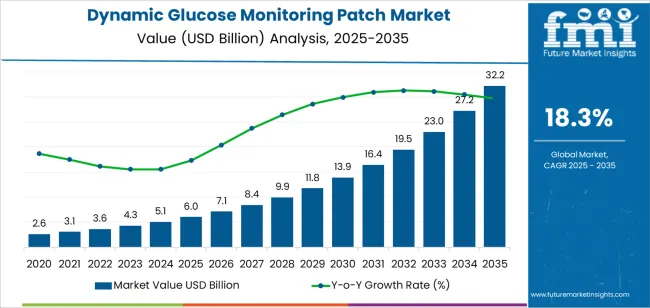

The global dynamic glucose monitoring patch market is valued at USD 6.0 billion in 2025 and is projected to reach USD 32.1 billion by 2035, growing at a strong CAGR of 18.3%. This surge represents an absolute dollar opportunity of USD 26.1 billion across the forecast period. Rolling CAGR analysis indicates a steep upward growth curve, particularly between 2026 and 2031, as real-time, non-invasive glucose tracking becomes integral to diabetes management and preventive healthcare systems worldwide.

Dynamic glucose monitoring patches provide continuous glucose readings through skin-interfaced biosensors, enabling early detection of fluctuations and improved treatment accuracy. Manufacturers are focusing on enhancing sensor longevity, miniaturization, and Bluetooth-enabled data synchronization with mobile and clinical applications. The integration of AI-based analytics and predictive alerts is improving patient compliance and clinical decision-making efficiency.

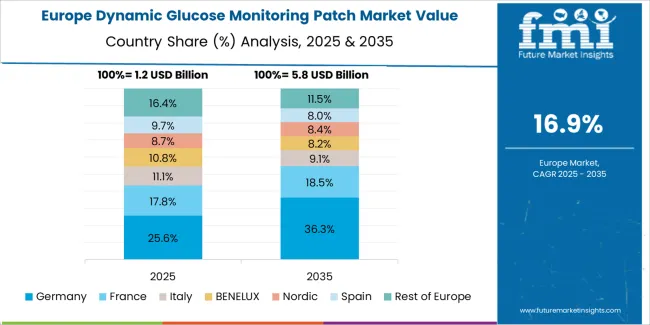

North America currently leads global adoption due to strong healthcare infrastructure and widespread insurance coverage for wearable medical devices. Europe follows, supported by national diabetes management programs and high awareness levels among patients. Asia Pacific is projected to exhibit the fastest growth, fueled by rising diabetes prevalence and increasing affordability of advanced medical wearables. Through 2035, material innovation, sensor calibration accuracy, and telehealth integration are expected to drive sustained expansion in the dynamic glucose monitoring patch market.

Between 2025 and 2030, the Dynamic Glucose Monitoring Patch Market is projected to surge from USD 6.0 billion to USD 13.9 billion, yielding a growth volatility index (GVI) of 1.45, indicating a phase of strong acceleration and disruptive expansion. This unprecedented growth will be driven by rising global diabetes prevalence, increasing patient preference for continuous glucose monitoring (CGM) systems, and rapid technological advancements in wearable medical sensors. Manufacturers are focusing on non-invasive, real-time glucose tracking solutions featuring wireless connectivity, AI-assisted data analytics, and integration with smartphone health ecosystems. Supportive regulatory approvals and reimbursement policies across major markets, combined with increased consumer health awareness, will further amplify adoption.

From 2030 to 2035, the market is forecast to expand from USD 13.9 billion to USD 32.1 billion, producing a GVI of 0.78, which signals a gradual deceleration as the technology transitions from rapid adoption to market maturity. This period will see saturation in developed regions, with growth shifting toward emerging economies and next-generation device upgrades. Innovations will emphasize miniaturized biosensors, extended patch wear duration, and interoperability with insulin delivery systems. Strategic alliances among medtech firms, digital health startups, and pharmaceutical companies will drive ecosystem integration, promoting comprehensive diabetes management solutions that combine monitoring, analytics, and therapeutic feedback.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6.0 billion |

| Market Forecast Value (2035) | USD 32.1 billion |

| Forecast CAGR (2025–2035) | 18.3% |

The dynamic glucose monitoring patch market is growing as diabetes management shifts toward continuous, non-invasive monitoring solutions that improve accuracy and patient adherence. These wearable patches use micro-sensors or enzymatic electrodes to track interstitial glucose levels in real time, transmitting data to mobile devices or clinical monitoring platforms. Unlike conventional finger-prick testing, dynamic patches provide continuous trend analysis, enabling users and healthcare providers to adjust therapy proactively. Rising global diabetes prevalence, particularly in aging and urban populations, drives adoption across both developed and emerging healthcare markets seeking effective long-term disease management.

Technological advancements in biosensor miniaturization, wireless communication, and skin-compatible materials enhance user comfort and data reliability. Manufacturers focus on improving calibration-free operation, multi-day wear duration, and water resistance to expand clinical usability. Integration with digital health ecosystems—such as telemedicine platforms and insulin delivery systems further strengthens market adoption. Supportive reimbursement policies in North America and Europe, along with growing awareness campaigns in Asia-Pacific, accelerate deployment in outpatient and home-care settings. However, high product costs and limited access in low-income regions remain challenges. Continuous innovation in electrochemical sensing and biocompatible adhesives ensures strong long-term growth prospects for dynamic glucose monitoring patches worldwide.

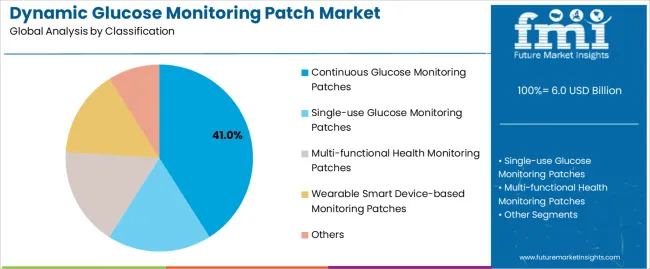

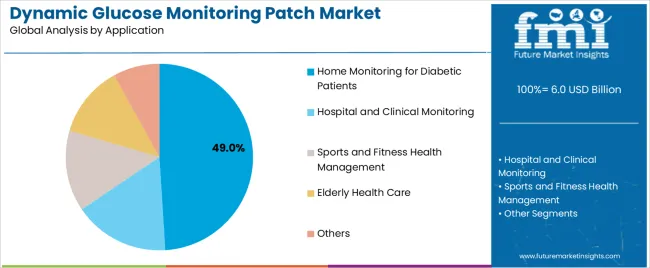

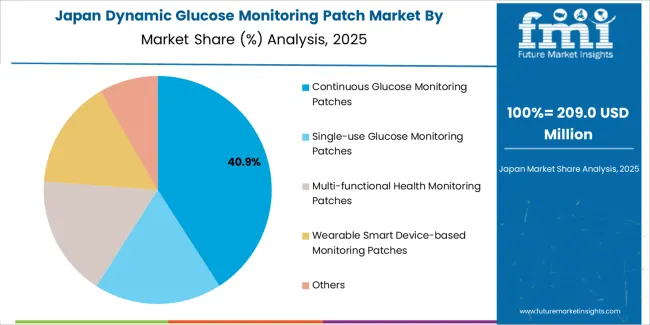

The dynamic glucose monitoring patch market is segmented by classification, application, and region. By classification, the market is divided into continuous glucose monitoring patches, single-use glucose monitoring patches, multi-functional health monitoring patches, wearable smart device-based monitoring patches, and others. Based on application, it is categorized into home monitoring for diabetic patients, hospital and clinical monitoring, sports and fitness health management, elderly health care, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions capture device functionality, user environment, and regional healthcare innovation trends shaping personalized glucose management solutions.

The continuous glucose monitoring (CGM) patch segment accounts for approximately 41.0% of the global dynamic glucose monitoring patch market in 2025, representing the leading classification category. Its leadership reflects the segment’s ability to deliver real-time glucose tracking, trend visualization, and automated data logging for both Type 1 and Type 2 diabetes management. CGM patches provide continuous measurement through subcutaneous sensors, eliminating the need for frequent finger-prick testing and improving glycemic control through immediate feedback.

This technology’s adoption is driven by increasing demand for accurate, non-invasive monitoring devices that integrate with smartphones and digital health platforms. Advancements in sensor accuracy, wear-time duration, and wireless connectivity continue to expand CGM usage among diabetic patients worldwide. Manufacturers are focusing on compact form factors, skin-friendly adhesives, and extended battery life to enhance user comfort and adherence. Strong regulatory approvals and insurance coverage expansion in North America and Europe further strengthen market growth. The continuous glucose monitoring patch segment remains central to the industry, reflecting the transition toward connected, data-driven diabetes management supported by technological convergence between medical devices and wearable health ecosystems.

The home monitoring for diabetic patients segment represents about 49.0% of the total dynamic glucose monitoring patch market in 2025, making it the largest application category. Its dominance is supported by the growing prevalence of diabetes and the increasing shift toward self-managed care enabled by wearable health technologies. Home-use glucose monitoring patches provide patients with continuous data access, facilitating proactive management of diet, medication, and physical activity.

The segment benefits from broader awareness of glycemic tracking, improved affordability of consumer health devices, and expanding digital health infrastructure. In addition, mobile app integration allows patients to share glucose readings with healthcare providers in real time, enhancing care coordination. Demand is particularly strong in North America, East Asia, and Europe, where healthcare systems encourage patient-driven monitoring to reduce hospital visits and overall treatment costs. Manufacturers focus on convenience, sensor longevity, and interoperability with insulin delivery systems to meet user expectations. The home monitoring for diabetic patient’s segment continues to dominate global demand, underscoring its role in advancing personalized healthcare and long-term diabetes management through wearable digital technologies.

The dynamic glucose monitoring patch market is gaining momentum as wearable health technologies evolve and diabetes management shifts toward continuous, minimally invasive monitoring. These patches, often applied to the skin and linked to mobile apps, support real-time glucose tracking without frequent finger pricks. Growth is driven by rising diabetes prevalence, increasing demand for home-based care, and consumer interest in metabolic wellness. However, market growth faces hurdle such as high device cost, regulatory complexity, and varied reimbursement policies across regions. Innovation in adhesive technology, user comfort and data connectivity is shaping how patches are designed and deployed.

The demand for glucose monitoring patches is strongly influenced by the increasing global incidence of diabetes and the rising number of individuals managing chronic metabolic conditions. At the same time, consumers without diabetes are showing interest in health insights and wellness tracking, expanding the potential user base. The convenience of overnight wear, seamless mobile integration and continuous data capture appeal to both patients and health-conscious individuals. As healthcare systems support remote monitoring and telemedicine, patches may be more widely adopted in both clinical and non-clinical settings.

Despite growth drivers, the market faces several significant restraints. The upfront cost of advanced patches and associated sensors remains high in many markets, and reimbursement by insurers is still inconsistent. Regulatory approval pathways vary by region, which can delay market entry. Some users and clinicians express concerns about sensor accuracy, skin adhesion and wear-time limitations. In addition, competing technologies such as traditional CGM systems and finger-prick meters are well established. These factors slow adoption, particularly in lower-income regions or among cost-sensitive users.

Key trends in this market include the development of thinner, more user-comfortable patches with enhanced skin adhesion and multi-day wear capabilities. Manufacturers are integrating wireless connectivity, mobile apps and health-platform data analytics to provide actionable insights rather than mere readings. Expansion of over-the-counter models and application in wellness and pre-diabetes populations broaden the target market. Regionally, growth is expected to accelerate in Asia-Pacific where diabetes prevalence is rising and digital health adoption is increasing. Standardisation of data platforms and improvements in sensor longevity are expected to support wider scale adoption globally.

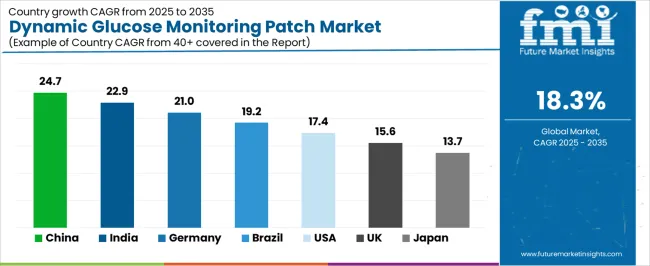

| Country | CAGR (%) |

|---|---|

| China | 24.7% |

| India | 22.9% |

| Germany | 21.0% |

| Brazil | 19.2% |

| USA | 17.4% |

| UK | 15.6% |

| Japan | 13.7% |

The dynamic glucose monitoring patch market is undergoing exceptional global expansion, with China leading at a robust 24.7% CAGR through 2035, driven by rapid advancements in wearable healthcare technologies, increasing diabetes prevalence, and strong domestic device manufacturing. India follows closely at 22.9%, supported by government health initiatives, growing digital health adoption, and affordability of continuous glucose monitoring solutions. Germany records 21.0%, reflecting innovation in biomedical sensors and integration with AI-based data analytics. Brazil grows at 19.2%, fueled by improved healthcare access and expanding diabetic patient awareness. The USA, at 17.4%, remains a mature yet innovation-centric market focusing on clinical accuracy and interoperability, while the UK (15.6%) and Japan (13.7%) emphasize patient comfort, miniaturized designs, and the integration of smart monitoring ecosystems within preventive healthcare frameworks.

China is observing rapid development in the dynamic glucose monitoring patch market, projected to grow at a CAGR of 24.7% through 2035. Rising diabetes prevalence and strong government investment in digital healthcare infrastructure are driving demand for continuous glucose monitoring (CGM) technologies. Domestic firms are enhancing sensor accuracy and skin compatibility while reducing costs. Integration of CGM data into mobile platforms supports remote patient management and clinical research. Expanding manufacturing capacity and partnerships with international medtech companies are reinforcing market scalability.

India is experiencing significant progress in the dynamic glucose monitoring patch market, advancing at a CAGR of 22.9% through 2035. Rapid growth in diabetes cases and adoption of telemedicine platforms are promoting wearable glucose monitoring solutions. Local startups are introducing affordable, user-friendly CGM patches compatible with smartphones. Expanding healthcare digitalization and urban awareness campaigns are supporting early diagnosis and continuous patient monitoring. Collaboration between medical device manufacturers and hospitals continues to accelerate product validation and clinical integration.

Across Germany, the dynamic glucose monitoring patch market is expanding at a CAGR of 21.0%, supported by technological precision and advanced clinical validation. Manufacturers emphasize multi-sensor integration, calibration-free operation, and biocompatible materials to improve patient comfort and reliability. Strong collaboration between research institutes and device producers promotes innovation in long-term wear technology. Government incentives for digital health adoption and remote patient monitoring systems continue to strengthen demand among diabetic populations.

Brazil is recording rapid expansion in the dynamic glucose monitoring patch market, forecast to grow at a CAGR of 19.2% through 2035. Rising diabetes incidence and government initiatives for chronic disease management are encouraging adoption of CGM patches. Local distributors are partnering with international manufacturers to expand supply and affordability. Growing private healthcare investment and public telehealth programs are increasing access to continuous glucose monitoring solutions across urban and regional areas.

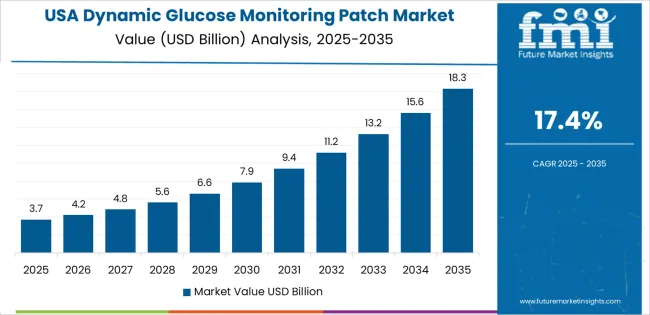

In the United States, the dynamic glucose monitoring patch market is growing at a CAGR of 17.4% through 2035. Advancements in biosensor miniaturization and wireless data transmission are driving adoption across diabetic care settings. Integration of CGM systems with insulin pumps and health apps enhances personalized treatment. Continuous reimbursement improvements and FDA approvals are supporting strong market penetration. Rising focus on digital therapeutics and patient data analytics reinforces ongoing investment in wearable diabetes technologies.

Across the United Kingdom, the dynamic glucose monitoring patch market is expanding at a CAGR of 15.6% through 2035. Increasing adoption of telehealth systems and government focus on digital healthcare innovation are boosting CGM usage. Manufacturers are developing skin-friendly, low-profile patches designed for continuous wear. Integration with national health data networks supports physician monitoring and patient engagement. Growing acceptance of home-based diagnostics and wearable devices ensures steady product adoption across healthcare providers and end users.

Japan is showing consistent development in the dynamic glucose monitoring patch market, projected to grow at a CAGR of 13.7% through 2035. Domestic companies emphasize precision biosensor design, enhanced adhesion, and long-lasting battery life. Integration of AI-driven analytics supports accurate glucose trend prediction and treatment optimization. Aging demographics and increasing Type 2 diabetes prevalence are promoting steady market demand. Collaboration between medical device firms and hospitals strengthens clinical validation and nationwide accessibility.

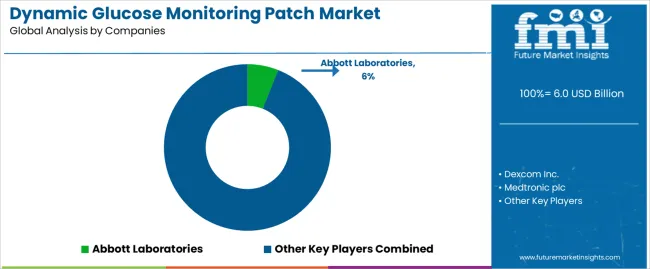

The global dynamic glucose monitoring (DGM) patch market is moderately concentrated, dominated by established medical technology companies and emerging innovators specializing in wearable biosensors. Abbott Laboratories leads with its FreeStyle Libre platform, representing significant market share through continuous, factory-calibrated glucose monitoring patches offering real-time data integration. Dexcom Inc. and Medtronic PLC hold strong positions with advanced sensor technologies emphasizing connectivity, low-latency alerts, and integration with insulin delivery systems. Senseonics Holdings Inc. differentiates its portfolio through long-term implantable CGM systems offering extended sensor life. Ascensia Diabetes Care and Roche Diabetes Care strengthen their presence via digital health ecosystems that combine glucose monitoring with data analytics and remote patient support for improved diabetes management.

Ypsomed AG and Medisana GmbH expand market accessibility through compact and user-friendly glucose patch systems aligned with growing homecare adoption. Biocorp and Nemaura Medical contribute to innovation in microfluidic and non-invasive sensor technologies, supporting accurate, low-cost monitoring solutions. PKvitality advances R&D in skin-interfacing biosensors for near-painless glucose measurement. Philips Healthcare, GE Healthcare, and Continua Health Alliance focus on interoperability and integration of glucose data within connected healthcare frameworks. GlucoRx enhances affordability through disposable sensor technology aimed at broader diabetic populations. Competition in this market is driven by sensor accuracy, wear duration, and digital interface reliability. Strategic differentiation depends on interoperability with digital insulin systems, data security, and user comfort. Long-term competitiveness relies on miniaturization, non-invasive sensing innovation, and integration with AI-based predictive glucose management platforms.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Continuous Glucose Monitoring Patches, Single-use Glucose Monitoring Patches, Multi-functional Health Monitoring Patches, Wearable Smart Device-based Monitoring Patches, Others |

| Application | Home Monitoring for Diabetic Patients, Hospital and Clinical Monitoring, Sports and Fitness Health Management, Elderly Health Care, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Abbott Laboratories, Dexcom Inc., Medtronic plc, Senseonics Holdings Inc., Ascensia Diabetes Care, Roche Diabetes Care, Ypsomed AG, Medisana GmbH, Biocorp, Nemaura Medical, PKvitality, Philips Healthcare, GE Healthcare, Continua Health Alliance, GlucoRx |

| Additional Attributes | Market segmentation by device type and healthcare application categories; regional adoption analysis across clinical and home-care monitoring environments; competitive focus on biosensor miniaturization, data connectivity, and AI-driven glucose analytics. |

The global dynamic glucose monitoring patch market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the dynamic glucose monitoring patch market is projected to reach USD 32.2 billion by 2035.

The dynamic glucose monitoring patch market is expected to grow at a 18.3% CAGR between 2025 and 2035.

The key product types in dynamic glucose monitoring patch market are continuous glucose monitoring patches, single-use glucose monitoring patches, multi-functional health monitoring patches, wearable smart device-based monitoring patches and others.

In terms of application, home monitoring for diabetic patients segment to command 49.0% share in the dynamic glucose monitoring patch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dynamic NFT (dNFT) Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Positioning System Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Vapor Sorption Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Plantar Tactile Instrument Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Spinal Tethering Systems Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Random Access Memory (DRAM) Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Data Management System Market Report – Trends & Forecast 2023-2033

Dynamic Mechanical Analyzer Market

High Dynamic Range Market Size and Share Forecast Outlook 2025 to 2035

Plasma Dynamic Air Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Spotlight Market

Demand for Plasma Dynamic Air Sterilizers in UK Size and Share Forecast Outlook 2025 to 2035

Computational Fluid Dynamics (CFD) Market – Trends & Forecast 2025 to 2035

Demand for Automotive Dynamic Map Data in USA Size and Share Forecast Outlook 2025 to 2035

Glucose Sensor Market Size and Share Forecast Outlook 2025 to 2035

Glucose Oxidase Market Analysis – Trends & Forecast 2025-2035

Glucose-Fructose Syrup Market – Growth, Demand & Food Industry Trends

Glucose Syrup Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA