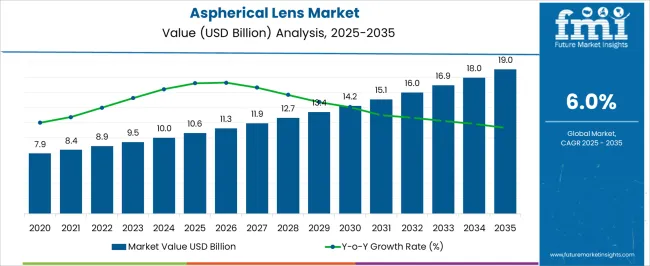

The Aspherical Lens Market is estimated to be valued at USD 10.6 billion in 2025 and is projected to reach USD 19.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The annual trajectory suggests consistent value gains, with the market crossing USD 15 billion by 2031 and pushing toward USD 19 billion by 2035. This progression demonstrates the steady integration of aspherical lenses in consumer electronics, automotive cameras, and advanced optical instruments.

Each year contributes incremental momentum, ensuring that the overall size almost doubles within the forecast period through sustained application expansion and industry-wide adoption. In terms of multipliers, the industry grows by a factor of 1.8x over the 10-year horizon. Early years (2025–2028) show moderate scaling, where demand rises gradually with increasing adoption in smartphones and imaging devices.

From 2029 onward, a stronger multiplier effect is observed as automotive sensing, AR/VR devices, and industrial optics contribute more significantly. By 2030, the market will surpass USD 14.2 billion, setting a higher base for accelerated compounding in the final stretch. This indicates that while early growth is foundation-building, the later years amplify overall gains, showing both steady momentum and expanding use cases across sectors.

| Metric | Value |

|---|---|

| Aspherical Lens Market Estimated Value in (2025 E) | USD 10.6 billion |

| Aspherical Lens Market Forecast Value in (2035 F) | USD 19.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The aspherical lens market is expanding due to increasing demand for compact and high-performance optical components across consumer electronics and imaging devices. Industry insights have highlighted the benefits of aspherical lenses in reducing optical aberrations and enhancing image quality compared to traditional spherical lenses.

Growth in mobile phone camera technology and demand for thinner devices has accelerated the adoption of advanced lens designs. Manufacturing advancements such as molding technology have improved production efficiency and reduced costs, making aspherical lenses more accessible across various applications.

Rising consumer expectations for superior camera performance and the integration of augmented reality and virtual reality features are further driving the market. As product innovation continues and new use cases emerge, the market is expected to sustain its growth momentum. Key growth drivers include the dominance of single aspherical lenses, the widespread use of molding technology, and strong demand from mobile phone manufacturers.

The aspherical lens market is segmented by type, technology, application, end use industry, and geographic regions. By type, the aspherical lens market is divided into Single Aspherical Lens and Double Aspherical Lens. In terms of technology, the aspherical lens market is classified into Molding, Grinding and Polishing, Injection Molding, Hot Pressing, and Others.

Based on application, the aspherical lens market is segmented into Mobile Phones, Advanced Driver Assistance Systems (ADAS), Cameras, Endoscopes, Head-Up Displays (HUDs), Ophthalmic Lenses, Optical Instruments, and Others. By end-use industry, the aspherical lens market is segmented into Consumer Electronics, Healthcare, Automotive, Industrial, Aerospace & Defense, and Others. Regionally, the aspherical lens industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

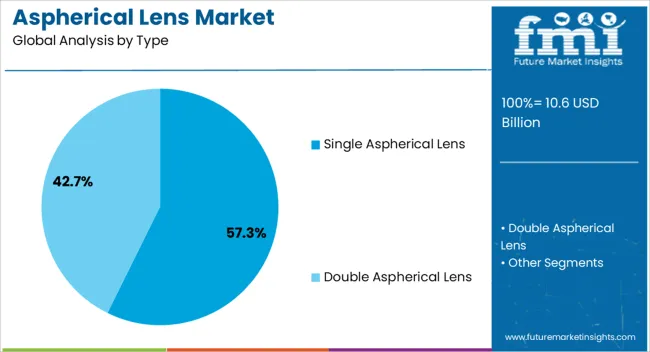

The Single Aspherical Lens segment is forecasted to hold 57.3% of the market revenue in 2025, reflecting its leading position among lens types. This growth is largely due to the lens's ability to correct spherical aberrations with a single element, allowing for lighter and more compact optical assemblies.

The simplicity of design reduces the number of lens elements required, lowering overall system weight and manufacturing complexity. Device makers prioritize single aspherical lenses for smartphones and compact cameras to achieve high-quality images without increasing device thickness.

The segment has been bolstered by technological refinements that improve lens surface precision and reduce production costs. As consumer demand for better optics in portable devices increases, the single aspherical lens is expected to maintain market leadership.

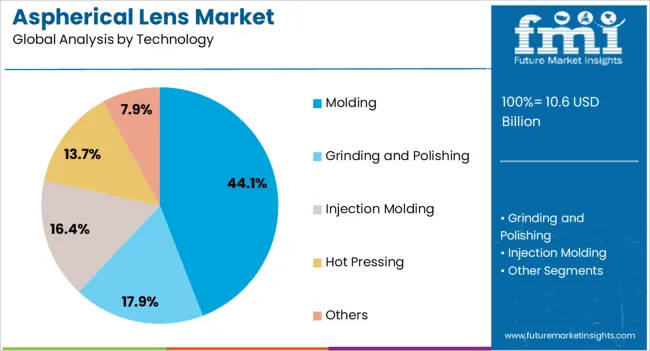

The Molding technology segment is projected to account for 44.1% of the aspherical lens market revenue in 2025, establishing itself as the leading manufacturing technique. The segment’s growth has been fueled by the cost-efficiency and scalability of molding processes compared to traditional grinding and polishing.

Molding enables high-precision lens production with consistent quality at faster rates, meeting the demands of high-volume consumer electronics manufacturing. Advancements in mold materials and process automation have improved yield rates and reduced defects.

This technology is favored for producing plastic aspherical lenses commonly used in smartphones, webcams, and augmented reality devices. As the industry seeks to balance performance with cost-effectiveness, molding technology is expected to remain dominant in lens fabrication.

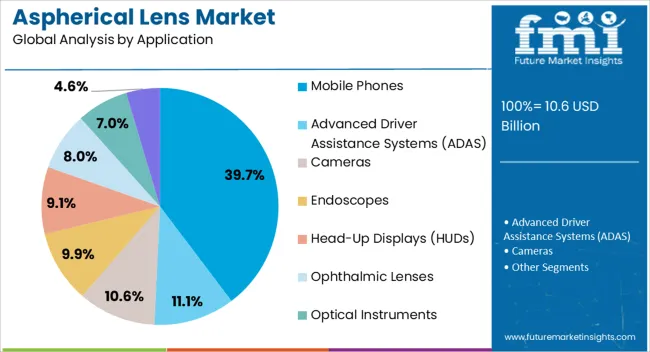

The Mobile Phones segment is expected to hold 39.7% of the aspherical lens market revenue in 2025, making it the largest application segment. Growth in this segment has been propelled by the increasing integration of advanced camera systems in smartphones.

As consumers demand higher resolution, better low-light performance, and optical zoom capabilities, mobile phone manufacturers have turned to aspherical lenses to meet these needs. The compact form factor of aspherical lenses suits the slim designs of modern smartphones, enabling enhanced imaging without compromising device size.

The rising adoption of multiple camera modules in phones has further increased lens demand. With ongoing innovation in mobile imaging technologies and growing smartphone penetration worldwide, the mobile phones segment is set to maintain its lead in the aspherical lens market.

The aspherical lens market is driven by the increasing demand for high-precision optical components in consumer electronics, automotive, and imaging systems. Opportunities are growing in miniaturization and lightweight designs, while emerging trends in consumer electronics and automotive applications are reshaping the market. However, challenges such as high manufacturing costs and complex production processes may limit growth. By 2025, overcoming these barriers through efficient production methods and technological advancements will be key to sustaining market expansion.

The aspherical lens market is growing due to the increasing demand for high-precision optical components used in cameras, eyeglasses, and imaging systems. These lenses provide better image quality by reducing optical aberrations compared to spherical lenses, which drives their adoption in industries like photography, consumer electronics, and healthcare. By 2025, the market will continue to expand as demand for high-performance optical systems in sectors such as automotive and security increases, ensuring sharp, clear images in various applications.

Opportunities in the aspherical lens market are rising in the consumer electronics and automotive sectors. In consumer electronics, aspherical lenses are widely used in smartphone cameras and other optical devices, driven by the growing demand for high-quality photography features. In the automotive sector, aspherical lenses are increasingly used in advanced driver assistance systems (ADAS) and LiDAR technology for self-driving cars. By 2025, the growing adoption of these technologies in both sectors will present substantial market growth opportunities.

Emerging trends in the aspherical lens market include the miniaturization and lightweight design of optical lenses. As industries demand more compact and portable devices, there is an increasing need for smaller and lighter lenses without compromising on image quality. These trends are particularly important in consumer electronics, where miniaturization plays a key role in enhancing product usability. By 2025, these innovations will drive demand for aspherical lenses, particularly in portable and wearable electronic devices.

Despite growth, challenges related to high manufacturing costs and complex processes persist in the aspherical lens market. The production of high-quality aspherical lenses requires advanced machinery and precise manufacturing techniques, which contribute to higher costs compared to traditional spherical lenses. Additionally, the complexity of the molding process can limit mass production and scalability. By 2025, addressing these challenges through cost-effective production methods and efficient manufacturing techniques will be crucial for expanding market accessibility.

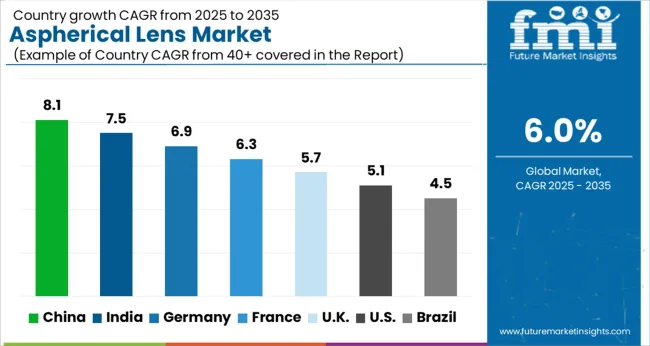

The global aspherical lens market is projected to grow at a 6% CAGR from 2025 to 2035. China leads with a growth rate of 8.1%, followed by India at 7.5%, and France at 6.3%. The United Kingdom records a growth rate of 5.7%, while the United States shows the slowest growth at 5.1%. These varying growth rates are driven by factors such as increasing demand for advanced optical components in the automotive, consumer electronics, and healthcare sectors. Emerging markets like China and India are witnessing higher growth due to rapid industrialization, technological advancements, and rising consumer demand for high-quality optical products, while more mature markets like the USA and the UK experience steady growth driven by innovation in precision optics, camera lenses, and medical devices. This report includes insights on 40+ countries; the top markets are shown here for reference.

The aspherical lens market in China is growing at a strong pace, with a projected CAGR of 8.1%. China’s rapidly expanding consumer electronics and automotive sectors, combined with growing demand for high-quality optical products, are driving the adoption of aspherical lenses. The country’s focus on precision engineering and technological advancements, particularly in the production of camera lenses, sensors, and optical systems for various applications, is significantly contributing to market growth. Additionally, China’s rising middle class and demand for advanced medical devices, including ophthalmic lenses, further accelerates the adoption of aspherical lenses in diverse industries.

The aspherical lens market in India is projected to grow at a CAGR of 7.5%. India’s expanding consumer electronics, automotive, and healthcare sectors are driving the demand for advanced optical products, particularly aspherical lenses. The increasing adoption of high-performance lenses in cameras, smartphones, and medical devices is contributing to market growth. Additionally, India’s growing focus on affordable healthcare solutions and the rising demand for corrective eyewear and ophthalmic lenses further boost the adoption of aspherical lenses, making them an essential component in various industries.

The aspherical lens market in France is projected to grow at a CAGR of 6.3%. France’s established demand for optical components in the healthcare, automotive, and consumer electronics sectors is driving steady market growth. The country’s emphasis on innovation in high-precision optics, particularly in medical imaging, camera lenses, and automotive lighting, is contributing to the adoption of aspherical lenses. Additionally, France’s growing focus on sustainable technology and increasing demand for high-quality eyewear solutions further accelerates the demand for advanced aspherical lenses.

The aspherical lens market in the United Kingdom is projected to grow at a CAGR of 5.7%. The UK’s focus on innovation and high-quality manufacturing in the optical, automotive, and healthcare industries is supporting steady market growth. The country’s growing demand for advanced camera lenses, medical imaging systems, and optical devices further accelerates the adoption of aspherical lenses. Additionally, the UK’s investment in precision optics and its growing demand for sustainable solutions in the eyewear industry contribute to continued market expansion.

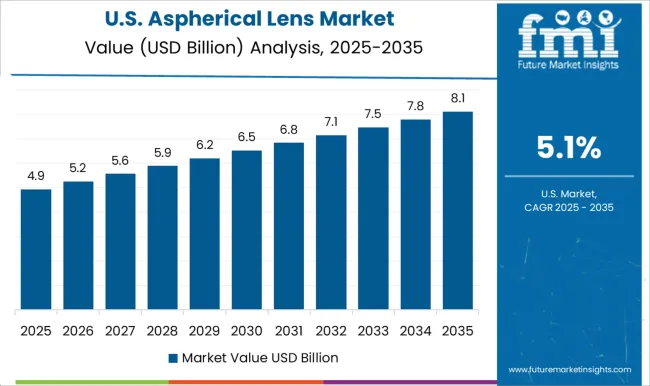

The aspherical lens market in the United States is expected to grow at a CAGR of 5.1%. The USA market remains steady, driven by demand for high-performance optical components in the automotive, consumer electronics, and healthcare industries. The growing need for advanced camera lenses in smartphones, digital cameras, and security systems, along with the increasing adoption of medical imaging technologies, supports market growth. Despite slower growth compared to emerging markets, the USA continues to be a key market for high-quality aspherical lenses due to its technological advancements and innovation in optical devices.

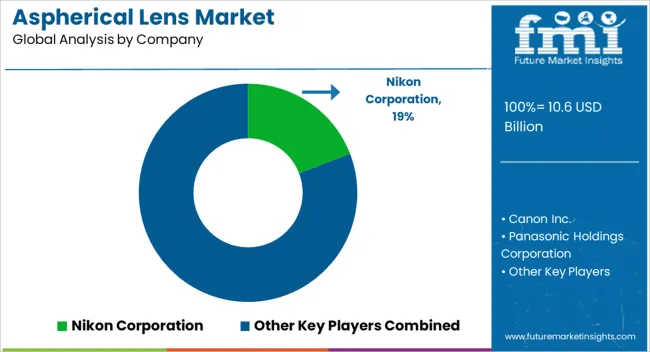

The aspherical lens market is dominated by Nikon Corporation, which leads with its high-precision aspherical lenses used in cameras, optical instruments, and automotive applications. Nikon’s dominance is supported by its advanced manufacturing capabilities, strong brand recognition, and extensive portfolio of high-quality optical solutions. Key players such as Canon Inc., HOYA Corporation, and Carl Zeiss AG maintain significant market shares by offering innovative aspherical lenses that enhance image quality, reduce optical aberrations, and improve performance in various optical devices, including digital cameras, microscopes, and binoculars. These companies focus on delivering cutting-edge optical technologies that meet the growing demand for superior clarity and compact lens designs.

Emerging players like Panasonic Holdings Corporation, AGC Inc., and SCHOTT AG are expanding their market presence by offering specialized aspherical lenses for niche applications such as medical imaging, virtual reality (VR), and automotive cameras. Their strategies include improving lens coatings, increasing manufacturing efficiency, and developing lightweight, durable lenses for high-performance applications. The increasing adoption of optical technologies in consumer electronics, the automotive sector, and healthcare drives market growth. Innovations in advanced coatings, materials, and multi-lens designs are expected to continue shaping competitive dynamics and drive further growth in the global aspherical lens market.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.6 Billion |

| Type | Single Aspherical Lens and Double Aspherical Lens |

| Technology | Molding, Grinding and Polishing, Injection Molding, Hot Pressing, and Others |

| Application | Mobile Phones, Advanced Driver Assistance Systems (ADAS), Cameras, Endoscopes, Head-Up Displays (HUDs), Ophthalmic Lenses, Optical Instruments, and Others |

| End Use Industry | Consumer Electronics, Healthcare, Automotive, Industrial, Aerospace & Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nikon Corporation, Canon Inc., Panasonic Holdings Corporation, HOYA Corporation, Carl Zeiss AG, AGC Inc., and SCHOTT AG |

| Additional Attributes | Dollar sales by lens type and application, demand dynamics across automotive, consumer electronics, and optical sectors, regional trends in aspherical lens adoption, innovation in high-precision manufacturing and multi-functional coatings, impact of regulatory standards on optical performance and safety, and emerging use cases in augmented reality and high-resolution imaging systems. |

The global aspherical lens market is estimated to be valued at USD 10.6 billion in 2025.

The market size for the aspherical lens market is projected to reach USD 19.0 billion by 2035.

The aspherical lens market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in aspherical lens market are single aspherical lens and double aspherical lens.

In terms of technology, molding segment to command 44.1% share in the aspherical lens market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Industry Analysis in GCC Size and Share Forecast Outlook 2025 to 2035

Scleral Lenses Market Size and Share Forecast Outlook 2025 to 2035

Contact Lenses Market – Trends, Growth & Forecast 2025 to 2035

Contact Lens Solution Market Analysis by Product Type, Volume, Purpose, Distribution Channel, and Region through 2035

Global Contact-lens Induced Infections Market Analysis – Size, Share & Forecast 2024-2034

Acrylic Lenses Market

Anti-Fog Lens Market Insights - Size, Trends & Forecast 2025 to 2035

Global Spectacle Lens Market Analysis – Size, Share & Forecast 2024-2034

Intraocular Lens Market Size and Share Forecast Outlook 2025 to 2035

Collimating Lens Market – Growth & Technology Trends 2025 to 2035

IR Corrected Lenses Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Prescription Lens Industry

Smart Contact Lens Market Size and Share Forecast Outlook 2025 to 2035

Digital Vision Lenses Market

Hydrogel Contact Lenses Market

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Posterior Chamber Lens Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA