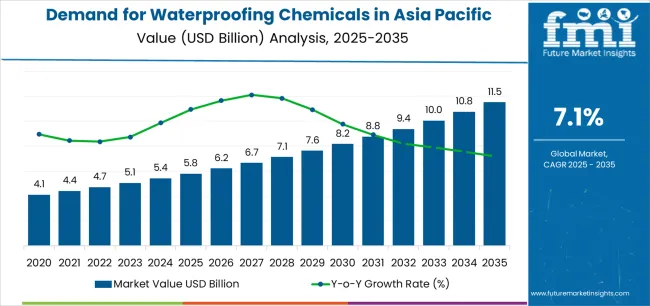

Global demand for Asia Pacific Waterproofing Chemicals is projected to grow from USD 5.8 billion in 2025 to approximately USD 11.5 billion by 2035, recording an absolute increase of USD 8.2 billion over the forecast period. This translates into total growth of 141.4%, with demand forecast to expand at a compound annual growth rate (CAGR) of 7.1% between 2025 and 2035. Based on FMI’s verified global materials database, covering industrial resins, coatings, and additives, overall sales are expected to grow by nearly 2.41X during the same period, supported by rising Asia Pacific infrastructure development activities, increasing urbanization and residential construction, and growing demand for durable waterproofing solutions across building, transportation, and industrial facility operations. Asia Pacific, led by Vietnam, India, Indonesia, and China, continues to demonstrate strong growth potential driven by climate resilience requirements and construction quality standards.

Between 2025 and 2030, Asia Pacific waterproofing chemicals demand is projected to expand from USD 5.8 billion to USD 8.9 billion, resulting in a value increase of USD 3.1 billion, which represents 37.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising Asia Pacific infrastructure construction operations globally, particularly across India, Vietnam, and Indonesia where government infrastructure programs and urban transportation projects are accelerating waterproofing system adoption. Increasing mechanization of construction practices and growing adoption of advanced membrane systems continue to drive demand. Waterproofing manufacturers are expanding their production capabilities to address the growing complexity of modern Asia Pacific construction operations and durability requirements, with Asian operations leading investments in regional manufacturing facilities and technical support infrastructure.

From 2030 to 2035, demand is forecast to grow from USD 8.9 billion to USD 11.5 billion, adding another USD 5.1 billion, which constitutes 62.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of sustainable low-VOC formulations and environmentally-friendly waterproofing systems, integration of advanced application technologies and quality assurance protocols, and development of standardized waterproofing specifications across different construction applications. The growing adoption of green building certifications and climate-resilient construction practices, particularly in India, China, and Southeast Asian countries, will drive demand for more sophisticated waterproofing systems and specialized installation capabilities.

Between 2020 and 2025, Asia Pacific waterproofing chemicals demand experienced steady expansion, driven by increasing Asia Pacific construction activities in infrastructure and residential development and growing awareness of waterproofing system benefits for structural protection and building longevity. The sector developed as construction operations, especially in India and China, recognized the need for specialized waterproofing technologies and quality materials to prevent water ingress while meeting evolving building codes and performance standards. Construction contractors and building owners began emphasizing proper waterproofing installation and quality product selection to maintain structural integrity and reduce long-term maintenance costs.

| Metric | Value |

|---|---|

| Asia Pacific Waterproofing Chemicals Sales Value (2025) | USD 5.8 billion |

| Asia Pacific Waterproofing Chemicals Forecast Value (2035) | USD 11.5 billion |

| Asia Pacific Waterproofing Chemicals Forecast CAGR (2025–2035) | 7.1% |

Demand expansion is being supported by the rapid increase in Asia Pacific construction operations worldwide, with region maintaining its position as a global construction growth leadership area, and the corresponding need for specialized waterproofing chemicals for building envelopes, infrastructure protection, and below-grade waterproofing activities. Modern construction operations rely on advanced waterproofing systems to ensure structural durability, moisture protection, and optimal building performance. Asia Pacific construction requires comprehensive waterproofing solutions including membrane systems, liquid-applied coatings, injection grouting materials, and integral crystalline admixtures to maintain structural integrity and performance standards.

The growing complexity of Asia Pacific construction projects and increasing building code requirements, particularly stringent specifications in India, Japan, and Australia, are driving demand for certified waterproofing products from approved manufacturers with appropriate technical documentation and performance testing capabilities. Construction developers are increasingly investing in premium waterproofing systems and professional installation services to improve building longevity, reduce maintenance liabilities, and enhance occupant comfort in challenging Asia Pacific climate environments. Regulatory requirements and construction specifications are establishing standardized waterproofing procedures that require specialized application expertise and certified installer networks, with regional operations establishing benchmark standards for tropical and monsoon climate construction practices.

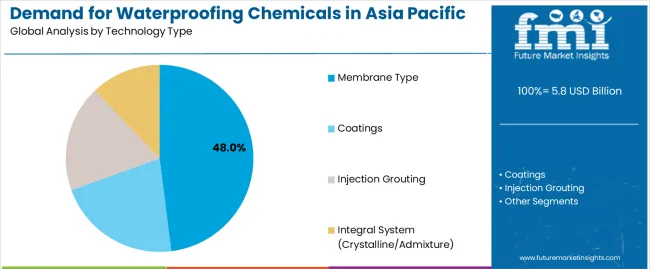

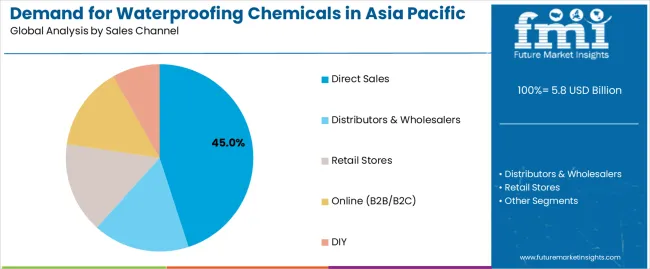

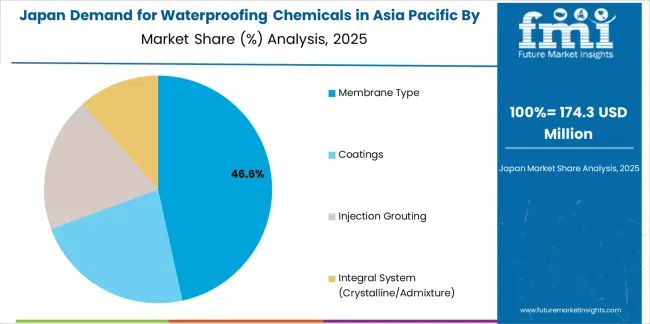

Demand is segmented by technology type, sales channel, end user, material/coating, and country. By technology type, sales are divided into membrane type (APP bitumen membranes, SBS bitumen membranes, PVC/TPO sheets, EPDM sheets), coatings, injection grouting, and integral system (crystalline/admixture). Based on sales channel, demand is categorized into direct sales, distributors & wholesalers, retail stores, online (B2B/B2C), and DIY. In terms of end user, sales are segmented into infrastructure sector, residential sector, commercial sector, industrial sector, and others. By material/coating, demand is divided into polyurethane (PU) coatings, acrylic & elastomeric coatings, cementitious coatings, silicone & hybrid systems, bitumen (all types, including emulsions), and others (epoxy, polyurea, etc.). By country, demand is divided into India, Vietnam, Indonesia, Philippines, China, Japan, and Australia, with Vietnam representing a key growth and innovation hub for Asia Pacific waterproofing chemical technologies.

Membrane type waterproofing systems are projected to account for 48% of Asia Pacific waterproofing chemicals demand in 2025, making them the leading technology across the sector. This dominance reflects the critical importance of continuous waterproofing barriers and proven performance reliability in infrastructure and building applications, where membrane systems provide comprehensive moisture protection and long-term durability. In Asia Pacific, building codes mandate membrane waterproofing for critical applications including basements, roofs, tunnels, and bridge decks, ensuring widespread adoption of APP bitumen membranes (22% segment share), SBS bitumen membranes (18%), and synthetic sheet systems. Continuous innovations are improving the flexibility of installation, adhesion performance, and weather resistance, enabling construction contractors to maintain quality while optimizing installation productivity. Advancements in self-adhesive membrane technologies and prefabricated sheet systems are enhancing installation efficiency by reducing torch application requirements and improving jobsite safety.

Direct sales channels are expected to represent 45% of Asia Pacific waterproofing chemicals demand in 2025, highlighting their critical role as dominant distribution mechanisms. Large-scale infrastructure contractors, real estate developers, and construction companies, particularly in China, India, and Southeast Asia, prefer to source waterproofing materials directly from manufacturers to exercise greater control over product specifications and reduce procurement costs. Direct procurement allows contractors to access technical support for project-specific requirements, whether basement waterproofing, tunnel applications, or specialized infrastructure protection needs. The segment is also fueled by increasing regional investments into mega-infrastructure projects, with contractors prioritizing direct manufacturer relationships that provide comprehensive technical services, on-site support, and customized product solutions. In India and Vietnam, leading construction contractors are maintaining strategic partnerships with global waterproofing manufacturers to ensure product quality, technical assistance, and application training.

Demand for Asia Pacific Waterproofing Chemicals is advancing steadily due to increasing Asia Pacific infrastructure development activities and growing recognition of waterproofing system importance for building durability and asset protection, with region serving as a key driver of construction volume growth and emerging application technologies. However, the sector faces challenges including quality variation among local manufacturers, need for skilled applicator training and proper installation practices, and varying performance requirements across diverse climate zones from tropical monsoon to temperate conditions. Green building certification programs and low-VOC formulation initiatives, particularly advancing in Australia, Japan, and urban China, continue to influence product specifications and regulatory requirements.

The growing development of metro rail networks, gaining particular momentum in India, Vietnam, Indonesia, and Philippines, is enabling urban areas to address transportation capacity constraints while requiring comprehensive waterproofing protection for underground stations, tunnels, and trackway structures. Metro construction projects equipped with sophisticated waterproofing specifications demand membrane systems, injection grouting capabilities, and crystalline admixture technologies while requiring long-term performance warranties and maintenance protocols. These infrastructure investments are particularly valuable for waterproofing manufacturers with technical expertise in below-grade applications and hydrostatic pressure resistance that require specialized engineering support without compromising system integrity and long-term reliability.

Modern waterproofing manufacturers, led by European and Japanese innovators with Asia Pacific operations, are incorporating water-based formulations and low-VOC polyurethane systems that reduce environmental impacts, improve applicator safety, and meet green building certification requirements. Integration of sustainable raw materials, bio-based polyols, and emission-reducing technologies enables more environmentally-responsible waterproofing solutions and comprehensive sustainability documentation. Advanced products also support next-generation construction practices including green building certification systems such as LEED, GRIHA, and Green Mark that prioritize low-emission materials and indoor air quality objectives, with regional construction operations increasingly adopting these specifications to meet corporate sustainability targets and regulatory requirements.

| Country | CAGR (2025-2035) |

|---|---|

| India | 8.3% |

| Vietnam | 8.5% |

| Indonesia | 8.1% |

| Philippines | 8% |

| China | 7.4% |

| Japan | 6.8% |

| Australia | 6.2% |

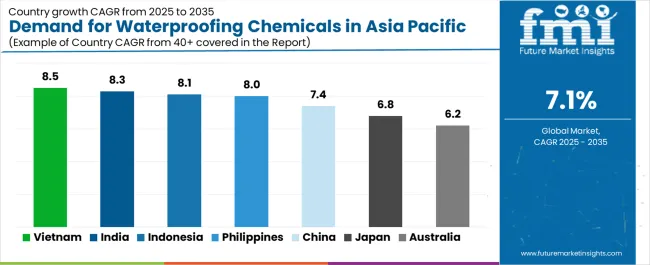

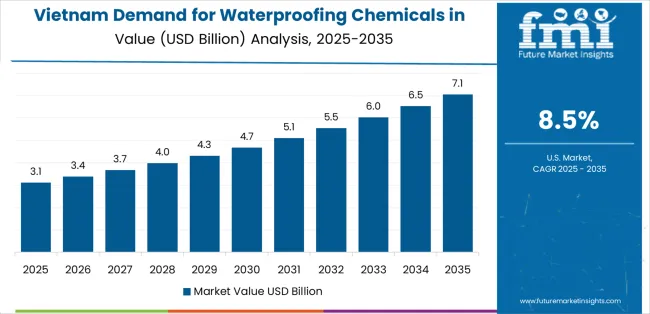

The demand for Asia Pacific waterproofing chemicals is witnessing robust growth, supported by rising infrastructure investment standards, climate resilience requirements, and the integration of advanced waterproofing systems across construction operations. Vietnam leads the region with an 8.5% CAGR, reflecting strong investments in industrial park development, port infrastructure expansion, and building specifications addressing high rainfall resilience requirements. India follows with an 8.3% CAGR, driven by expressway construction programs, metro system expansion, and housing sector growth supported by BIS-led product standards adoption. Indonesia grows at 8.1%, as new capital city Nusantara development, transportation infrastructure programs, and tropical climate roofing requirements drive waterproofing system consumption.

The demand for Asia Pacific waterproofing chemicals in India is projected to exhibit strong growth with a CAGR of 8.3% through 2035, driven by ongoing Asia Pacific expressway construction programs including Bharatmala Pariyojana, expanding metro rail networks across tier-1 and tier-2 cities, and government housing initiatives supporting affordable housing and urban development. The country's emphasis on infrastructure quality standards and BIS (Bureau of Indian Standards) product specification adoption is creating significant demand for certified waterproofing products with documented performance testing and quality assurance. Major waterproofing manufacturers including Sika AG (new mortar & waterproofing line commissioned 2024) and Pidilite Industries (Dr. Fixit next-gen PU liquid membrane range launched 2025) are establishing comprehensive production facilities and distribution networks to support expanding Asia Pacific construction operations throughout India.

The demand for Asia Pacific waterproofing chemicals in Vietnam is expanding at a CAGR of 8.5%, supported by extensive Asia Pacific industrial park development serving foreign direct investment inflows, port facility expansion supporting export-oriented manufacturing, and building code requirements addressing high annual rainfall and flood resilience specifications. The country's construction sector, representing a crucial component of Asia Pacific infrastructure development, is increasingly adopting advanced waterproofing technologies including liquid-applied membranes, polyurethane coatings, and injection grouting systems. Waterproofing suppliers including Mapei (commissioned additional waterproofing production in Southeast Asia 2024) are implementing regional manufacturing strategies to serve expanding Asia Pacific construction activities throughout Vietnam and broader Southeast Asian operations. Government infrastructure investment programs and industrial zone development initiatives sustain waterproofing material consumption across factory construction, logistics facilities, and transportation infrastructure.

The demand for Asia Pacific waterproofing chemicals in Indonesia is growing at a CAGR of 8.1%, driven by new capital city Nusantara development representing USD 30+ billion infrastructure investment, national road and bridge construction programs improving interisland connectivity, and tropical climate roofing applications requiring heat reflection and moisture protection. The country's construction sector emphasizes infrastructure modernization and urban development supporting economic growth objectives. Waterproofing manufacturers and distributors are investing in regional distribution networks and technical training programs to address expanding construction requirements and tropical application challenges.

The demand for Asia Pacific waterproofing chemicals in Philippines is expanding at a CAGR of 8%, supported by flood-control infrastructure programs addressing urban drainage and water management challenges, transportation public-private partnerships developing expressways and rail networks, and typhoon-resilient building envelope specifications improving climate adaptation. The country's infrastructure sector represents significant waterproofing consumption, with Build Build Build program legacy projects and ongoing climate resilience investments requiring comprehensive moisture protection systems. International development financing and government infrastructure budgets facilitate waterproofing system adoption across public works projects and disaster-resilient construction.

The demand for Asia Pacific waterproofing chemicals in China is growing at a CAGR of 7.4%, driven by urban renewal programs modernizing aging residential stock in major cities, waterproofing system upgrades in existing infrastructure addressing deterioration and performance deficiencies, and continued new construction activity in tier-2 and tier-3 cities. The country's mature construction sector represents Asia Pacific's largest waterproofing consumption volume, with established manufacturing capacity, comprehensive distribution networks, and sophisticated technical standards. Government urban renewal initiatives and building renovation programs sustain waterproofing material demand despite slower new construction growth compared to previous decades.

The demand for Asia Pacific waterproofing chemicals in Japan is expanding at a CAGR of 6.8%, supported by building refurbishment cycle addressing aging construction stock from 1970s-1990s development period, seismic retrofitting programs incorporating waterproofing system upgrades, and typhoon-proof building envelope specifications ensuring weather resilience. The country's mature construction sector emphasizes quality materials, professional installation practices, and long-term performance warranties. Japanese waterproofing manufacturers maintain advanced technical standards and rigorous quality control protocols serving domestic construction requirements.

The demand for Asia Pacific waterproofing chemicals in Australia is growing at a CAGR of 6.2%, driven by transportation infrastructure rehabilitation addressing aging roads and bridges, water infrastructure renewal supporting urban supply systems, and low-VOC regulatory requirements mandating sustainable waterproofing formulations. The country's construction sector emphasizes environmental compliance, worker safety standards, and building sustainability certifications. Waterproofing manufacturers serving Australian operations prioritize water-based formulations, low-emission products, and green building certification compatibility.

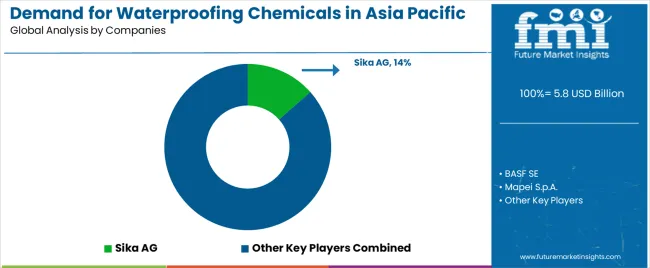

The demand for Asia Pacific waterproofing chemicals is defined by competition among specialized construction chemical manufacturers, regional waterproofing producers, and international building material companies, with European and regional Asian manufacturers maintaining significant influence. Manufacturers are investing in advanced formulation technologies, regional production facilities, technical support infrastructure, and comprehensive distributor networks to deliver effective, durable, and application-appropriate waterproofing solutions across Asia Pacific construction operations. Strategic partnerships, technical service excellence, and local manufacturing expansion are central to strengthening product portfolios and presence across Asia Pacific construction segments.

Sika AG, Switzerland-based global leader with 13.5% estimated Asia Pacific share, operates comprehensive regional manufacturing network including new mortar & waterproofing production line commissioned in India (2024), offering diverse waterproofing technologies including membranes, coatings, injection systems, and admixtures with focus on technical performance, application support, and quality assurance across infrastructure and building construction segments. BASF SE, operating globally from Germany with substantial Asia Pacific presence, provides advanced polyurethane systems, cementitious waterproofing, and specialty formulations with emphasis on innovation and sustainability. Mapei S.p.A., Italy, delivers technologically advanced waterproofing solutions including liquid-applied membranes following commissioning of additional Southeast Asia production capacity (2024) serving regional construction growth. Wacker Chemie AG, Germany, emphasizes polymer-based waterproofing technologies and dispersion systems for coating applications.

Pidilite Industries (Dr. Fixit brand), India's leading waterproofing manufacturer, introduced next-generation PU liquid membrane range for terraces and podium decks (2025) aligned with low-VOC specifications, serving Indian residential and commercial construction segments. Waterproofing manufacturers are establishing comprehensive technical training programs throughout Asia Pacific, developing sustainable low-VOC formulation alternatives, and integrating advanced quality control technologies to meet evolving construction operation requirements and building code standards across Asia Pacific infrastructure, residential, commercial, and industrial construction operations.

Asia Pacific waterproofing chemicals represent a specialized construction material category within building and infrastructure protection applications, projected to grow from USD 5.8 billion in 2025 to USD 14 billion by 2035 at a 7.1% CAGR. This critical building protection solution—primarily supplied in membrane systems, liquid coatings, and crystalline admixture forms for infrastructure, residential, commercial, and industrial construction—serves as essential material for moisture protection compliance in construction applications across diverse climate zones from tropical to temperate environments. Demand expansion is driven by accelerating infrastructure investment in India and Southeast Asia, increasing climate resilience requirements for flood and typhoon protection, expanding green building certification adoption requiring low-VOC products, and rising emphasis on construction quality standards in diverse building and civil engineering applications.

How Construction Regulators Could Strengthen Waterproofing Standards and Quality Verification?

Waterproofing Performance Standards: Establish comprehensive technical standards for waterproofing systems, including moisture barrier effectiveness specifications, durability testing requirements, application protocol standards, and long-term performance criteria that ensure consistent building protection in construction applications.

Building Code Integration: Develop regulatory frameworks that link waterproofing specifications to building permits and construction approvals, requiring verified system performance that meets structural protection requirements, supports occupant safety, and ensures overall building durability objectives.

Applicator Certification Protocols: Implement mandatory training standards for waterproofing system installation, contractor licensing, and quality inspection in construction operations, including installation verification systems, workmanship standards, and warranty documentation procedures that ensure application quality and system effectiveness.

Climate Resilience Guidelines: Create specialized guidelines for waterproofing system selection addressing regional climate challenges including monsoon rainfall, typhoon exposure, and flood risk specific to Asia Pacific construction environments and disaster mitigation objectives.

Quality Testing Programs: Provide regulatory frameworks and inspection protocols for waterproofing system verification that improve installation reliability, enhance building durability, and support long-term maintenance planning in construction operations.

How Construction Industry Associations Could Advance Installation Excellence and Technical Standards?

Waterproofing Best Practices: Develop comprehensive technical guidelines for waterproofing system selection, surface preparation requirements, and application procedures that maximize system effectiveness, minimize installation defects, and ensure reliable moisture protection across different construction types and building applications.

Quality Management Protocols: Establish standardized installation procedures, inspection methods, and performance testing systems specifically designed for waterproofing assessment in diverse construction environments with varying structural configurations and environmental exposure conditions.

Performance Benchmarking Systems: Create industry-wide metrics for waterproofing system durability, contractor workmanship, and building protection effectiveness that enable comparative analysis, identify installation best practices, and drive continuous improvement across Asia Pacific construction projects.

Professional Training and Certification: Develop specialized training programs for construction contractors, waterproofing applicators, and quality inspectors covering system selection, surface preparation, application techniques, and quality verification in building and infrastructure construction.

Technology Innovation Partnerships: Facilitate collaboration between construction contractors, waterproofing manufacturers, and research institutions to advance system development and address emerging challenges in sustainable formulations and climate-resilient construction applications.

How Waterproofing Manufacturers Could Drive Product Innovation and Technical Support?

Advanced Formulation Development: Invest in research and development of low-VOC polyurethane systems, self-healing concrete admixtures, and enhanced-performance membrane technologies that enable superior moisture protection while reducing environmental impacts and installation complexity.

Regional Manufacturing Expansion: Develop geographically distributed production facilities with local raw material sourcing, efficient logistics networks, and strategic inventory positioning that ensure product availability while minimizing supply chain costs and delivery lead times.

Quality Assurance Excellence: Engineer comprehensive analytical capabilities with batch testing systems, performance verification protocols, and technical data documentation that ensure consistent product specifications while reducing quality variation and construction defects.

Technical Service Integration: Create extensive application support with on-site technical consultation, contractor training programs, and installation troubleshooting assistance that enhance customer value while addressing diverse construction requirements and climate challenges.

Sustainability Innovation: Establish water-based formulation programs, bio-based raw material sourcing, and recyclable packaging initiatives that reduce production environmental impacts while maintaining product performance and cost competitiveness.

How Construction Contractors Could Optimize Waterproofing System Selection and Installation?

Strategic Material Procurement: Conduct comprehensive assessments of waterproofing technologies, manufacturer technical support, and product performance history to optimize material selection while ensuring application suitability and long-term reliability.

Advanced Quality Control: Implement surface preparation verification, installation inspection protocols, and performance testing procedures to optimize waterproofing effectiveness, reduce callback risks, and improve overall construction quality.

Warranty Management Integration: Utilize comprehensive installation documentation, manufacturer warranty compliance, and maintenance planning to ensure long-term protection while minimizing liability risks and building owner disputes.

Workforce Training Investment: Develop systematic applicator training strategies that incorporate manufacturer certification programs, hands-on installation practice, and quality awareness while maintaining productivity and managing labor costs effectively.

Technology Adoption Planning: Adopt spray application equipment, thermal imaging inspection tools, and moisture monitoring systems while maintaining installation quality standards and managing equipment investment costs effectively.

How Building Owners and Developers Could Enable Construction Quality Excellence?

Comprehensive Specification Development: Provide detailed requirements for waterproofing performance, warranty expectations, and maintenance provisions that enable contractors to optimize system selection for specific building applications and environmental exposure conditions.

Quality Assurance Programs: Conduct independent inspection services, third-party testing verification, and installation monitoring that ensure construction compliance while supporting quality documentation and liability protection objectives.

Contractor Selection Criteria: Establish qualification requirements emphasizing waterproofing experience, manufacturer certifications, and reference project verification to ensure capable contractor engagement while minimizing construction defect risks.

Maintenance Planning Integration: Develop comprehensive inspection schedules, preventive maintenance protocols, and warranty claim procedures that maximize waterproofing system longevity while managing building operating costs and asset value protection.

Sustainability Requirements: Incorporate green building certification goals, low-VOC product mandates, and environmental performance criteria into construction specifications to enhance building sustainability while meeting corporate responsibility objectives.

How Investment and Financial Enablers Could Support Demand Growth and Industry Development?

Manufacturing Capacity Financing: Provide capital for waterproofing production facility construction, formulation technology upgrades, and regional capacity expansion initiatives that drive demand growth while supporting local supply security and product availability.

Infrastructure Investment Support: Finance government infrastructure programs, transportation project development, and climate resilience initiatives that create waterproofing consumption opportunities while supporting economic development and disaster risk reduction.

Technology Innovation Support: Support waterproofing manufacturers in implementing sustainable formulation systems, establishing quality testing capabilities, and developing advanced membrane technologies that improve competitiveness while ensuring product performance.

Green Building Financing: Fund sustainable construction projects, LEED certification programs, and low-emission building development that enhance environmental performance while creating demand for sustainable waterproofing products and low-VOC formulations.

Emerging Market Development: Provide financing and technical assistance for construction industry development in emerging Asia Pacific economies, creating new waterproofing consumption opportunities while supporting infrastructure development and building quality improvement initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 14 billion |

| Technology Type | Membrane type (APP bitumen membranes, SBS bitumen membranes, PVC/TPO sheets, EPDM sheets), coatings, injection grouting, integral system (crystalline/admixture) |

| Sales Channel | Direct sales, distributors & wholesalers, retail stores, online (B2B/B2C), DIY |

| End User | Infrastructure sector, residential sector, commercial sector, industrial sector, others |

| Material/Coating | Polyurethane (PU) coatings, acrylic & elastomeric coatings, cementitious coatings, silicone & hybrid systems, bitumen (all types, including emulsions), others (epoxy, polyurea, etc.) |

| Countries Covered | India, Vietnam, Indonesia, Philippines, China, Japan, Australia |

| Key Companies Profiled | Sika AG, BASF SE, Mapei S.p.A., Wacker Chemie AG, Pidilite Industries (Dr. Fixit), Fosroc, Saint-Gobain Weber, H.B. Fuller, Jiahua Chemicals Inc., Akzo Nobel |

| Additional Attributes | Dollar sales by technology type, sales channel, end-user segment, and material category, country demand trends across India, Vietnam, Indonesia, Philippines, China, Japan, and Australia, competitive landscape with established European and regional Asian manufacturers and construction chemical innovators, contractor preferences for membrane systems versus liquid-applied coatings versus integral crystalline admixtures, integration with green building certification systems and low-VOC regulatory requirements particularly advancing in Australia, Japan, and urban China, innovations in sustainable polyurethane formulations and self-healing concrete technologies. |

The global demand for waterproofing chemicals in asia pacific is estimated to be valued at USD 5.8 billion in 2025.

The market size for the demand for waterproofing chemicals in asia pacific is projected to reach USD 11.5 billion by 2035.

The demand for waterproofing chemicals in asia pacific is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in demand for waterproofing chemicals in asia pacific are membrane type, coatings, injection grouting and integral system (crystalline/admixture).

In terms of sales channel, direct sales segment to command 45.0% share in the demand for waterproofing chemicals in asia pacific in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Asia Pacific Tartrazine Market Analysis – Trends, Demand & Forecast 2025–2035

Asia Pacific Secondhand Goods Market Growth, Trends and Forecast from 2025 to 2035

Analysis and Growth Projections for Asia Pacific Essential Oil and Oleoresin Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA