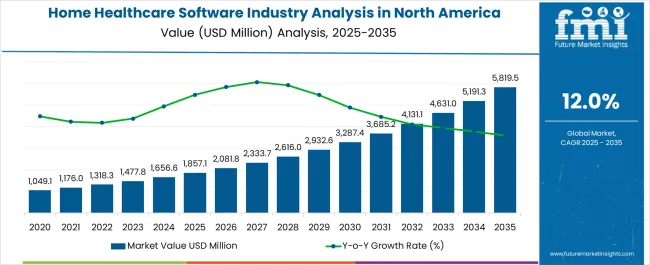

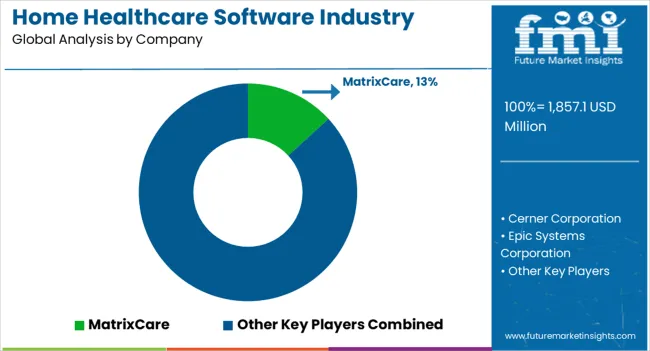

The Home Healthcare Software Industry Analysis in North America is estimated to be valued at USD 1857.1 million in 2025 and is projected to reach USD 5819.5 million by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

| Metric | Value |

|---|---|

| Home Healthcare Software Industry Analysis in North America Estimated Value in (2025 E) | USD 1857.1 million |

| Home Healthcare Software Industry Analysis in North America Forecast Value in (2035 F) | USD 5819.5 million |

| Forecast CAGR (2025 to 2035) | 12.0% |

The home healthcare software industry in North America is experiencing robust expansion, driven by the increasing shift toward remote patient monitoring, rising healthcare costs, and the growing adoption of digital solutions in home-based care. Aging demographics and a higher prevalence of chronic diseases have intensified demand for effective home healthcare management platforms.

The current market landscape reflects accelerated adoption of software solutions that improve patient engagement, reduce hospital readmissions, and optimize care coordination. Cloud-based platforms and advanced analytics are reshaping the delivery of healthcare services by enabling real-time data access for both patients and providers.

The future outlook is supported by favorable reimbursement models, government initiatives for digital healthcare adoption, and technological innovations integrating AI and telehealth functionalities. The industry is expected to continue growing as stakeholders focus on patient-centric care models and cost-effective delivery systems.

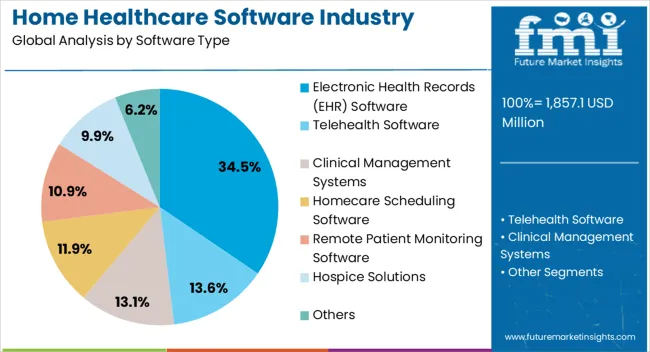

The electronic health records (EHR) software segment represents approximately 34.50% share of the software type category in the home healthcare software industry in North America. Its leading role is supported by the critical importance of digital recordkeeping in ensuring accurate, secure, and accessible patient data.

EHR platforms enable healthcare providers to streamline documentation, improve decision-making, and facilitate coordinated care across multiple caregivers. Adoption has been reinforced by regulatory requirements for digital recordkeeping and interoperability standards in the region.

The segment’s expansion is also linked to its integration with telehealth platforms, enabling remote monitoring and continuous care management. With ongoing investments in healthcare IT infrastructure and emphasis on patient data accessibility, the EHR software segment is positioned to maintain significant market influence.

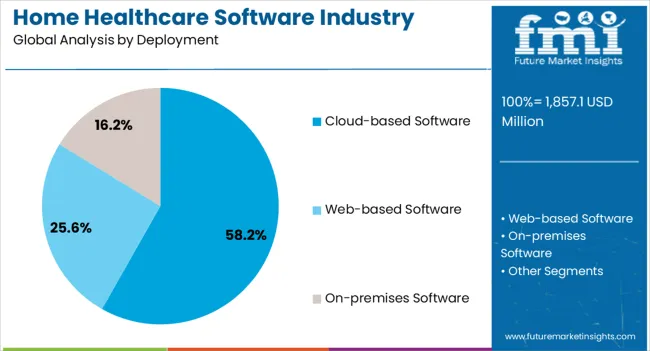

The cloud-based software segment dominates the deployment category with approximately 58.20% share, driven by its scalability, cost-efficiency, and ability to support real-time access to patient data. Cloud platforms facilitate secure storage, remote collaboration, and integration with mobile applications, making them highly suitable for home healthcare providers.

Adoption has been accelerated by the need for flexible and interoperable systems that can be updated seamlessly. The segment also benefits from growing provider interest in subscription-based models, reducing upfront IT infrastructure costs.

As data security protocols improve and cloud adoption becomes mainstream, this segment is expected to retain its leadership position in the foreseeable future.

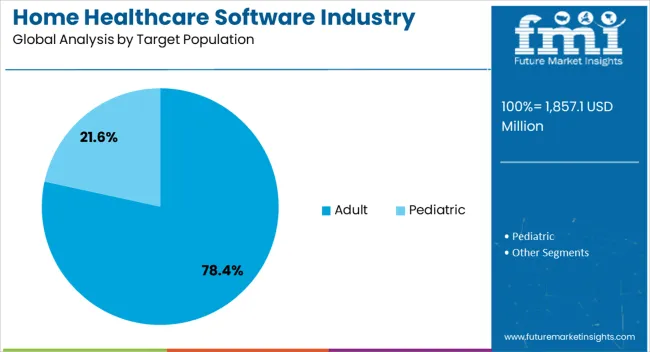

The adult segment accounts for approximately 78.40% share in the target population category, highlighting its dominance in the North American home healthcare software industry. This leadership is linked to the rising prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory illnesses among the adult population.

Increased demand for home-based monitoring and personalized care solutions has reinforced software adoption within this demographic. Healthcare providers are leveraging digital platforms to enhance medication adherence, manage long-term conditions, and reduce hospitalization rates for adult patients.

The segment’s growth is also supported by increasing insurance coverage and policy-level support for home healthcare programs. With a strong focus on managing adult chronic conditions, this segment is projected to sustain its high market share in the coming years.

From 2020 to 2025, the North America home healthcare software industry experienced a CAGR of 10.3%, reaching a size of USD 1,477.8 million in 2025. The primary factor driving the industry was the aging demographic, with an increasing number of seniors preferring home-based care.

This trend and the rising prevalence of chronic illnesses underscored the need for advanced technology solutions to enhance patient monitoring, care coordination, and healthcare management.

The demand for home healthcare software is further propelled by the industry's rapid digital transformation and continuous technological advancements. Healthcare providers sought solutions to streamline workflows, improve data accuracy, and enhance communication among care teams.

Electronic health records (EHR) software emerged as a cornerstone, ensuring efficient patient information management.

The integration of telehealth capabilities also gained prominence, enabling virtual consultations and remote monitoring, which is especially valuable for individuals receiving care at home. These technological advancements addressed the immediate needs of the home healthcare sector and positioned the industry for future innovations and improvements in care delivery.

The home healthcare software industry is expected to rise at a CAGR of 12.1% from 2025 to 2035. The industry size is expected to reach USD 4,624.0 million during the forecast period.

North America's home healthcare software industry is expected to witness increased adoption of advanced technologies that further enhance the capabilities of software solutions. Artificial intelligence (AI) and machine learning applications within home healthcare software are anticipated to play a pivotal role in predictive analytics.

They are set to help in assisting healthcare providers in identifying potential health issues before they escalate. Integrating internet of things (IoT) devices for remote monitoring and intelligent healthcare solutions will likely become more prevalent, contributing to a holistic and patient-centric approach.

With the evolving healthcare landscape, adherence to regulatory standards and interoperability will remain crucial factors influencing the demand for home healthcare software. Providers seek solutions that comply with existing regulations and allow for seamless data exchange between different healthcare entities.

Recognizing the integral role mental well-being plays in overall health, healthcare providers seek innovative solutions to address mental health challenges in the home setting. The software becomes a valuable asset in fostering mental well-being by integrating tools for mood tracking, stress assessment, and virtual counseling sessions.

The flexibility of home healthcare software also allows for creating personalized mental health and wellness plans. As the stigma surrounding mental health diminishes, the integration of mental health and wellness features in home healthcare software becomes a proactive response to the evolving healthcare landscape.

The table presents the expected CAGR for North America home healthcare software industry over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the field is predicted to surge at a CAGR of 10.4%, followed by a slightly higher growth rate of 10.6% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 12.7% in the first half and remain relatively moderate at 12.9% in the second half.

| Particular | Value CAGR |

|---|---|

| H1 | 10.4% (2025 to 2035) |

| H2 | 10.6% (2025 to 2035) |

| H1 | 12.7% (2025 to 2035) |

| H2 | 12.9% (2025 to 2035) |

The below section shows the electronic health records (EHR) software segment dominating by software type. It is forecast to thrive at 12.4% CAGR between 2025 and 2035. Based on deployment, the cloud-based software segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 13.9% during the forecast period.

| Segment | Value CAGR |

|---|---|

| Electronic Health Records (EHR) Software (Software Type) | 12.4% |

| Cloud-based Software (Deployment) | 13.9% |

| Adult (Target Population) | 12.7% |

| Hospice Care (End-user) | 13.7% |

EHR systems have become integral to the home healthcare ecosystem, offering a comprehensive and centralized platform for healthcare providers to manage patient information, administrative workflows, and seamless communication.

The adoption of EHR software is driven by the need for accurate, real-time access to patient data, enhancing the quality of care delivered in home settings. These systems enable healthcare professionals to maintain up-to-date records, track patient progress, and facilitate secure information exchange, ultimately contributing to improved patient outcomes and continuity of care.

EHR systems streamline documentation processes, reducing paperwork and administrative burdens for home healthcare agencies. The interoperability features of EHR software enable seamless communication between different healthcare entities, ensuring that patient information is accessible across the care continuum.

The ever-evolving regulatory landscape in healthcare, including standards such as HIPAA, underscores the importance of EHR systems in maintaining data security and privacy. As the home healthcare sector prioritizes digitalization and technology integration to improve patient care, the widespread adoption of EHR software is poised to persist, maintaining its leading position.

Based on deployment, the cloud-based software is expected to surge at 13.9% CAGR by 2035. Cloud-based software offers unparalleled flexibility, scalability, and accessibility, addressing the dynamic needs of home healthcare providers. The inherent advantages of cloud computing, such as remote access to data, enhanced collaboration, and cost-effectiveness, align perfectly with the requirements of the evolving home healthcare landscape.

Home healthcare agencies, clinicians, and caregivers benefit from accessing patient information securely from any location, streamlining workflows, and ensuring real-time coordination. Additionally, the scalability of cloud-based solutions enables providers to adapt quickly to changing demands, making them well-suited for the dynamic and geographically dispersed nature of home healthcare services.

Cloud-based software eliminates the need for extensive physical infrastructure, reducing the burden on healthcare agencies to invest in and maintain complex IT systems. This, in turn, allows providers to allocate resources more efficiently, directing efforts toward improving patient care rather than managing infrastructure.

The cloud also enhances data security through advanced encryption and regular updates, ensuring compliance with healthcare regulations as the home healthcare industry embraces digital transformation. The scalability, accessibility, and cost-effectiveness of cloud-based software position it as a critical enabler for delivering high-quality, patient-centric care in North America.

As the baby boomer generation enters their senior years, there is a significant preference among older adults to receive healthcare services in the familiar and comfortable setting of their homes rather than in institutionalized facilities. This demographic shift toward aging in place is accompanied by a higher prevalence of chronic conditions and age-related illnesses, necessitating ongoing healthcare management.

Home healthcare software empowers individuals by offering solutions that enhance accessibility and convenience of care in home setting. The software's ability to support interdisciplinary collaboration ensures a holistic approach to care, encompassing the aging population's physical, emotional, and social well-being.

As healthcare continues to evolve towards patient-centered models, home healthcare software emerges as a critical enabler of personalized and efficient care for the growing adult demographic in North America. Based on Target Population, adult segment is projected to grow at a CAGR of 12.7% by 2035.

Based on end-use, hospice care segment is expect to rise at a CAGR of 13.7% by 2035.There is increasing recognition of the benefits of hospice care in providing specialized end-of-life support to patients in the comfort of their homes. As the aging population continues to rise in North America, there is a growing demand for personalized and compassionate care that hospice services offer.

Home healthcare software is crucial in optimizing hospice care by facilitating efficient communication and coordination among healthcare providers, patients, and their families. These software solutions streamline administrative tasks, enable real-time patient monitoring, and enhance communication between hospice care teams and patients.

Growing emphasis on value-based care and the shift towards patient-centered healthcare models further contribute to the anticipated growth of hospice care within the North America home healthcare software industry. Integrating innovative software solutions allows hospice care providers to deliver more personalized and holistic services, ensuring patients receive the appropriate care at every stage of their end-of-life journey.

With the continuous advancements in technology, such as telehealth capabilities and electronic health records, home healthcare software has become a pivotal tool in supporting the comprehensive and patient-centric approach to hospice care. As the healthcare industry continues to evolve towards a more home-centered and patient-focused paradigm, the growth of hospice care within North America is expected to be robust.

Key players tailor their software to meet the specific needs of different healthcare providers, accommodating diverse workflows and patient populations. Integration capabilities are another key strategy, as vendors seek to seamlessly connect their software with other healthcare systems, ensuring interoperability and a more comprehensive patient record.

Product Innovation

Companies are investing in research and development to create cutting-edge technologies that improve patient care, optimize administrative processes, and ensure compliance with regulatory standards. Innovations include remote patient monitoring, predictive analytics, and interoperability with other healthcare systems.

This strategy allows companies to stay competitive by providing healthcare providers with advanced tools that meet current needs and anticipate and adapt to future trends in the rapidly evolving home healthcare landscape.

Strategic Partnerships and Collaborations

Strategic partnership collaboration is another key strategy embraced by leading companies. By forming alliances with other technology providers, software companies expand their offerings and provide comprehensive solutions to their clients.

These partnerships foster a collaborative approach to problem-solving and innovation, ultimately developing more comprehensive and effective home healthcare solutions.

Strategic collaboration also facilitates a more interconnected healthcare ecosystem, promoting interoperability and data exchange among different systems, which is crucial for improving patient care and streamlining healthcare workflows.

Expansion

Expanding into emerging industry is a strategic initiative companies undertake to tap into new geographical regions with a growing demand for home healthcare software.

This involves adapting software solutions to meet this emerging industry’s unique regulatory, cultural, and technological requirements. By entering untapped regions, vendors open new revenue streams and contribute to developing healthcare infrastructure in these areas.

Mergers and Acquisitions

Mergers and acquisitions (M&A) represent a strategic move to consolidate the home healthcare software industry. Companies acquire smaller competitors, specialized technology companies, or complementary service providers to expand their solution portfolio and customer base. Through mergers and acquisitions, key players can achieve economies of scale, streamline operations, and eliminate competition.

Key Developments:

| Attribute | Details |

|---|---|

| Estimated Value (2025) | USD 1,477.8 million |

| Projected Value (2035) | USD 4,624.0 million |

| Anticipated Growth Rate (2025 to 2035) | 12.1% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Software, Deployment, Target Population, End-user, Country |

| Key Companies Profiled | Cerner Corporation; Epic Systems Corporation; McKesson Corporation; Athenahealth, Inc.; MEDITECH; Allscripts Healthcare Solutions; Homecare Homebase, LLC; Netsmart Technologies, IncA; MatrixCare; Brightree LLC; AlayaCare |

The global home healthcare software industry analysis in North America is estimated to be valued at USD 1,857.1 million in 2025.

The market size for the home healthcare software industry analysis in North America is projected to reach USD 5,819.5 million by 2035.

The home healthcare software industry analysis in North America is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in home healthcare software industry analysis in North America are electronic health records (ehr) software, telehealth software, clinical management systems, homecare scheduling software, remote patient monitoring software, hospice solutions and others.

In terms of deployment, cloud-based software segment to command 58.2% share in the home healthcare software industry analysis in North America in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Homeland Security Market Size and Share Forecast Outlook 2025 to 2035

Home Wi-Fi Security Solutions Market Size and Share Forecast Outlook 2025 to 2035

Home Security Drone Market Size and Share Forecast Outlook 2025 to 2035

Homeopathic Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Home Elevator Market Growth – Trends & Forecast 2025 to 2035

Home Automation Market Analysis by Product, Application, Networking Technology, and Region Through 2035

Home Security Sensors Market Analysis by Application, Product, and Region through 2035

Home and Garden Pesticides Market Analysis by Type, Application, and Region from 2025 to 2035

Home Audio Equipment Market Analysis & Forecast 2025 to 2035

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA