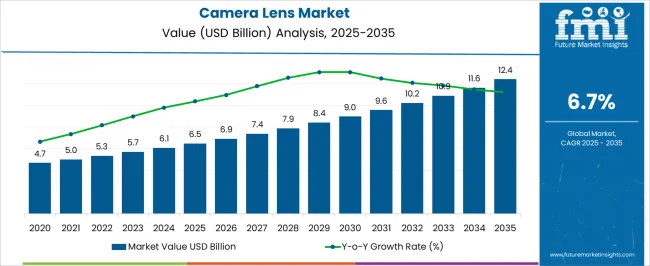

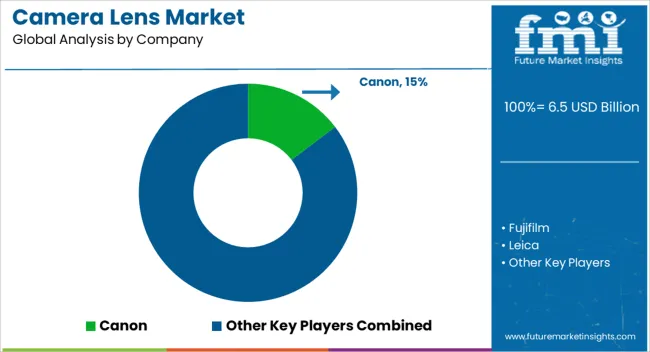

The camera lens market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 12.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. Breakpoint analysis shows the market progressing through distinct adoption phases shaped by consumer preferences, technological transitions, and professional-grade usage patterns. In the early years from 2025 to 2027, values climb from USD 6.5 billion to nearly USD 6.9 billion as smartphone manufacturers expand partnerships with lens makers, enhancing compact device imaging.

Between 2028 and 2030, the market advances more rapidly, touching USD 7.9 to USD 8.4 billion, driven by increasing adoption of mirrorless and DSLR cameras among professionals and content creators. From 2031 onward, momentum strengthens as high-resolution video creation, AI-enabled autofocus systems, and demand for lightweight, multi-purpose lenses push values to USD 10.2 billion by 2032 and beyond USD 11.6 billion by 2034. The endpoint of 2035 takes the industry to USD 12.4 billion, underscoring how innovations in optical glass materials, advancements in zoom mechanisms, and consumer preference for premium photography solutions reinforce expansion.

Market dynamics also reflect a growing replacement cycle for professionals, rising popularity of cinematic lens kits for independent filmmakers, and a visible shift toward lenses optimized for 8K and AR/VR applications. The competitive outlook highlights that collaborations between camera OEMs and specialized lens manufacturers, combined with rising e-commerce channels for lens distribution, further strengthen long-term growth potential.

The camera lens market is shaped by five interconnected parent markets that collectively influence its adoption and growth across industries. The largest contributor is the consumer electronics market, holding about 35% share, as smartphones and tablets increasingly rely on advanced multi-lens systems to deliver high-quality imaging and enhanced user experiences. The imaging and photography equipment market contributes around 25%, reflecting the demand from professional photographers and enthusiasts who prioritize optical precision, interchangeable lenses, and innovations in autofocus and aperture control.

The automotive industry accounts for nearly 15%, driven by the integration of camera-based driver assistance, rear-view monitoring, and autonomous vehicle technologies where lens performance directly impacts safety and navigation. The security and surveillance market represents close to 15%, with rising demand from smart cities, commercial facilities, and residential monitoring systems that require high-resolution and wide-angle lenses for reliable visibility across varied environments.

The healthcare and medical imaging market adds nearly 10%, leveraging miniaturized and distortion-free lenses in endoscopy, surgical visualization, and diagnostic imaging to improve accuracy and patient outcomes. Together, these parent markets provide the foundation for camera lens innovations and ensure sustained adoption across both consumer and industrial applications.

| Metric | Value |

|---|---|

| Camera Lens Market Estimated Value in (2025 E) | USD 6.5 billion |

| Camera Lens Market Forecast Value in (2035 F) | USD 12.4 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The camera lens market is experiencing stable growth, supported by advancements in imaging technology, rising consumer interest in high-quality photography, and expanding applications in both consumer and professional segments. Increasing integration of advanced lens systems into smartphones, mirrorless, and DSLR cameras is being reinforced by consumer demand for superior optical performance and versatility. Manufacturers are focusing on innovation in optical design, materials, and coatings to enhance clarity, reduce aberrations, and meet diverse usage requirements.

Pricing trends have remained competitive, with mid-range products gaining traction due to their balance of performance and affordability. Global distribution networks are being strengthened, supported by e-commerce channels and direct-to-consumer strategies.

In emerging markets, rising disposable incomes and lifestyle-oriented consumption are contributing to sales momentum, while developed regions are seeing replacement demand and niche adoption among enthusiasts Over the forecast period, continuous R&D investment, product differentiation, and increasing penetration in commercial imaging sectors are expected to drive steady revenue expansion.

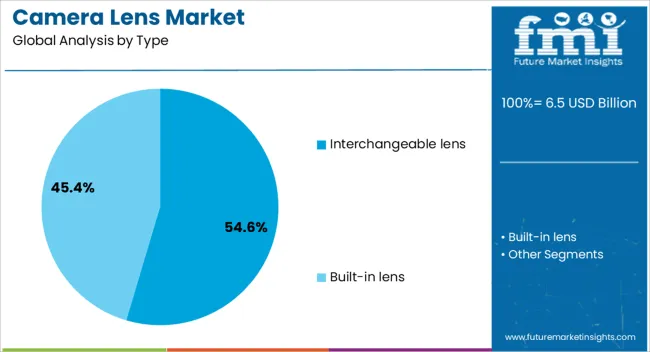

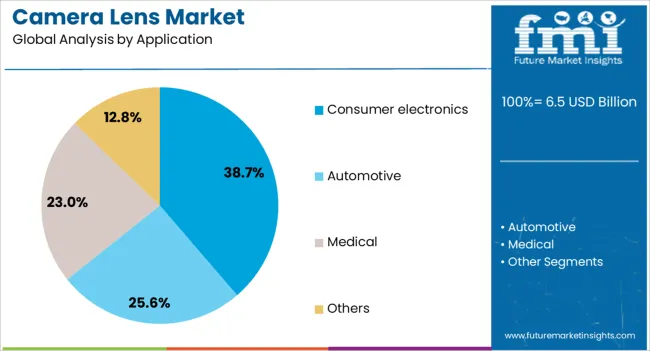

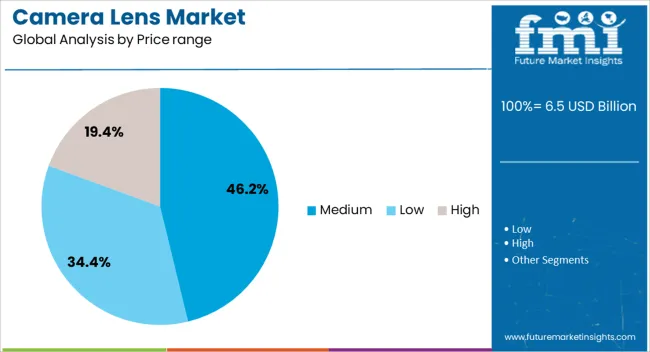

The camera lens market is segmented by type, application, price range, distribution channel, and geographic regions. By type, camera lens market is divided into interchangeable lens and built-in lens. In terms of application, camera lens market is classified into consumer electronics, automotive, medical, and others. Based on price range, camera lens market is segmented into medium, low, and high. By distribution channel, camera lens market is segmented into online and offline. Regionally, the camera lens industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The interchangeable lens segment, accounting for 54.60% of the type category, has sustained its lead due to its versatility and adaptability across multiple camera bodies, appealing to both professional photographers and serious hobbyists. This segment benefits from a broad range of focal lengths and specialized lens types, enabling users to customize performance for diverse shooting conditions.

Market share has been supported by the expansion of mirrorless camera adoption, where interchangeable lens systems offer portability without compromising image quality. Enhanced optical engineering, including aspherical elements and advanced coatings, has strengthened product value propositions, while strong brand ecosystems encourage lens compatibility and repeat purchases. Sales performance is being bolstered by bundled offerings and targeted marketing to photography communities, ensuring that this category remains central to overall market revenue.

The consumer electronics segment, holding 38.70% of the application category, has emerged as a dominant demand driver due to the proliferation of cameras in smartphones, drones, and personal imaging devices. Integration of higher-quality lenses into compact devices has significantly expanded the consumer base, attracting both casual users and enthusiasts.

Manufacturers are leveraging partnerships with electronics brands to develop co-engineered products that optimize both hardware and software performance. Growth in social media content creation and video streaming has further intensified demand for high-performance yet portable lens solutions. Competitive positioning is reinforced by continuous improvements in autofocus speed, low-light capability, and compact design, ensuring that consumer electronics remain a robust and expanding end-use segment.

The medium price range segment, representing 46.20% of the price range category, has maintained its leadership due to its optimal balance between quality and affordability, appealing to a wide spectrum of consumers. This segment attracts both entry-level professionals and serious hobbyists seeking advanced features without the premium cost of high-end lenses.

Demand stability is reinforced by consistent product upgrades, offering enhanced optical performance and build quality at accessible prices. Manufacturers are targeting this segment with versatile zoom and prime lenses that cater to multiple use cases, thereby increasing customer value perception. Distribution through both online and offline channels ensures broad market reach, while competitive pricing strategies are enabling sustained volume growth in both mature and emerging markets.

The camera lens market is being shaped by expanding consumer electronics, rising professional use, industrial integration, and shifting preferences for premium optical quality. Each dynamic highlights how lenses are at the center of both consumer and industrial imaging needs.

The camera lens market has been shaped strongly by rising adoption in smartphones, tablets, and wearable devices. Compact lens modules with higher resolution capabilities are being engineered to meet user demand for professional-grade photography on consumer gadgets. The appetite for mobile photography has resulted in continuous improvements in aperture, autofocus speed, and optical zoom. Wide-angle and periscope lenses have become mainstream as brands focus on differentiation through advanced imaging quality. It is evident that camera lenses are no longer limited to traditional DSLRs or mirrorless cameras but are now a core element of handheld electronics, making them a direct driver of consumer engagement and brand competitiveness.

The demand for DSLR and mirrorless cameras has been supported by professionals, hobbyists, and content creators who prefer precision and high-quality imaging. Camera lenses designed with specialty features such as low-light adaptability, depth-of-field control, and enhanced bokeh performance are favored in these categories. The growth of social media platforms has amplified the requirement for visual content, where clarity and detailing are crucial. Prime lenses and zoom lenses with superior coatings have gained popularity for reducing distortions and improving light transmission. This trend highlights how professional lenses serve as a premium segment in the global imaging market, reinforcing the importance of optical innovation.

Industrial applications have been a major driver for camera lens adoption across machine vision, surveillance, automotive, and aerospace sectors. Security systems are being enhanced with advanced camera modules equipped with lenses capable of covering wide areas with high precision. Automotive cameras rely heavily on specialized lenses for driver assistance, lane detection, and automated safety features. Machine vision in manufacturing has created new demand for durable and accurate optical components. These uses show how lenses have become vital not only for entertainment or personal use but also for safety, monitoring, and automation purposes across different industries.

The preference for sharper image quality and advanced optical performance has led consumers toward investing in premium lenses. Brand competition has intensified as companies emphasize coatings, stabilization systems, and multi-layer glass structures that enhance overall output. The appeal of interchangeable lenses has grown, as consumers prefer flexibility to capture diverse scenes such as landscapes, portraits, or wildlife. This shift demonstrates how buyers value long-term performance and superior build quality over lower-cost options. As consumer choices mature, manufacturers are under pressure to balance affordability with technical superiority, creating a highly competitive and evolving market scenario.

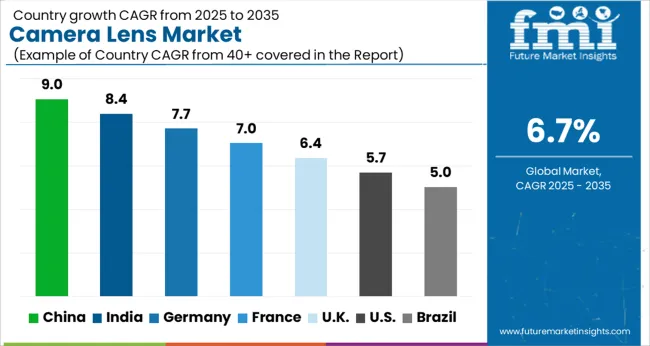

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The global camera lens market is expected to expand at a CAGR of 6.7% between 2025 and 2035. China leads growth at 9.0%, followed by India at 8.4%, France at 7.0%, the United Kingdom at 6.4%, and the United States at 5.7%. Growth is driven by increasing demand for high-resolution imaging in smartphones, professional photography, automotive ADAS systems, surveillance, and medical imaging.

BRICS nations, led by China and India, are driving expansion through strong consumer electronics manufacturing, rising disposable incomes, and advancements in mobile photography. OECD economies such as France, the United Kingdom, and the United States emphasize innovation in optical technologies, integration with AR/VR applications, and development of lenses for autonomous vehicles and healthcare imaging. The analysis includes over 40+ countries, with the leading markets detailed below.

The camera lens market in China is projected to grow at a CAGR of 9.0% from 2025 to 2035, supported by the country’s leadership in consumer electronics manufacturing and smartphone production. The demand for high-resolution lenses in flagship smartphones, surveillance systems, and professional cameras is accelerating adoption. Automotive OEMs are integrating advanced lenses into driver assistance systems and autonomous navigation solutions. Domestic manufacturers are scaling production capacity, while global brands are outsourcing component manufacturing to China due to cost efficiency.

Government policies encouraging AI-based surveillance and smart transportation projects are creating added demand for camera optics. With its strong position in electronics exports and rising consumer appetite for premium photography, China is becoming a dominant hub in the global camera lens market.

The camera lens market in India is expected to grow at a CAGR of 8.4% from 2025 to 2035, fueled by rising smartphone penetration, social media adoption, and increased demand for budget-friendly photography devices. The growing middle class is driving sales of mobile phones with advanced camera systems, leading to higher consumption of compact and multi-lens modules.

E-commerce platforms are expanding access to digital cameras and accessories, creating opportunities for both domestic and international brands. Automotive and security industries are adopting camera-based systems for monitoring and vehicle safety, enhancing the scope of applications. India’s role as a manufacturing hub under initiatives like “Make in India” is attracting investment in optical component production, ensuring long-term market expansion.

The camera lens market in France is anticipated to expand at a CAGR of 7.0% between 2025 and 2035, supported by strong consumer interest in professional-grade photography and video production. France has a vibrant creative industry, with media, fashion, and entertainment sectors heavily relying on advanced imaging devices. Camera lens adoption is also strengthening in medical imaging and defense applications, where precision optics are critical. The presence of leading optical companies in Europe, combined with research-driven advancements in lens coatings and materials, positions France as an influential market. Consumer preferences for premium DSLRs and mirrorless cameras, alongside government investments in healthcare imaging systems, are further supporting steady market growth.

The camera lens market in the United Kingdom is forecasted to rise at a CAGR of 6.4% between 2025 and 2035, driven by increasing adoption of digital imaging in surveillance, automotive, and creative industries. Security and monitoring systems are being upgraded with advanced optical technologies in both public and private sectors. Professional photography and film production remain strong contributors, supported by demand from advertising and media firms. Camera lenses are also seeing increased integration into AR/VR headsets, enabling immersive experiences for gaming and training applications. The UK’s focus on R&D in imaging technologies, along with government investments in security and healthcare infrastructure, is creating consistent opportunities for lens manufacturers and suppliers.

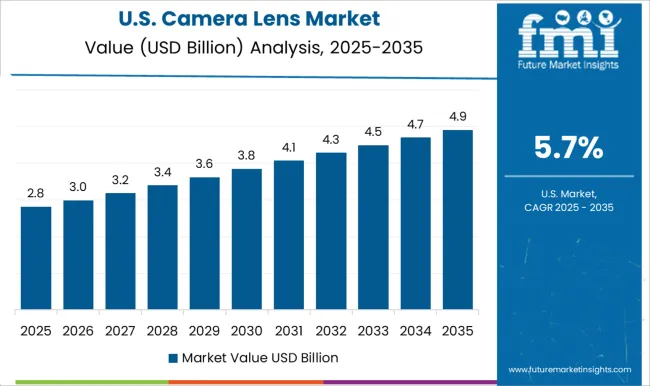

The camera lens market in the United States is expected to witness a CAGR of 5.7% from 2025 to 2035, supported by strong demand in professional photography, consumer electronics, and advanced automotive systems. The USA creative sector, particularly film and media production, is creating a significant need for premium lenses. Automotive companies are increasingly integrating camera lenses into autonomous driving technologies and safety systems. Healthcare applications, especially in diagnostic imaging and surgical tools, are further contributing to demand. Domestic innovation in lens materials and partnerships between tech firms and camera manufacturers are shaping the market. Consumer interest in high-end cameras for social media, vlogging, and sports photography also continues to strengthen adoption.

Competition in the camera lens market is shaped by product quality, optical precision, and ecosystem compatibility. Leadership is held by Canon, Nikon, and Sony, supported by strong brand equity and expansive product portfolios catering to both professional and consumer photographers. Fujifilm, Panasonic, and Olympus maintain competitive strength with mirrorless camera ecosystems that emphasize compact designs and high-performance lenses. Leica and Zeiss dominate the premium and luxury segment, known for exceptional craftsmanship and optical clarity, appealing to professionals and enthusiasts seeking high-end solutions. Sigma, Tamron, and Tokina serve as key third-party manufacturers, offering cost-effective alternatives with specialized zoom and prime lenses, capturing significant market share in the enthusiast segment. Samyang, Rokinon, and Viltrox focus on affordable yet versatile lenses, expanding reach in the entry-level and mid-tier photography market.

Yongnuo builds traction by offering budget-friendly lenses, primarily targeting amateur photographers and emerging markets. Collectively, these brands compete across diverse price segments, ensuring accessibility while addressing the needs of professionals, hobbyists, and casual users alike. Strategies revolve around expanding mirrorless-compatible lens lines, integrating autofocus and image stabilization technologies, and developing lightweight, travel-friendly optics. Companies highlight lens coatings, low-light adaptability, and wide-aperture designs to differentiate in professional imaging and videography.

Partnerships with camera manufacturers, alongside growing support for cross-brand compatibility, enhance adoption. Product brochures emphasize sharpness, bokeh quality, and build durability, with detailed specifications on focal lengths, apertures, and stabilization. Specialized options for portrait, landscape, wildlife, and cinematic production are showcased to address varied customer demands. Development kits, firmware updates, and compatibility tools are provided to support seamless integration across different camera systems, ensuring long-term ecosystem loyalty.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 billion |

| Type | Interchangeable lens and Built-in lens |

| Application | Consumer electronics, Automotive, Medical, and Others |

| Price range | Medium, Low, and High |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Canon, Fujifilm, Leica, Nikon, Olympus, Panasonic, Rokinon, Samyang, Sigma, Sony, Tamron, Tokina, Viltrox, Yongnuo, and Zeiss |

| Additional Attributes | Dollar sales, share, demand by lens type (DSLR, mirrorless, smartphone), competitive landscape, regional opportunities, pricing trends, supply chain risks, and tech innovation. |

The global camera lens market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the camera lens market is projected to reach USD 12.4 billion by 2035.

The camera lens market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in camera lens market are interchangeable lens and built-in lens.

In terms of application, consumer electronics segment to command 38.7% share in the camera lens market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camera Module Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Camera Accessories Market Trends - Growth & Forecast 2024 to 2034

Camera Case Market Trends & Industry Growth Forecast 2024-2034

IP Camera Market Trends – Growth, Demand & Forecast 2025 to 2035

3D Camera Market Growth – Trends & Forecast 2025 to 2035

TDI Camera Market Growth - Trends & Forecast 2025 to 2035

Intracameral Antibiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CMOS Camera Market Size and Share Forecast Outlook 2025 to 2035

GigE Camera Market Size and Share Forecast Outlook 2025 to 2035

CCTV Camera Market Demand & Sustainability Trends 2025-2035

Smart Camera Market Analysis – Size, Share & Forecast 2025 to 2035

Drain Camera Market

InGaAs Cameras Market by Technology, Scanning Type, Industry & Region Forecast till 2035

Action Camera Market

Mobile Camera Module Market

Network Cameras and Video Analytics Market Analysis – Trends & Forecast 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cameras Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Camera Market Growth - Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA