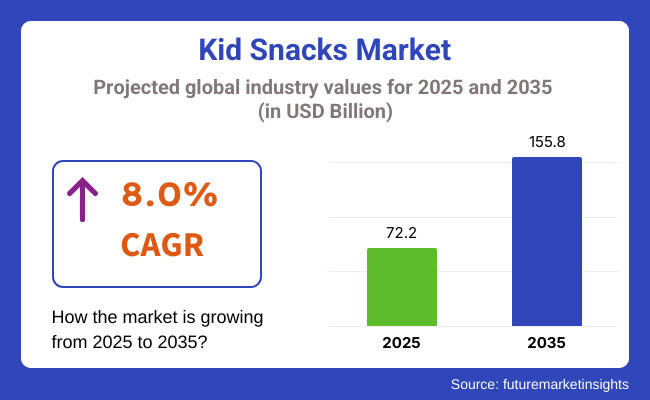

The global kid snacks market reached USD 72.2 billion in 2025. Demand for kid-friendly snacks registered an 8.0% year-on-year growth in 2025, indicating that the international market would reach USD 155.8 billion by 2035.

One of the main forces behind the global kid snacks market is the sprout of the need insatiability of the customers for more natural products that also have fewer ingredients. General -Preservative diets are becoming a norm as parents explore more options without artificial preservatives, colors, and refined sugars. Companies such as Annie’s Homegrown, Happy Family Organics, and Clif Kid have led the brand to create gluten-free, non-GMO, and nutritious snack foods, which meet such requirements.

Production expansion is the main focus for companies to catch up with the tendency in the market. Big players, including The Kraft Heinz Company, General Mills, and Mondelez Internationa, have increased the production output of these organic and functional snack products. In the expansion, the brands are increasing the proportion of non-synthesized raw materials and cutting the use of artificial ones, thus, moving beside with the consumer expectation.

Transferring the hype of the plant-based and allergen-free snacks, the sector is experiencing a layout change. Observe the trend where snacks made with whole grains, fruits, vegetables, and protein sources such as chickpeas and lentils are getting popular. In their efforts to cater to the parents' concerns about the nutrition of their children, companies are fortifying snacks with the addition of the allergy-free foods and probiotics.

Reformulated marketing strategies are used by brands to focus on sustainability and transparency front and center. The attraction of environmentally friendly customers is achieved through introducing recyclable packaging, decreasing sugar levels, and using responsibly sourced ingredients.

In addition, the leading snack brands are aligning their marketing, such as targeted digital advertising, influencer partnerships, and educational campaigns, to strengthen the trust among parents that demand these products.

In conclusion, the constant expansive growth of the global kid snacks market has been achieved due to a combination of health-driven inventions, the production capacity's growth, and the consumer's preference for clear-label, functional, and sustainable snacks.

The table below offers a cross-sectional analysis of the changes in CAGR for the global kid snacks market base year (2024) and current year (2025), both over six months. It gives the market operators key directions in the revenue trends and shifts for the sector's growth path as they assess their performance results.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.8% |

| H2 (2024 to 2034) | 8.0% |

| H1 (2025 to 2035) | 7.9% |

| H2 (2025 to 2035) | 8.1% |

The term H1 or first half of the year consists of six months from January to the beginning of July, while H2 or second half of the year includes the last part of July and six months until December. According to the estimation, the 2024 to 2034 decade will be scantily expanded during its first chapter with an R&R of 7.8%, but it will shift into a more significantly increased growth rate of 8.2% in the same decade's second chapter.

The subsequent period from H1 2025 to H2 2035 is expected to see the CAGR grow further; in the first half, it is projected to reach 8.0%, and it will remain strong at 8.1% in the second half. In H1, the sector saw an increase of 10 BPS, while in H2,2, the market observed a slight move up by 10 BPS.

More Functional and Cognitive Snack for Kids

The global kid snacks market is experiencing a hearty rise in the valuation of snacks that are functional and cognitive. The mothers are pickier with the kids' snacks that should be full of nutrients like the ones that improve their cognition such as brain development, memory retention, and concentration. Manufacturers are taking this chance of trend alteration and turning kid-friendly foods into health supporters. Protein-packed bars, fruit-flavored chews with added vitamins, and whole-grain snacks with essential nutrients have found their space.

Brands are depicting their creations also as those that will help children in their studies and maintain their mental well-being. Companies that are adding omega-3 fats, DHA, choline, and nootropic elements to the formulae instead of using sugar and sweeteners that are artificial are also catering to the needs of the time. The sector is bound to register the expansion of such innovations in the area of functional ingredients, mainly for cognitive health and overall childhood development.

Kids Portion-Controlled and Satiety-Focused Snacks

Portion-controlled snacks for kids are a trending topic that has also become the centre of interest because of the rising parental concern about childhood obesity and unhealthy eating habits. Manufacturers have launched pre-measured packages of snacks that not only regulate calories but also pleasure by increasing the sense of control over the health of children. The most vivid example is the schools where the need for single-serve, resalable packages and portion packs is pronounced in lunchbox snacks.

The companies at a further stage endeavour to loose high-fiber and protein-rich products that not only achieve their target ratio but also provide a full feeling of satiety in children for a more extended period. The brands have turned around and are reformulating existing items into mini sizes whilst utilizing the new eco-friendly packaging that endorses regulated consumption. This trend of portion control echoes the overall concern for nutrition and healthy choices in children.

The Concept of Gamification and Sensory Engagement of Snacks

The blend of gaming culture and food consumption is continuously reshaping the global kid snacks market, as the brands use gamification strategies to stimulate participation. Introduced by manufacturers, interactive, augmented reality packaging, collectible incentives, and gamified eating experiences time to engage with kids. Snacks that change color, fizzes in the mouth, or add a new texture are examples that are becoming popular.

In terms of snacks, not only the taste and nutrition are catered to, but also the brands are widening their multi-sensory impact, thus, the products would be a fun & engaging experience for children. Companies partner with popular animated characters and gaming franchises to create desirability of their products. This is more digitized, and innovative snacks result in companies seeking to differentiate themselves in the intense competition.

The Quick Growth of Kids Snacks Based on Alternative Flours

The genre of alternative flours driven by chickpea, lentil, sweet potato, and cassava has made the sharpest rise among all the kid candy optioning the snacks section. The mother's choice of these nutrient-load snacks is made easier since they have a higher protein and fiber content and also are a good source of vitamins. As a result, manufacturers have been creating new snack types like naturally gluten-free baked chips, puffs, and crackers, among others.

The trend of demanding foods that are friendly to the gut and easily digestible has been the most significant reason for this change. In addition, the brands have focused on promoting the ingredients that enhance digestive health, which in turn encourages them. Some companies are also trying to develop hybrid forms of alternative flours that will provide a better taste as well as nutritional value while keeping the texture appealing. Besides the knowledge of food allergies and the diversity of nutrients, the popularity of alternative flour products is expected to increase.

The structure of the global kid snacks market includes a mix of international industry leaders and solid regional players, which leads to a competitive environment in different tiers. The degree of market concentration is highly region-specific, as local brands often take the lead in their territories due to their vast knowledge of consumer preferences, legislation, and pricing strategies.

Tier 1 players' profile includes multinational corporations at the global level, with a complete production line and a wide range of products. These organizations agree to a substantial investment in R&D, innovation, and marketing to go alongside the changing consumer preferences.

Their marketplaces with well-established distribution networks are advantageous for penetration; thus, they can exploit advantages such as economies of scale and strong brand equity, leading to continuing market leadership.

Tier 2 players are mid-range regional manufacturers that have a foothold in selective territories. Generally, these brands opt for localized flavors that reflect culture, traditional dietary habits, and, among other things, specific nutritional offerings.

A number of these regional players expand their range with snack alternatives organically and functionally branded, thus, improving the competition against multinational brands. They are usually using a combination of modern retail and e-commerce to achieve greater exposure.

Tier 3 players incorporate smaller, niche brands and private-label manufacturers, which mainly deal with local markets. They specialize in specific product categories like allergen-free, protein-enriched, or minimally processed snacks.

Private-label brands from common retailers can also be found in this group, as they benefit due to better prices and direct consumer reach. Demand for the label, the unique and local character of the food, shall be the cause for Tier 3 pooling the traction in specific consumer segments.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | United States |

|---|---|

| Market Volume (2025) | USD 15.5 billion |

| CAGR (2025 to 2035) | 4.6% |

| Country | China |

|---|---|

| Market Volume (2025) | USD 12.3 billion |

| CAGR (2025 to 2035) | 8.4% |

| Country | Japan |

|---|---|

| Market Volume (2025) | USD 9.8 billion |

| CAGR (2025 to 2035) | 6.1% |

| Country | Germany |

|---|---|

| Market Volume (2025) | USD 7.6 billion |

| CAGR (2025 to 2035) | 5.7% |

| Country | India |

|---|---|

| Market Volume (2025) | USD 6.4 billion |

| CAGR (2025 to 2035) | 7.8% |

The United States kid snacks market, according to predictions, will register a CAGR of 4.6% between 2025 and 2035. The driving force for this growth will be the rising parental awareness of nutrition being a key element of children's development. Of late, convenience and health-oriented snack options are sought the most as parents are on the lookout for products that easily fit into their busy lifestyles and at the same time meet their children's required diet.

The manufacturers are finding a solution in the way of fortification by launching products that are enriched with essential vitamins and minerals besides the organic and non-GMO options. The clean-label circulation trend of artificial additive and preservative-free products is further gaining traction. The emergence of online retail platforms has also improved parents' access to a myriad of kid-friendly snacks while also pushing market growth in the USA.

China's kid snacks market is expected to grow at a rate of 8.4% throughout 2025 to 2035, driven by urbanization, the rise of disposable income, and the growth of the middle class, which allocates a more significant part of the budget for children's overall health and nutrition. A more significant part of the budget goes to children's health and nutrition.

According to the search form, it provides both health and having fun, which are two diverse aspects of the food industry. The incorporation of traditional foods in modern formats is a contributor to the promotion of health and nutrition among children. Government measures aimed at child health and nutrition are also responsible for this, along with the growing recognition of childhood obesity.

Thus, they are making it possible for less sugar and low-fat snacks to come into being. The abundance of online retail channels also serves as a supportive framework to distribute and make available a wider variety of snack products all across the country.

The kid's snacks market in Japan is set to register a 6.1% CAGR between 2025 and 2035. There would be massive demand for avant-garde and easily consumable snacks in the market, owing to the cleverness of Japanese children. The high quality and safety that sorfactical parents demand leads to the selection of snacks from natural and local sources.

Portion-controlled packaging is also integrated with the cultural practices of balancing food and eating mindfully. Manufacturers are bringing out various flavors and textures, many of which are inspired by traditional Japanese food, to keep kids interested over this period. The idea of adding educational elements to the snack packaging, including interactive designs and collectible items, along with the trend that is gaining ground in the Japanese market, is being explored.

| Segment | Value Share (2025) |

|---|---|

| Conventional Kids Snacks (By Source) | 68.4% |

The Conventional kid's snacks category comes first among the main sub-categories all over the world, and the market was able to get a 68.4% value share. Appropriately, affordability and accessibility are the key points of sales for kid snacks, and therefore, this sub-category is invulnerable to the ongoing shift of organic and clean-label products. The snacks comprise a mix of Wade packaged items, such as biscuits, chips, and cereal bars, predominantly sold to all types of customers through mass assembly or fast manufacture.

This proven demand is the reason why the producers are changing the traditional recipes for snacks with the substance of less sugar, sodium, and no artificial preservatives but typical flavor and texture taste. Conventional snacks are still the most found product in supermarkets, grocery stores, and convenience outlets where buyers can find them consistently. Moreover, the mass production capacity gives the chance for the manufacturers to take the lead in the competition due to the cheaper prices, which are very appealing for a middle-income family.

| Segment | Value Share (2025) |

|---|---|

| Bakery (By Type) | 36.7% |

The bakery type sub-segment alone holds more than a quarter of the kid snacks market globally (26.7% market share), and it thus becomes the most valued one in the product segment. Bakery snacks such as muffins, cookies, and cereal bars are known for their convenience and deliciousness, thus they are the easiest sell in the market. Kids usually consume bakery snacks that are specially packed for school because they are a combination of carbohydrates, proteins, and fortified nutrients, making them a perfect snack either at school or on the go.

With a wide variety of options, manufacturers don’t fall behind, and they are adding whole grains, fiber, and low-sugar formulations to their product range to cater to particular parents. Besides, brands have been quite innovative with character-themed and interactive packaging that will draw attention to kids.

The worldwide kid snacks market is going to see a surge in the years to come, especially in 2024, due to the increasing wish of parents for nutritious and easy snacks. The big players in the game are already starting to make their moves by performing various maneuvers like acquiring, product innovation, and stepping into the new markets. The scene is filled with both big multinationals and local brands trying to cope with the changing consumer expectations and dietary trends.

For Instance

The global kid snacks market is segmented into organic kids snacks and conventional kids snacks.

The market is categorized into salty, refrigerated or frozen, confectionery, bakery, vegetable, fruit, and nut-based snacks.

The market is divided into sales via supermarkets/hypermarkets, sales via online stores, sales via specialty stores, sales via grocery stores, and sales via convenience stores.

The market spans across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global kid snacks market is projected to grow at a CAGR of 8.0% during the forecast period from 2025 to 2035.

The global kid snacks market is expected to reach a total market valuation of approximately USD 155.8 billion by the end of 2035.

Among all segments, the organic kid snacks category is anticipated to witness the fastest growth due to rising consumer preference for clean-label, non-GMO, and natural ingredient-based products.

The market is being driven by increasing parental awareness regarding children's nutrition, demand for functional and fortified snacks, rising preference for convenient on-the-go snacking, and the expansion of e-commerce and digital retail channels.

Some of the dominant players in the global kid snacks market include Mars, Incorporated, Mondelez International, Nestlé S.A., The Kraft Heinz Company, General Mills, Inc., and Kellogg Company.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Source, 2023 to 2033

Figure 22: Global Market Attractiveness by Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Source, 2023 to 2033

Figure 46: North America Market Attractiveness by Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kids Splint Market Size and Share Forecast Outlook 2025 to 2035

Kids Toys Market Size and Share Forecast Outlook 2025 to 2035

Kids Sports Equipment and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Kids Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Kids’ Brain Health Supplements Market Size and Share Forecast Outlook 2025 to 2035

Kidney Stone Extraction Balloon Market Size and Share Forecast Outlook 2025 to 2035

Kids Sports Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

Kids Musical Instrument Market Size and Share Forecast Outlook 2025 to 2035

Kids Storage Furniture Market by Type, Material, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Kidney Transplant Market Analysis by Transplant, Age Group, End User, and Region through 2035

Kids’ Food and Beverages Market Analysis by Product Type, Age Group, Category, Distribution Channel and Region through 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Kids Recreational Services Market by Activity Type, Service Type, and Region - Forecast to 2025 to 2035

Kids Watch Market

Kids’ Eyewear Market Report – Trends & Forecast 2024-2034

Skid Steer Loader Market Growth - Trends & Forecast 2025 to 2035

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

Pet Snacks and Treats Market Analysis by Product, Pet Type, Distribution Channel, and Region Through 2035

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA