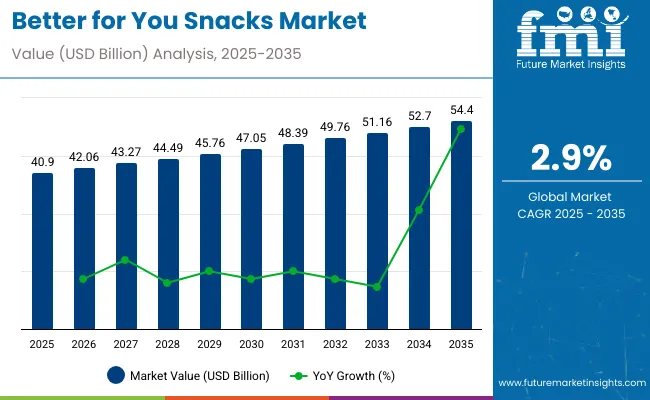

The global better for you snacks market is projected to grow from USD 40.9 billion in 2025 to approximately USD 54.4 billion by 2035, recording an absolute increase of USD 13.5 billion over the forecast period. This translates into a total growth of 33.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 2.9% between 2025 and 2035.

Better for You Snacks Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 40.9 billion |

| Forecast Value (2035) | USD 54.4 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

The overall market size is expected to grow by nearly 1.33X during the same period, supported by shifting consumer preferences toward healthier eating options and rising concerns over lifestyle-related diseases driving demand for low-calorie, high-protein, and functional snack alternatives.

Between 2025 and 2030, the better for you snacks market is projected to expand from USD 40.9 billion to USD 47.1 billion, resulting in a value increase of USD 6.2 billion, which represents 45.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising health consciousness among millennials and Gen Z consumers, increasing demand for clean-label and functional ingredients, and expanding availability of plant-based and protein-rich snack options. Food manufacturers are enhancing product formulations to meet evolving wellness expectations while maintaining taste and convenience attributes.

From 2030 to 2035, the market is forecast to grow from USD 47.1 billion to USD 54.4 billion, adding another USD 7.3 billion, which constitutes 54.1% of the overall ten-year expansion. This period is expected to be characterized by technological innovations in natural sweeteners and plant proteins, development of personalized nutrition solutions, and increasing adoption of sustainable packaging materials. The growing emphasis on functional ingredients including probiotics and adaptogens will drive demand for specialized manufacturing capabilities and advanced formulation expertise.

Between 2020 and 2025, the better for you snacks market experienced accelerated growth, catalyzed by the COVID-19 pandemic which jumpstarted consumer focus on wellness beyond physical health to include mental and social well-being. The market developed as consumers sought convenient products that align with their wellness and ethical values. Rising demand for organic, non-GMO, and gluten-free options contributed significantly to market expansion during this transformational period.

Market expansion is being supported by shifting consumer preferences toward healthier eating driven by rising concerns over lifestyle-related diseases and increasing demand for low-calorie, high-protein, gluten-free, and functional snack options.

Millennials and Gen Z consumers are particularly shaping this market, seeking convenient products that align with their wellness and ethical values while supporting holistic well-being beyond nutrition. The COVID-19 pandemic has served as a catalyst for transformation in how consumers think about wellness, extending snack consumption beyond fuel to integral components of wellness lifestyles.

The growing importance of transparency, sustainability, and ethical sourcing is driving manufacturers to incorporate eco-friendly packaging, clean ingredient lists, and sustainable supply chains to build consumer trust and brand loyalty.

Leading brands are channeling investments into research and development and strategic acquisitions to strengthen and diversify their better for you snack portfolios. Continuous innovation in areas such as natural sweeteners, plant proteins, and gut-health-focused ingredients enables brands to deliver authentic, functional value without compromising taste or consumer experience.

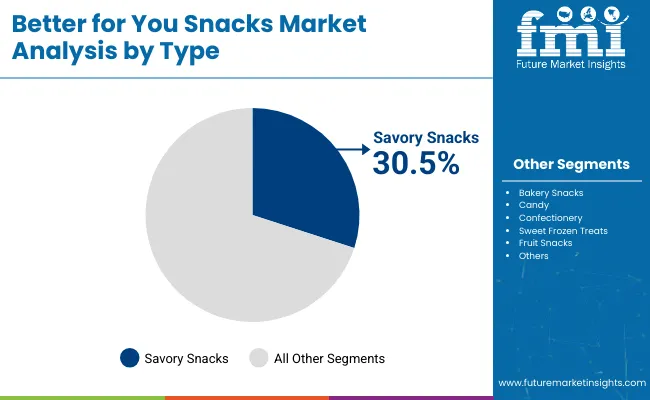

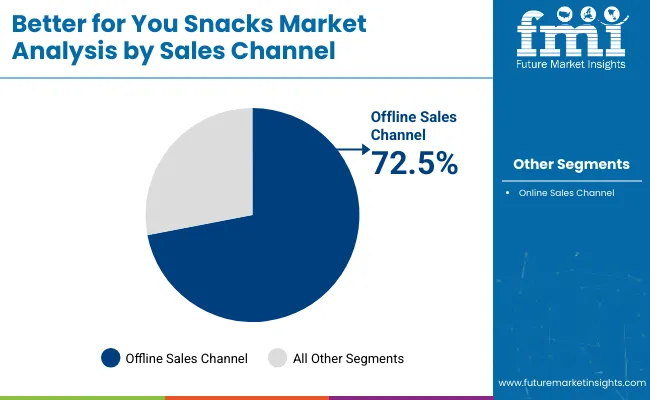

The market is segmented by type, sales channel, and region. By type, the market is divided into bakery snacks, candy, confectionery, sweet frozen treats, fruit snacks, and savory snacks. Based on sales channel, the market is categorized into offline sales channel including supermarkets/hypermarkets, departmental stores, convenience stores, and online sales channel including company websites and e-commerce platforms. Regionally, the market is divided into key countries including United States, United Kingdom, European Union, Japan, and South Korea.

Savory snacks are projected to account for 30.5% of the better for you snacks market in 2025. This leading share is supported by rising consumer demand for lower-fat, high-protein, and plant-based savory products that cater to wellness-focused consumers.

Brands such as PepsiCo's Off The Eaten Path and Nestlé's YES! are offering vegetable-based and legume-based snacks, while gluten-free and allergen-free offerings by brands like Simple Mills and RW Garcia have been adopted widely across the United States and Europe. The segment benefits from innovations in air-popped chips and roasted pulse snacks by companies such as HIPPEAS and Biena Snacks.

The dominance of savory snacks reflects growing consumer preference for nutritious alternatives that satisfy traditional snacking desires while providing functional benefits. Companies are developing chickpea-based and lentil-based products that cater to both nutritional and taste expectations, supported by retail penetration and clean eating marketing initiatives.

The rise of functional snacks infused with probiotics and adaptogens is shaping future trends, with brands like Purely Elizabeth and Buddha Bowl Foods introducing products offering digestive and immune system benefits. Innovation in plant-based formulations and protein-dense ingredients enables manufacturers to meet evolving consumer demands for healthier snacking options that maintain satisfying taste profiles and convenient consumption formats.

Offline sales channels are expected to represent 72.5% of better for you snacks distribution in 2025. This dominant share reflects the strength of robust distribution networks and the ability to deliver sensory product experiences that remain critical for snack categories. Supermarkets such as Walmart, Tesco, and Carrefour have dedicated significant shelf space to better for you snack offerings, while in-store promotions and sampling campaigns by companies such as General Mills and Mondelēz International have enhanced consumer engagement through direct product interaction.

The offline channel's market leadership demonstrates the continued importance of physical retail environments that enable impulse buying and tactile product evaluation. Health-focused retailers including Whole Foods Market and Sprouts Farmers Market have prioritized premium positioning for functional and organic snack options, while partnerships with gym chains and wellness studios provide new offline avenues for brands such as KIND Snacks and RXBAR.

As omnichannel retail strategies evolve, offline sales are expected to remain integral, complemented by experiential marketing, influencer-led in-store activations, and strategic placement of better for you snacks in checkout zones and wellness aisles that capture consumer attention at critical purchase moments.

The Better for You Snacks market is advancing steadily due to increasing health consciousness and rising demand for functional ingredients. However, the market faces challenges including high production costs related to premium ingredients, natural preservatives, and organic packaging, regulatory compliance requirements, and consumer perception challenges as many wellness-conscious consumers associate healthier snacks with bland tastes or elevated prices. Innovation in processing technologies and personalized nutrition platforms continue to influence market development patterns.

Development of Functional Ingredients and Personalized Nutrition

The growing focus on functional snacks fortified with protein, fiber, probiotics, and superfoods is enabling manufacturers to cater to specific dietary demands including keto, paleo, and gluten-free diets. Advances in AI-powered personalized nutrition platforms are allowing brands to offer tailored snack solutions based on individual health targets and dietary preferences. These functional formulations are particularly valuable for health-conscious consumers seeking convenient products that provide targeted nutritional benefits while supporting specific wellness goals and lifestyle requirements.

Integration of Sustainable Packaging and Clean-Label Solutions

Modern better for you snacks manufacturers are incorporating eco-friendly and sustainable packaging solutions that serve as major selling points for environmentally conscious consumers who prefer biodegradable, recyclable, and plastic-free wrapping. Development of clean ingredient lists and transparent production pathways addresses consumer demands for recognizable, natural ingredients. Advanced packaging technologies also support extended shelf life while maintaining product integrity and visual appeal that meets consumer expectations for premium healthy snacking experiences.

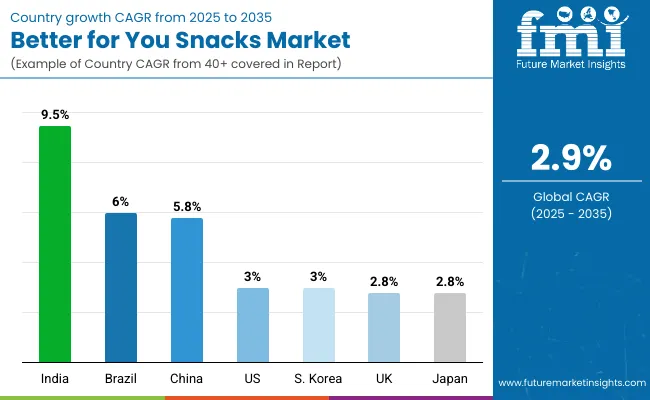

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.5% |

| Brazil | 6.0% |

| China | 5.8% |

| United States | 3.0% |

| South Korea | 3.0% |

| United Kingdom | 2.8% |

| Japan | 2.8% |

The better for you snacks market demonstrates varied growth rates across key countries from 2025 to 2035. India leads with the fastest CAGR of 9.5%, driven by urbanization, rising disposable incomes, and a strong vegetarian culture supporting plant-based, nutrient-rich formulations. Brazil follows with 6.0%, reflecting Latin America’s growing emphasis on natural, fruit, and nut-based snacks alongside strong agricultural resources. China records 5.8%, propelled by cultural alignment with traditional health foods, digital commerce expansion, and superfood trends.

The United States and South Korea both grow at 3.0%, supported by innovation in plant-based and functional snacks, coupled with expanding e-commerce and digital marketing strategies. Meanwhile, the United Kingdom and Japan each post steady growth of 2.8%, with the UK focusing on clean-label, gluten-free, and low-calorie options, while Japan emphasizes functional, probiotic-rich snacks aligned with health-conscious dietary practices and aging demographics. This diversity highlights both cultural preferences and regional innovation shaping growth trajectories.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Sales of better for you snacks in the United States is projected to exhibit strong growth at 3.0% CAGR through 2035, driven by consumers placing increasing importance on maintaining healthy eating habits and rising demand for organic, non-GMO, and protein-rich snacks.

American manufacturers are concentrating on plant-based, low-sugar, and functional ingredient-based products to satisfy health-conscious customers seeking convenient nutritional alternatives. The country's advanced food processing industry and innovation capabilities support development of specialized formulations that meet diverse dietary requirements and wellness trends.

The United States' emphasis on e-commerce expansion and direct-to-consumer sales channels enables comprehensive market development across diverse consumer segments. The growth of online retail platforms and digital marketing strategies create additional opportunities for niche brands to reach health-focused consumers seeking specialized better for you snacking options.

Sales of better for you in South Korea is expanding at 3.0% CAGR, supported by evolving awareness of nutritional benefits and growing influence of wellness trends among health-conscious consumers. South Korean consumers demonstrate increasing demand for nutritious snacking alternatives including vegetable-based, sugar-free, and antioxidant-rich products that align with modern lifestyle preferences. The rapid growth of health-oriented retail stores and e-commerce platforms additionally propels market penetration across urban consumer segments.

South Korea's technological advancement in food processing and customization capabilities enable development of tailored product offerings that meet specific consumer preferences. The rising utilization of digital media and social marketing strengthens consumer awareness and brand engagement in the competitive better for you snacks landscape.

Revenue from better for you snacks market in China is projected to grow at 5.8% CAGR, driven by consumers incorporating traditional Chinese medicine principles and health awareness into snacking choices. The market benefits from growing demand for nutrient-rich options including red dates, goji berries, nuts, and herbal-based snacks that align with cultural preferences for functional foods. China's expanding elderly population creates increased demand for bone-strengthening and brain-enhancing snacks that support specific health benefits across aging demographics.

China's advanced digital commerce infrastructure and social media influence significantly impact consumer purchasing decisions toward trendy yet healthy snacking alternatives. The country's sophisticated food production technology enables manufacturers to develop plant-based and superfood-dense products that meet evolving consumer expectations for convenient wellness-focused nutrition.

Demand for better for you snacks in India is projected to grow at 9.5% CAGR, representing the fastest growth rate in the Asia Pacific region as consumers increasingly adopt healthier lifestyle choices and seek nutritious alternatives to traditional snacking options. The expanding urban population and rising disposable incomes support growing demand for organic, low-calorie, and gluten-free selections that cater to health-conscious consumers mindful of dietary choices. India's strong vegetarian culture influences development of plant-based and protein-rich formulations that align with cultural preferences and wellness expectations.

India's evolving retail infrastructure and increasing penetration of organized retail channels enable broader accessibility of specialized better for you snack products across diverse consumer segments. The country's young demographic profile and growing influence of Western eating habits create sustained demand for convenient ready-to-eat healthy snacking options that support active lifestyles.

Revenue from better for you snacks in Brazil is expanding at 6.0% CAGR, supported by consumers increasingly prioritizing natural and organic ingredients in their snacking choices while seeking convenient nutritional alternatives. The growing emphasis on fruit, nuts, and seeds-based products reflects consumer preference for wholesome ingredients that provide sustained energy and nutritional benefits. Brazil's position as the fastest growing market in Latin America demonstrates strong consumer adoption of healthier snacking habits across diverse demographic segments.

Brazil's established food manufacturing capabilities and agricultural resources support development of locally-sourced better for you snack formulations that meet quality standards while maintaining cost competitiveness. The country's expanding middle class and urbanization trends create favorable conditions for premium positioning of health-focused snacks that deliver measurable wellness benefits.

Revenue from better for you in the United Kingdom is expanding at 2.8% CAGR, supported by consumers adopting clean labels and nutritious alternatives to traditional snacks that meet evolving health and wellness expectations. The rising availability of gluten-free, low-calorie, and fortified selections boosts consumer demand across diverse demographic segments. Guidelines promoting reduced sugar and salt intake in packaged foods inspire innovative solutions that maintain taste while meeting nutritional standards.

The United Kingdom's advanced retail infrastructure and consumer willingness to embrace premium health-focused products support market development through established distribution channels. The country's emphasis on ingredient transparency and ethical sourcing creates opportunities for brands that demonstrate authentic commitment to consumer wellness and environmental responsibility.

Demand for better for you snacks in Japan is projected to grow at 2.8% CAGR, supported by citizens prioritizing portion-controlled and nutrient-dense snacking options that align with traditional health-conscious dietary practices. The rising popularity of protein-rich, probiotic, and fiber-enriched snacks shapes market trends toward functional ingredients that support specific health benefits. With an aging society, demand increases for functional snacks supporting gut health, immunity, and general well-being across older consumer demographics.

Japan's sophisticated understanding of functional ingredients and emphasis on quality control enable development of specialized products that meet stringent consumer expectations. The country's traditional focus on health and longevity creates sustained demand for snacks that provide measurable wellness benefits while maintaining convenient consumption formats.

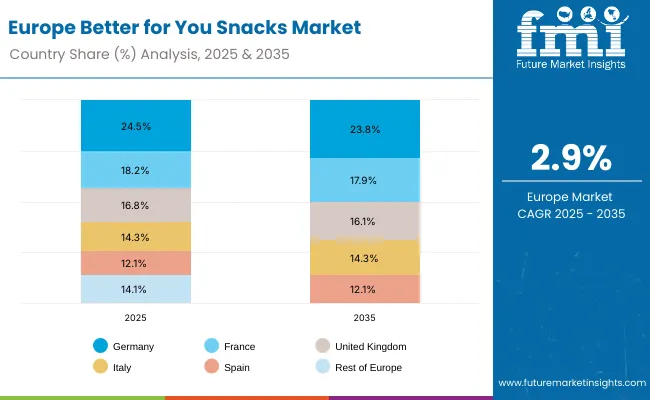

The better for you snacks market in Europe is projected to grow from approximately USD 9.8 billion in 2025 to about USD 12.9 billion by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to lead with a 24.5% share in 2025, declining slightly to 23.8% by 2035, thanks to its strong retail infrastructure and high per-capita health awareness.

France follows with an 18.2% share in 2025, progressing to 17.9% by 2035, driven by demand for clean-label and fortified snack options. The United Kingdom holds around 16.8% share in 2025, slipping to 16.1% by 2035, as consumer demand remains high but regulatory and pricing pressures intensify.

Italy has about 14.3%, while Spain accounts for roughly 12.1% in 2025. The Rest of Europe is expected to increase its collective share from 14.1% in 2025 to 15.4% by 2035, led by rising interest in plant-based snacks and greater retail access in Eastern and Nordic regions.

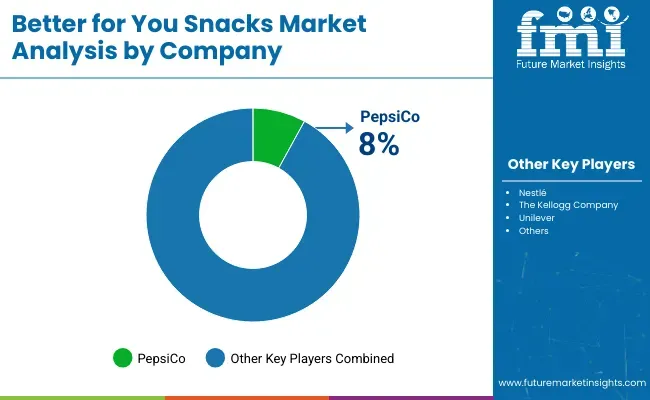

The better for you snacks market is characterized by competition among established food manufacturers, health-focused snack brands, and innovative startups focused on functional ingredients and sustainable production. Leading companies are investing in AI-guided product development, plant-based and protein-dense formulations, and sustainable packaging to enhance nutrition, taste, and convenience across diverse consumer segments. Nestlé, The Kellogg Company, Unilever, PepsiCo, and Mondelēz International represent major players leveraging scale advantages and established distribution networks.

Additional key companies including Hormel Foods Corporation, Dole Packaged Foods, Del Monte Foods, Select Harvests, and Monsoon Harvest contribute through specialized product portfolios and regional market expertise that serve evolving consumer preferences for healthier snacking alternatives.

“Better-for-you” snacks sit at the intersection of convenience, health, and sustainability - think high-protein bars, low-sugar crisps, fiber-rich bites, upcycled snacks, and plant-based jerky. Growth is driven by time-poor consumers who still want nutrition, retailers chasing healthier private labels, and foodservice operators seeking differentiated offerings. Whether this category becomes mainstream depends on how policy, industry institutions, equipment & food-tech providers, ingredient suppliers, and capital markets push product credibility, scale, and affordability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 54.4 Billion |

| Type | Bakery Snacks, Candy, Confectionery, Sweet Frozen Treats, Fruit Snacks, Savory Snacks |

| Sales Channel | Offline Sales Channel (Supermarkets/Hypermarkets, Departmental Stores, Convenience Store, Other Sales Channel), Online Sales Channel (Company Website, E-commerce Platform) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Companies Profiled | Nestlé, The Kellogg Company, Unilever, PepsiCo, Mondelēz International, Hormel Foods Corporation, Dole Packaged Foods LLC, Del Monte Foods Inc., Select Harvests, Monsoon Harvest |

| Additional Attributes | Dollar sales by category/channel, sugar reduction and clean-label trends, growth of plant-based/protein snacks, functional ingredients adoption, regional formulation innovation, e-commerce/DTC expansion, and sustainable packaging uptake |

The overall market size for better for you snack market was USD 40.9 Billion in 2025.

Better for you snack market is expected to reach USD 54.4 Billion in 2035.

The demand for Better-for-You Snacks is expected to rise due to increasing health-conscious consumer preferences, growing demand for clean-label and functional ingredients, and rising awareness of nutritional benefits. Additionally, innovations in plant-based, protein-rich, and low-calorie snack options are driving market growth.

The top 5 countries which drives the development of better for you snack market are USA, UK, Europe Union, Japan and South Korea.

Savory Snacks and Online Sales to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Forchlorfenuron Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortifying Agent Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Forensic Imaging Market Size and Share Forecast Outlook 2025 to 2035

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Forskolin Market Size and Share Forecast Outlook 2025 to 2035

Fortified Milk and Milk Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Form Fill Seal Equipment Market by Equipment Type from 2025 to 2035

Fortified Eggs Market Analysis - Size, Growth, and Forecast 2025 to 2035

Forklift Attachments Market Growth - Trends & Forecast 2025 to 2035

Global Forage Seeds Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA