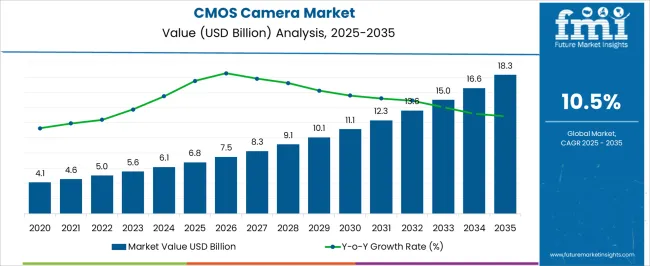

The CMOS Camera Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 18.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period.

| Metric | Value |

|---|---|

| CMOS Camera Market Estimated Value in (2025 E) | USD 6.8 billion |

| CMOS Camera Market Forecast Value in (2035 F) | USD 18.3 billion |

| Forecast CAGR (2025 to 2035) | 10.5% |

The CMOS Camera market is experiencing sustained growth due to the increasing adoption of high-performance imaging systems across multiple industries including security, industrial automation, automotive, and entertainment. Current market dynamics are being shaped by the shift from traditional CCD-based cameras to CMOS technology, which offers advantages such as lower power consumption, faster readout speeds, and higher integration with digital signal processing. The ongoing demand for compact and intelligent imaging solutions has further reinforced this trend.

Advancements in sensor technology and image processing algorithms are enabling enhanced image quality, real-time analytics, and adaptive functionalities in diverse applications. Growing investments in professional imaging systems, imaging consultancy services, and high-resolution deployments are also paving the way for future expansion.

In addition, the push for smart surveillance, industrial monitoring, and automotive safety systems is creating an environment favorable for CMOS-based solutions The market outlook is optimistic, with increased emphasis on modular, upgradeable camera platforms that can meet evolving requirements without substantial hardware replacement.

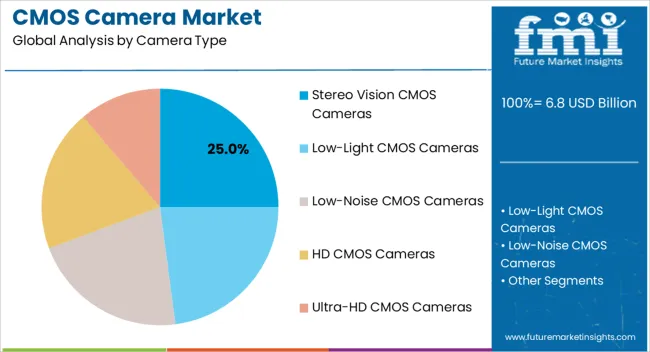

The Stereo Vision CMOS Camera segment is projected to hold 25.0% of the CMOS Camera market revenue in 2025, establishing it as a leading camera type. The dominance of this segment has been attributed to its ability to provide depth perception and three-dimensional imaging, which is critical for robotics, autonomous vehicles, industrial inspection, and smart surveillance.

Adoption has been accelerated by the demand for precise spatial measurements and the need for real-time processing capabilities in commercial and industrial environments. The growth is supported by technological advancements in sensor miniaturization, high-speed processing, and integration with AI-driven software analytics, which allow enhanced performance without increasing system complexity.

As the need for accurate 3D imaging continues to rise, the Stereo Vision CMOS Camera segment has benefited from its proven capability to support applications requiring high precision, low latency, and scalable deployment.

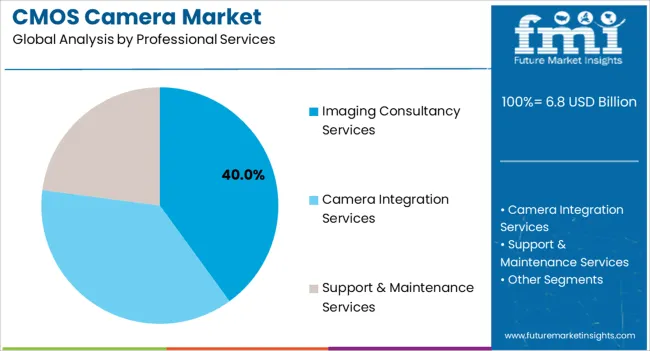

The Imaging Consultancy Services segment is expected to account for 40.0% of the professional services market in 2025, making it the leading service type. Growth in this segment has been driven by increasing demand for expert guidance in selecting, implementing, and optimizing imaging solutions across diverse applications.

Organizations are increasingly relying on consultancy services to design camera networks, integrate software-defined capabilities, and ensure maximum operational efficiency. The segment has benefited from the complexity of deploying high-performance CMOS cameras in specialized environments, where tailored solutions can improve accuracy, reduce downtime, and optimize costs.

The need for strategic planning in imaging infrastructure and the growing emphasis on scalable, upgradeable solutions has further reinforced this segment’s leadership position Professional guidance allows businesses to achieve better ROI and maintain long-term adaptability in an evolving technological landscape.

![]()

The 10-20MP CMOS Camera segment is projected to hold 35.0% of the market revenue in 2025, making it the largest segment in terms of pixel density. The growth of this segment has been fueled by the increasing requirement for high-resolution imaging in surveillance, industrial inspection, content creation, and autonomous navigation systems.

High-resolution sensors allow for detailed image capture, improved analytics, and greater flexibility in post-processing, enabling enhanced operational efficiency. The segment’s adoption has been supported by improvements in sensor technology, miniaturization of components, and integration with advanced imaging software that enhances image quality while maintaining low latency.

Demand for precise, high-resolution imaging continues to rise across commercial and industrial applications, driving the widespread adoption of 10-20MP CMOS cameras as standard for scalable and future-ready imaging solutions.

Cameras have found a multitude of applications in various end-use industries such as security and surveillance, military, entertainment, etc.

In recent years digital cameras have gained massive popularity and subsequently, they have driven demand for image sensors as well. Moreover, CMOS camera consumption increased at a high CAGR of 10.5% from 2020 to 2025 as the popularity of digital cameras rose in an increasingly digital world.

Increasing use of smartphones, high demand for digital cameras, increasing use of cameras in multiple end-use industries, rapid technological advancements in camera technology, and wide availability of CMOS image sensors are some a few key factors that are expected to guide sales of CMOS cameras over the forecast.

Wireless CMOS cameras are anticipated to see a high increase in popularity and are anticipated to see high scope of application in the security and surveillance industry.

Further, scientific CMOS cameras are expected to be popular in the healthcare industry as imaging becomes popular and mainstream in diagnostic and treatment procedures. CMOS camera demand is projected to rise at a phenomenal CAGR of 11% from 2025 to 2035.

High Demand from Security & Surveillance Industry to Boost CMOS Security Camera Sales

Focus on security and surveillance has increased more than ever before and this has fostered a new demand for CMOS security cameras. CMOS cameras for security and surveillance are gaining popularity due to their cost-effectiveness, low power consumption features, and compact size with high-quality imaging capabilities. For instance,

Most smartphones in the modern world utilize CMOS image sensors as they are extremely compact and are easy to fit in a small form factor without compromising picture quality.

Also, CMOS camera modules have been immensely popular among smartphone manufacturers and now even camera manufacturers are opting for CMOS image sensors as they develop mirrorless cameras.

Increasing adoption of smartphones on a global scale is expected to prove highly beneficial for CMOS camera manufacturers.

The global CMOS camera industry has detailed insights into North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

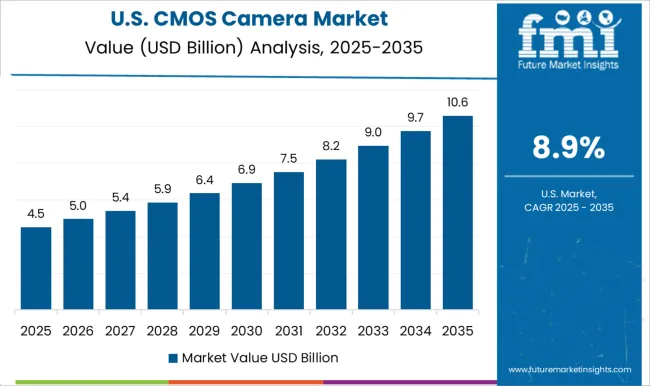

Additionally, CMOS camera consumption in North America is expected to account for a dominant market share in the global landscape. The increasing use of smartphones and rising demand for machine vision technologies are expected to majorly drive sales of CMOS camera sensors in this region.

Increasing research and development activities in Europe are expected to propel the demand for scientific CMOS cameras in the region. Further, healthcare and security end-use industries are anticipated to provide key opportunities for CMOS camera module manufacturers in this region. North America accounted for a market share of 45% in 2025.

Increasing Focus on Security to Boost Demand for CMOS Security Cameras

The United States is a highly dominant market for CMOS camera providers as the nation has seen investments to bolster its security and surveillance systems. CMOS image sensors have found application in the security and surveillance industry due to their compact size and high picture quality.

The United States has seen an increase in demand for CMOS security cameras from the military as well as residential sectors as security expenditure of individuals and government has increased. Also, scientific CMOS cameras are also expected to see an increase in demand as research and development activities in the nation increase.

The Presence of Key CMOS Camera Companies to Bolster Market Potential in China

China has been identified as a key manufacturing hub for many technologies and especially for semiconductor components like image sensors.

CMOS camera manufacturers can benefit from the established manufacturing infrastructure in China and can also leverage government initiatives to boost their investments and increase their market presence to establish themselves.

Further, the presence of key CMOS camera vendors in China is expected to boost CMOS camera shipments across the nation. The market in China is anticipated to thrive at a CAGR of 10%.

HD CMOS Cameras are Expected to See Increased Demand

CMOS cameras have gained massive popularity over the past few years and cameras equipped with CMOS sensors have proven to be highly efficient and productive. Low-light and night vision CMOS cameras are expected to have a dominant outlook in the CMOS camera marketplace as they are holding a market share of 38% in 2025.

HD CMOS cameras are also expected to see an increase in sales as demand for high-quality video increases and advancements in video technology pace up. Currently, HD CMOS cameras account for 28% of the global CMOS camera sales revenue.

CMOS camera manufacturers are focusing on providing optimal products to multiple end-use industries and are investing in the research and development of advanced image sensor technologies.

CMOS camera vendors are also opting for collaborations and mergers to speed up the research and development of new CMOS camera modules and CMOS image sensors.

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| CMOS Camera Market Size (2025) | USD 5.5 billion |

| Estimated Valuation (2035) | USD 15.6 billion |

| Projected Market Growth Rate (2025 to 2035) | 11% CAGR |

| Market Analysis | USD million for Value, Units for Volume |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; The Middle East & Africa (MEA) |

| Key Countries Covered | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Market Segments Covered | Camera Type, Professional Services, Pixel Density (Megapixels), Application, Region |

| Key Companies Profiled | Canon Inc.; Imperx Inc.; Teledyne Technologies; Samsung; Hamamatsu Photonics; Sony Corporation; Toshiba Corporation; Baumer; Basler AG; Fairchild Imaging (BAE Systems); Kappa optronics GmbH; Adimec Advanced Image Systems, LHERITIER (ALCEN Group); Hangzhou Hikvision Digital Technology Co. Ltd.; PCO-TECH Inc. (PCO); IDS Imaging Development Systems GmbH; SVS-Vistek GmbH; Teledyne Lumenera; STEMMER IMAGING AG; JAI A/S |

| Pricing | Available upon Request |

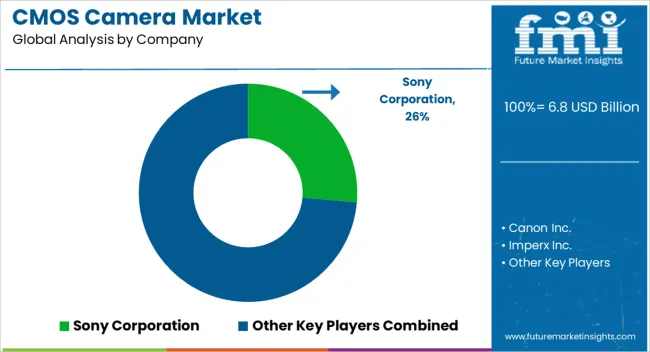

The global CMOS camera market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the CMOS camera market is projected to reach USD 18.3 billion by 2035.

The CMOS camera market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in CMOS camera market are stereo vision CMOS cameras, low-light CMOS cameras, low-noise CMOS cameras, hd CMOS cameras and ultra-hd CMOS cameras.

In terms of professional services, imaging consultancy services segment to command 40.0% share in the CMOS camera market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Camera Module Market Size and Share Forecast Outlook 2025 to 2035

CMOS Power Amplifier Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Module, Application, and Region

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Camera Case Market Trends & Industry Growth Forecast 2024-2034

IP Camera Market Trends – Growth, Demand & Forecast 2025 to 2035

3D Camera Market Growth – Trends & Forecast 2025 to 2035

TDI Camera Market Growth - Trends & Forecast 2025 to 2035

Intracameral Antibiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

GigE Camera Market Size and Share Forecast Outlook 2025 to 2035

CCTV Camera Market Demand & Sustainability Trends 2025-2035

Smart Camera Market Analysis – Size, Share & Forecast 2025 to 2035

Drain Camera Market

InGaAs Cameras Market by Technology, Scanning Type, Industry & Region Forecast till 2035

Action Camera Market

Mobile Camera Module Market

Network Cameras and Video Analytics Market Analysis – Trends & Forecast 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cameras Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA