The thermochromic closure market is valued at USD 0.8 billion and is projected to reach USD 1.6 billion by 2035, growing at a CAGR of 7.2%. The market is expected to experience steady growth, driven by rising demand for innovative packaging solutions, particularly in the beverage industry.

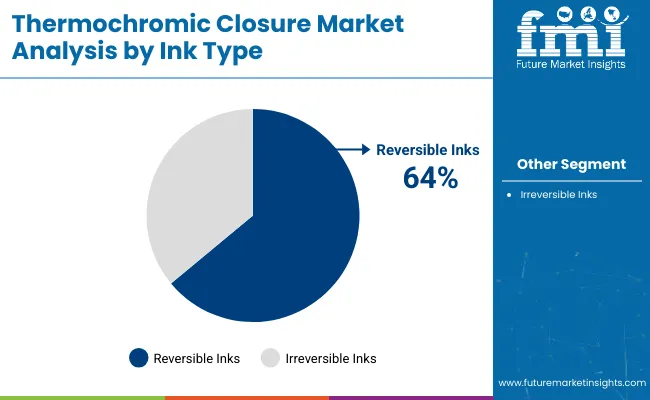

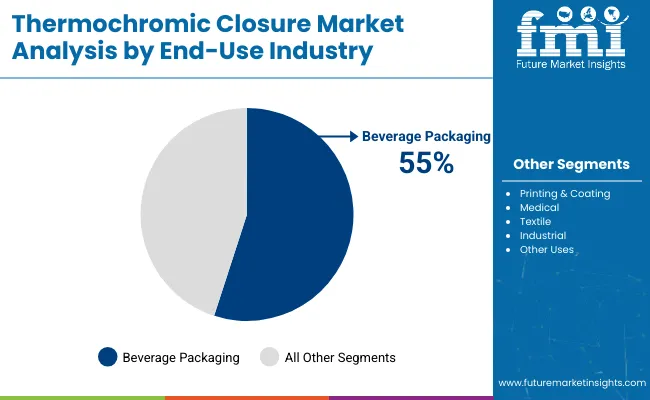

Reversible ink types are expected to continue their dominance, capturing 64% of the market share in 2025. The beverage packaging industry is the largest end-use sector, accounting for 55% of the total market demand. Thermochromic closures are increasingly being used in beverage packaging to create dynamic, interactive consumer experiences by indicating product temperature or freshness.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 0.8 billion |

| Market Value (2035F) | USD 1.6 billion |

| CAGR (2025 to 2035) | 7.2% |

The adoption of thermochromic inks in beverage packaging is anticipated to drive growth, as brands seek to enhance consumer engagement. Key players, including Caps & Closures and G3 Enterprises are investing heavily in R&D to improve the functionality and environmental responsibility of thermochromic inks, further fueling market expansion.

In 2025, a key development is the application of thermochromic inks in packaging to enhance consumer safety and engagement. For instance, Dove has introduced a skin care product in the Canadian market with packaging that employs thermochromic ink to display a warning when water temperature exceeds 40°C.

This innovation aims to prevent potential burns by alerting consumers to unsafe water temperatures. While specific market share data for thermochromic closures is limited, such applications highlight the growing trend of integrating thermochromic materials into packaging solutions to improve user experience and safety.

The thermochromic closure Industry is driven by reversible ink types, leuco dyes, and beverage packaging. Reversible inks lead the ink segment, while leuco dyes dominate materials. Beverage packaging remains the largest end-use sector, as consumer demand for interactive, engaging packaging solutions continues to rise.

Reversible inks are projected to dominate, capturing 64% of the market share in 2025. These inks change color when exposed to temperature variations, allowing packaging to visually indicate temperature changes, freshness, or product status.

Leuco dyes are projected to maintain dominance in the material segment, holding 37.9% of the market in 2025. These dyes are commonly used in thermochromic inks due to their ability to change color in response to temperature fluctuations. Leuco dyes are particularly popular in beverage packaging, where they provide a visually appealing and interactive way to display temperature-sensitive information.

Beverage packaging is expected to account for 55% of the market in 2025, making it the largest end-use sector. As consumer demand for interactive, engaging packaging increases, beverage companies are increasingly adopting thermochromic inks to enhance product visibility and create dynamic consumer experiences.

The thermochromic closure industry is growing due to the demand for interactive packaging solutions in beverage packaging, driven by consumer interest in visually dynamic products. However, challenges such as high production costs and regulatory hurdles on material safety could limit market expansion, requiring innovation to make thermochromic closures more accessible and cost-effective.

Growing demand for interactive packaging solutions

The demand for thermochromic packaging is rising as brands seek to offer unique, engaging experiences to consumers. Thermochromic inks, particularly reversible inks, are used to create packaging that visually changes in response to temperature. This dynamic feature is increasingly popular in beverage packaging, where it helps indicate freshness or ideal drinking temperature. The trend toward interactive and visually appealing packaging is fueling market growth.

Challenges related to cost and regulation

Despite the growth, the thermochromic closure industry faces challenges, such as the high production costs associated with thermochromic inks and materials. These advanced technologies are often more expensive than traditional packaging solutions, which can limit adoption, especially among small and medium-sized manufacturers. Additionally, regulatory requirements concerning the safety of chemicals used in thermochromic inks may pose further challenges for market players. Overcoming these barriers will be essential for the continued expansion of the market.

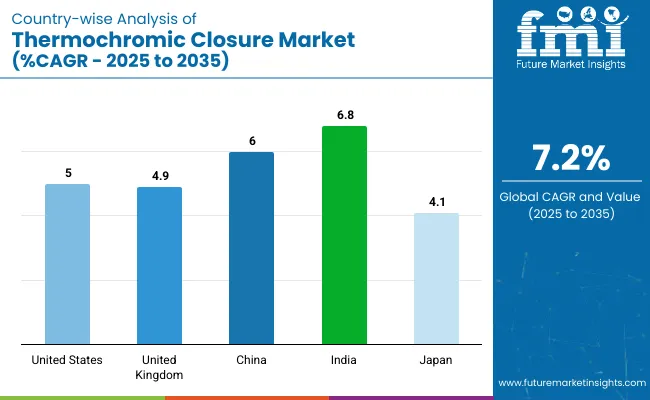

The thermochromic closure market is growing across the United States, United Kingdom, China, India, and Japan, driven by demand in beverage packaging and interactive consumer engagement. The United States and China are expected to experience significant growth, while India presents a high-growth opportunity.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5% |

| United Kingdom | 4.9% |

| China | 6% |

| India | 6.8% |

| Japan | 4.1% |

With a CAGR of 5.0%, the United States is expected to remain a dominant player, especially as beverage companies embrace thermochromic closures for enhanced consumer engagement and product differentiation. The USA is a leading market driven by the high demand for innovative packaging in the beverage sector.

With a projected CAGR of 4.9%, the market is expected to continue its growth, driven by strong consumer preferences for visually dynamic and interactive packaging in the beverage sector. In the United Kingdom, the market is expanding as businesses increasingly demand premium and eco-friendly packaging solutions.

With a projected CAGR of 6.0%, China’s market is poised for significant growth, supported by the booming beverage industry and increasing consumer interest in innovative packaging. China’s market is projected to experience robust growth, driven by the rapid expansion of the beverage and packaging sectors.

With a CAGR of 6.8%, India is expected to see strong growth, particularly in the beverage packaging sector, as more brands adopt thermochromic inks for their products. India’s thermochromic closure market is growing rapidly, fueled by the rising demand for advanced packaging solutions in the beverage and food industries.

With a projected CAGR of 4.1%, Japan is expected to experience steady growth in the thermochromic closure industry, particularly as more beverage brands seek to differentiate themselves with interactive and dynamic packaging features. Japan’s market is driven by increasing demand for high-quality packaging, particularly in the beverage sector.

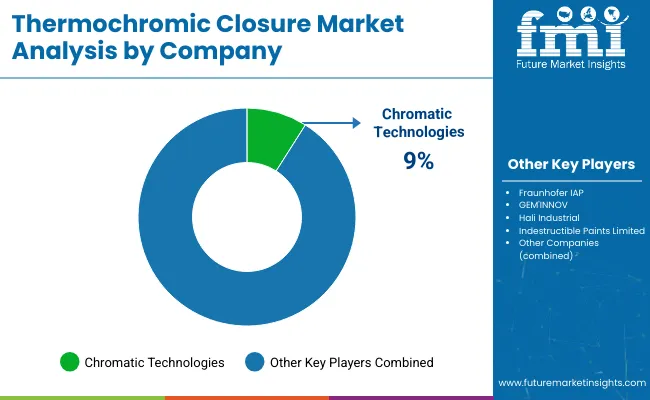

The thermochromic closure industry has witnessed significant growth due to innovative solutions from leading companies like G3 Enterprises, Inc. and Crown Holdings, Inc. These industry giants are pioneering advancements in packaging by incorporating temperature-sensitive inks that change color to enhance consumer experience. In 2023, G3 Enterprises introduced a smart wine closure that signals the optimal drinking temperature, creating a more interactive experience for wine lovers. Similarly, Crown Holdings unveiled color-changing crown caps for beverages, allowing consumers to monitor drink temperatures easily.

Entry barriers in the market are substantial, with challenges like patent protections on thermochromic inks, high manufacturing costs, and the need for advanced R&D. The market is moderately fragmented, though increasing consolidation is evident as large companies acquire smaller innovators to improve their product offerings and extend market reach. These developments are shaping the future of the industry.

Recent Industry News

The industry is witnessing significant innovations, driven by increased demand for interactive and green packaging. Companies like CTI Inks are developing eco-friendly, Bisphenol-free thermochromic inks to meet growing safety standards in the pharmaceutical sector. Coca-Cola Turkey launched limited-edition cans using thermochromic inks that change color when chilled, enhancing consumer engagement.

Dove introduced packaging that uses thermochromic ink to indicate when the bottle is too hot to handle, improving user safety. These developments underscore the increasing integration of thermochromic inks in packaging to offer enhanced consumer experiences and safety, while promoting eco-friendly practices.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 0.8 billion |

| Projected Market Size (2035) | USD 1.6 billion |

| CAGR (2025 to 2035) | 7.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Ink Types Analyzed | Reversible, Irreversible |

| Material Types Analyzed | Leuco Dyes, Liquid Crystals, Pigments, Others |

| End-Use Industry Segmentation | Beverage Packaging, Printing & Coating, Medical, Textile, Industrial, Other Uses |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Market | Caps & Closures. G3 Enterprises, Inc. Crown Holdings, Inc. |

| Additional Attributes | Dollar sales by ink type, material, and end-use industry, growing demand in beverage packaging and medical applications, adoption of smart packaging solutions, regulatory impact on food and medical packaging standards, technological advancements in thermochromic inks. |

The market is segmented into reversible and irreversible inks.

The market is segmented into leuco dyes, liquid crystals, pigments, and others.

The market is segmented into beverage packaging, printing & coating, medical, textile, industrial, and other uses.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Middle East & Africa.

The global market is projected to reach USD 1600 million by 2035.

The market is expected to be valued at USD 800 million in 2025.

Reversible inks will dominate the ink type segment, accounting for 64% of the market share in 2025.

Leuco Dyes are expected to lead the material segment, holding 37.9% of the market share in 2025.

Beverage packaging will hold the largest market share, representing 55% of the total demand in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermochromic Fabrics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Enclosure Support Arm Systems Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Bag Closure Clip Providers

Case Closures and Sealers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

T-Top Closures Market - Growth & Demand 2025 to 2035

Crown Closures Market Growth & Packaging Innovations 2025 to 2035

Metal Closures Market Report – Key Trends & Forecast 2024-2034

Spout Closures Market

Ribbed Closures Market

Cranial Closure And Fixation Devices Market Size and Share Forecast Outlook 2025 to 2035

Snap-on Closures Market Analysis by Diameter, Material Type, End Use, and Region Forecast Through 2035

Clic Loc Closure Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Vascular Closure Devices Analysis by Product Type by Product, By Age Group and by Distribution Channel through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA