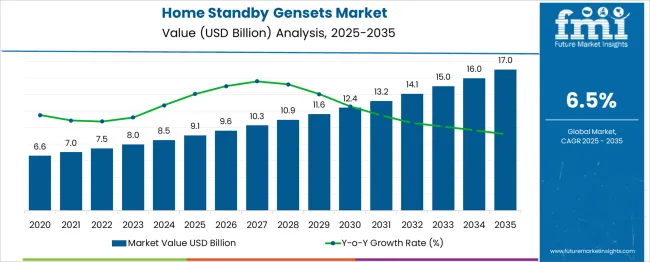

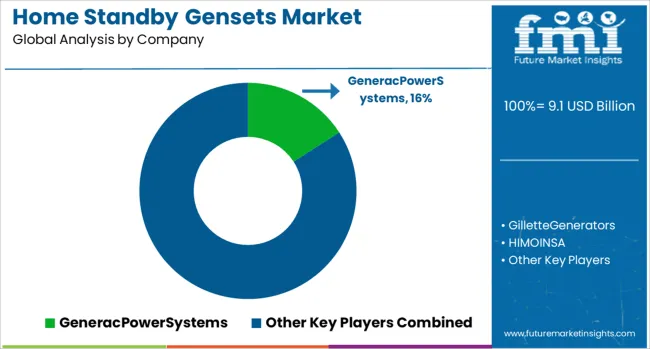

The Home Standby Gensets Market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 17.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The home standby gensets market is projected to grow from USD 9.1 billion in 2025 to USD 17.0 billion by 2035, with a CAGR of 6.5%. A Breakpoint Analysis reveals key transitions in market growth, reflecting both acceleration and stabilization. Between 2025 and 2030, the market grows from USD 9.1 billion to USD 12.4 billion, contributing USD 3.3 billion in growth, with a CAGR of 6.7%. This phase shows strong growth driven by rising demand for reliable backup power solutions in homes, fueled by concerns over power grid instability, climate-related events, and an increasing preference for energy independence. The first breakpoint occurs around 2030, when the market reaches USD 12.4 billion, signaling a shift toward more gradual, stable growth. From 2030 to 2035, the market continues to expand, moving from USD 12.4 billion to USD 17.0 billion, contributing USD 4.6 billion in growth, with a CAGR of 5.9%. This deceleration reflects the market nearing maturity as widespread adoption of home standby gensets becomes common. Growth continues but at a more stable rate, driven by technological innovations such as quieter, more fuel-efficient gensets and growing interest in hybrid or renewable energy-powered backup systems. The overall analysis shows strong early-stage growth, followed by a stable and sustained expansion in later years as the market reaches maturity.

| Metric | Value |

|---|---|

| Home Standby Gensets Market Estimated Value in (2025 E) | USD 9.1 billion |

| Home Standby Gensets Market Forecast Value in (2035 F) | USD 17.0 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The home standby gensets market is expanding steadily, propelled by rising residential electrification needs and increasing occurrences of power outages. The growing emphasis on uninterrupted power supply for critical household applications, such as heating, cooling, and home security systems, is stimulating demand for dependable standby generators.

Technological advancements in genset efficiency, noise reduction, and automatic transfer switches are further enhancing user experience, promoting adoption in both urban and semi-urban households. Increasing consumer awareness about energy security coupled with favorable government incentives in various regions to improve residential power resilience is supporting market growth.

Moreover, the trend toward integrating smart home technologies with standby generators is expected to create future opportunities for enhanced remote monitoring and control. Rising construction of new residential properties in developing economies and replacement of aging power infrastructure in mature markets also contribute to positive outlooks for the home standby genset market.

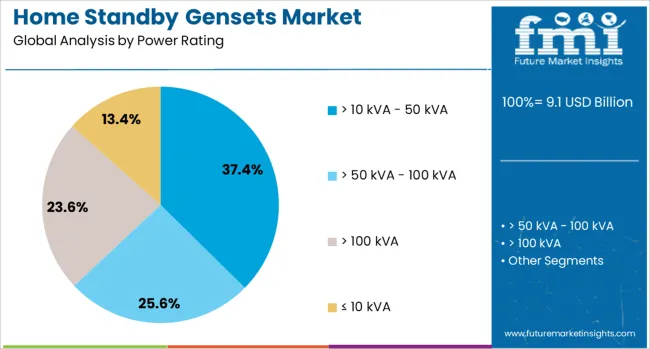

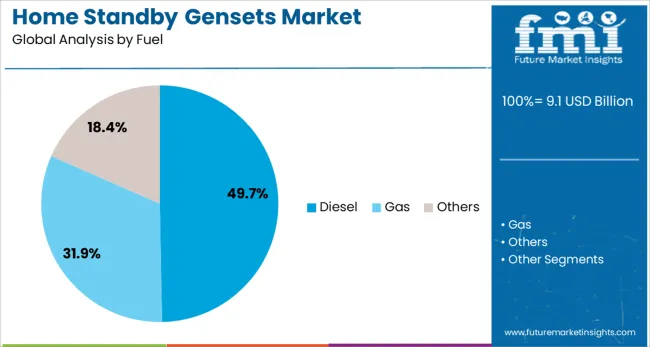

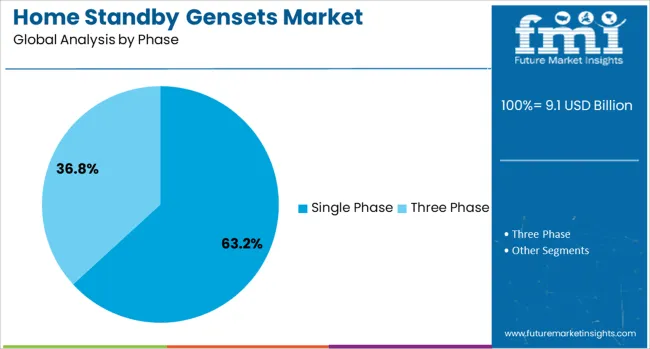

The home standby gensets market is segmented by power rating, fuel, phase product, and geographic regions. By power rating of the home standby gensets market is divided into > 10 kVA - 50 kVA, > 50 kVA - 100 kVA, > 100 kVA≤ 10 kVA. In terms of fuel of the home standby gensets market is classified into Diesel, Gas Others. Based on phase of the home standby gensets market is segmented into Single Phase Three Phase. By product of the home standby gensets market is segmented into Air Cooled Liquid Cooled. Regionally, the home standby gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Power ratings between 10 kVA and 50 kVA are expected to constitute 37.4% of the market share in 2025, reflecting their suitability for typical residential power backup requirements. This segment’s dominance is influenced by the balance it offers between capacity and efficiency, effectively supporting essential household loads without excessive fuel consumption or noise emissions.

The ability of gensets in this power range to handle multiple appliances simultaneously, including HVAC systems and kitchen equipment, has made them highly preferred among homeowners. Additionally, improved design for easy installation and compatibility with automatic transfer switches enables seamless power transitions, boosting their appeal.

The segment benefits from widespread availability of both diesel and gas-fueled models within this capacity range, catering to varying consumer preferences and regional fuel accessibility. The combination of reliability, operational efficiency, and moderate pricing has positioned the 10 kVA to 50 kVA category as a market leader for home standby applications.

Diesel-fueled gensets are projected to hold 49.7% of the market share by 2025, underpinned by their robustness, fuel efficiency, and long operational life. Diesel’s higher energy density compared to alternative fuels makes it the preferred choice for homeowners seeking dependable, long-duration power backup solutions.

The fuel’s widespread availability, established supply infrastructure, and relatively lower cost contribute to its leading position. Furthermore, advances in emission control technologies and noise dampening have alleviated some environmental concerns traditionally associated with diesel generators, encouraging broader adoption.

The diesel segment is also supported by increasing awareness regarding lifecycle costs and maintenance advantages over gasoline or propane options. Given these factors, diesel gensets continue to be favored for home standby applications requiring extended runtime and higher load support.

Single-phase gensets are anticipated to represent 63.2% of the market revenue share in 2025, largely driven by their alignment with typical residential electrical systems. The prevalence of single-phase electricity supply in homes globally ensures compatibility and straightforward integration of such gensets into existing power infrastructures.

The segment’s growth is supported by its simpler design, ease of installation, and cost-effectiveness compared to three-phase alternatives. Single-phase generators adequately meet the power needs of most households, delivering sufficient capacity for lighting, appliances, and heating or cooling systems.

Additionally, ongoing improvements in single-phase genset technology, including enhanced fuel efficiency and reduced noise levels, are further increasing consumer preference. The dominance of single-phase gensets is expected to persist, as residential power systems continue to rely on this configuration for cost-efficient and reliable backup power solutions.

The demand for home standby gensets is increasing due to the growing need for reliable backup power solutions. As power outages become more frequent and prolonged, consumers are investing in backup generators to ensure uninterrupted power supply, particularly for essential household appliances. These gensets, powered by natural gas or propane, are designed to automatically activate during power failures, offering convenience and peace of mind. While high initial costs and maintenance requirements remain challenges, technological advancements and the increasing awareness of power reliability are driving market growth.

The primary driver of the home standby gensets market is the growing need for reliable backup power solutions, especially as power outages become more frequent due to extreme weather conditions, grid failures, and increased energy demand. With essential household appliances, medical equipment, and security systems relying on a constant power supply, homeowners are increasingly turning to standby generators to ensure they are not left vulnerable during power failures. Additionally, rising awareness about the importance of reliable power sources, along with government incentives for energy-efficient solutions, is further pushing the adoption of home standby gensets.

A significant challenge in the home standby gensets market is the high upfront cost associated with purchasing and installing these systems. While they provide long-term value and security, the initial investment for home standby generators, especially larger, higher capacity models, can be prohibitive for some consumers. Furthermore, ongoing maintenance costs and the need for periodic servicing to ensure reliable operation can add to the total cost of ownership. Additionally, the installation process can be complex, requiring professional services to ensure proper integration with a home’s electrical system. These factors may deter some homeowners from adopting standby gensets.

The home standby gensets market presents significant growth opportunities through technological advancements and increasing market demand. Innovations such as the integration of smart technology, remote monitoring, and fuel-efficient systems are improving the functionality and efficiency of these gensets, making them more appealing to consumers. Moreover, as the need for uninterrupted power continues to rise, particularly in regions prone to natural disasters or unreliable grid systems, the demand for home standby generators is expanding. Additionally, growing interest in green energy solutions offers opportunities to develop hybrid gensets that combine traditional fuel sources with renewable energy options like solar power, broadening their appeal.

A key trend in the home standby gensets market is the integration of smart features, which allow consumers to monitor and control their generators remotely through mobile apps or home automation systems. These smart features enhance the user experience by providing real-time status updates, diagnostics, and alerts for maintenance. Another notable trend is the shift toward more eco-friendly and fuel-efficient genset models, driven by increasing consumer preference for green energy solutions. Manufacturers are developing hybrid models that use cleaner energy sources, such as natural gas or propane, and are improving fuel consumption rates, contributing to a reduction in carbon emissions and operational costs.

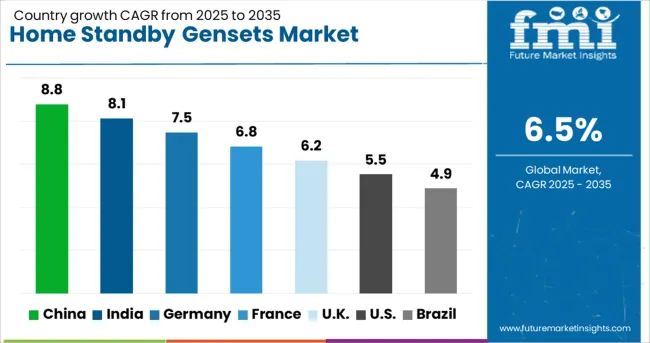

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global home standby gensets market is expected to grow at a CAGR of 6.5% from 2025 to 2035. China, a key member of the BRICS group, leads with an impressive growth rate of 8.8%, followed by India at 8.1%. Developed markets in the OECD, such as Germany, the UK, and the USA, show more moderate growth, with CAGRs of 7.5%, 6.2%, and 5.5%, respectively. Emerging markets are driven by increasing demand for reliable power solutions, particularly in rural and underserved areas, while developed countries face steady demand due to power backup needs during extreme weather events and grid failures. The analysis includes over 40 countries, with the top market detailed below.

The home standby genset market in China is growing at an impressive CAGR of 8.8%. The country’s rapid industrialization, ongoing urbanization, and the frequent occurrence of natural disasters like floods and typhoons are significant drivers of demand. As China continues to expand its infrastructure, including residential housing and rural electrification, the need for reliable backup power solutions increases. With the rising focus on energy security and the government’s support for renewable energy and grid improvements, China’s home standby genset market is expected to grow rapidly, meeting the power backup needs in both urban and rural areas.

The home standby genset market in India is expected to grow at a CAGR of 8.1%. The country’s expanding population, along with the increasing frequency of power outages, particularly in rural areas, is driving demand for backup power solutions. As India’s infrastructure grows and more people move to urban and semi-urban areas, the need for reliable and accessible power systems becomes crucial. Additionally, frequent power disruptions caused by storms, cyclones, and other natural disasters are driving the demand for home standby gensets, which provide uninterrupted power for households.

Demand for home standby genset in Germany is projected to grow at a CAGR of 7.5%. The country’s reliable power grid and focus on renewable energy sources are prompting increased interest in home backup power solutions. Despite a stable grid infrastructure, extreme weather events, such as storms and floods, highlight the need for reliable power systems in residential areas. Furthermore, Germany’s commitment to energy independence and smart home solutions is contributing to the rising adoption of home standby gensets. The market is expected to grow steadily, driven by energy security concerns and the increasing role of residential solar installations.

The UK home standby genset market is expected to grow at a CAGR of 6.2%. Although the UK has a stable and well-developed power grid, the increasing frequency of extreme weather conditions, including storms and snowfalls, raises the need for backup power systems. The growing awareness around the importance of energy security and the rise in demand for smart homes are fueling the adoption of standby gensets. With the UK aiming for net-zero emissions by 2050, the shift toward renewable energy sources further accelerates the demand for backup power solutions to ensure grid reliability during power outages.

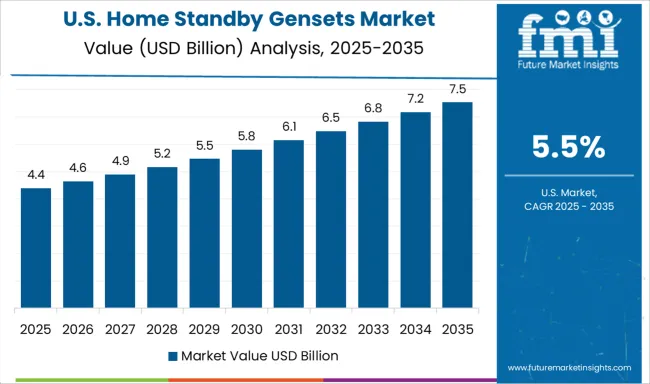

The USA home standby genset market is projected to grow at a CAGR of 5.5%. Despite having a well-established power grid, the USA faces growing demand for backup power solutions due to the increasing frequency of natural disasters, such as hurricanes, tornadoes, and wildfires. As more households seek reliable power sources during grid failures, home standby gensets are becoming an essential part of residential infrastructure. The growing adoption of renewable energy solutions like solar power, coupled with the need for backup systems during emergencies, is driving steady growth in the USA home standby genset market.

The home standby gensets market is driven by key manufacturers specializing in providing reliable, efficient, and durable power backup solutions for residential use. Generac Power Systems is a market leader, offering a wide range of home standby generators known for their reliability, performance, and integration with home automation systems. Gillette Generators and HIMOINSA provide high-quality, durable gensets designed for residential use, focusing on energy efficiency and ease of installation. Hipower and Kirloskar are significant players, offering home standby generators with a focus on long-lasting performance and fuel efficiency, catering to a growing demand for reliable power backup in both urban and rural areas. Mahindra Powerol and Pinnacle Generators provide affordable, high-performance standby gensets, focusing on robustness, easy operation, and efficient power delivery. Ashok Leyland offers advanced genset solutions with an emphasis on fuel-efficient technologies and cost-effectiveness.

Briggs and Stratton and Caterpillar specialize in delivering both small-scale and heavy-duty residential backup power solutions, focusing on high-performance engines and low operational costs. Champion Power Equipment and Cummins offer versatile and reliable home standby generators designed for seamless integration with homes, with a focus on durability, low maintenance, and cost-efficient energy solutions. Eaton and Echo Group are known for their smart home backup systems, integrating gensets with advanced monitoring and control features, focusing on enhancing convenience and optimizing power usage for homeowners. Competitive differentiation in the home standby gensets market is driven by factors such as power output, fuel efficiency, ease of installation, product reliability, and the ability to integrate with home automation systems. Barriers to entry include high production costs, technical complexity, and stringent safety and environmental regulations. Strategic priorities include improving fuel efficiency, expanding product features, and enhancing customer service offerings.

Recent Development

| Item | Value |

|---|---|

| Quantitative Units | USD 9.1 Billion |

| Power Rating | > 10 kVA - 50 kVA, > 50 kVA - 100 kVA, > 100 kVA, and ≤ 10 kVA |

| Fuel | Diesel, Gas, and Others |

| Phase | Single Phase and Three Phase |

| Product | Air Cooled and Liquid Cooled |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GeneracPowerSystems, GilletteGenerators, HIMOINSA, Hipower, Kirloskar, MahindraPowerol, PinnacleGenerators, AshokLeyland, BriggsandStratton, Caterpillar, ChampionPowerEquipment, Cummins, Eaton, and EchoGroup |

| Additional Attributes | Dollar sales by genset type (portable, stationary) and end-use segments (residential, small commercial). Demand dynamics are driven by growing concerns over power reliability, the increasing frequency of power outages, and rising adoption of renewable energy systems that require backup power solutions. Regional trends show strong growth in North America due to high demand for residential power backup, while Asia-Pacific is expanding due to increased urbanization and economic growth. |

The global home standby gensets market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the home standby gensets market is projected to reach USD 17.0 billion by 2035.

The home standby gensets market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in home standby gensets market are > 10 kva - 50 kva, > 50 kva - 100 kva, > 100 kva and ≤ 10 kva.

In terms of fuel, diesel segment to command 49.7% share in the home standby gensets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Standby Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA