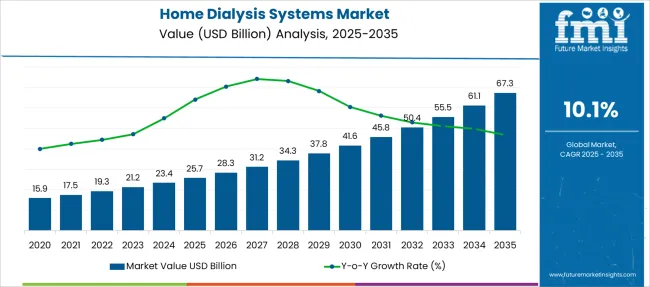

The Home Dialysis Systems Market is estimated to be valued at USD 25.7 billion in 2025 and is projected to reach USD 67.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period.

| Metric | Value |

|---|---|

| Home Dialysis Systems Market Estimated Value in (2025 E) | USD 25.7 billion |

| Home Dialysis Systems Market Forecast Value in (2035 F) | USD 67.3 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

The home dialysis systems market is expanding steadily, driven by the growing prevalence of chronic kidney disease and the increasing preference for patient-centric care models. Healthcare providers have placed a strong emphasis on improving quality of life for patients by enabling dialysis treatments in home settings.

Technological advancements in portable and user-friendly dialysis devices have made home treatment more feasible and safer. Additionally, healthcare systems are encouraging home dialysis as a cost-effective alternative to in-center treatments, reducing hospital visits and associated expenses.

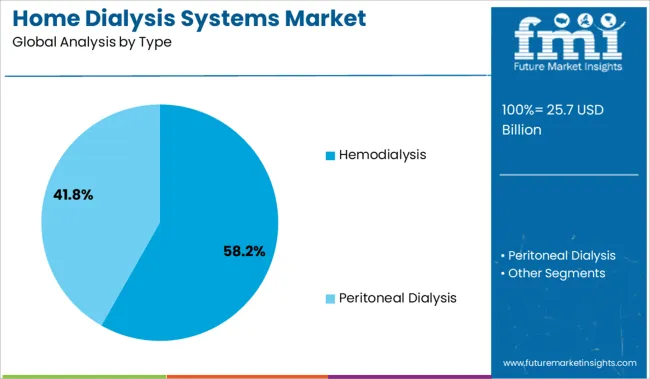

Patient education and telehealth support have further improved treatment adherence and outcomes. Future growth is expected to be propelled by rising awareness, expanding healthcare infrastructure for home care, and continued innovation in dialysis equipment. Segmental growth is anticipated to be led by Hemodialysis as the dominant treatment type, Devices as the leading product category, and Chronic Kidney Disease as the primary treatment indication.

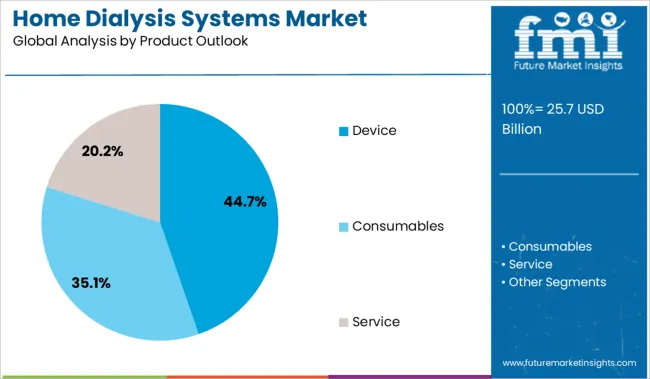

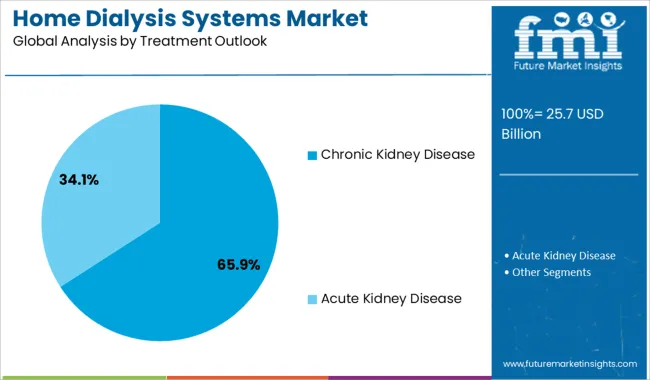

The market is segmented by Type, Product Outlook, and Treatment Outlook and region. By Type, the market is divided into Hemodialysis and Peritoneal Dialysis. In terms of Product Outlook, the market is classified into Device, Consumables, and Service. Based on Treatment Outlook, the market is segmented into Chronic Kidney Disease and Acute Kidney Disease. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Hemodialysis segment is expected to hold 58.2% of the home dialysis systems market revenue in 2025, maintaining its lead as the primary treatment type. This segment’s growth is supported by the widespread clinical adoption of hemodialysis for patients with end-stage renal disease requiring efficient and effective blood filtration.

Hemodialysis devices designed for home use have become increasingly sophisticated, offering safety features and ease of operation that empower patients to manage their treatment schedules. The ability to provide regular dialysis sessions at home reduces hospital dependence and enhances patient comfort.

As more patients and healthcare providers recognize the benefits of home-based hemodialysis, the segment is projected to retain its dominant market share.

The Device segment is projected to contribute 44.7% of the home dialysis systems market revenue in 2025, establishing itself as the key product category. Growth in this segment is fueled by advancements in portable, compact, and automated dialysis machines that facilitate home use.

These devices have been designed to minimize user error and provide real-time monitoring and alerts, increasing treatment safety and effectiveness. Manufacturers continue to innovate with technologies that reduce treatment time and improve patient comfort.

The rising preference for devices over consumables reflects the trend toward empowering patients with reliable, durable equipment. As the healthcare industry focuses on decentralized care and patient autonomy, device sales are expected to grow significantly.

The Chronic Kidney Disease segment is anticipated to hold 65.9% of the home dialysis systems market revenue in 2025, reflecting its status as the leading treatment indication. This segment’s growth is driven by the increasing global incidence of chronic kidney disease due to factors such as diabetes, hypertension, and aging populations.

Early diagnosis and management efforts have led to a larger patient pool eligible for home dialysis solutions. The chronic nature of the disease requires ongoing treatment, creating consistent demand for reliable home dialysis systems.

Healthcare providers are also advocating for home-based care models to improve patient outcomes and reduce healthcare system burdens. With the rising prevalence of chronic kidney disease worldwide, the segment is expected to remain the primary driver of market growth.

The high cost associated to the home dialysis systems, manufacturing halt due to lockdowns and logistics ban along with end users preferring healthcare units over these systems are hampering the demand for home dialysis systems.

The growth outlook of home dialysis systems has been hindered through the course of the pandemic, high capital investments, and transplant alternatives. With the growing demand for home dialysis systems, the growing capital crunch in organizations and individuals is also one reality. This leads to the lower adoption of these systems in the end user’s household.

Another factor that slows down the sales of home dialysis systems is the lower production cycle, especially during the pandemic, and its implications such as lockdowns and logistics bans have affected the availability of raw parts and technology in order to complete production, restricting the demand for home dialysis systems globally.

According to the home dialysis systems market analysis, the market is categorized into product, type, and treatment. The product category is distributed into Devices, consumables, and Services. The leading segment in the product category is service as it is easily installed and applicable for patients along with its best applications in emergency conditions, holding 55.44% of the market share.

Higher growth opportunities for this segment are attributed to its prevalent use during the covid-19 and post covid implications. Though consumables segment thrives at the highest CAGR and is likely to cross the market space of services segment by the end of the forecast period in the global market share, flourishing the demand for Home dialysis systems.

Emerging trends in the home dialysis systems market show that the chronic kidney disease segment is the leading treatment category. The other segment of the treatment category is Acute Kidney Disease.

The chronic kidney disease segment holds 80.22% of the global revenue. The factors contributing to the growth of this segment are rising kidney issues, high blood pressure, and multiple pre-existing illnesses. Other diseases like obesity and diabetes also have their implications, and chronic kidney disease is one of the most common conditions. This increases the sales of home dialysis systems.

North America is anticipated to hold 38.40% of the global share in the home dialysis systems market by the end of 2035.

The rising home dialysis systems market in the North American region is owed to the highest geriatric population, youth suffering from chronic diseases like diabetes and blood pressure. These conditions are born because of lifestyle irregularities. This region has fueled the market as the number of patients suffering from kidney (Remal) based disease are the high and high impact of covid-19 has led a lot of patients to adopt the home dialysis units because of the post covid implications, fueling the demand for home dialysis systems in new regions. Higher investments through government programs have also fueled the sales of home dialysis systems.

The Asia Pacific region is anticipated to grow in the home dialysis systems market with the highest CAGR as the cases of failing kidney is rising in the region. This happens because of the lower quality of drinking water and unhygienic food.

Government initiatives, increasing healthcare spending, rising awareness campaigns regarding CKD, technologically enhanced products, and the presence of newly-established state-of-the-art healthcare facilities in the region are a few other factors contributing to market growth, fueling the demand for home dialysis systems.

The home dialysis system market size expands and its credit goes to the rising chronic and respiratory diseases. The start-up system vendors are trying to provide the best dialysis solutions with innovative technology and modern-age tools. Especially after the covid-19, startups that deal with home healthcare relief systems have increased, fueling the sales of home dialysis systems.

The home dialysis systems market has various key competitors that focus on expanding their supply chain while expanding the sales channel. The key competitors understand and focus on making the devices and services easy to access and operate while making them cost friendly for the end users. This makes the competitive landscape more dynamic and versatile, owing to the expansion of home dialysis systems market.

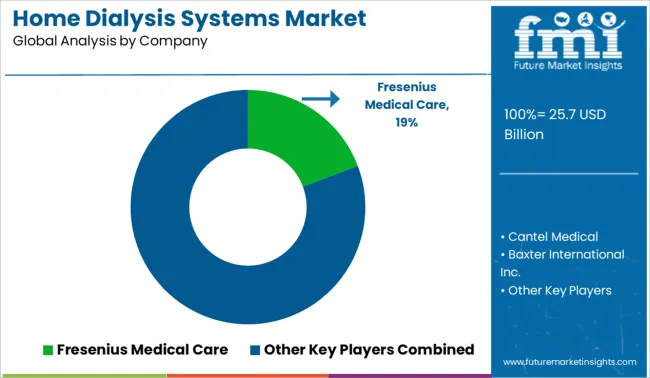

The key competitors flourishing to the growth of home dialysis systems are B Fresenius Medical Care, Cantel Medical., Baxter International Inc., Europlaz Technologies Ltd., Quanta Dialysis Technologies, Outset Medical, AWAK Technologies and DaVita.

Recent Developments in Global Home dialysis systems Market

The global home dialysis systems market is estimated to be valued at USD 25.7 billion in 2025.

The market size for the home dialysis systems market is projected to reach USD 67.3 billion by 2035.

The home dialysis systems market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in home dialysis systems market are hemodialysis, _conventional, _short daily hemodialysis, _nocturnal hemodialysis, peritoneal dialysis, _continuous ambulatory peritoneal dialysis (capd) and _ambulatory peritoneal dialysis (apd).

In terms of product outlook, device segment to command 44.7% share in the home dialysis systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Homeland Security Market Size and Share Forecast Outlook 2025 to 2035

Home Wi-Fi Security Solutions Market Size and Share Forecast Outlook 2025 to 2035

Home Security Drone Market Size and Share Forecast Outlook 2025 to 2035

Home Infusion Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Healthcare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Homeopathic Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Home Sleep Apnea Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Office Spending Market by Solution Deployment, Application & Region Forecast till 2025 to 2035

Home Baking Ingredients Market Growth - Consumer Trends 2025 to 2035

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Home Blood Testing Devices Market Insights - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA