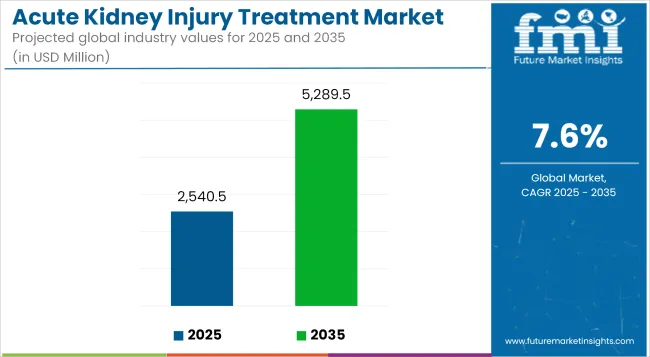

The global sales of acute kidney injury treatment is estimated to be worth USD 2,540.5 million in 2025 and anticipated to reach a value of USD 5,289.5 million by 2035. Sales are projected to rise at a CAGR of 7.6% over the forecast period between 2025 and 2035. The revenue generated by acute kidney injury treatment in 2024 was USD 2,382.9 million.

Acute kidney injury is an abrupt loss of renal function over a short span of time, results in an accumulation of toxic substances, fluids, and electrolytes within the body.

The circumstances disrupt critical functions in the physiological processes, and without effective treatment, potentially leads to some severe complications and death. AKI usually occurs in association with or because of another initiating disease, such as dehydration, sepsis, or nephrotoxic drug administration, and may be caused by prerenal, intrinsic, or post renal injury.

Treatment of AKI include dialysis, pharmacologic interventions, fluid management, and innovative regenerative medicine. The growing rate of expansion of the global AKI treatment market is primarily because of the soaring cases of kidney injuries, advancement in technology in therapeutic and diagnostic solutions, and hospital admissions related to critical illnesses.

Global Acute Kidney Injury Treatment Industry Assessment

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 2,382.9 million |

| Estimated Size, 2025 | USD 2,540.5 million |

| Projected Size, 2035 | USD 5,289.5 million |

| CAGR (2025 to 2035) | 7.6% |

One of the major drivers for the growth of the market is the growing burden of acute kidney injuries. ISN reported that AKI impacts more than 13 million people worldwide every year, and most of these occur in developing countries where lack of access to health care further aggravates the mortality rate.

The predominant form of treatment has been dialysis, where much advancement is observed: from portable dialysis machines to automated peritoneal dialysis systems, to improved membranes that facilitate a more effective process with minimal pain and discomfort.

The most increasingly popular pharmacological therapy would include nephroprotective agents to avoid the exacerbation of damage and help speed recovery. This has enabled the early detection of AKI because of the integration with artificial intelligence and machine learning, hence timely interventions with improved outcomes.

However, the AKI treatment market still has some challenges. It opens avenues for innovation and investment. The cost of advanced dialysis treatment and equipment is hefty, making their use limited to a few cases in countries with a high prevalence of AKI.

Moreover, healthcare professionals and the public know little about AKI and its subtle early symptoms, thereby delaying diagnosis and initiation of treatment. Significant gaps for market players exist in addressing affordable and accessible solutions to cater for resource-poor settings.

The global acute kidney injury treatment market compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 8.8%, followed by a slightly lower growth rate of 8.3% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 8.8% (2024 to 2034) |

| H2 | 8.3% (2024 to 2034) |

| H1 | 7.6% (2025 to 2035) |

| H2 | 7.3% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 7.6% in the first half and remain relatively lower at 7.3% in the second half. In the first half (H1) the industry witnessed a decrease of 120 BPS while in the second half (H2), the industry witnessed a decrease of 100 BPS.

Increasing Prevalence of Acute Kidney Injury (AKI) is driving the Market Growth

The high rate of newly diagnosed acute kidney injuries had been one of those forces responsible for boosting up the patients in the market of treatment concerning acute kidney injuries. Various factors contribute to the rising number of AKI cases, including the existence of elderly citizens, rising prevalence of chronic illness, and mounting numbers of surgeries which are considered high risk.

Older individuals will certainly have a higher risk of developing AKI as the functioning of their kidneys starts to decline with old age. Rising prevalence of AKI is further complicated by the ongoing trend of increased global health care access and improved diagnostics.

Awareness regarding health of kidneys has increased, and as a result, a lot more newly diagnosed cases of acute kidney injuries find their way to treatment, also creating a wider space for the market growth.

Besides, healthcare providers are focused now more than ever on making an early diagnosis and implementing timely intervention to prevent a transition from acute kidney injury to chronic kidney disease, which is quite a tough and costly condition to treat.

A combination of multiple risk components involved with end-heart and kidney surgeries, sepsis, trauma, and the use of nephrotoxic drugs have pressed for such intense care.

As the count of patients for dialysis and other kidney treatments is increasing day by day, pharmaceutical companies, device manufacturers, and healthcare service providers are bringing in more effective solutions to tackle this patient group.

Advancements in Treatment Technologies is driving Revenue Growth for Acute Kidney Injury Treatment

Advances in pharmaceutical therapy and medical device technology are presenting numerous opportunities to make better treatments available for AKI. More targeted and effective therapies, such as those emerging in RRTs and dialysis methods, can help improve the outcome of AKI patients.

For example, advances in dialysis machines and technology have resulted in more efficient filtration processes, reduced treatment times, and fewer complications from traditional dialysis treatments. All these advancements have improved patient compliance and satisfaction with their treatments.

With rapid advancements in biomarker testing, it is changing the way health care providers diagnose AKI. Early detection of AKI is a critical event to prevent progression toward worse forms of kidney damage, and new biomarkers are in development for the detection of kidney injury at an earlier stage, even before traditional signs such as elevated serum creatinine levels become apparent.

Advantages of this development include an advanced approach toward managing AKI while reducing the chances of needing intervention and hence reducing patient prognosis. These innovative therapies are geared at repairing the damaged kidney cells or stimulating regeneration, which can ultimately be translated into better renal function and longer-term benefits for the patient.

Addressing Healthcare Needs of Rural and Low-Resource Regions within Emerging Economies is Creating Opportunities in the Market

The acute kidney injury (AKI) treatment market has an exciting opportunity in addressing the healthcare needs of rural and low-resource regions within emerging economies. In countries such as India, Bangladesh, Sub-Saharan Africa, and parts of Latin America, healthcare infrastructure remains limited, particularly in rural areas where access to specialized care, such as dialysis or renal replacement therapies, is scarce.

On the other hand, these areas reflect a growth point because AKI rates continue increasing with increasing drivers such as infection, trauma and high mortality when patients present with failure kidneys.

Both local governments and international organizations are addressing improvement of healthcare delivery, which could open a gap for companies that can offer cheap, portable, and accessible AKI treatments that could be suited for these environments.

Affordable medical technologies, such as low-cost kidney care devices and mobile dialysis machines, could make this gap bridged in areas where resources are minimal. In addition, a number of other initiatives, like mobile clinics, community health worker programs, and telemedicine networks, improve access to healthcare for rural populations.

These efforts make much-needed access to care for populations at risk of AKI but who cannot afford or previously could not access advanced treatment facilities.

High Treatment Costs and Affordability Issues may Restrict Market Growth

Even with advances in AKI treatment, the cost remains one of the greatest deterrents to market growth, especially in low- and middle-income countries. It is a tough hill to climb for many patients who struggle with treatment options such as RRT, dialysis, and hospitalization mainly because they are very expensive.

For instance, dialysis is very expensive; it does require long-term care and frequent sessions, which are usually prohibitive whenever such patients lack proper insurance coverage. Treatments for AKI have become much less affordable in emerging markets, where the burden of kidney disease is increasing.

Apart from this, the government's inability to fund full treatment of costly conditions has exacerbated health inequalities in many regions.

This cost constraint can delay a diagnosis or treatment, causing patients to have bad outcomes and increasing healthcare costs in the long term. In addition, the lack of economic access to dialysis or other therapies may encourage patients to take less effective or alternative treatments that will lead to severe complications like kidney failure.

The expensive initial costs for purchasing and maintaining dialysis machines and other medical equipment restrict the capabilities of healthcare facilities, especially those in rural settings, to deliver the best possible care. In the absence of economic incentives to extend healthcare services to these underserved regions, AKI treatment becomes a significant issue, thereby stifling the potential growth of the market in such areas.

The global acute kidney injury treatment industry recorded a CAGR of 3.9% during the historical period between 2020 and 2024. The growth of acute kidney injury treatment industry was positive as it reached a value of USD 5,289.5 million in 2035 from USD 2,540.5 million in 2025.

The improvement of medical devices and the better understanding of renal operations have allowed increasingly targeted interventions. However, nearer fifty years ago with the introduction of dialysis, a treatment that began to make the possibility of life-saving options for patients suffering from severe renal impairment a reality. However, many regions restricted dialysis treatments to a limited audience due to its high costs.

With the rising rate of risk factors including diabetes, hypertension, and cardiovascular diseases, cases of AKI are on an upward trend. Progress in technologies regarding diagnostics and developments of novel biomarkers along with imaging techniques make the diagnosis even more precise with detection at the initial stages, therefore improving patients' outcomes.

Improved patient outcome as well as extension of options to treat diseases. It is predicted that in the future, progress in personalized medicine would significantly shape AKI treatment.

Tailoring therapies based on individual genetic profiles and specific disease mechanisms might lead to more effective and targeted interventions. Moreover, the integration of artificial intelligence and machine learning in monitoring and managing AKI patients is expected to enhance early detection and optimize treatment protocols.

The expansion of healthcare access in emerging economies is a significant opportunity for market growth. As countries invest more in healthcare infrastructures and upgrade access to more medical services, the demand for AKI treatment is expected to increase.

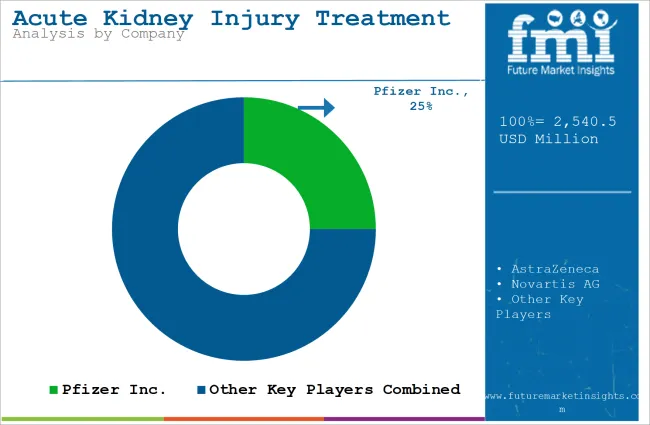

Tier 1 companies are the industry leaders with 54.1% of the global industry. These companies stand out for having a large product portfolio and a high production capacity.

These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. Prominent companies within tier 1 include Pfizer Inc., AstraZeneca, Novartis AG, Medtronic plc, GE Healthcare among others

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 26.1% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology.

The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Sanofi, Fresenius Medical Care, B. Braun Melsungen AG among others.

Compared to Tiers 1 and 2, Tier 3 companies offer acute kidney injury treatment, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for acute kidney injury treatment in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below.

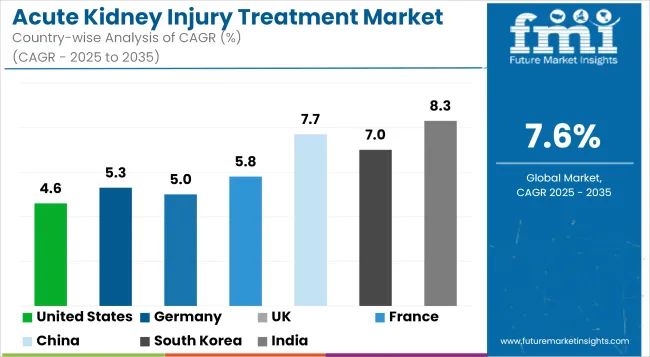

It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 89.2%. By 2035, China is expected to experience a CAGR of 7.7% in the Asia-Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

| Germany | 5.3% |

| UK | 5.0% |

| France | 5.8% |

| China | 7.7% |

| South Korea | 7.0% |

| India | 8.3% |

Germany’s acute kidney injury treatment market is poised to exhibit a CAGR of 5.3% between 2025 and 2035. The Germany holds highest market share in European market.

The country has had the leadership role in medical innovation that has really transformed healthcare. Its contribution was seen in terms of early detection and diagnosis of acute kidney injury, or AKI. Indeed, Germany made heavy investments in research and development (R&D), which were particularly directed at highly advanced diagnostic technologies enabling the detection of AKI from its earliest possible stages.

One of the important features of the progress of Germany in AKI diagnosis is the development and introduction of new biomarkers in blood and urine tests. Biomarkers are specific substances in the body that can point to the start of kidney damage even before the traditional symptoms, such as changes in urine output or increased serum creatinine levels, are apparent.

These diagnostic tools enable early identification of AKI, thus allowing timely interventions that are critical in preventing the condition from progressing to more severe stages that require complex treatments such as dialysis or kidney transplants.

United States is anticipated to show a CAGR of 4.6% between 2025 and 2035. Chronic conditions such as diabetes, hypertension, cardiovascular diseases, and obesity are vastly common in the United States, all of which keep the risks of renal injury more pronounced.

Diabetes and hypertension are the leading causes of chronic kidney disease (CKD) and AKI through long-term injury to blood vessels and kidneys. Chronic hyperglycemia in diabetic subjects gradually injures renal tissue, whereas hypertensive subjects present those alterations in the renal blood vessels leading to their narrowing and hardening, and hence, the renal function becomes impaired.

The other important risk factor is cardiovascular disease, with heart disease often affecting the supply of blood to the kidneys, which could trigger an AKI existentially during the time of surgery, especially in those who have pre-existing clinical concerns over kidneys.

Even more threatening is obesity, being the third risk factor to AKI, with the sole purpose that it augurs most of the time toward developing diabetes and hypertension. The indices of risk of incidences with AKI would heighten with rising obesity prevalence cases in the USA.

Besides, adiposity predisposes the milieu of the body to risks which lead to the impairment of functions such as the imbalance of lipid metabolism, which could lead to furtherance of kidney insults.

India is anticipated to show a CAGR of 8.3% between 2025 and 2035.

This has caused a considerable surge in the incidence rate of AKI in India, coupled with the rising healthcare industry and more high-risk surgeries.The present scenario of health care in India is progressing at a breakneck speed, with more and more hospital setups providing advanced treatments. With increased frequency and complexity in surgery, patients undergoing cardiac, abdominal, or orthopedic surgeries are more susceptible to AKI risks.

Moreover, the high accident rate on the roads in India adds another layer of trauma that keeps feeding the rise of AKI cases. These factors indicate a rapid increase in need for AKI management, including dialysis and renal replacement therapies (RRT).

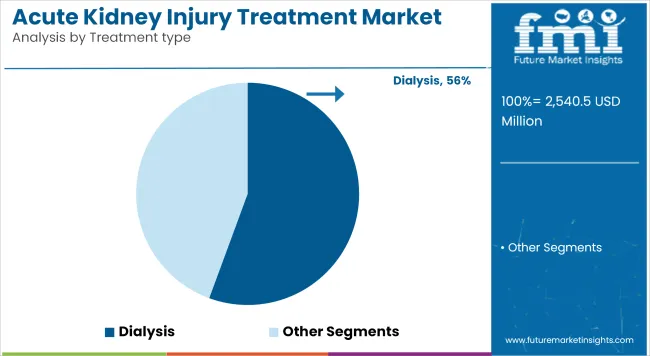

The section contains information about the leading segments in the industry. Based on treatment type, the dialysis segment is expected to account for 54.3% of the global share in 2025.

| By Treatment type | Dialysis |

|---|---|

| Value Share (2025) | 55.6% |

The dialysis segment is projected to be a dominating segment in terms of revenue, accounting for almost 55.6% of the market share in 2025.

Dialysis is the most common treatment for AKI patients since it provides instant relief and stabilizes life-threatening conditions caused by renal failure.In cases where kidney function is acutely compromised, dialysis provides a life-saving mechanism by removing toxins, excess fluids, and electrolytes that the kidneys can no longer filter on their own.

This is highly important especially in severe AKI where the failure of these organs can lead to complications such as uremic poisoning, fluid overload, and hyperkalemia very rapidly.By undertaking such functions, dialysis prevents further damage to the body, hence stabilizing the patients while their kidneys recover or even require more long-term intervention.

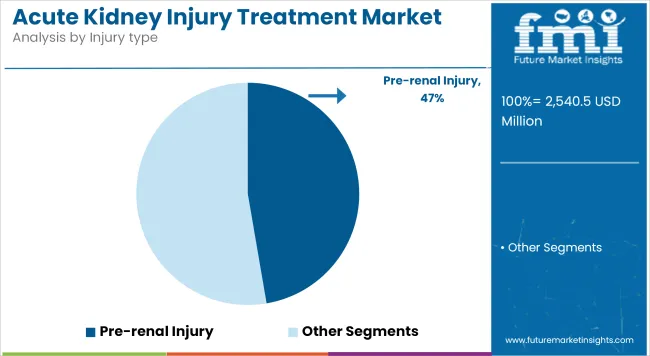

| By Injury type | Pre-renal Injury |

|---|---|

| Value Share (2025) | 47.3% |

Pre-renal injury is one of the leading causes for acute kidney injury, which is prominent and potent due to associations with a host of clinical conditions that compromise renal blood flow. The renal perfusion goes down, causing a drop in GFR and leading to kidney dysfunction. This type of AKI is usually reversible, provided the underlying cause is promptly addressed-a situation that has led to its prominence in both clinical diagnosis and management.

One of the primary reasons pre-renal injury leads in AKI is due to its common occurrence in critical care settings. Conditions such as dehydration, hypotension, heart failure, blood loss, or sepsis can all lead to a reduction in renal perfusion, which is a primary factor in pre-renal injury. For example, significant blood loss from trauma or surgery can lower circulating blood volume, leading to decreased kidney perfusion and AKI.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. Strategic partnerships and collaborations with research institutions and healthcare providers are being utilized to broaden their product portfolio.

Geographical expansion into the emerging markets, particularly China and India, has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong.

Recent Industry Developments in Acute Kidney Injury Treatment Industry Outlook

In terms of treatment type, the industry is divided into dialysis (intermittent hemodialysis, peritoneal dialysis and sustained low-efficiency dialysis (sled), drug therapy (antibiotics, diuretics, immunosuppressive agents), supportive care (nutritional support and) fluid therapy

In terms of injury type, the industry is segregated into pre-renal injury, intrinsic renal injury and post-renal injury

In terms of end user, the industry is divided into hospitals, ambulatory surgical centers, specialty clinics, home healthcare among others

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global acute kidney injury treatment industry is projected to witness CAGR of 7.6% between 2025 and 2035.

The global acute kidney injury treatment industry stood at USD 2,382.9 million in 2024.

The global acute kidney injury treatment industry is anticipated to reach USD 5,289.5 million by 2035 end.

China is expected to show a CAGR of 7.7% in the assessment period.

The key players operating in the global acute kidney injury treatment industry are Pfizer Inc., AstraZeneca, Novartis AG, Sanofi, Fresenius Medical Care, B. Braun Melsungen AG, Baxter International Inc., Medtronic plc, and GE Healthcare among others.

Table 01: Global Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 02: Global Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 03: Global Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Distribution Channel

Table 04: Global Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Region

Table 05: North America Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Country

Table 06: North America Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 07: North America Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 08: North America Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, ByDistribution Channel

Table 09: Latin America Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Country

Table 10: Latin America Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 11: Latin America Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 12: Latin America Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, ByDistribution Channel

Table 13: Europe Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Country

Table 14: Europe Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 15: Europe Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 16: Europe Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, ByDistribution Channel

Table 17: South Asia Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Country

Table 18: South Asia Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 19: South Asia Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 20: South Asia Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, ByDistribution Channel

Table 21: East Asia Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Country

Table 22: East Asia Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 23: East Asia Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 24: East Asia Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Distribution Channel

Table 25: Oceania Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Country

Table 26: Oceania Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 27: Oceania Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 28: Oceania Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Distribution Channel

Table 29: MEA Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Country

Table 30: MEA Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 31: MEA Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 32: MEA Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Distribution Channel

Table 33: India Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 34: India Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 35: India Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Distribution Channel

Table 36: China Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 37: China Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 38: China Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Distribution Channel

Table 39: Brazil Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Product Type

Table 40: Brazil Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Injury Type

Table 41: Brazil Market Size (US$ Million) Analysis 2014 to 2021 and Opportunity Assessment 2022 to 2029, By Distribution Channel

Figure 01: Global Historical Market Size and Y-o-Y, 2014 to 2021

Figure 02: Global Market Size (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 03: Global Market Absolute $ Opportunity, 2014-2029

Figure 04: Global Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 05: Global Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 06: Global Market Attractiveness Analysis, By Product Type

Figure 07: Global Market Analysis by Injury Type - 2022 & 2029

Figure 08: Global Market Y-o-Y Growth Projections by Injury Type, 2022 to 2029

Figure 09: Global Market Attractiveness Analysis, By Injury Type

Figure 10: Global Market Share Analysis (%) By Distribution Channel, 2022 & 2029

Figure 11: Global Market Y-o-Y Growth (%) By Distribution Channel, 2022 to 2029

Figure 12: Global Market Attractiveness Analysis, By Distribution Channel

Figure 13: Global Market Share Analysis (%) By Region, 2022 & 2029

Figure 14: Global Market Y-o-Y Growth (%) By Region, 2022 to 2029

Figure 15: Global Market Attractiveness Analysis, By Region

Figure 16: North America Market Size (US$ Million), 2014 to 2021

Figure 17: North America Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 18: North America Market Analysis by Country – 2022 & 2029

Figure 19: North America Market Y-o-Y Growth Projections by Country, 2022 to 2029

Figure 20: North America Market Attractiveness Analysis by Country, 2022 to 2029

Figure 21: North America Market Analysis by Product Type - 2022 & 2029

Figure 22: North America Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 23: North America Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 24: North America Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 25: North America Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 26: Latin America Market Size (US$ Million), 2014 to 2021

Figure 27: Latin America Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 28: Latin America Market Analysis by Country – 2022 & 2029

Figure 29: Latin America Market Y-o-Y Growth Projections by Country, 2022 to 2029

Figure 30: Latin America Market Attractiveness Analysis by Country, 2022 to 2029

Figure 31: Latin America Market Analysis by Product Type – 2022 & 2029

Figure 32: Latin America Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 33: Latin America Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 34: Latin America Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 35: Latin America Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 36: Europe Market Size (US$ Million), 2014 to 2021

Figure 37: Europe Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 38: Europe Market Analysis by Country – 2022 & 2029

Figure 39: Europe Market Y-o-Y Growth Projections by Country, 2022 to 2029

Figure 40: Europe Market Attractiveness Analysis by Country, 2022 to 2029

Figure 41: Europe Market Analysis by Product Type – 2022 & 2029

Figure 42: Europe Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 43: Europe Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 44: Europe Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 45: Europe Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 46: South Asia Market Size (US$ Million), 2014 to 2021

Figure 47: South Asia Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 48: South Asia Market Analysis by Country – 2022 & 2029

Figure 49: South Asia Market Y-o-Y Growth Projections by Country, 2022 to 2029

Figure 50: South Asia Market Attractiveness Analysis by Country, 2022 to 2029

Figure 51: South Asia Market Analysis by Product Type – 2022 & 2029

Figure 52: South Asia Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 53: South Asia Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 54: South Asia Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 55: South Asia Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 56: East Asia Market Size (US$ Million), 2014 to 2021

Figure 57: East Asia Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 58: East Asia Market Analysis by Country – 2022 & 2029

Figure 59: East Asia Market Y-o-Y Growth Projections by Country, 2022 to 2029

Figure 60: East Asia Market Attractiveness Analysis by Country, 2022 to 2029

Figure 61: East Asia Market Analysis by Product Type – 2022 & 2029

Figure 62: East Asia Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 63: East Asia Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 64: East Asia Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 65: East Asia Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 66: Oceania Market Size (US$ Million), 2014 to 2021

Figure 67: Oceania Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 68: Oceania Market Analysis by Country – 2022 & 2029

Figure 69: Oceania Market Y-o-Y Growth Projections by Country, 2022 to 2029

Figure 70: Oceania Market Attractiveness Analysis by Country, 2022 to 2029

Figure 71: Oceania Market Analysis by Product Type – 2022 & 2029

Figure 72: Oceania Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 73: Oceania Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 74: Oceania Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 75: Oceania Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 76: MEA Market Size (US$ Million), 2014 to 2021

Figure 77: MEA Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 78: MEA Market Analysis by Country – 2022 & 2029

Figure 79: MEA Market Y-o-Y Growth Projections by Country, 2022 to 2029

Figure 80: MEA Market Attractiveness Analysis by Country, 2022 to 2029

Figure 82: MEA Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 83: MEA Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 84: MEA Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 85: MEA Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 86: Emerging Countries Market Size (US$ Million) Analysis, 2022

Figure 87: Emerging Countries Market Size (US$ Million) 2014 to 2029

Figure 88: India Market Size (US$ Million), 2014 to 2021

Figure 89: India Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 90: India a Market Analysis by Product Type - 2022 & 2029

Figure 91: India Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 92: India Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 93: India Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 94: India Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 95: China Market Size (US$ Million), 2014 to 2021

Figure 96: China Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 97: China Market Analysis by Product Type - 2022 & 2029

Figure 98: China Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 99: China China Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 100: China a Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 101: China Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 102: Brazil Market Size (US$ Million), 2014 to 2021

Figure 103: Brazil Market Size (US$) & Y-o-Y Growth (%), 2022 to 2029

Figure 104: Brazil Market Analysis by Product Type - 2022 & 2029

Figure 105: Brazil Market Y-o-Y Growth Projections by Product Type, 2022 to 2029

Figure 106: Brazil Market Attractiveness Analysis by Product Type, 2022 to 2029

Figure 107: Brazil Market Attractiveness Analysis by Distribution Channel, 2022 to 2029

Figure 108: Brazil Market Attractiveness Analysis by Injury Type, 2022 to 2029

Figure 109: MEA Market Analysis by Product Type - 2022 & 2029

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acute Migraine Treatment Market Trends – Analysis & Forecast 2024-2034

Severe Acute Respiratory Syndrome Treatment Market

ICU-acquired Acute Kidney Treatment Market

Long Term Post-Acute Care Software Market Size and Share Forecast Outlook 2025 to 2035

Kidney Stone Extraction Balloon Market Size and Share Forecast Outlook 2025 to 2035

Kidney Transplant Market Analysis by Transplant, Age Group, End User, and Region through 2035

APOL1 Mediated Kidney Disease Market - Demand, Growth & Forecast 2025 to 2035

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Autosomal Dominant Polycystic Kidney Disease Treatment Market Overview - Growth & Forecast 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Algae Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA