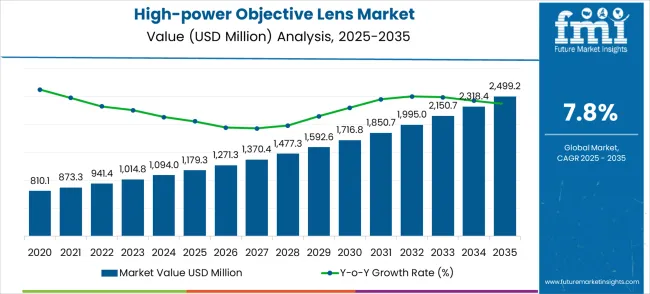

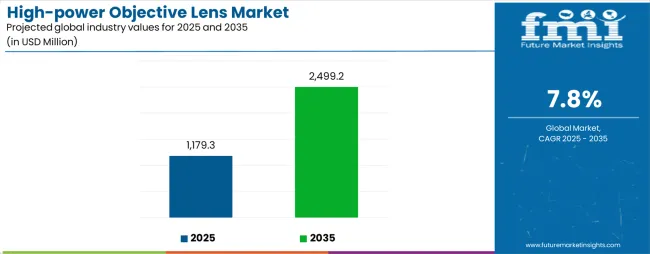

The global high-power objective lens market is projected to grow from USD 1,179.3 million in 2025 to USD 2,499.2 million by 2035, advancing at a CAGR of 7.8%. recording an absolute increase of USD 1,319.9 million over the forecast period. The market is valued at 1,179.3 million in 2025 and is set to rise at a CAGR of 7.8% during the assessment period. The overall market size is expected to grow by nearly 2.12 times during the same period, supported by increasing demand for high-resolution imaging across medical diagnostics, semiconductor manufacturing, and industrial inspection applications. Market expansion faces constraints from high manufacturing costs and technical complexity requirements for precision optics.

Between 2025 and 2030, the high-power objective lens market is projected to expand from USD 1,179.3 million to USD 1,716.8 million, resulting in a value increase of USD 537.5 million, which represents 40.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for advanced imaging capabilities in medical diagnostics, product innovation in immersion lens technology and automated microscopy systems, and expanding applications across semiconductor inspection and industrial quality control sectors. Companies are establishing competitive positions through investment in precision optics development, strategic technology partnerships, and market expansion across research institutions, clinical laboratories, and manufacturing facilities.

From 2030 to 2035, the market is forecast to grow from USD 1,716.8 million to USD 2,499.2 million, adding another USD 782.4 million, which constitutes 59.3% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized imaging solutions including multi-spectral objective systems and AI-integrated microscopy platforms tailored for specific diagnostic and industrial applications, strategic collaborations between lens manufacturers and microscopy system developers, and enhanced integration with digital imaging workflows and automated analysis systems. The growing emphasis on precision manufacturing and advanced medical diagnostics will drive demand for high-resolution objective lenses across diverse clinical and industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,179.3 million |

| Market Forecast Value (2035) | USD 2,499.2 million |

| Forecast CAGR (2025 to 2035) | 7.8% |

The high-power objective lens market grows by enabling researchers, clinicians, and industrial inspectors to obtain high-resolution imaging data that reduces analysis time and improves diagnostic accuracy. Demand drivers include expanding healthcare applications requiring detailed cellular and tissue imaging, increasing semiconductor manufacturing needs for defect inspection and quality control, and growing adoption in industrial sectors for precision measurement and surface analysis applications. Priority segments include medical diagnostic laboratories and semiconductor manufacturing facilities, with China and India representing key growth geographies due to expanding healthcare infrastructure and electronics manufacturing capabilities. Market growth faces constraints from high precision manufacturing costs and the need for specialized technical expertise to operate advanced optical systems.

The High-power Objective Lens market is entering a new phase of growth, driven by demand for advanced medical diagnostics, expanding healthcare infrastructure, and evolving precision imaging standards across industries. By 2035, these pathways together can unlock USD 1,850-2,300 million in incremental revenue opportunities beyond baseline growth.

Pathway A - Healthcare & Life Sciences Leadership (Medical Diagnostics Applications) The healthcare segment already holds the largest share due to its critical role in medical diagnosis and biological research applications. Expanding precision imaging capabilities, automated diagnostic workflows, and multi-modal microscopy can consolidate leadership. Opportunity pool: USD 580-720 million.

Pathway B - Oil Immersion Technology Dominance (High-Resolution Imaging Platforms) Oil immersion applications account for significant market demand. Growing requirements for high-resolution cellular imaging, especially in pathology and research sectors, will drive higher adoption of advanced immersion lens systems. Opportunity pool: USD 460-580 million.

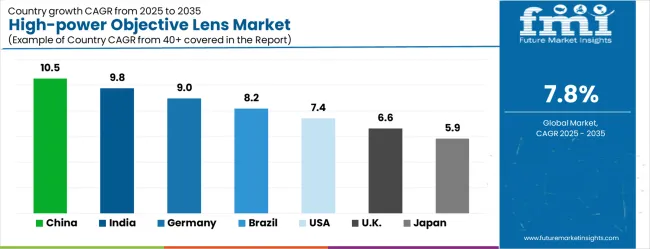

Pathway C - Asia-Pacific Market Expansion (China & India Growth) China and India present the highest growth potential with CAGRs of 10.5% and 9.8% respectively. Targeting expanding healthcare institutions and government-funded infrastructure projects will accelerate adoption. Opportunity pool: USD 380-480 million.

Pathway D - Semiconductor Applications (Industrial Inspection Sectors) Semiconductor and electronics applications represent significant growth potential with increasing chip manufacturing precision needs. Systems optimized for defect detection and process monitoring can capture substantial growth. Opportunity pool: USD 280-350 million.

Pathway E - Automation & AI Integration With increasing demand for automated imaging workflows, there is an opportunity to promote AI-integrated platforms optimized for precision analysis and diagnostic interpretation. Opportunity pool: USD 200-250 million.

Pathway F - Industrial Applications Expansion (Quality Control Systems) Systems optimized for industrial measurement, surface analysis, and precision manufacturing offer premium positioning for emerging industrial sectors. Opportunity pool: USD 150-190 million.

Pathway G - Service & Technical Support Revenue Recurring revenue from equipment maintenance, operator training, and system integration services creates long-term revenue streams across global markets. Opportunity pool: USD 110-140 million.

Pathway H - Digital Imaging Integration Advanced image processing systems, cloud connectivity, and digital laboratory workflow integration can elevate objective lenses into comprehensive diagnostic ecosystem platforms. Opportunity pool: USD 80-100 million.

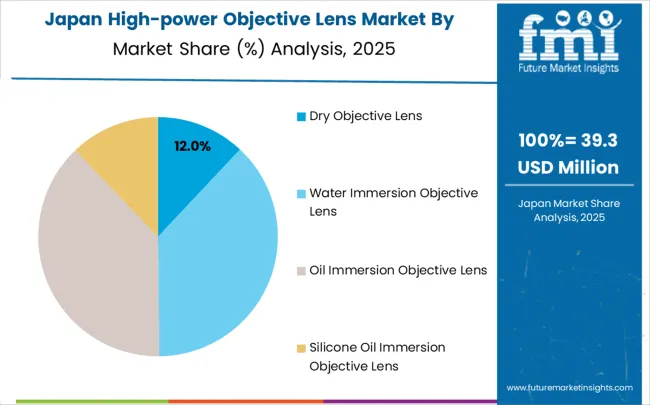

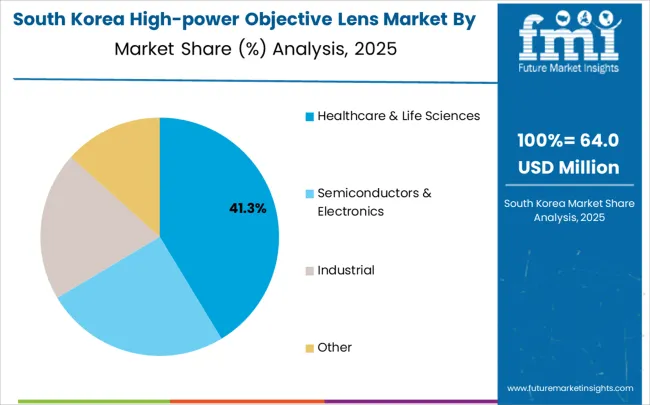

The market is segmented by lens type, application, end-user, technology, and region. By lens type, the market is divided into Dry Objective Lens, Water Immersion Objective Lens, Oil Immersion Objective Lens, and Silicone Oil Immersion Objective Lens. Based on application, the market is categorized into Healthcare & Life Sciences, Semiconductors & Electronics, Industrial, and Other applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Oil immersion objective lens is projected to account for a substantial portion of 38% of the high-power objective lens market in 2025. This share is supported by superior resolution capabilities and enhanced light-gathering efficiency that make it indispensable for critical applications requiring maximum optical performance. Oil immersion technology provides the highest numerical aperture achievable in light microscopy, typically reaching 1.4 or higher, enabling researchers and clinicians to observe fine cellular details and structures that are critical for accurate diagnosis and analysis. The immersion medium eliminates the refractive index mismatch between the coverslip and air, dramatically reducing spherical aberration and improving light collection efficiency.

The segment's dominance is further reinforced by its widespread adoption in pathological diagnosis, where precise cellular morphology assessment is crucial for cancer detection and disease classification. In research applications, oil immersion lenses enable detailed studies of protein localization, cellular dynamics, and molecular interactions at the subcellular level. The technology's ability to resolve structures as small as 200 nanometers makes it essential for fluorescence microscopy applications, where researchers need to visualize specific proteins or cellular components with high contrast and clarity. Additionally, the segment benefits from continuous technological improvements, including the development of specialized immersion oils with optimized refractive indices and reduced autofluorescence properties that enhance imaging quality for specific applications.

Key factors supporting oil immersion adoption:

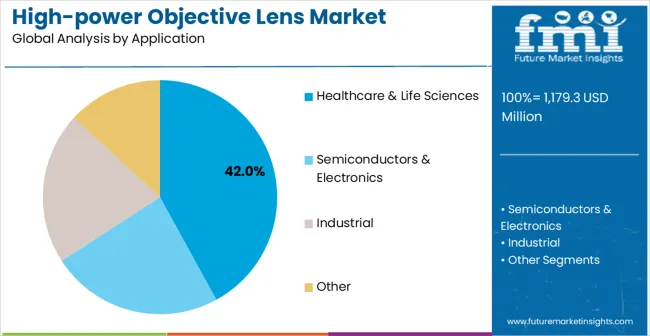

Healthcare & life sciences applications are expected to represent the largest share of 42% of the high-power objective lens applications in 2025. This dominant share reflects the critical need for high-resolution imaging in medical diagnostics and biological research that appeals to hospitals, clinical laboratories, research institutions, and pharmaceutical companies. The segment provides essential imaging support for pathological diagnosis, cellular research, drug development processes, and clinical decision-making in medical environments. Growing demand for precision medicine, personalized therapy approaches, and advanced diagnostic techniques drives sustained adoption in this application area.

The healthcare segment's leadership is strengthened by increasing investments in digital pathology systems, where high-power objective lenses serve as critical components for whole-slide imaging and telepathology applications. Clinical laboratories rely on these optical systems for routine diagnostic procedures, including hematology analysis, cytology screening, and histopathological examination of tissue samples. In research settings, pharmaceutical companies and academic institutions utilize high-power objective lenses for drug discovery processes, cellular biology studies, and biomedical research that contributes to therapeutic development. The segment also benefits from regulatory requirements for standardized imaging procedures in clinical diagnostics, ensuring consistent demand for high-quality optical components.

Furthermore, the expansion of point-of-care diagnostic devices and portable microscopy systems creates additional growth opportunities within the healthcare segment. The integration of artificial intelligence and machine learning algorithms with microscopy systems requires high-quality objective lenses to ensure accurate automated analysis and diagnostic support. The ongoing global focus on healthcare improvement, aging populations requiring increased medical attention, and the expansion of healthcare infrastructure in emerging markets contribute to the segment's sustained growth trajectory.

Healthcare & Life Sciences segment advantages include:

Market drivers include expanding healthcare applications requiring high-resolution cellular and tissue imaging for accurate diagnosis, where advanced optical systems enable pathologists and clinicians to detect subtle morphological changes crucial for early disease detection and treatment planning. The increasing prevalence of chronic diseases, cancer diagnosis requirements, and aging populations globally drive sustained demand for precision diagnostic equipment. Semiconductor manufacturing needs for defect detection and quality control processes represent another major growth driver, as the industry's continuous miniaturization requires increasingly sophisticated optical inspection capabilities to identify nanoscale defects that could compromise device performance. Growing adoption in industrial sectors for precision measurement and surface analysis applications reflects expanding quality control requirements across manufacturing industries, where objective lenses support advanced metrology, surface inspection, and failure analysis processes essential for maintaining product quality and competitive advantage.

The rise of digital pathology and telepathology systems creates significant growth opportunities, as healthcare institutions worldwide adopt remote diagnostic capabilities and AI-assisted analysis platforms that rely on high-quality imaging systems. Research and development activities in life sciences continue expanding, driven by biotechnology advancement, pharmaceutical drug discovery programs, and academic research initiatives that require sophisticated microscopy capabilities. These drivers reflect direct buyer outcomes including improved diagnostic accuracy, enhanced manufacturing quality control, reduced analysis time, and increased research productivity across multiple application areas.

Market restraints encompass high precision manufacturing costs that limit adoption among smaller institutions and developing markets, where budget constraints affect capital equipment procurement decisions. Technical complexity requiring specialized operator training and maintenance expertise creates barriers to entry, particularly for institutions lacking technical support infrastructure. Long replacement cycles for optical instruments, typically 7-10 years, slow market penetration and limit repeat purchase opportunities. Integration challenges with existing microscopy systems and laboratory workflows require additional investment in compatible hardware and software platforms. The need for ongoing calibration, alignment services, and specialized maintenance increases total cost of ownership and operational complexity.

Additional constraints include rapid technological evolution that may render current systems obsolete, creating uncertainty about long-term investment value. Regulatory compliance requirements in medical applications add complexity and cost to product development and certification processes. Supply chain challenges for precision optical components and specialized materials can affect availability and pricing stability.

Key trends show adoption accelerating in China and India where expanding healthcare infrastructure, government healthcare initiatives, and electronics manufacturing growth drive substantial demand increases. Design shifts toward automated imaging systems and AI-integrated platforms enable broader market access by reducing operator skill requirements and improving diagnostic consistency. Technology advancement focuses on enhanced resolution capabilities, improved light sensitivity, and multi-modal imaging systems that expand application possibilities across different wavelengths and contrast mechanisms. Integration with digital laboratory workflows, cloud-based image storage, and remote diagnostic platforms represents a significant trend reshaping market dynamics. The development of specialized objective lenses for emerging applications such as super-resolution microscopy, live-cell imaging, and multi-photon microscopy creates new market segments. Market thesis faces risk from alternative imaging technologies, including computational imaging methods and advanced sensor technologies that could provide similar results at lower costs or with simplified operation requirements.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9% |

| Brazil | 8.2% |

| USA | 7.4% |

| UK | 6.6% |

| Japan | 5.9% |

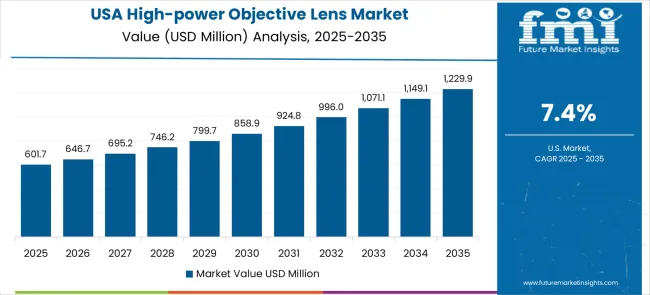

The high-power objective lens market shows varied growth dynamics across key countries from 2025–2035. China leads globally with a CAGR of 10.5%, fueled by government-backed healthcare modernization programs, semiconductor manufacturing expansion, and growing adoption in academic and clinical laboratories. India follows closely at 9.8%, driven by healthcare infrastructure development, industrial R&D growth, and strong academic-industry collaborations. Germany remains Europe's growth engine with 9.0%, leveraging its advanced manufacturing sector, especially in precision optics and medical technology applications. Brazil records 8.2%, reflecting opportunities in healthcare expansion and industrial development despite infrastructure challenges. The United States maintains steady expansion at 7.4%, supported by robust medical research and semiconductor manufacturing ecosystems. Growth in the United Kingdom (6.6%) and Japan (5.9%) remains stable, backed by established institutions and domestic optical manufacturers, though comparatively slower.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the high-power objective lens market with its expanding healthcare infrastructure and substantial government investment in advanced optical technologies. The market is projected to grow at a CAGR of 10.5% through 2035, driven by comprehensive healthcare system modernization programs, rapidly expanding semiconductor manufacturing sector, and increasing medical diagnostics capabilities across major urban centers. Chinese healthcare institutions are experiencing unprecedented growth in diagnostic imaging requirements, fueled by government initiatives to improve healthcare accessibility and quality standards nationwide. The country's massive population base and aging demographics create sustained demand for advanced diagnostic equipment, while rising healthcare spending and insurance coverage expansion enable broader adoption of sophisticated medical technologies.

China's semiconductor manufacturing industry represents another crucial growth driver, as the country pursues technological self-reliance and advanced chip production capabilities. Major semiconductor fabs and research institutions require high-precision optical inspection equipment for quality control and failure analysis applications. The government's strategic investments in technological innovation, including the "Made in China 2025" initiative, prioritize advanced manufacturing capabilities and research infrastructure development. Academic institutions across Beijing, Shanghai, Shenzhen, and other major cities are significantly expanding their research capabilities, creating substantial demand for advanced microscopy equipment. The integration of artificial intelligence and automated analysis systems with microscopy platforms aligns with China's digital transformation objectives and smart manufacturing initiatives.

High-power objective lens market in India reflects exceptional growth potential based on expanding healthcare infrastructure, increasing clinical laboratory investments, and growing biotechnology sector development. The market is projected to grow at a CAGR of 9.8% through 2035, with growth accelerating through government healthcare initiatives, private sector medical facility expansion, and increasing research and development activities across pharmaceutical and biotechnology industries. The country's healthcare system is undergoing significant transformation, driven by government programs such as Ayushman Bharat and National Digital Health Mission, which prioritize healthcare accessibility and diagnostic capabilities improvement. Rising middle-class healthcare spending, increasing health insurance penetration, and growing awareness of preventive healthcare drive demand for advanced diagnostic equipment.

India's pharmaceutical and biotechnology sectors represent major growth catalysts, as the country strengthens its position as a global pharmaceutical manufacturing hub and expands research capabilities. Clinical research organizations, contract manufacturing companies, and academic research institutions require sophisticated analytical equipment for drug development, quality control, and regulatory compliance activities. The government's emphasis on indigenous manufacturing through initiatives like "Make in India" and "Atmanirbhar Bharat" encourages domestic medical device production and technology adoption. Educational institutions and research organizations across Mumbai, Delhi, Bangalore, Chennai, and Hyderabad are expanding their research infrastructure, creating sustained demand for advanced microscopy systems. The integration of telemedicine and digital pathology platforms with traditional diagnostic workflows creates additional opportunities for optical instrumentation adoption.

Germany demonstrates established leadership in the high-power objective lens market through its advanced manufacturing sector, robust research infrastructure, and world-class optical industry ecosystem. The market shows robust growth at a CAGR of 9.0% through 2035, supported by the country's position as Europe's largest economy and its significant investments in healthcare technology, precision manufacturing, and industrial automation. German healthcare institutions maintain some of the world's highest medical technology adoption rates, driven by excellent healthcare funding, insurance coverage, and commitment to advanced medical care standards. The country's renowned medical research institutions, university hospitals, and clinical centers create consistent demand for state-of-the-art diagnostic equipment and research instrumentation.

Germany's industrial manufacturing sector, particularly automotive, aerospace, and precision engineering industries, requires sophisticated optical inspection and quality control systems for maintaining competitive advantage in global markets. The country hosts major optical instrument manufacturers and suppliers, creating a favorable ecosystem for technology development, technical support, and market growth. Industry 4.0 initiatives and digital manufacturing transformation drive adoption of automated inspection systems and AI-integrated quality control platforms. Academic institutions and research organizations across Berlin, Munich, Hamburg, Stuttgart, and other major cities maintain extensive research programs requiring advanced microscopy capabilities. The country's strong engineering tradition, skilled technical workforce, and established supplier relationships support consistent market development and technology innovation.

High-power objective lens market in Brazil demonstrates solid growth potential at a CAGR of 8.2% through 2035, driven by expanding healthcare programs, industrial development initiatives, and increasing research capabilities across academic and private sector institutions. The country's healthcare system is undergoing significant modernization, supported by government investments in public health infrastructure and growing private healthcare sector development. Brazil's large population base and emerging middle class create substantial demand for improved medical diagnostic capabilities, while increasing healthcare spending and insurance coverage expansion enable broader adoption of advanced medical technologies. The unified health system (SUS) modernization programs prioritize diagnostic capability enhancement across regional medical centers.

Brazil's industrial sector, including mining, petrochemicals, and manufacturing industries, requires precision optical inspection equipment for quality control, materials analysis, and safety compliance applications. The country's significant natural resources sector creates demand for geological analysis and materials characterization equipment. Academic institutions and research organizations are expanding their capabilities, supported by government research funding and international partnerships with technology providers. The growing biotechnology sector and pharmaceutical industry development create additional demand for analytical instrumentation. Infrastructure development challenges in certain regions affect equipment accessibility and technical support availability, but major urban centers including São Paulo, Rio de Janeiro, and Belo Horizonte demonstrate strong market growth potential.

The United States maintains steady and substantial growth in the high-power objective lens market through its established healthcare infrastructure, advanced research ecosystem, and leading semiconductor manufacturing capabilities. Market expansion at a CAGR of 7.4% through 2035 reflects consistent demand from medical institutions, research facilities, government laboratories, and industrial manufacturing companies requiring cutting-edge optical capabilities. The country's healthcare system, while complex, maintains high technology adoption rates and significant investment in diagnostic equipment modernization. Major hospital systems, clinical laboratories, and medical research institutions continuously upgrade their analytical capabilities to maintain competitive advantage and meet evolving diagnostic requirements.

The United States leads global research and development activities across multiple sectors, including biomedical research, pharmaceutical development, materials science, and advanced manufacturing. Federal research funding through agencies such as NIH, NSF, and DOD supports extensive research infrastructure requiring sophisticated analytical equipment. The country's semiconductor industry, including major manufacturers and research institutions, drives substantial demand for precision optical inspection systems. Private sector research and development activities across biotechnology, pharmaceutical, and technology companies create sustained market demand. The integration of artificial intelligence, machine learning, and automated analysis platforms with traditional microscopy systems aligns with the country's technological leadership objectives and digital transformation initiatives across healthcare and industrial sectors.

The United Kingdom demonstrates consistent and stable progress in the high-power objective lens market with a CAGR of 6.6% through 2035, supported by established healthcare institutions, world-class research universities, and strong pharmaceutical industry presence. The National Health Service (NHS) modernization programs and private healthcare sector growth drive sustained demand for advanced diagnostic equipment. British universities and research centers, including those in London, Cambridge, Oxford, Edinburgh, and Manchester, maintain extensive research programs requiring sophisticated microscopy capabilities for medical research, materials science, and biological studies. The country's pharmaceutical and biotechnology industries, concentrated in clusters such as the Cambridge Biomedical Campus and London's MedCity, create substantial demand for analytical instrumentation.

Brexit-related changes have created both challenges and opportunities in the market, with some institutions seeking to diversify supplier relationships while maintaining access to advanced technologies. The UK's focus on life sciences as a strategic economic priority, supported by government initiatives and investment programs, creates favorable conditions for optical instrumentation adoption. Academic-industrial partnerships between universities and pharmaceutical companies drive technology transfer and create demand for cutting-edge research equipment. The country's strong regulatory framework and quality standards in healthcare and research ensure consistent demand for high-quality optical systems. Digital health initiatives and telemedicine platform development create additional opportunities for optical instrumentation integration with modern healthcare delivery systems.

High-power objective lens market in Japan shows steady and mature development with a CAGR of 5.9% through 2035, reflecting the country's established position as a global leader in optical technology development and precision manufacturing. As home to major optical instrument manufacturers including Olympus, Nikon, and others, Japan benefits from domestic technology leadership, extensive technical expertise, and strong supplier networks that support consistent market conditions. The country's healthcare system maintains high technology adoption rates and significant investment in medical equipment modernization, driven by an aging population requiring increased medical attention and diagnostic services. Japanese hospitals and clinical laboratories consistently upgrade their analytical capabilities to maintain world-class healthcare standards.

The country's precision manufacturing industries, including electronics, automotive, and semiconductor sectors, require sophisticated optical inspection and quality control systems for maintaining competitive advantage in global markets. Japan's research institutions and universities maintain extensive research programs across multiple disciplines, creating sustained demand for advanced microscopy equipment. The integration of artificial intelligence and automation technologies with traditional optical systems aligns with Japan's leadership in robotics and advanced manufacturing technologies. Domestic optical manufacturers provide extensive technical support infrastructure, training programs, and maintenance services that support stable market conditions. While growth rates are moderate compared to emerging markets, the market benefits from high-value applications, premium product adoption, and long-term customer relationships that ensure consistent revenue streams.

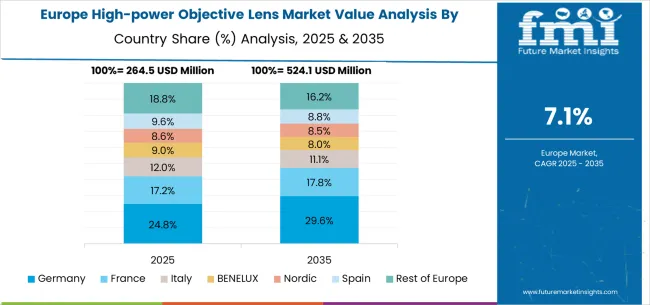

The high-power objective lens market in Europe is forecast to expand from USD 285.2 million in 2025 to USD 589.8 million by 2035, registering a CAGR of 7.6%. Germany will remain the largest market, holding 32.5% share in 2025, easing to 32.0% by 2035, supported by strong healthcare infrastructure and advanced medical technology programs. The United Kingdom follows, rising from 24.0% in 2025 to 24.5% by 2035, driven by healthcare system modernization and medical research expansion. France is expected to grow from 18.5% to 19.0%, reflecting increased clinical facility investment. Italy maintains growth at around 14.0% to 14.5%, supported by healthcare programs and industrial quality control, while Spain grows from 6.0% to 6.5% with expanding healthcare infrastructure and manufacturing development. Nordic markets rise from 5.0% to 5.5%, while the remainder of Europe hovers near 4.0%-4.0%, balancing emerging Eastern European healthcare growth against established Western markets.

In South Korea, the market is expected to remain dominated by clinical laboratories, which hold a 50% share in 2025. These facilities are typically specialized diagnostic service providers where advanced imaging requirements require comprehensive optical capabilities. Research institutions and semiconductor manufacturers each hold 22% market share, with growing emphasis on in-house imaging capabilities. Industrial laboratories account for the remaining 6%, but are gradually gaining traction in quality control services due to manufacturing requirements and expanded precision measurement programs.

The high-power objective lens market operates with a concentrated structure featuring approximately 18-22 meaningful players, with the top five companies holding roughly 62-67% market share. Competition centers on optical performance, product reliability, and comprehensive technical support rather than price competition alone. Market leaders include OLYMPUS CORPORATION, Carl Zeiss Microscopy GmbH, and Nikon Instruments Inc., which maintain competitive positions through established distribution networks, comprehensive product portfolios, and strong research and development capabilities. These companies benefit from scale advantages in precision manufacturing, extensive technical support networks, and established relationships with key medical institutions and research laboratories worldwide.

Challenger companies include Leica Microsystems and JENOPTIK AG, which compete through specialized product offerings and regional market focus, particularly in specific application areas or geographic regions. These companies differentiate through innovative optical designs, competitive pricing strategies, and targeted customer service approaches. Thermo Fisher Scientific Inc. represents another significant player with established presence in scientific instrumentation markets and strong technical capabilities in imaging and analysis technologies.

Competition intensifies around product innovation, with companies investing in automated imaging capabilities, enhanced resolution performance, and integrated software platforms that improve user experience and diagnostic productivity. Market dynamics reflect the importance of technical support services, training programs, and ongoing maintenance capabilities that influence customer purchasing decisions. Geographic expansion strategies and strategic partnerships with medical institutions and distribution partners shape competitive positioning across different regional markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,179.3 million |

| Lens Type | Dry Objective Lens, Water Immersion Objective Lens, Oil Immersion Objective Lens, Silicone Oil Immersion Objective Lens |

| Application | Healthcare & Life Sciences, Semiconductors & Electronics, Industrial, Other |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | OLYMPUS CORPORATION, Carl Zeiss Microscopy GmbH, Nikon Instruments Inc., Leica Microsystems, Thermo Fisher Scientific Inc., JENOPTIK AG, AmScope, Avantier Inc., Edmund Optics Inc., KERN & SOHN GmbH, KYOCERA SOC Corporation, Meiji Techno Co., Ltd., Mitutoyo Corporation, Navitar Inc., Newport Corporation, Thorlabs Inc., Wavelength Opto-Electronic |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, adoption patterns across healthcare institutions and industrial laboratories, integration with automated imaging workflows and digital diagnostic systems, innovations in immersion lens technology and AI-assisted analysis, and development of multi-modal optical platforms with enhanced resolution capabilities. |

The global high-power objective lens market is estimated to be valued at USD 1,179.3 million in 2025.

The market size for the high-power objective lens market is projected to reach USD 2,499.2 million by 2035.

The high-power objective lens market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in high-power objective lens market are dry objective lens, water immersion objective lens, oil immersion objective lens and silicone oil immersion objective lens.

In terms of application, healthcare & life sciences segment to command 42.0% share in the high-power objective lens market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lens Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Contact-lens Induced Infections Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Industry Analysis in GCC Size and Share Forecast Outlook 2025 to 2035

Scleral Lenses Market Size and Share Forecast Outlook 2025 to 2035

Contact Lenses Market – Trends, Growth & Forecast 2025 to 2035

Contact Lens Solution Market Analysis by Product Type, Volume, Purpose, Distribution Channel, and Region through 2035

Acrylic Lenses Market

Anti-Fog Lens Market Insights - Size, Trends & Forecast 2025 to 2035

Global Spectacle Lens Market Analysis – Size, Share & Forecast 2024-2034

Aspherical Lens Market Size and Share Forecast Outlook 2025 to 2035

Intraocular Lens Market Size and Share Forecast Outlook 2025 to 2035

Collimating Lens Market – Growth & Technology Trends 2025 to 2035

IR Corrected Lenses Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Prescription Lens Industry

Smart Contact Lens Market Size and Share Forecast Outlook 2025 to 2035

Digital Vision Lenses Market

Hydrogel Contact Lenses Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA