The Dynamic Structural Packs Market will grow from USD 1.7 billion in 2025 to USD 3.2 billion by 2035, at a CAGR of 6.5%. Growth is driven by industrial transformation and increasing adoption of modular, collapsible packaging for smart logistics. The dynamic structural packs market is being shaped by rising interest in modular formats that improve packaging movement, stacking stability, and warehouse flow. Growth from 2025 to 2035 is supported by wider use of collapsible and reconfigurable structures that help distribution centers cut handling time and reduce material load. Kinetic folding systems and self-locking formats are gaining wider acceptance because they allow packaging units to shift between flat and expanded states without mechanical support, thereby improving storage density along logistics chains. Retailers and e-commerce operators are encouraging converters to adopt recyclable corrugated grades, molded fiber reinforcements, and hybrid composites that ensure strength with lower weight.

Between 2025 and 2030, lightweight corrugated formats and recyclable composites are expected to dominate as automation in retail and logistics expands. Asia Pacific is positioned to maintain the highest growth rate due to rising freight volumes and a strong packaging engineering base. North America and Europe are likely to focus on structural optimization, precision converting, and material consistency. Leading companies include Amcor, Sonoco Products, Great Northern, IPAK, DCA Design International, PakFactory, JohnsByrne, DS Smith, WestRock, and Mondi Group.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.7 billion |

| Industry Value (2035F) | USD 3.2 billion |

| CAGR (2025 to 2035) | 6.5% |

Between 2020 and 2024, logistics digitization and e-commerce expansion revolutionized the structural packaging industry. Modular and kinetic designs gained popularity for enabling quick assembly, disassembly, and reuse. By 2035, the market will reach USD 3.2 billion, fuelled by eco-innovation, industrial automation, and pressure to reduce transport emissions. Asia-Pacific will dominate due to manufacturing scalability and export-oriented growth, while North America and Europe lead in design innovation and sustainability compliance for smart logistics packaging.

The growth of the dynamic structural packs market is driven by increasing demand for durable, foldable, and reusable packaging that optimizes warehouse storage and reduces logistics costs. The rise of smart warehouses and international shipping is accelerating the adoption of dynamic, recyclable structural packs globally.

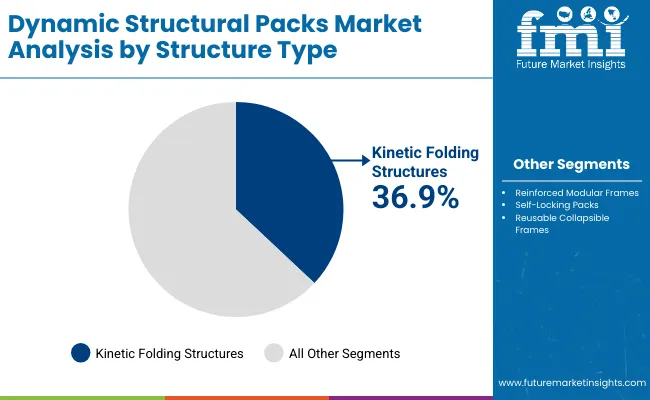

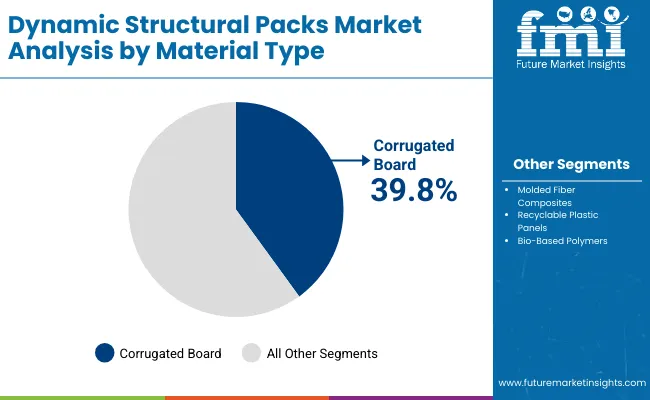

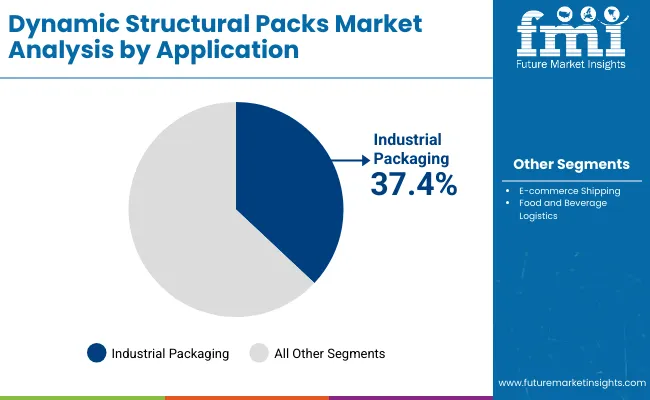

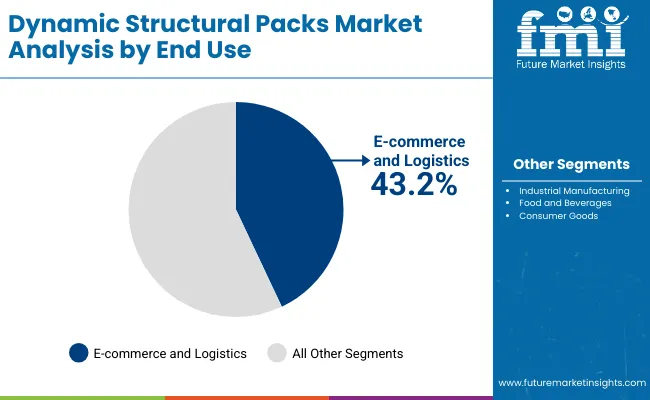

The market is segmented by structure type, material, application, end-use industry, and region. Structure types include kinetic folding structures, reinforced modular frames, self-locking packs, and reusable collapsible frames. Materials cover corrugated board, moldedfiber composites, recyclable plastic panels, and bio-based polymers. Applications span industrial packaging, e-commerce shipping, and food and beverage logistics. End-use industries include e-commerce and logistics, industrial manufacturing, food and beverages, and consumer goods.

Kinetic folding structures are projected to account for 36.9% of the market in 2025, driven by their ability to provide efficient collapsibility and reusability in storage and transport. Their lightweight yet robust design ensures fast setup and compact return logistics, reducing warehousing costs.

These structures are increasingly adopted in automated facilities and distribution centers where adaptability and space utilization are critical. Integration with robotic handling systems further improves operational efficiency. As logistics networks modernize, kinetic folding structures remain the preferred solution for dynamic, reusable packaging.

Corrugated board is expected to hold 39.8% of the market in 2025, supported by its strength-to-weight ratio, recyclability, and low production cost. Its adaptability enables a wide range of industrial and retail packaging solutions, including foldable crates and modular containers.

The material’s renewable sourcing aligns with global sustainability mandates, making it a preferred alternative to rigid plastics. Advances in moisture-resistant coatings enhance durability for multi-trip use. As the demand for eco-efficient transit packaging rises, corrugated board continues to dominate material selection.

Industrial packaging is forecast to capture 37.4% of the market in 2025, propelled by the need for resilient solutions in equipment, automotive parts, and machinery logistics. Foldable packaging systems reduce volume during return transport, improving cost efficiency and storage management.

Manufacturers favor collapsible formats that maintain product protection while minimizing handling time. Integration of RFID tags and smart folding mechanisms enhances traceability. As heavy-duty supply chains prioritize sustainable materials, industrial packaging remains the leading application segment.

E-commerce and logistics are projected to represent 43.2% of the market in 2025, driven by rapid growth in last-mile delivery and warehouse automation. Foldable packaging solutions optimize space utilization and reduce shipment waste in high-frequency distribution models.

Reusable corrugated and composite formats enhance circular logistics and reduce carbon emissions. Companies are adopting collapsible systems compatible with robotic sorting and palletization. As sustainability and speed define the next generation of logistics, e-commerce and distribution networks remain the largest end-use segment.

The market is driven by rising e-commerce packaging volumes and the global transition toward reusable and returnable industrial packaging solutions. Companies are adopting reusable systems to reduce waste, lower transportation costs, and meet circular economy goals. Growing regulatory pressure to minimize single-use materials and the rise of sustainable logistics models are accelerating adoption across retail, automotive, and manufacturing sectors.

Market growth is restrained by the high initial costs associated with foldable, modular, and smart reusable packaging systems. The complexity of reverse logistics, including cleaning, collection, and redistribution, adds operational challenges. Limited standardization across supply chains and the need for durable yet lightweight materials also increase development expenses. These factors slow adoption, particularly among small and mid-sized enterprises.

Expanding integration of IoT-enabled tracking systems and smart folding mechanisms presents new avenues for efficiency and automation. Connected reusable containers equipped with RFID or GPS sensors enhance traceability and inventory control. Partnerships between packaging innovators and logistics providers are fostering closed-loop systems that optimize resource use. The growing shift toward B2B leasing models and service-based packaging solutions offers further commercial potential.

Sustainable corrugated and composite modular systems are emerging as preferred solutions for eco-conscious logistics. Rapid packaging reconfiguration technology is enabling adaptable supply chains that respond dynamically to shipment size and frequency. Digitalized logistics optimization, powered by AI and predictive analytics is improving route efficiency and reducing environmental impact. Together, these trends are positioning reusable packaging systems as essential components of next-generation, circular supply networks.

The global dynamic structural packs market is expanding as automation, sustainability, and e-commerce logistics converge. Asia-Pacific dominates due to large-scale manufacturing capacity and rapid logistics infrastructure growth. North America and Europe lead advancements in sustainable corrugated materials and automated handling systems. Increasing focus on modular, reusable, and collapsible packaging structures continues to shape innovation, enabling cost-efficient, lightweight, and secure transport solutions across industrial supply chains worldwide.

The USA will grow at 6.6% CAGR, driven by automation in warehousing and smart logistics. Self-locking and collapsible structural packs are increasingly integrated into automated packaging lines to reduce handling time. Expanding industrial exports and sustainability mandates further support market momentum.

Germany will expand at 6.4% CAGR, propelled by innovation in sustainable corrugated and hybrid structural systems. Smart automation and eco-design principles are reshaping packaging workflows across the industrial and automotive sectors. Strong export-oriented manufacturing sustains long-term demand.

The UK will grow at 6.5% CAGR, supported by rapid adoption of collapsible and modular packaging for logistics optimization. E-commerce growth and sustainability goals encourage investment in lightweight, recyclable designs. Continuous R&D in composite materials enhances durability and reusability.

China will grow at 6.5% CAGR, benefiting from strong logistics automation and industrial packaging upgrades. Large-scale corrugated production and green material development enhance competitiveness in export markets. Domestic policies supporting recycling further stimulate innovation.

India will grow at 6.4% CAGR, led by improvements in warehousing, e-commerce, and manufacturing logistics. Adoption of reusable and fiber-based packaging solutions is increasing under sustainability initiatives. Domestic demand growth and infrastructure expansion strengthen market penetration.

Japan will grow at 7.3% CAGR, emphasizing high-precision modular frame development for logistics and electronics industries. Integration of smart folding and automated locking systems enhances efficiency. Robotics-driven packaging innovation positions Japan at the forefront of intelligent structural design.

South Korea will lead with 7.4% CAGR, backed by technological leadership in smart packaging systems and recyclable corrugated materials. Dynamic packaging solutions for export industries are expanding rapidly, aided by investments in automated logistics networks.

Japan’s dynamic structural packs market, valued at USD 200.0 million in 2025, is led by kinetic folding structures with a 35.3% share due to their lightweight, reconfigurable design suited for automated assembly lines. Reinforced modular frames offer enhanced durability, while self-locking packs and reusable collapsible frames support logistics efficiency and circular economy adoption.

South Korea’s dynamic structural packs market, worth USD 100.0 million in 2025, is dominated by corrugated board, accounting for 40.8% share driven by recyclability and structural adaptability. Moldedfiber composites gain traction in consumer electronics, while recyclable plastic panels and bio-based polymers promote sustainability and multi-cycle industrial packaging usage.

The market is moderately consolidated, featuring Amcor plc, Sonoco Products, Great Northern, IPAK, DCA Design International, PakFactory, JohnsByrne, DS Smith, WestRock, and Mondi Group. Companies focus on lightweight materials, automation compatibility, and circular packaging design for logistics optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion (2025) |

| By Structure Type | Kinetic Folding, Reinforced Modular, Self-Locking, Collapsible Frames |

| By Material | Corrugated Board, Molded Fiber, Recyclable Panels, Bio-Based Polymers |

| By Application | Industrial, E-commerce Shipping, Food & Beverage Logistics |

| By End-Use Industry | E-commerce & Logistics, Industrial, Food & Beverages, Consumer Goods |

| Key Companies Profiled | Amcor plc, Sonoco Products, Great Northern, IPAK, DCA Design International, PakFactory, JohnsByrne, DS Smith, WestRock, and Mondi Group |

| Additional Attributes | Market driven by logistics automation, sustainable design, and modular packaging innovation |

The market is valued at USD 1.7 billion in 2025, driven by logistics automation and packaging reusability.

It will reach USD 3.2 billion by 2035, supported by industrial automation and e-commerce expansion.

The market will grow at a CAGR of 6.5 % over the forecast period.

Kinetic Folding Structures lead with a 36.9 % share, offering flexibility and space-saving performance.

Key players include Amcor plc, Sonoco Products, Great Northern, DS Smith, WestRock, and Mondi Group, focusing on modular, recyclable, and automated packaging solutions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dynamic Glucose Monitoring Patch Market Size and Share Forecast Outlook 2025 to 2035

Dynamic NFT (dNFT) Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Positioning System Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Vapor Sorption Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Plantar Tactile Instrument Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Spinal Tethering Systems Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Random Access Memory (DRAM) Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Data Management System Market Report – Trends & Forecast 2023-2033

Dynamic Mechanical Analyzer Market

High Dynamic Range Market Size and Share Forecast Outlook 2025 to 2035

Plasma Dynamic Air Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Spotlight Market

Demand for Plasma Dynamic Air Sterilizers in UK Size and Share Forecast Outlook 2025 to 2035

Computational Fluid Dynamics (CFD) Market – Trends & Forecast 2025 to 2035

Demand for Automotive Dynamic Map Data in USA Size and Share Forecast Outlook 2025 to 2035

Structural Waterproofing Services Market Size and Share Forecast Outlook 2025 to 2035

Structural Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA