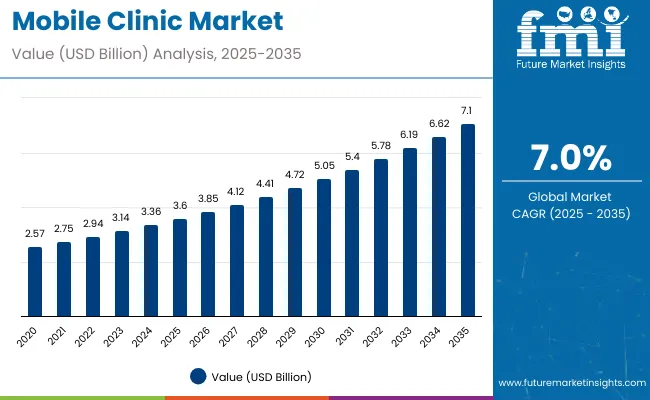

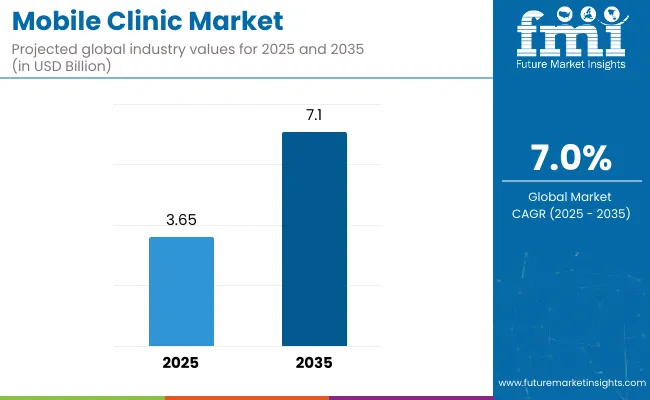

The mobile clinic market is estimated to be valued at USD 3.6 billion in 2025. It is projected to reach USD 7.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 3.5 billion over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 3.6 billion |

| Projected Value (2035F) | USD 7.1 billion |

| CAGR (2025 to 2035) | 7% |

This reflects a 1.97 times growth at a compound annual growth rate of 7%. The market's evolution is expected to be shaped by the rising demand for accessible healthcare services, technological advancements in telemedicine and mobile health apps, growing need for healthcare in underserved or remote locations, and increasing emphasis on preventive care, particularly where healthcare accessibility and community outreach are prioritized.

By 2030, the market is likely to reach USD 5.0 billion, accounting for USD 1.5 billion in incremental value over the first half of the decade. The remaining USD 2.0 billion is expected to be realized during the second half, suggesting a moderately accelerated growth pattern. Product innovation in telemedicine capabilities, remote monitoring devices, and mobile health applications are gaining traction.

Companies such as Matthews Specialty Vehicles, ADI Mobile Health, and Odulair LLC are advancing their competitive positions through investment in mobile clinic customization, technological integration, and global service expansion. Rising healthcare accessibility demands, rural healthcare needs, and improved mobile health technologies are supporting expansion into community healthcare, emergency services, and specialized medical applications. Market performance will remain anchored in healthcare delivery efficiency, patient accessibility, and service quality benchmarks.

The market holds a significant share across its parent markets. Within the global healthcare delivery market, it accounts for 8.5% due to its critical role in accessible healthcare provision. In the mobile healthcare segment, it commands a 35% share, supported by increasing demand for point-of-care services.

It contributes nearly 15% to the specialty vehicle market and 12% to the telemedicine sector. In emergency healthcare services, mobile clinics hold around 18% share, driven by disaster response and rural healthcare requirements. Across the preventive healthcare market, its share is close to 22%, owing to its position as a key component in community health initiatives.

The market is undergoing a strategic transformation driven by rising demand for accessible healthcare services, telemedicine integration, and the adoption of advanced mobile health technologies. Advanced mobile clinic technologies using telemedicine capabilities, remote monitoring devices, and electronic health record systems have enhanced healthcare delivery efficiency, patient accessibility, and service quality, making modern mobile clinics essential alternatives to traditional fixed healthcare facilities.

Manufacturers are introducing specialized designs, including maternal health clinics, dental care units, and diagnostic centers tailored for different community needs, expanding their role beyond basic healthcare delivery to comprehensive medical services. Strategic collaborations between mobile clinic operators and healthcare providers have accelerated innovation in community health applications and market penetration.

The mobile clinic market's steady growth is driven by increasing demand for accessible healthcare services, rising healthcare needs in underserved areas, and growing emphasis on preventive care, making them an essential solution for healthcare providers seeking to reach remote populations. The growing adoption of telemedicine technologies, improved mobile health applications, and expanding community health initiatives appeal to healthcare organizations and governments prioritizing healthcare accessibility and patient outreach.

A growing focus on healthcare equity, rural healthcare development, and emergency medical response is further propelling adoption, particularly in community health programs, disaster relief efforts, and specialized medical services. Rising healthcare costs, regulatory support for mobile health initiatives, and technological advancements in portable medical equipment are also enhancing service delivery and market penetration.

As telemedicine integration and IoT-enabled health monitoring accelerate across healthcare delivery systems, the market outlook remains favorable. With healthcare providers and governments prioritizing patient accessibility, cost-effective care delivery, and community health outcomes, mobile clinics are well-positioned to expand across various healthcare applications and geographic markets.

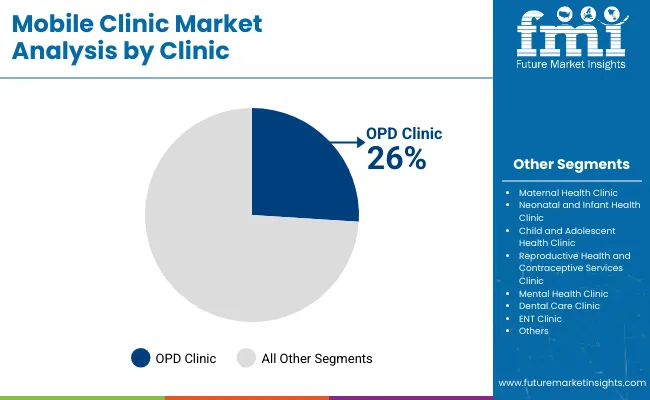

The market is segmented by clinic, design layout, vehicle, and region. By clinic, the market is divided into maternal health clinic, neonatal and infant health clinic, child and adolescent health clinic, reproductive health and contraceptive services clinic, mental health clinic, dental care clinic, ENT clinic, geriatric care clinic, OPD clinic, diagnostic/screening clinic, and emergency care clinic.

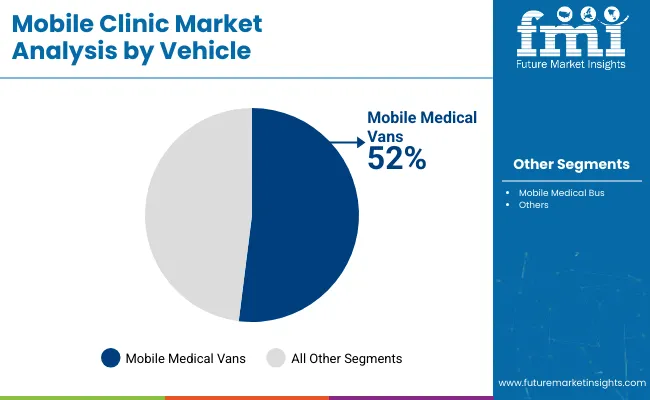

Based on design layout, the market is categorized into single exam rooms, double exam rooms, and triple exam rooms. In terms of vehicle, the market is bifurcated into mobile medical vans and mobile medical buses. Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The mobile medical vans segment is projected to hold a dominant position, accounting for 52% of the market share in the vehicle category, due to their convenience, affordability, and high-quality care benefits across various healthcare delivery applications. Mobile medical vans are widely used across community health programs, emergency services, and specialized care delivery due to their mobility advantages, cost-effectiveness, and ability to reach underserved populations in various geographic settings.

They enable healthcare providers and organizations to deliver optimal service while maintaining excellent patient accessibility and operational efficiency in both urban and rural healthcare settings. As demand for flexible, accessible healthcare solutions grows, the mobile medical vans segment continues to maintain preference in community health applications.

Manufacturers are investing in advanced van designs, improved medical equipment integration, and enhanced patient comfort features to maintain market leadership, broaden application scope, and improve service delivery capabilities. The segment is positioned to remain dominant as global healthcare markets prioritize accessible and cost-effective mobile solutions.

OPD (Outpatient Department) clinics are projected to remain the core clinic segment with 26% of the market share in 2025, as they represent the largest consumer of mobile clinic services across primary care, specialty consultations, and routine medical services. The segment's dominance is driven by increasing demand for outpatient services, growing emphasis on preventive care, and the need for accessible primary healthcare in both developed and developing regions.

OPD clinic applications also benefit from technological advancements in portable diagnostic equipment, telemedicine integration, and electronic health records, making mobile OPD units essential components in modern healthcare delivery systems. This makes OPD clinics indispensable in contemporary community health programs and rural healthcare initiatives.

Ongoing healthcare accessibility concerns and the growing emphasis on cost-effective primary care delivery are key trends driving the sustained relevance of OPD clinic applications in the mobile clinics market.

In 2024, global mobile clinic adoption grew by 8% year-on-year, with Asia-Pacific taking a 42% share. Applications include community healthcare, emergency services, and specialized medical care. Manufacturers are introducing telemedicine-enabled mobile units and smart healthcare integration that deliver superior accessibility profiles and service optimization. Electronic health record formulations now support IoT positioning.

Healthcare accessibility regulations and community health initiatives support healthcare providers’ confidence. Technology providers increasingly supply ready-to-deploy mobile clinic systems with integrated telemedicine capabilities to reduce deployment complexity.

Telemedicine Integration Accelerates Mobile Clinic Market Demand

Healthcare providers and community organizations are choosing telemedicine-enabled mobile clinic to achieve superior healthcare accessibility, enhance service delivery, and meet growing demands for connected, remote healthcare solutions. In field applications, mobile clinics with telemedicine capabilities deliver up to 40% improvement in patient reach compared to traditional fixed clinic.

Units equipped with telemedicine technology maintain continuous specialist consultation throughout varying patient loads and geographic challenges. In rural communities, integrated telemedicine systems help reduce healthcare gaps while maintaining care standards by up to 35%. Telemedicine applications are now being deployed for mental health and diagnostic segments, increasing adoption in sectors demanding specialized medical expertise. These advantages help explain why telemedicine-enabled mobile clinics adoption rates rose 20% in 2024 across underserved markets.

Regulatory Barriers and Infrastructure Challenges Limit Growth

Market expansion is constrained by complex regulatory requirements, licensing challenges, and infrastructure limitations. Mobile clinic operations face 40-60% more regulatory compliance costs compared to fixed facilities, depending on service complexity and geographic coverage requirements, impacting deployment in cost-sensitive applications. Licensing processes across different jurisdictions require system validation, adding 4-6 weeks to deployment timelines. Infrastructure limitations in rural areas, including inadequate transportation networks and unstable power supplies, extend operational costs by 25-35% compared to urban deployments.

Limited availability of qualified medical professionals for mobile clinic operations restricts scalable deployment, especially in remote areas. These constraints make mobile clinic expansion challenging in underserved markets despite growing healthcare accessibility needs and regulatory support.

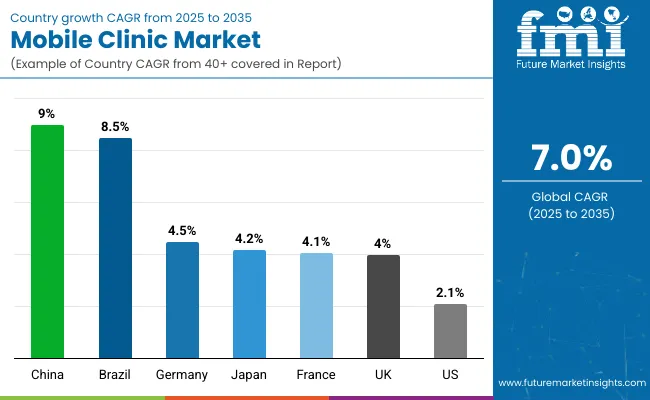

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.0% |

| Brazil | 8.5% |

| Germany | 4.5% |

| Japan | 4.2% |

| France | 4.1% |

| UK | 4.0% |

| USA | 2.1% |

In the mobile clinic market, China leads with the highest projected CAGR of 9.0% from 2025 to 2035, driven by government healthcare initiatives, rural access expansion, and massive healthcare infrastructure development. Brazil follows with a CAGR of 8.5%, supported by emerging market healthcare infrastructure development and community health programs.

Germany shows moderate growth at 4.5%, benefiting from established healthcare systems and regulatory support. Japan demonstrates steady growth at 4.2%, supported by aging population needs and healthcare accessibility initiatives. France and the UK show consistent growth at 4.1% and 4.0% respectively, driven by public health focus and NHS integration initiatives. The USA, with a CAGR of 2.1%, experiences slower growth due to market maturity and established healthcare infrastructure, reflecting regional differences in healthcare development and mobile clinic market maturity.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Demand for mobile clinics in Brazil is projected to expand at a CAGR of 8.5% from 2025 to 2035, driven by healthcare infrastructure development and the development of community health programs. Growth is concentrated in urban and rural markets, including São Paulo, Rio de Janeiro, and Brasília, where public health initiatives and healthcare accessibility requirements are expanding. Government health programs and rural healthcare development are gradually building comprehensive mobile healthcare system requirements.

Key Statistics:

Revenue from mobile clinics in Japan is projected to rise at a CAGR of 4.2% from 2025 to 2035, supported by aging population healthcare needs and established healthcare infrastructure modernization. Mobile healthcare systems in Tokyo, Osaka, and Nagoya are experiencing expansion in elderly care technologies, specialized medical applications, and rural healthcare delivery practices. Japanese healthcare standards and demographic changes are driving the adoption of advanced mobile clinic options to meet quality expectations for comprehensive geriatric care systems.

Key Statistics:

Sales of mobile clinics in France are expected to increase at a CAGR of 4.1% from 2025 to 2035, reflecting steady demand for public health programs and healthcare accessibility initiatives. Healthcare systems in Paris, Lyon, and Marseille are experiencing moderate expansion in mobile health technologies, community health applications, and preventive care practices. French healthcare policies and social medicine programs are incorporating mobile clinic solutions to meet accessibility standards for comprehensive population health systems.

Key Statistics:

The mobile clinics market in the UK is expected to grow at a CAGR of 4.0% from 2025 to 2035, reflecting steady healthcare accessibility expansion. Growth is driven by NHS integration initiatives and community health programs in the London, Manchester, and Edinburgh regions. Integrated mobile healthcare systems and public health standards are driving the expansion of technology adoption, while healthcare operators incorporate accessibility-focused protocols into comprehensive community health management programs. Brexit-related healthcare challenges and NHS efficiency requirements are influencing market dynamics.

Key Statistics:

Demand for mobile clinics in Germany is expected to increase at a CAGR of 4.5% from 2025 to 2035, exceeding the European average. Demand is driven by established healthcare infrastructure, comprehensive health insurance systems, and regulatory support for mobile healthcare in Berlin, Munich, and Hamburg markets. Evidence-based healthcare policies and specialized mobile health programs are increasingly adopting telemedicine technologies for optimal healthcare delivery.

Key Statistics:

Revenue from mobile clinics in China is projected to grow at a CAGR of 9.0% from 2025 to 2035, significantly exceeding the global average of 7%. Growth is fueled by government healthcare initiatives, rural access expansion, and increasing community health program development across major regions, including Beijing, Shanghai, and Guangzhou. Chinese healthcare markets are increasingly adopting advanced mobile clinic technologies as healthcare accessibility requirements become more stringent and telemedicine integration improves. The country is expected to account for 45% of the Asia-Pacific market share, driven by both domestic healthcare needs and mobile health technology advancement.

Key Statistics:

The mobile clinics market in the USA is anticipated to expand at a CAGR of 2.1% from 2025 to 2035, reflecting mature market dynamics with a focus on service optimization. Growth is centered on healthcare accessibility improvements and specialized care delivery in California, Texas, and Florida regions. Advanced telemedicine integration and smart healthcare technologies are being deployed for community health programs, rural healthcare, and emergency response systems. Healthcare regulations and accessibility standards support practical mobile clinic application development across diverse geographic areas.

Key Statistics:

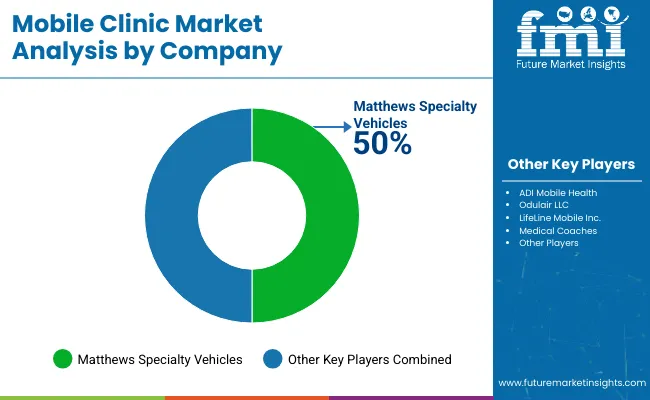

The market is moderately concentrated, featuring a mix of specialty vehicle manufacturers, healthcare equipment providers, and mobile health technology companies that vary in terms of technical expertise, manufacturing capabilities, and healthcare service proficiency. Matthews Specialty Vehicles leads the market with an estimated 50% share, primarily driven by its dominance in custom mobile health vehicle manufacturing and a comprehensive portfolio of healthcare solutions across multiple applications.

ADI Mobile Health maintains a significant market presence with its 40+ years of expertise in mobile health and dental clinics, leveraging established relationships with healthcare providers and a proven track record in custom mobile clinic development. Odulair LLC and LifeLine Mobile Inc. differentiate through specialized healthcare applications, advanced medical equipment integration, and comprehensive technical support that cater to various community health, emergency response, and specialized medical service requirements.

Regional specialists and emerging manufacturers focus on specific market segments, cost-effective solutions, and local healthcare development, addressing growing demand from developing markets, government health programs, and specialized healthcare applications.

Entry barriers remain moderate, driven by challenges in healthcare equipment integration, regulatory compliance, and technical expertise across multiple healthcare categories. Competitiveness increasingly depends on technological innovation, healthcare service capabilities, and market access for diverse community health and specialized medical environments.

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 3.6 Billion |

| Clinic Type | Maternal Health Clinic, Neonatal and Infant Health Clinic, Child and Adolescent Health Clinic, Reproductive Health and Contraceptive Services Clinic, Mental Health Clinic, Dental Care Clinic, ENT Clinic, Geriatric Care Clinic, OPD Clinic, Diagnostic/Screening Clinic, Emergency Care Clinic |

| Design Layout | Single Exam Room, Double Exam Room, Triple Exam Room |

| Vehicle Type | Mobile Medical Vans, Mobile Medical Bus, Mobile Medical Shipping Containers |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, India, and 40+ Countries |

| Key Companies Profiled | ADI Mobile Health, LifeLine Mobile Inc., Medical Coaches, Matthews Specialty Vehicles, Odulair LLC, Johnson Medical International Sdn Bhd, MinFound Medical Systems Co., Ltd, EMS Mobile Systems Inc., Farber Specialty Vehicles |

| Additional Attributes | Dollar sales by clinic type and vehicle configuration, regional healthcare accessibility trends, competitive landscape, healthcare provider preferences for mobile versus fixed facilities, integration with telemedicine platforms, innovations in portable medical equipment and healthcare delivery optimization for diverse community applications |

The global mobile clinic market is estimated to be valued at USD 3.6 billion in 2025.

The market size for mobile clinic is projected to reach USD 7.1 billion by 2035.

The mobile clinic market is expected to grow at a 7.0% CAGR between 2025 and 2035.

Mobile medical vans are projected to lead in the mobile clinic market with 52% market share in 2025.

In terms of clinic type, OPD clinic segment is projected to command 26% share in the mobile clinic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA