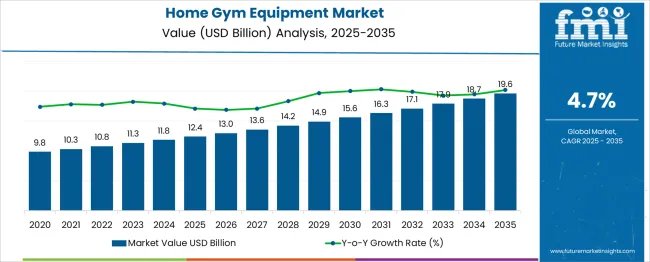

The Home Gym Equipment Market is estimated to be valued at USD 12.4 billion in 2025 and is projected to reach USD 19.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. A 10-year growth comparison reveals steady, consistent expansion across the forecast period. Between 2025 and 2030, the market increases from USD 12.4 billion to USD 15.6 billion, contributing USD 3.2 billion in growth, which represents a CAGR of 4.8%.

This growth phase is primarily driven by an increasing global focus on health and fitness, a surge in home-based fitness activities, and growing awareness around the benefits of physical wellness. The market benefits from the rise of fitness trends like online classes and virtual coaching, as well as the convenience of home gym setups.

Between 2030 and 2035, the market continues to expand, reaching USD 19.6 billion, with an additional USD 4.0 billion in value, reflecting a CAGR of 4.5%. This phase shows slightly slower growth, signaling a maturation stage where product innovation, consumer loyalty, and diversification in equipment offerings will become key drivers.

The latter period of the forecast will see continued demand for technologically advanced and multifunctional fitness equipment. Overall, the 10-year comparison reveals a stable market with a slight deceleration in growth rate as the industry matures, with sustained demand for home fitness solutions.

| Metric | Value |

|---|---|

| Home Gym Equipment Market Estimated Value in (2025 E) | USD 12.4 billion |

| Home Gym Equipment Market Forecast Value in (2035 F) | USD 19.6 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The home gym equipment market is witnessing steady expansion driven by increased health awareness, rising urbanization, and a shift toward home-based fitness due to lifestyle convenience and cost efficiency. The pandemic accelerated a permanent behavioral change, prompting consumers to invest in personal workout setups to avoid crowded fitness centers.

Advancements in connected fitness platforms, along with smartphone-integrated training systems, have further fueled demand for tech-enabled solutions. Manufacturers are responding by developing compact, multifunctional, and aesthetically integrated fitness gear that aligns with urban space constraints.

The market is likely to benefit from increased adoption among older demographics, hybrid fitness programs, and ongoing innovations in smart tracking and immersive workout experiences.

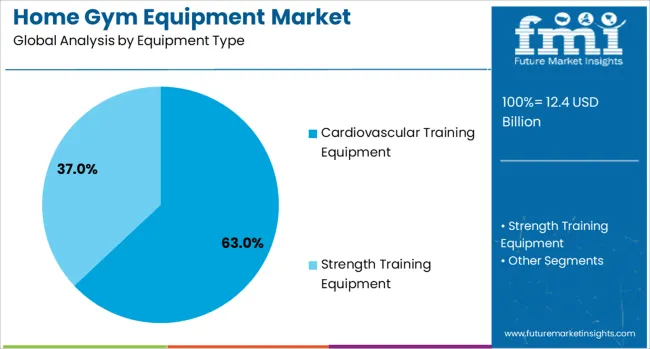

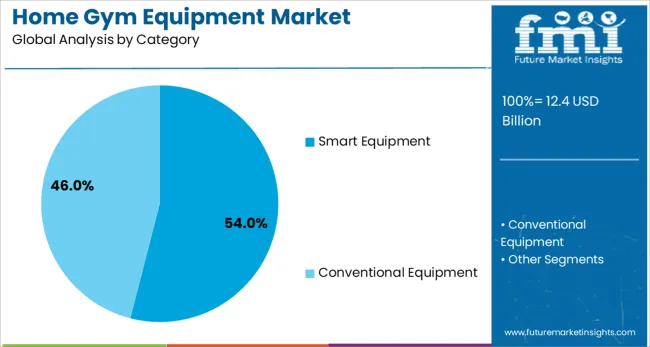

The home gym equipment market is segmented by equipment type, category, price rangedistribution channel, and geographic regions. By equipment type of the home gym equipment market is divided into Cardiovascular Training EquipmentStrength Training Equipment. In terms of category of the home gym equipment market is classified into Smart EquipmentConventional Equipment.

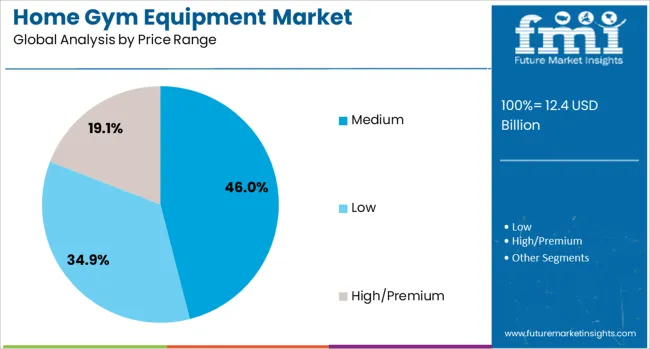

Based on price range of the home gym equipment market is segmented into Medium, LowHigh/Premium. By distribution channel of the home gym equipment market is segmented into OfflineOnline. Regionally, the home gym equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cardiovascular training equipment is projected to dominate the home gym equipment market with a 63.00% revenue share in 2025. This leading position stems from the popularity of treadmills, stationary bikes, ellipticals, and rowing machines, which provide full-body workouts and aid in weight loss, heart health, and endurance.

These machines are often seen as essential baseline investments in a home gym due to their wide appeal across age groups and fitness goals. The integration of Bluetooth, heart rate sensors, and virtual training sessions has enhanced their functionality, keeping them in high demand among tech-savvy consumers.

Additionally, foldable and space-saving cardio solutions have made it easier for consumers in urban apartments to prioritize these machines.

Smart equipment is expected to lead the category segment with a 54.00% market share in 2025. The rapid adoption of connected fitness devices—such as app-synced resistance machines, smart weights, and AI-enabled personal trainers—has revolutionized home workouts.

This trend is being driven by consumers’ desire for personalized, real-time feedback and access to on-demand classes without requiring gym memberships. As wearable tech integration becomes seamless and brands offer subscription-based digital fitness ecosystems, smart home gym setups are becoming the preferred choice for users seeking structured progress tracking and virtual coaching.

The growing millennial and Gen Z interest in tech-infused fitness further strengthens the segment’s future outlook.

The medium price range segment is anticipated to account for 46.00% of total revenue in the home gym equipment market by 2025, positioning it as the most dominant pricing tier. This segment strikes a balance between affordability and advanced features, making it attractive to middle-income households seeking quality without overspending.

Mid-tier equipment often includes durable materials, moderate smart capabilities, and compact designs suited for limited spaces, fulfilling most user needs without entering premium cost brackets.

As discretionary spending on health and wellness rises, this segment is expected to remain resilient, especially among first-time buyers and fitness enthusiasts looking to upgrade from entry-level gear.

The home gym equipment market is growing as more consumers opt for convenient and affordable fitness solutions at home. Rising health awareness, coupled with the increasing demand for personalized workout routines, is driving market expansion. The shift towards home-based fitness has been further accelerated by technological innovations, such as smart equipment with built-in fitness tracking and virtual training programs. Despite challenges like high initial costs and limited space in households, the market is benefiting from growing interest in wellness, fitness, and self-care. As more consumers invest in long-term health, the market shows promising growth potential.

The growing trend of home fitness is fueling the demand for home gym equipment, as consumers seek convenient alternatives to traditional gyms. The increasing awareness of physical health and wellness, combined with the desire for personalized workout experiences, has led to greater investment in home-based fitness solutions. Home gym equipment enables consumers to exercise on their own schedules, avoiding the time commitment and membership fees associated with commercial gyms. Technological advancements in smart fitness equipment that offers real-time tracking, personalized workout plans, and virtual classes have further accelerated this trend. Additionally, with the rise in demand for convenience, many consumers are turning to compact, space-saving gym equipment for home use, boosting market growth.

The home gym equipment market faces challenges related to high upfront costs and limited space in residential areas. Purchasing equipment such as treadmills, stationary bikes, or strength training machines often requires significant financial investment, which may deter price-sensitive consumers. Moreover, the space required for storing larger gym equipment is another barrier, particularly for individuals living in small apartments or homes with limited room for exercise equipment. While smaller, more compact solutions are available, they often come with fewer features or capabilities compared to larger machines. These challenges create obstacles for widespread adoption, especially among younger or budget-conscious consumers. Furthermore, maintenance and repair costs associated with specialized equipment can add to the total cost of ownership.

The home gym equipment market presents significant opportunities driven by technological innovations and a growing consumer focus on health and wellness. The rise of smart equipment integrated with fitness tracking apps and virtual classes is reshaping the market, making home fitness more interactive and personalized. These innovations allow consumers to have access to professional training programs, performance tracking, and even group workouts from the comfort of their homes. As more individuals embrace healthier lifestyles, there is an opportunity to develop specialized products for diverse fitness needs, such as weight loss, strength training, or mobility improvement. The increased focus on fitness in emerging markets further presents growth opportunities as consumer spending on health and fitness equipment rises

A key trend in the home gym equipment market is the increasing integration of smart technology. Consumers are seeking equipment that offers real-time data and progress tracking, with many products now incorporating sensors, Bluetooth connectivity, and compatibility with fitness apps. These innovations allow users to monitor their performance, track progress, and customize workouts based on individual goals. Virtual training programs, which offer live-streamed or on-demand classes, are becoming a standard feature of home gym solutions, allowing consumers to follow guided workout routines at home. Furthermore, the demand for compact, multifunctional, and space-efficient equipment is on the rise as consumers prioritize both functionality and convenience in their fitness solutions.

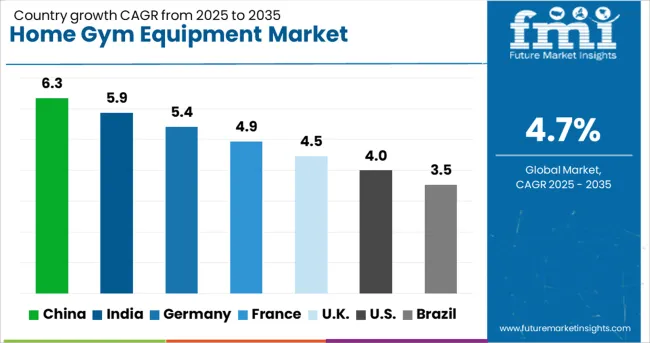

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

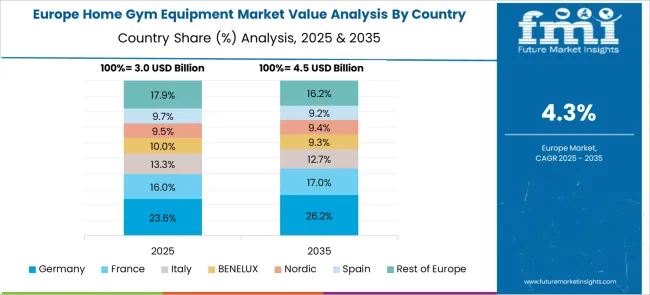

The home gym equipment market is projected to grow at a CAGR of 4.7% from 2025 to 2035. Among the top five profiled markets, China leads at 6.3%, followed by India at 5.9%, Germany at 5.4%, the United Kingdom records 4.5%, and the United States stands at 4.0%. These growth rates reflect strong demand in BRICS economies like China and India, fueled by increasing health awareness, rising disposable income, and urbanization. Developed markets such as Germany, the UK, and the USA show steady growth, supported by the growing popularity of home fitness solutions, technological innovations in fitness equipment, and a shift toward healthier lifestyles. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 6.3% through 2035, with growing urbanization, rising health consciousness, and a focus on personal fitness driving market demand. The shift toward home-based fitness solutions, coupled with increasing disposable income, is propelling the growth of the home gym equipment market. Fitness trends such as weight training, yoga, and functional training are gaining popularity among Chinese consumers, and home gym equipment is becoming more accessible due to increased online sales and retail penetration. This trend is further supported by innovations in compact, multifunctional fitness equipment suitable for smaller urban spaces.

India is expected to grow at a CAGR of 5.9% through 2035, driven by increasing health awareness, rising disposable incomes, and a growing middle class. As India’s urban population embraces a fitness-focused lifestyle, the demand for home gym equipment is growing. With rising fitness concerns and the increasing popularity of online fitness programs, more consumers are investing in home-based workout solutions. Additionally, the growing number of gyms and fitness centers in urban areas reflects a broader cultural shift toward fitness, which in turn supports demand for high-quality home gym equipment.

Germany is expected to grow at a CAGR of 5.4% through 2035, driven by rising awareness about health and fitness. As one of the leading European markets, Germany is embracing home fitness solutions, particularly as more consumers look for convenience and flexibility in their workout routines. The demand for home gym equipment is further supported by the increased popularity of functional fitness, weight training, and virtual workout programs. The market is also influenced by the growing trend toward wellness and balanced living, with an increasing number of consumers seeking to integrate fitness into their daily lives.

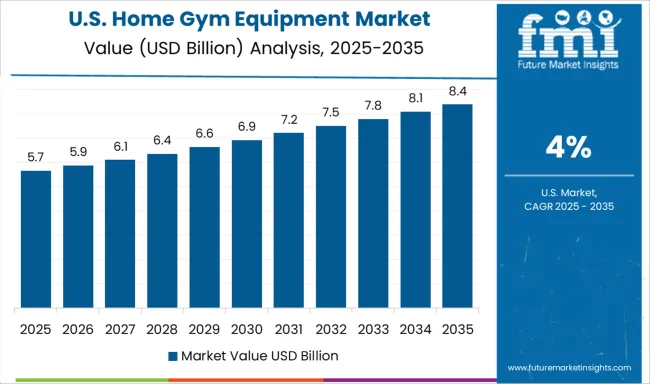

The United States is projected to grow at a CAGR of 4.0% through 2035, supported by the continued interest in fitness and wellness. As consumers increasingly prioritize health and fitness, home gym equipment is gaining traction, especially with the rise of remote working. The USA market is influenced by trends in home-based fitness solutions such as strength training, yoga, and pilates, with consumers seeking high-quality, durable equipment. The availability of innovative, smart home gym equipment, which connects to virtual fitness platforms, further drives demand. This trend is also supported by the growing popularity of fitness apps and online training programs.

The United Kingdom is projected to grow at a CAGR of 4.5% through 2035, with a growing demand for home-based fitness solutions. As consumers prioritize fitness and wellbeing, the home gym equipment market is seeing steady expansion. The rise in digital fitness platforms, including apps and online classes, is contributing to the adoption of gym equipment in homes. Additionally, the increasing interest in self-care and personal fitness has led to a boost in demand for home workout solutions. The market is also supported by technological innovations in fitness equipment that enhance user experience and efficiency.

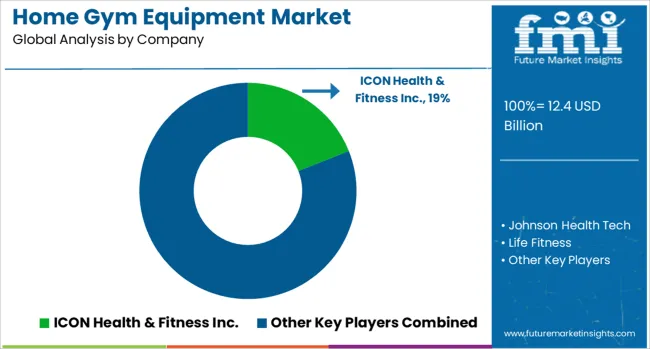

The home gym equipment market is driven by leading fitness brands and technology-focused companies offering a wide range of exercise machines and accessories tailored for home use. ICON Health & Fitness Inc., a dominant player, leads the market with its popular brands like NordicTrack, ProForm, and FreeMotion, providing high-quality treadmills, ellipticals, and stationary bikes, while integrating advanced technology for interactive workouts.

Life Fitness and Johnson Health Tech are major competitors, offering premium fitness equipment such as treadmills, exercise bikes, and strength-training machines, with a focus on durability and innovation in the fitness experience. PELOTON has revolutionized the home gym sector by combining state-of-the-art exercise bikes with live and on-demand streaming classes, establishing itself as a major player in the connected fitness space.

Technogym focuses on high-end, luxury gym equipment with a strong emphasis on design, functionality, and connectivity, catering to both home and commercial fitness needs. Tonal Systems Inc. differentiates itself with its innovative digital strength training system, offering an all-in-one fitness solution that replaces traditional weight stacks with digital resistance technology.

Nautilus, Inc., Tonal Systems, and Schwinn focus on versatility in home fitness, offering products such as stationary bikes, strength machines, and rowing machines, tailored for small living spaces. PENT, Precor Inc., and Speediance emphasize cutting-edge fitness technology and home-compatible designs, appealing to consumers seeking premium, space-saving solutions.

Competitive differentiation in this market is driven by product design, durability, smart connectivity, integration of virtual training programs, and the ability to offer personalized workout experiences. Barriers to entry include high production costs, brand loyalty, and establishing partnerships with fitness content providers. Strategic priorities include expanding the connected fitness ecosystem, enhancing the integration of wearable devices, and offering subscription-based models to ensure ongoing customer engagement.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.4 Billion |

| Equipment Type | Cardiovascular Training Equipment and Strength Training Equipment |

| Category | Smart Equipment and Conventional Equipment |

| Price Range | Medium, Low, and High/Premium |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ICON Health & Fitness Inc., Johnson Health Tech, Life Fitness, Nautilus, Inc, NOHrD, Nordic Track, PELOTON, PENT, Precor Inc., PRIME Fitness USA, ProForm, Schwinn, Speediance, Technogym, and Tonal Systems Inc. |

| Additional Attributes | Dollar sales by generation type (coal-based, gas-based, hybrid fossil-renewable systems) and end-user application (utility-scale generation, industrial cogeneration), with demand driven by energy security requirements and grid balancing needs amid growing renewable penetration. Regional dynamics highlight Asia-Pacific as the largest market due to continued reliance on coal and gas, while Europe and North America lead in transitioning toward cleaner fossil-based systems. Innovation trends include ultra-supercritical boiler technology, advanced CCS systems, co-firing with biofuels, and integration of AI-based operational efficiency tools for predictive maintenance and emission optimization. |

The global home gym equipment market is estimated to be valued at USD 12.4 billion in 2025.

The market size for the home gym equipment market is projected to reach USD 19.6 billion by 2035.

The home gym equipment market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in home gym equipment market are cardiovascular training equipment, _treadmills, _exercise bikes, _rowing machines, _elliptical and others, _stair climber/step mill, _others (spin bike, cross-trainer, air dyne bike, jacob’s ladder, etc.), strength training equipment, _dumbbells, _barbells, _body bars, _kettlebells, _resistance band and _others (stability balls, stability balls, slam balls, trx, etc.).

In terms of category, smart equipment segment to command 54.0% share in the home gym equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Homeland Security Market Size and Share Forecast Outlook 2025 to 2035

Home Wi-Fi Security Solutions Market Size and Share Forecast Outlook 2025 to 2035

Home Security Drone Market Size and Share Forecast Outlook 2025 to 2035

Home Infusion Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Healthcare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Homeopathic Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Home Sleep Apnea Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Office Spending Market by Solution Deployment, Application & Region Forecast till 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA