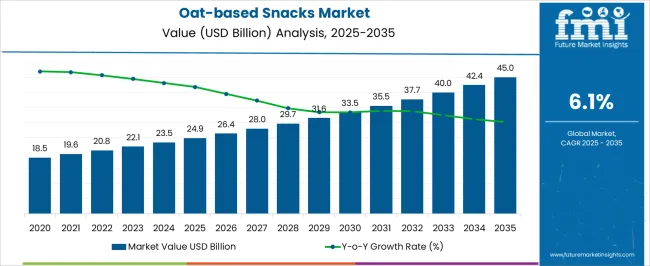

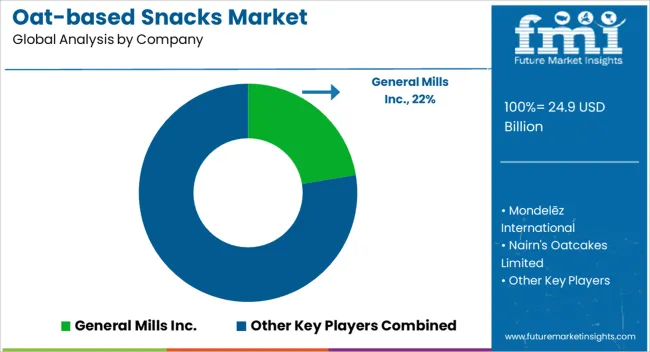

The Oat-based Snacks Market is estimated to be valued at USD 24.9 billion in 2025 and is projected to reach USD 45.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Oat-based Snacks Market Estimated Value in (2025 E) | USD 24.9 billion |

| Oat-based Snacks Market Forecast Value in (2035 F) | USD 45.0 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The Oat-Based Snacks market is experiencing steady growth driven by increasing consumer preference for nutritious and functional food products. Growing awareness about health, wellness, and dietary fiber benefits has accelerated the adoption of oat-based snacks across different demographic groups. In 2025, conventional oat-based products are expected to dominate the market due to familiarity, established taste profiles, and wide availability in retail channels.

The market is being influenced by the rising trend of on-the-go snacking, as consumers seek convenient yet healthy options that align with lifestyle and wellness goals. Innovations in formulation, including protein fortification and reduced sugar content, are further expanding the appeal of oat-based snacks. Future growth opportunities are likely to emerge from clean label trends, plant-based initiatives, and increasing incorporation of oats into functional snack formats.

Additionally, distribution through modern retail, e-commerce, and organized convenience stores is enhancing market penetration The overall outlook indicates continued growth driven by health-conscious consumer behavior and expanding snack consumption patterns globally.

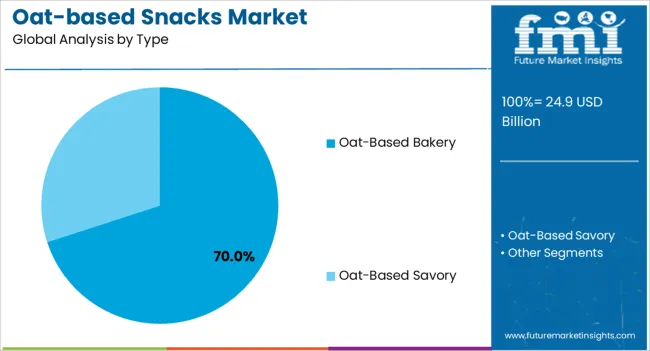

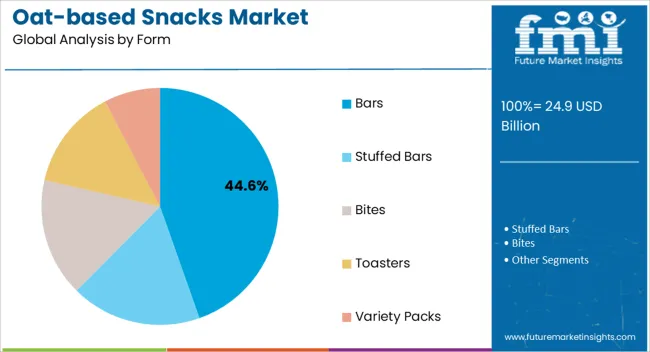

The oat-based snacks market is segmented by nature, type, form, sales channel, processing, and geographic regions. By nature, oat-based snacks market is divided into Conventional and Organic. In terms of type, oat-based snacks market is classified into Oat-Based Bakery and Oat-Based Savory. Based on form, oat-based snacks market is segmented into Bars, Stuffed Bars, Bites, Toasters, and Variety Packs.

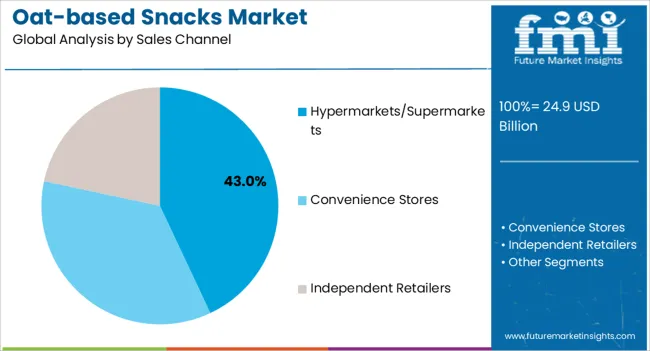

By sales channel, oat-based snacks market is segmented into Hypermarkets/Supermarkets, Convenience Stores, and Independent Retailers. By processing, oat-based snacks market is segmented into Rolled Oats and Steel Oats.

Regionally, the oat-based snacks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional nature segment is projected to hold 63.50% of the Oat-Based Snacks market revenue in 2025, making it the leading nature category. This dominance is attributed to established consumer trust in conventional oat products and their wide acceptance across households. Conventional products benefit from mature supply chains, stable pricing, and easy availability across retail outlets, which reinforce their market share.

Consumer preference for familiar flavors and textures, along with the perception of conventional oats as natural and wholesome, has contributed to their high adoption. The growth of this segment has also been supported by product innovation, where conventional oats are incorporated into bars, cookies, and other snack formats, enhancing their convenience and appeal.

Additionally, conventional products have benefited from sustained brand loyalty and strong marketing efforts, which have cemented their leading position As health and wellness trends continue to influence purchasing behavior, the conventional nature segment is expected to retain its dominance due to its combination of reliability, accessibility, and consumer confidence.

The Oat-Based Bakery type is expected to hold 70.00% of the market revenue in 2025, emerging as the leading type segment. This prominence is being driven by the versatility of bakery formats, which allow the incorporation of oats into a wide range of snack items such as cookies, muffins, and bars.

Bakery products offer convenience, portability, and long shelf life, which makes them highly suitable for on-the-go consumption. The segment has gained traction due to consumer demand for healthy alternatives to traditional baked goods, with oats being recognized for their heart-healthy and fiber-rich properties.

Product development efforts have focused on taste, texture, and functional benefits, further increasing acceptance in both retail and food service channels As consumer interest in clean label and fortified bakery snacks continues to rise, the oat-based bakery segment is anticipated to maintain its leading position, driven by its ability to combine health benefits with indulgent and convenient snacking options.

The Bars form is expected to capture 44.60% of the Oat-Based Snacks market revenue in 2025, positioning it as the leading form segment. This dominance is being attributed to the rising demand for portable, convenient, and ready-to-eat snack options that can be consumed at work, school, or during travel. Bars provide a concentrated source of nutrition, including fiber and protein, which aligns with the growing trend of functional snacking.

The segment’s growth has been accelerated by innovations in flavor, texture, and fortification, which have broadened their appeal across different age groups. Bars are often favored by health-conscious consumers for their portion-controlled format and perceived energy benefits.

The ease of distribution through retail stores, gyms, and e-commerce channels has further reinforced their market share Moving forward, the bars segment is expected to maintain leadership due to the combination of convenience, nutritional value, and adaptability to emerging trends such as plant-based and clean label snacks.

The global Oat-Based Snacks market is expected to reach a market valuation of US$ 22.1 billion by 2025, recording a CAGR of 6.1% from 2025 to 2035.

Oats are a nutrient-dense source of fiber, antioxidants, vitamins, and minerals, making the food products created from them. Snacks made of oats are very popular because of their many health benefits and high nutritional content. There is a great variety of wholesome snacks available in every country. These snacks are typically consumed along with breakfast. As consumers become more aware of the high nutritional value of oat-based snacks throughout the course of the projection period, demand is anticipated to rise. Oats aid in healthy metabolism and weight loss while reducing the risk of diabetes and cardiovascular disease.

| Attributes | Details |

|---|---|

| Oat-Based Snacks Market Size (2025E) | US$ 22.1 billion |

| Oat-Based Snacks Market Projected Size (2035F) | US$ 39.7 billion |

| Value CAGR (2025 to 2035) | 6.1% |

| Top 3 Countries Marketing Share | 70.3% |

As a result, manufacturers of processed foods and snacks are emphasizing the use of healthy ingredients like oats. It is anticipated that rising consumer awareness of the additives, preservatives, and chemicals used in snacks will boost market demand. In a number of supermarkets, department stores, hypermarkets, and even online retailers, oat-based foods now have more shelf space.

In our new study, ESOMAR-certified market research and consulting firm Future Market Insights (FMI) offers insights into key factors driving demand for Oat-Based Snacks.

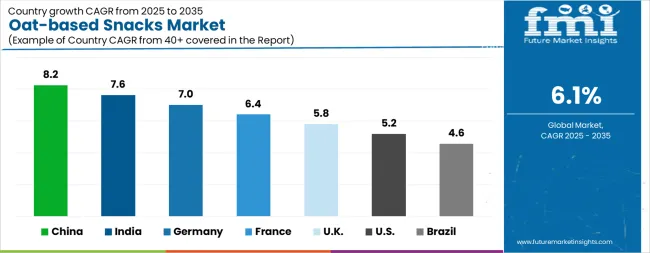

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The Oat-based Snacks Market is expected to register a CAGR of 6.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.2%, followed by India at 7.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Brazil posts the lowest CAGR at 4.6%, yet still underscores a broadly positive trajectory for the global Oat-based Snacks Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.0%.

The USA Oat-based Snacks Market is estimated to be valued at USD 9.3 billion in 2025 and is anticipated to reach a valuation of USD 15.4 billion by 2035. Sales are projected to rise at a CAGR of 5.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.3 billion and USD 795.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.9 Billion |

| Nature | Conventional and Organic |

| Type | Oat-Based Bakery and Oat-Based Savory |

| Form | Bars, Stuffed Bars, Bites, Toasters, and Variety Packs |

| Sales Channel | Hypermarkets/Supermarkets, Convenience Stores, and Independent Retailers |

| Processing | Rolled Oats and Steel Oats |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Mills Inc., Mondelēz International, Nairn's Oatcakes Limited, WK Kellogg Co, The Quaker Oats Company, Bobo's Oat Bars, Britannia Industries, Abbott, Seamild food Group, and Pamela's Products |

The global oat-based snacks market is estimated to be valued at USD 24.9 billion in 2025.

The market size for the oat-based snacks market is projected to reach USD 45.0 billion by 2035.

The oat-based snacks market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in oat-based snacks market are conventional and organic.

In terms of type, oat-based bakery segment to command 70.0% share in the oat-based snacks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

Kid Snacks Market Analysis by Source, Type, and Distribution Channel Through 2035

Pet Snacks and Treats Market Analysis by Product, Pet Type, Distribution Channel, and Region Through 2035

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

Protein Snacks Market Growth - Demand, Trends & Industry Forecast 2025 to 2035

Extruded Snacks Market Size and Share Forecast Outlook 2025 to 2035

Pregnancy Snacks Market Analysis by Product Type, Nutritional Content, Distribution Channel, Packaging Format and Stage of Pregnancy Flavors Through 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dog Food and Snacks Market Size and Share Forecast Outlook 2025 to 2035

Insect-Based Snacks Market Analysis - Size, Share & Forecast 2025 to 2035

Refrigerated Snacks Market Trends - Healthy & Fresh Innovations 2025 to 2035

Better for You Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mushroom-Based Snacks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Crunch‑textured Snacks in Spain Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA