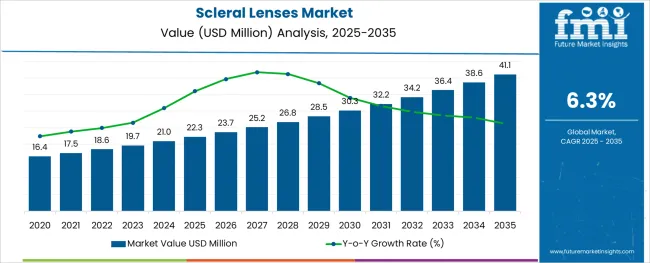

The Scleral Lenses Market is estimated to be valued at USD 22.3 million in 2025 and is projected to reach USD 41.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

The scleral lenses market is experiencing sustained growth due to increasing prevalence of corneal disorders, rising awareness around specialty contact lenses, and expanding clinical acceptance of custom fit lens technologies. These lenses have proven highly effective in treating complex ocular surface conditions where conventional lenses fall short, thus gaining traction in ophthalmic practices globally.

Technological advancements in oxygen permeable materials, tear reservoir design, and computer aided fitting systems have significantly improved patient comfort and therapeutic outcomes. In parallel, a growing aging population and increased diagnosis of conditions such as keratoconus and dry eye syndrome are driving demand.

The market is expected to maintain upward momentum as eye care providers increasingly adopt these lenses for their versatility, precision, and long term ocular health benefits in patients with irregular corneas or advanced visual impairments.

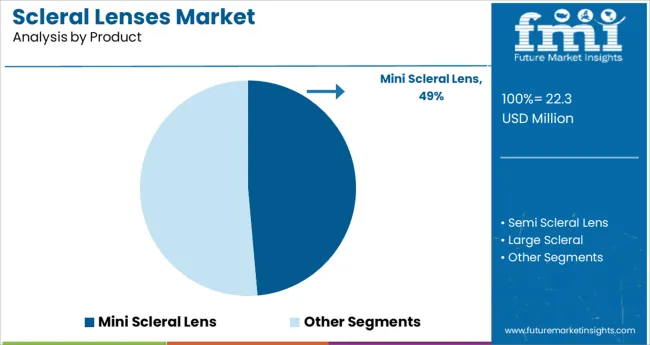

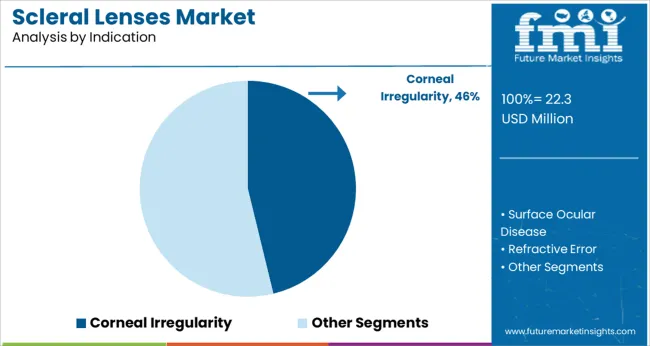

The market is segmented by Product and Indication and region. By Product, the market is divided into Mini Scleral Lens, Semi Scleral Lens, and Large Scleral. In terms of Indication, the market is classified into Corneal Irregularity, Surface Ocular Disease, Refractive Error, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mini scleral lens segment is projected to represent 48.60% of total market revenue by 2025 within the product category, establishing it as the leading segment. This growth is supported by its ease of handling, improved fit for a wider range of eye shapes, and better adaptability for patients new to scleral lenses.

These lenses typically cover a smaller portion of the sclera, making them more comfortable for extended wear and easier to insert and remove. Eye care practitioners often prefer mini scleral lenses due to simplified fitting procedures and favorable outcomes in managing moderate corneal irregularities and dry eye symptoms.

Their availability in a variety of customizable parameters further enhances their suitability across diverse patient needs. As demand rises for lenses that balance therapeutic benefit with comfort and convenience, the mini scleral lens segment continues to lead in both clinical and commercial adoption.

The corneal irregularity indication segment is expected to account for 46.20% of total market revenue by 2025, positioning it as the dominant indication. This prominence is driven by the high incidence of conditions such as keratoconus, post surgical ectasia, and corneal scarring, where scleral lenses offer superior visual rehabilitation compared to traditional corrective options.

These lenses create a tear filled vault over the cornea, masking surface irregularities and providing stable vision. Increased screening rates and early diagnosis of corneal disorders are contributing to the rising prescription of scleral lenses in this category.

Clinicians favor their use for their ability to improve visual acuity, reduce discomfort, and prevent progression in complex corneal cases. With growing awareness among patients and providers about the effectiveness of scleral lenses in managing corneal irregularity, this segment remains central to the market's expansion.

The market value of the scleral lenses was approximately 1.4% of the overall ~USD 21 billion global contact lens market in 2024.

The sales of scleral lens products expanded at a CAGR of 3.0% from 2012 to 2024.

Over the projection period, it is anticipated that there will be a strong demand for scleral lenses because of the rising incidence of eye illnesses and difficulties. The market for scleral lenses is anticipated to develop as a result of the rising demand for eye movement analysis. The market is also anticipated to develop because of the increasing older population, a rise in the number of people seeking treatment, and changes in lifestyle.

The market for scleral lenses is anticipated to expand as a result of rising demand for non-surgical products for vision care and treatment. One of the major trends in the scleral lenses industry is the rise in customized scleral lens production. The market is anticipated to rise as scleral lenses are increasingly prescribed to treat corneal irregularities and ocular surface diseases.

As per an article published in 2020 by the contact lens spectrum, the SCOPE (Scleral Lenses in Current Ophthalmic Practice Evaluation) study group, in n=673, it was observed that the most frequent reason for using scleral lenses was reported to be corneal irregularity, 74%, followed by ocular surface illness, 16%, and refractive error, 10%.

Thus, owing to the aforementioned factors, the global market for scleral lenses is expected to grow at a CAGR of 6.3% during the forecast period from 2025 to 2035.

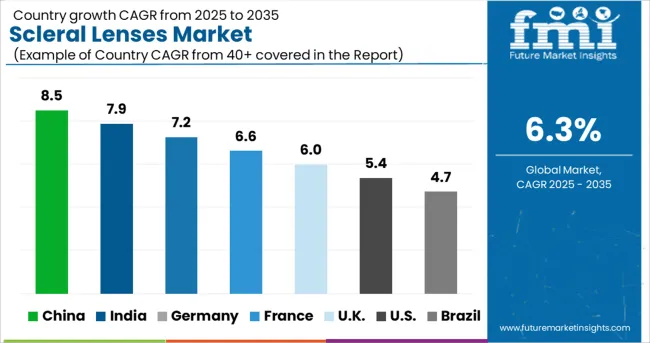

Considering the growing awareness in developing countries, the market is expected to have a positive outlook. The adoption rate is increasing with new products entering the emerging market. This growth is attributed to the developing nations' increasing collaboration and effort of the manufacturers.

For instance, The LV Prasad Eye Institute (LVPEI) and Boston Foundation collaborated in 2020 to improve access to specialized lenses for patients in developing geographies. There is now Boston Sight SCLERAL & PROSE in India and they are starting to cater to patients in other countries of South and Middle-East Asia as well.

The market is having an opportunistic outlook as the patient currently looks for advanced products that would ease their day-to-day activities along with providing comfort. This in turn benefits the manufacturers who are involved in providing new and customized products as per the need of the patients.

Thus, this can be considered an opportunistic factor for the growth and wider adoption of scleral lenses.

The major factor restraining the demand for scleral lenses is the high cost of the scleral lenses. These lenses are four to five times more expensive compared to other soft contact lenses or other standard contact lenses. The cost of the customized scleral lenses can be more than USD 4000 as well.

This in turn significantly decreases the adoption of scleral lenses for low and middle-income group patients. There are also minimal options for reimbursement of scleral lenses and most insurance companies do not directly cover the full cost of these lenses and thus can be a restraining factor in this aspect. Thus, it is a major growth concern, especially in some developing countries.

Other than this, certain side effects of the use of scleral lenses also have a negative impact on market growth. As per a retrospective study of keratoconus subjects examined between 2013 and 2020, conducted by the Southern College of Optometry, the complications of scleral lenses included 90.8% poor lens wetting, 84.8% lens fogging, 53% blurred vision, 34.8% ocular redness, 24.4% ocular dryness and 20.7% ocular pain and discomfort.

Thus, these abovementioned factors restrain the developmental growth of the scleral lenses market.

The USA dominates the North American region with total market revenue of about USD 69.09 million, and a similar trend is expected over the forecast period.

Due to the strong demand for scleral lenses as a treatment choice for various eye disorders in the USA, the country dominates the North American market for scleral lenses. The increasing number of eye disorders in The USA is adding to the wider adoption of scleral lenses. For instance, as per the Cornea Research Foundation of America, approximately 50 to 200 of every 100,000 people are afflicted with keratoconus.

Hence, the sales of scleral lenses in the USA are quite high and are anticipated to grow moving forward.

In 2024, Germany held a market share of about 44.7% in the Europe market.

Technical developments and growth in the usage of non-surgical eye care products are driving the industry forward. The development of a protective aqueous vault over the cornea, computer-assisted lens designs, computerized measurements of the topography of the ocular surface, and high-tech lens material qualities are a few examples of technical developments. Because of these technological developments, scleral lenses are now more widely used in Germany.

Thus, considering this factor, the market for scleral lenses in Germany is quite lucrative.

India held approximately 59.8% market share in South Asia in 2024.

In terms of scleral lenses, India is expected to see faster growth rates because of the advancements in medical technology, government support for the treatment of eye problems, and a large patient base. The increasing population in India and the increasing number of eye diseases will eventually increase the adoption of scleral lenses in the region.

Thus, it has eventually boosted the availability of scleral lens products in India and is expected to show optimum growth in the forecast period.

Mini scleral lenses are expected to present high growth at a CAGR of 4.9% by the end of the forecast period, with a contributing value of nearly USD 21 million in the global market in 2024. Mini-scleral lenses are firm lenses with a large diameter that are used to restore vision when the cornea is deformed due to disease, scarring, or following a corneal graft operation.

It is safe as well as well tolerated by many patients. The use of these lenses improves the quality of life. This is why the usage of mini scleral lenses is highest in the scleral lenses market.

Corneal irregularity is the most common indication and accounted for the largest revenue share globally valued at USD 82.2 million in 2024. Corneal irregularities such as keratoconus and pellucid marginal degeneration are quite common.

These instances are mostly known to be caused by genetic and environmental factors as well as collagen abnormalities. Corneal irregularity causes symptoms like distorted and blurry vision, sudden onset vision, or eye pain. The market is growing with the increase in cases of corneal irregularity.

The leading companies engage in a variety of product launches, expansions, collaborations, mergers, and acquisitions to enhance their global presence and improve their business strategy.

The primary advertising tactics used by the major participants in the scleral lenses market are listed below:

Similarly, recent developments related to companies manufacturing scleral lenses, have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2024 |

| Market Analysis | million for Value, Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | The USA Canada, Mexico, Brazil, Argentina, The United Kingdom, Germany, Italy, France, Spain, Russia, BENELUX, China, Japan, South Korea, India, Indonesia, Malaysia, Thailand, Australia, New Zealand, GCC Countries, Turkey, South Africa, and North Africa |

| Key Market Segments Covered | Product, Indication, and Region |

| Key Companies Profiled | Cooper Vision; (VisionaryOptic) Euclid Systems; Bausch & Lomb; Art Optical Contact Lens, Inc.; AccuLens; Valley Contax Inc.; ABB Optical Group; EssilorLuxottica; Optact International Ltd.; Solotica, Smart Optics LLC; OPTO CENTER; OKVision; No7 Contact Lenses; Multilens AB; Laboratoire LCS; HERZ submicron lathing s.r.l.; Gelflex; Firma Concor Ltd.; Biolens Lab; Appenzeller Kontaktlinsen AG; Advanced Vision Technologies; Metro Optics |

| Pricing | Available upon Request |

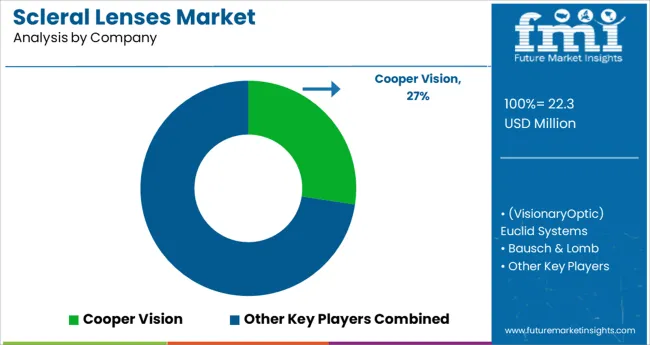

The global scleral lenses market is estimated to be valued at USD 22.3 million in 2025.

It is projected to reach USD 41.1 million by 2035.

The market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types are mini scleral lens, semi scleral lens and large scleral.

corneal irregularity segment is expected to dominate with a 46.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Contact Lenses Market – Trends, Growth & Forecast 2025 to 2035

Acrylic Lenses Market

IR Corrected Lenses Market Size and Share Forecast Outlook 2025 to 2035

Digital Vision Lenses Market

Hydrogel Contact Lenses Market

Phakic Intraocular Lenses (IOL) Market Analysis - Size, Share & Forecast 2025 to 2035

Disposable Contact Lenses Market Trends & Insights 2025-2035

Single Use Contact Lenses Market

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Extended & Continuous Wear Lenses Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA