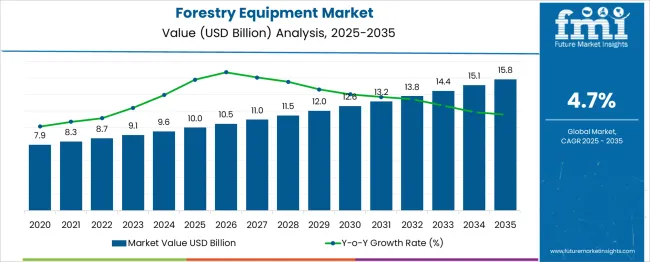

The Forestry Equipment Market is estimated to be valued at USD 10.0 billion in 2025 and is projected to reach USD 15.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The forestry equipment market represents a total growth of 58%, backed by a steady CAGR of 4.7%. A breakdown of the data reveals a relatively balanced expansion trajectory; the first half of the decade (2025–2030) contributes an incremental gain of USD 2.6 billion, rising from USD 10.0 billion to USD 12.6 billion.

This accounts for approximately 45% of the total absolute opportunity. The remaining USD 3.2 billion of growth occurs between 2030 and 2035, highlighting a slight acceleration in the latter half, as annual increments expand from USD 0.5 billion in early years to USD 0.7 billion by 2035. This trend aligns with projected upticks in mechanized harvesting, demand for sustainable biomass extraction, and investment in precision forestry solutions.

Published research in top-tier forestry and agricultural engineering journals supports the view that modernization efforts and emissions-compliant machinery will be key growth levers. As such, the absolute dollar opportunity is not only measurable but strategically distributed across a predictable equipment upgrade cycle, creating stable return potential for OEMs and distributors targeting logging, thinning, and land-clearing applications.

| Metric | Value |

|---|---|

| Forestry Equipment Market Estimated Value in (2025 E) | USD 10.0 billion |

| Forestry Equipment Market Forecast Value in (2035 F) | USD 15.8 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The forestry equipment market holds approximately 15–18% of the heavy machinery and equipment market, supported by demand for purpose-built harvesters, forwarders, and feller bunchers used in industrial-scale logging operations. Within the agricultural and farm equipment market, the segment captures 8–10%, with utility tractors and mulchers deployed in agroforestry zones and plantation maintenance.

Forestry equipment contributes around 6–8% of the construction and earthmoving equipment market, where tracked dozers and adapted excavators are used for terrain clearing and road building in forested regions. It represents 20–25% of the timber and wood processing industry market, driven by its role in upstream harvesting, skidding, and transportation of raw logs. In the environmental and land management equipment market, forestry machinery accounts for 12–15% due to expanding use in reforestation, wildfire control, and biomass collection.

The market is being shaped by rising investments in mechanized logging, regulatory pressure for sustainable forestry, and expansion of bioenergy supply chains. Automation and GPS integration in harvesters are enhancing operator efficiency and timber yield. Demand is increasing for low-impact equipment designed to minimize soil disturbance in sensitive forest areas. Equipment financing models and government-backed forest renewal programs are further supporting equipment upgrades in both developed and emerging markets.

The forestry equipment market is undergoing steady growth propelled by increasing demand for efficient and sustainable forest management practices. Factors such as rising global demand for timber, wood-based products, and biomass energy are driving investment in advanced machinery.

Equipment innovations focusing on automation, fuel efficiency, and operator safety are enabling forestry operations to meet productivity and environmental goals simultaneously. Growing regulatory pressure to minimize the impact of deforestation and promote sustainable harvesting methods is influencing market dynamics.

Large-scale reforestation initiatives and government incentives in key regions are expected to support expansion further. Integration of digital technologies such as telematics and remote monitoring is improving operational control and maintenance efficiency, paving the way for future market growth across commercial and governmental forestry applications.

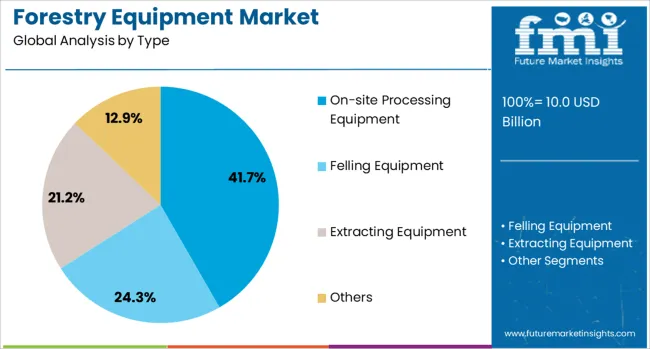

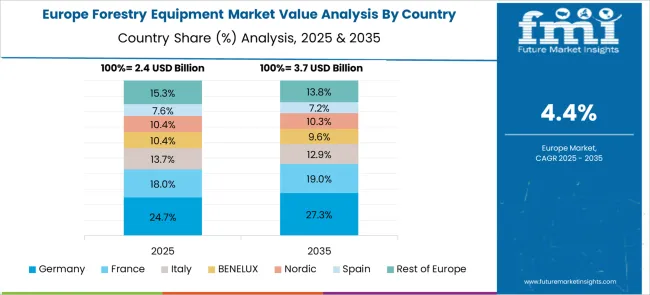

The forestry equipment market is segmented by type and geographic regions. The forestry equipment market is divided by type into On-site Processing Equipment, Felling Equipment, Extracting Equipment, and Others. Regionally, the forestry equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the On-site Processing Equipment segment holds 41.7 % of the market revenue in 2025, making it the leading segment. Its prominence is attributed to the efficiency gains it offers by allowing processing activities to occur directly in the forest, reducing transportation costs and time delays.

These equipment types are designed to perform multiple functions such as cutting, delimbing, and bucking at the harvesting site, enhancing operational productivity. Additionally, improved machine durability and advancements in automation have increased reliability in challenging forest terrains.

The ability to minimize environmental disturbance through selective and precise harvesting techniques has also contributed to widespread adoption. Operational cost savings coupled with enhanced resource utilization continue to drive the segment’s market leadership.

Demand for forestry equipment grew as global timber and biomass production expanded. Sales of GPS-guided harvesters and low-emission machinery accelerated, especially in North America and Northern Europe. Growth was supported by sustainable forestry mandates, digital logging integration, and mechanization of thinning and biomass harvesting operations.

Precision forestry operations spurred a 27% increase in demand for GPS-guided harvesters during 2025. European and North American timber producers deployed units with spatial mapping and cut-to-length automation to increase yield and reduce waste by nearly 20%. Harvester operators benefited from real-time location data integrated into fleet management dashboards. Use of eco-mode engine settings cut fuel consumption per cubic meter by 18%. OEMs offering modular sensor add-ons and subscription-based software updates strengthened market position in sustainable logging zones.

Sales of low-emission forestry machines including hybrid forwarders and battery-assist harvesters rose sharply in 2025. Adoption was strongest in Nordic countries such as Sweden and Finland, where carbon-neutral harvesting regulations encouraged transition to machines with Tier 5 diesel engines or electric propulsion. Noise footprint reductions of 25% and particulate emissions drop of 30% were noted. Operators reported a 22% improvement in working hours per refill cycle due to hybrid energy recovery systems. Partnership strategies involving OEMs and forest management authorities reinforced demand through incentive alignments and green certification programs.

Mechanized thinning equipment witnessed a 24% surge in shipments in 2025, as bioenergy producers and pulp manufacturers intensified raw material sourcing from young forests. Equipment featuring narrow-profile tracks and hydraulic boom extensions was deployed across plantation zones in Canada, Germany, and Japan. Use of lightweight thinning harvesters allowed operations in wet or sloped terrain with minimal soil disruption, enhancing biodiversity compliance. Biomass pellet producers reported a 19% reduction in procurement costs due to faster access to pre-commercial thinnings. Investments by rental fleets and cooperatives drove broader access to mechanized solutions among small and mid-sized landowners.

Retrofit kits for digitizing legacy forestry equipment recorded a 33% increase in orders in 2025, driven by fleet modernization programs and compliance tracking. Loggers integrated CAN bus-based telemetry units and digital log scaling sensors into existing feller bunchers and forwarders. Use of remote diagnostics and predictive maintenance alerts reduced unplanned downtime by 21% across USA and Polish fleets. Forestry contractors gained real-time load data and route optimization support via cloud platforms, enabling better asset deployment. Equipment suppliers that offered retrofit-compatible software and open protocol APIs captured aftermarket growth while aligning with ESG reporting mandates.

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

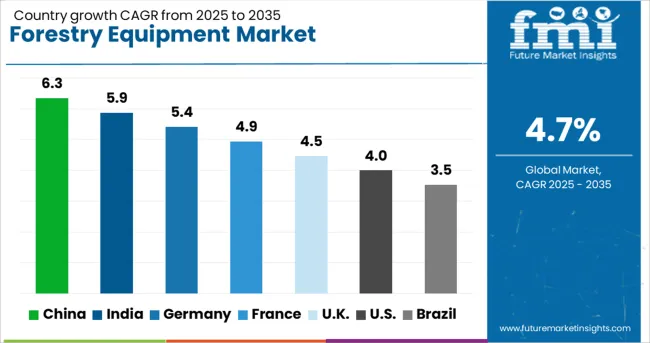

The market is projected to expand at a CAGR of 4.7% globally between 2025 and 2035, supported by rising mechanization, sustainable forestry practices, and digital fleet management. In China, where growth is forecasted at 6.3%, national reforestation programs and state investments in logging automation have been key accelerators. India’s market, advancing at 5.9%, is being influenced by the increasing adoption of compact harvesters and brush cutters in plantation forestry and commercial timber zones.

Germany, growing at 5.4%, has witnessed higher demand for precision forestry technologies and hybrid logging machinery aligned with EU decarbonization goals. In the UK, with a CAGR of 4.5%, remote-operated felling and biomass extraction machinery are gaining traction amid carbon offset programs. The US market, expanding at 4.0%, is seeing strong replacement demand for skidders and mulchers driven by sustainability certifications and digital telemetry integration. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s forestry equipment market is projected to expand at a CAGR of 6.3% from 2025 to 2035. From 2020 to 2024, equipment demand rose as reforestation efforts increased in Inner Mongolia, Sichuan, and Heilongjiang. In the forecast period, mechanized logging and biomass harvesting will be key growth drivers. Government-backed afforestation programs and digital transformation in forest management will also strengthen procurement of forwarders, feller bunchers, and skidders.

India is forecast to see a CAGR of 5.9% in its forestry equipment market between 2025 and 2035. The 2020–2024 period saw limited mechanization, but equipment sales rose steadily due to state-led afforestation initiatives. Over the next decade, increasing use of brush cutters, log skidders, and portable sawmills in plantation management and forest fire mitigation will support growth. Equipment financing access is also improving among local cooperatives and forestry contractors.

Germany’s forestry equipment market is set to grow at a CAGR of 5.4% through 2035. Between 2020 and 2024, demand was driven by replanting efforts to restore storm-damaged and beetle-infested woodlands. Looking ahead, the adoption of climate-resilient forestry practices and digital asset monitoring systems will boost sales of high-precision harvesters, mulchers, and grapple loaders. Subsidies for sustainable forestry equipment will also remain a key policy lever.

A CAGR of 4.5% is anticipated for the UK forestry equipment market between 2025 and 2035. During 2020–2024, rewilding programs and Scotland’s timber modernization plans fueled equipment demand. In the next decade, growth will be supported by the integration of automation in tree planting and harvesting, along with investments in carbon credit-linked forest expansion projects. Timber-focused grants are prompting SMEs to modernize aging equipment fleets.

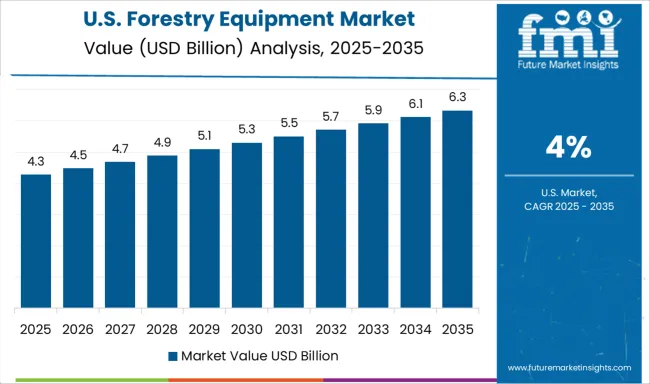

The USA forestry equipment market is projected to grow at a CAGR of 4.0% from 2025 to 2035. From 2020 to 2024, growth was anchored by salvage logging, fuel reduction, and wildfire management across the West. In the upcoming decade, investments in resilient forest landscapes and climate-smart harvesting will accelerate demand for high-efficiency chippers, mulchers, and tracked harvesters. Federal infrastructure funding will also enhance procurement of next-generation machines.

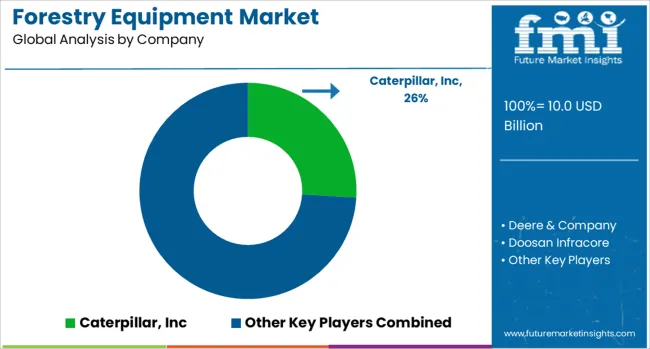

The forestry equipment market is characterized by a mix of global leaders and specialized regional players, each leveraging distinct capabilities across harvesting, processing, and site preparation segments. Caterpillar, Inc maintains a strong global presence by offering a broad portfolio of high-performance equipment designed for both large-scale logging and land development.

Deere & Company continues to enhance its competitive edge with telematics-integrated machinery and widespread dealer support, particularly in North America where forest infrastructure projects are growing in complexity. Komatsu Ltd. is widely recognized for its durable harvesters and forwarders, which are well suited for intensive operations in high-yield plantations.

Doosan Infracore and Hitachi Construction Machinery Ltd. are incorporating electric-drive components into key equipment lines such as feller bunchers and loaders, meeting operational demands for lower fuel use and quieter operation. In handheld and compact tool segments, Husqvarna AB dominates in chainsaws and related equipment, addressing growing demand for efficient thinning tools across both commercial and managed forest areas in Europe and Asia. Logset Oy and Eco Log Sweden AB are gaining momentum in the Nordic region with compact harvesters engineered for maneuverability in rugged, uneven terrains.

Kesla OYJ and Malwa Forest AB focus on specialized mechanized solutions tailored to selective logging and small-scale operations. Morbark LLC and Hohenloher Spezial-Maschinenbau GmbH serve biomass, sawmill, and land-clearing applications through high-throughput processors and chippers. Product innovation, terrain-specific engineering, and integration of smart features continue to shape the competitive environment.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.0 Billion |

| Type | On-site Processing Equipment, Felling Equipment, Extracting Equipment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Inc, Deere & Company, Doosan Infracore, Eco Log Sweden AB, Hohenloher Spezial-Maschinenbau GmbH & Co., Hitachi Construction Company Ltd., Husqvarna AB, Kesla OYJ, Komatsu Ltd., Logset Oy, Malwa Forest AB, and Morbark LLC. |

| Additional Attributes | Dollar sales by equipment type (harvesters, skidders, forwarders, mulchers) and power source (diesel, hybrid, fully electric), demand dynamics driven by timber demand, bioenergy, and mechanization in emerging regions, regional leadership in North America with fastest growth in Asia‑Pacific, innovation in AI-enabled mapping and GPS, and environmental impact via reduced soil disturbance and carbon-efficient logging practices. |

The global forestry equipment market is estimated to be valued at USD 10.0 billion in 2025.

The market size for the forestry equipment market is projected to reach USD 15.8 billion by 2035.

The forestry equipment market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in forestry equipment market are on-site processing equipment, _chipper, _delimber, felling equipment, _chainsaw, _harvester, _feller buncher, extracting equipment, _forwarder, _skidder, others, _loader and _mulcher.

In terms of , segment to command 0.0% share in the forestry equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Forestry Lubricants Manufacturers

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA