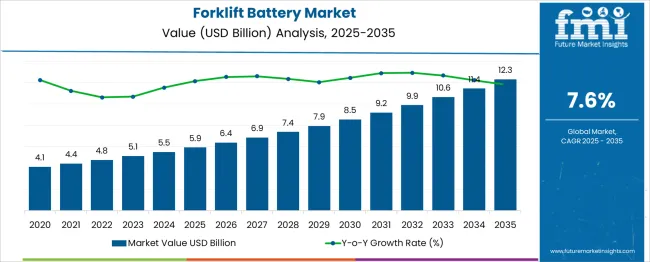

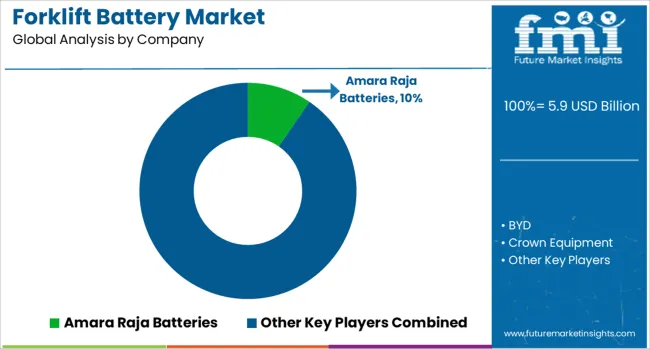

The Forklift Battery Market is estimated to be valued at USD 5.9 billion in 2025 and is projected to reach USD 12.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Forklift Battery Market Estimated Value in (2025 E) | USD 5.9 billion |

| Forklift Battery Market Forecast Value in (2035 F) | USD 12.3 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The forklift battery market is driven by the rising demand for efficient, low-emission material handling equipment across manufacturing, logistics, and warehousing operations. With global supply chains becoming more automated and productivity-focused, there is increasing emphasis on electric forklifts powered by reliable battery systems.

Regulatory pressure to reduce carbon footprints and lower workplace emissions is accelerating the shift from internal combustion forklifts to electric variants, thereby boosting battery adoption. Additionally, the growing adoption of e-commerce and expansion of distribution centers are pushing demand for high-performance, long-duration battery solutions.

The market is expected to see continued evolution with technological enhancements in battery design, improved charging infrastructure, and increasing interest in sustainable energy storage alternatives. Long-term growth is projected to be reinforced by government incentives, operational cost savings, and advancements in smart battery management systems.

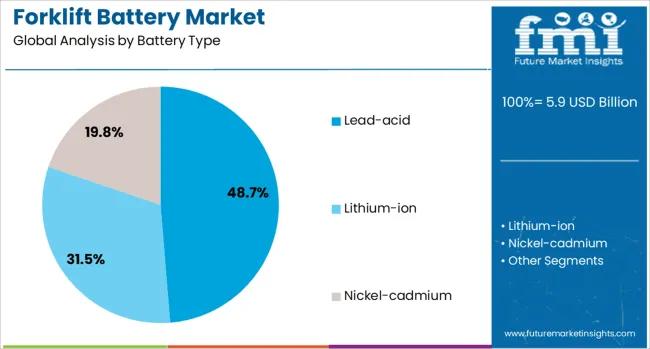

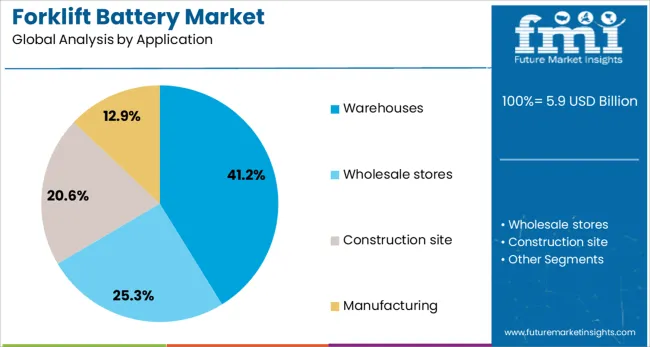

The forklift battery market is segmented by battery type and application, and geographic regions. The forklift battery market is divided by battery type into Lead-acid, Lithium-ion, and Nickel-cadmium. In terms of application, the forklift battery market is classified into Warehouses, Wholesale stores, Construction sites, and Manufacturing. Regionally, the forklift battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lead-acid battery segment holds a leading 48.7% share in the forklift battery market, supported by its cost-effectiveness, robustness, and proven track record in industrial applications. Despite the emergence of lithium-ion alternatives, lead-acid batteries remain a preferred choice among budget-conscious operators due to their lower upfront cost and ease of recycling.

Their durability in high-load, low-cycle environments makes them especially suitable for conventional warehouse and factory settings. Manufacturers continue to improve lead-acid technology with maintenance-free variants and enhanced safety features, sustaining their relevance in the modern industrial fleet.

Well-established service infrastructure and operator familiarity further strengthen the segment’s position. While future market dynamics may gradually tilt toward advanced chemistries, lead-acid batteries are expected to retain significant traction in cost-sensitive regions and among users prioritizing reliability and proven performance.

The warehouses segment leads the application category with a 41.2% market share, reflecting the growing importance of battery-powered forklifts in high-density storage and logistics operations. Increased adoption of electric forklifts in warehouses is driven by the need for cleaner, quieter, and more efficient operations, particularly in indoor environments where emissions and noise are tightly regulated.

The rise of global e-commerce and demand for faster order fulfillment has led to rapid warehouse expansion, boosting the need for dependable battery solutions. Forklift batteries used in warehouses must deliver long runtimes, quick charging capabilities, and minimal maintenance to support high-turnover inventory systems.

As companies increasingly focus on automation, energy efficiency, and operational uptime, the warehouse sector remains a critical driver of forklift battery demand. Continued investment in warehouse infrastructure and fleet electrification is expected to sustain this segment's leading position in the market.

The forklift battery market is driven by rising e-commerce and warehousing needs, pushing demand for high-efficiency, fast-charging lithium-ion solutions. Integration of battery management systems and OEM partnerships further supports adoption, while lead-acid remains in use for cost-sensitive applications.

The demand for forklift batteries has been influenced by the expansion of e-commerce and large-scale warehousing operations. Companies are moving toward electric forklifts due to lower operating costs and reduced maintenance needs compared to internal combustion models. High energy density and extended operating hours have become primary requirements, prompting manufacturers to focus on lithium-ion technology. Businesses have shown interest in fast-charging capabilities to minimize downtime during intensive material handling operations. Growing distribution networks and the surge in same-day delivery models have required fleets with enhanced efficiency and reliable power sources. This shift is expected to push stakeholders toward partnerships and long-term battery supply agreements to secure consistent availability of advanced energy solutions.

The market for forklift batteries is undergoing change with lithium-ion batteries gaining dominance due to superior energy efficiency and longer life cycles. Enhanced safety, minimal maintenance, and compatibility with automated guided vehicles have supported this adoption trend. Battery management systems are being integrated to monitor performance, optimize charging, and extend lifecycle value. Lead-acid batteries remain in use in cost-sensitive applications, but the shift toward advanced chemistries has accelerated, especially in logistics and manufacturing hubs. Companies are investing in modular battery designs that allow easy scalability across different forklift models. Partnerships between battery suppliers and OEMs have emerged as a strategic approach to ensure product compatibility and operational reliability across multiple industry verticals.

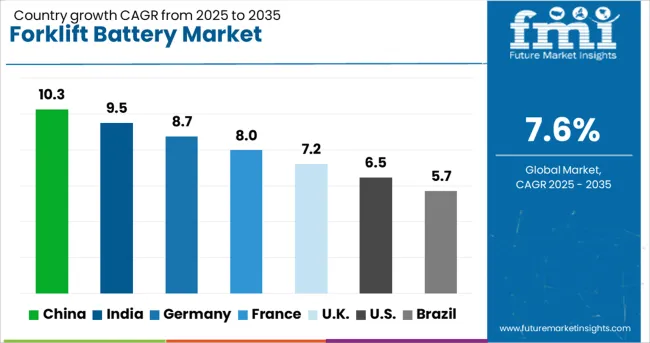

| Country | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

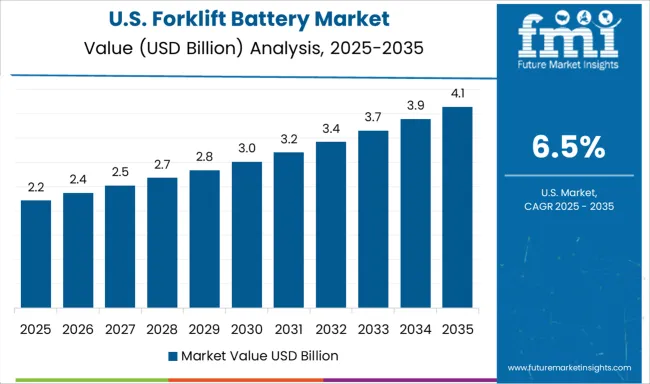

| USA | 6.5% |

| Brazil | 5.7% |

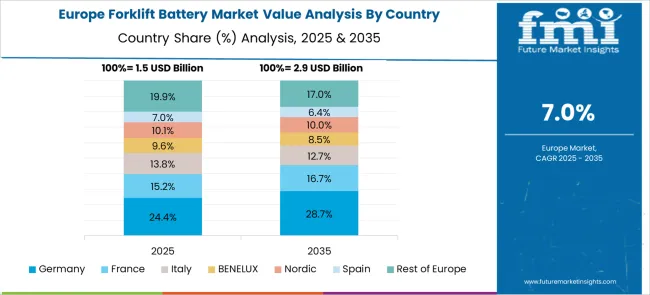

The forklift battery industry, expected to grow at a global CAGR of 7.6% from 2025 to 2035, shows strong performance across major economies. A 10.3% CAGR is being recorded in China, a BRICS member, supported by large-scale manufacturing and significant adoption of electric forklifts in industrial hubs. India, another BRICS member, is experiencing a 9.5% CAGR, driven by expansion in warehousing and logistics, supported by government-backed infrastructure initiatives. Germany, an OECD member, is posting an 8.7% CAGR due to high automation levels in material handling and rising demand for advanced energy storage systems. Moderate growth is being noted in the United Kingdom at 7.2%, attributed to the integration of electric fleets in warehousing and retail supply chains. The United States, also an OECD member, is showing a 6.5% CAGR as companies focus on fleet electrification and efficient charging systems. High-growth prospects continue to emerge in Asia-Pacific economies, while developed markets maintain steady adoption through operational efficiency strategies. The report offers insights into 40+ countries, with the top five profiled for reference.

China is projected to grow at a 10.3% CAGR, leading globally due to large-scale electric forklift adoption across industrial hubs and e-commerce-driven warehouses. Battery manufacturers focus on high-capacity lithium-ion solutions, replacing lead-acid systems for improved energy efficiency and rapid charging. Strong policy support under the Made in China 2025 initiative accelerates local production of advanced energy storage systems. Strategic partnerships between OEMs and battery firms ensure integrated solutions for logistics automation. Expansion in retail distribution and manufacturing clusters further strengthens demand for long-life batteries with smart energy monitoring systems. Export opportunities for cost-optimized lithium-ion packs also enhance China’s position in global supply chains.

India is forecast to grow at a 9.5% CAGR, driven by rising investments in warehousing, logistics, and industrial automation. Adoption of electric forklifts is expanding under government initiatives such as the National Logistics Policy and Make in India programs. Lithium-ion batteries are gaining preference for their fast charging and maintenance-free benefits, replacing conventional lead-acid systems in high-volume operations. Local manufacturers focus on affordable lithium-based solutions to meet cost-sensitive market needs, while global suppliers target premium applications in organized logistics sectors. Growth in cold-chain logistics and e-commerce fulfillment centers further accelerates demand for durable and energy-efficient forklift batteries.

Germany is expected to grow at an 8.7% CAGR, supported by high automation levels in warehouses and manufacturing facilities. Demand for advanced forklift batteries is driven by Industry 4.0 adoption and the push toward carbon-neutral logistics operations. Lithium-ion technology dominates due to its energy density and compatibility with fast-charging systems integrated into smart factories. German OEMs invest in modular battery systems with predictive maintenance features for operational continuity. Strategic collaborations between battery firms and logistics providers enhance the deployment of high-performance energy storage solutions across automotive, retail, and industrial supply chains.

The United Kingdom is projected to grow at a 7.2% CAGR, driven by electrification of material handling fleets in warehousing, retail, and logistics. Adoption of lithium-ion batteries accelerates due to their ability to reduce downtime and increase efficiency in high-throughput operations. E-commerce growth and distribution center modernization create opportunities for advanced battery technologies. Manufacturers emphasize development of quick-charging infrastructure to meet the operational requirements of multi-shift environments. Partnerships between logistics firms and energy solution providers promote integrated energy management platforms, ensuring efficient charging and monitoring.

The United States is expected to grow at a 6.5% CAGR, supported by fleet electrification trends in logistics and manufacturing sectors. Adoption of lithium-ion technology is driven by lower total cost of ownership and sustainability objectives under corporate ESG frameworks. Leading companies implement battery swapping and fast-charging systems to reduce downtime in 24/7 operations. Integration of telematics for energy usage optimization strengthens demand for smart battery systems. Partnerships between OEMs and energy solution providers enhance access to turnkey battery-as-a-service models, reducing upfront costs for enterprises.

In the forklift battery industry, top players are strengthening their positions through technology upgrades, strategic alliances, and capacity expansions. Companies like EnerSys, Exide Technologies, and Amara Raja Batteries are investing in lithium-ion and advanced lead-acid solutions to meet operational efficiency requirements across industrial and warehousing sectors. These brands focus on improving charge cycles, durability, and compatibility with automated material-handling systems. BYD and Toyota Industries Corporation have accelerated in-house battery innovations, offering integrated solutions for electric forklift fleets to cater to high-performance logistics environments. Emerging companies such as Flux Power Holdings, OneCharge, and Electrovaya are targeting niche markets by providing fast-charging lithium-ion battery systems and IoT-enabled energy monitoring solutions. European players like Hoppecke Batteries, HAWKER, and Midac Batteries maintain strong distribution networks, ensuring high penetration in manufacturing hubs. Suppliers such as Crown Equipment, GB Industrial Battery, and Godrej Enterprises Group complement OEM strategies with modular battery packs and aftermarket support to meet varied customer needs globally.

In July 2025, Electrovaya launches multiple battery system products for robotic vehicles; an additional USD 4.5 Million order was received, raising the total to over USD 20 Million in fiscal 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.9 Billion |

| Battery Type | Lead-acid, Lithium-ion, and Nickel-cadmium |

| Application | Warehouses, Wholesale stores, Construction site, and Manufacturing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amara Raja Batteries, BYD, Crown Equipment, East Penn Manufacturing, Electrovaya, EnerSys, Exide Technologies, Flux Power Holdings, GB Industrial Battery, Godrej Enterprises Group, HAWKER, Hoppecke Batteries, Midac Batteries, OneCharge, Toyota Industries Corporation, and Trojan Battery |

| Additional Attributes | Dollar sales by region, share by battery chemistry (lithium-ion, lead-acid), competitive landscape, pricing trends, regulatory compliance impact, OEM partnerships, demand from e-commerce and warehousing sectors, adoption in automation, and aftermarket service opportunities. |

The global forklift battery market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the forklift battery market is projected to reach USD 12.3 billion by 2035.

The forklift battery market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in forklift battery market are lead-acid, lithium-ion and nickel-cadmium.

In terms of application, warehouses segment to command 41.2% share in the forklift battery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Forklift Attachments Market Growth - Trends & Forecast 2025 to 2035

Forklift-Mounted Computers Market

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Cherry Picker Forklift Market Growth - Trends & Forecast 2025 to 2035

3-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA