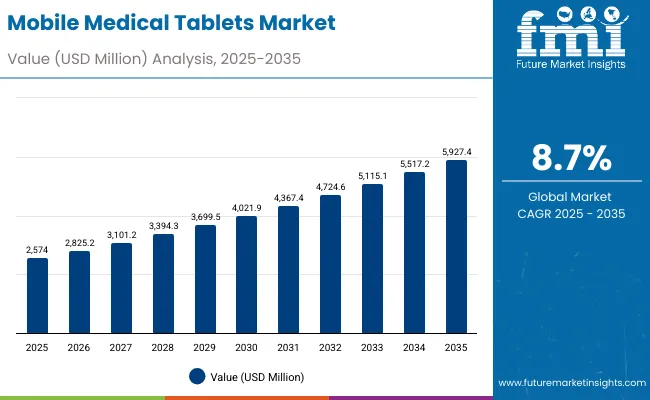

The Global Mobile Medical Tablets Market has been forecasted to attain a valuation of USD 2,574.0 million in 2025, rising to USD 5927.94 million by 2035, resulting in an incremental gain of USD 3,353.9 million, which reflects a 43.4% increase over the forecast decade. A compound annual growth rate (CAGR) of 8.7% is expected to be recorded, indicating a rapid expansion trajectory for the Global Mobile Medical Tablets Market.

Global Mobile Medical Tablets Market Key Takeaways

| Metric | Value |

|---|---|

| Global Mobile Medical Tablets Market Estimated Value in (2025E) | USD 2,574.0 million |

| Global Mobile Medical Tablets Market Forecast Value in (2035F) | USD 5,927.94 million |

| Forecast CAGR (2025 to 2035) | 8.7% |

Between 2025 and 2030, the Global Mobile Medical Tablets Market will gain broader adoption across hospitals, diagnostic centers, and telehealth providers, as clinicians and healthcare administrators increasingly rely on mobile point-of-care solutions to streamline workflows, improve patient monitoring, and support digital health integration.

It will grow up to USD 3,906.2 million in that period, from USD 2,574.0 million in 2025 to USD 3,906.2 million in 2030. The convergence of ruggedized hardware with user-friendly healthcare software platforms is making medical tablets more accessible, prompting growth even among mid-tier hospitals and community clinics.

Between 2030 and 2035, the market is projected to expand further by USD 2,021.7 million, driven by advances in AI-powered clinical applications, secure cloud integration, and compatibility with electronic health record (EHR) systems.

Rising demand from home-based healthcare, emergency response services, and digital therapeutics providers will drive the next phase of adoption. Continuous development in biometric authentication, 5G connectivity, and medical-grade data encryption will shape the next generation of mobile medical tablets.

From 2020 to 2024, the Global Mobile Medical Tablets Market expanded from USD 1,633.4 million to USD 2,386.1 million, maturing through broader availability of specialized healthcare devices and customized software ecosystems. During this phase, global equipment manufacturers partnered with healthcare institutions to optimize data capture, improve interoperability, and enhance infection-control designs laying the foundation for the broader use of medical tablets across hospitals, clinics, and remote care settings.

Going forward, the mobile medical tablet ecosystem will likely evolve to incorporate AI-driven diagnostic support, real-time patient monitoring dashboards, and hybrid integration with other medical devices such as portable ultrasound and wearable sensors. These innovations aim to reduce the burden on clinical staff, expand usability across specialties, and improve efficiency making mobile medical tablets a staple tool in modern healthcare delivery.

The growth of the Global Mobile Medical Tablets Market is reinforced by the unique ability of these devices to deliver real-time clinical data access, patient monitoring, and workflow management directly at the point of care. Unlike conventional desktop systems, medical tablets provide portability, ruggedized form factors, and specialized medical software integration making them indispensable for modern healthcare delivery.

Over the last decade, the scope of mobile medical tablets has expanded beyond basic electronic health record (EHR) access. They are now critical tools in diagnostics, telemedicine, and remote patient monitoring, enabling clinicians to access imaging results, lab data, and treatment protocols seamlessly during patient interactions. As digital transformation accelerates across hospitals, ambulatory centers, and home care, tablets are becoming mandatory platforms for enhancing efficiency, reducing documentation errors, and supporting virtual care models.

Another factor driving adoption is the shift from consumer-grade devices to purpose-built medical-grade tablets. Vendors now offer solutions that combine antimicrobial enclosures, biometric authentication, HIPAA-compliant software ecosystems, and long-battery operation designed for hospital use. This healthcare-specific design is transforming accessibility and reliability, particularly in regions expanding digital health infrastructure.

Moreover, increasing demand from interdisciplinary healthcare domains including emergency response, chronic disease management, and personalized medicine is fostering integration of tablets with AI-powered decision support, wearable sensors, and connected diagnostic tools. These systems cater to the growing need for secure, real-time, and mobile-enabled care delivery.

Collectively, these clinical and technological drivers are positioning the Global Mobile Medical Tablets Market for sustained expansion, fueled by its essential role in enabling connected, efficient, and patient-centric healthcare systems.

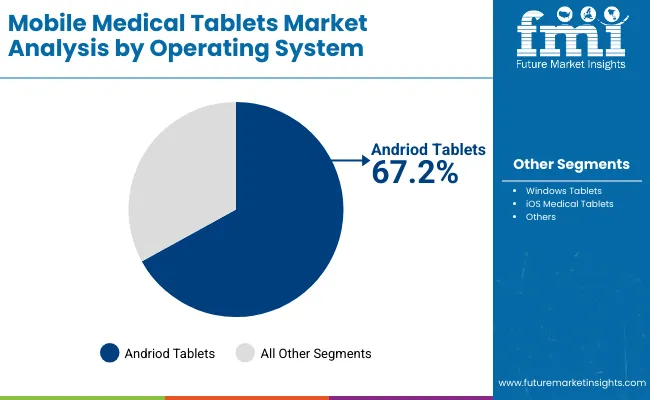

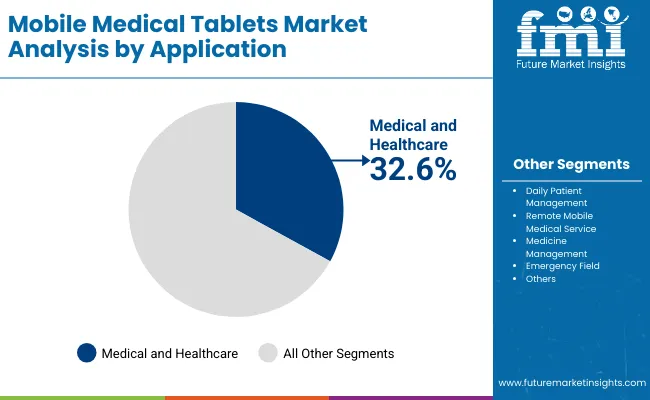

The Global Mobile Medical Tablets Market is segmented by operating system, application, end user, sales channel, and region. By operating system, the market is divided into Android Tablets, Windows Tablets, and iOS Medical Tablets. Application-based segmentation includes Medical and Healthcare, Daily Patient Management, Remote Mobile Medical Service, Medicine Management, Emergency Field, and Others.

Based on end user, the market is classified into Hospitals, Specialty Clinics, Diagnostic Centers, Nursing Homes & Assisted Living, and Home Healthcare Providers. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Product | Market Value Share, 2025 |

|---|---|

| Andriod Tablets | 67.2% |

| Windows Tablets | 27.6% |

| iOS Medical Tablets | 5.2% |

Android Tablets are projected to lead the operating system segment with a 67.2% market share in 2025, supported by their flexibility, cost-effectiveness, and broad OEM ecosystem. Unlike Windows-based devices, Android platforms offer greater compatibility with third-party healthcare applications, seamless integration with cloud-based EHR systems, and customizable security protocols features that have accelerated their deployment across hospitals, clinics, and remote care facilities.

Advances in ruggedized tablet design, antimicrobial coatings, and hot-swappable power modules have improved their clinical usability, while collaborations with healthcare software vendors ensure native support for telemedicine, bedside monitoring, and imaging applications. Their lower infrastructure requirements and affordability have also made them the preferred choice in emerging healthcare markets.

Windows Tablets maintain a solid presence where integration with enterprise workflows and legacy software is essential, while iOS Medical Tablets, despite their limited share, retain importance in premium health networks emphasizing device standardization and long-term OS support. As healthcare digitization expands globally, Android’s balance of scalability, accessibility, and application support positions it as the dominant operating system for mobile medical tablets.

| Technology Type | Market Value Share, 2025 |

|---|---|

| Medical and Healthcare | 32.6% |

| Daily Patient Management | 20.4% |

| Remote Mobile Medical Service | 18.1% |

| Medicine Management | 12.3% |

| Emergency Field | 10.9% |

| Others | 5.7% |

Medical and healthcare applications continue to dominate the global mobile medical tablets market, accounting for 32.6% of total demand in 2025. These devices have become indispensable across hospitals, clinics, and specialty centers, where they are widely used for patient record management, diagnostic imaging access, real-time clinical data sharing, and point-of-care decision support. Their integration into electronic health record (EHR) systems allows providers to streamline workflows and improve care coordination, reinforcing their leadership in the application landscape.

The central role of mobile tablets in healthcare lies in their adaptability, interoperability, and ease of use across a range of medical specialties. Physicians and nurses increasingly rely on tablets for bedside consultations, telemedicine sessions, and seamless communication with diagnostic systems, thereby improving treatment accuracy and patient outcomes. Their portability makes them particularly valuable in intensive care units and surgical environments, where access to patient data must be immediate and reliable.

Continuous improvements in battery performance, ruggedized designs, and data security protocols have further enhanced their utility in clinical settings. Hospitals worldwide are also prioritizing digital transformation initiatives, supported by government incentives and national health digitization programs, ensuring long-term adoption and investment in medical tablet solutions.

While other applications such as daily patient management, remote mobile medical services, and medicine tracking are expanding in niche and home-care contexts, medical and healthcare use remains the backbone of the market. Its broad adoption, proven reliability, and centrality to healthcare delivery ensure that it will remain the largest and most influential application segment.

The adoption of mobile medical tablets is rising rapidly as healthcare systems accelerate their digital transformation and embrace connected care models. These devices are becoming central to point-of-care delivery, telemedicine, and home health, offering clinicians real-time access to patient data and enabling faster, safer decision-making. While growth is strong, the market still faces limitations linked to cost, infrastructure, and regulatory compliance, which shape the pace of expansion across regions.

Growing Demand for Point-of-Care and Digital Health Solutions

Mobile medical tablets are gaining traction as healthcare providers push for faster, more accurate, and more connected patient care. Their ability to integrate directly with EHR systems, provide bedside access to lab reports and imaging, and support barcode-enabled medication administration is transforming clinical workflows.

Hospitals and clinics are adopting them to reduce errors, accelerate documentation, and replace paper-based systems with secure, real-time data entry. At the same time, tablets are increasingly embedded in telemedicine and remote monitoring setups, giving clinicians a portable and versatile platform for virtual consultations and chronic disease management. These factors are driving adoption across both developed and emerging healthcare ecosystems.

Barriers from Cost, Infrastructure, and Data Security

Despite strong momentum, adoption is tempered by structural constraints. Healthcare-grade tablets designed for rugged use, antimicrobial safety, and medical-grade compliance come at a significantly higher cost than consumer devices, limiting penetration in smaller clinics or resource-constrained settings.

Data protection and regulatory compliance remain critical hurdles, as tablets handle highly sensitive patient information and require robust cybersecurity frameworks. Infrastructure gaps also persist in developing regions where limited internet connectivity and weak IT integration hinder effective deployment. Without adequate networks and support systems, even advanced tablets risk being underutilized.

Shift Toward Specialized, Connected, and AI-Enabled Devices

The market is moving toward specialized and more intelligent solutions. Vendors are designing tablets tailored for nursing workflows, emergency care, radiology, and home healthcare, ensuring usability across diverse clinical environments. The integration of AI-powered decision support tools and advanced imaging capabilities is pushing their role beyond simple data access, making them diagnostic and predictive tools in their own right.

In parallel, their role within the Internet of Medical Things (IoMT) ecosystem is growing serving as central hubs that connect to wearables, diagnostic devices, and hospital systems. With the rise of home-based care and preventive healthcare models, mobile medical tablets are poised to extend far beyond hospital walls, shaping the next wave of digital health adoption.

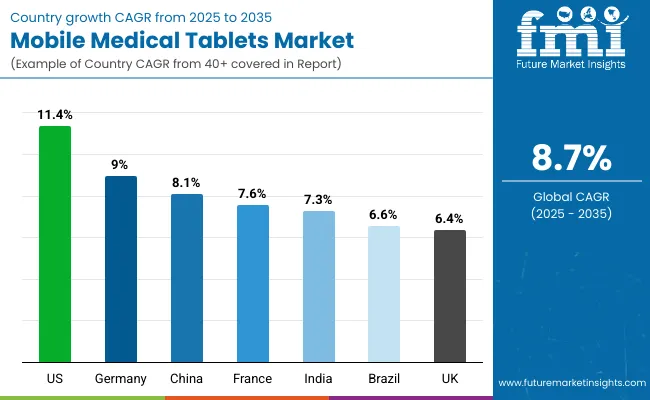

| Country | CAGR |

|---|---|

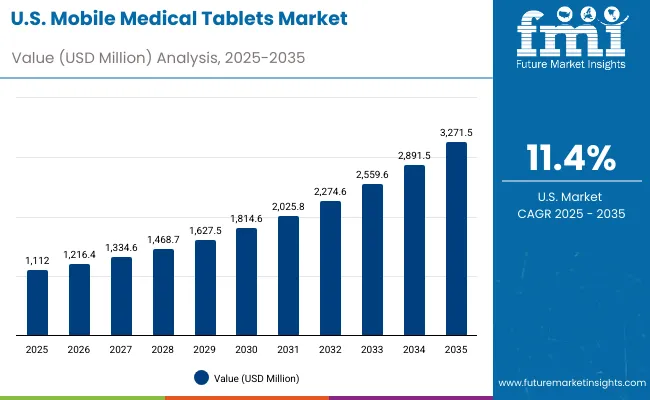

| USA | 11.4% |

| Brazil | 6.6% |

| China | 8.1% |

| India | 7.3% |

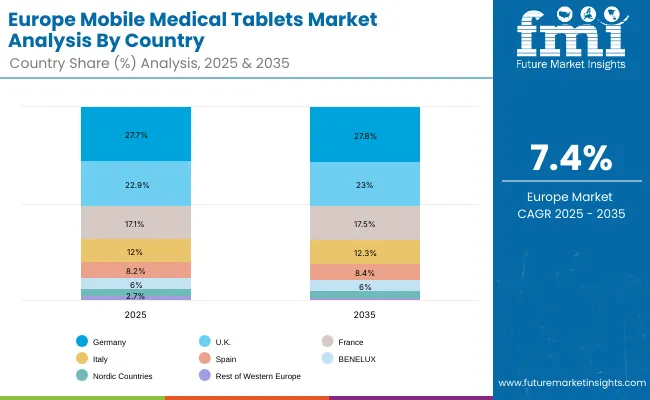

| Europe | 7.4% |

| Germany | 9.0% |

| France | 7.6% |

| UK | 6.4% |

The adoption and growth patterns of mobile medical tablets exhibit distinct variations across regions, influenced by healthcare infrastructure maturity, government digital health initiatives, and clinical adoption in hospitals and clinics.

In the United States, the mobile medical tablets market is characterized by strong growth driven by widespread hospital IT integration, extensive adoption of telemedicine platforms, and deployment of mobile point-of-care devices. The availability of advanced clinical IT infrastructure and hospital networks supports real-time patient monitoring and connected care workflows, resulting in widespread adoption.

The presence of government-backed digital health programs and continuous investment in hospital modernization further propels demand for mobile medical tablets, particularly in areas such as remote patient monitoring, inpatient care efficiency, and telehealth services. The market here is projected to grow at a CAGR of 11.4%.

In Europe, countries such as Germany, France, and the UK lead the mobile medical tablets market, with growing emphasis on integrating connected care devices within hospital IT infrastructure and national digital health initiatives.

Government-backed eHealth programs and large-scale hospital modernization projects have simplified technology adoption, enabling use of mobile point-of-care devices for inpatient monitoring, telehealth services, and workflow optimization.

Regulatory support for digital health standards and strategic funding foster sustained market growth, though adoption remains cautiously progressive as hospitals continue to evaluate device interoperability and clinical utility. The market in Germany is expected to expand at a CAGR of 8.4%, France at 7.1%, and the UK at 6.4%.

Overall, the global mobile medical tablets market reflects a strategic blend of healthcare infrastructure readiness, digital health policy alignment, and clinical adoption, which together govern the pace and scale of adoption across countries. This dynamic interplay underscores the central role that regional hospital IT capabilities, government programs, and clinical expertise play in shaping the trajectory of this specialized healthcare technology market.

The Global Mobile Medical Tablets Market in the United States is forecasted to grow at a CAGR of 11.4% between 2025 and 2035. The USA remains the most mature and technologically advanced market, driven by early adoption in hospitals, clinics, and home-care settings.

Leading healthcare systems such as Mayo Clinic, Cleveland Clinic, and Kaiser Permanente have integrated mobile medical tablets into patient monitoring, telehealth, and electronic health record workflows. The USA also hosts a strong ecosystem of medical device manufacturers and software developers, enabling continuous innovation in tablet functionality, connectivity, and cybersecurity.

The Global Mobile Medical Tablets Market in India is expected to expand at a CAGR of 7.3% between 2025 and 2035, fueled by rising demand for digital healthcare solutions and telemedicine adoption. Growth is concentrated in metropolitan areas, with hospitals and private clinics leading adoption, while rural penetration remains limited due to network constraints and affordability. Leading hospitals such as Apollo, Fortis, and AIIMS are piloting tablet-based patient monitoring and teleconsultation programs.

China’s Global Mobile Medical Tablets Market is projected to grow at a CAGR of 8.1% from 2025 to 2035. The market is expanding rapidly, driven by smart hospital initiatives, telemedicine programs, and domestic manufacturing capabilities.

Top hospitals in Beijing, Shanghai, and Shenzhen are implementing tablets for patient triage, electronic health record access, and remote monitoring. China also benefits from strong government support for healthcare digitization, particularly in urban centers and emerging smart hospital programs.

| Europe Country | 2025 |

|---|---|

| Germany | 27.7% |

| UK | 22.9% |

| France | 17.1% |

| Italy | 12.0% |

| Spain | 8.2% |

| BENELUX | 6.0% |

| Nordic Countries | 3.4% |

| Rest of Western Europe | 2.7% |

| Europe Country | 2035 |

|---|---|

| Germany | 27.8% |

| UK | 23.0% |

| France | 17.5% |

| Italy | 12.3% |

| Spain | 8.4% |

| BENELUX | 6.0% |

| Nordic Countries | 3.4% |

| Rest of Western Europe | 1.6% |

The Global Mobile Medical Tablets Market in the United Kingdom is projected to grow at a CAGR of 6.4% between 2025 and 2035. Growth is supported by strong adoption in hospitals, clinics, and telemedicine platforms, as well as government initiatives to digitize healthcare services.

Key academic and medical institutions, including the NHS Digital Innovation Hubs, University College London Hospitals, and King’s College Hospital, are integrating mobile medical tablets to streamline patient monitoring, electronic health record (EHR) access, and bedside diagnostics.

The Global Mobile Medical Tablets Market in Germany is anticipated to grow at a CAGR of 9.0% between 2025 and 2035. Germany is emerging as a key hub for mobile healthcare technology, particularly in hospital IT integration, outpatient care, and digital diagnostics.

While hospital adoption remains strong, significant growth is driven by collaborations between healthcare providers, medical device manufacturers, and software developers that enhance patient monitoring and clinical workflow efficiency.

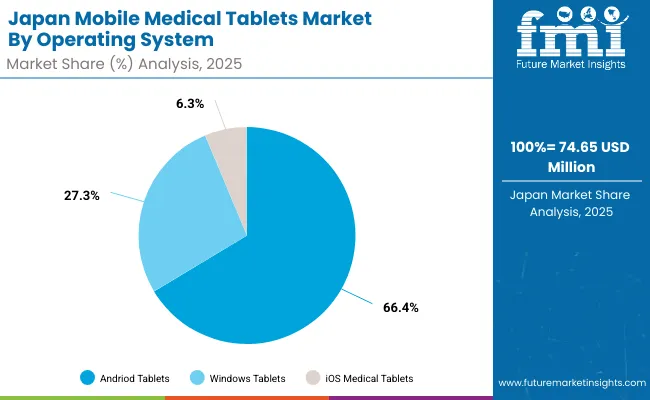

| Product | Market Value Share, 2025 |

|---|---|

| Andriod Tablets | 66.4% |

| Windows Tablets | 27.3% |

| iOS Medical Tablets | 6.3% |

The global mobile medical tablets market in Japan is projected to reach USD 74.65 million by 2025. Android tablets will dominate the product landscape with a 66.4% share, followed by Windows tablets at 27.3%, and iOS medical tablets at 6.3%.

The market is shaped by Japan’s advanced healthcare infrastructure, widespread adoption of digital health solutions, and the integration of mobile devices into clinical workflows. Leading hospitals and medical research institutions are increasingly using tablets for electronic health record (EHR) management, telemedicine, and real-time patient monitoring.

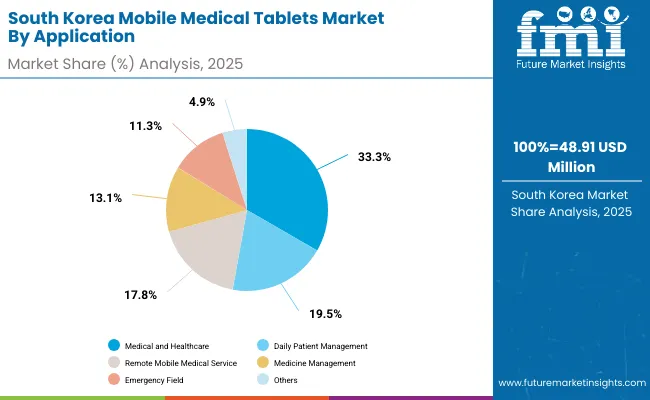

| Technology Type | Market Value Share, 2025 |

|---|---|

| Medical and Healthcare | 33.3% |

| Daily Patient Management | 19.5% |

| Remote Mobile Medical Service | 17.8% |

| Medicine Management | 13.1% |

| Emergency Field | 11.3% |

| Others | 4.9% |

The Global Mobile Medical Tablets Market in South Korea has been projected to reach USD 48.91 million in 2025. Medical and healthcare applications are expected to lead the technology landscape, followed by daily patient management and remote mobile medical services.

South Korea’s mobile medical tablets market is evolving from traditional hospital IT use toward telemedicine, remote patient monitoring, and industrial-grade healthcare applications. Leading institutions and hospitals, such as Seoul National University Hospital and Samsung Medical Center, are integrating tablets into electronic health record (EHR) management, real-time patient monitoring, and clinical workflow optimization.

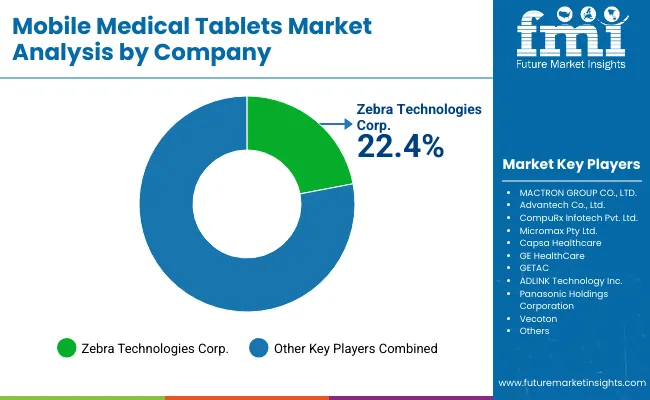

| Company | Global Value Share 2024 |

|---|---|

| Zebra Technologies Corp. | 22.4% |

| Others | 77.6% |

The global mobile medical tablets market is moderately concentrated, with Zebra Technologies Corp. holding a leading position with a 22.4% market share. The company’s strength lies in its integrated hardware-software solutions tailored for healthcare, enabling seamless patient data management, inventory tracking, and real-time monitoring across hospital workflows.

Zebra Technologies also provides specialized support for ruggedized tablets, remote device management, and healthcare-specific software applications, positioning it as a preferred vendor for clinical and hospital-grade deployments.

Other key players in the market, which collectively account for 77.6% of the market, include MACTRON GROUP CO., LTD., Advantech Co., Ltd., CompuRxInfotech Pvt. Ltd., Micromax Pty Ltd., Capsa Healthcare, GE HealthCare, GETAC, ADLINK Technology Inc., Panasonic Holdings Corporation, and Vecoton.

These companies address different segments of the mobile medical tablet ecosystem. Advantech and ADLINK focus on industrial-grade and hospital-ready tablets, GE HealthCare and Capsa Healthcare integrate tablets into broader medical device portfolios, while GETAC and Panasonic specialize in ruggedized solutions for field and emergency medical applications. Smaller players, including Micromax and CompuRxInfotech, target cost-sensitive or specialized healthcare deployments, providing flexible solutions for niche applications.

Key Developments in Global Mobile Medical Tablets Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2574.0 million |

| Operating Systems | Android Tablets, Windows Tablets, iOS Medical Tablets |

| Applications | Daily Patient Management, Remote Mobile Medical Services, Medicine Management, Emergency Field, Others |

| End User | Hospitals, Specialty Clinics, Diagnostic Centers, Nursing Homes & Assisted Living, Home Healthcare Providers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | Zebra Technologies Corp., MACTRON GROUP CO., LTD., Advantech Co., Ltd., CompuRx Infotech Pvt. Ltd., Micromax Pty Ltd., Capsa Healthcare, GE HealthCare, GETAC, ADLINK Technology Inc., Panasonic Holdings Corporation, Vecoton |

The global Global Mobile Medical Tablets Market is estimated to be valued at USD 2,574.0 million in 2025.

The market size for the Global Mobile Medical Tablets Market is projected to reach approximately USD 5,927.94 million by 2035.

The Global Mobile Medical Tablets Market is expected to grow at a CAGR of 8.7% between 2025 and 2035.

The Operating System formats in the Global Mobile Medical Tablets Market include Android Tablets, Windows Tablets, iOS Medical Tablets.

In terms of Application, Medical and Healthcare segment is projected to command the highest share at 32.6% in the Global Mobile Medical Tablets Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA