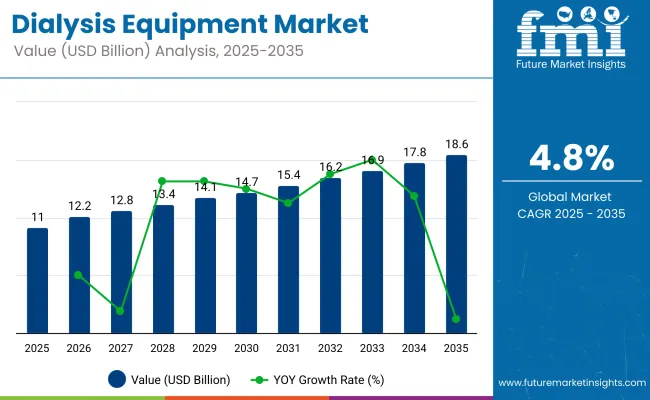

The global dialysis equipment market is valued at USD 11.66 billion in 2025 and is anticipated to reach a value of USD 18.63 billion by 2035. Sales are projected to rise at a compound annual growth rate (CAGR) of 4.8% over the forecast period between 2025 and 2035.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 11.66 billion |

| Projected Size, 2035 | USD 18.63 billion |

| Value-based CAGR (2025 to 2035) | 4.8% |

This growth is primarily driven by the increasing prevalence of chronic kidney diseases (CKD) and the rising number of patients requiring dialysis treatment. The growing aging population, along with the rising incidence of diabetes and hypertension, which are major risk factors for CKD, is contributing significantly to the demand for dialysis equipment.

Furthermore, advancements in dialysis technologies, such as portable and home dialysis systems, are expanding treatment options and improving patient convenience, which is further fueling market growth.

Looking ahead, the dialysis equipment market is likely to continue its upward trajectory, driven by technological advancements and increasing demand for at-home dialysis treatments. Innovations such as wearable dialysis machines and automated home dialysis systems are expected to enhance patient comfort and offer greater flexibility, leading to wider adoption.

Additionally, the integration of remote monitoring and telehealth capabilities in dialysis systems is likely to improve treatment management, especially in home settings. With these advancements, the market is set to experience a shift towards more personalized and patient-centric solutions, further accelerating growth in the coming years.

Government regulations will play a significant role in shaping the dialysis equipment market’s future. Regulatory bodies, such as the USA Food and Drug Administration (FDA) and the European Medicines Agency (EMA), continue to enforce stringent guidelines to ensure the safety and efficacy of dialysis machines.

These regulations push manufacturers to innovate and meet high standards, driving the demand for advanced, reliable dialysis solutions. As regulatory requirements evolve and healthcare systems prioritize better access to dialysis treatments, the market is expected to grow steadily.

The dialysis equipment industry is undergoing a technological transformation, with leading manufacturers integrating smart solutions to optimize treatment, enhance patient care, and support home-based therapies. Companies are embedding remote monitoring, AI-driven analytics, cloud connectivity, and user-friendly automation to enable predictive maintenance, personalized therapy, and improved accessibility.

Government regulations in the dialysis equipment market play a critical role in ensuring patient safety, device efficacy, manufacturing quality, and fair market practices. These regulations span product approvals, clinical usage standards, quality certifications, and post-market surveillance. Key areas of regulatory oversight include device classification, home-use approval, and data privacy for connected smart systems.

• United States (FDA): Dialysis equipment is classified as Class II or III medical devices by the U.S. Food and Drug Administration. Manufacturers must follow stringent protocols under the FDA's 510(k) clearance or Premarket Approval (PMA) processes. Devices with smart technology also need to comply with software validation, cybersecurity standards, and data security guidelines under HIPAA (Health Insurance Portability and Accountability Act).

• European Union (EU MDR): Under the EU Medical Device Regulation, dialysis machines must undergo CE marking, requiring clinical evaluations, safety testing, and post-market surveillance. The MDR also requires greater transparency in performance data and technical documentation, especially for software-driven or connected devices.

• India (CDSCO): The Central Drugs Standard Control Organization oversees dialysis device regulation. Imported and locally manufactured devices must meet quality and safety standards under the Medical Devices Rules, with increasing attention on home-based smart dialysis solutions.

The above table presents the expected CAGR for the global dialysis equipment market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 4.8%, followed by a slightly lower growth rate of 4.4% in the second half (H2) of the same period.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.8% |

| H2 (2024 to 2034) | 4.4% |

| H1 (2025 to 2035) | 5.9% |

| H2 (2025 to 2035) | 5.5% |

The above table presents the expected CAGR for the global dialysis equipment market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 4.8%, followed by a slightly lower growth rate of 4.4% in the second half (H2) of the same period.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 5.9% in the first half and decrease slightly to 5.5% in the second half. In the first half (H1), the market witnessed a decrease of -70.00 BPS, while in the second half (H2), the market witnessed a decrease of -90.00 BPS.

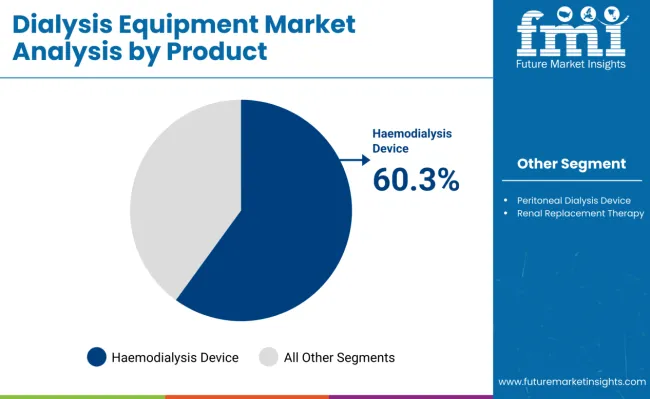

The market is segmented based on product type, disease condition, end use, and region. By product type, the market is divided into haemodialysis devices, peritoneal dialysis devices, and continuous renal replacement therapy. Haemodialysis devices are further segmented into haemodialysis machines, dialyzers and filters, and vascular access devices, while peritoneal dialysis devices include dialyzers and filters and vascular access devices.

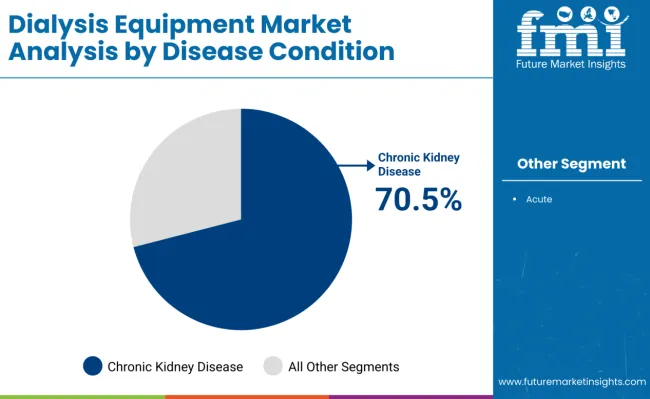

In terms of disease condition, it is segmented into chronic and acute. Based on end use, the market is categorized into hospitals, clinics, ambulatory surgical centres, and home care settings. Regionally, the market is classified into North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East and Africa.

Haemodialysis devices are projected to remain the leading segment in the dialysis equipment market, commanding 60.3% value share in 2025. This dominance stems from their widespread clinical adoption for the management of end-stage renal disease (ESRD) and chronic kidney disease (CKD).

These devices efficiently mimic renal function by removing toxins and excess fluids from the bloodstream, addressing a critical health burden worldwide. Their cost-effective nature, compared to alternatives such as peritoneal dialysis or renal transplantation, further solidifies their market position. Continuous improvements in haemodialysis technology including advanced membrane designs, biocompatible materials, and automated monitoring systems enhance treatment safety and patient comfort.

Major manufacturers like Fresenius Medical Care and Baxter International are investing heavily in R&D to develop user-friendly, portable, and home-friendly haemodialysis solutions. Furthermore, the global rise in diabetes and hypertension cases, which are primary risk factors for CKD, is set to fuel demand.

The hospital sector also relies predominantly on haemodialysis machines due to their high throughput capability, making them indispensable across care settings. This segment’s strong growth trajectory reflects a robust pipeline of technological enhancements and increasing ESRD prevalence globally.

| Product Type Segment | Market Share (2025) |

|---|---|

| Haemodialysis Devices | 60.3% |

Chronic kidney disease (CKD) is projected to retain its leadership position in the dialysis equipment market, accounting 70.5% of the value share in 2025. CKD continues to be a major global health concern due to its progressive nature and its strong association with prevalent conditions such as diabetes and hypertension.

The expanding elderly population and the surging incidence of metabolic disorders have significantly contributed to the rising number of CKD cases requiring dialysis intervention. CKD patients require consistent and long-term dialysis support, unlike acute cases, which are typically short-term. This persistent need for treatment sustains the demand for dialysis equipment, particularly haemodialysis machines, across hospitals, clinics, and home care settings.

Leading manufacturers such as Nikkiso Co., Ltd., B. Braun Melsungen AG, and Fresenius focus on developing devices tailored for chronic use, offering enhanced durability, automated features, and patient-centric designs. Moreover, CKD’s silent progression often results in late diagnosis, thereby necessitating immediate and regular dialysis, further boosting equipment sales. The segment's share is anticipated to remain dominant due to these sustained medical necessities and the growing chronic disease burden worldwide.

| Disease Condition Segment | Market Share (2025) |

|---|---|

| Chronic kidney disease (CKD) | 70.5% |

The home care settings segment is projected to witness the fastest CAGR of 6.5% from 2025 to 2035, emerging as the most promising end-use category in the dialysis equipment market. This growth is primarily attributed to the rising adoption of home-based dialysis therapies, especially peritoneal dialysis, driven by technological advancements such as device miniaturization, automation, and ease of use.

Patients increasingly prefer the comfort, flexibility, and independence offered by home-based dialysis over frequent hospital visits, particularly among elderly populations and those with mobility challenges.

Additionally, governments in regions such as North America and Europe are encouraging the shift toward home dialysis through favorable reimbursement policies and public health campaigns, thereby supporting wider acceptance. Healthcare providers are also promoting home care to reduce the burden on hospital infrastructure and lower overall treatment costs.

Key manufacturers are focusing on portable and wearable dialysis devices integrated with smart monitoring systems that allow remote supervision by nephrologists, ensuring patient safety while improving treatment adherence. The segment’s growing appeal is further strengthened by the global trend toward personalized healthcare solutions, making home care settings a critical driver of the dialysis equipment market’s expansion during the forecast period.

| End-Use Segment | CAGR (2025 to 2035) |

|---|---|

| Home Care Settings | 6.5% |

One of the major driving factors for the dialysis equipment market is certainly the growing demand for dialysis from the aging population. With growing old age, there is a corresponding surge in the prevalence of chronic kidney disease and end-stage renal disease hence, the requirement for the adoption of more improved and comprehensive dialysis solutions increases.

For instance, the World Health Organization has made projections indicating that the percentage of the world's population that will be 60 years of age or older by mid this century will double and peg at

Improved healthcare has led to increased life expectancy, and more people live longer but not necessarily in perfect health. Much as longevity might be an expected and welcome outcome, it also presents the higher risk of age-related diseases like CKD. The more years one lives, the higher the chances of requiring dialysis at some point or the other. In turn, this definitely leads to a higher demand for dialysis clinics, home dialysis alternatives, and the necessary equipment.

While the aging population has greatly fueled the dialysis equipment market, it also comes with its challenges. The high expenses for dialysis treatments and trained health care workers who monitor the treatment are very significant difficulties.

In a way, these difficulties create opportunities for innovations. Indeed, in that respect, the market witnesses growth in the development of new cost-effective and efficient solutions able not only to minimize the burden on healthcare systems but also to improve patient outcomes.

ESRD is one of the major healthcare problems globally. One of the drivers of demand for advanced dialysis equipment arises from ESRD. This is a very critical condition, and it manifests as permanent kidney failure and is thus fatal unless the patient is on dialysis or was transplanted. Statistics indicate that its prevalence has risen over the past couple of decades with large underlying drivers.

According to American Kidney Fund, up to 37 million Americans have kidney disease. Nearly 808,000 Americans are living with kidney failure. More than 557,000 Americans are on dialysis. Kidney disease is increasing at an alarming rate.

It currently affects greater than 1 in 7 or 14% of American adults. In 2021, there were about 135,000 new cases of kidney failure among Americans. Nine out of ten people with kidney disease are unaware they have it, and one in three of those with severely reduced kidney function have no awareness of their kidney disease but are not yet on dialysis.

ESRD, driven by the prevalence of chronic diseases, ageing populations, and lifestyle factors, is growing in ascending trends and is expected ultimately to have a significant influence on the demand for dialysis equipment. This trend impresses on three critical needs: continued innovation, investment in healthcare infrastructure, and global collaboration to combat the growing burden of kidney diseases worldwide.

Awareness programs on kidney health have been engaged in by different organizations and healthcare bodies. For example, World Kidney Day is an annual event aware of kidney health and attempts at reducing the incidence and consequences of kidney disease and its complications.

Accordingly, numerous programs aimed at sensitizing risk factors of kidney disease, diabetes, hypertension, and obesity, as well as unhealthy lifestyles, have been implemented and encouraged people to live healthier and regularly check on them. This therefore stressed early detection and more lately, some general screening programs were affected. Evidence of CKD will allow timely institution of interventions early in people with CKD hence slowing down the progression of CKD to ESRD.

Growing awareness has also led to planning and implementation of chronic disease management programs where kidney health forms a significant concern. These facilities are intended to control and reduce the risk factors of kidney disease by making lifestyle changes, managing medication, and providing continuous monitoring.

One of the major drivers for the dialysis equipment market is increasing awareness about kidney health. With increasing awareness, the market for dialysis equipment will grow accordingly so as to provide adequate treatment for patients who suffer from CKD and ESRD.

The operations of dialysis machines are pretty complex; hence, sophisticated technology is required. They have to filter and cleanse the blood correctly; this requires sophisticated engineering and high-precision components. Here is where the complexity of the machines calls for specialized materials and highly developed techniques of production, which will greatly increase the cost.

Since dialysis treatment is a very critical process, the equipment has to meet very stringent specifications of safety and quality. Since such equipment must adhere to the compliance requirements of the regulatory bodies, like FDA or European CE, a protracted process of testing and validation is needed. These regulatory compliance requirements increase the cost of production due to extended research, development, and quality control.

Components, such as pumps, filtration units, and sensors, in dialysis machines are normally fabricated from expensive materials that are highly durable and reliable. It is these components, along with the need for precision engineering, that sets the biggest share of the total cost in the manufacturing of dialysis machines.

Dialysis equipment requires constant maintenance to be always kept in top condition and to extend their life span, but routine checks, servicing, and periodic replacement of parts that have a finite lifetime are also required. This has the implication of increasing operational costs for hospitals/dialysis centers through investment in competent technicians and the necessity of maintenance contracts.

It is mostly the high costs of production and maintenance that limit accessibility to the treatment of dialysis equipment in most cases, especially in low- and middle-income countries. In tight healthcare budgets, the cost of purchasing and servicing dialysis machines may be unaffordable and therefore creates inequalities in access to this life-saving intervention.

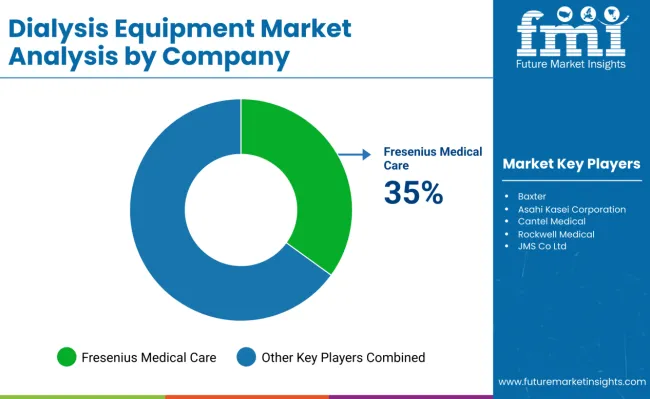

Tier 1 companies comprise market leaders with a market revenue of above USD 100 million capturing significant market share of 54.4% in global market. These companies invest in advanced research and development to innovate new technologies that enhance treatment efficacy and improve patient outcomes.

Expanding global market presence is another key strategy, often achieved through strategic partnerships, acquisitions, and establishing strong distribution networks. Prominent companies within tier 1 include Baxter, Asahi Kasei Corporation, Fresenius Medical Care AG & Co. KGaA and Cantel Medical.

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market and holds around 6.1% market share. These companies often differentiate themselves through niche product offerings or specialized services that cater to specific segments of the market. Prominent companies in tier 2 include Rockwell Medical, JMS Co.Ltd., Teleflex Incorporated, B. Braun Melsungen AG and NIPRO.

Finally, Tier 3 companies, such as HEMOCLEAN CO., LTD., Quanta and Outset Medical, Inc. are essential for the market. They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the dialysis equipment market remains dynamic and competitive.

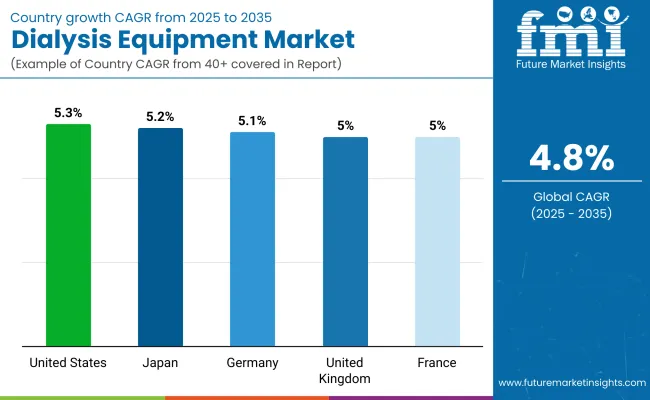

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

| United Kingdom | 5.0% |

| Germany | 5.1% |

| France | 5.0% |

| Japan | 5.2% |

The USA dialysis equipment market is estimated to grow at 5.3% CAGR during the study period. The market is expanding due to the rising incidence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), driven by factors such as obesity, diabetes, and hypertension.

Advanced healthcare infrastructure and favorable reimbursement policies encourage the adoption of modern dialysis equipment, including portable and home-based systems. Moreover, continuous research and technological innovations in hemodialysis and peritoneal dialysis devices are improving treatment outcomes and patient comfort, further driving demand. The growing elderly population and increasing awareness of renal health are also contributing to sustained market growth across the country.

The UK dialysis equipment market is estimated to grow at 5.0% CAGR during the study period. Growing prevalence of CKD among the aging population and an increase in lifestyle-related diseases such as diabetes and hypertension are key drivers of market expansion.

The National Health Service (NHS) actively supports home-based dialysis treatments, boosting the adoption of compact and patient-friendly devices. Technological advancements such as wearable dialysis machines and telemonitoring solutions are gaining traction to address the shortage of specialized dialysis centers. Additionally, increasing investments in healthcare infrastructure and a shift toward value-based care models are creating new opportunities for dialysis equipment manufacturers in the country.

The Germany dialysis equipment market is estimated to grow at 5.1% CAGR during the study period. Germany’s market growth is fueled by its well-established healthcare system, rising elderly population, and high awareness of renal diseases.

Demand for hemodialysis machines remains strong, with increasing acceptance of peritoneal dialysis and home dialysis solutions to reduce hospital burden. Government initiatives to improve healthcare efficiency and patient convenience are encouraging the development of smart, automated dialysis equipment. Furthermore, partnerships between hospitals and dialysis service providers are enhancing access to state-of-the-art treatment technologies, ensuring steady demand for both consumables and durable dialysis equipment.

The French dialysis equipment market is estimated to grow at 5.0% CAGR during the study period. Rising CKD incidence among aging demographics and diabetic patients is propelling market demand.

The French healthcare system’s focus on quality patient outcomes and adoption of home-based dialysis therapies is driving the uptake of portable and user-friendly dialysis machines. Continuous improvement in technology, including automated peritoneal dialysis (APD) systems and real-time monitoring devices, ensures better patient management and compliance. Government reimbursement schemes and public-private partnerships in dialysis care services are further supporting market growth, making advanced dialysis treatments more accessible and affordable across the country.

The Japanese dialysis equipment market is estimated to grow at 5.2% CAGR during the study period. Japan has one of the highest rates of dialysis patients globally, primarily due to its super-aged society and high prevalence of diabetes-related renal complications.

The market benefits from state-sponsored healthcare coverage, ensuring affordability of dialysis treatments for the population. Technological innovations such as compact, wearable dialysis units and advanced blood purification systems are enhancing patient comfort and treatment efficiency. Additionally, strong local manufacturing capabilities and export-oriented production of dialysis equipment contribute to domestic availability and adoption, driving consistent market growth in Japan.

Substantial investments are seen in the dialysis equipment industry towards research and development in order to drive innovations by differentiating products through advanced features and improved patient outcomes. Another key strategic focus of these companies is to actively look for strategic partners to bolster their product portfolios and expand their global market presence.

In terms of product, the industry is divided into haemodialysis devices (haemodialysis machines, dialyzers and filters, vascular access devices), peritoneal dialysis devices (dialyzers and filters, vascular access devices) and continuous renal replacement therapy.

In terms of disease condition, the industry is segregated into chronic and acute.

In terms of end use, the industry is segregated into hospitals, clinics, ambulatory surgical centres and home care settings.

Key countries of North America, Latin America, Western Europe, Eastern, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global dialysis equipment market is expected to grow from USD 11.66 billion in 2025 to USD 18.63 billion by 2035, reflecting a CAGR of 4.8% during the forecast period.

The haemodialysis devices segment is projected to dominate the market, commanding 60.3% value share in 2025 due to its widespread adoption for managing end-stage renal disease (ESRD) and chronic kidney disease (CKD).

Chronic kidney disease (CKD) is expected to remain the leading disease condition segment, accounting 70.5% of the value share in 2025, driven by its progressive nature and increasing global prevalence.

The home care settings segment is projected to witness the fastest CAGR of 6.5% from 2025 to 2035, driven by the growing adoption of home-based dialysis therapies and government support for home dialysis initiatives.

Top companies include Fresenius Medical Care, Baxter International, Asahi Kasei Corporation, Cantel Medical, Rockwell Medical, and Nipro, providing a range of dialysis solutions tailored to different patient needs and healthcare settings.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dialysis Equipment Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Dialysis Water Filters Market Size and Share Forecast Outlook 2025 to 2035

Dialysis Induced Anemia Treatment Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dialysis Device and Concentrates Market Growth - Trends & Forecast 2025 to 2035

Hemodialysis and Peritoneal Dialysis Market Analysis – Size, Share & Forecast 2024-2034

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ambulatory Peritoneal Dialysis Bags Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA