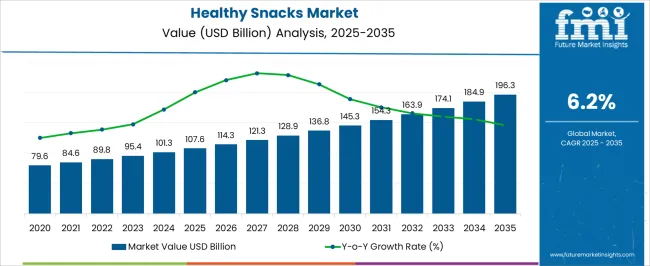

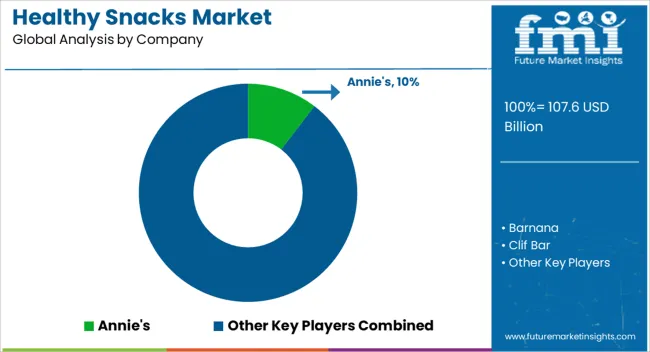

The Healthy Snacks Market is estimated to be valued at USD 107.6 billion in 2025 and is projected to reach USD 196.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. Volume growth remains the primary contributor in the initial half of the period as rising consumer adoption of healthier alternatives fuels consistent demand across diverse regions. Greater urbanization, lifestyle changes, and increasing focus on nutrition drive households to replace conventional processed snacks with options such as protein-enriched bars, baked chips, and dried fruit blends. This volume surge is further enabled by improved retail penetration through supermarkets, specialty health stores, and digital platforms.

Price growth, while less dominant in the early years, gradually assumes greater importance in the latter half of the forecast horizon. Premiumization trends such as the introduction of organic, plant-based, fortified, and functional snacks elevate the market’s average unit price. Companies leverage product innovation and branding strategies to differentiate offerings, capturing higher margins.

By 2030 onward, price-based contributions expand as consumers display a willingness to pay more for perceived quality, health assurance, and sustainable sourcing claims. Overall, the decade-long progression reflects a multiplication factor of 1.82 times, where early expansion stems from volume, while later growth increasingly arises from premium pricing strategies.

| Metric | Value |

|---|---|

| Healthy Snacks Market Estimated Value in (2025 E) | USD 107.6 billion |

| Healthy Snacks Market Forecast Value in (2035 F) | USD 196.3 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The healthy snacks market is driven by five primary parent markets with specific shares. Packaged food leads with 35%, as manufacturers introduce nutrient-rich alternatives to traditional snacks. Functional food products contribute 25%, offering snacks fortified with protein, fiber, and vitamins. Beverages represent 15%, with on-the-go healthy drinkable snacks gaining popularity. Bakery and confectionery account for 15%, reformulated with natural sweeteners, whole grains, and reduced fats. Retail and e-commerce distribution holds 10%, expanding access and variety for consumers worldwide. These parent markets collectively shape demand and innovation, positioning healthy snacks as a major segment within the global food industry. Recent developments in the healthy snacks market emphasize natural ingredients, convenience, and sustainability. Companies are launching plant-based protein bars, fruit and nut mixes, and low-sugar alternatives to meet changing dietary preferences. Innovations in packaging focus on portion control, eco-friendly materials, and resealable options for convenience. Functional additives such as probiotics, adaptogens, and superfoods are gaining traction in new product formulations. Growth in online retail channels and subscription services is expanding consumer reach.

The healthy snacks market is experiencing strong growth momentum, driven by increased consumer awareness regarding nutritional intake, lifestyle-related health concerns, and the demand for clean-label, convenient food products. Shifts in eating patterns toward frequent, smaller meals have intensified the consumption of snack items perceived as healthy alternatives to traditional processed snacks.

Market players are responding with innovative product formulations featuring natural ingredients, reduced sugar content, and functional benefits such as added protein or fiber. The rising influence of wellness trends, especially among urban millennials and Gen Z consumers, is further fueling demand.

Growth is anticipated to continue due to expanding product availability, broader retail access, and the integration of sustainable and plant-based ingredients. The combination of on-the-go convenience and health-conscious appeal positions the healthy snacks market for sustained relevance and profitability.

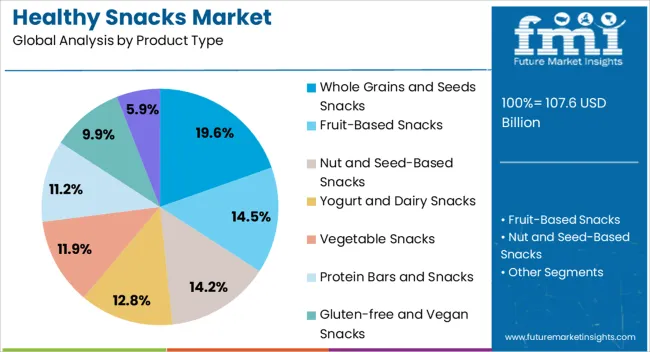

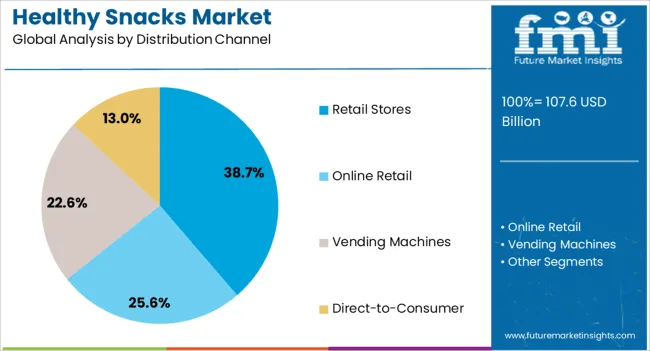

The healthy snacks market is segmented by product type, distribution channel, and geographic regions. By product type, healthy snacks market is divided into Whole Grains and Seeds Snacks, Fruit-Based Snacks, Nut and Seed-Based Snacks, Yogurt and Dairy Snacks, Vegetable Snacks, Protein Bars and Snacks, Gluten-free and Vegan Snacks, and Others. In terms of distribution channel, healthy snacks market is classified into Retail Stores, Online Retail, Vending Machines, and Direct-to-Consumer.

Regionally, the healthy snacks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The whole grains and seeds snacks segment accounted for 20% of the healthy snacks market, reflecting growing consumer preference for fiber-rich, minimally processed snack options that support digestive health and long-term wellness. These products are favored for their natural nutrient content and ability to deliver sustained energy without compromising taste or convenience.

Manufacturers are enhancing this segment by incorporating superfoods such as chia, flax, and quinoa into snack bars, crackers, and trail mixes. The clean-label movement has further amplified demand, as consumers seek recognizable, plant-based ingredients with transparent sourcing.

Increasing research around the health benefits of whole grains and seeds has positively influenced purchasing behavior. As snacking becomes a part of daily dietary routines, this segment is expected to expand steadily, driven by the dual appeal of functional nutrition and wholesome indulgence.

The retail stores segment holds a leading 39% share within the distribution channel category, driven by its widespread accessibility, established infrastructure, and consumer preference for physical product selection. Brick-and-mortar retail outlets, including supermarkets, convenience stores, and specialty health food shops, remain the primary purchasing point for healthy snacks, particularly in urban and suburban areas.

In-store visibility and promotional activities play a crucial role in influencing consumer choices, especially for new or seasonal product launches. Additionally, retail formats support impulse buying behavior and allow for sampling, which enhances consumer engagement and trial.

Despite the growth of e-commerce, retail stores continue to dominate in markets where consumers value immediate availability and product transparency. The segment is expected to retain its dominance as retailers invest in health-focused assortments, private-label offerings, and dedicated wellness aisles to meet evolving consumer expectations.

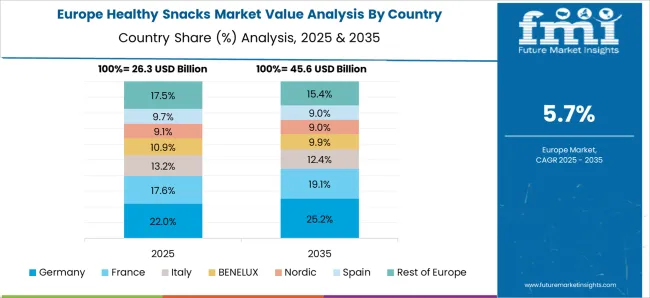

The global healthy snacks market is growing due to rising demand for convenient, nutritious, and clean-label food products. Asia Pacific holds more than 35% of consumption, supported by urbanization and changing dietary preferences in China and India. North America and Europe emphasize protein-rich, gluten-free, and plant-based snack products. Product innovation in granola bars, dried fruits, functional nuts, and low-sugar beverages drives market expansion. E-commerce platforms and retail chains are improving accessibility. Rising consumer awareness of obesity, diabetes, and lifestyle-related conditions is fueling consistent demand worldwide.

The primary driver of the healthy snacks market is consumer preference for convenient, nutritious, and portion-controlled foods. Rising incidence of obesity and diabetes has increased demand for snacks with reduced sugar, salt, and artificial additives. Protein bars, yogurt-based snacks, roasted nuts, and functional beverages are experiencing annual growth of 7–9%. North America emphasizes plant-based protein snacks, while Europe focuses on organic and gluten-free alternatives. Asia Pacific growth is driven by rapid urbanization and demand for on-the-go packaged foods. Retailers and supermarkets dedicate more shelf space to healthy snacks, while online channels expand availability, driving growth in both developed and emerging markets.

Opportunities in the healthy snacks market are linked to plant-based innovation and digital retail growth. Plant protein bars, pea-based crisps, and dairy-free yogurt snacks are gaining traction among vegan and lactose-intolerant consumers. E-commerce sales of healthy snacks have risen by 12–15% annually due to subscription models and convenient home delivery. Asia Pacific presents measurable opportunities with its growing middle-class population and evolving dietary patterns. Functional snacks enriched with probiotics, vitamins, and minerals create additional value propositions. Manufacturers investing in eco-friendly packaging, clean-label formulations, and personalized nutrition solutions can capture larger market share across global consumer segments seeking healthier alternatives.

Key trends in the healthy snacks market include functional ingredient integration, clean-label positioning, and sustainable packaging. Ingredients such as probiotics, antioxidants, and plant proteins are being added to enhance nutritional benefits. Minimally processed and gluten-free snacks are increasingly favored by health-conscious consumers. Asia Pacific growth is supported by the popularity of fruit-based snacks, while North America emphasizes keto-friendly and high-protein products. Europe leads in organic and environmentally certified packaging adoption. The rising use of biodegradable wrappers, recyclable cartons, and digital traceability tools reflects a shift toward eco-conscious consumer behavior. This aligns with growing preference for sustainable and functional nutrition worldwide.

Despite strong growth, the healthy snacks market faces restraints from high prices and raw material supply challenges. Premium ingredients such as nuts, organic fruits, and plant proteins increase production costs by 20–30%, making healthy snacks less affordable in price-sensitive regions. Seasonal dependency of fruits and nuts leads to supply volatility, impacting product consistency. Regulatory compliance for organic and clean-label certifications increases costs and operational complexity. Shelf-life limitations of minimally processed snacks add logistical challenges. Manufacturers must focus on cost optimization, alternative ingredient sourcing, and improved packaging solutions to maintain affordability and reliability while meeting global consumer demand for healthy options.

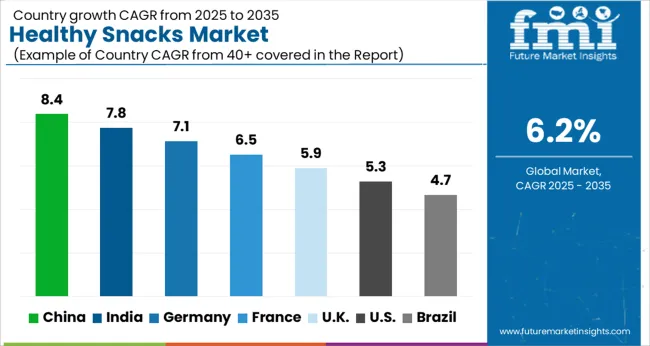

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

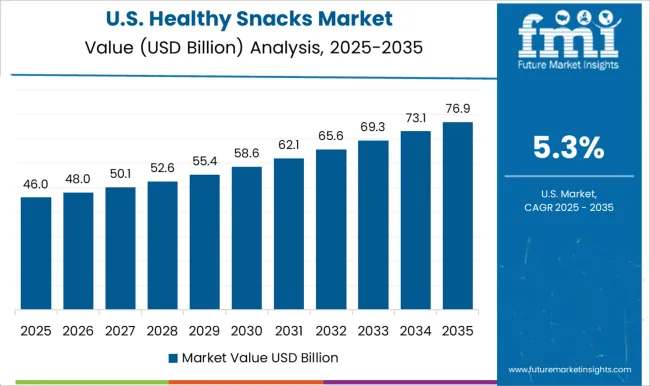

| USA | 5.3% |

| Brazil | 4.7% |

The healthy snacks market is forecast to expand at a global CAGR of 6.2% through 2035, propelled by changing dietary patterns, convenience-driven consumption, and rising health awareness. China records the strongest growth at 8.4%, a 1.35× multiple of the global rate, supported by BRICS-driven demand for functional foods, online retail expansion, and premium product offerings. India follows with 7.8%, a 1.26× multiple, reflecting urban consumption shifts, wider product availability, and a strong presence of regional brands. Germany reaches 7.1%, a 1.15× multiple, shaped by OECD-backed emphasis on organic labeling, stricter nutritional regulations, and innovation in plant-based formats. The United Kingdom posts 5.9%, just below the global average, influenced by consumer preference for portion-controlled packs and natural ingredients. The United States shows 5.3%, 0.85× of the benchmark, with demand driven by protein-rich snacks, functional bars, and clean-label products. BRICS markets lead with strong expansion in retail penetration, OECD countries strengthen the market with innovation and compliance standards, while ASEAN adds momentum through youth-driven consumption. This report includes insights on 40+ countries; the top markets are shown here for reference.

The healthy snacks market in China is projected to expand at a CAGR of 8.4%, supported by increasing awareness of balanced diets and preference for nutrient-rich packaged products. Domestic companies and global players are investing in baked chips, protein bars, nuts, and fruit-based snacks that are marketed as functional and convenient. E-commerce platforms play a central role in distribution, with digital promotions targeting younger demographics and urban families. Consumers are showing a preference for clean-label products, portion-controlled packs, and functional ingredients such as probiotics. International brands are competing with local producers by introducing flavor innovations and premium segments, while domestic firms emphasize affordability and locally sourced raw materials.

The healthy snacks market in India is forecast to grow at a CAGR of 7.8%, with consumer demand shaped by rising interest in functional foods, plant-based proteins, and low-fat snacks. Regional players are innovating with millet-based, chickpea-based, and seed-based snacks that cater to traditional taste preferences while offering nutritional benefits. Distribution through supermarkets and quick-commerce platforms has improved product reach, particularly in urban centers. Startups are entering the segment with premium protein snacks, fortified beverages, and gluten-free products, challenging established packaged food companies. Government support for food processing and value-added agriculture provides momentum for manufacturers to scale production. Affordability and flavor diversity remain important in attracting middle-income consumers.

The healthy snacks market in Germany is expected to expand at a CAGR of 7.1%, supported by strong consumer interest in plant-based and clean-label food categories. Demand is concentrated in protein bars, nut mixes, yogurt-based snacks, and functional beverages marketed for fitness and wellness. German retailers are dedicating greater shelf space to organic and fortified snack products, while private labels are expanding their presence. Innovation focuses on plant-based protein sources, sugar reduction, and environmentally conscious packaging. Premiumization is evident, with consumers willing to pay more for high-quality and traceable ingredients. Startups and established brands are introducing novel formats to attract health-conscious consumers across both urban and rural areas.

The healthy snacks market in the United Kingdom is forecast to grow at a CAGR of 5.9%, supported by rising consumer focus on portion-controlled and low-calorie products. Demand is concentrated in cereal bars, baked crisps, fruit snacks, and protein-enriched options. Retailers are introducing more private-label healthy snacks, intensifying competition with multinational food brands. Innovation is focusing on plant-based formulations, natural flavoring, and reformulation of traditional products into healthier versions. E-commerce channels, particularly direct-to-consumer websites and grocery delivery platforms, are gaining traction. Government campaigns promoting healthier eating habits are expected to encourage further product adoption, while manufacturers are focusing on value-for-money offerings.

The healthy snacks market in the United States is projected to grow at a CAGR of 5.3%, driven by interest in functional nutrition, weight management, and clean-label snacks. Demand is concentrated in protein bars, nut-based snacks, fruit snacks, and low-sugar alternatives. Leading companies such as Mondelez, Kellogg, and PepsiCo are reformulating products with reduced sugar, added protein, and gluten-free claims. Distribution is shifting toward e-commerce and convenience stores, which cater to on-the-go consumers. Plant-based and keto-friendly snack innovations are becoming mainstream, supported by lifestyle-driven purchasing. Premium brands are expanding into retail chains, while private labels are attracting cost-sensitive buyers. The market focus remains on health, convenience, and taste balance.

Competition in the healthy snacks sector focuses on natural ingredients, functional nutrition, and consumer-friendly formats that cater to rising demand for convenient yet wholesome options. Annie’s has built a reputation for organic snack products designed to appeal to both children and adults seeking better-for-you choices. Barnana specializes in upcycled banana-based snacks that promote clean eating while addressing food waste. Clif Bar remains one of the most recognized names in energy bars, offering products made with organic ingredients that target athletes and active consumers. Graze delivers personalized snack boxes with portion-controlled options, expanding the reach of healthier alternatives to mainstream snacking habits. Health Warrior, now part of PepsiCo, provides chia-based bars and snacks rich in plant-based nutrition. KIND Snacks emphasizes simple, transparent ingredients with nut-based bars that have gained global recognition. LesserEvil Snacks focuses on minimally processed, organic popcorn and puffed snacks that highlight clean-label formulations. Navitas Organics supplies nutrient-dense superfood snacks using ingredients like cacao, goji berries, and chia seeds.

Nature’s Bakery is known for fig bars and baked snack products that appeal to families seeking balanced, portable options. Peeled Snacks delivers dried fruit snacks free from added sugars, aligning with clean eating trends. Quest Nutrition has gained traction with high-protein, low-sugar snacks, particularly among fitness-focused consumers. Rhythm Superfoods specializes in plant-based snacks, such as kale chips, while RXBAR differentiates itself with protein bars that clearly list simple ingredients on the front of the packaging. Together, these companies shape a competitive landscape centered on nutrition, convenience, and transparency of ingredients.

| Item | Value |

|---|---|

| Quantitative Units | USD 107.6 Billion |

| Product Type | Whole Grains and Seeds Snacks, Fruit-Based Snacks, Nut and Seed-Based Snacks, Yogurt and Dairy Snacks, Vegetable Snacks, Protein Bars and Snacks, Gluten-free and Vegan Snacks, and Others |

| Distribution Channel | Retail Stores, Online Retail, Vending Machines, and Direct-to-Consumer |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Annie's, Barnana, Clif Bar, Graze, Health Warrior, KIND Snacks, LesserEvil Snacks, Navitas Organics, Nature's Bakery, Peeled Snacks, Quest Nutrition, Rhythm Superfoods, and RXBAR |

| Additional Attributes | Dollar sales by snack type and end use, demand dynamics across retail, foodservice, and online channels, regional trends in health-conscious consumption, innovation in functional ingredients, portion control, and packaging, environmental impact of sourcing and waste, and emerging use cases in plant-based, protein-rich, and on-the-go nutrition products. |

The global healthy snacks market is estimated to be valued at USD 107.6 billion in 2025.

The market size for the healthy snacks market is projected to reach USD 196.3 billion by 2035.

The healthy snacks market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in healthy snacks market are whole grains and seeds snacks, fruit-based snacks, nut and seed-based snacks, yogurt and dairy snacks, vegetable snacks, protein bars and snacks, gluten-free and vegan snacks and others.

In terms of distribution channel, retail stores segment to command 38.7% share in the healthy snacks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthy Fat-Free Snacks Market Insights – Growth & Consumer Shifts 2025 to 2035

Healthy Fats Low Carb Market Trends - Demand & Consumer Shifts 2025 to 2035

Healthy Low-Fat Desserts Market Growth – Innovations & Trends 2025 to 2035

Healthy Takeout Market Trends - Convenience & Clean Eating Growth 2025 to 2035

Healthy Food Market – Trends, Demand & Consumer Shifts

Healthy Aging Supplement Market – Demand, Innovations & Market Growth

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

Kid Snacks Market Analysis by Source, Type, and Distribution Channel Through 2035

Pet Snacks and Treats Market Analysis by Product, Pet Type, Distribution Channel, and Region Through 2035

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Protein Snacks Market Growth - Demand, Trends & Industry Forecast 2025 to 2035

Extruded Snacks Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Pregnancy Snacks Market Analysis by Product Type, Nutritional Content, Distribution Channel, Packaging Format and Stage of Pregnancy Flavors Through 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA