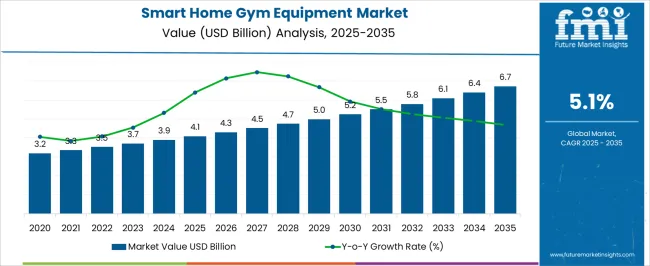

The smart home gym equipment market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 6.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

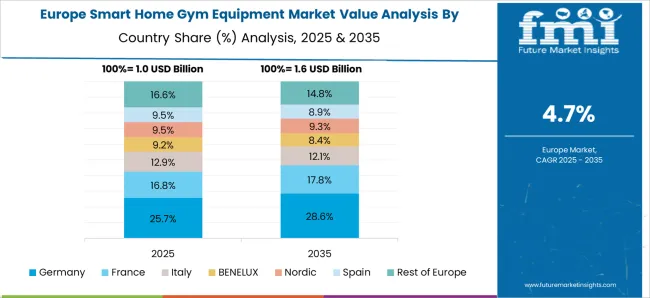

Market share analysis over this period highlights both erosion and gain across different segments and regions. Between 2021 and 2025, the market grows from USD 3.2 billion to 4.1 billion, with incremental values of USD 3.3 billion, 3.5 billion, 3.7 billion, and 3.9 billion. During this phase, traditional fitness equipment providers experience slight market share erosion as connected, AI-powered, and app-integrated home gym solutions capture consumer interest. From 2026 to 2030, the market advances from USD 4.1 billion to 5.2 billion, passing through USD 4.3 billion, 4.5 billion, 4.7 billion, and 5.0 billion. Growth gains are led by integrated smart devices, subscription-based virtual workouts, and increasing adoption in North America and Europe, where consumers favor convenience and interactive fitness experiences.

Emerging markets contribute to share gains for new entrants offering cost-effective and compact solutions, while legacy brands adapt with upgraded offerings. Between 2031 and 2035, the market progresses from USD 5.5 billion to 6.7 billion, with intermediate values of USD 5.8 billion, 6.1 billion, and 6.4 billion. In this period, market share gains continue for innovative smart equipment providers leveraging IoT, AR/VR, and connected fitness platforms, while slower adoption in conventional home gyms slightly erodes legacy positions.

| Metric | Value |

|---|---|

| Smart Home Gym Equipment Market Estimated Value in (2025 E) | USD 4.1 billion |

| Smart Home Gym Equipment Market Forecast Value in (2035 F) | USD 6.7 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The home fitness and exercise equipment market contributes the largest share, about 25-30%, as connected treadmills, stationary bikes, strength machines, and rowing equipment provide convenience, performance tracking, and interactive workouts for health-conscious consumers. The wearable fitness and health tracking market adds roughly 18-22%, since integration with smartwatches, heart rate monitors, and activity trackers enhances personalization, performance analytics, and motivation during workouts. The digital fitness and subscription platform market contributes approximately 15-18%, as live streaming, on-demand classes, and AI-guided training programs drive engagement, subscription-based revenue, and interactive home workout experiences.

The connected home and IoT devices market accounts for 10-12%, enabling seamless integration of gym equipment with mobile apps, voice assistants, and smart home ecosystems to provide automated routines, progress tracking, and environmental control. Lastly, the wellness and health management market represents about 8-10%, where smart home gym equipment supports preventive health, rehabilitation, and holistic fitness by combining physical activity, monitoring, and user data insights.

The smart home gym equipment market is expanding rapidly, supported by the convergence of fitness technology, connected devices, and evolving consumer health priorities. Advancements in AI-driven workout guidance, real-time performance tracking, and interactive fitness platforms have significantly enhanced user engagement and training efficiency.

Industry announcements and product portfolio expansions from leading fitness brands have highlighted increased adoption of multifunctional cardio and strength systems designed for compact home spaces. Shifts in lifestyle preferences, accelerated by hybrid work models, have further boosted at-home training demand.

Integration of subscription-based virtual classes and social workout communities has also strengthened user retention. As consumers increasingly prioritize convenience, personalization, and long-term health investment, the market is poised for sustained growth. Key drivers include innovation in connected cardiovascular training equipment, professional-grade solutions tailored for home use, and strong uptake in the medium price tier, which balances quality with affordability.

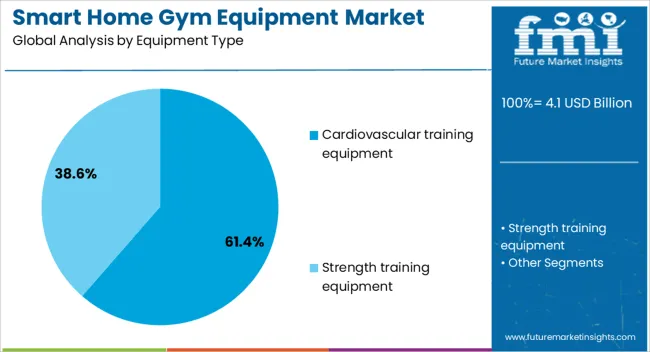

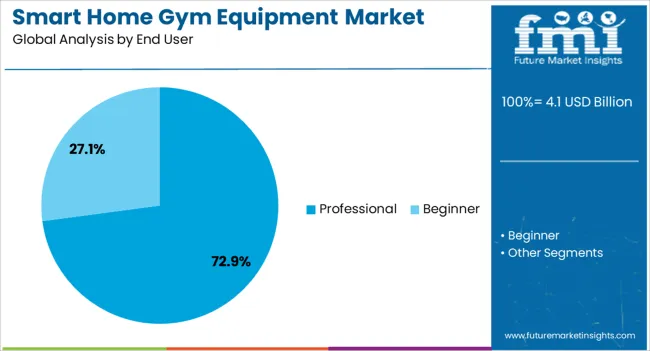

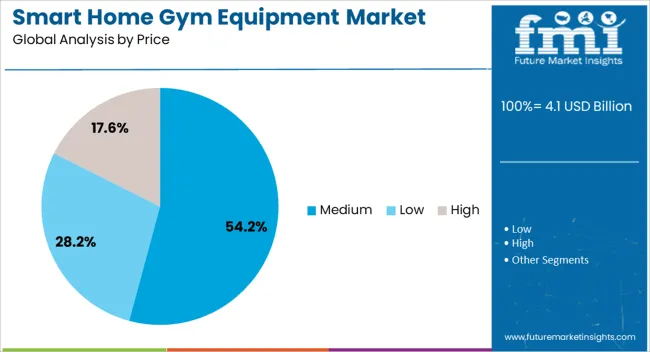

The smart home gym equipment market is segmented by equipment type, end user, price, distribution channel, and geographic regions. By equipment type, smart home gym equipment market is divided into cardiovascular training equipment and strength training equipment. In terms of end user, smart home gym equipment market is classified into professional and beginner. Based on price, smart home gym equipment market is segmented into medium, low, and high. By distribution channel, smart home gym equipment market is segmented into online and offline. Regionally, the smart home gym equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cardiovascular training equipment segment is projected to hold 61.4% of the smart home gym equipment market revenue in 2025, reinforcing its status as the leading equipment category. Growth in this segment is driven by the versatility and accessibility of cardio machines, which cater to a broad range of fitness levels and goals. Consumers have increasingly favored connected treadmills, bikes, and rowers that integrate performance analytics, interactive classes, and virtual terrains. Professional athletes and casual users alike have embraced these machines for their ability to deliver structured workouts that improve endurance, calorie burn, and cardiovascular health. Continuous innovation, such as adaptive resistance and personalized training programs, has expanded appeal and usage frequency. The growing importance of heart health monitoring in preventive care has further amplified adoption, solidifying the cardiovascular training equipment segment’s dominance.

The professional segment is forecasted to account for 72.9% of the smart home gym equipment market revenue in 2025, positioning it as the largest end user group. This segment’s growth is attributed to demand from fitness professionals, athletes, and dedicated enthusiasts who seek high-performance equipment for consistent, results-driven training. Professional-grade smart gym systems are designed with advanced durability, precision engineering, and compatibility with specialized training software, meeting the rigorous demands of daily use. Brand endorsements and product launches tailored to serious fitness users have enhanced credibility and uptake in this category. Moreover, remote coaching platforms and integrated workout tracking have made professional-level training more accessible in home environments. As competitive sports, personal training businesses, and influencer-led fitness content grow, the professional end user segment is expected to remain the primary driver of high-value equipment sales.

The medium price segment is projected to capture 54.2% of the smart home gym equipment market revenue in 2025, establishing itself as the preferred pricing tier for a wide consumer base. This range has been successful in balancing affordability with advanced features, attracting consumers seeking premium experiences without the cost of high-end models. Equipment in this tier often includes integrated smart displays, performance tracking, and compatibility with popular fitness apps, making them appealing to both intermediate and advanced users. Retail trends show strong sales in this segment through both online platforms and specialty fitness stores, driven by promotional bundles and flexible payment options. The medium price category also benefits from a broad offering of models that blend compact design with multifunctional capabilities, meeting the needs of consumers with space constraints. As innovation continues to democratize access to advanced fitness technology, the medium price segment is expected to sustain its market leadership.

The smart home gym equipment market is growing due to rising consumer demand for connected, personalized, and interactive fitness solutions. Products such as smart treadmills, stationary bikes, AI-enabled strength trainers, and virtual training platforms drive adoption. Key challenges include high costs, connectivity reliability, and technical integration with mobile apps and wearables. Opportunities lie in AI coaching, gamified workouts, subscription-based fitness content, and IoT-enabled monitoring. Manufacturers offering user-friendly, customizable, and digitally integrated gym equipment are best positioned to capture market share. North America and Asia-Pacific lead adoption, driven by health awareness, digital fitness trends, and urban lifestyles.

The civil engineering market is expanding as governments and private sectors invest heavily in infrastructure, including roads, bridges, railways, airports, and urban development projects. Growth is driven by rapid urbanization, industrialization, and smart city initiatives across Asia-Pacific, North America, and Europe. Projects focused on transportation networks, water management, and residential and commercial construction fuel demand for civil engineering services. Firms are increasingly adopting advanced construction technologies, Building Information Modeling (BIM), and project management software to enhance efficiency. Contractors, consultants, and engineering service providers focus on delivering timely, cost-effective, and high-quality infrastructure solutions. Increasing investment in renewable energy infrastructure, industrial parks, and public utilities further supports market expansion and positions civil engineering as a critical sector for economic development worldwide.

Market constraints include high initial investment, energy-intensive operation, and ongoing maintenance of pumps, motors, and control systems. Fluctuations in raw material prices such as stainless steel, cast iron, and specialty alloys impact manufacturing costs. Regulatory standards for energy efficiency, safety, and environmental compliance add complexity, particularly for water and chemical applications. Technical challenges include handling corrosive fluids, maintaining pressure stability, and ensuring long-term durability under continuous operation. Buyers increasingly seek suppliers with certified products, predictable supply chains, technical support, and preventive maintenance solutions to ensure reliability, efficiency, and compliance with local and international regulations.

Rapid urbanization and government initiatives for smart city development present significant growth opportunities in civil engineering. Expanding transportation infrastructure, including highways, metro systems, and airports, creates demand for planning, design, and execution services. Industrial facility development, water treatment plants, and renewable energy projects also contribute to market growth. Asia-Pacific leads in new infrastructure projects, while North America and Europe continue upgrading aging infrastructure. Engineering firms offering integrated project management, digital design, and turnkey solutions are gaining a competitive edge. Adoption of modular construction techniques, prefabricated structures, and modern construction materials enhances project efficiency. Collaboration with public agencies and private developers ensures long-term project pipelines and positions service providers to capitalize on large-scale civil engineering developments globally.

Technological trends are reshaping civil engineering, including the adoption of Building Information Modeling (BIM), drone-assisted surveying, and automated construction equipment. Advanced materials such as high-performance concrete, fiber-reinforced composites, and corrosion-resistant steel improve durability and reduce maintenance costs. Digital project management tools enable better coordination, resource allocation, and real-time monitoring of construction activities. Firms are also focusing on lifecycle management, predictive maintenance, and energy-efficient building designs to meet client requirements. Integration of Geographic Information Systems (GIS) and IoT-enabled sensors supports data-driven decision-making in large-scale projects. Civil engineering companies offering technology-enabled, high-quality, and cost-efficient services are well-positioned to meet evolving infrastructure needs, enhance operational efficiency, and secure growth across global construction markets.

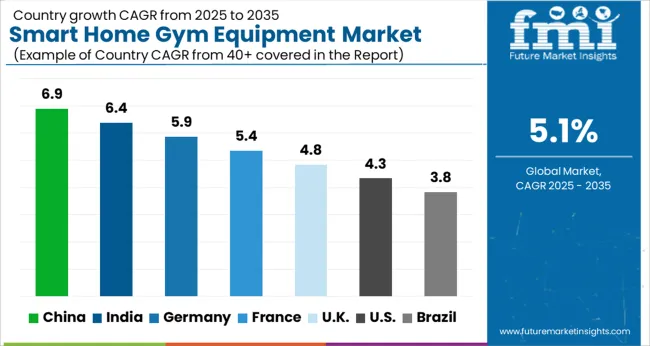

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global smart home gym equipment market is projected to grow at a CAGR of 6.1% from 2025 to 2035. China (6.9%) and India (6.4%) are the fastest-growing markets, driven by rising health awareness, increasing disposable income, and rapid adoption of connected fitness devices. Germany (5.9%) emphasizes high-quality, durable equipment integrated with smart home systems, while the UK (4.8%) shows steady growth through interactive workout solutions and app connectivity. The USA (4.3%) experiences moderate growth, supported by AI-enabled strength equipment, smart treadmills, and virtual training platforms. Key growth drivers include home fitness trends, online retail expansion, app integration, AI-driven personalization, and urban lifestyle shifts. The analysis spans over 40+ countries, with the leading markets shown below.

The smart home gym equipment market in China is projected to grow at a CAGR of 6.9% from 2025 to 2035, fueled by rising health awareness, increasing disposable income, and rapid urbanization. The growing popularity of connected fitness devices, interactive workout platforms, and smart home integration is accelerating adoption. E-commerce and online retail channels are making smart fitness equipment more accessible, while local manufacturers focus on innovation, user-friendly designs, and digital connectivity. The country’s tech-savvy population and rising demand for home-based fitness solutions post-pandemic further drive growth.

The smart home gym equipment market in India is expected to grow at a CAGR of 6.4% from 2025 to 2035, supported by an expanding middle class, rising disposable income, and increasing awareness of personal fitness. Urbanization and lifestyle shifts toward home workouts are driving demand for smart gym equipment, including connected treadmills, stationary bikes, and strength training systems. Online platforms and retail chains are facilitating product availability nationwide. Local manufacturers are investing in digital features, app integration, and AI-enabled training modules to enhance user experience. Fitness-focused campaigns and influencer endorsements are also stimulating demand.

The smart home gym equipment market in Germany is projected to expand at a CAGR of 5.9% from 2025 to 2035, driven by increasing health consciousness and demand for high-quality, durable fitness devices. The market benefits from well-established fitness culture, preference for connected devices, and integration with smart home ecosystems. Consumers are seeking compact, efficient, and tech-enabled equipment suitable for home use. Fitness equipment manufacturers are investing in advanced sensors, interactive screens, and connected platforms for personalized workouts. Adoption is also supported by online sales and boutique fitness trends.

The UK market is expected to grow at a CAGR of 4.8% from 2025 to 2035, with rising adoption of home fitness solutions and connected gym devices. Consumers are increasingly investing in interactive workout equipment such as smart treadmills, bikes, and strength training systems. The shift toward home-based fitness is supported by urban lifestyles, limited gym access, and preference for technology-driven solutions. Manufacturers are focusing on integrating virtual classes, app connectivity, and AI-based training features. Online and offline retail expansion further enhances accessibility across urban and suburban regions.

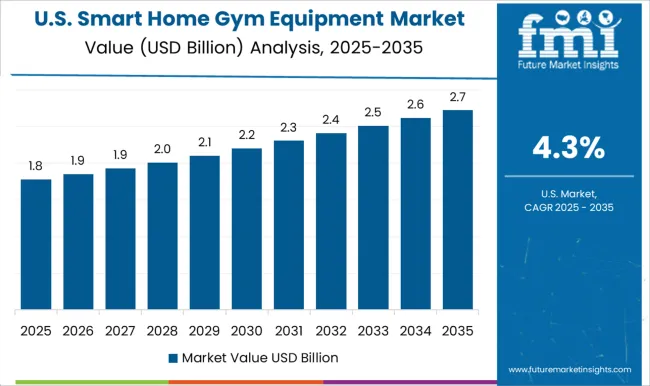

The USA smart home gym equipment market is projected to grow at a CAGR of 4.3% from 2025 to 2035, supported by rising health awareness, home fitness trends, and demand for connected and interactive devices. Consumers are increasingly adopting AI-enabled strength equipment, smart treadmills, and virtual training systems. Online retail platforms and subscription-based interactive content are enhancing accessibility. Manufacturers are focusing on durable design, app integration, and personalized fitness tracking to meet consumer expectations. While growth is moderate compared to Asia, niche applications such as boutique home gyms, premium smart devices, and AI-powered training solutions offer incremental market opportunities.

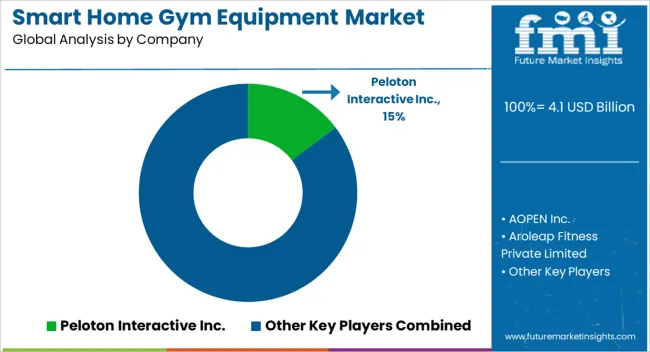

Competition in the smart home gym equipment market is shaped by connectivity, interactivity, and product ecosystem integration. Peloton Interactive Inc. leads with connected bikes and treadmills offering live and on-demand classes, subscription-based content, and performance tracking. AOPEN Inc. focuses on modular smart fitness solutions with integrated sensors and interactive interfaces for personalized training at home. Aroleap Fitness Private Limited differentiates through compact, affordable smart devices targeting emerging markets and first-time home gym users. Aviron Interactive emphasizes rowing machines with gamified workouts, real-time metrics, and leaderboard engagement, appealing to performance-oriented users.

Beyond Power Inc. competes via AI-powered strength training platforms and adjustable resistance systems, emphasizing automation and form correction. EGYM provides connected strength and cardio equipment that sync with mobile apps and corporate wellness programs, highlighting analytics-driven fitness insights. Flexnest Gym Accessories and INNODIGYM focus on smart accessories, resistance bands, and compact multi-functional equipment integrated with mobile apps for real-time feedback. Life Fitness and Maxpro Fitness combine traditional fitness engineering with digital monitoring, offering strength machines, dumbbells, and connected cardio devices. Nordic Track and Precor emphasize interactive treadmill and bike solutions with live coaching, terrain simulation, and multimedia integration.

Speediance targets high-intensity interval training with smart resistance and AI-guided programming, while TECHNOGYM S.p.A positions premium smart fitness platforms with wellness tracking, personalized coaching, and subscription-based content. Tonal Systems Inc. specializes in wall-mounted strength training systems with digital weights, AI-guided workouts, and space-efficient design. Strategies across the market focus on software subscriptions, connected platforms, and integration with mobile apps for real-time feedback. Product brochures highlight smart bikes, treadmills, rowers, AI-driven resistance systems, strength training modules, interactive displays, virtual coaching, heart rate and performance monitoring, and compact modular designs. Together, these offerings demonstrate a market defined by connected fitness, personalized training experiences, and the convergence of hardware, software, and content for home wellness.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 billion |

| Equipment Type | Cardiovascular training equipment and Strength training equipment |

| End User | Professional and Beginner |

| Price | Medium, Low, and High |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Peloton Interactive Inc., AOPEN Inc., Aroleap Fitness Private Limited, Aviron Interactive, Beyond Power Inc., EGYM, Flexnest Gym Accessories, INNODIGYM, Life Fitness, Maxpro Fitness, Nordic Track, Precor, Speediance, TECHNOGYM S.p.A, and Tonal Systems Inc. |

| Additional Attributes | Dollar sales by equipment type (cardio machines, strength training, rowing, multi-functional), connectivity features (AI coaching, app integration, cloud tracking), and target user (home, premium, professional). Demand dynamics are fueled by home fitness adoption, digital workout trends, and health-conscious consumer behavior. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, supported by increasing adoption of smart home technologies and connected fitness ecosystems. |

The global smart home gym equipment market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the smart home gym equipment market is projected to reach USD 6.7 billion by 2035.

The smart home gym equipment market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in smart home gym equipment market are cardiovascular training equipment, treadmills, exercise bikes, rowing machines, elliptical and others, stair climber/step mill, others, strength training equipment, dumbbells, barbells, body bars, kettlebells, resistance band and others.

In terms of end user, professional segment to command 72.9% share in the smart home gym equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA