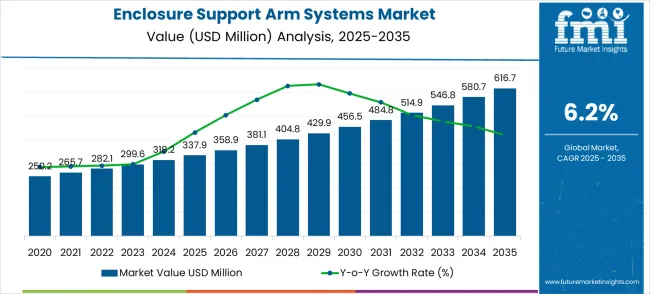

The enclosure support arm systems market begins its forecast journey from a USD 337.9 million foundation in 2025, setting the stage for substantial expansion ahead. The first half of the decade witnesses steady momentum building, with market value climbing from USD 358.9 million in 2026 to USD 484.8 million by 2030. This initial phase reflects growing industrial automation adoption and increasing precision requirements across manufacturing and medical sectors.

The latter half will witness steady growth dynamics, propelling the market from USD 514.9 million in 2031 to reach USD 616.7 million by 2035. Dollar additions during 2030-2035 maintain consistent expansion, with annual increments averaging USD 26.4 million compared to USD 29.4 million in the first phase. This progression represents an 82.5% total value increase over the forecast decade.

Market maturation factors include expanding medical device production volumes, increasing precision demands for industrial automation, and the sophistication of automotive manufacturing. The 6.2% compound annual growth rate positions participants to capitalize on USD 278.8 million in additional market value creation. This trajectory signals robust opportunities for material innovators, automation solution developers, and end-user system providers across the global industrial landscape.

Market expansion unfolds through two distinct growth periods with different industrial characteristics for each phase. The 2025-2030 foundation period delivers USD 146.9 million in value additions, representing 43.5% growth from the baseline. Market dynamics during this phase center on automation system standardization, medical device integration acceleration, and industrial manufacturing precision enhancement.

The 2030-2035 maturation period generates USD 131.9 million in incremental value, reflecting 27.2% growth from the 2030 position. This phase exhibits mature market characteristics with enhanced competition, material optimization strategies, and geographic expansion initiatives. Dollar contributions shift from foundational automation infrastructure development to market share optimization and technological advancement refinement.

The competitive landscape evolves from early automation adoption to established precision positioning. The first period emphasizes market education and the reduction of integration barriers. The second period witnesses intensified competition for premium industrial segments and medical application territory expansion. Market maturation factors include standardized support specifications, automated mounting capabilities, and cross-industry application development across medical, industrial, and automotive sectors.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 337.9M |

| Market Forecast (2035) ↑ | USD 616.7M |

| Growth Rate ↑ | 6.2% CAGR sustained expansion |

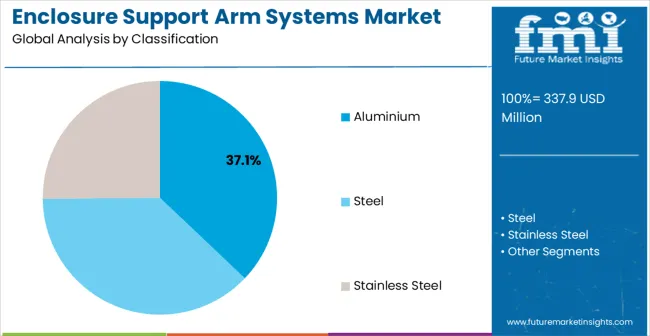

| Segment Leader → | Aluminium type |

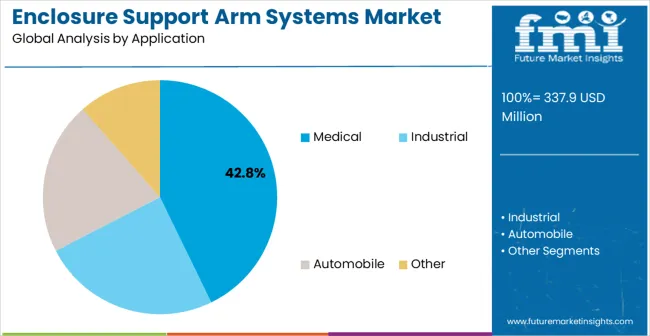

| Application Focus ★ | Medical |

Market expansion rests on four fundamental shifts driving industrial support system demand acceleration:

The growth faces headwinds from high precision manufacturing costs and installation complexity requirements. Traditional fixed mounting systems maintain cost advantages for less demanding applications. Technical expertise needs create adoption barriers for smaller manufacturing facilities lacking specialized engineering capabilities.

Primary Classification: Material Type Distribution

Secondary Breakdown: Application Categories

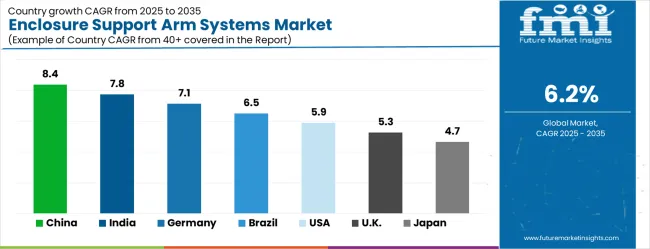

Geographic Segmentation: Regional Market Distribution

Market Position: Aluminium enclosure support arm systems establish clear market leadership through lightweight advantages and corrosion resistance benefits. Advanced aluminium alloy formulations eliminate weight concerns while maintaining structural integrity requirements. Anodized surface treatments provide enhanced durability and aesthetic appeal for medical and industrial applications.

Value Drivers: Aluminium construction reduces system weight by 40-60% compared to steel alternatives while maintaining equivalent load-bearing capacity. Corrosion resistance eliminates maintenance requirements in challenging environments including medical facilities and industrial settings. Machinability characteristics enable complex geometries and precise tolerances required for sophisticated mounting applications.

Competitive Advantages: Aluminium systems offer superior strength-to-weight ratios enabling larger extension ranges without structural compromise. Thermal stability prevents dimensional changes during temperature variations common in industrial environments. Material recyclability supports environmental compliance initiatives increasingly important for institutional procurement decisions.

Market Challenges: Higher material costs increase system prices compared to steel alternatives creating budget constraints for cost-sensitive applications. Specialized joining techniques require skilled installation capabilities not available in all facilities. Limited load capacity compared to steel systems restricts applications requiring maximum strength specifications.

Strategic Market Importance: Medical applications represent the primary demand driver for precision support arm systems across healthcare facility equipment mounting and positioning requirements. Hospital environments require adjustable mounting solutions for diagnostic equipment, patient monitoring systems, and surgical instrumentation. Medical device manufacturers demand stable support mechanisms ensuring accurate equipment operation and patient safety compliance.

Market Dynamics Q&A:

Business Logic: Medical facilities prioritize equipment accessibility and patient safety, making precision support arm systems essential for optimal healthcare delivery. Regulatory compliance requires documented mounting stability for critical medical equipment. Cost justification occurs through improved workflow efficiency and enhanced patient care capabilities.

Forward-looking Implications: Digital health technology expansion creates new mounting requirements for advanced monitoring equipment and connected medical devices. Minimally invasive surgery development demands precision support systems for imaging equipment and surgical instrumentation. Healthcare facility modernization sustains market demand across emerging medical technology adoption.

Growth Accelerators: The enclosure support arm systems market is expanding in response to several structural drivers. Healthcare infrastructure growth is a primary accelerator, as new medical facilities and renovation projects increasingly require precision mounting systems to support sensitive diagnostic and treatment equipment. Parallel to this, the spread of industrial automation generates demand for flexible support solutions capable of accommodating frequent reconfigurations of machinery and operator interfaces. In automotive manufacturing, rising production sophistication underscores the need for ergonomic support systems that enhance worker productivity while ensuring safety compliance. Additionally, stringent quality control standards in multiple industries necessitate stable, vibration-free platforms for mounting inspection tools and measurement instrumentation. Finally, the growing emphasis on space optimization within factories and laboratories places adjustable, space-efficient support systems at the center of facility planning strategies.

Growth Inhibitors: Despite these drivers, the market faces notable restraints. High precision manufacturing costs often position advanced support arm systems above budget thresholds in cost-sensitive applications, where basic alternatives suffice. Complex installation processes require skilled technical expertise that may not be readily available in all facilities, creating adoption bottlenecks. Moreover, load capacity limitations constrain the use of support arms in heavy-duty industrial contexts. The presence of moving components also introduces maintenance demands that elevate total cost of ownership. Further, customization requirements though critical for specialized environments0020can extend delivery lead times and complicate project execution for time-sensitive installations.

Market Evolution Patterns: Modular design development enables standardized components with customization flexibility, reducing manufacturing costs and delivery times. Digital integration capabilities connect support systems with facility management platforms for operational monitoring and predictive maintenance. Material advancement produces stronger, lighter solutions, improving performance while reducing installation complexity. Ergonomic optimization enhances user experience and workplace safety compliance across diverse applications. Emerging sustainability initiatives are also encouraging the use of recyclable materials and energy-efficient production methods. Growing adoption of smart factory frameworks positions enclosure support arms as critical enablers of Industry 4.0 environments.

| Country | Market Share (%) |

|---|---|

| China | 8.4 |

| India | 7.8 |

| Germany | 7.1 |

| Brazil | 6.5 |

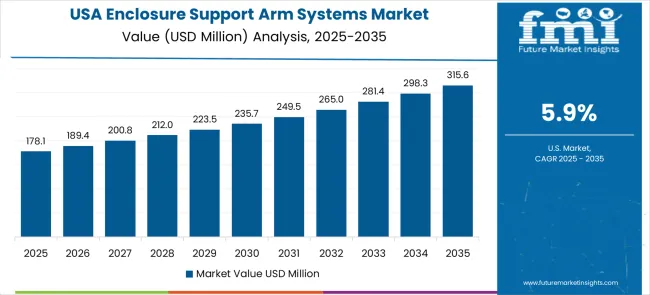

| United States | 5.9 |

| United Kingdom | 5.3 |

| Japan | 4.7 |

The global enclosure support arm systems market is expected to grow at a steady pace through 2035, with a projected CAGR of 6.2%. Leading markets include China (8.4%), India (7.8%), Germany (7.1%), Brazil (6.5%), the USA (5.9%), the UK (5.3%), and Japan (4.7%). Key growth drivers include the ongoing industrial automation, increased demand for high-performance manufacturing equipment, and a focus on advanced protection solutions across industries such as automotive, electronics, and telecommunications. Technological advancements, including modular solutions and precision manufacturing, are reshaping market dynamics.

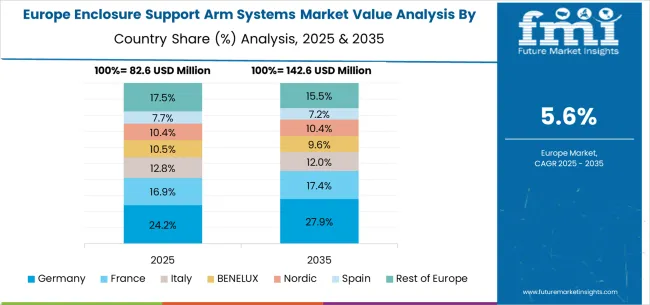

Regional synthesis indicates Asia Pacific leadership through manufacturing concentration and export production requirements. European markets emphasize precision engineering and quality standard compliance. North American demand reflects medical facility expansion and industrial automation adoption initiatives.

China establishes market leadership through massive healthcare infrastructure expansion and comprehensive manufacturing modernization initiatives creating unprecedented demand for mounting system solutions. The 8.4% CAGR reflects substantial investment in hospital construction, industrial automation, and automotive manufacturing capacity requiring advanced support arm systems across multiple application segments. Government healthcare reforms drive medical facility expansion while manufacturing competitiveness initiatives promote industrial modernization requiring sophisticated mounting solutions.

Healthcare system development includes over 1,000 new hospitals annually requiring comprehensive medical equipment mounting systems supporting diverse clinical applications. Manufacturing sector modernization incorporates Industry 4.0 technologies demanding flexible mounting solutions for control systems and monitoring equipment. Electric vehicle production scaling creates specialized mounting requirements for automotive assembly and quality control applications supporting domestic and export market competitiveness.

India demonstrates exceptional growth potential through expanding healthcare infrastructure and manufacturing ecosystem development supported by government modernization initiatives. The 7.8% CAGR reflects increasing healthcare capacity and industrial sophistication creating demand for advanced mounting system solutions across medical and manufacturing applications. Make in India programs promote domestic production requiring comprehensive facility infrastructure including mounting systems supporting local manufacturing capabilities.

Healthcare sector expansion includes medical college development and hospital capacity increases requiring extensive medical equipment mounting solutions. Manufacturing hub development creates opportunities for industrial mounting system applications supporting electronics production and automotive assembly operations. Foreign investment brings international standards requiring certified mounting solutions meeting global quality specifications and performance requirements.

Germany maintains technology leadership through precision engineering excellence and comprehensive mounting system development capabilities. The 7.1% CAGR reflects established manufacturing expertise with continuous advancement in mounting technology and industrial solutions. Automotive industry leadership creates consistent demand for specialized mounting systems while medical device manufacturing requires precision positioning solutions supporting export market competitiveness.

Manufacturing sector excellence drives continuous innovation in mounting system technology supporting advanced automation and quality control applications. Medical device industry leadership requires sophisticated mounting solutions for manufacturing equipment and clinical applications ensuring superior product quality. Export market competitiveness necessitates superior mounting system quality and performance characteristics supporting German industrial excellence and global market positioning.

Brazil represents emerging market growth potential with a 6.5% CAGR through expanding healthcare infrastructure and industrial development initiatives. Healthcare system modernization creates opportunities for medical equipment mounting solutions while manufacturing expansion requires industrial support systems. Government infrastructure investment promotes domestic production capacity requiring comprehensive facility equipment including mounting systems supporting economic development objectives.

Healthcare facility development includes public hospital expansion and private medical center construction requiring extensive medical equipment mounting solutions. Industrial development programs create opportunities for manufacturing automation and quality control mounting applications. Regional automotive production expansion requires specialized mounting systems supporting assembly operations and equipment installations ensuring competitive manufacturing capabilities.

The United States demonstrates steady growth with a 5.9% CAGR through healthcare system modernization and advanced manufacturing initiatives. Medical facility renovations and hospital expansion projects create consistent demand for medical equipment mounting solutions. Industrial automation adoption requires sophisticated mounting systems supporting manufacturing competitiveness and operational efficiency improvement across diverse sectors.

Healthcare infrastructure modernization includes hospital renovation projects incorporating advanced medical equipment mounting systems supporting clinical workflow optimization. Manufacturing competitiveness initiatives promote automation requiring flexible mounting solutions for control systems and monitoring equipment. Defense and aerospace applications require specialized mounting systems meeting stringent quality and performance specifications supporting national security objectives.

The United Kingdom demonstrates focused growth with a 5.3% CAGR through healthcare system modernization and industrial technology advancement. NHS facility improvements create opportunities for medical equipment mounting system installations while manufacturing modernization requires industrial support solutions. Brexit-related industrial strategy promotes domestic manufacturing requiring comprehensive facility infrastructure supporting economic independence objectives.

Healthcare facility modernization includes hospital equipment upgrades and clinical workflow optimization requiring advanced mounting system solutions. Manufacturing sector development creates demand for industrial automation support systems and ergonomic workplace solutions. Export market focus necessitates quality mounting system production meeting international standards and specifications ensuring global competitiveness.

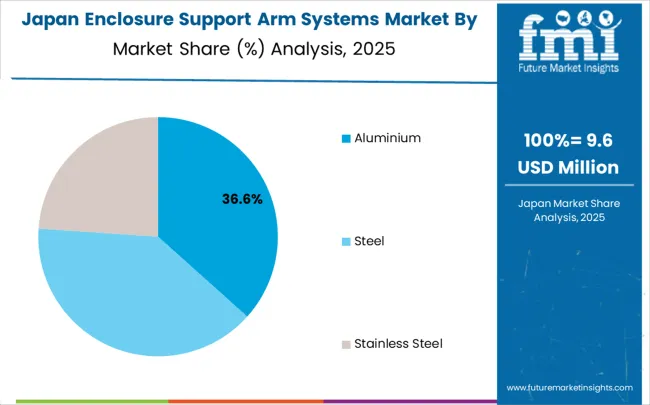

Japan maintains established market position with a 4.7% CAGR through precision manufacturing excellence and advanced healthcare technology development. Medical device industry leadership creates consistent demand for sophisticated mounting systems while automotive manufacturing requires specialized support solutions. Industrial automation expertise drives continuous advancement in mounting system technology and applications supporting technological leadership.

Healthcare technology development requires precision mounting systems for medical device manufacturing and clinical applications ensuring superior quality standards. Automotive industry excellence creates demand for specialized mounting solutions supporting advanced manufacturing and quality control processes. Industrial equipment export leadership necessitates superior mounting system integration and performance characteristics supporting global competitiveness.

Market structure reflects moderate fragmentation with established industrial suppliers maintaining significant positions while specialized manufacturers serve application-specific segments. Competition emphasizes engineering customization, application expertise development, and customer service capability enhancement. Industry dynamics favor companies combining technical innovation with comprehensive support offerings across diverse industrial applications.

Tier 1 - Global Industrial Leaders: Tier 1 competitors such as ROLEC and Rittal dominate with broad product portfolios, international service networks, and strong engineering expertise. Their competitive advantages stem from significant research and development resources, long-established customer relationships, and economies of scale in manufacturing. These companies enjoy strong brand recognition and reputations for quality, allowing them to serve both industrial and medical applications globally. Their strength lies in offering standardized yet adaptable solutions that meet diverse requirements. By leveraging global reach and proven performance, these leaders maintain market control while continuously investing in innovation to reinforce long-term competitive positions.

Tier 2 - Specialized Application Providers: Tier 2 players such as SIMEON Medical, Phoenix Mecano, and BERNSTEIN AG focus on specialized segments or targeted regional markets. Their advantage lies in application expertise, technical customization, and flexible customer service models. Unlike Tier 1 leaders, these companies emphasize niche engineering solutions and relationship-based growth strategies. Market positioning highlights their ability to tailor products for specific applications, providing higher adaptability and responsiveness. By developing deep application knowledge and maintaining close partnerships with customers, Tier 2 suppliers carve strong positions in segments where customization and reliability are valued more highly than global scale or standardized offerings.

Tier 3 - Regional and Niche Competitors: Tier 3 comprises smaller, often regionally focused manufacturers that serve local markets and niche applications. These competitors differentiate through cost competitiveness, rapid customization, and specialized technical expertise. Their strengths include agility in meeting unique customer needs, offering tailored solutions with quick turnaround times. Market participation centers on serving localized industries, smaller clients, and applications not fully addressed by larger suppliers. While lacking global presence, these companies remain valuable in markets requiring flexibility, proximity, and personalized service. Strong relationships drive their continued relevance, the ability to innovate within narrow niches, and responsiveness to regional customer requirements.

The enclosure support arm systems market is central to industrial automation efficiency, medical equipment precision, automotive manufacturing quality, and workplace ergonomics. With the acceleration of digitalization, safety compliance requirements, and the expanding adoption of automation, the sector faces pressure to balance mounting precision, load capacity optimization, and cost-effectiveness. Coordinated action from governments, industry bodies, OEMs/automation players, suppliers, and investors is essential to transition toward smart-integrated, ergonomically optimized, and digitally connected support arm systems.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Automation Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 337.9 million |

| Material Type | Aluminium, Steel, Stainless Steel |

| Application | Medical, Industrial, Automobile, and Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | ROLEC, Rittal, GEBA, BERNSTEIN AG, SIMEON Medical, Phoenix Mecano, Krömker GmbH, SANY Group, Teknokol (NRS), Delta Regis Tools, Fisso, Hammond |

| Additional Attributes | Dollar sales by material categories, regional demand trends across Asia Pacific, Europe, and North America, competitive landscape with player descriptions, adoption patterns across industries, integration with automation systems and medical equipment, innovations in material technology and modular design, development of specialized applications with enhanced precision capabilities |

The global enclosure support arm systems market is estimated to be valued at USD 337.9 million in 2025.

The market size for the enclosure support arm systems market is projected to reach USD 616.7 million by 2035.

The enclosure support arm systems market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in enclosure support arm systems market are aluminium, steel and stainless steel.

In terms of application, medical segment to command 42.8% share in the enclosure support arm systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Noise Control Enclosures Packaging Market

Fiberglass Electrical Enclosure Market Analysis - Size, Share & Forecast 2025 to 2035

Unsupported Single Coated Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-Supporting Aerial Optical Cable Market Size and Share Forecast Outlook 2025 to 2035

Soft Support Products Market

Life Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Organ Support Supplements Market Analysis Size and Share Forecast Outlook 2025 to 2035

Memory Support Supplement Market Size and Share Forecast Outlook 2025 to 2035

Combat Support Vehicle Market

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Die Cut Support Pads Market Size and Share Forecast Outlook 2025 to 2035

Lactation Support Supplements Market - Size, Share, and Forecast Outlook 2025-2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Support Software Solutions Market Size and Share Forecast Outlook 2025 to 2035

GLP-1 Nutritional Support Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Decision Support App Market – AI-Powered Insights 2034

Clinical Decision Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Research Publication Support Service Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA