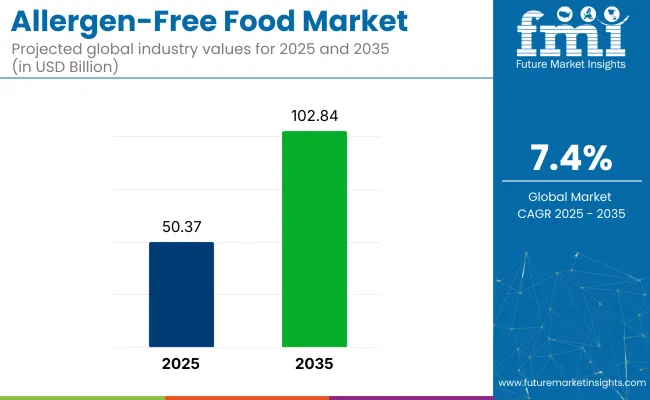

The global allergen-free food market is estimated to grow from USD 50.37 billion in 2025 to USD 102.84 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.4%. This market expansion is primarily driven by the increasing prevalence of food allergies, rising consumer awareness of allergens, and a growing demand for healthier, safer food options.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 50.37 billion |

| Industry Value (2035F) | USD 102.84 billion |

| CAGR (2025 to 2035) | 7.4% |

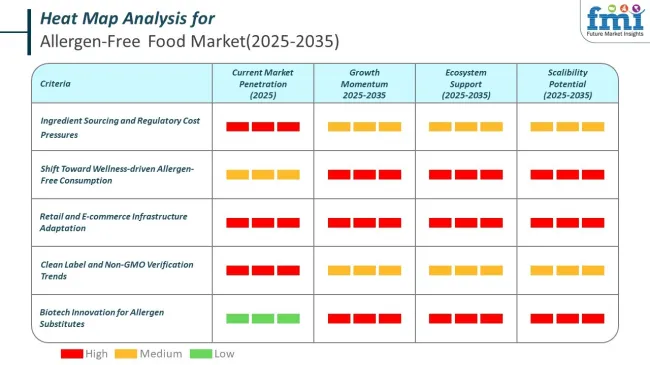

The shift toward allergen-free products is increasingly seen not only as a dietary necessity but as a lifestyle choice for those seeking to avoid common allergens such as gluten, dairy, nuts, and soy.

The allergen-free food segment holds a relatively modest share within the larger health and wellness foods, estimated at approximately 5-7%. Within the organic food market, allergen-free products occupy a growing yet niche portion, comprising around 3-5%, driven by increasing demand for safe, organic alternatives.

In the functional food market, allergen-free options account for about 4-6%, as more consumers seek foods that not only avoid allergens but also offer additional health benefits. In the dietary supplements market, allergen-free products, especially those catering to specific food sensitivities, make up around 2-4%. Within the food and beverage industry, allergen-free foods represent a significant but still emerging segment, roughly 6-8%, reflecting growing consumer

In 2025, significant developments have taken place in the allergen-free food industry. In April 2025, Nestlé expanded its product portfolio by launching a new range of allergen-free snacks, including dairy-free, nut-free, and gluten-free options, aiming to cater to the growing consumer demand for inclusive food solutions in Europe and North America.

In March 2025, Unilever strengthened its allergen-free offerings by acquiring Thevegetarian butcher, a leading plant-based food company. This acquisition enables Unilever to tap into the rising preference for dairy-free, gluten-free, and plant-based foods, aligning with its broader strategy to meet the needs of health-conscious and sustainability-focused consumers.

In the United States, allergen‑free food intake for active consumers is 11.5 kg per person each year. China follows at 10.4 kg, while India stands at 8.8 kg. Japan averages 9.9 kg, and Germany records 11.0 kg annually among allergen‑free eaters.

For this segment, consumption equals about 25-35 g per day, comparable to a serving of gluten‑free bread or plant‑based milk. Across the broader population, intake falls to nearly 1 kg annually, reflecting the concentrated nature of demand.

In the United States, 30 percent of adults report some form of allergy, with food allergies affecting 11 percent of adults and 7.5 percent of children. Germany records a 20 percent adult allergy prevalence, with 4.7 percent of adults experiencing food allergies. Japan shows the highest rates, with 62.2 percent of adults reporting any allergy, 15.2 percent affected by food allergies, and 10 percent of children aged 1-19 impacted.

In the United Kingdom, 20 percent of adults report allergies, with food allergies affecting 6 percent of adults and 4 percent of children under five. France reports 20.2 percent of adults with allergies, with 6 percent of children under 5.5 years experiencing food allergies. Canada shows 5-10 percent of adults and 2.5 percent of children affected by food allergies. Australia records 19-20 percent of adults with allergies, approximately 2 percent of adults with food allergies, and 10 percent of infants under one year affected.

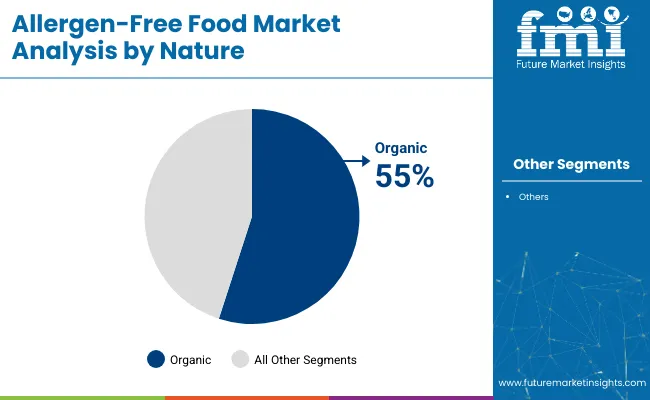

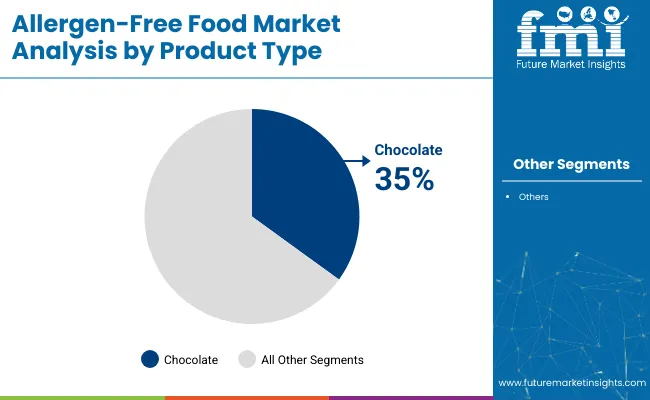

The allergen-free food market continues to grow rapidly, with organic products taking the lead at 55% market share. Sugar-free foods dominate product claims, comprising 40% of revenue. Chocolate and beverages are key segments, while processed meat & poultry are emerging as growing categories in response to consumer demand for allergen-free, healthy food options.

Organic allergen-free products are taking center stage, accounting for 55% of the allergen-free food industry in 2025.

The sugar-free product claim dominates the industry, capturing an impressive 40% share in 2025.

Chocolate, a major product category in the allergen-free food industry, leads with a 35% market share in 2025.

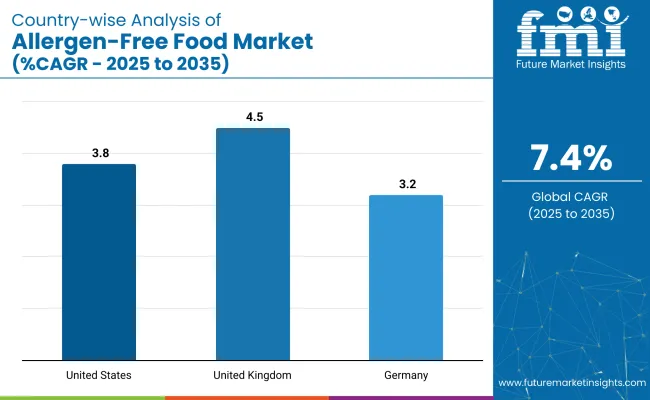

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

| United Kingdom | 4.5% |

| Germany | 3.2% |

The industry, anticipated to grow at a global CAGR of 3.8% from 2025 to 2035, is showing varied performance across key countries. The United States, a member of the OECD, is leading the industry with a 3.8% CAGR, driven by strong demand for allergen-free products amid increasing food allergies, especially in children, and a shift towards plant-based and organic options.

The United Kingdom, also part of the OECD, follows with a 4.5% CAGR, as the demand for allergen-free foods rises with the growing trend towards vegan, gluten-free, and dairy-free diets, supported by strong regulatory standards on food labeling. Germany, another OECD member, displays a 3.2% CAGR, with growth spurred by increased awareness of food allergies, a preference for local and sustainable products, and widespread availability of allergen-free options in supermarkets and specialty stores.

Slower growth is being recorded in the United Kingdom and Germany compared to the United States, with stable demand in these developed industry due to their already established allergen-free food systems. The United States, with its large and diverse consumer base, continues to exhibit the strongest expansion opportunities.

The report provides a detailed analysis of 40+ countries, with the top three United States, United Kingdom, and Germany highlighted as key markets within the OECD group.

The USA allergen-free food sector is projected to grow at a CAGR of 3.8% from 2025 to 2035. This expansion is driven by the increasing demand for clinically formulated allergen-free foods, particularly among individuals with gut issues and immune diseases. Companies like Kate Farms, Neocate (Nutricia), and Else Nutrition are leading the way, providing hypoallergenic meal replacements and snacks. The growth of distribution channels, including e-commerce and healthcare platforms, is further supporting this trend.

The UK allergen-free food sector is set to grow at a CAGR of 4.5% through 2035. The primary driver of this growth is the innovation seen in private-label products from supermarket giants like Tesco, Sainsbury’s, and Marks & Spencer, which have introduced extensive allergen-free product ranges. Retailers are central to this shift, incorporating allergen-free sections, AI-driven filters, and online platforms for tailored shopping experiences

Germany is expected to see a growth rate of 3.2% from 2025 to 2035, driven by advancements in microbial-derived allergen-free proteins. Biotech companies such as Formo, Vly Foods, and QOA are pioneering the production of precision fermentation-based dairy and egg alternatives that eliminate cross-allergenicity. These innovations are offering a more nutritious profile compared to traditional plant-based alternatives. Collaboration between major players like Nestlé and Danone and biotech firms is accelerating the introduction of new allergen-free offerings.

The allergen-free food industry is shaped by major players like Nestlé, Danone, Unilever, and General Mills, who drive innovation through extensive R&D and strategic product launches. For example, Nestlé has expanded its range of allergen-free chocolates, while Danone has introduced dairy-free yogurt options, both catering to an increasing demand for allergen-free alternatives. Emerging companies are also making a mark by offering specialized products that appeal to specific consumer preferences and dietary restrictions.

The landscape remains fragmented, with opportunities for smaller players to enter, though significant entry barriers exist, such as strict regulatory standards and the need for substantial investment in product development and manufacturing. To stay competitive, large companies often consolidate through acquisitions, while others focus on enhancing regional supply chains to streamline production and distribution.

Recent Allergen Free Food Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 50.37 billion |

| Projected Market Size (2035) | USD 102.84 billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Nature Types Analyzed (Segment 1) | Organic, Conventional |

| Product Types Analyzed (Segment 2) | Chocolate, Beverages, Processed Meat & Poultry, Others |

| Claims Analyzed (Segment 3) | Sugar-Free, GMO-Free, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, Brazil, Australia |

| Key Players Influencing the Market | Nestlé S.A., Danone S.A., Unilever PLC, General Mills Inc., The Kraft Heinz Company, Mondelēz International, Inc., Conagra Brands, Inc., Kellogg Company, The Hain Celestial Group, Inc., Tyson Foods, Inc. |

| Additional Attributes | Dollar sales, share by type and end user, rising demand in post-surgery recovery, growth in sports medicine and physiotherapy sectors, development of eco-friendly and biodegradable allergen-free food products, regional demand variations, increasing preference for clean-label products and plant-based allergen-free options, and consumer shift toward healthier snack and beverage alternatives. |

Organic, Conventional

Chocolate, Beverages, Processed Meat & Poultry, Others

Sugar-Free, GMO-Free, Others

North America, Latin America, Europe, Middle East & Africa, East Asia, South Asia, Oceania

The global allergen-free food market is expected to reach USD 102.84 billion by 2035, growing at a CAGR of 7.4% from 2025.

Major players include Nestlé, Danone, General Mills, Mondelēz International, Enjoy Life Foods, Made Good, and Free2b Foods, with increasing competition from biotech-driven startups.

The market is driven by rising food allergies, stricter labeling regulations, increasing demand for clean-label and sugar-free options, and advancements in precision fermentation-based allergen-free ingredients.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Allergen-Free Food Market Report – Demand, Trends & Industry Forecast 2025–2035

Demand for Allergen-free Food in EU Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA