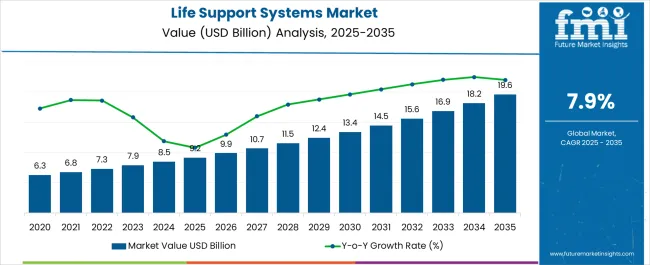

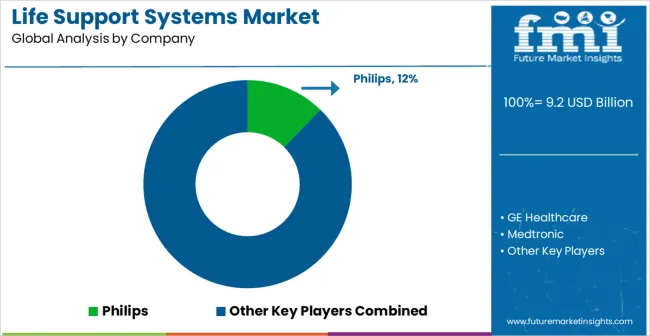

The Life Support Systems Market is estimated to be valued at USD 9.2 billion in 2025 and is projected to reach USD 19.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

| Metric | Value |

|---|---|

| Life Support Systems Market Estimated Value in (2025 E) | USD 9.2 billion |

| Life Support Systems Market Forecast Value in (2035 F) | USD 19.6 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The Life Support Systems market is experiencing sustained growth as demand rises for advanced medical technologies designed to support patients with critical health conditions. The increasing prevalence of chronic diseases, respiratory disorders, and cardiac complications has reinforced the need for reliable systems that ensure patient survival during emergencies and long-term treatments. Growing investments in hospital infrastructure and the expansion of intensive care units across emerging economies are fueling adoption.

The integration of digital technologies, including real-time monitoring, remote connectivity, and advanced sensor-based systems, is enhancing the efficiency and reliability of life support equipment. Additionally, the ongoing impact of infectious disease outbreaks and the rise in surgical interventions requiring post-operative support are contributing to market growth.

A strong focus on patient safety, regulatory compliance, and continuous improvements in device performance is shaping industry dynamics As healthcare providers aim to reduce mortality rates and improve patient outcomes, the Life Support Systems market is expected to continue expanding, driven by advancements in technology and increasing global healthcare expenditure.

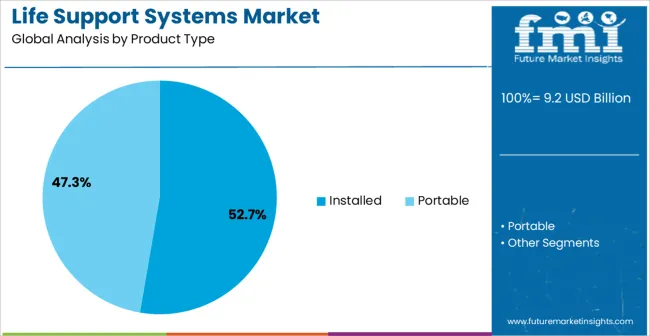

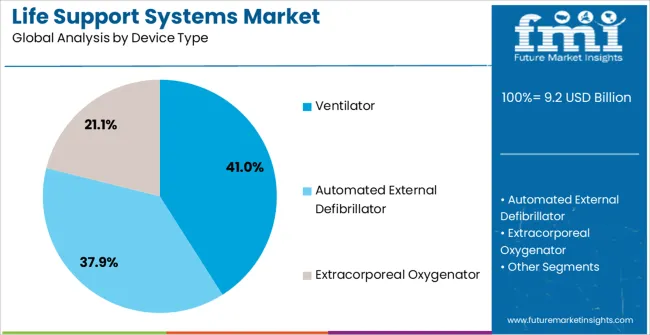

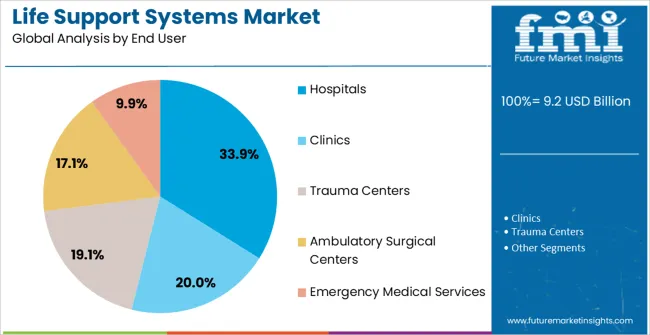

The life support systems market is segmented by product type, device type, end user, and geographic regions. By product type, life support systems market is divided into Installed and Portable. In terms of device type, life support systems market is classified into Ventilator, Automated External Defibrillator, and Extracorporeal Oxygenator. Based on end user, life support systems market is segmented into Hospitals, Clinics, Trauma Centers, Ambulatory Surgical Centers, and Emergency Medical Services. Regionally, the life support systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The installed product type segment is expected to capture 52.7% of the market revenue share in 2025, establishing itself as the dominant category. This leadership is primarily driven by the extensive use of permanently installed systems within hospitals and intensive care units, where reliability and continuous operation are critical. Installed systems provide stable, uninterrupted support for patients requiring long-term care, particularly in settings with complex medical needs.

Their integration into centralized hospital infrastructure ensures seamless functionality, compatibility with other devices, and compliance with strict regulatory standards. These systems are also favored due to their scalability and ability to support high patient volumes in critical care environments.

Healthcare institutions are prioritizing installed solutions for their durability and advanced features such as integrated monitoring and automated alerts With increasing investments in critical care facilities and a rising emphasis on patient safety, the installed segment is expected to maintain its dominant share, supported by strong institutional demand and technological improvements that enhance operational efficiency.

The ventilator device type segment is projected to account for 41.0% of the Life Support Systems market revenue in 2025, making it the leading device type. This growth is being fueled by the high prevalence of respiratory conditions such as chronic obstructive pulmonary disease and asthma, alongside acute respiratory distress cases. Ventilators play a vital role in sustaining life by providing artificial respiratory support for patients who are unable to breathe adequately on their own.

During the COVID-19 pandemic, the demand for ventilators surged globally, highlighting their essential role in emergency preparedness and hospital care. Advancements in ventilator technology, including portability, automated oxygen regulation, and integration with monitoring systems, have increased adoption across diverse care settings. Hospitals and critical care units are increasingly relying on ventilators to manage both chronic and emergency respiratory conditions.

Their proven effectiveness in improving patient outcomes has positioned them as indispensable components of life support systems As healthcare infrastructure continues to advance, ventilators will remain a key growth driver in this market.

The hospitals end user segment is anticipated to hold 33.9% of the market revenue share in 2025, positioning it as the leading end-use sector. Hospitals represent the largest consumer base for life support systems due to the concentration of critical care units, surgical theaters, and emergency departments. These settings require continuous access to advanced devices to ensure patient survival and recovery during complex procedures or critical illnesses.

The increasing number of hospital admissions, rising surgical volumes, and the need for advanced post-operative care are reinforcing demand within this segment. Hospitals also benefit from strong budgets and government funding, allowing them to invest in cutting-edge technologies and ensure compliance with regulatory standards.

Furthermore, the integration of life support systems with hospital information systems and telemedicine platforms enhances operational efficiency and patient outcomes With healthcare providers striving to improve survival rates and patient care quality, hospitals are expected to remain the dominant end user in the market, supported by continuous modernization of medical infrastructure worldwide.

Life supports system in healthcare is the complex machine used for supporting the functioning of various body organs and systems. These systems are mostly required mostly in cases of major organs failure such as brain, heart or lungs. These systems include invasive as well as non-invasive systems being used in various applications such as surgery support or trauma incidences.

Life support systems help in restoring airway, breathing, circulation and thus maintaining patient's homeostasis. It also helps the patients from complications of the underlying disease and its treatment. These devices play an immensely important role in urgent patient management in emergency departments, intensive care units and neonatal intensive care units.

Life support systems consists of basic life support which is provided in situation requiring immediate attention followed by advance life support provided by a trained healthcare professional. Equipment used in the life support systems may be installed one or portable. These systems are used in hospitals, trauma centers, and ambulatory surgical centres or by emergency medical support services.

Life support systems is very painful, expensive and emotionally disturbing experience with no guarantee of body restoration. However, it exposes patients to risk of further medical complications. Intensive monitoring is usually done for the patients associated with life support systems.

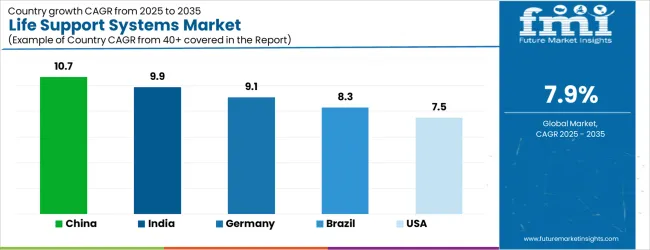

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| Brazil | 8.3% |

| USA | 7.5% |

| UK | 6.7% |

| Japan | 5.9% |

The Life Support Systems Market is expected to register a CAGR of 7.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.7%, followed by India at 9.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.9%, yet still underscores a broadly positive trajectory for the global Life Support Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.1%. The USA Life Support Systems Market is estimated to be valued at USD 3.2 billion in 2025 and is anticipated to reach a valuation of USD 3.2 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 427.9 million and USD 275.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.2 Billion |

| Product Type | Installed and Portable |

| Device Type | Ventilator, Automated External Defibrillator, and Extracorporeal Oxygenator |

| End User | Hospitals, Clinics, Trauma Centers, Ambulatory Surgical Centers, and Emergency Medical Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Philips, GE Healthcare, Medtronic, Resmed, ZOLL Medical, Stryker, Drager Medical, Abbott Laboratories, Physio-Control, Fisher & Paykel, LivaNova, BD, Schiller, Cardiac Science, and Nihon Kohden |

The global life support systems market is estimated to be valued at USD 9.2 billion in 2025.

The market size for the life support systems market is projected to reach USD 19.6 billion by 2035.

The life support systems market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in life support systems market are installed and portable.

In terms of device type, ventilator segment to command 41.0% share in the life support systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Life Science Software Market Size and Share Forecast Outlook 2025 to 2035

Life Sciences Next-generation Customer Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Lifestyle Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Life Science Multichannel Campaign Management Market Size and Share Forecast Outlook 2025 to 2035

Life Sciences Analytics Market Size and Share Forecast Outlook 2025 to 2035

Life Science Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lifestyle Sneakers Industry Analysis in United Kingdom Growth, Trends and Forecast from 2025 to 2035

Life Science and Chemical Instruments Market Analysis - Growth & Forecast 2024 to 2034

Wildlife Tourism Market Size and Share Forecast Outlook 2025 to 2035

Wildlife Health Market Size and Share Forecast Outlook 2025 to 2035

Early Life Nutrition Market Size and Share Forecast Outlook 2025 to 2035

Plant life Extensions (PLEX) and Plant Life Management (PLIM) for Nuclear Reactors Market

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Second-Life Battery Storage Systems Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Contract Lifecycle Management Market Growth – Trends & Forecast 2025 to 2035

Lymphoproliferative Disorder Treatment Market

Agile Application Life-Cycle Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA