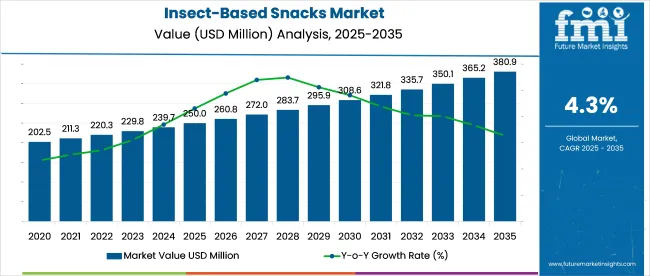

The insect-based snacks market is valued at USD 250 million in 2025 and is projected to reach USD 380.9 million by 2035, registering a CAGR of 4.3%. Global demand has been shaped by rising interest in high-protein, shelf-stable alternatives such as cricket bars, mealworm chips, and grasshopper-based savory items.

Powdered insect flours are being favored for formulation in baked goods and extruded snacks, while whole-insect formats remain confined to niche channels. It is argued that brands offering flavored variants, transparent sourcing, and allergen labeling will gain faster acceptance.

However, inconsistent regulatory approvals and cultural resistance are being cited as growth inhibitors unless broader consumer education and standardized safety frameworks are prioritized. Market consolidation is expected as specialty startups are acquired by larger food ingredient firms.

In 2023, EdoardoImparato, Co-Founder and CEO of Small Giants, shared the motivation behind the company’s foray into insect-based snacks, highlighting a personal and strategic shift toward sustainable protein alternatives. Inspired by the FAO’s landmark 2013 report on edible insects, Small Giants developed cricket-based crackers and snacks designed to appeal to eco-conscious and protein-seeking consumers.

The brand has since expanded across several European retailers and online channels. Reflecting on the company’s origins, EdoardoImparato stated, “Our insect-based snacks were born from our shared commitment to sustainability. Both my cofounder Francesco and I were reducing our meat consumptio. Our search for alternatives to protein led us to a 2013 FAO report titled ‘Edible Insects: Future prospects for food and feed security.’”

The insect-based snacks market holds a niche but growing share within its parent markets. In the snacks market, it accounts for approximately 1-2%, as insect-based snacks are a unique segment compared to traditional snacks like chips and nuts.

Within the alternative protein market, the share is around 5-7%, driven by the increasing demand for sustainable and high-protein food sources. In the sustainable food market, its share is about 4-6%, as insect-based products are considered environmentally friendly. In the functional foods market, the share is approximately 2-3%, due to their nutritional benefits. In the health and wellness food market, the share is around 3-5%, as insect-based snacks are gaining popularity for their high protein and low-fat content.

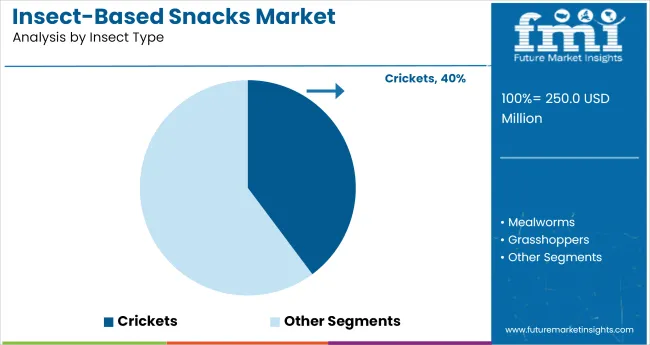

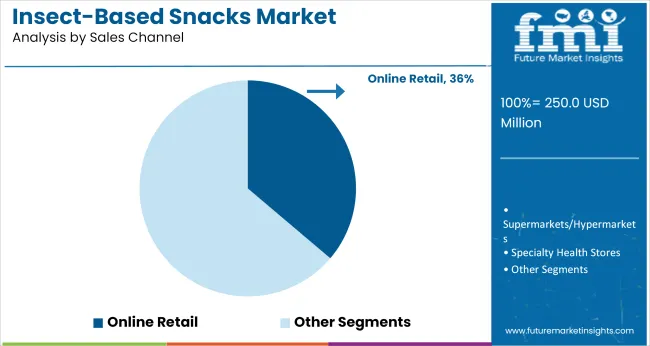

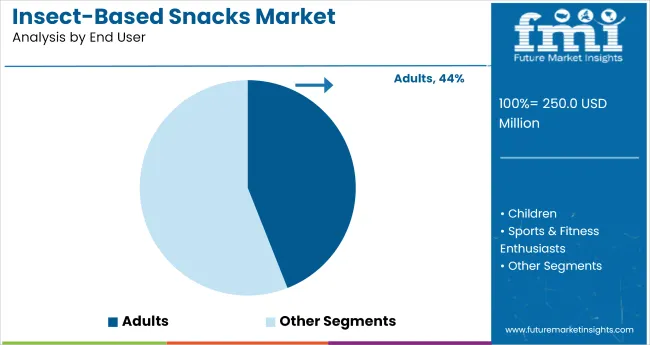

In 2025, the insect-based snacks market is expected to be led by crickets, which will account for 40% of the market. Protein bars will dominate product types with 27.5%, while online retail channels will capture 36% of the sales. Adults will remain the largest consumer group, comprising 44% of the end-user market.

Crickets are expected to capture 40% of the insect-based snacks market in 2025, making them the leading insect type in this segment. Crickets are a preferred choice due to their high protein content, sustainability, and versatility in various snack products.

They are rich in essential amino acids, making them a valuable source of nutrition, especially for consumers looking for plant-based protein alternatives. As the demand for sustainable and nutrient-dense ingredients rises, crickets will continue to dominate the market for insect-based snacks, particularly in protein bars, chips, and other snack formats.

Protein bars are projected to capture 27.5% of the market share in 2025, making them the dominant product type in the insect-based snacks market. These bars provide a convenient, on-the-go snack option that appeals to health-conscious consumers, particularly those seeking high-protein, sustainable snacks.

Insect-based protein bars, using crickets or mealworms, offer a high-quality protein source while also appealing to those looking for environmentally friendly and clean-label options. The growing fitness and wellness trend will continue to drive demand for protein bars, making them a key segment in the market.

Online retail is expected to dominate the sales channel segment with 36% market share in 2025. The convenience and accessibility of online shopping, paired with the increasing consumer preference for sustainable and innovative food products, drive the growth of insect-based snacks in e-commerce platforms.

Online channels allow for easy comparison, direct-to-consumer sales, and the ability to target niche markets looking for specialty food products, such as insect-based snacks. The growing popularity of subscription-based models and direct brand marketing further supports the dominance of online retail in this market.

Adults are projected to account for 44% of the market share in 2025, making them the largest consumer group for insect-based snacks. This segment's dominance is driven by the growing trend of health-conscious, environmentally aware adults seeking sustainable, high-protein, and nutrient-dense snack options.

The increasing awareness of the health benefits of insect protein, as well as the sustainability aspect of consuming insects, is influencing purchasing decisions. Adults, particularly those involved in fitness, wellness, and eco-friendly lifestyles, will continue to drive demand for insect-based snacks, especially in protein bars and snack foods.

The insect-based snacks market is expanding due to increasing consumer demand for alternative protein sources and the growing popularity of high-protein, low-fat diets. However, challenges such as cultural perceptions, regulatory hurdles, and supply chain complexities are hindering broader adoption.

Growing Interest in Alternative Protein Sources

The insect-based snacks market is experiencing growth driven by the increasing consumer interest in alternative protein sources. Insects, such as crickets and mealworms, offer a sustainable and efficient means of protein production.

They require fewer resources, such as water and land, compared to traditional livestock, and emit fewer greenhouse gases. This makes them an attractive option for consumers seeking environmentally friendly and nutritious snack alternatives. As awareness of these benefits spreads, the market for insect-based snacks is expected to continue its upward trajectory.

Cultural Perceptions and Consumer Acceptance Challenges

Despite the benefits, the insect-based snacks market faces significant challenges related to cultural perceptions and consumer acceptance. In many Western cultures, the idea of consuming insects is met with skepticism and aversion.

This cultural barrier hinders the widespread adoption of insect-based snacks, even among individuals who are open to alternative protein sources. Overcoming these perceptions requires targeted education and marketing efforts to familiarize consumers with the benefits and safety of insect consumption.

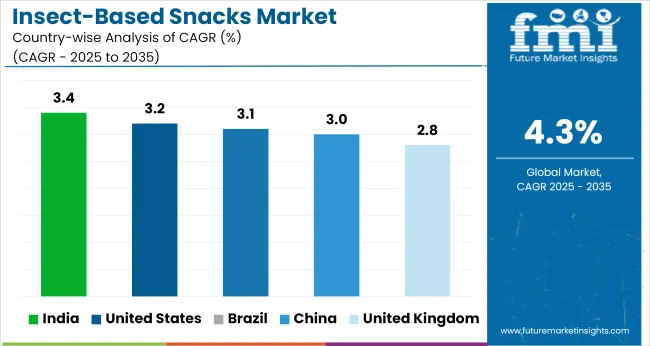

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

| United Kingdom | 2.8% |

| China | 3% |

| India | 3.4% |

| Brazil | 3.1% |

Global insect-based snacks market demand is projected to rise at a 4.3% value-based CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, the United Kingdom leads at 4.9%, followed by India at 3.5%, and China at 3.2%, while South Korea posts 3% and the United States records the slowest growth at 2.6%.

These rates translate to a growth premium of +13% for the United Kingdom, -18% for India, and -27% for the United States versus the baseline, while South Korea and China show more moderate growth. Divergence reflects local catalysts: growing interest in sustainable and protein-rich snacks in the United Kingdom, while more mature markets like the United States show slower adoption due to consumer resistance to insect-based food products.

India, China, and South Korea reflect more gradual but steady market expansion driven by increasing awareness of alternative protein sources.

Sales of insect-based snacks in the United States are expected to grow at a CAGR of 2.6% through 2035. Adoption has remained niche due to regulatory uncertainty and limited consumer acceptance, especially in mainstream retail. However, interest in high-protein, low-footprint snacks is expanding among fitness enthusiasts and sustainability-conscious consumers.

Regional startups are introducing flavored cricket chips and larval protein bars through online channels. Co-branding with health influencers has created awareness in e-commerce platforms, though brick-and-mortar visibility remains low. Regulatory support from the FDA on edible insect labeling may shape future demand pathways. Expansion is occurring mostly through specialty retailers and wellness outlets.

Sales of insect-based snacks in the United Kingdom are forecasted to rise at a CAGR of 4.9% through 2035. The Food Standards Agency’s post-Brexit regulatory framework has accelerated novel food approvals, including edible insects. Retailers have expanded listings of insect granola bites and protein crisps in vegan sections.

Public interest has grown following national sustainability campaigns linking protein diversification to long-term food security. Taste trials and school awareness programs have supported normalization of insect-based ingredients. Direct-to-consumer models led by startups are leveraging the ethical protein narrative. Insect-based snacks are finding traction among flexitarian and adventure-eating segments.

Demand for insect-based snacks in China is estimated to grow at a CAGR of 3.2% from 2025 to 2035. Traditional use of edible insects in regional cuisines has enabled smoother consumer transition into processed insect snacks. Major domestic brands have launched flavored silkworm crisps and beetle jerky under premium health snack lines.

Product development focuses on protein density and shelf stability, aligning with snacking-on-the-go trends. Although not yet mainstream in urban retail chains, interest is visible among health-oriented youth segments and specialty stores. Policy clarity on food labeling has helped consolidate supply chains and reduce import dependency for insect flours.

India’s insect-based snacks market is projected to grow at a CAGR of 3.5% through 2035. Interest has risen within the wellness and functional snack segments, although cultural resistance and regulatory opacity have slowed commercialization. Startups are experimenting with low-dose cricket blends in baked snacks and protein-rich flours for rural outreach.

Ayurveda-aligned positioning is being tested for gut-friendly insect snacks. Trials are underway in institutional nutrition channels, targeting protein deficiency concerns. Consumer education, flavor adaptation, and religious dietary norms remain central to shaping the scale and speed of demand. Growth is expected to be strongest in e-commerce and curated nutrition kits.

South Korea’s insect-based snacks market is projected to grow at a CAGR of 3.0% from 2025 to 2035. Government inclusion of insects in the national food code has accelerated product innovation in processed snacks. The popularity of novelty and extreme eating trends has enabled successful test launches of silkworm pupae chips and insect-infused chocolate bites.

Marketing has focused on high-protein and immunity-boosting traits to win over young professionals. However, scale remains limited outside niche consumer groups. Convenience stores and online platforms dominate distribution, with limited penetration in conventional grocery retail. Collaborations with culinary schools and televised food shows have expanded awareness.

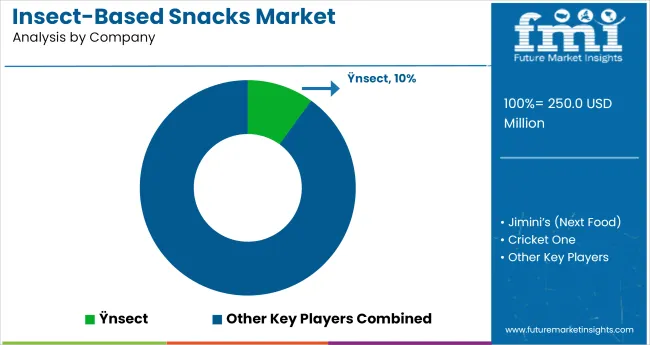

In the insect-based snacks market, appetite is being shaped by a balance of protein quality, flavor appeal, and regulatory clarity. Ÿnsect is leading edible-protein positioning in Europe by offering powdered cricket and mealworm ingredients to food brands and ingredient formulators.

Jimini’s (Next Food) and Cricket One have differentiated offerings in the USA, promoting cricket-chip lines and functional protein bites via direct-to-consumer platforms and select retail grocers. Chapul’s flavored bars have been co-developed for private-label retailers in North America.

Entomo Farms serves regional demand in Canada and the USA with bulk cricket protein, scaling operations through feedstock-sourced rearing systems. All players have navigated allergen labeling, novel food registration, and import approvals across EU, USA, India, and ASEAN markets.

Recent Industry Developments

| Attribute Category | Details |

|---|---|

| Industry Size (2025E) | USD 250 million |

| Projected Industry Value (2035F) | USD 380.9 million |

| Value-based CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD million / Volume in metric tons |

| By Insect Type | Crickets, Mealworms, Grasshoppers, Black Soldier Fly Larvae, Ants |

| By Product Type | Whole Roasted Insects, Protein Bars, Chips & Crisps, Protein Powders (used in snacks), Granola & Energy Bites, Biscuits & Crackers |

| By Sales Channel | Online Retail, Supermarkets/Hypermarkets, Specialty Health Stores, Convenience Stores, Foodservice & Vending |

| By End User | Adults, Children, Sports & Fitness Enthusiasts, Pet Snacks (cross-application) |

| By Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, Poland, Russia, South Korea, Japan, China, India, Australia, Indonesia, Saudi Arabia, United Arab Emirates, South Africa |

| Key Players | Ÿnsect, Jimini’s (Next Food), Cricket One, Chapul, Entomo Farms, Others |

| Additional Attributes | Dollar by sales, share by product type and end-user, trends in consumer preferences across geographies, omni -channel retail performance, demand seasonality insights, and market potential in emerging high-protein snack hubs |

Insect types include Crickets, Mealworms, Grasshoppers, Black Soldier Fly Larvae, and Ants.

Product segmentation includes Whole Roasted Insects, Protein Bars, Chips & Crisps, Protein Powders (used in snacks), Granola & Energy Bites, and Biscuits & Crackers.

Sales channels comprise Online Retail, Supermarkets/Hypermarkets, Specialty Health Stores, Convenience Stores, and Foodservice & Vending.

End-user categories include Adults, Children, Sports & Fitness Enthusiasts, and Pet Snacks (cross-application).

Regional analysis includes North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The estimated industry size of the insect-based snacks market in 2025 is USD 250 million.

The market value of the insect-based snacks market in 2035 is USD 380.9 million, with a CAGR of 4.3%.

Crickets lead the insect-based snacks market with a 40% market share.

Protein bars dominate the insect-based snacks market with a 27.5% market share.

The United Kingdom is projected to have the highest CAGR in the insect-based snacks market with a growth rate of 4.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

Kid Snacks Market Analysis by Source, Type, and Distribution Channel Through 2035

Pet Snacks and Treats Market Analysis by Product, Pet Type, Distribution Channel, and Region Through 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Snacks Market Trends – Protein-Packed & Industry Growth 2024-2034

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

Protein Snacks Market Growth - Demand, Trends & Industry Forecast 2025 to 2035

Extruded Snacks Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Pregnancy Snacks Market Analysis by Product Type, Nutritional Content, Distribution Channel, Packaging Format and Stage of Pregnancy Flavors Through 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dog Food and Snacks Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Snacks Market Trends - Healthy & Fresh Innovations 2025 to 2035

Better for You Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mushroom-Based Snacks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Crunch‑textured Snacks in Spain Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA