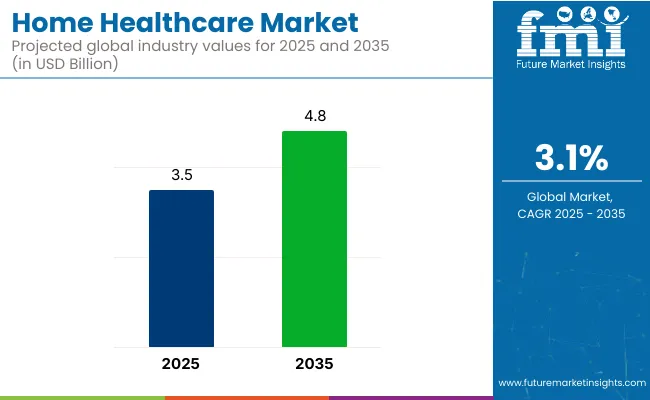

The global home healthcare market is valued at USD 3.5 billion in 2025 and is poised to be worth USD 4.8 billion by 2035, reflecting a CAGR of 3.1%. The market’s expansion is being fueled by the increasing need for home-based treatment options, driven by an aging global population and rising chronic disease prevalence. Innovations in remote patient monitoring, wearable devices, and AI-integrated telehealth platforms are expected to reinforce this growth.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 3.5 billion |

| Market Size (2035) | USD 4.8 billion |

| CAGR (2025 to 2035) | 3.1% |

Innovations in the home healthcare market are transforming patient care through advanced technologies and personalized services. Remote patient monitoring (RPM) devices now enable continuous tracking of vital signs like blood pressure, glucose levels, and oxygen saturation. Smart home integrations, including IoT-enabled medication dispensers and fall detection systems, enhance safety for the elderly.

Artificial intelligence is driving virtual health assistants that support medication adherence and predictive diagnostics. Companion and assistive robots are also being used to aid mobility and reduce loneliness. Additionally, wearable tech combined with edge AI provides real-time health insights, enabling timely intervention and greater autonomy for home-based patients.

Government regulations focus on ensuring patient safety, quality care, and data protection. In the USA, the Centers for Medicare & Medicaid Services (CMS) sets standards for home healthcare providers, including license, reimbursement policies, and patient rights. Regulations also include compliance with HIPAA (Health Insurance Portability and Accountability Act) for patient privacy, as well as equipment safety standards. In Europe, the European Medicines Agency (EMA) and national health agencies enforce similar guidelines for medical devices and services.

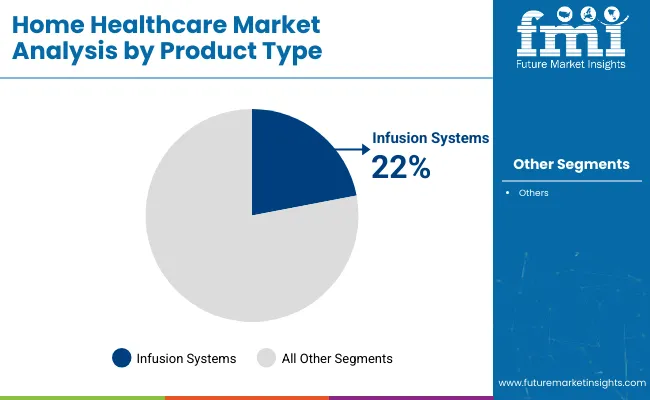

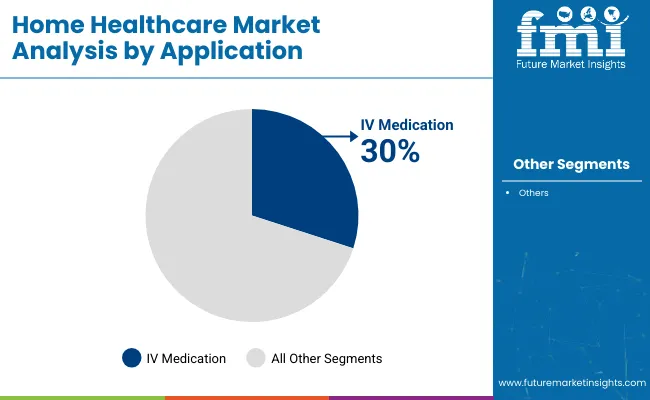

The USA is expected to be the fastest-growing market, with a projected CAGR of 2.9%. Infusion systems will dominate the product type segment with a 22% market share by 2025. IV medication will lead the application segment, capturing 30% of the market. Germany and France are also expected to witness significant growth, with projected CAGRs of 2.8% and 2.7%, respectively.

The home healthcare market is segmented into product type, application, and region. By product type, the market is divided into infusion systems, pressure relief devices, hydrocolloids dressings, hydrofibres dressings, hydrogels dressings, semi-permeable films dressings, superabsorbents dressings, wound contact layers, gauze sponges, gauzes, sponges, and ostomy drainage bags.

In terms of application, the market is categorized into total parenteral nutrition, IV medication, pressure ulcer, and stoma care. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

Infusion systems are projected to lead the product type segment, accounting for 22% of the global market share by 2025. These systems have been favored for their ability to deliver fluids, medications, and nutrients with precision and safety in home-based care settings, making them essential for chronic disease management.

IV medication is anticipated to dominate the application segment, securing 30% of the global market share by 2025. This dominance has been attributed to the growing need for long-term intravenous therapies administered in home settings, especially among patients with chronic conditions, infections, or recovering post-surgery.

The home healthcare market is witnessing steady growth, driven by increasing demand for cost-effective in-home treatments, advancements in remote monitoring technologies, and a rising preference for personalized patient care solutions.

Recent Trends in This Market

Challenges in This Market

The home healthcare market in the USA is projected to grow at a CAGR of 2.9% between 2025 and 2035. Growth has been supported by a strong healthcare infrastructure, a rising elderly population, and widespread insurance coverage for home-based care. Demand for advanced home medical technologies has also been amplified by increasing chronic disease prevalence.

The UK home healthcare market is expected to expand at a CAGR of 2.5% during the forecast period. Market demand has been driven by NHS-supported home care initiatives and growing preference for cost-effective alternatives to institutional treatment. The integration of digital health tools has been encouraged through national telehealth programs.

Germany’s home healthcare market is anticipated to grow at a CAGR of 2.8% from 2025 to 2035. A high incidence of age-related diseases and a focus on reducing hospital stays have driven demand. Government regulations have supported high standards in home-based medical devices and caregiver certification.

France’s home healthcare market is projected to witness a CAGR of 2.7% in the home healthcare market over the forecast decade. Market growth has been driven by strong public healthcare systems, increased adoption of home-based palliative care, and expansion of nurse-assisted treatment services. Investments in telecare have also been amplified nationwide.

Japan’s home healthcare market is expected to grow at a CAGR of 2.6% through 2035. As one of the world’s most rapidly aging populations, Japan has prioritized long-term in-home care. Technological innovation, including robotic caregiving and AI health platforms, has been accelerated through national health policies.

The home healthcare market is moderately consolidated, with a few tier‑one providers commanding the largest share while multiple regional and specialty players maintain niche positions, enabling both economies of scale and localized innovation.

Competition has been intensified by strategies focused on pricing efficiency, technological innovation, strategic partnerships, and geographic expansion. Leading companies are balancing cost-sensitive care delivery models with cutting-edge remote monitoring, AI integration, and M&A activities to broaden service portfolios and access.

Recent Home Healthcare Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.5 billion |

| Projected Market Size (2035) | USD 4.8 billion |

| CAGR (2025 to 2035) | 3.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billions /Volume in million units |

| By Product Type | Infusion Systems, Pressure Relief Devices, Hydrocolloids, Hydrofibres , Hydrogels, Semi-permeable Films, Superabsorbents , Wound Contact Layers, Gauze Sponges, Gauzes, Sponges, Ostomy Drainage Bags |

| By Application | Total Parenteral Nutrition, IV Medication, Pressure Ulcer, Stoma Care |

| Regions Covered | North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia Pacific |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Kindred Healthcare, B. Braun Melsungen AG, Baxter International Inc., Hollister Incorporated, Becton Dickinson and Co, ConvaTec Group Plc, Medtronic plc, Amedisys Home Health and Hospice Care, American Well, CVS Health. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is valued at USD 3.5 billion in 2025.

The market is forecasted to reach USD 4.8 billion by 2035, reflecting a CAGR of 3.1%.

Infusion systems will lead the market by product type with a 22% market share in 2025.

The IV medication segment will dominate the market with a 30% share in 2025.

The USA is projected to grow at the fastest rate, with a CAGR of 2.9% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Home Healthcare Software Market Analysis - Innovations & Forecast 2025 to 2035

Pediatric Home Healthcare Market - Growth & Demand Trends 2025 to 2035

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Homeland Security Market Size and Share Forecast Outlook 2025 to 2035

Home Wi-Fi Security Solutions Market Size and Share Forecast Outlook 2025 to 2035

Home Security Drone Market Size and Share Forecast Outlook 2025 to 2035

Home Infusion Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Homeopathic Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Home Sleep Apnea Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA