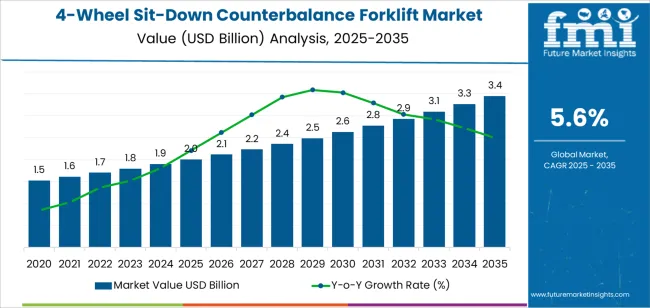

The global 4-wheel sit-down counterbalance forklift market is valued at USD 2.0 billion in 2025. It is slated to reach USD 3.4 billion by 2035, recording an absolute increase of USD 1.5 billion over the forecast period. This translates into a total growth of 72.5%, with the market forecast to expand at a compound annual growth rate of 5.6% between 2025 and 2035. The market size is expected to grow by nearly 1.7 times during the same period, supported by expanding warehouse automation, growth in logistics infrastructure, and increasing adoption of electric and lithium-powered forklifts across manufacturing, distribution centers, and port terminals.

Between 2025 and 2030, the market is projected to expand from USD 2.0 billion to USD 2.6 billion, resulting in a value increase of USD 0.6 billion, which represents 43.2% of the total forecast growth for the decade. This phase of development will be shaped by expanding e-commerce fulfillment operations, rising warehouse capacity additions in emerging markets, and growing preference for electric-powered material handling equipment driven by environmental regulations and operational cost considerations. Manufacturing facilities and logistics operators are expanding their forklift fleets to address growing material handling requirements while transitioning toward cleaner and more efficient power technologies.

From 2030 to 2035, the market is forecast to grow from USD 2.6 billion to USD 3.4 billion, adding another USD 0.8 billion, which constitutes 56.8% of the overall ten-year expansion. This period is expected to be characterized by accelerated adoption of lithium-ion battery technology, integration of telematics and fleet management systems, and expansion of automated guided vehicle capabilities in industrial warehousing operations. The growing focus on operational efficiency, reduced downtime, and lower total cost of ownership will drive demand for advanced 4-wheel sit-down counterbalance forklifts with enhanced performance characteristics and connectivity features.

Between 2020 and 2025, the market experienced steady growth, driven by recovery in manufacturing activity, expansion of distribution networks, and growing recognition of counterbalance forklifts as versatile material handling solutions for diverse load handling applications. The market developed as warehouse managers and logistics professionals recognized the operational advantages of 4-wheel configurations for stability, load capacity, and operator comfort in intensive material handling environments. Technological advancement in battery systems and ergonomic design began focusing the importance of operator safety, energy efficiency, and equipment reliability in demanding warehouse and manufacturing operations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.0 billion |

| Forecast Value in (2035F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

Market expansion is being supported by the increasing global demand for efficient material handling solutions driven by e-commerce growth and expanding warehouse infrastructure, alongside the corresponding need for reliable load handling equipment that can improve operational productivity, ensure worker safety, and maintain performance in demanding indoor and outdoor applications. Modern warehouse operators and manufacturing facilities are increasingly focused on implementing forklift solutions that can handle heavy loads, provide operator comfort, and deliver consistent performance across extended operating shifts.

The growing focus on sustainability and operational efficiency is driving demand for electric and lithium-powered forklifts that can reduce energy costs, minimize emissions, and ensure comprehensive environmental compliance. Facility managers' preference for equipment that combines load capacity with maneuverability and processing efficiency is creating opportunities for advanced 4-wheel counterbalance configurations. The rising influence of automation technology and connected fleet management is also contributing to increased adoption of forklifts that can provide operational data and support predictive maintenance without compromising performance or safety standards.

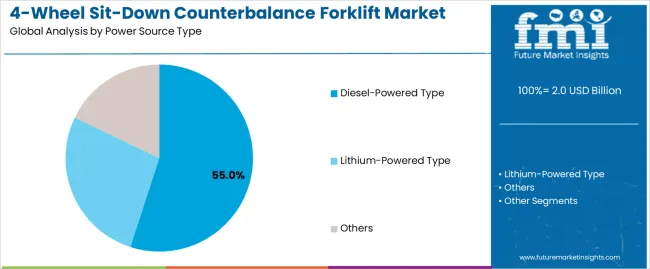

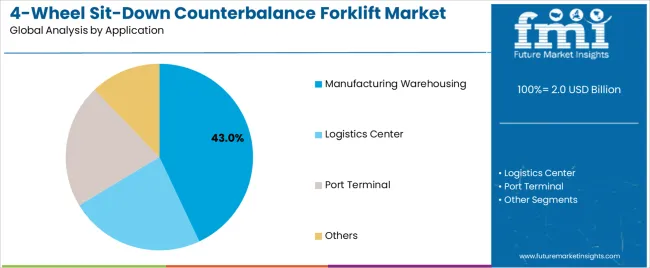

The market is segmented by power source type, application, and region. By power source type, the market is divided into diesel-powered type, lithium-powered type, and others. Based on application, the market is categorized into manufacturing warehousing, logistics center, port terminal, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The diesel-powered type segment is projected to maintain its leading position in the market with 55.0% market share in 2025, reaffirming its role as the preferred power source for outdoor applications and heavy-duty material handling operations. Warehouse operators and industrial facilities utilize diesel-powered forklifts for their superior power output, extended operating ranges, and proven effectiveness in handling heavy loads across construction sites, lumber yards, and port terminals. Diesel technology's proven reliability and refueling convenience directly address industry requirements for continuous operation and minimal downtime across diverse operating environments and weather conditions.

This power source segment forms the foundation of outdoor material handling operations, as it represents the equipment type with the greatest load capacity and established performance record across multiple industrial applications and challenging operating conditions. Industrial sector investments in heavy-duty material handling continue to strengthen adoption among facility operators and logistics providers. With operational requirements demanding extended run times and high load capacities, diesel-powered forklifts align with both productivity objectives and application demands, making them the central component of comprehensive outdoor material handling strategies.

The manufacturing warehousing application segment is projected to represent the 43.0% market share of 4-wheel sit-down counterbalance forklift demand in 2025, highlighting its role as the primary driver for forklift adoption across production facilities, assembly plants, and manufacturing distribution centers. Manufacturing operators prefer 4-wheel sit-down counterbalance forklifts for material movement due to their load stability, operator visibility, and ability to handle diverse materials while supporting production flow and inventory management. Positioned as essential equipment for modern manufacturing operations, these forklifts offer both operational efficiency and safety benefits.

The segment is supported by continuous expansion in manufacturing capacity and the growing availability of advanced forklift features that enable improved material flow with enhanced productivity and reduced operational disruptions. Manufacturing facilities are investing in comprehensive fleet modernization programs to support increasingly demanding production schedules and material handling complexity. As industrial automation advances and manufacturing output increases, the manufacturing warehousing application will continue to dominate the market while supporting advanced equipment utilization and operational optimization strategies.

The 4-wheel sit-down counterbalance forklift market is advancing due to increasing demand for efficient material handling solutions driven by e-commerce expansion and growing adoption of warehouse automation technologies providing enhanced operational capabilities and productivity benefits across diverse manufacturing, logistics, and distribution applications. The market faces challenges, including high initial equipment costs and maintenance requirements, competition from alternative forklift configurations and automated guided vehicles, and operational constraints related to operator training and facility infrastructure limitations. Innovation in battery technology and fleet management systems continues to influence product development and market expansion patterns.

The growing expansion of e-commerce fulfillment operations is driving demand for versatile material handling equipment that addresses warehouse throughput requirements including rapid load movement, consistent operational availability, and flexible handling capabilities for diverse product categories. Distribution center operators require reliable forklift solutions that deliver stable performance across extended operating hours while maintaining safety standards and cost-effectiveness. Logistics providers are increasingly recognizing the operational advantages of 4-wheel counterbalance configurations for e-commerce warehouse applications and facility scalability, creating opportunities for equipment specifically designed for high-volume distribution environments.

Modern forklift manufacturers are incorporating lithium-ion battery systems to enhance operational efficiency, reduce charging time, and support comprehensive productivity objectives through optimized power delivery and extended battery life. Leading companies are developing fast-charging battery solutions, implementing opportunity charging protocols, and advancing power management technologies that minimize energy consumption and operational costs. These technologies improve equipment utilization while enabling operational flexibility, including opportunity charging during breaks, elimination of battery change rooms, and reduced maintenance requirements. Advanced battery integration also allows operators to support comprehensive fleet efficiency objectives and operational optimization beyond traditional lead-acid limitations.

The expansion of telematics technology and connected equipment capabilities is driving adoption of fleet management systems with real-time operational monitoring and data analytics for maintenance planning and operator performance optimization. These advanced systems require forklift configurations with integrated sensor networks and communication capabilities that enable predictive maintenance and operational insights, creating specialized market segments with enhanced service propositions. Manufacturers are investing in connectivity platforms and analytics capabilities to serve emerging smart warehouse applications while supporting innovation in material handling automation and operational intelligence.

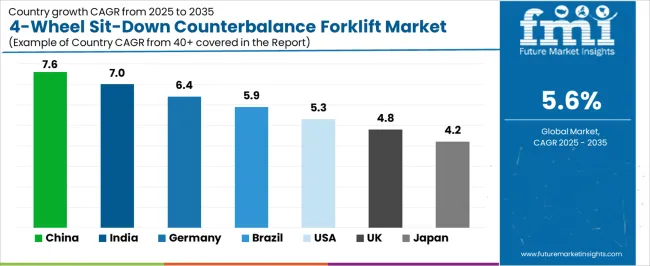

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| Brazil | 5.9% |

| United States | 5.3% |

| United Kingdom | 4.8% |

| Japan | 4.2% |

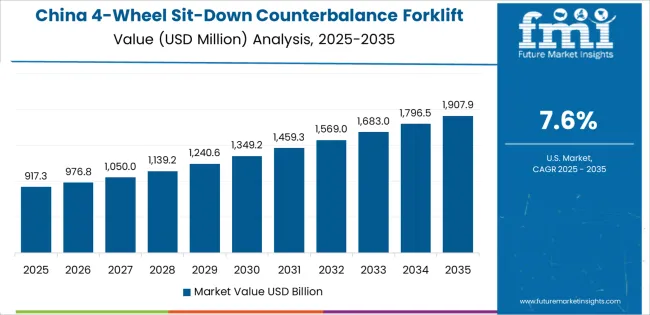

The market is experiencing solid growth globally, with China leading at a 7.6% CAGR through 2035, driven by massive manufacturing expansion, logistics infrastructure development, and increasing warehouse automation adoption. India follows at 7.0%, supported by expanding industrial capacity, growing e-commerce fulfillment operations, and government initiatives promoting domestic manufacturing. Germany shows growth at 6.4%, focusing advanced material handling technology, automotive sector demand, and precision engineering applications.

Brazil demonstrates 5.9% growth, supported by agricultural product handling, expanding logistics networks, and industrial sector recovery. The United States records 5.3%, focusing on warehouse modernization, e-commerce distribution expansion, and fleet replacement programs. The United Kingdom exhibits 4.8% growth, focusing logistics sector investments and post-Brexit supply chain adjustments. Japan shows 4.2% growth, focusing quality manufacturing applications and advanced forklift technology adoption.

The report covers an in-depth analysis of 40 countries, top-performing countries are highlighted below.

China is projected to exhibit exceptional growth with a CAGR of 7.6% through 2035, driven by expanding manufacturing capacity and rapidly growing logistics infrastructure supported by government initiatives promoting industrial modernization and supply chain development. The country's massive industrial sector expansion and increasing investment in warehouse automation technologies are creating substantial demand for material handling equipment. Major forklift manufacturers and international equipment suppliers are establishing comprehensive production and distribution capabilities to serve both domestic markets and export opportunities.

India is expanding at a CAGR of 7.0%, supported by expanding manufacturing sector, growing warehouse infrastructure, and increasing adoption of modern material handling equipment driven by Make in India initiatives and logistics sector modernization. The country's industrial capacity expansion and infrastructure investments are driving demand for reliable forklift solutions throughout diverse manufacturing and distribution applications. Leading equipment manufacturers and local suppliers are establishing production facilities and service networks to address growing domestic demand.

Germany is expanding at a CAGR of 6.4%, supported by the country's advanced manufacturing sector, automotive industry strength, and focus on precision material handling equipment for high-performance applications. Germany's engineering excellence and industrial sophistication are driving demand for advanced forklift technologies throughout manufacturing and logistics sectors. Leading equipment manufacturers and technology providers are investing in next-generation forklift development and automation integration.

Brazil is growing at a CAGR of 5.9%, driven by agricultural product handling requirements, expanding industrial capacity, and growing logistics infrastructure supporting domestic manufacturing and export operations. Brazil's diverse industrial base and agricultural sector strength are supporting investment in material handling equipment. Equipment suppliers and local manufacturers are establishing service capabilities for agricultural and industrial applications.

The United States is expanding at a CAGR of 5.3%, supported by warehouse modernization programs, e-commerce fulfillment expansion, and ongoing fleet replacement driven by aging equipment and advancing technology standards. The nation's established logistics infrastructure and distribution network are driving demand for advanced forklift solutions. Equipment manufacturers and dealers are investing in service capabilities and technology offerings to serve diverse customer requirements.

The United Kingdom is expanding at a CAGR of 4.8%, supported by logistics sector investments, warehouse infrastructure development, and ongoing supply chain adjustments following Brexit transition. The country's logistics sector strength and distribution network complexity are driving demand for reliable material handling equipment. Equipment suppliers are adapting service offerings to support evolving customer requirements.

Japan is expanding at a CAGR of 4.2%, supported by the country's focus on quality manufacturing, advanced material handling technology, and precision industrial applications. Japan's technological sophistication and manufacturing excellence are driving demand for high-specification forklift equipment. Leading manufacturers are investing in advanced features and automation capabilities for domestic applications.

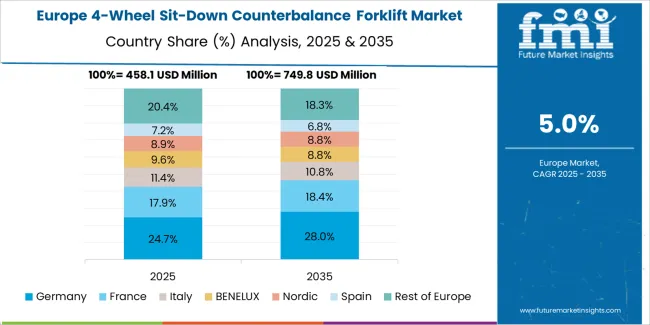

The 4-wheel sit-down counterbalance forklift market in Europe is projected to grow from USD 446.2 million in 2025 to USD 725.0 million by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain leadership with a 28.5% market share in 2025, moderating to 27.8% by 2035, supported by advanced manufacturing infrastructure, automotive sector strength, and precision material handling requirements.

France follows with 18.2% in 2025, projected at 18.6% by 2035, driven by logistics sector development, industrial capacity expansion, and distribution network modernization. The United Kingdom holds 16.4% in 2025, declining to 15.9% by 2035 due to post-Brexit operational adjustments. Italy commands 13.7% in 2025, rising slightly to 13.9% by 2035, while Spain accounts for 9.8% in 2025, reaching 10.1% by 2035 aided by warehouse expansion and logistics infrastructure growth.

The Netherlands maintains 7.6% in 2025, up to 7.9% by 2035 due to port operations and distribution hub activities. The Rest of Europe region, including Nordic countries, Central and Eastern Europe, and other markets, is anticipated to hold 5.8% in 2025 and 5.8% by 2035, reflecting steady adoption in emerging logistics markets and industrial facility modernization programs.

The market is characterized by competition among established material handling equipment manufacturers, diversified industrial equipment companies, and regional forklift suppliers. Companies are investing in battery technology development, telematics integration, ergonomic design improvements, and application-specific feature development to deliver reliable, efficient, and operator-friendly forklift solutions. Innovation in lithium-ion power systems, automated guidance capabilities, and connected fleet management technologies is central to strengthening market position and competitive advantage.

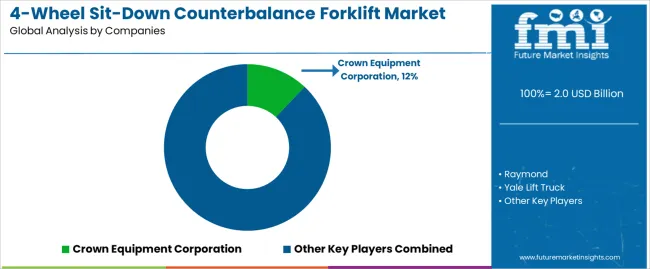

Crown Equipment Corporation leads the market with comprehensive counterbalance forklift solutions with a focus on operator ergonomics, energy efficiency, and advanced control systems across diverse industrial and logistics applications. Raymond provides innovative material handling equipment with focus on productivity optimization and fleet management integration. Yale Lift Truck offers versatile forklift solutions with focus on durability and application flexibility. RICO delivers specialized equipment for demanding industrial environments. Toyota Material Handling provides comprehensive forklift portfolios with focus on reliability and service support. KION Group offers advanced material handling technologies through multiple equipment brands serving global markets.

Jungheinrich specializes in integrated warehouse solutions with comprehensive equipment and automation capabilities. Hyster-Yale manufactures robust forklift equipment for heavy-duty applications. Crown Equipment emphasizes innovation in electric powertrains and operator assistance systems. Mitsubishi Logisnext provides material handling solutions with focus on Asian markets and global expansion. Komatsu offers industrial equipment with comprehensive service networks. Anhui Heli focuses on cost-effective forklift solutions for emerging markets. Clark Material Handling provides established equipment lines for diverse applications. Doosan Industrial Vehicle delivers material handling equipment with focus on performance and reliability.

4-wheel sit-down counterbalance forklifts represent a material handling equipment segment within industrial and logistics applications, projected to grow from USD 2.0 billion in 2025 to USD 3.4 billion by 2035 at a 5.6% CAGR. These versatile load handling machines serve as essential equipment in manufacturing facilities, distribution centers, logistics operations, and industrial warehouses where stable load handling, operator comfort, and reliable performance are required. Market expansion is driven by warehouse infrastructure growth, e-commerce fulfillment demand, advancing battery technology, and rising focus on operational efficiency across diverse material handling applications.

How Industrial Regulators Could Strengthen Safety Standards and Operational Requirements?

How Industry Associations Could Advance Equipment Standards and Market Development?

How Forklift Manufacturers Could Drive Innovation and Market Leadership?

How End-User Industries Could Optimize Equipment Performance and Productivity?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.0 billion |

| Power Source Type | Diesel-Powered Type, Lithium-Powered Type, Others |

| Application | Manufacturing Warehousing, Logistics Center, Port Terminal, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40 countries |

| Key Companies Profiled | Crown Equipment Corporation, Raymond, Yale Lift Truck, RICO, Toyota Material Handling, KION Group |

| Additional Attributes | Dollar sales by power source type and application category, regional demand trends, competitive landscape, technological advancements in battery systems, automation integration, ergonomic design improvements, and operational efficiency optimization |

The global 4-wheel sit-down counterbalance forklift market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the 4-wheel sit-down counterbalance forklift market is projected to reach USD 3.4 billion by 2035.

The 4-wheel sit-down counterbalance forklift market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in 4-wheel sit-down counterbalance forklift market are diesel-powered type, lithium-powered type and others.

In terms of application, manufacturing warehousing segment to command 43.0% share in the 4-wheel sit-down counterbalance forklift market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Forklift Attachments Market Growth - Trends & Forecast 2025 to 2035

Forklift-Mounted Computers Market

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Cherry Picker Forklift Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA