tire technology, manufacturers are focusing on producing tires that offer better fuel efficiency, durability, and safety. The rise of electric vehicles (EVs) and stringent regulations on emissions is also driving the market. Innovations such as self-healing, smart tires, and sustainable materials are reshaping the industry. Despite challenges in raw material sourcing and high costs, there are significant growth opportunities in both developed and emerging markets.

The demand for advanced tires is driven by the growing need for high-performance tires that offer better fuel efficiency, safety, and longevity. As fuel economy becomes a primary concern for both consumers and manufacturers, tires that reduce rolling resistance are gaining traction. The rise of electric vehicles (EVs) further fuels the market for tires that offer improved energy efficiency and performance. Stricter regulations on emissions and vehicle safety are pushing manufacturers to develop tires that can meet these requirements while maintaining durability. The shift toward autonomous vehicles also demands the development of advanced tire technologies capable of enhancing driving performance and reliability. This growing demand for high-performance, fuel-efficient tires across different vehicle segments is a key factor propelling market growth.

One of the main challenges in the advanced tires market is the high cost associated with manufacturing these innovative tire solutions. Advanced tires often require specialized materials, such as silica and synthetic rubbers, which can significantly increase production costs. Moreover, the volatility in the prices of raw materials, including rubber and oil-based derivatives, can affect the overall cost structure of tire manufacturers. While technological advancements aim to reduce costs, the production of advanced tires still requires significant investment in research and development. Sourcing alternative materials for tire production remains a challenge, as the market grapples with finding options that do not compromise performance. These factors can limit widespread adoption, particularly in cost-sensitive markets.

A prominent trend in the advanced tires market is the integration of smart technology. Smart tires equipped with sensors and real-time data collection systems are gaining popularity, providing enhanced performance and safety by continuously monitoring tire pressure, temperature, and wear. These tires offer benefits like improved fuel efficiency, longer lifespan, and reduced risk of tire failure. Another significant trend is the growing focus on using innovative materials, with manufacturers exploring options that improve performance without sacrificing quality. Tires made with bio-based rubbers and recycled materials are becoming more prevalent. These innovations are helping to meet consumer demand for high-performing products while also improving tire safety and efficiency.

The growing adoption of electric vehicles (EVs) presents substantial opportunities for the advanced tires market. EVs require specialized tires to support their unique weight distribution, torque demands, and energy efficiency. Manufacturers are developing tires optimized for electric vehicles, ensuring low rolling resistance, enhanced durability, and long-range capabilities. Emerging markets, particularly in Asia-Pacific and Africa, offer significant growth potential as urbanization increases and vehicle ownership rises. As infrastructure develops and the demand for vehicles continues to grow in these regions, the need for advanced tires will increase. Companies that can cater to the needs of the growing EV market while addressing regional market requirements will be well-positioned for expansion and success.

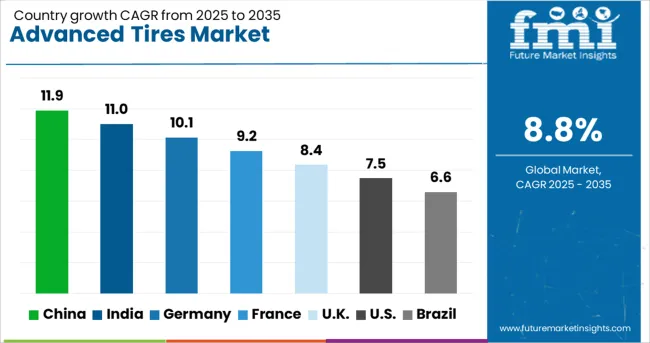

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

The advanced tires market is projected to grow at a CAGR of 8.8% from 2025 to 2035. Among the top five profiled markets, China leads at 11.9%, followed by India at 11.0%, Germany at 10.1%, the United Kingdom records 8.4%, and the United States stands at 7.5%. These growth rates reflect stronger demand in BRICS economies like China and India, driven by rapid industrialization, growing automotive demand, and rising consumer preference for high-performance and eco-friendly tires. Developed markets such as Germany, the UK, and the USA show steady growth, supported by innovations in tire technology, including fuel-efficient, durable, and eco-friendly tires, as well as regulatory pressure to meet goals. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 11.9% through 2035, with robust demand driven by rapid growth in the automotive industry. As the world’s largest automotive market, China is witnessing significant shifts toward electric vehicles (EVs) and high-performance tires, driving the demand for advanced tire technologies. The country’s focus on improving fuel efficiency, reducing emissions, and enhancing tire longevity is contributing to the increasing adoption of advanced tires in both passenger cars and commercial vehicles. The rise in environmental regulations and government initiatives supporting green technologies further boosts the market for eco-friendly and energy-efficient tires. China’s large-scale infrastructure projects and growing vehicle production capacity also support this trend.

India is expected to grow at a CAGR of 11.0% through 2035, driven by increasing demand in the automotive sector, particularly in electric vehicles (EVs) and commercial vehicles. The Indian market for advanced tires is expanding as vehicle manufacturers focus on improving fuel efficiency, performance, and durability. As India’s automotive industry grows, so does the demand for high-performance tires that meet regulatory standards for safety and environmental considerations. The government’s push for electric mobility further strengthens the market for advanced tires, as EVs require specialized tires. The growth in infrastructure and the commercial vehicle sector also contributes to the demand for durable and cost-efficient tires.

Germany is expected to grow at a CAGR of 10.1% through 2035, driven by a strong automotive industry focused on performance and environmental efficiency. Germany, home to leading automotive manufacturers, continues to push for innovations in tire technology, including fuel-efficient, durable, and noise-reducing tires. The shift towards electric vehicles (EVs) and sustainable mobility is further accelerating demand for advanced tires, as EVs require tires designed to improve energy efficiency and handling. The German market also benefits from government policies that support the adoption of green technologies and the reduction of CO2 emissions, which has influenced the demand for eco-friendly and high-performance tire solutions.

The United Kingdom is projected to grow at a CAGR of 8.4% through 2035, with growth supported by the rise in electric vehicles (EVs) and regulatory pressure for more efficient and eco-friendly tires. The UK automotive market is witnessing a shift toward more sustainable transportation solutions, increasing demand for tires that align with new emissions standards and offer better fuel efficiency. The government’s push for reducing carbon emissions and encouraging the adoption of EVs has further propelled the demand for advanced tire technologies. As the UK automotive sector continues to expand, the need for high-performance and durable tires is also expected to grow.

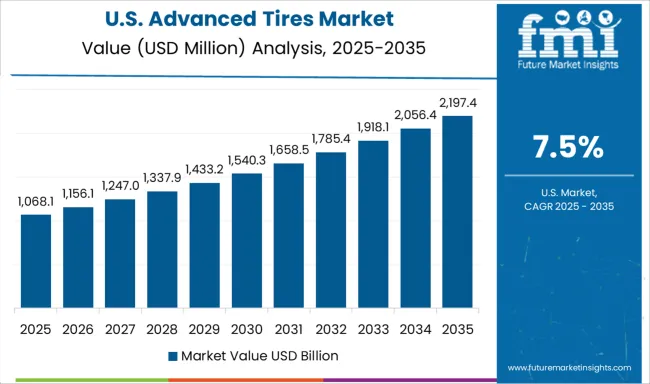

The United States is projected to grow at a CAGR of 7.5% through 2035, driven by demand for high-performance tires and growing interest in electric vehicles (EVs). As the USA automotive market continues to focus on fuel efficiency, vehicle performance, and environmental sustainability, the demand for advanced tires that meet regulatory standards for emissions and energy efficiency is rising. The increasing adoption of EVs in the USA also boosts the market for specialized tires that enhance performance and increase energy efficiency. The demand for commercial vehicle tires is another contributing factor, as more vehicles are needed for logistics and transportation.

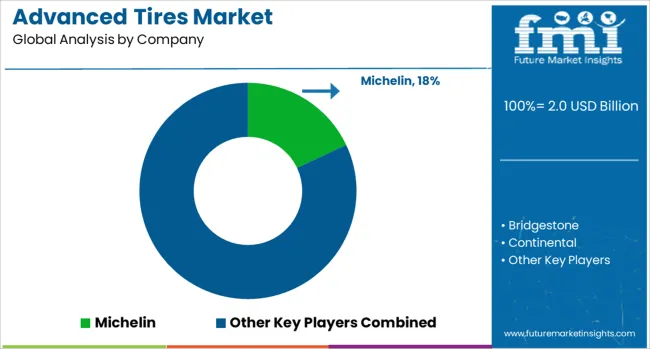

The advanced tires market is led by top global tire manufacturers focusing on developing high-performance, energy-efficient, and eco-friendly tires for automotive, commercial, and industrial applications. Michelin and Bridgestone dominate the market with innovative tire technologies, emphasizing sustainability, improved fuel efficiency, and long-lasting durability for both consumer and commercial vehicles.

Continental and Goodyear are key players, offering a wide range of advanced tire solutions, including smart tires with embedded sensors for real-time monitoring and performance optimization. Hankook and Nokian focus on premium and environmentally friendly tires, with a strong emphasis on performance and safety in both summer and winter tires.

Pirelli leads in the high-performance and luxury vehicle tire segment, known for cutting-edge technologies in tire design that enhance handling, comfort, and fuel efficiency. Sumitomo, Toyo, and Yokohama provide cost-effective yet advanced tire solutions for the mass-market segment, focusing on increasing longevity, improving fuel efficiency, and meeting global emission standards.

Competitive differentiation in the advanced tire market is driven by performance, safety features (such as improved grip and braking), rolling resistance, tire lifespan, and innovations in eco-friendly tire production. Barriers to entry include high research and development costs, stringent regulatory compliance, and maintaining brand loyalty among consumers. Strategic priorities include advancing tire technologies for electric vehicles, improving fuel economy, and enhancing tire durability while reducing environmental impact through the use of sustainable materials and processes.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Tires | Pneumatic, Airless, Run-flat, and Others |

| Material | Synthetic Rubber, Natural Rubber, Elastomers, and Others |

| Technology | Self-Inflating, Chip-Embedded, Multi-chamber, All-In-One, and Self-Sealing |

| Sales Channel | OEM and Aftermarket |

| Vehicle | Light-duty, Heavy-duty, and Off-highway |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Michelin, Bridgestone, Continental, Goodyear, Hankook, Nokian, Pirelli, Sumitomo, Toyo, and Yokohama |

| Additional Attributes | Dollar sales by tire type (passenger vehicle tires, commercial vehicle tires, off-road tires) and application (OEM, replacement). Demand dynamics are driven by increasing consumer preference for fuel-efficient tires, the growing adoption of electric vehicles (EVs), and the rising need for smart tire technologies for fleet management and real-time monitoring. Regional trends indicate North America and Europe leading in high-performance tire demand, while Asia-Pacific is expanding rapidly due to increasing vehicle production and rising urbanization. Innovation trends include the development of tires optimized for EVs, self-healing and puncture-resistant tires, and integration of sensor-based technologies for vehicle connectivity. |

The global advanced tires market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the advanced tires market is projected to reach USD 4.6 billion by 2035.

The advanced tires market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in advanced tires market are pneumatic, airless, run-flat and others.

In terms of material, synthetic rubber segment to command 46.0% share in the advanced tires market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA