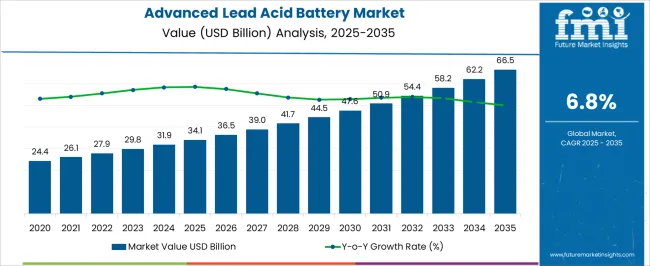

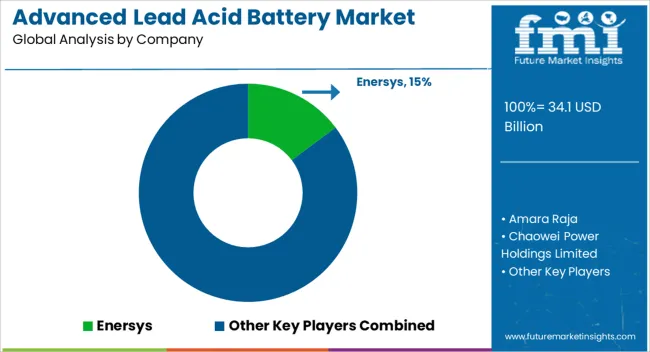

The Advanced Lead Acid Battery Market is estimated to be valued at USD 34.1 billion in 2025 and is projected to reach USD 66.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Advanced Lead Acid Battery Market Estimated Value in (2025 E) | USD 34.1 billion |

| Advanced Lead Acid Battery Market Forecast Value in (2035 F) | USD 66.5 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The advanced lead acid battery market is experiencing steady expansion, supported by its widespread use in motive power, automotive systems, and industrial backup applications. High recyclability, established manufacturing infrastructure, and cost-effectiveness compared to alternative chemistries have reinforced the adoption of advanced lead acid batteries.

The current market scenario reflects a balance between traditional demand in automotive starting applications and increasing reliance on batteries for forklifts, material handling equipment, and renewable energy storage. Technological improvements in battery design, including enhanced cycle life and maintenance-free operation, have expanded their competitiveness.

Regulatory emphasis on sustainable energy storage and circular economy practices further strengthens demand. Looking forward, growth will be driven by ongoing electrification in transportation, the need for robust power backup systems, and increasing integration with hybrid renewable installations, ensuring that advanced lead acid batteries retain their role in the global energy storage landscape.

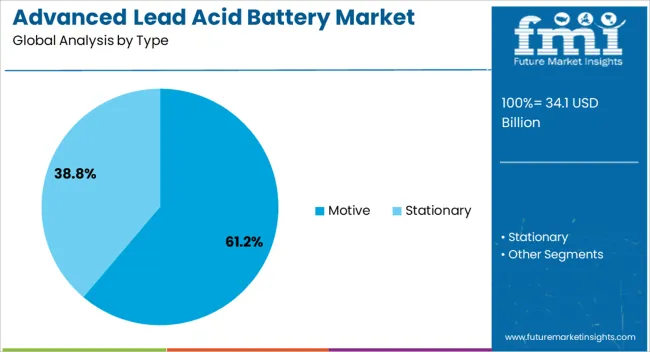

The motive segment leads the type category, accounting for approximately 61.20% share of the advanced lead acid battery market. This dominance is attributed to the extensive use of lead acid batteries in forklifts, electric material handling equipment, and mobility vehicles, where high reliability and cost-efficiency are essential.

The segment benefits from strong penetration in logistics, warehousing, and manufacturing sectors, which rely on motive power solutions for uninterrupted operations. Demand has been reinforced by the growth of e-commerce and increased investments in automated warehouse systems.

The durability and deep-cycle capability of advanced lead acid batteries support their ongoing relevance in heavy-duty applications. With electrification trends in industrial vehicles and consistent need for high-performance storage solutions, the motive segment is expected to maintain its leadership through the forecast period.

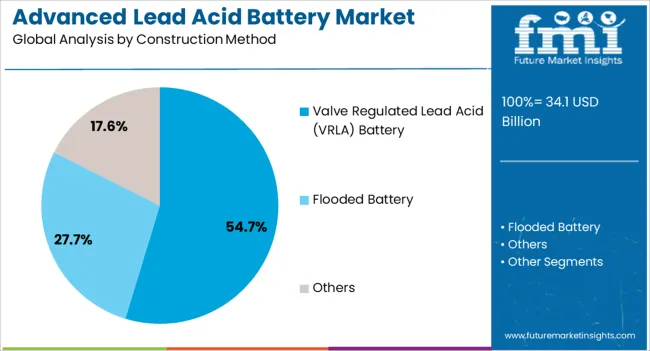

The VRLA battery segment dominates the construction method category with approximately 54.70% share, supported by its maintenance-free design and improved safety profile. The segment has gained traction in both stationary and motive applications due to its sealed construction, which prevents leakage and reduces handling requirements.

VRLA batteries are preferred in environments requiring reliable backup power, including data centers, telecommunication systems, and uninterruptible power supply units. Their compact design and compatibility with confined spaces further contribute to adoption.

Advancements in AGM (Absorbent Glass Mat) and gel battery technologies have improved cycle life and performance, reinforcing their dominance. With growing demand for energy storage solutions that minimize operational downtime and reduce maintenance, the VRLA segment is positioned to sustain its leading share.

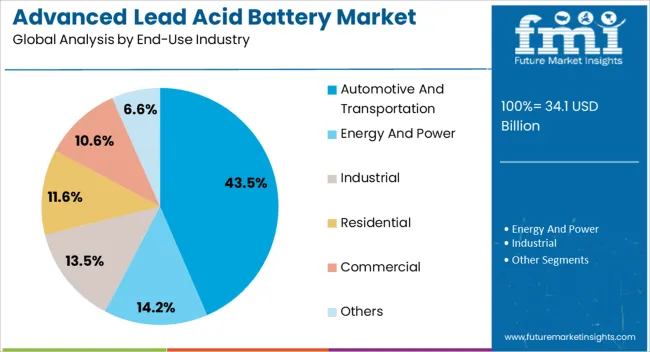

The automotive and transportation segment accounts for approximately 43.50% of the end-use industry category in the advanced lead acid battery market. This share is underpinned by the continued reliance on lead acid batteries for starting, lighting, and ignition (SLI) functions in conventional vehicles.

The segment also benefits from rising demand for auxiliary batteries in electric and hybrid vehicles, where lead acid technology supports secondary systems. Growth in global automotive production and increased vehicle parc, particularly in emerging markets, reinforce demand.

The widespread availability of service networks and cost-competitive positioning further strengthen adoption. As vehicles become increasingly electrified and energy-intensive, advanced lead acid batteries are expected to remain integral to automotive applications, sustaining the segment’s prominence in the forecast horizon.

Fueled by heightened emphasis on research and development and substantial investments in the automotive sector, particularly in the domain of electric vehicles, the advanced lead-acid battery market is projected to experience a CAGR of 6.9% from 2025 to 2035. The 8.6% CAGR recorded during the period from 2020 to 2025.

The rise in global demand for energy-efficient solutions has been a driving force behind the growth of the advanced lead-acid battery market. The consistent increase in the adoption of advanced lead-acid batteries aligns with the emergence of electric and hybrid vehicles in recent years.

| Market Value in 2025 | USD 29.6 billion |

|---|---|

| Market Value in 2035 | USD 62.0 billion |

The following table shows the top five countries by revenue, led by South Korea and Japan. The ongoing advancements in lead-acid battery technology, leading to improved performance, energy density, and cycle life, could contribute to the growth of the market in South Korea.

Government policies and support for renewable energy, energy storage, and environmental sustainability can significantly influence the growth of the advanced lead-acid battery market. These two countries are predicted to boost their market sales through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| United States | 7.1% |

| United Kingdom | 8.0% |

| China | 7.9% |

| Japan | 8.5% |

| South Korea | 9.0% |

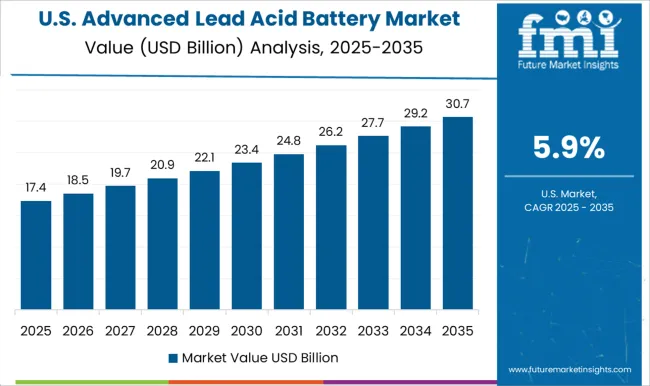

The advanced lead acid battery market in the United States is expected to grow with a CAGR of 7.1% from 2025 to 2035. The growth of the automotive sector and the increasing adoption of electric and hybrid vehicles in the United States could contribute to the demand for advanced lead-acid batteries.

The United States has been actively working towards increasing the share of renewable energy in its energy mix. Advanced lead-acid batteries may find applications in energy storage systems connected to renewable energy sources, helping to stabilize the grid and store excess energy.

The advanced lead-acid battery market in the United States may be influenced by competition with other energy storage technologies, such as lithium-ion batteries. Innovations and advancements that improve the competitiveness of advanced lead-acid batteries may influence market dynamics.

China has been a significant player in the electric vehicle (EV) market, and advanced lead-acid batteries have found applications in start-stop systems and mild-hybrid vehicles. The growth of the automotive sector, including electric and hybrid vehicles, could contribute to increased demand for advanced lead-acid batteries.

Lead-acid batteries, including advanced variants, are widely used in the telecommunications sector for backup power in cell towers and other communication infrastructure. The ongoing expansion and development of power infrastructure in China may drive demand for reliable energy storage solutions

China's focus on renewable energy and the integration of solar and wind power into the grid could drive the demand for energy storage solutions. Advanced lead-acid batteries may find applications in energy storage systems that support renewable energy sources. Over the assessment period, the demand for advanced lead acid batteries in China is projected to surge at a 7.9% CAGR.

The advanced lead acid battery market in the United Kingdom is expected to expand at a CAGR of 8.0% by 2025. The market growth in the country is attributed to the United Kingdom's commitment to reducing carbon emissions and promoting sustainable transportation.

Increased use of advanced lead-acid batteries in industrial and commercial applications, such as backup power systems, forklifts, and telecommunications, can contribute to market growth in the United Kingdom.

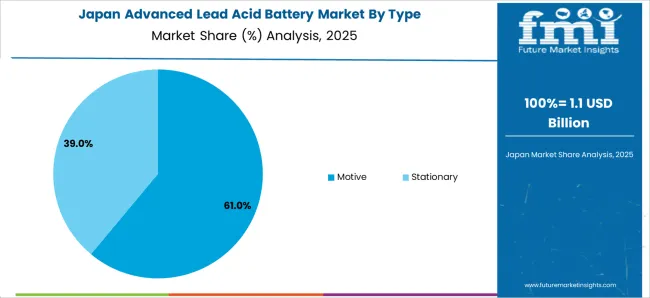

The demand for advanced lead acid batteries is expected to rise in Japan. By 2035, the market is expected to expand at a CAGR of 8.5%. Japan has been a major player in the automotive industry, and advanced lead-acid batteries find applications in vehicles, particularly in start-stop systems and mild-hybrid vehicles.

The growth of the automotive sector, including electric and hybrid vehicles, could drive the demand for advanced lead-acid batteries. Lead-acid batteries, including advanced types, are widely used for backup power in the telecommunications sector.

With the continuous expansion and development of telecommunications infrastructure, there may be a growing demand for advanced lead-acid batteries in the country.

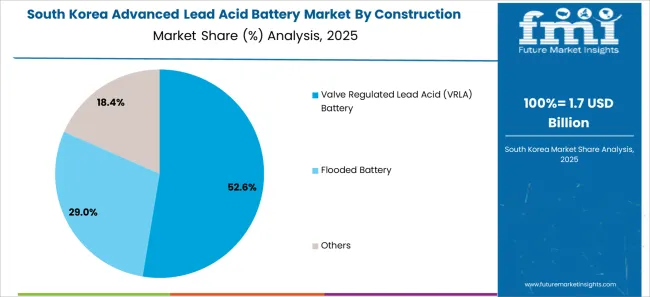

The advanced lead acid battery market in South Korea is expected to expand at a CAGR of 9.0% by 2025. The market growth in the country is influenced by the presence of a strong automotive industry. The growth of electric and hybrid vehicles in the country could drive the demand for advanced lead-acid batteries, especially in applications like start-stop systems and mild-hybrid vehicles.

South Korea has been making efforts to increase the share of renewable energy in its energy mix. Advanced lead-acid batteries may find applications in energy storage systems connected to renewable sources, contributing to the growth of the market.

Ongoing advancements in lead-acid battery technology, leading to improved performance, energy density, and cycle life, could contribute to the growth of the market in South Korea.

The below section shows the leading segment leading type and construction method. The motive segment is forecast to have a 6.7% CAGR between 2025 and 2035.

Based on the construction method, the Valve Regulated Lead Acid (VRLA) Battery segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 6.5% during the forecast period.

| Category | Market share |

|---|---|

| Motive | 6.7% |

| Valve Regulated Lead Acid (VRLA) Battery | 6.5% |

Vvalve regulated lead acid (VRLA) battery to lead the advanced lead acid market. Valve Regulated Lead Acid (VRLA) batteries will dominate the advanced lead acid battery market, and this dominance is expected to continue throughout the forecast period, with a CAGR of 6.5%.

Valve Regulated Lead Acid (VRLA) batteries are known for their maintenance-free operation, which makes them attractive for a wide range of applications. They do not require regular watering, and users do not need to check the electrolyte levels or add water periodically. The sealed design of VRLA batteries eliminates the need for ventilation and minimizes the risk of acid leakage. This feature enhances safety, making them suitable for applications where safety and environmental concerns are critical.

VRLA batteries are generally more cost-effective than some other types of batteries, such as lithium-ion batteries. This cost advantage makes them a preferred choice, particularly in applications where cost is a significant consideration.

VRLA batteries offer reliable performance and have a relatively long service life. This makes them suitable for applications where a dependable power source is crucial, such as backup power systems and emergency lighting.

Based on type, the motive segment is expected to account for a CAGR of 6.7% from 2025 to 2035. Advanced lead-acid batteries have a well-established track record in motive applications, providing predictable performance and minimal maintenance requirements.

Lead-acid batteries boast an impressive recycling rate, making them a more environmentally friendly choice compared to some alternatives. Advanced lead-acid batteries offer several attractive features for motive applications like electric vehicles, forklifts, and other industrial equipment.

Advanced lead-acid batteries represent a mature and reliable technology for motive applications, offering a balance of cost-effectiveness, durability, and safety

Leading advanced lead acid battery companies are investing heavily in the research and development of novel battery technologies and acquiring new patents to gain a competitive edge over other market players.

Key players operating in the advanced lead acid battery market include Amara Raja, Chaowei Power Holdings Limited, Coslight Technology International Group Co., Ltd, Crown Battery, East Penn Manufacturing, Enersys, Exide Industries Ltd, Hitachi Chemical Energy Technology, GS Yuasa International Ltd, Furukawa Battery Co., Ltd,

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 31.9 billion |

| Projected Market Valuation in 2035 | USD 62.0 billion |

| Value-based CAGR 2025 to 2035 | 6.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Type, Construction Method, End-use Industry, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Amara Raja; Chaowei Power Holdings Limited; Coslight Technology International Group Co. Ltd; Crown Battery; East Penn Manufacturing; Enersys; Exide Industries Ltd; Hitachi Chemical Energy Technology; GS Yuasa International Ltd; Furukawa Battery Co. Ltd |

The global advanced lead acid battery market is estimated to be valued at USD 34.1 billion in 2025.

The market size for the advanced lead acid battery market is projected to reach USD 66.5 billion by 2035.

The advanced lead acid battery market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in advanced lead acid battery market are motive and stationary.

In terms of construction method, valve regulated lead acid (vrla) battery segment to command 54.7% share in the advanced lead acid battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA