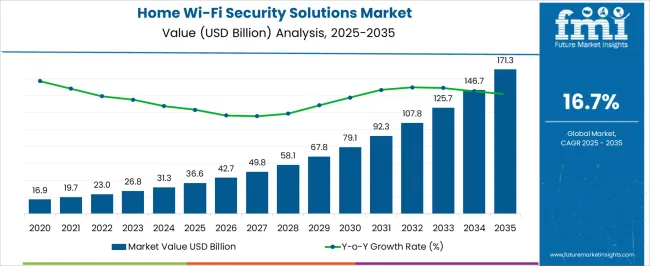

The Home Wi-Fi Security Solutions Market is estimated to be valued at USD 36.6 billion in 2025 and is projected to reach USD 171.3 billion by 2035, registering a compound annual growth rate (CAGR) of 16.7% over the forecast period.

| Metric | Value |

|---|---|

| Home Wi-Fi Security Solutions Market Estimated Value in (2025 E) | USD 36.6 billion |

| Home Wi-Fi Security Solutions Market Forecast Value in (2035 F) | USD 171.3 billion |

| Forecast CAGR (2025 to 2035) | 16.7% |

The Home Wi-Fi Security Solutions market is expanding rapidly due to a growing number of households integrating smart devices, creating a heightened need for reliable cybersecurity at the residential level. With remote work, online learning, and IoT device usage becoming permanent features of modern living, home networks have emerged as critical attack surfaces. As a result, demand for advanced Wi-Fi security infrastructure that can safeguard digital ecosystems against malware, phishing, unauthorized access, and data theft has increased significantly.

Industry stakeholders have been actively investing in intelligent firewalls, secure boot architectures, and encrypted communication protocols to address this evolving threat landscape. Moreover, government awareness initiatives and regulatory frameworks have played a key role in encouraging the adoption of security-first designs in consumer-grade networking equipment.

The integration of cloud-managed platforms and AI-driven threat detection in Wi-Fi routers is also opening avenues for continuous real-time monitoring and dynamic risk mitigation Looking ahead, market growth will be driven by the convergence of privacy-by-design principles with next-generation smart home architecture.

The market is segmented by Component, Network Architecture, and Home Type and region. By Component, the market is divided into Hardware and Software. In terms of Network Architecture, the market is classified into Modem and router as separate device, Wito Fi router, Modem and router as one device, and Wito Fi range extender. Based on Home Type, the market is segmented into Independent Homes and Condominiums/ Apartments. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

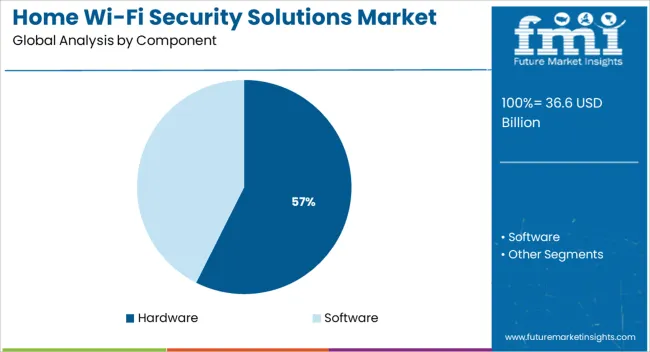

The hardware segment is expected to contribute 57.4% of the overall revenue share in the Home Wi-Fi Security Solutions market in 2025, emerging as the dominant component. This segment's leadership has been propelled by growing consumer preference for integrated security features embedded directly into physical devices such as routers, firewalls, and access points.

Hardware-based security solutions offer higher resistance to tampering and provide low-latency protection by processing data locally at the network edge. Their ability to support advanced encryption standards, secure boot processes, and chipset-level threat prevention has made them essential in securing connected home environments.

Manufacturers are increasingly embedding proprietary firmware and secure operating systems into hardware components, which has reinforced their relevance in the evolving cybersecurity landscape The rise of mesh networking and the demand for all-in-one connectivity devices with embedded security capabilities have further accelerated the deployment of security-focused hardware solutions in home networks.

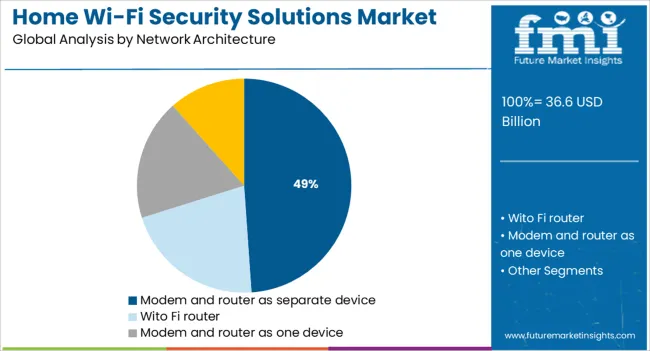

The modem and router as separate device segment is projected to account for 48.9% of the Home Wi-Fi Security Solutions market revenue share in 2025. This configuration has gained traction due to the added flexibility, control, and upgrade potential it offers to consumers aiming to enhance network performance and security.

Users opting for separate devices can integrate high-performance routers that come equipped with customizable firewall settings, advanced parental controls, and software-defined threat detection modules. This separation enables faster updates, more frequent firmware patches, and reduced vendor lock-in, all of which are critical for maintaining optimal security in a dynamic threat environment.

The ability to segment network traffic and isolate IoT devices through dedicated router configurations has made this architecture increasingly popular among tech-savvy users and small home offices Furthermore, rising awareness around bandwidth optimization and data privacy has encouraged consumers to invest in tailored networking stacks, reinforcing demand for modular device setups.

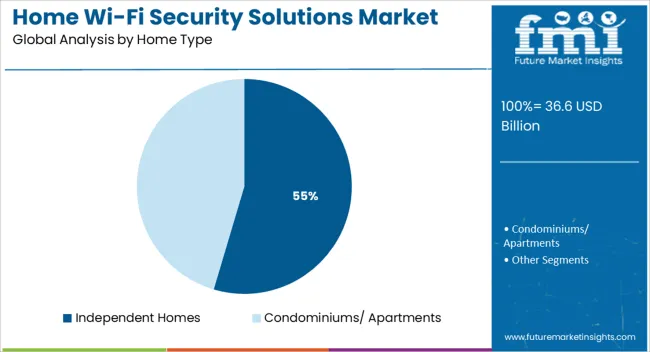

The independent homes segment is anticipated to represent 54.6% of the Home Wi-Fi Security Solutions market’s revenue share in 2025, making it the leading home type category. The growing footprint of smart appliances, voice assistants, surveillance systems, and entertainment platforms in stand-alone residences has made robust Wi-Fi security an essential requirement.

Independent homes often feature larger property areas and multiple connected zones, necessitating advanced and scalable network protection to cover extended perimeters. The increasing adoption of premium routers and mesh systems with embedded threat analytics and dynamic access controls has been instrumental in this segment’s growth.

Additionally, homeowners in this category are more likely to invest in customized security setups, reflecting a higher willingness to adopt professional-grade solutions for safeguarding personal and family data Enhanced privacy expectations, rising property digitization, and integration of smart home automation platforms have collectively contributed to the segment’s expanding share in the market.

The home Wi-Fi security solutions market is estimated to rise at 16.7% CAGR between 2025 and 2035 in comparison to the 15.2% CAGR registered during the historical period of 2020 to 2024. Increasing penetration of the internet across the globe, growing usage of IoT devices, and rising adoption of Wi-Fi protection systems are some of the key factors driving the global home wi-fi security solutions market.

Home wi-fi security solutions are being increasingly adopted to secure wireless connections. They keep data hidden and protect communications while blocking hackers from users’ networks.

These security devices are connected to a wireless internet network, making the service available to all customers regardless of wireless or home broadband service provider. They can be managed from home or remotely via smartphone, tablet, or PC with secure login. These home Wi-Fi security solutions offer features such as setting up for internet usage, apps, and internet usage, per device profiles, internet stop button, and weekly usage report.

The increasing incidence of cyberattacks along with the growing adoption of wireless security to prevent unauthorized access or damage to computers or data using wireless networks will continue to boost sales of home Wi-Fi security solutions in the global market.

Similarly, growing awareness about the benefits of using various wi-fi security solutions, especially across emerging economies will bode well for the home wi-fi security solutions market growth during the next ten years.

By network architecture, the modem and router as one device segment is expected to grow at the highest CAGR of 19.4% during the forecasted period. Similarly, by component segment, the software segment is anticipated to grow at the highest CAGR of 18.8% from 2025 to 2035.

Regionally, North America is expected to dominate the global home Wi-Fi security solutions market, reaching around ~USD 171.3 billion by 2035. However, South Asia & Pacific home wi-fi security solutions market is anticipated to grow at the highest CAGR of 21.1% during the forecast period of 2025 to 2035.

Rapid Surge in the Number of Internet Users and Smart Devices to Bolster Demand

One of the key elements fueling the expansion of the smart home market is the use of smart gadgets. The demand for smart devices like Amazon Echo, Alexa, Google Home, smart TVs, home theatres, fitness bands, and other products is increasing at a robust pace and the trend is likely to continue during the upcoming years. Since internet users and smart devices are integrated, as their usage grows, there will likely be a corresponding rise in demand for internet users.

The internet connects smart devices, enabling users to control features like home security access, temperature, lighting, HVAC control, and entertainment. Smart gadgets make it simple to multitask, give users the power to rapidly find information and answers, assist in setting reminders and appointments, and much more.

Thus, with the rising penetration of the internet and smart devices across the globe, the overall home security systems. Is likely to witness a strong growth rate during the forecast period.

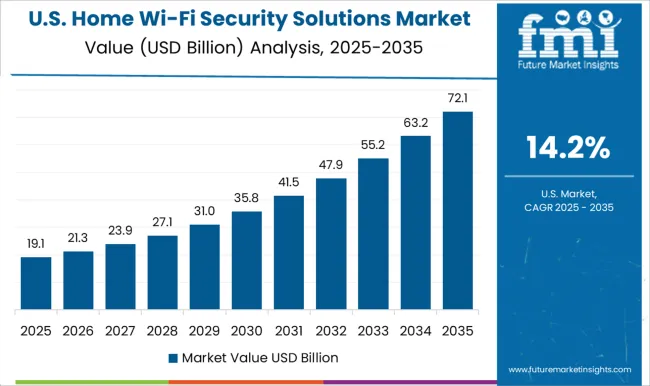

How will Growth Unfold in the USA Home Wi-Fi Security Solutions Market?

The surge in Cyberattacks and Need for Improved Wireless Network Security Driving Demand

The USA Home Wi-Fi security solutions market is anticipated to exhibit a growth rate of over 13.8% CAGR during the forecast period, reaching a valuation of around USD 36.6 billion in 2025. Growing security concerns due to the rise in cyberattacks and increasing adoption of advanced technologies are some of the key factors driving growth in the USA market.

Similarly, the heavy presence of leading market players and novel product launches in the country will bode well for market growth during the next ten years.

The USA home wi-fi security solutions market will be further strengthened by the expanding research and development within this sector, which is creating a space for the internet of things, home alarm systems & security home automation, and remote monitoring.

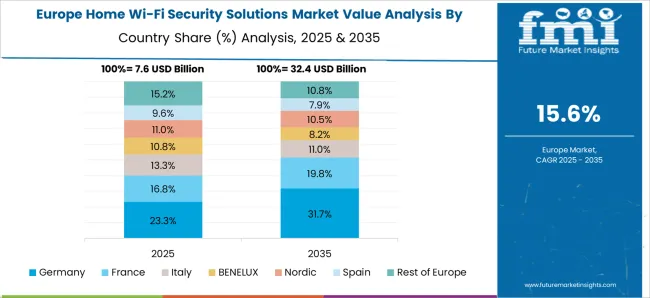

Growing Adoption of Advanced Security Solutions to Boost the Sales

The home wi-fi security solutions market in Germany is anticipated to grow at a prolific CAGR of 18.5% during the forecast period of 2025 and 2035, making it one of the most prominent markets in Europe.

Increasing rates of crime, growing awareness related to security and safety, declining prices of security products and the rising adoption of cloud-based technologies in the country are fueling the demand for home Wi-Fi security solutions.

Similarly, constant developments in security technologies like sensors and smart cameras and the growing adoption of machine learning and artificial intelligence software in the residential security sector will propel the demand for Wi-Fi security solutions in the country during the next ten years.

Rise in Internet Users Propelling Demand for Wi-Fi Security Solutions in China

China is likely to remain one of the most dominating markets for home wi-fi security solutions across East Asia and is expected to grow at an impressive CAGR of 18.5% from 2025 to 2035. This can be attributed to factors such as increasing internet penetration, rising government support, growing IoT market, & increasing awareness about smart home technology.

Similarly, increasing urbanization, the rising need for home monitoring from remote locations, and stringent government rules and regulation are expected to spur the demand for Wi-Fi security solutions in the country during the forecast period.

Demand to Remain High for Software Components in Home Wi-Fi Security Solutions Market

Based on components, the hardware segment will continue to dominate the global home Wi-Fi security solutions market during the forecast period, accounting for the largest share by the end of 2035.

However, the software segment is set to register the highest growth rate of 18.8% CAGR during the forecast period (2025 to 32). This can be attributed to the rising usage of various wireless security software by end users to improve wireless network security and prevent cyberattacks.

Modem and Router as One Device Segment to Generate Highest Revenues Through 2035

Based on network architecture, the Wi-Fi router segment is anticipated to expand up to 4.3X through 2035. However, the modem and router as one device segment are likely to grow at the highest CAGR of 19.4% during the forecast period (2025 to 2035).

A modem, also known as an ISP, is a device that links home networks to internet service providers. A router is a simple box that lets all wireless and wired devices use that internet connection at once. The router and modem as one device help WiFi security hardware systems to perform better and thus demand modem and router as one device will continue to surge amid the growing need for improving wireless network security.

Demand for Wi-Fi Security Solutions to Remain High Across Independent Homes

Based on home type, the independent homes segment will continue to retain its dominance in the global home Wi-Fi security solutions market by accounting for the largest market share through 2035. Furthermore, FMI predicts a CAGR of around 17.5% CAGR for the independent homes segment throughout the forecast period. This can be attributed to the rapid urbanization and increasing adoption of home Wi-Fi security solutions across independent homes.

Home WiFi security solutions provide advantages to independent homes including real-time security alerts, remote monitoring & video surveillance, and control of household functions. Besides these, they save money on utility bills. Therefore, the adoption of home WiFi security solutions will continue to remain high in the independent homes segment.

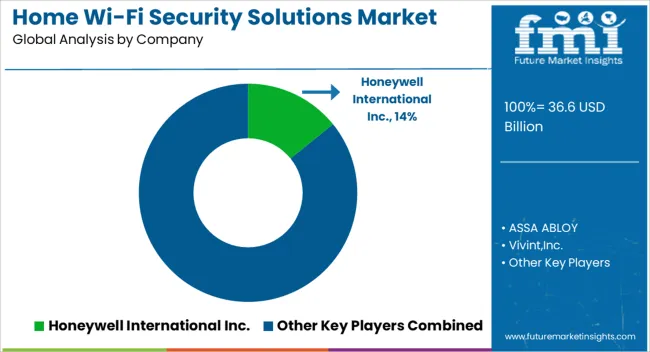

Leading players in the home Wi-Fi security solutions market are concentrating on investing heavily in innovation, research, and development practices. They are also adopting strategies such as launching new security solutions and establishing partnerships and collaborations to gain a competitive edge in the market. For instance,

CUJO AI is the industry pioneer in the creation and use of artificial intelligence to enhance the safety, management, and privacy of connected devices in homes and workplaces. The CUJO AI Engine was developed using billions of actual data points. By discretely monitoring network traffic, it efficiently detects and stops harmful activities. The objective is to protect the overall connected experience while fusing artificial intelligence and machine learning.

The company brings to network, mobile, and public wi-fi operators around the world a complete portfolio of products to provide their customers with a seamlessly integrated suite of digital life protection services. The company recently (September 2024) announced that its security products and services are now available in more than 40 million households.

CUJO AI is continuously striving to provide effective security solutions to end users by launching new products and services, for instance, in October 2024, in order to effectively identify and safeguard devices that employ MAC address randomization, CUJO AI unveiled its recently patented Device Identification function.

Similarly, in September 2024, CUJO AI announced that its Digital Life Protection services are currently being implemented in the networks of five key North American operators at scale.

Another leading provider of home wi-fi security solutions is ASSA ABLOY. The company offers a complete range of access solutions making people feel safe and secure in simple and convenient ways.

ASSA ABLOY’s wireless control solutions can upgrade existing security or build a completely new access system that effectively secures the wireless connection and prevents cyberattacks. The company is increasingly adopting merger and acquisition strategies to expand its global footprint. For instance, in 2024, ASSAT ABLOY acquired B&B Roadway and Security Solutions in the USA.

Paul Judge and Mike Van Bruinisse, who have previously collaborated at cybersecurity companies CipherTrust and Purewire, founded Luma in 2014. The creators' perception of inconsistent Wi-Fi throughout private houses and the necessity for greater security as the Internet of Things (IoT) spreads was the inspiration for the idea.

Luma was an Atlanta, Georgia-based provider of Wi-Fi solutions. The business offers mesh networking-enabled Wi-Fi routers for distributing a steady Wi-Fi signal across individual houses, as well as a related mobile app for parental controls and additional levels of protection. The company (LUMA) was acquired by Mural in March 2025.

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 36.6 billion |

| Projected Market Value (2035) | USD 171.3 billion |

| Market CAGR 2025 to 2035 | 16.7% |

| Share of top 5 players | Around 40% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | The USA, Canada, Germany, The United Kingdom, France, Italy, Spain, BENELUX, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, and South Africa |

| Key Segments Covered | Component, Network Architecture, Home Type, and Region |

| Key Companies Profiled | Honeywell International; ASSA ABLOY; Vivint, Inc.; SimpliSafe, Inc.; Axis Communications AB; NETGEAR Inc.; Hangzhou Hikvision Digital Technology Co. Ltd; Cove Smart, LLC; Bosch Service Solutions GmbH; Metadata; Eero; Securifi |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global home wi-fi security solutions market is estimated to be valued at USD 36.6 billion in 2025.

The market size for the home wi-fi security solutions market is projected to reach USD 171.3 billion by 2035.

The home wi-fi security solutions market is expected to grow at a 16.7% CAGR between 2025 and 2035.

The key product types in home wi-fi security solutions market are hardware and software.

In terms of network architecture, modem and router as separate device segment to command 48.9% share in the home wi-fi security solutions market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Home Infusion Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Healthcare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Homeopathic Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Home Sleep Apnea Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Office Spending Market by Solution Deployment, Application & Region Forecast till 2025 to 2035

Home Baking Ingredients Market Growth - Consumer Trends 2025 to 2035

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Home Blood Testing Devices Market Insights - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA