The High Dynamic Range Market is estimated to be valued at USD 53.2 billion in 2025 and is projected to reach USD 589.4 billion by 2035, registering a compound annual growth rate (CAGR) of 27.2% over the forecast period.

In the early phase from 2025 to 2030, rapid uptake of HDR-enabled TVs, smartphones, and streaming services will drive demand, with the market projected to exceed USD 175 billion by the end of this period.

Between 2030 and 2035, growth is expected to accelerate further as HDR becomes a standard in immersive entertainment, augmented reality, and professional imaging. This period will see strong integration into next-generation content ecosystems, pushing the market toward USD 589.4 billion. The incremental opportunity of USD 536.2 billion underscores HDR’s role as a disruptive enabler of enhanced visual experiences. Competitive dynamics will be shaped by display manufacturers, chipset providers, and streaming platforms offering advanced color, contrast, and brightness capabilities.

| Metric | Value |

|---|---|

| High Dynamic Range Market Estimated Value in (2025 E) | USD 53.2 billion |

| High Dynamic Range Market Forecast Value in (2035 F) | USD 589.4 billion |

| Forecast CAGR (2025 to 2035) | 27.2% |

The high dynamic range market is experiencing robust growth as consumer demand for enhanced visual experiences continues to rise across content consumption and content creation platforms. Improvements in display technologies, increased penetration of ultra high definition screens, and the widespread availability of HDR supported content have collectively contributed to this upward trend.

Industry leaders are investing in content mastering, chipset optimization, and streaming infrastructure to support smoother delivery of HDR formats across digital platforms. Regulatory bodies and broadcast standards are also aligning to support interoperability and quality assurance in HDR content.

As more content creators and device manufacturers adopt HDR as a standard, the market is expected to expand steadily, with significant advancements in real time rendering, brightness mapping, and color accuracy driving continued innovation and consumer adoption.

The high dynamic range market is segmented by HDR type, product type, application, end-use industry, and geographic regions. By HDR type, the high dynamic range market is divided into Dolby Vision, HDR10, HDR10+, Hybrid Log-Gamma, Advanced HDR, and Others. In terms of product type, the high dynamic range market is classified into Capturing devices and Display devices. Based on the application of the high dynamic range market, it is segmented into Television, Smartphone, Monitor, Cameras and camcorders, and Others.

The high dynamic range market is segmented by end-use industry into Consumer Electronics, Media & Entertainment, Automotive, Healthcare, and Others. Regionally, the high dynamic range industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Dolby Vision segment is projected to hold 44.60% of total revenue by 2025 within the HDR type category, making it the leading format. This dominance is supported by its superior dynamic metadata capabilities, enhanced brightness range, and precision in color grading.

Dolby Vision allows content creators to optimize each frame individually, delivering an enriched visual experience across various screen sizes and lighting conditions. Its strong integration into premium devices and partnerships with major streaming services have further amplified adoption.

Content producers and device manufacturers favor Dolby Vision due to its technical reliability, viewer impact, and consistent performance across ecosystems, solidifying its leadership within the HDR type segment.

The capturing devices segment is expected to account for 57.30% of overall market revenue by 2025 within the product type category, emerging as the dominant segment. This is driven by the widespread integration of HDR capabilities into professional cameras, smartphones, and digital camcorders.

Consumers and professionals alike are seeking improved image depth, contrast, and clarity in both video and photography, which has led manufacturers to prioritize HDR features. Advancements in image sensors, AI-assisted processing, and real-time HDR rendering are enabling high-fidelity content creation at scale.

As social media and streaming platforms emphasize high-quality visuals, the demand for HDR-enabled capturing devices continues to grow rapidly.

The television segment is projected to contribute 48.20% of total market revenue by 2025 under the application category, positioning it as the most significant area of use. This growth is being fueled by increasing consumer adoption of 4K and 8K televisions that support HDR formats and the availability of HDR content through streaming services and digital broadcasting.

Television manufacturers are incorporating multiple HDR standards into their devices to ensure broad compatibility and user satisfaction. The improved contrast ratios, vibrant color representation, and immersive viewing experiences offered by HDR televisions are key drivers of their popularity.

As consumers seek cinematic quality visuals at home, the television application segment continues to lead the HDR market in both demand and innovation.

The HDR market is driven by increasing demand for superior visual quality, with strong growth in consumer electronics and streaming content. As HDR is integrated into more devices, its role in enhancing user experiences will continue to expand.

The growing consumer demand for superior image quality is driving the adoption of High Dynamic Range (HDR) technology across various display devices. HDR offers improved contrast, brightness, and color accuracy, providing an enhanced viewing experience for consumers. As 4K and 8K televisions become more prevalent, HDR has become a key feature, especially for high-end displays in gaming and home entertainment. The increasing popularity of HDR-enabled streaming platforms and content, such as Netflix and Amazon Prime, is further boosting its demand. Additionally, the rise of gaming consoles with HDR capabilities is driving widespread adoption among gamers who seek realistic, immersive visuals.

HDR technology is expanding beyond televisions into a wide range of consumer electronics. Smartphones, laptops, and monitors are increasingly adopting HDR to cater to consumer preferences for superior display quality. This trend is particularly visible in high-end devices, where HDR support is becoming a standard feature. The shift toward HDR in mobile devices and personal computers is fueled by consumer demand for better media experiences, especially for video streaming, gaming, and photo editing. As the demand for content-rich and immersive multimedia applications increases, HDR's role in enhancing everyday electronic devices continues to grow.

The proliferation of HDR content is driving the growth of HDR adoption in display technologies. Streaming services are actively producing and offering HDR-compatible content to meet the growing demand for high-quality visuals. Popular platforms, such as Netflix, Disney+, and YouTube, are increasingly offering a variety of movies, shows, and documentaries in HDR formats. The availability of HDR content across multiple genres, including sports, gaming, and movies, is encouraging consumers to invest in HDR-compatible displays. As more content creators embrace HDR formats, the market for HDR displays will continue to expand, providing a diverse range of options for consumers.

HDR is being integrated into next-generation devices, such as 8K TVs, gaming consoles, and virtual reality headsets, positioning it as a key feature for future entertainment technologies. The growing focus on high-definition and ultra-high-definition resolutions is driving the need for enhanced color depth and brightness, making HDR a vital element for the best viewing experience. In the gaming industry, HDR support in consoles like PlayStation and Xbox is becoming a standard for delivering immersive graphics. As the demand for next-gen devices rises, HDR technology's presence in these devices will be critical for delivering cutting-edge, realistic media experiences.

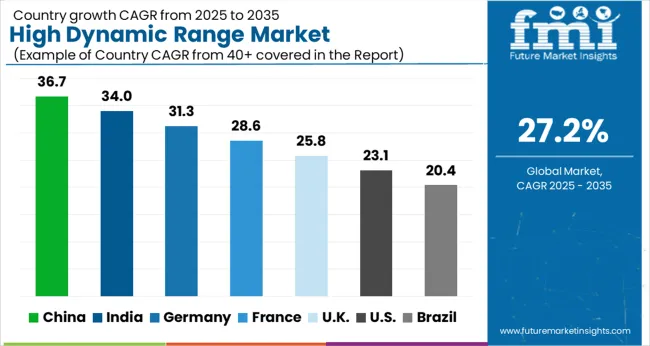

| Country | CAGR |

|---|---|

| China | 36.7% |

| India | 34.0% |

| Germany | 31.3% |

| France | 28.6% |

| UK | 25.8% |

| USA | 23.1% |

| Brazil | 20.4% |

The High Dynamic Range (HDR) market is projected to grow globally at a CAGR of 27.2% from 2025 to 2035, driven by increasing consumer demand for superior visual quality, rapid adoption of HDR in displays, and growth in streaming content. China leads with a CAGR of 36.7%, fueled by strong demand for high-definition displays, the booming gaming industry, and the growing popularity of HDR content in streaming platforms. India follows at 34.0%, supported by rapid urbanization, increasing disposable incomes, and a rising number of consumers seeking premium home entertainment systems. France grows at 28.6%, influenced by regulatory initiatives promoting digital media content and adoption of HDR in televisions and mobile devices. The United Kingdom posts a CAGR of 25.8%, supported by increasing investments in next-generation display technology and growing demand for UHD television. The United States records 23.1%, with steady demand from entertainment, gaming, and consumer electronics industries, including the adoption of HDR-enabled content and devices. The analysis spans more than 40 countries, with these five serving as key benchmarks for market expansion, product development, and HDR content adoption strategies.

The UK is projected to grow at a CAGR of 25.8% from 2025 to 2035, slightly below the global average of 27.2%. Between 2020 and 2024, the market grew at a CAGR of 18.5%, driven by the rising adoption of 4K and 8K TVs and growing demand for immersive media experiences. This phase saw slower adoption of HDR technology due to high initial costs and limited content availability. However, the market is expected to gain momentum as the demand for HDR-enabled content increases across streaming platforms, with key players expanding HDR catalog offerings. The future growth will be driven by wider adoption of HDR in gaming, sports broadcasting, and high-end consumer electronics. Increasing investments in next-generation displays, including OLED and QLED, will drive adoption in both consumer and professional segments, including cinema and media production.

China is projected to grow at a CAGR of 36.7% from 2025 to 2035, significantly above the global average of 27.2%. Between 2020 and 2024, the market grew at a CAGR of 29.5%, driven by the country's massive consumer base, strong manufacturing capabilities, and rapid adoption of HDR-enabled devices. The faster-than-expected growth was fueled by high demand for 4K and 8K televisions, particularly in the premium segment, alongside a surge in gaming and content creation industries. The next phase of growth will see even more widespread adoption as China's media sector expands and HDR becomes a standard feature for content producers and broadcasters. The push toward better display technologies like OLED, QLED, and microLED will further drive HDR demand in both consumer electronics and professional markets.

India is expected to grow at a CAGR of 34.0% from 2025 to 2035, significantly surpassing the global average of 27.2%. During 2020–2024, the market grew at a CAGR of 28.5%, driven by increasing consumer interest in high-quality entertainment and growing middle-class purchasing power. The market was initially limited by high prices and limited availability of HDR content. However, the growth outlook for 2025–2035 is bolstered by increasing investments in the television, smartphone, and gaming industries, as well as the rising number of streaming platforms offering HDR content. The increasing affordability of HDR-enabled TVs and smartphones is expected to drive mass adoption across urban and rural areas. Furthermore, the growing demand for high-definition content and the expansion of the OTT market will continue to support HDR adoption.

France is projected to grow at a CAGR of 28.6% from 2025 to 2035, surpassing the global average of 27.2%. Between 2020 and 2024, the market grew at a CAGR of 23.0%, driven by increasing demand for UHD content and premium television sets. The slower growth during 2020–2024 was due to the initial high costs of HDR-enabled devices and limited content availability. The outlook for 2025–2035 is significantly stronger due to the expanding availability of HDR content across popular streaming platforms, combined with the growing adoption of 4K and 8K TVs. Furthermore, France's strong presence in the entertainment and media production sectors, along with the government's support for digital initiatives, will contribute to the increasing demand for high-quality displays and HDR-enabled devices.

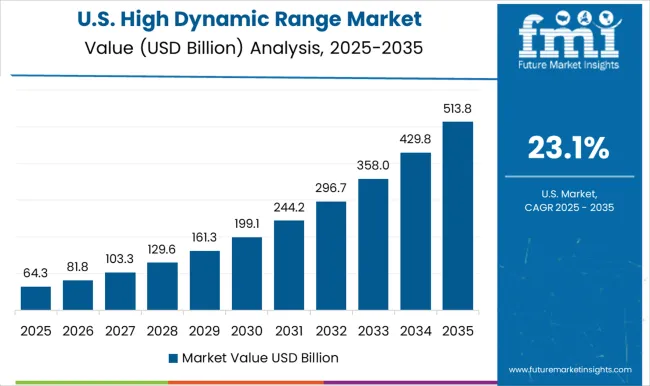

The United States is projected to grow at a CAGR of 23.1% from 2025 to 2035, slightly below the global average of 27.2%. Between 2020 and 2024, the market grew at a CAGR of 18.4%, driven by the continued demand for high-definition televisions, increasing consumer interest in immersive media, and the rapid growth of HDR content across streaming platforms. During the 2020–2024 period, growth was somewhat limited by the premium pricing of HDR-enabled devices and the availability of compatible content. The next phase of growth will benefit from the continued expansion of HDR-supported content across major streaming platforms like Netflix, Amazon Prime, and Disney+. The rise of HDR-compatible gaming consoles and professional-grade displays will contribute to broader adoption across consumer and professional markets, ensuring the continued growth of the HDR market in the USA

The High Dynamic Range (HDR) market is highly competitive, featuring a mix of global technology giants and display innovators such as Samsung Electronics Co. Ltd., LG Display Co. Ltd., Sony Corporation, Apple, Inc., and Panasonic Corporation, each competing on display quality, innovation, and content integration. Samsung Electronics leads the market with its cutting-edge QLED and Neo QLED displays, offering premium HDR features with enhanced brightness and color accuracy. LG Display specializes in OLED technology, pushing the boundaries of HDR with self-lighting pixels that provide perfect black levels and wide viewing angles.

Sony integrates HDR in its Bravia series, emphasizing advanced image processing for optimal content delivery. Apple has integrated HDR across its devices, from iPhones to MacBooks, making it a key player in the mobile and consumer electronics sector. Panasonic is renowned for its high-end OLED and LED TVs, which offer cinematic HDR experiences, particularly in the professional sector. The competitive environment is shaped by technological advancements, consumer demand for high-quality displays, and the availability of content across various streaming platforms. Strategies in the sector include developing proprietary HDR technologies, expanding content partnerships, and enhancing integration with next-generation entertainment devices, such as gaming consoles and streaming services. The market is increasingly focusing on content-rich HDR solutions, gaming, and the adoption of HDR in mobile devices.

| Item | Value |

|---|---|

| Quantitative Units | USD 53.2 Billion |

| HDR Type | Dolby vision, HDR10, HDR10+, Hybrid log-gamma, Advanced HDR, and Others |

| Product Type | Capturing devices and Display devices |

| Application | Television, Smartphone, Monitor, Cameras and camcorders, and Others |

| End-use Industry | Consumer electronics, Media & entertainment, Automotive, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Electronics Co. Ltd., LG Display Co. Ltd., Sony Corporation, Apple, Inc., and Panasonic Corporation |

| Additional Attributes | Dollar sales projections and market share of leading players in the display, entertainment, and consumer electronics sectors. Key factors would include growth drivers such as increasing demand for 4K/8K TVs, streaming services, and gaming. |

The global high dynamic range market is estimated to be valued at USD 53.2 billion in 2025.

The market size for the high dynamic range market is projected to reach USD 589.4 billion by 2035.

The high dynamic range market is expected to grow at a 27.2% CAGR between 2025 and 2035.

The key product types in high dynamic range market are dolby vision, hdr10, hdr10+, hybrid log-gamma, advanced hdr and others.

In terms of product type, capturing devices segment to command 57.3% share in the high dynamic range market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

High Current Ion Implanter Market Size and Share Forecast Outlook 2025 to 2035

High Rate Discharge Test Machine Market Size and Share Forecast Outlook 2025 to 2035

High-precision Confocal Sensor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

High Heat Waste Packaging Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High-power Objective Lens Market Size and Share Forecast Outlook 2025 to 2035

High Purity PFA Resins Market Size and Share Forecast Outlook 2025 to 2035

High Purity Mullite Powder Market Size and Share Forecast Outlook 2025 to 2035

High Precision Heavy Load Bearings Market Size and Share Forecast Outlook 2025 to 2035

High Performance Mercury Sorbent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA