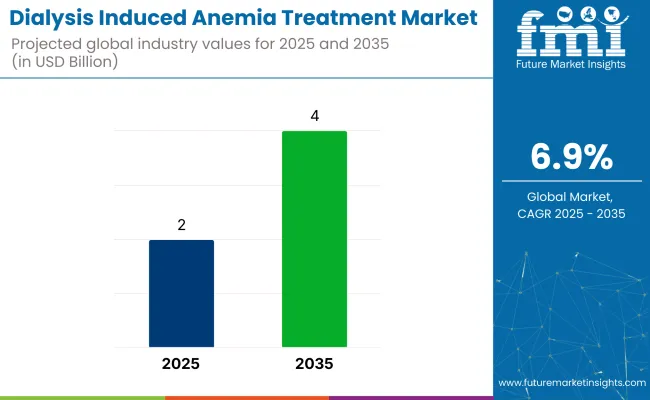

The global dialysis induced anemia treatment market is expected to reach USD 2 billion in 2025 and grow to USD 4.5 billion by 2035, registering a CAGR of 6.9%. Rising prevalence of chronic kidney disease (CKD), particularly end-stage renal disease (ESRD), is driving the need for effective anemia management in dialysis patients. Iron deficiency remains a primary concern in this population due to poor dietary absorption, frequent blood draws, and dialysis-related blood loss.

According to the National Kidney Foundation, patients on dialysis are at high risk of iron deficiency due to several contributing factors such as limited consumption of iron-rich foods, blood loss during hemodialysis sessions, and the use of erythropoiesis-stimulating agents (ESAs) that further deplete iron levels.

The foundation emphasizes that even small amounts of blood lost during dialysis procedures can accumulate, exacerbating iron deficiency and anemia. It highlights the need for routine monitoring and patient-specific iron supplementation strategies to maintain hemoglobin levels and ensure optimal anemia control.

The industry holds a specialized but significant share within its parent markets. Within the anemia treatment market, it accounts for approximately 10-12%, as dialysis-induced anemia represents a specific type of anemia with targeted treatments. In the renal care market, its share is around 7-9%, driven by the increasing need for specialized anemia treatments in dialysis patients.

Within the pharmaceuticals market, its share is about 2-3%, as treatments like erythropoiesis-stimulating agents and iron supplements are part of the larger pharmaceutical landscape. In the healthcare and hospital supplies market, the share is approximately 3-5%, as these treatments are critical for dialysis patients in hospital settings. Within the chronic kidney disease market, it holds about 5-7%, as anemia management is closely linked to CKD treatment and care.

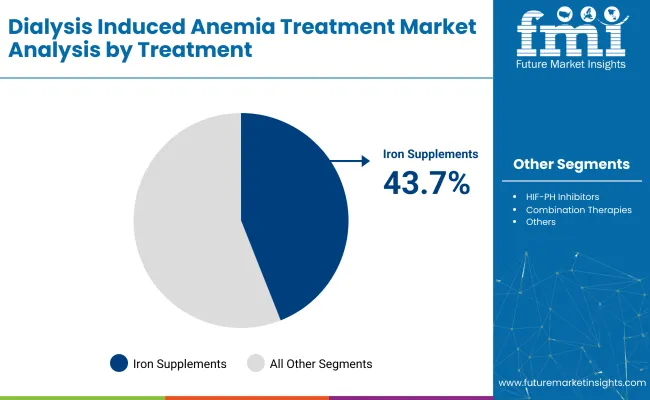

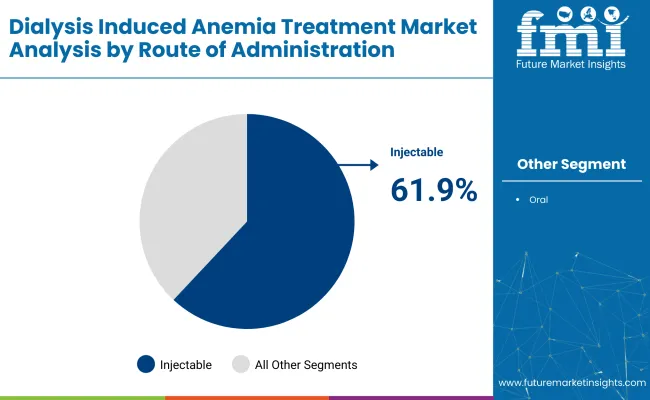

The industry is projected to be led by iron supplements, injectable routes, and hospital pharmacies in 2025. Iron supplements are expected to capture 43.7%, injectable routes 61.9%, and hospital pharmacies will dominate the sales channel segment with 56%.

Iron supplements are expected to dominate the industry with 43.7% of the industry share in 2025. These supplements are critical for restoring iron levels and supporting erythropoiesis in dialysis patients, particularly those with chronic kidney disease (CKD). Intravenous iron formulations, with superior bioavailability and quicker response compared to oral forms, are increasingly preferred, especially for hemodialysis patients with poor iron absorption.

The growth of this segment is supported by the rising prevalence of ESRD, cost-effectiveness in reducing ESA dependency, and innovations like ferric carboxymaltose, iron sucrose, and newer iron complexes, which offer reduced dosing frequency and fewer side effects.

Injectable formulations are projected to dominate the route of administration segment, holding a 61.9% industry share in 2025. These formulations are the preferred choice for managing moderate-to-severe anemia in CKD patients, particularly during dialysis. Intravenous administration ensures effective treatment due to better absorption and precise dosing control, which is crucial in hemodialysis procedures.

The segment’s growth is further supported by advancements in long-acting injectable formulations, which offer sustained release and reduced dosing frequency. The rise in pre-filled syringes and safety-engineered injectable systems is increasing provider convenience and minimizing administration errors and contamination risks.

Hospital pharmacies are expected to capture 56% of the industry share in 2025, making them the leading channel for anti-anemia treatments. These pharmacies play a crucial role in administering iron therapies and erythropoiesis-stimulating agents (ESAs) in inpatient and dialysis settings. Hospital pharmacies offer secure storage, clinical oversight, and reimbursement alignment, ensuring safe and effective medication management.

The integration of electronic medical records (EMRs) and automated dispensing systems streamlines anemia management by improving inventory tracking, patient compliance monitoring, and workflow efficiency. With centralized treatment protocols, hospitals remain the most trusted and reliable channel for administering anti-D immunoglobulin.

The industry is evolving with innovations such as biosimilar erythropoiesis-stimulating agents (ESAs) and personalized intravenous iron therapies. These advancements aim to improve patient care, reduce treatment costs, and optimize individualized anemia management, particularly in renal care.

Emerging Erythropoiesis-Stimulating Agents & Biosimilars

New erythropoiesis-stimulating agents (ESAs) and biosimilars are improving anemia management in renal care by providing cost-effective alternatives to original ESAs. Darbepoetin alpha biosimilars, for example, are gaining approvals and being utilized for less frequent dosing, reducing the injection burden on hemodialysis patients.

Value-based contracts between payers and providers are facilitating biosimilar use in dialysis units, while updated guidelines encourage earlier anemia intervention. These changes help standardize care, improve access, and reduce therapy costs across nephrology practices.

Integration of Intravenous Iron Therapies and Personalized Regimens

The adoption of intravenous iron therapies, such as ferric carboxymaltose and iron sucrose, is growing in the treatment of dialysis-induced anemia. Protocols are becoming more personalized, with dosing adjusted based on patient response and hepcidin levels. Point-of-care monitoring systems for hemoglobin and iron levels are guiding real-time dosing to optimize treatment efficacy.

Personalized regimens are reducing the risk of iron overload and improving hemoglobin stability. This data-driven approach, implemented by dialysis clinics in collaboration with nephrologists, is enhancing patient outcomes and minimizing transfusion requirements.

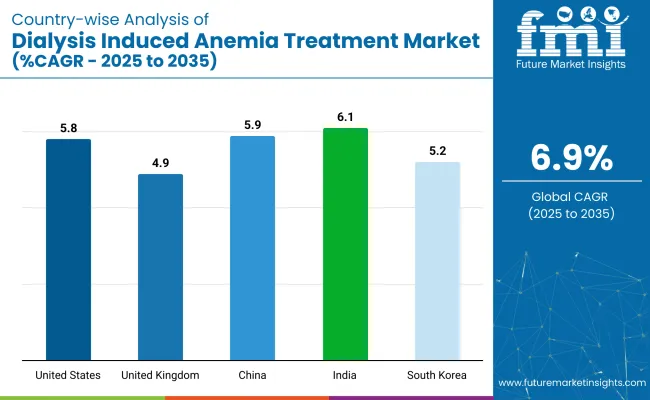

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| United Kingdom | 4.9% |

| China | 5.9% |

| India | 6.1% |

| South Korea | 5.2% |

The global industry is projected to grow at a CAGR of 6.9% from 2025 to 2035. The United States, with a CAGR of 5.8%, shows steady growth, driven by increasing awareness and advancements in anemia treatments related to dialysis, as well as a large patient population requiring ongoing dialysis care. The United Kingdom, at 4.9%, experiences more moderate growth, influenced by the country's well-established healthcare system and consistent demand for dialysis treatments.

China, with a CAGR of 5.9%, demonstrates solid growth, reflecting its expanding healthcare infrastructure and growing number of patients undergoing dialysis due to an increasing incidence of chronic kidney disease. India, at 6.1%, shows stronger growth, supported by rapid healthcare improvements, a rising patient base, and increased access to dialysis treatment.

South Korea, with a CAGR of 5.2%, experiences steady growth due to advancements in treatment protocols and a well-developed healthcare system. While OECD countries show steady growth, India stands out with its higher growth rate, highlighting the shift toward emerging economies as key players in the future expansion of the industry.

The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

The industry in the United States is set to record a CAGR of 5.8% through 2035. Medicare bundle payments have preserved coverage for erythropoiesis-stimulating agents (ESAs) and intravenous iron, encouraging guideline-aligned dosing. FDA Breakthrough and Fast-Track programmes have accelerated hypoxia-inducible-factor (HIF) stabiliser reviews, widening therapeutic choice.

Dialysis centers operated by DaVita and Fresenius have embedded point-of-care hemoglobin analytics and medication prompts, improving adherence. Integrated pharmacy networks have secured favorable purchase terms, keeping ESA supply stable despite input volatility. Continuous data feeds support anemia-management analytics.

Sales of dialysis-induced anemia therapies in the United Kingdom are projected to grow at a CAGR of 4.9% through 2035. NHS framework deals have locked ESA pricing, enabling predictable budgeting. NICE guidelines have standardized ferritin and transferrin saturation thresholds, facilitating algorithm-based dose titration across hospital and community units.

Real-world outcome registries under the UK Renal Registry feed dashboards visible to clinicians, fostering peer benchmarking. Biosimilar epoetin alfa and darbepoetin alfa have been embraced, releasing capacity for novel long-acting formulations. Community nurses have broadened home-dialysis coverage, enabling decentralized anemia-management visits.

Demand for dialysis-induced anemia therapies in China is estimated to grow at a CAGR of 5.9% through 2035.Centralized volume-based procurement has compressed ESA prices, expanding access in provincial hemodialysis centers. The Healthy China 2030 blueprint has mandated anemia screening within National Basic Public Health Services, boosting early identification of low hemoglobin.

Domestic biosimilar epoetin and darbepoetin have secured priority listing, while HIF prolyl-hydroxylase inhibitors are undergoing Phase-III bridging studies under NMPA fast review. Cloud-linked dialysis machines now upload real-time hemoglobin data to hospital exchanges, allowing automated dose suggestions that reduce workload and variability.

The industry in India is set to record a CAGR of 6.1% through 2035. The Pradhan Mantri National Dialysis Program has expanded hemodialysis capacity across district hospitals, embedding ESAs and intravenous iron within subsidized care bundles.

Local firms such as Bharat Serums and Biological E have ramped biosimilar ESA output under revised GMP norms, trimming import reliance. Ayushman Bharat insurance claims now capture hemoglobin metrics, linking reimbursement to guideline adherence. Telemedicine networks operated by nephrology specialists have guided dose optimization in peripheral centers, while blended AYUSH-allopathic protocols remain trialed under ethics oversight.

The industry in South Korea is set to record a CAGR of 5.2% through 2035. National Health Insurance coverage has ensured reimbursement for ESAs and intravenous iron across hemodialysis and peritoneal facilities. Smart nephrology platforms integrating wearable hemoglobin sensors stream real-time values to cloud dashboards, triggering automated dose recalculation within electronic prescribing software.

Domestic biologic producers and global innovators have collaborated on long-acting ESA formulations and combination anti-inflammatory products, proceeding under MFDS fast review. Hospital-biotech consortia are prototyping microneedle patches and drug-eluting implants that target erythropoietin release in outpatient settings.

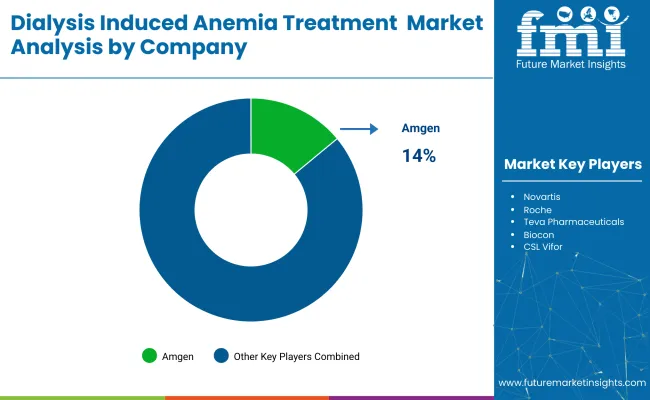

Leading Company - Amgen Industry Share - 14%

The industry is shaped by dominant players such as Amgen, Johnson & Johnson, Roche, and Novartis, who lead with patented biologics, advanced erythropoiesis-stimulating agents (ESAs), and global distribution networks. Key players including Teva, Biocon, CSL Vifor, and GSK focus on biosimilar ESAs, regional licensing agreements, and renal-specific commercialization strategies.

Emerging players like Akebia Therapeutics are driving innovation through novel oral HIF-PH inhibitors and strategic partnerships within the dialysis ecosystem. These companies are expanding patient access and treatment options, backed by clinical research, regulatory approvals, and industry-specific drug delivery technologies.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 2 billion |

| Projected Industry Size (2035) | USD 4 billion |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million patients treated for volume |

| Treatment Types Analyzed (Segment 1) | Erythropoiesis-Stimulating Agents, Iron Supplements, HIF-PH Inhibitors, Combination Therapies |

| Routes of Administration Analyzed (Segment 2) | Injectable, Oral |

| Sales Channels Analyzed (Segment 3) | Hospital Pharmacies, Dialysis Centers, Retail Pharmacy Chains, Mail Order Pharmacies |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Saudi Arabia, UAE, South Africa |

| Key Players influencing the Industry | Amgen, Johnson & Johnson, Novartis, Roche, Teva Pharmaceuticals, Biocon, CSL Vifor, Akebia Therapeutics, GSK Plc |

| Additional Attributes | Dollar sales, share by treatment class and route, ESA biosimilar uptake, impact of HIF-PH inhibitors in Asia and Europe, Medicare reimbursement impact, oral iron therapy adoption in outpatient dialysis |

By treatment, the industry is segmented into Erythropoiesis-stimulating Agents, Iron Supplements, HIF-PH Inhibitors, and Combination Therapies.

By route of Administration, the industry includes Injectable and Oral Formulations.

By sales channel, the industry comprises Hospital Pharmacies, Dialysis Centers, Retail Pharmacy Chains, and Mail Order Pharmacies.

By region, the industry is categorized into North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa.

The industry is valued at USD 2 billion in 2025.

It is projected to reach USD 4 billion by 2035.

The industry is anticipated to grow at a CAGR of 6.9% during this period.

Injectable lead the treatment segment with a 61.9% industry share.

Amgen is the leading player with a 14% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anemia Treatment Market Analysis - Growth & Forecast 2025 to 2035

Chemotherapy Induced Anemia Market Trends and Forecast 2025 to 2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Radiation-Induced Fibrosis Treatment Market - Growth & Forecast 2025 to 2035

Opioid-Induced Constipation (OIC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Myelosuppression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Heparin-Induced Thrombocytopenia (HIT) Treatment Market - Trends & Forecast 2025 to 2035

Radiotherapy-Induced Oral Mucositis Treatment Market Analysis – Growth & Forecast 2024-2034

Chemotherapy-Induced Myelosuppression Treatment Market Growth - Forecast 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Dialysis System Powder Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Dialysis Water Filters Market Size and Share Forecast Outlook 2025 to 2035

Dialysis Equipment Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Induced Pluripotent Stem Cells Production Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dialysis Equipment Market Insights - Growth & Forecast 2025 to 2035

Dialysis Device and Concentrates Market Growth - Trends & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA