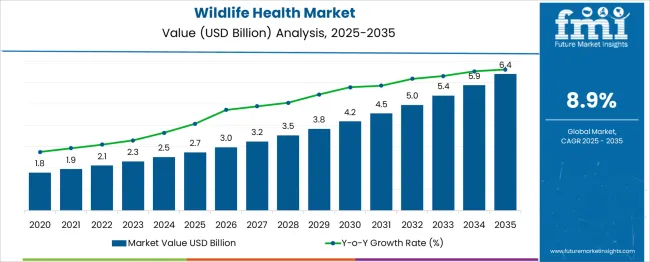

The Wildlife Health Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period. Examining the rolling CAGR over shorter periods within this decade highlights a robust growth trajectory. Between 2025 and 2030, the market expands from USD 2.7 billion to about USD 3.8 billion at a CAGR of 7.4%. This period is driven by increasing efforts to monitor and manage the health of wildlife populations, addressing concerns related to disease outbreaks and ecological balance.

Growing awareness among conservation organizations and government bodies supports steady demand for wildlife health products and services. From 2030 to 2035, the growth rate accelerates, with the market increasing from USD 3.8 billion to USD 6.4 billion, corresponding to a CAGR of approximately 11.6%. This sharper rise is supported by expanded programs for wildlife disease prevention and health monitoring across various regions.

Additionally, increased funding and initiatives aimed at protecting diverse species contribute to stronger market momentum. Replacement and upgrade of health monitoring equipment also play a role in sustaining growth. Overall, the rolling CAGR analysis highlights a dynamic and expanding market, reflecting heightened global attention to wildlife health challenges and ongoing efforts to address them effectively through 2035.

| Metric | Value |

|---|---|

| Wildlife Health Market Estimated Value in (2025 E) | USD 2.7 billion |

| Wildlife Health Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

Growing investments from governmental bodies, conservation agencies, and private stakeholders are fostering the development of advanced health interventions and surveillance systems for wildlife populations.

Increasing awareness of the interconnection between animal health and public health is leading to the prioritization of One Health initiatives, which have further elevated the demand for specialized veterinary care and diagnostics in wild species. The market is also benefiting from the expansion of genomic research, environmental monitoring tools, and disease detection platforms specifically tailored for wildlife.

As climate change alters natural habitats and introduces new threats to animal populations, stakeholders are accelerating efforts to improve early detection, preventive care, and rehabilitation practices. These evolving challenges are paving the way for sustainable solutions, making wildlife health a critical component of global environmental and public health strategy..

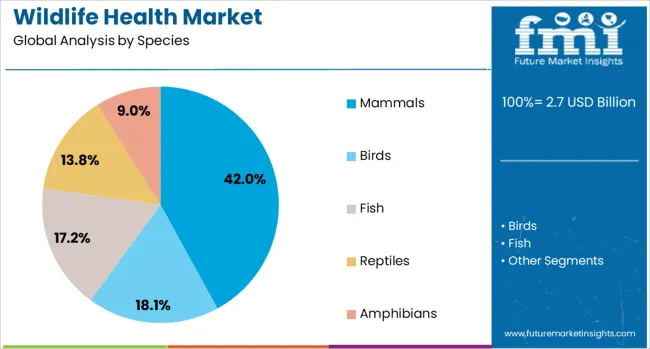

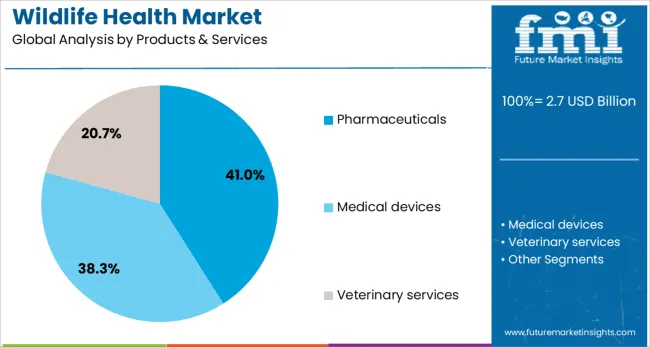

The wildlife health market is segmented by species, products & servicesend-user, and geographic regions. By species of the wildlife health market is divided into Mammals, Birds, Fish, ReptilesAmphibians. In terms of products & services of the wildlife health market is classified into Pharmaceuticals, Medical devicesVeterinary services.

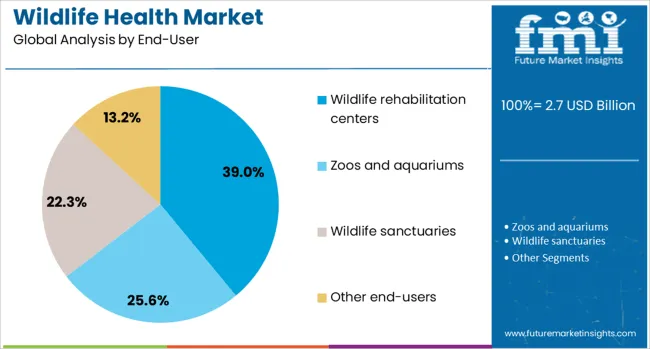

Based on end-user of the wildlife health market is segmented into Wildlife rehabilitation centers, Zoos and aquariums, Wildlife sanctuariesOther end-users. Regionally, the wildlife health industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mammals segment is anticipated to account for 42% of the Wildlife Health market revenue share in 2025, making it the dominant species segment. This growth has been influenced by the high prevalence of health surveillance programs targeting mammalian populations due to their ecological significance and role as carriers of zoonotic diseases. Mammals are more frequently monitored and treated owing to their closer interaction with human environments, which elevates the risk of disease spillover.

Conservation efforts and research funding have increasingly focused on large mammal populations, particularly in biodiversity hotspots, further strengthening the demand for species-specific health protocols. In addition, the growing integration of field diagnostics, telemetry, and AI-powered disease modeling in mammalian studies has enhanced their visibility within the market.

The frequent admission of mammals in wildlife rescue and rehabilitation centers has also driven the segment’s expansion. As ecosystems continue to undergo anthropogenic pressures, safeguarding mammal health has remained a priority within both conservation and public health frameworks..

The pharmaceuticals segment is projected to hold 41% of the Wildlife Health market revenue share in 2025, establishing it as the leading category within products and services. This segment’s growth has been driven by the increased requirement for therapeutic interventions in treating infectious diseases, managing injuries, and supporting recovery in various wildlife species. Pharmaceuticals have played a pivotal role in disease eradication efforts and are commonly utilized in both preventive care and post-rescue treatment.

Advancements in wildlife pharmacology, including species-specific dosage protocols and slow-release formulations, have made pharmaceutical products more effective in field settings. The rise in rehabilitation and relocation programs has also contributed to the demand for reliable medicinal solutions tailored for wild animals.

Regulatory frameworks encouraging ethical treatment and health management of wildlife have supported pharmaceutical development, particularly for non-domesticated species. As more complex health conditions are observed in wild populations, the demand for therapeutic drugs has been further reinforced, positioning pharmaceuticals as a cornerstone in modern wildlife care strategies..

The wildlife rehabilitation centers segment is expected to capture 39% of the Wildlife Health market revenue share in 2025, marking it as the leading end-user category. This growth has been attributed to the central role rehabilitation centers play in the treatment, recovery, and eventual release of injured, orphaned, or ill wildlife. These centers serve as operational hubs for disease diagnostics, nutritional support, and therapeutic care, and are often the first point of contact for distressed animals.

The increase in wildlife injuries due to habitat encroachment, road accidents, and environmental contamination has amplified the need for specialized care facilities. Rehabilitation centers have also expanded their capacity to integrate advanced medical technologies, including imaging, lab testing, and surgical interventions, enhancing their impact on wildlife survival outcomes.

Additionally, public awareness campaigns and volunteer-driven support have led to more community involvement and funding, allowing centers to scale up operations. Their ability to deliver hands-on, responsive care has made them an indispensable part of the wildlife health ecosystem..

The wildlife health market is expanding as global awareness grows about the importance of protecting wild animal populations and ecosystems. Increasing zoonotic disease outbreaks and habitat disruptions highlight the need for veterinary care, diagnostics, and disease management in wildlife. Challenges include limited funding and logistical difficulties in monitoring wild populations. Advances in veterinary biotechnology, remote health monitoring, and conservation initiatives create growth opportunities. Regional focus on biodiversity preservation and government support further fuel market demand in conservation and research applications worldwide.

Emerging infectious diseases that can spread between wildlife, livestock, and humans have increased the importance of wildlife health monitoring. Governments, conservation groups, and research institutions are investing more in vaccination programs, diagnostic tools, and disease surveillance to control outbreaks and protect biodiversity. Early detection and management of diseases such as avian influenza and chronic wasting disease are priorities. Improved understanding of wildlife disease ecology and transmission dynamics is driving demand for specialized veterinary products and services. The need to safeguard endangered species and prevent zoonotic spillovers strengthens the market, especially in regions with rich biodiversity.

Wildlife health initiatives often face funding constraints, limiting the scope and scale of research and intervention programs. Remote habitats and difficult terrain pose logistical challenges for monitoring, capturing, and treating wild animals. Maintaining cold chains for vaccines and diagnostic samples is difficult in field conditions. Skilled personnel shortage and limited infrastructure for wildlife veterinary care complicate efforts. These factors contribute to inconsistent data and delayed responses to health threats. Collaboration among governments, NGOs, and private sectors is essential to overcome these barriers. Innovations in portable diagnostics and remote sensing technology aim to reduce field challenges and improve operational efficiency.

Recent advances in biotechnology, including molecular diagnostics, vaccines, and gene editing, offer promising tools for wildlife disease management. Portable diagnostic devices enable rapid onsite testing, improving response times. Remote health monitoring using GPS collars, drones, and camera traps allows continuous observation of animal behavior and health status without invasive methods. These technologies support early disease detection and population health assessments. Additionally, integration with data analytics and AI enhances understanding of disease patterns and environmental impacts. Expanding conservation programs increasingly incorporate these innovations, creating demand for cutting-edge products and services. Collaborations with academic and research institutions foster ongoing development and application.

Regions with high biodiversity, such as parts of Asia Pacific, Africa, and South America, prioritize wildlife health as part of conservation and sustainable development agendas. Government policies and international agreements focus on protecting endangered species and mitigating human-wildlife conflicts. Funding from environmental organizations supports research and intervention projects. Increasing ecotourism creates economic incentives to maintain healthy wildlife populations. Meanwhile, developed regions invest in advanced wildlife health technologies and rehabilitation centers. Variations in wildlife species and ecosystems require tailored veterinary solutions and region-specific strategies. Companies offering customizable and scalable health products benefit from expanding regional markets driven by conservation priorities.

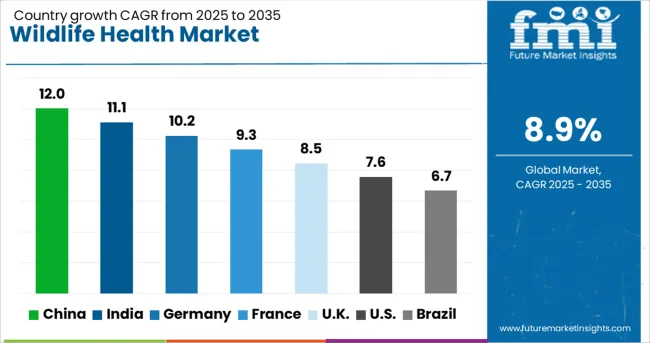

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

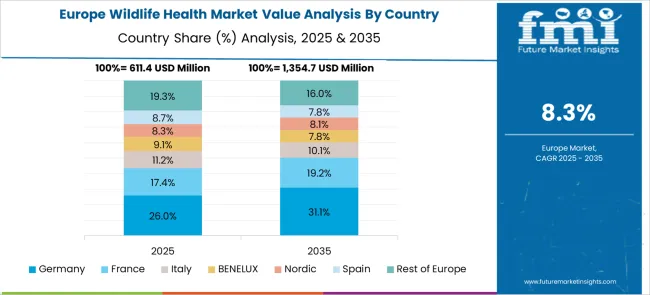

The global wildlife health market is growing strongly at an 8.9% CAGR, supported by key regional players. Among BRICS nations, China leads with 12.0% growth, driven by expanding veterinary healthcare infrastructure and conservation programs. India follows at 11.1%, benefiting from increased government initiatives and rising awareness around wildlife protection. Within the OECD group, Germany contributes 10.2% growth, characterized by strict regulatory enforcement and advanced research activities. The United Kingdom maintains steady growth at 8.5%, focusing on innovation in diagnostics and treatment solutions. The United States, as a mature market, records 7.6% growth, emphasizing regulatory compliance and comprehensive wildlife health management. Together, these countries influence market trends through the development of improved diagnostics, therapeutic products, and monitoring systems. This report includes insights on 40+ countries; the top countries are shown here for reference.

The wildlife health market in China is expanding rapidly with a 12.0% CAGR. This growth is driven by increasing governmental focus on biodiversity conservation and wildlife disease control. Rising awareness of zoonotic diseases and their impact on public health has led to enhanced surveillance and health management programs for wild animals. Investments in research and development are accelerating innovation in vaccines, diagnostics, and treatment solutions tailored for native species. The expansion of protected areas and national parks has increased demand for veterinary services and wildlife health products. Additionally, partnerships between government agencies and private sectors are supporting sustainable wildlife management and health monitoring initiatives.

India’s wildlife health market is growing at an 11.1% CAGR, supported by government initiatives aimed at protecting endangered species and managing wildlife diseases. The country is home to diverse fauna requiring specialized health care and monitoring solutions. Increasing incidences of zoonotic disease outbreaks have prompted enhanced veterinary interventions and public awareness campaigns. Wildlife rehabilitation centers and conservation programs are driving demand for vaccines, medicines, and diagnostic tools. Collaborative efforts between wildlife organizations and research institutions promote advancements in wildlife health technologies. Funding support from international conservation bodies also aids in expanding healthcare infrastructure for wildlife.

The wildlife health market in Germany is growing at a 10.2% CAGR, propelled by strong environmental policies and advanced veterinary research. Germany invests in wildlife disease surveillance and control programs to maintain ecological balance. High awareness of zoonotic risks encourages regular health monitoring and vaccination campaigns for wild animal populations. Germany’s well-established veterinary infrastructure supports wildlife health initiatives with modern diagnostic and treatment technologies. Public and private sector cooperation advances research into emerging wildlife diseases and development of preventive solutions. The market also benefits from integration of digital health tools for remote monitoring and data collection.

The United Kingdom wildlife health market is expanding at an 8.5% CAGR due to increasing conservation activities and disease management programs. Wildlife trusts and governmental agencies are actively involved in monitoring animal health and controlling outbreaks. The market sees demand for vaccines, diagnostic kits, and treatment options tailored for local species. Public education and awareness campaigns promote wildlife health as part of broader environmental conservation goals. The UK is also investing in research collaborations to develop innovative healthcare solutions and improve wildlife rehabilitation techniques. Focus on sustainable practices and ecosystem health further drives market growth.

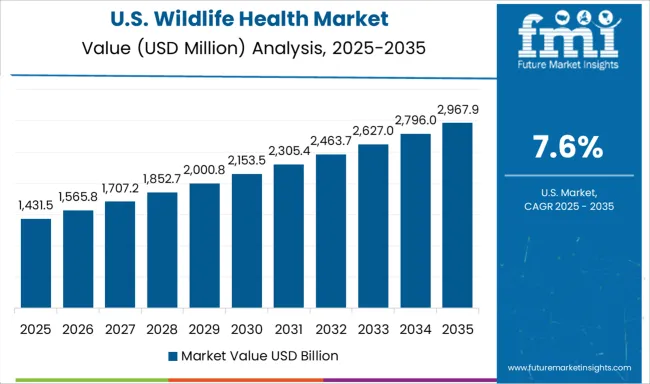

The wildlife health market in the United States is growing at a 7.6% CAGR. Federal and state agencies prioritize wildlife disease surveillance and management to protect biodiversity and public health. The market is driven by demand for vaccines, therapeutics, and diagnostics for wildlife species in national parks and protected areas. Increasing focus on zoonotic disease prevention has accelerated the adoption of advanced health monitoring technologies. Collaborative research programs between government, academia, and private sectors foster development of innovative wildlife health solutions. The market also benefits from strong funding support and public engagement in conservation efforts.

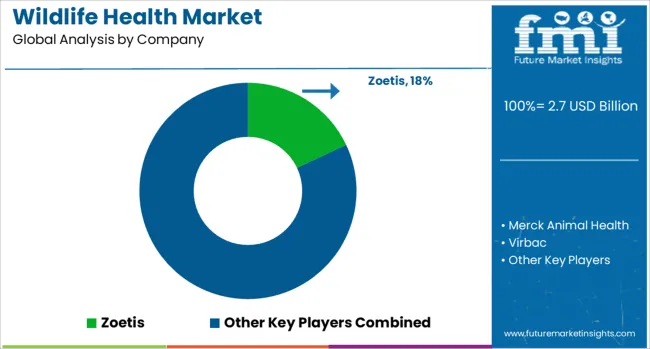

The wildlife health market is led by prominent players such as Zoetis, Merck Animal Health, Virbac, Boehringer Ingelheim, Elanco Animal Health, and Vetoquinol. These companies focus on developing veterinary pharmaceuticals, vaccines, diagnostics, and nutritional supplements aimed at preserving the health of wild animal populations.

Their offerings address a wide range of wildlife diseases and conditions, ensuring healthier ecosystems and supporting biodiversity conservation efforts. The market emphasized treatments for common infectious diseases and parasites that affect wildlife, often relying on established pharmaceutical formulations adapted from livestock health.

However, there is a growing emphasis on specialized solutions tailored specifically for wildlife species, including endangered and protected animals. This shift requires advanced research into species-specific responses and environmental impact, demanding close collaboration with conservation bodies and wildlife organizations. In

According to Zoetis’s official press release dated February 14, 2025, the USA Department of Agriculture’s Center for Veterinary Biologics granted a conditional license for its Avian Influenza Vaccine, H5N2 Subtype (Killed Virus) for use in chickens On March 21, 2025, Zoetis officially announced the launch of the 0.5 mL Vanguard® B Intranasal vaccine for protection against Bordetella bronchiseptica in puppies as young as three weeks old, offering single-nostril administration on their site

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Species | Mammals, Birds, Fish, Reptiles, and Amphibians |

| Products & Services | Pharmaceuticals, Medical devices, and Veterinary services |

| End-User | Wildlife rehabilitation centers, Zoos and aquariums, Wildlife sanctuaries, and Other end-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis, Merck Animal Health, Virbac, Boehringer Ingelheim, Elanco Animal Health, and Vetoquinol |

| Additional Attributes | Dollar sales vary by animal type, with mammals leading and reptiles growing fastest; by end-use, including zoos, sanctuaries, and rehab centers; by product, covering medicines, equipment, and consumables; and by region, led by North America and Asia‑Pacific. Growth stems from zoonotic disease surveillance, technology advancements, and conservation funding. |

The global wildlife health market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the wildlife health market is projected to reach USD 6.4 billion by 2035.

The wildlife health market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in wildlife health market are mammals, birds, fish, reptiles and amphibians.

In terms of products & services, pharmaceuticals segment to command 41.0% share in the wildlife health market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Wildlife Tourism Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Health and Fitness Club Market Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA