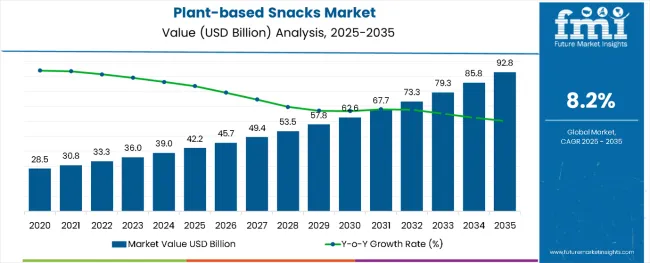

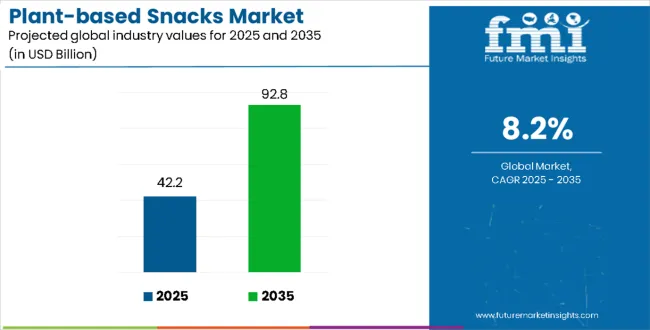

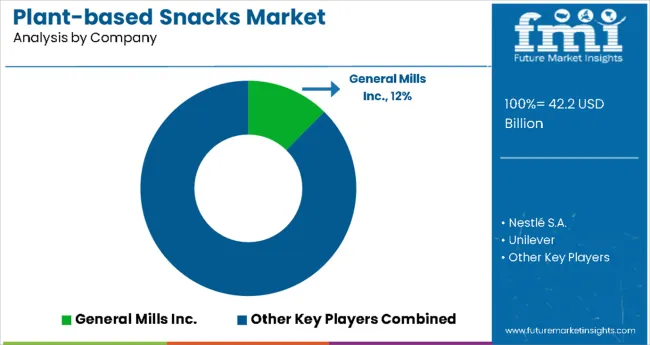

The global plant-based snacks market is valued at USD 42.2 billion in 2025 and is slated to reach USD 92.8 billion by 2035, recording an absolute increase of USD 50.7 billion over the forecast period. This translates into a total growth of 120.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8.2% between 2025 and 2035.

Plant-based Snacks Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 42.2 billion |

| Forecast Value in (2035F) | USD 92.8 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The overall market size is expected to grow by nearly 2.2X during the same period, supported by increasing consumer awareness about health benefits, rising demand for sustainable food options, and growing focus on plant-based nutrition and ethical consumption.

Between 2025 and 2030, the plant-based snacks market is projected to expand from USD 42.2 billion to USD 62.8 billion, resulting in a value increase of USD 20.6 billion, which represents 40.6% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer awareness about health and sustainability benefits, increasing demand for natural and organic formulations, and growing penetration of plant-based products in mainstream retail channels. Food manufacturers are expanding their plant-based snack portfolios to address the growing demand for nutritious and sustainable snacking solutions.

From 2030 to 2035, the market is forecast to grow from USD 62.8 billion to USD 92.8 billion, adding another USD 30.1 billion, which constitutes 59.4% of the overall ten-year expansion. This period is expected to be characterized by expansion of e-commerce channels, integration of advanced processing technologies in formulations, and development of personalized nutrition solutions. The growing adoption of clean label trends and nutritionist-recommended products will drive demand for premium plant-based snacks with enhanced nutritional profiles and sustainability credentials.

Between 2020 and 2025, the plant-based snacks market experienced robust expansion, driven by increasing consumer focus on health-conscious eating and growing awareness of environmental sustainability. The market developed as food brands recognized the need for nutritious snacking alternatives to address wellness concerns and environmental impact. Social media influence and nutritionist recommendations began emphasizing the importance of plant-based nutrition in daily dietary routines for maintaining optimal health and supporting sustainable food systems.

The decade ahead is transformative for plant-based snacks. Consumers are seeking healthier, sustainable, and convenient alternatives to traditional snacks. Policymakers are reinforcing this with nutrition labeling and sugar/fat reduction mandates, while innovators push the boundaries with functional ingredients and new formats. Together, these forces create eight powerful growth pathways, unlocking USD 90-120 billion in incremental revenue by 2035.

Pathway A - Clean Label & Ingredient Innovation.

Novel plant proteins such as pea, lentil, and chickpea are redefining taste and texture. Organic, non-GMO, and allergen-free claims meet the rising demand for clean-label products. Expected revenue pool: USD 12-18 billion.

Pathway B - Functional & Health-Oriented Snacking.

Snacks fortified with protein, fibre, probiotics, or reduced sugar reposition plant-based products as wellness tools. Target groups include athletes, weight managers, and health-conscious consumers. Opportunity size: USD 10-15 billion.

Pathway C - Format & Application Diversification.

Expansion beyond bars and chips into jerky, dips, coated snacks, frozen products, and ready-to-eat kits broadens usage occasions. Incremental pool: USD 8-12 billion.

Pathway D - Emerging Market Penetration & Localisation.

Asia-Pacific, Latin America, and Africa are poised for rapid uptake. Local sourcing of raw materials and flavour adaptation drive affordability and consumer acceptance. Expected upside: USD 15 to 20 billion.

Pathway E - Sustainability & ESG Monetization.

Sustainable farming practices, recyclable packaging, and carbon-reduction claims resonate with ESG-focused buyers and institutions. Additional value: USD 8-12 billion.

Pathway F - Brand & Premium Positioning.

Premiumisation through gourmet flavours, exotic botanicals, and artisan blends elevates plant-based snacks beyond “healthy alternatives.” Incremental revenue: USD 6-10 billion.

Pathway G - Digital & Subscription Models.

Direct-to-consumer platforms, snack subscription boxes, and wellness bundling strengthen consumer relationships and recurring revenues. Smaller but fast-growing pool: USD 5-8 billion.

Pathway H - Regulatory & Policy Tailwinds.

Sugar/fat reduction mandates, stricter labelling rules, and public procurement programs (schools, hospitals) accelerate adoption. Potential upside: USD 6-9 billion.

Market expansion is being supported by the increasing consumer awareness about the health benefits of plant-based nutrition and the corresponding demand for sustainable snacking options. Modern consumers are increasingly focused on clean eating practices that can support overall wellness, weight management, and environmental sustainability. Plant-based snacks' proven benefits in providing essential nutrients while reducing environmental footprint make them a preferred choice in health-conscious snacking formulations.

The growing emphasis on clean label and natural ingredients is driving demand for plant-based snack products derived from whole food sources such as fruits, nuts, grains, and vegetables. Consumer preference for multifunctional products that combine nutritional benefits with taste satisfaction and convenience is creating opportunities for innovative formulations. The rising influence of social media wellness trends and nutritionist recommendations is also contributing to increased product adoption across different age groups and demographics.

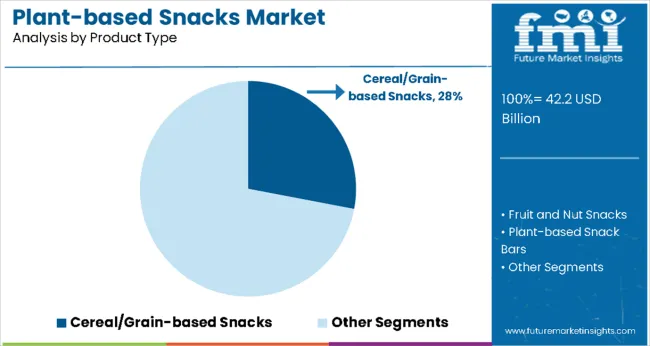

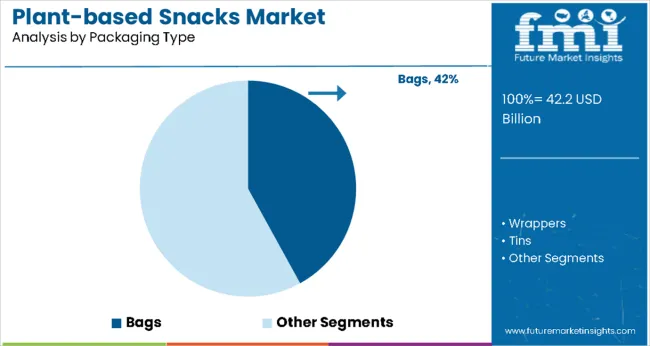

The market is segmented by product type, packaging, flavor, and distribution channel. By product type, the market is divided into cereal/grain-based snacks, fruit and nut snacks, plant-based snack bars, meat alternative snacks, wafers, and others. Based on packaging, the market is categorized into bags, wrappers, tins, and antiseptic packaging.

In terms of flavor, the market is segmented into savory and sweet varieties. By distribution channel, the market is classified into indirect and direct channels, with indirect channels including hypermarkets/supermarkets, online retailers, convenience stores, specialty stores, grocery stores, and independent retailers.

The cereal/grain-based snacks segment is projected to account for 28.0% of the plant-based snacks market in 2025, reaffirming its position as the category's leading product type. Consumers increasingly understand the nutritional benefits of whole grains, including fiber content, protein, and essential vitamins and minerals that support digestive health and sustained energy levels. Cereal and grain-based snacks' versatility in flavor profiles and convenience factor directly address modern snacking preferences by offering wholesome nutrition in portable formats.

This segment forms the foundation of most product positioning, as it represents the most accessible and familiar form of plant-based snacking for mainstream consumers. Nutritionist endorsements and ongoing research validation continue to strengthen trust in grain-based formulations. With consumer lifestyles demanding convenient yet nutritious snacking options, cereal/grain-based snacks align with both health-conscious and practical snacking goals. Their broad appeal across demographics ensures sustained dominance, making them the central growth driver of plant-based snack demand.

Bags are projected to represent 42.0% of plant-based snack packaging demand in 2025, underscoring their role as the preferred packaging format for convenient snack consumption. Consumers gravitate toward bag packaging for its portability, resealability, and ability to preserve product freshness while offering clear product visibility and branding opportunities. Positioned as practical and cost-effective packaging solutions, bags offer both functionality for on-the-go consumption and sustainability benefits through recyclable material options.

The segment is supported by the rising popularity of portion-controlled snacking, where bags play a central role in providing appropriate serving sizes. Additionally, brands are increasingly utilizing innovative bag designs with sustainable materials, enhanced barrier properties, and eye-catching graphics, enhancing appeal and justifying premium positioning. As convenience-focused consumers prioritize portable and fresh snacking experiences, bag packaging will continue to dominate demand, reinforcing its practical positioning within the plant-based snacks market.

The plant-based snacks market is advancing rapidly due to increasing consumer awareness about health and wellness and growing demand for sustainable food options. However, the market faces challenges including ingredient sourcing complexities, taste and texture optimization issues, and competition from traditional snack categories. Innovation in processing technologies and sustainable sourcing practices continue to influence product development and market expansion patterns.

Expansion of E-commerce and Direct-to-Consumer Channels

The growing adoption of e-commerce platforms is enabling brands to reach consumers directly and provide personalized nutrition recommendations. Online channels offer convenience, detailed product information, and customer reviews that influence purchasing decisions. Social media marketing and influencer partnerships are driving brand awareness and product adoption, particularly among younger demographics who prefer online shopping experiences and value transparency in food sourcing.

Integration of Advanced Processing Technologies and Formulation Innovation

Modern plant-based snack manufacturers are incorporating advanced processing technologies such as air-drying, freeze-drying, and high-pressure processing to enhance nutritional retention and extend shelf life. These technologies improve the taste and texture of plant-based snacks while maintaining nutritional integrity and providing better consumer experience. Advanced formulation techniques also enable combination products that deliver multiple nutritional benefits and satisfy diverse taste preferences in single applications.

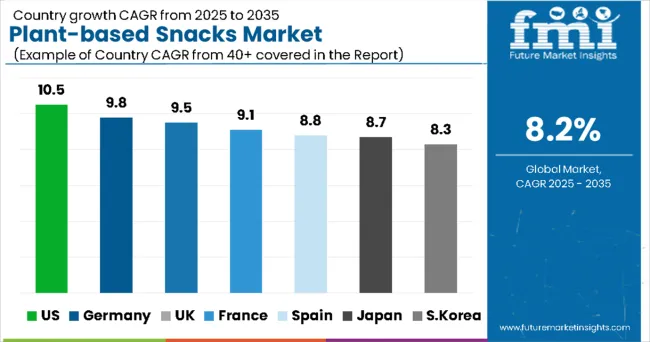

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 10.5% |

| Germany | 9.8% |

| UK | 9.5% |

| France | 9.1% |

| Spain | 8.8% |

| Japan | 8.7% |

| South Korea | 8.3% |

The plant-based snacks market is experiencing robust growth globally, with the United States leading at a 10.5% CAGR through 2035, driven by strong health and wellness trends, increasing consumer awareness of sustainable eating, and growing penetration of plant-based products in mainstream retail.

Germany follows at 9.8%, supported by strong organic food culture, environmental consciousness, and increasing demand for premium healthy snacks. The UK shows steady growth at 9.5%, emphasizing clean eating trends and sustainability-focused consumption. France records 9.1%, focusing on gourmet plant-based formulations and premium positioning. Spain shows 8.8% growth, prioritizing Mediterranean diet integration and healthy snacking practices.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from plant-based snacks in the United States is projected to exhibit strong growth with a CAGR of 10.5% through 2035, driven by rapid adoption of health-conscious eating habits among consumers and increasing influence of wellness trends on snacking choices.

The country's expanding health-aware population and growing sustainability consciousness are creating significant demand for nutritious and environmentally friendly snack products. Major food manufacturers and emerging brands are establishing comprehensive distribution networks to serve the growing population of health-conscious consumers across urban and suburban markets.

Revenue from plant-based snacks in Germany is expanding at a CAGR of 9.8%, supported by strong organic food culture, environmental awareness, and rising demand for sustainable food options. The country's health-conscious demographic profile and increasing focus on sustainable consumption are driving demand for premium plant-based snacking solutions. International food brands and domestic manufacturers are establishing distribution channels to serve the growing demand for organic and environmentally responsible snack products.

Demand for plant-based snacks in the UK is projected to grow at a CAGR of 9.5%, supported by consumer preference for healthy snacking options and environmentally conscious food choices. British consumers are increasingly focused on nutritional transparency, product efficacy, and sustainable food practices. The market is characterized by strong demand for premium formulations that combine plant-based nutrition with innovative flavors and convenient packaging formats.

Revenue from plant-based snacks in France is projected to grow at a CAGR of 9.1% through 2035, driven by the country's strong focus on food quality, gourmet positioning, and consumer preference for premium food experiences. French consumers consistently demand high-quality, artisanal products that deliver exceptional taste while maintaining nutritional benefits.

Revenue from plant-based snacks in Spain is projected to grow at a CAGR of 8.8% through 2035, supported by integration with traditional Mediterranean diet principles and rising consumer interest in healthy snacking alternatives. Spanish consumers value natural ingredients, traditional food preparation methods, and nutritional authenticity, positioning plant-based snacks as a natural extension of Mediterranean eating patterns.

Revenue from plant-based snacks in Japan is projected to grow at a CAGR of 8.7% through 2035, supported by the country's strong emphasis on food quality, innovation, and health-conscious eating habits. Japanese consumers prioritize nutritional density, natural ingredients, and functional food benefits, making plant-based snacks a trusted choice in the premium healthy snacking segment.

Revenue from plant-based snacks in South Korea is projected to grow at a CAGR of 8.3% through 2035, supported by the country's strong emphasis on wellness culture, beauty-from-within trends, and consumer preference for functional food products. Korean consumers prioritize nutritional benefits, natural ingredients, and innovative food technologies, making plant-based snacks a trusted choice in the premium healthy lifestyle segment.

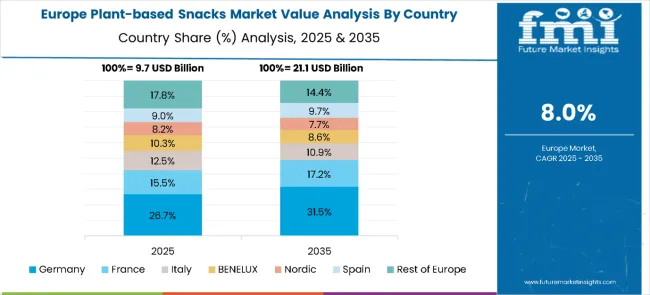

The plant-based snacks market in Europe is projected to grow from USD 9.1 billion in 2025 to USD 20.0 billion by 2035, registering a CAGR of 8.2% over the forecast period. Germany will continue to lead the regional market, accounting for 23.5% in 2025 and rising slightly to 24.1% by 2035, supported by a large health-conscious consumer base, strong organic retail channels, and innovation from domestic food brands. The United Kingdom follows with 18.9% in 2025, increasing to 19.7% by 2035, driven by rapid adoption of clean-label products, DTC/e-commerce penetration, and ongoing product innovation.

France holds 16.3% in 2025, edging up to 16.6% by 2035 as premium and gourmet plant-based snack formulations gain traction among quality-seeking consumers. Italy contributes 11.8% in 2025, remaining broadly stable at 11.6% by 2035, supported by Mediterranean ingredient adjacencies and growing premium snack launches.

Spain represents 8.9% in 2025, easing slightly to 8.6% by 2035, while the Rest of Europe (Nordic, BENELUX, Eastern Europe and smaller markets) accounts for the remainder, moderating from 20.6% in 2025 to 19.4% by 2035 as larger Western markets capture a greater share of premium and mainstream plant-based snack demand.

The plant-based snacks market is characterized by competition among established food manufacturers, specialty health food companies, and emerging plant-based brands. Companies are investing in advanced processing technologies, sustainable sourcing practices, premium packaging, and digital marketing strategies to deliver nutritious, appealing, and accessible plant-based snacking solutions. Brand positioning, ingredient innovation, and channel expansion are central to strengthening product portfolios and market presence.

General Mills Inc. leads the market with 12.4% global value share, offering diverse plant-based snack formulations with a focus on nutritional benefits and taste satisfaction. Nestlé S.A. provides comprehensive plant-based product ranges with emphasis on quality ingredients and global distribution. Unilever delivers sustainable and health-focused formulations with strong brand recognition and consumer trust. The Hain Celestial Group focuses on organic and natural plant-based snacking solutions with premium positioning.

Danone and Beyond Meat Inc., operating globally, provide innovative plant-based product ranges across multiple price points and distribution channels. Kellogg Company emphasizes nutritional benefits and convenient packaging with mainstream market appeal. Mondelez International offers premium plant-based snack solutions with focus on taste innovation and global reach. PepsiCo Inc. and Kind LLC provide specialized healthy snacking solutions with focus on specific nutritional benefits and natural ingredient preferences.

The rise of plant-based snacks, fueled by shifting consumer diets, ESG-linked food strategies, and digital retail expansion, will not only accelerate healthier eating habits but also strengthen food security and climate resilience. It will consolidate emerging regions as hubs for sustainable ingredient sourcing (legumes, pulses, fruits, nuts) and align advanced economies with clean-label, low-carbon snacking. This calls for a concerted effort by all stakeholders: governments, industry bodies, suppliers, OEMs, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 42.2 Billion |

| Product Type | Cereal/grain-based snacks, Fruit and nut snacks, Plant-based snack bars, Meat alternative snacks, Wafers, Others |

| Packaging | Bags, Wrappers, Tins, Antiseptic |

| Flavor | Savory, Sweet |

| Distribution Channel | Indirect, Direct |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, Japan, South Korea, Spain, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | General Mills Inc., Nestlé S.A., Unilever, The Hain Celestial Group, Danone, Beyond Meat Inc., Kellogg Company, Mondelez International, PepsiCo Inc., and Kind LLC |

| Additional Attributes | Dollar sales by product type and packaging format, regional demand trends, competitive landscape, buyer preferences for organic versus conventional sources, integration with health/wellness positioning, innovations in processing technology, sustainable packaging, and clean label formulations |

The global plant-based snacks market is expected to grow at a CAGR of 8.2% during the forecast period of 2025 to 2035.

The market is projected to reach a value of approximately USD 92.9 billion by 2035.

The plant-based snack bars segment is anticipated to witness the highest growth rate, driven by increasing consumer demand for convenient and nutritious snack options.

Key drivers include rising health consciousness, increasing adoption of vegan and vegetarian diets, and growing awareness of environmental sustainability.

Major players in the market include Amy's Kitchen Inc., Beyond Meat Inc., Danone S.A., Hain Celestial Group, Inc., Nestlé S.A., and PepsiCo, Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Plant-based Snacks in EU Size and Share Forecast Outlook 2025 to 2035

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

Kid Snacks Market Analysis by Source, Type, and Distribution Channel Through 2035

Pet Snacks and Treats Market Analysis by Product, Pet Type, Distribution Channel, and Region Through 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Snacks Market Trends – Protein-Packed & Industry Growth 2024-2034

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

Protein Snacks Market Growth - Demand, Trends & Industry Forecast 2025 to 2035

Extruded Snacks Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Pregnancy Snacks Market Analysis by Product Type, Nutritional Content, Distribution Channel, Packaging Format and Stage of Pregnancy Flavors Through 2035

Dog Food and Snacks Market Size and Share Forecast Outlook 2025 to 2035

Insect-Based Snacks Market Analysis - Size, Share & Forecast 2025 to 2035

Refrigerated Snacks Market Trends - Healthy & Fresh Innovations 2025 to 2035

Better for You Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mushroom-Based Snacks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA