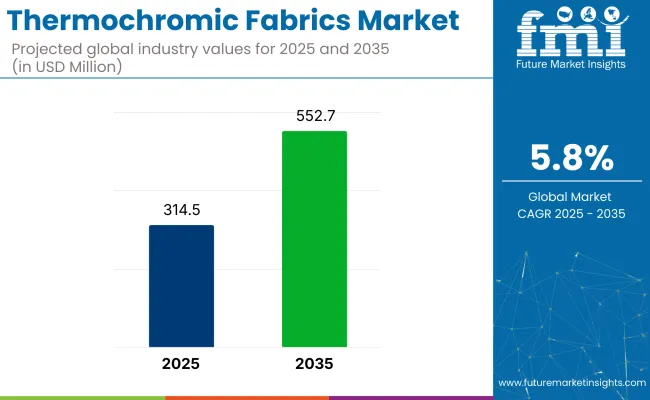

The thermochromic fabrics market is expected to grow from USD 314.5 million in 2025 to USD 552.7 million by 2035, reflecting a CAGR of 5.8% during the forecast period.

This upward trend is being supported by growing experimentation in fashion, functional textiles, and smart wearable technologies. Thermochromic textiles change color in response to temperature variations, offering a visual indication of thermal shifts, which is increasingly being leveraged in both creative and performance-driven applications.

As of 2025, the thermochromic fabrics market holds a niche but growing position within its broader parent markets. Within the global smart textiles market, it contributes approximately 4-6%, as color-changing fabrics are gaining traction in wearable technology and interactive clothing. In the functional apparel market, its share is around 2-3%, especially in activewear and children’s clothing designed for temperature awareness.

Within the textile chemicals market, thermochromic applications account for roughly 1-2%, since they represent a small subset of specialty pigments and coatings. In the fashion and sportswear market, it holds about 1-1.5%, where novelty and innovation drive limited but premium use cases. In the technical textiles market, the share stands at 2-3%, primarily in defense, medical, and safety applications.

Between 2020 and 2024, the thermochromic fabrics market saw rising consumption due to its integration into high-margin, limited-edition fashion lines by brands like Vollebak and The Unseen, which utilized microencapsulated leuco dyes for responsive color change. Unlike earlier novelty use, recent growth stemmed from activewear and climate-adaptive apparel, especially in North America and Northern Europe, where demand for garments responding to body heat and environmental changes intensified.

Key innovation came from UK-based fabric startups applying dual-temperature response systems that shift shades at both 27°C and 37°C, targeting both external and skin-contact triggers. From 2025 onward, demand is forecasted to pivot toward medical and defense textiles, with military R&D units in South Korea and Israel trialing thermochromic camouflage. Wearable diagnostics firms are incorporating thermochromic patches in wound dressings for non-invasive fever detection.

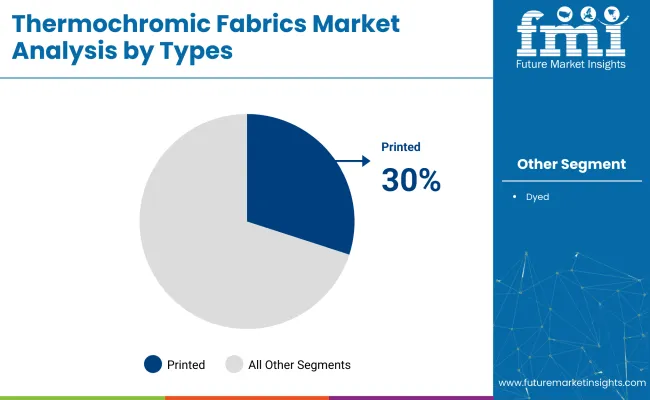

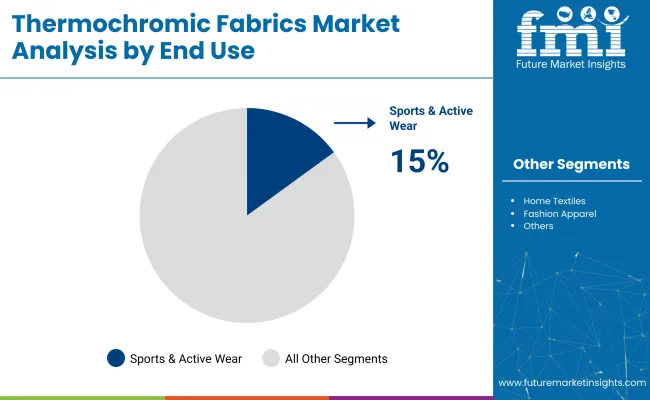

Cotton is projected to lead the substrate segment with a 25% market share by 2025, while printed thermochromic fabrics are expected to dominate the type segment with a 30% share. Sports and active wear will emerge as the leading end-use category, capturing 15% of the market, fueled by rising demand for smart textiles and temperature-responsive apparel.

Cotton-based thermochromic fabrics are projected to account for 25% of the global substrate segment in 2025 due to their comfort, breathability, and dye compatibility.

Printed thermochromic fabrics are expected to command 30% of the type segment by 2025, driven by design flexibility and scalable production.

Sports and active wear is projected to lead the end-use segment with a 15% market share by 2025, as thermochromic fabrics become more integrated into performance-focused apparel.

The market is growing due to rising demand for color-changing textiles in fashion, sportswear, home décor, and medical applications. Innovation in microencapsulation and dye chemistry is driving product performance and expanding end-use opportunities.

Increasing Adoption in Fashion, Apparel, and Footwear

Fashion designers and sportswear brands are incorporating thermochromic fabrics to create interactive garments that change color with body heat or environmental temperature. These fabrics enhance visual appeal and offer a novel user experience. Activewear, jackets, and shoes featuring thermochromic elements are gaining traction among trend-driven consumers.

Material Innovation and Durability Improvements Supporting Growth

Research into more stable dyes and encapsulation methods is improving the colorfastness, wash resistance, and reusability of thermochromic fabrics. Manufacturers are developing fabrics that respond to narrow temperature ranges, allowing for customized applications. Smart textiles combining thermochromic properties with other sensors are also emerging in wearable technology.

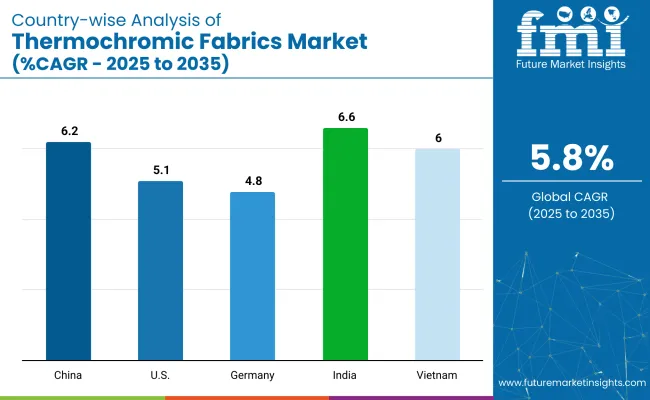

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

| USA | 5.1% |

| Germany | 4.8% |

| India | 6.6% |

| Vietnam | 6.0% |

India’s momentum is being driven by textile digitization, smart garment exports, and low-cost pigment integration in domestic mills. China is advancing with high-speed digital textile printing and adoption in sportswear and functional fashion. In contrast, developed economies such as the United States (5.1%), Germany (4.8%), and Vietnam (6.0%) are expanding steadily at 0.73-0.97x the global rate.

The USA focuses on apparel personalization and wearable innovation. Germany is targeting automotive and interior textiles with heat-responsive functions. Vietnam leads in low-cost fashion exports using color-change designs. As the market becomes more design-centric, both functional and fashion-forward regions are shaping thermochromic textile evolution.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Indian market is projected to grow at a CAGR of 6.6% through 2035. Domestic textile clusters are integrating color-changing pigments in casualwear and promotional apparel. Low-cost production and export orientation are attracting orders from European fashion startups and USA sportswear brands. Print-on-demand facilities in Gujarat and Tamil Nadu are leading development. Product use is also expanding in baby apparel and interactive learning accessories. India's pigment suppliers are creating heat-activated blends suitable for cotton and polyester substrates, supporting widespread adoption.

China is expected to grow at a CAGR of 6.2% through 2035. High-speed digital printing units in Zhejiang and Jiangsu provinces are producing thermochromic fabrics for fast fashion and outerwear. Demand is rising in temperature-sensitive uniforms, wearable health indicators, and novelty-based fashion collections. Domestic chemical suppliers are scaling microencapsulated pigment production to serve apparel exporters. Advanced R&D centers are developing dual-tone and reversible shift fabrics. China's scale and speed advantage make it a key global supplier.

The USA market is projected to grow at a CAGR of 5.1% through 2035. Customized fashion, smart garments, and responsive children’s apparel are driving demand. Small-batch runs for streetwear and theme merchandise are incorporating color-shifting effects. R&D partnerships between universities and startups are advancing wearables that respond to skin temperature. Fabric printers are working with local designers to create unique thermally reactive collections. Growth is driven by personalization, sensory engagement, and tech-fashion convergence.

Germany is expected to grow at a CAGR of 4.8% through 2035. Functional textiles for car interiors, seating covers, and performance gear are being developed using heat-reactive dyes. Automotive suppliers are using thermochromic materials to improve visual safety and comfort perception. Textile labs are customizing dyes to fit EU environmental safety standards. Premium home textiles and luxury loungewear are also adopting subtle temperature-driven color shifts. Germany’s growth is rooted in performance engineering and sustainable textile chemistry.

Vietnam’s market is projected to grow at a CAGR of 6.0% through 2035. Export-oriented garment units are adopting color-change prints for casualwear and children’s clothing. Global brands are sourcing from Vietnamese factories due to competitive pricing and rapid fulfillment. Thermochromic pigment application is expanding in print-on-demand t-shirts and summer activewear. Local dyeing houses are collaborating with Korean and Japanese pigment suppliers to develop stable blends for cotton knits. Vietnam’s position as a low-cost exporter supports fast-scale production.

The thermochromic fabrics market is relatively niche and fragmented, with innovation-driven players focusing on smart textiles that change color with temperature variations. Shadow Shifter leads the market with patented heat-reactive dye technologies used in apparel and accessories.

Yunai Textile and WujiangTuoxin Textile Co., Ltd. offer customizable thermochromic fabrics for sportswear and fashion applications, primarily catering to the Asian and global B2B markets. Mook Fabrics and Kuler LLC are emerging players that supply specialty materials for craft, novelty clothing, and industrial use, emphasizing sustainability and responsiveness to environmental triggers. The market’s growth is fueled by rising demand for interactive clothing and advancements in microencapsulation dye techniques.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 314.5 million |

| Projected Market Size (2035) | USD 552.7 million |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Substrates Analyzed (Segment 1) | Cotton, Polyester, Nylon, Synthetic Blends, Others |

| Types Analyzed (Segment 2) | Dyed Fabric, Printed Fabric |

| End Uses Analyzed (Segment 3) | Fashion Apparel, Sportswear & Activewear , Home Textiles, Industrial Applications, Others |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Shadow Shifter, Yunai Textile, Mook Fabrics, Kuler LLC, Wujiang Tuoxin Textile Co., Ltd. |

| Additional Attributes | Dollar sales by substrate and end use, expanding applications in a dynamic fashion and home décor, increasing preference for color-changing textiles, and R&D investments in responsive fabric technologies. |

The market is segmented by substrate into cotton, polyester, nylon, synthetic blends, and other fabric types.

Based on type, the market is categorized into dyed fabric and printed fabric segments.

Key end-use industries include fashion apparel, sportswear and activewear, home textiles, industrial applications, and others.

Geographically, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is estimated to be valued at USD 314.5 million in 2025.

The market is expected to reach USD 552.7 million by 2035.

The market is projected to grow at a CAGR of 5.8% from 2025 to 2035.

Printed thermochromic fabrics are projected to dominate with a 30% market share in 2025.

Sports and active wear is expected to lead the end-use segment with a 15% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermochromic Closure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics for Defense Market 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fabrics Market Trends 2025 to 2035

Global Healthcare Fabrics Market Insights – Trends & Forecast 2024-2034

Tensile Roof Fabrics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Fire Retardant Fabrics Market - Growth & Demand 2025 to 2035

Germany Coated Fabrics Market Report – Trends, Demand & Industry Forecast 2025–2035

Flame Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Pavement Overlay Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord and Tire Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA