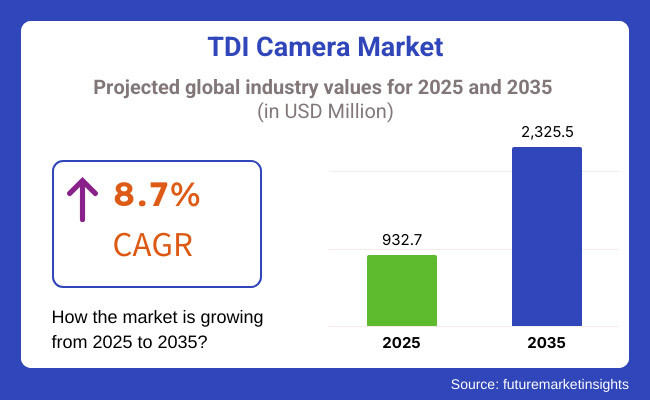

The global TDI Camera market is projected to grow significantly, from USD 932.7 Million in 2025 to USD 2,325.5 Million by 2035 an it is reflecting a strong CAGR of 8.7%.

Demand for high-speed data and imaging and high-resolution imaging across various sectors can only be met via the TDI (Time Delay Integration) Camera Market as a result is proliferating. The delivery of advanced imaging solutions requires a wide variety of external vendors and technology partners, so the selection of vendors is important. This demand is on the rise and driven by industries that require better-imaging capabilities like aerospace, healthcare, and industrial inspection.

The need for high-sensitivity imaging for remote sensing, biomedical imaging, and scientific research applications is one of the leading factors driving the market. As industries increasingly turn to machine vision and AI-driven automation, the demand is being continued to accelerate as they look for precision imaging for quality control and inspection.

Moreover, growing pressure to comply with stringent regulatory requirements in medical and scientific imaging is driving adoption of advanced imaging solutions meeting rigorous industry standards.

With ever-increasing digital transformation, TDI cameras are gaining traction in industries like security surveillance, PCB inspection, and DNA sequencing. This has created an urgent need for real time, efficient imaging technologies that enables businesses to maintain high operational precision and prevent inefficiencies. As industries grow, so does their dependency on high-performance imaging solutions, which will be intertwined with quality assurance and cutting-edge developments.

As imaging systems are becoming increasingly threatened by cyber-physical vulnerabilities, the demand for more secure and provisional cameras is emerging. TDI cameras that process data in real time, offering better imaging integration with the organization and every bit of security that will help the organization protect imaging integrity. Sectors like defense, aerospace, or industrial automation, where accuracy in imaging and confidentiality are key, are driving this demand.

North America is the leading market owing to high R&D investments, rapid technical advancements, and adoption in various important industries. The market leadership of the region is reinforced by the presence of leading TDI camera manufacturers.

On the other hand, there are also factors like recent upsurge in the industrial & research applications in few countries like India & Australia, which is proving boon for the market, while others are facing competition in terms of market share.

| Company | Teledyne DALSA |

|---|---|

| Contract/Development Details | Secured a contract with a semiconductor manufacturer to supply Time Delay Integration (TDI) cameras for wafer inspection systems, enhancing defect detection capabilities and production yield through high-resolution imaging. |

| Date | January 2024 |

| Contract Value (USD Million) | Approximately USD 10 |

| Renewal Period | 3 years |

| Company | Hamamatsu Photonics K.K. |

|---|---|

| Contract/Development Details | Partnered with a medical imaging company to integrate TDI cameras into advanced diagnostic equipment, aiming to improve image quality, reduce scan times, and enhance patient outcomes through precise imaging technology. |

| Date | September 2024 |

| Contract Value (USD Million) | Approximately USD 12 |

| Renewal Period | 4 years |

Rising demand for high-speed, high-sensitivity imaging in industrial and scientific applications

The need for high-speed, high-sensitivity imaging in many industrial and scientific fields has resulted in the development of Time Delay Integration (TDI) cameras. TDI cameras are employed in industrial applications, including semiconductor and electronics manufacturing, enabling fast inspection processes to ensure product quality and operational efficiency.

Their capacity for high-quality image capture at high speeds fulfills needs for fast production line inspections. In scientific research, especially in fields such as materials science and astronomy, TDI cameras allow for the study of quick-motion phenomena at very low illuminance.

For instance, in fields like materials science, they contribute to investigating rapid-phase transitions, and in astronomy, they are employed for measurement of celestial bodies with speed. Incorporating TDI cameras in the aforementioned sectors helps to attain absolute precision of data; so these industries are seeing accelerated research and development timelines that contribute heavily to technological advancements.

Increasing use of TDI cameras in remote sensing, PCB inspection, and biomedical imaging

The applications of TDI cameras have a wide range from remote sensing, printed circuit board (PCB) inspections, and biomedical imaging [3, 4]. In this regard, in the context of remote sensing, TDI cameras find application for capturing high-resolution images of the Earth's surface when mounted on either satellites or aircraft, typically used for environmental monitoring, urban planning, and disaster management.

High sensitivity and speed are critical for capturing clear images over large areas. For example, in PCB inspection, TDI cameras identify tiny defects in electronic circuits, thereby ensuring the reliability of electronic products. Enhanced manufacturing efficiency High-Speed High-Quality Scans Because of their capability to swiftly scan materials at great speeds without compromising the quality of the images, they boost the productivity of the manufacturing process.

This immersive view is used as the core of endoscopy and fluorescence imaging of biological tissues in biomedical imaging using TDI cameras. This is crucial for detecting diseases in their early stages, for guiding surgeries, enabling better patient outcomes. Their use of TDI cameras in these applications highlights their value in driving progress in both industrial quality control and medical diagnostics.

Increasing use of TDI cameras in DNA sequencing and optical coherence tomography (OCT)

TDI cameras have broadly propagated into cutting-edge biomedical techniques like DNA sequencing and Optical Coherence Tomography (OCT). In single-molecule fluorescence experiments, such as DNA sequencing, TDI cameras can greatly increase the detection of fluorescent signals resulting from nucleotide incorporation events, which is essential for achieving high-throughput sequencing methods.

The new capability also speeds up genomic research, which is helping to boost advances in personalized medicine and biotechnology. The non-invasive imaging modality TDI (used in, for example, ophthalmology and cardiology) acquires a number of cross-sectional images of the tissue, typically with micrometer resolution, with cameras.

Their high-speed imaging capabilities allow for real-time visualization of tissue structures, assisting in the early diagnosis of diseases such as macular degeneration and coronary artery disease. TDI cameras implemented in these areas showcase their significant contribution to improving diagnostic accuracy and advancing the capabilities of medical imaging technologies caretakers.

Limited awareness and adoption in emerging markets due to high initial investment

The Time Delay Integration (TDI) cameras are facing many challenges in adoption in the emerging markets as there is a very high upfront investment involved in procuring the TDI cameras, installing them within the facility, and even integrating them within the operations.

The TDI cameras include advanced sensors used in conjunction with specific imaging techniques, which so made them more costly compared to conventional imaging systems. Since most industries in developing areas value cost-effective solutions over image quality, TDI imaging (and high-performance imaging, in general) goes unutilized and falls by the wayside.

In these markets, it can take a long time to adopt a new technology, and many businesses may not truly understand the benefits of TDI technology (including increased sensitivity and faster imaging speed) and complicate the entry of TDI.

Moreover, its usage is also limited from the lack of technical skills and knowledge in these regions. Despite the advanced nature of differs from other imaging laboratories, such as CCD, CMOS, etc, they are economically less feasible and accessible compared to traditional counterparts. Financial barriers are also exacerbated by the cost of incorporating TDI cameras into existing workflows and purchasing additional data processing infrastructure.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter quality inspection standards increased demand for high-resolution imaging. |

| AI & Image Processing | AI-powered image analysis improved industrial inspection processes. |

| Industrial & Aerospace Applications | Growth in semiconductor and aerospace industries fueled adoption. |

| Sensor & Optics Advancements | Higher sensitivity sensors enhanced image capture in challenging environments. |

| Market Growth Drivers | Rising demand for precision imaging in manufacturing and healthcare. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven compliance ensures automated defect detection and regulatory adherence. |

| AI & Image Processing | Quantum-enhanced imaging enables ultra-high-speed, precision inspections. |

| Industrial & Aerospace Applications | AI-integrated imaging solutions enable real-time monitoring in space and defense applications. |

| Sensor & Optics Advancements | Self-learning AI algorithms improve image clarity and defect detection in real time. |

| Market Growth Drivers | AI-powered automation in manufacturing and medical imaging accelerates adoption. |

The Tier 1 vendors, such as Hamamatsu Photonics, Teledyne DALSA, and Vieworks are leaders in this space with superior imaging solutions, robust R&D capabilities, and global presence. These companies provide high-performance TDI cameras that are used in scientific research, industrial inspection, and medical imaging. Their proven reputation and extensive production capabilities enable them to service high-demand applications, as they continue to dominate market share.

Tier 2 vendors including Nuvu Camera, X-Scan Imaging, and NTB Elektronische Geräte GmbH, fill in the need for niche applications, providing specialized TDI camera solutions. They might not have Tier 1 type global reach, but they still all focus on customized imaging technologies for the biomedical imaging, non-destructive testing, and security screening industries. These vendors hold a competitive position in regional markets and often partner with research institutions and industrial companies to create customized solutions.

Phenomenon on Tier 3 vendors: Emerging players such as Detection Technology, I-TEK OptoElectronics, and Prodrive Technologies are coming up with innovative imaging systems with specific features. Although they are not the market leaders, they are the ones pushing for advances in technology by developing low-cost and/or new imaging technologies.

They are agile enough to challenge traditional approaches and respond to changing industry demand. These established partners act as a bedrock of support; competitive mid-tier firms push them to evolve with trends in high-speed, high-sensitivity push imaging; and new entrants-driven by research and development needs-become innovators.

The section highlights the CAGRs of countries experiencing growth in the TDI Camera market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 11.9% |

| China | 10.8% |

| Germany | 6.4% |

| Japan | 7.2% |

| United States | 8.0% |

With the rapid development of China's electronics manufacturing industry, TDI (Time Delay Integration) cameras are widely used in high-speed and high-precision inspection. As the country has had a top ranking in semiconductor fabrication, printed circuit board (PCB) production, and display panel manufacturing, the need for advanced imaging solutions has increased rapidly.

TDI cameras can achieve better sensitivity, providing defect detection to ensure quality control in mass production lines. The Electronics Manufacturing sector is not a new player in the automation and AI manufacturing game.

The US-China trade war, the Chinese government rolled out a multi-billion-dollar plan to expand its semiconductor manufacturing capabilities to limit reliance on foreign technology. As part of this effort, monetary resources were earmarked to enhance inspection and imaging solutions utilized in chip manufacturing. China is anticipated to see substantial growth at a CAGR 10.8% from 2025 to 2035 in the TDI Camera market.

The expanding technological arena of healthcare delivery in India and the growing number of medical specialties are driving TDI camera demand across biomedical imaging applications such as optical coherence tomography (OCT) and DNA sequencing. Essential for diagnosing and studying complex biological structures, these cameras provide high-speed, high-sensitivity imaging.

The increasing prevalence of chronic disorders and soaring demand for early detection systems are anticipated to drive investments in advanced medical imaging systems throughout the country.

The National Biomedical Innovation Initiative, the Indian government allocated a large amount of funds to upgrade their medical imaging infrastructure. This also includes financial assistance for hospitals and research organizations that implement advanced imaging technologies such as TDI-based OCT systems.

On top of that the government has also announced a 20% increase in their budget for medical research, to facilitate the detection of cancer, genomics, precision diagnostics, which are all huge potential applications for TDI cameras. India's TDI Camera market is growing at a CAGR of 11.9% during the forecast period.

The USA is one of the top countries in life sciences research, and growing public investments are accelerating the development of high-resolution imaging technologies such as TDI cameras. These cameras are a common tool used in biomedical imaging, neuroscience, and molecular diagnostics that facilitate research for cancer diagnosis, drug development, and genetic analysis. With the increasing demand for precision medicine and AI-based diagnostic, the application of TDI cameras has been further promoted in cutting-edge research.

In the United States, a USD 1.2 billion research funding package for advanced generation imaging technologies passed through the USA government in 2023 under the National Institutes of Health (NIH) and the Advanced Research Projects Agency for Health (ARPA-H). The effort seeks to speed advances in medical diagnostics by funding universities, hospitals and biotech companies developing high-speed imaging solutions.

Over USD 300 million of this has been invested in the field of optical imaging, where TDI cameras enable real-time, ultra-sensitive imaging for studying complex biology,” explains Emma Stowe, who specializes in TDI technology at Teledyne Technologies. USA is anticipated to see substantial growth in the TDI Camera market significantly holds dominant share of 72.1% in 2025.

The section contains information about the leading segments in the industry. By Camera type, the Color TDI Cameras segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Application, Machine Vision segment holds dominant share in 2025.

| Camera Type | CAGR (2025 to 2035) |

|---|---|

| Color TDI Cameras | 9.8% |

Color TDI Cameras segment is expected to grow at a CAGR of 9.8% from the period 2025 to 2035. The color TDI (Time Delay Integration) cameras are growing fast owing to the high-resolution, high-speed image capturing ability with exact color differentiation.

Color TDI cameras allow for more advanced defect detection, material analysis, and quality control compared with monochrome TDI cameras that work only in grayscale, making color TDI cameras suitable for many fields like semiconductor manufacturing, printed circuit board (PCB) inspection, food processing, and automotive manufacturers. More importantly, their specialization in generating extreme color contrast and sharp imaging at ultra-rapid speeds makes them suitable for industries that demand precision in identifying small changes.

In 2023, the EU launched a €500 million technology advancement fund aimed at enhancing industrial imaging and optical sensor technologies. The Color TDI cameras are very vital in semiconductor fabrication and automated manufacturing, and so some of this money has gone into improving imaging solutions in these areas. The initiative seeks to improve quality control efficiency by 30 percent across a wide range of industries, promoting the adoption of color TDI camera technology even further.

| Application | Value Share (2025) |

|---|---|

| Machine Vision | 28.5% |

The Machine Vision is poised to capture share 28.5% in 2025. The role of machine vision systems in such applications has helped the TDI camera market, and machine vision systems have been a major contributor to the overall value of the TDI camera market with these systems being implemented in automated inspection, robotics and industrial manufacturing.

Ultra-fast TDI cameras with extreme sensitivity are essential for non-destructive, high-speed quality control in automotive, electronics, pharmaceuticals and food processing. Ultra-fast image capture with minimal motion blur assists to improve production efficiency and could also increase defect detection accuracy.

The USA government invested USD 1 billion in smart manufacturing and AI-driven automation through the post-COVID pandemic recovery agency in 2024; a focus area of this investment was on how we can improve imaging and sensor technologies to help with industrial automation.

It is part of a fund that also supports machine vision systems using TDI cameras to enhance real-time monitoring and predictive maintenance in manufacturing plants. The initiative targets a 40% improvement in production efficiency along with a 20% reduction in defective output, driving increased demand for TDI cameras in machine vision applications.

TDI camera market is segmented, based on application, into high speed, and high sensitivity segments. To stay ahead in the game, companies want advanced sensors for better resolution of images which require faster to process data.

There is fierce competition in this market on pricing, product differentiation, and integration with cutting-edge imaging systems in industrial and scientific analytical application domains. In addition, strategic collaborations, R&D activities, and expanding industry solutions in healthcare, electronics, and security also add intensity to the competition.

Recent Industry Developments in TDI Camera Market

In terms of Camera Type, the segment is segregated into Monochrome TDI Cameras and Color TDI Cameras.

In terms of Pixel Size, the segment is segregated into S 5 x 5 µm, 7 x 7 µm, 10 x 10 µm, 12 x 12 µm and 14 x 14 µm.

In terms of Application, it is distributed into Remote Sensing, Optical Coherence Tomography (OCT), DNA Sequencing, Biomedical Imaging, Security and Surveillance, Machine Vision, Scientific Imaging, Industrial Inspection, PCB Inspection and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global TDI Camera industry is projected to witness CAGR of 8.7% between 2025 and 2035.

The Global TDI Camera industry stood at USD 932.7 million in 2025.

The Global TDI Camera industry is anticipated to reach USD 2,325.5 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 10.8% in the assessment period.

The key players operating in the Global TDI Camera Industry Teledyne DALSA, Hamamatsu Photonics, Vieworks Co., Ltd., Gpixel Inc., STEMMER IMAGING, Detection Technology Plc, Canon USA, Inc., FLIR Systems (Teledyne FLIR), Emergent Vision Technologies, JAI A/S.

Table 01: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 02: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 03: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 04: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 05: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Region

Table 06: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 07: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 08: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 09: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 10: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 11: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 12: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 13: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 14: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 15: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by country

Table 16: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 17: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 18: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 19: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 20: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 21: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 22: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 23: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 24: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 25: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 26: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 27: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 28: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 29: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 30: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 31: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 32: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 33: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 34: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 35: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 36: Central Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 37: Central Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 38: Central Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 39: Central Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 40: Russia and Belarus Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 41: Russia and Belarus Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 42: Russia and Belarus Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 43: Russia and Belarus Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 44: Balkan and Baltics Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 45: Balkan and Baltics Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 46: Balkan and Baltics Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 47: Balkan and Baltics Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 48: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Camera Type

Table 49: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Pixel Size

Table 50: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 51: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Sales Channel

Table 52: Middle East and Africa Market Value (US$ million) Forecast (2023 to 2033) by Country

Figure 01: Global Market Shipments (Units) and Y-o-Y Growth Rate from 2022 to 2033

Figure 02: Global Market Value (US$ million), 2018 to 2022

Figure 03: Global Market Value (US$ million), 2023 to 2033

Figure 04: Global Market Size (US$ million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 05: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 06: Global Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 07: Global Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 08: Global Market: Market Attractiveness, by Camera Type

Figure 09: Global Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 10: Global Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 11: Global Market: Market Attractiveness, by Pixel Size

Figure 12: Global Market: Market Share Analysis, by Application 2023 to 2033

Figure 13: Global Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 14: Global Market: Market Attractiveness, by Application

Figure 15: Global Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 16: Global Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 17: Global Market: Market Attractiveness, by End Use Sales Channel

Figure 18: Global Market: Market Share Analysis, by Region – 2023 to 2033

Figure 19: Global Market: Y-o-Y Growth Comparison, by Region, 2023 to 2033

Figure 20: Global Market: Market Attractiveness, by Region

Figure 21: North America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 22: Latin America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 23: East Asia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 23: South Asia and Pacific Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 24: South Asia and Pacific Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 25: Western Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 26: Eastern Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 27: Central Asia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 28: Russia and Belarus Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 29: Balkan and Baltics Countries Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 30: Middle East and Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 31: North America Market Value (US$ million), 2018 to 2022

Figure 32: North America Market Value (US$ million), 2023 to 2033

Figure 33: North America Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 34: North America Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 35: North America Market: Market Attractiveness, by Camera Type

Figure 36: North America Market: Market Share Analysis, by Pixel Size– 2023 to 2033

Figure 37: North America Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 38: North America Market: Market Attractiveness, by Pixel Size

Figure 39: North America Market: Market Share Analysis, by Application 2023 to 2033

Figure 40: North America Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 41: North America Market: Market Attractiveness, by Application

Figure 42: North America Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 43: North America Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 44: North America Market: Market Attractiveness, by End Use Sales Channel

Figure 45: North America Market: Market Share Analysis, by Country – 2023 to 2033

Figure 46: North America Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 47: North America Market: Market Attractiveness, by Country

Figure 48: North America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 49: Latin America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 50: Latin America Market Value (US$ million), 2018 to 2022

Figure 51: Latin America Market Value (US$ million), 2023 to 2033

Figure 52: Latin America Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 53: Latin America Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 54: Latin America Market: Market Attractiveness, by Camera Type

Figure 55: Latin America Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 56: Latin America Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 57: Latin America Market: Market Attractiveness, by Pixel Size

Figure 58: Latin America Market: Market Share Analysis, by Application 2023 to 2033

Figure 59: Latin America Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 60: Latin America Market: Market Attractiveness, by Application

Figure 61: Latin America Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 62: Latin America Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 63: Latin America Market: Market Attractiveness, by End Use Sales Channel

Figure 64: Latin America Market: Market Share Analysis, by country – 2023 to 2033

Figure 65: Latin America Market: Y-o-Y Growth Comparison, by country, 2023 to 2033

Figure 66: Latin America Market: Market Attractiveness, by country

Figure 67: Brazil Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 68: Mexico Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 69: Argentina Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 70: Rest of Latin America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 71: South Asia and Pacific Market Value (US$ million), 2018 to 2022

Figure 72: South Asia and Pacific Market Value (US$ million), 2023 to 2033

Figure 73: South Asia and Pacific Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 74: South Asia and Pacific Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 75: South Asia and Pacific Market: Market Attractiveness, by Camera Type

Figure 76: South Asia and Pacific Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 77: South Asia and Pacific Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 78: South Asia and Pacific Market: Market Attractiveness, by Pixel Size

Figure 79: South Asia and Pacific Market: Market Share Analysis, by Application 2023 to 2033

Figure 80: South Asia and Pacific Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 81: South Asia and Pacific Market: Market Attractiveness, by Application

Figure 82: South Asia and Pacific Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 83: South Asia and Pacific Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 84: South Asia and Pacific Market: Market Attractiveness, by End Use Sales Channel

Figure 85: South Asia and Pacific Market: Market Share Analysis, by Country – 2023 to 2033

Figure 86: South Asia and Pacific Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 87: South Asia and Pacific Market: Market Attractiveness, by Country

Figure 88: India Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 89: ASEAN Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 90: Australia and New Zealand Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 91: Rest of South Asia and Pacific Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 92: East Asia Market Value (US$ million), 2018 to 2022

Figure 93: East Asia Market Value (US$ million), 2023 to 2033

Figure 94: East Asia Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 95: East Asia Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 96: East Asia Market: Market Attractiveness, by Camera Type

Figure 97: East Asia Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 98: East Asia Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 99: East Asia Market: Market Attractiveness, by Pixel Size

Figure 100: East Asia Market: Market Share Analysis, by Application 2023 to 2033

Figure 101: East Asia Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 102: East Asia Market: Market Attractiveness, by Application

Figure 103: East Asia Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 104: East Asia Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 105: East Asia Market: Market Attractiveness, by End Use Sales Channel

Figure 106: East Asia Market: Market Share Analysis, by Country – 2023 to 2033

Figure 107: East Asia Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 108: East Asia Market: Market Attractiveness, by Country

Figure 109: China Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 110: Japan Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 111: South Korea Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 112: Western Europe Market Value (US$ million), 2018 to 2022

Figure 113: Western Europe Market Value (US$ million), 2023 to 2033

Figure 114: Western Europe Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 115: Western Europe Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 116: Western Europe Market: Market Attractiveness, by Camera Type

Figure 117: Western Europe Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 118: Western Europe Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 119: Western Europe Market: Market Attractiveness, by Pixel Size

Figure 120: Western Europe Market: Market Share Analysis, by Application 2023 to 2033

Figure 121: Western Europe Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 122: Western Europe Market: Market Attractiveness, by Application

Figure 123: Western Europe Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 124: Western Europe Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 125: Western Europe Market: Market Attractiveness, by End Use Sales Channel

Figure 126: Western Europe Market: Market Share Analysis, by Country – 2023 to 2033

Figure 127: Western Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 128: Western Europe Market: Market Attractiveness, by Country

Figure 129: Germany Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 130: Italy Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 131: France Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 132: UK Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 133: Spain Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 134: BENELUX Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 135: Nordics Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 136: Rest of Western Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 137: Eastern Europe Market Value (US$ million), 2018 to 2022

Figure 138: Eastern Europe Market Value (US$ million), 2023 to 2033

Figure 139: Eastern Europe Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 140: Eastern Europe Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 141: Eastern Europe Market: Market Attractiveness, by Camera Type

Figure 142: Eastern Europe Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 143: Eastern Europe Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 144: Eastern Europe Market: Market Attractiveness, by Pixel Size

Figure 145: Eastern Europe Market: Market Share Analysis, by Application 2023 to 2033

Figure 146: Eastern Europe Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 147: Eastern Europe Market: Market Attractiveness, by Application

Figure 148: Eastern Europe Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 149: Eastern Europe Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market: Market Attractiveness, by End Use Sales Channel

Figure 151: Eastern Europe Market: Market Share Analysis, by Country – 2023 to 2033

Figure 152: Eastern Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 153: Eastern Europe Market: Market Attractiveness, by Country

Figure 154: Poland Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 155: Hungary Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 156: Romania Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 157: Czech Republic Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 158: Rest of Eastern Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 159: Central Asia Market Value (US$ million), 2018 to 2022

Figure 160: Central Asia Market Value (US$ million), 2023 to 2033

Figure 161: Central Asia Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 162: Central Asia Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 163: Central Asia Market: Market Attractiveness, by Camera Type

Figure 164: Central Asia Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 165: Central Asia Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 166: Central Asia Market: Market Attractiveness, by Pixel Size

Figure 167: Central Asia Market: Market Share Analysis, by Application 2023 to 2033

Figure 168: Central Asia Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 169: Central Asia Market: Market Attractiveness, by Application

Figure 170: Central Asia Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 171: Central Asia Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 172: Central Asia Market: Market Attractiveness, by End Use Sales Channel

Figure 173: Russia and Belarus Market Value (US$ million), 2018 to 2022

Figure 174: Russia and Belarus Market Value (US$ million), 2023 to 2033

Figure 175: Russia and Belarus Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 176: Russia and Belarus Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 177: Russia and Belarus Market: Market Attractiveness, by Camera Type

Figure 178: Russia and Belarus Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 179: Russia and Belarus Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 180: Russia and Belarus Market: Market Attractiveness, by Pixel Size

Figure 181: Russia and Belarus Market: Market Share Analysis, by Application 2023 to 2033

Figure 182: Russia and Belarus Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 183: Russia and Belarus Market: Market Attractiveness, by Application

Figure 184: Russia and Belarus Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 185: Russia and Belarus Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 186: Russia and Belarus Market: Market Attractiveness, by End Use Sales Channel

Figure 187: Balkan and Baltics Market Value (US$ million), 2018 to 2022

Figure 188: Balkan and Baltics Market Value (US$ million), 2023 to 2033

Figure 189: Balkan and Baltics Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 190: Balkan and Baltics Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 191: Balkan and Baltics Market: Market Attractiveness, by Camera Type

Figure 192: Balkan and Baltics Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 193: Balkan and Baltics Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 194: Balkan and Baltics Market: Market Attractiveness, by Pixel Size

Figure 195: Balkan and Baltics Market: Market Share Analysis, by Application 2023 to 2033

Figure 196: Balkan and Baltics Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 197: Balkan and Baltics Market: Market Attractiveness, by Application

Figure 198: Balkan and Baltics Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 199: Balkan and Baltics Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 200: Balkan and Baltics Market: Market Attractiveness, by End Use Sales Channel

Figure 201: Middle East and Africa Market Value (US$ million), 2018 to 2022

Figure 202: Middle East and Africa Market Value (US$ million), 2023 to 2033

Figure 203: Middle East and Africa Market: Market Share Analysis, by Camera Type – 2023 to 2033

Figure 204: Middle East and Africa Market: Y-o-Y Growth Comparison, by Camera Type, 2023 to 2033

Figure 205: Middle East and Africa Market: Market Attractiveness, by Camera Type

Figure 206: Middle East and Africa Market: Market Share Analysis, by Pixel Size– 2023 and 033

Figure 207: Middle East and Africa Market: Y-o-Y Growth Comparison, by Pixel Size, 2023 to 2033

Figure 208: Middle East and Africa Market: Market Attractiveness, by Pixel Size

Figure 209: Middle East and Africa Market: Market Share Analysis, by Application 2023 to 2033

Figure 210: Middle East and Africa Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 211: Middle East and Africa Market: Market Attractiveness, by Application

Figure 212: Middle East and Africa Market: Market Share Analysis, by End Use Sales Channel – 2023 to 2033

Figure 213: Middle East and Africa Market: Y-o-Y Growth Comparison, by End Use Sales Channel, 2023 to 2033

Figure 214: Middle East and Africa Market: Market Attractiveness, by End Use Sales Channel

Figure 215: Middle East and Africa Market: Market Share Analysis, by Country – 2023 to 2033

Figure 216: Middle East and Africa Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 217: Middle East and Africa Market: Market Attractiveness, by Country

Figure 218: Saudi Arabia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 219: UAE Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 220: Turkey Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 221: Northern Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 222: South Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 223: Israel Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 224: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Camera Module Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Camera Accessories Market Trends - Growth & Forecast 2024 to 2034

Camera Case Market Trends & Industry Growth Forecast 2024-2034

IP Camera Market Trends – Growth, Demand & Forecast 2025 to 2035

3D Camera Market Growth – Trends & Forecast 2025 to 2035

Intracameral Antibiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CMOS Camera Market Size and Share Forecast Outlook 2025 to 2035

GigE Camera Market Size and Share Forecast Outlook 2025 to 2035

CCTV Camera Market Demand & Sustainability Trends 2025-2035

Smart Camera Market Analysis – Size, Share & Forecast 2025 to 2035

Drain Camera Market

InGaAs Cameras Market by Technology, Scanning Type, Industry & Region Forecast till 2035

Action Camera Market

Mobile Camera Module Market

Network Cameras and Video Analytics Market Analysis – Trends & Forecast 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cameras Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Camera Market Growth - Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA